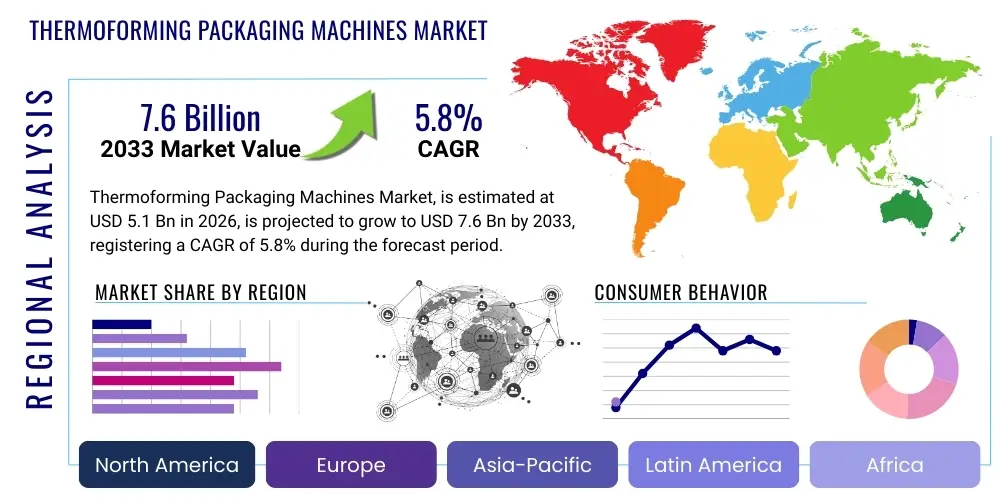

Thermoforming Packaging Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437167 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Thermoforming Packaging Machines Market Size

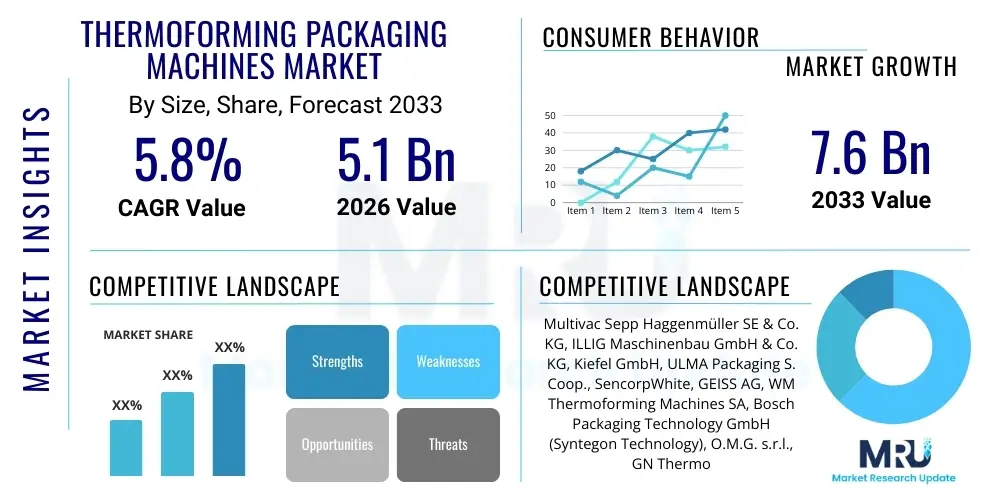

The Thermoforming Packaging Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.1 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Thermoforming Packaging Machines Market introduction

The global Thermoforming Packaging Machines Market is characterized by robust expansion driven by increasing demand for high-speed, flexible, and sustainable packaging solutions across critical end-use industries, particularly food, pharmaceuticals, and consumer electronics. Thermoforming, a manufacturing process where a plastic sheet is heated to a pliable temperature, formed into a specific shape in a mold, trimmed, and often filled and sealed, is integral to creating barrier and protective packaging formats such as blisters, trays, clamshells, and cups. These machines offer significant advantages, including high production output, material versatility (handling PET, PVC, PP, PS), and cost-effectiveness in mass production environments, making them indispensable for large-scale consumer goods manufacturing globally.

Product descriptions within this domain span various machine types, including roll-fed, cut-sheet, and highly integrated in-line or off-line systems, catering to diverse operational scales and complexity requirements. Roll-fed thermoforming machines, generally used for high-volume, thin-gauge packaging like blister packs and rigid film trays, dominate the market due to their continuous operation capability. Major applications include high-barrier packaging for perishable foods such as chilled meats, dairy products, and prepared meals, sterile blister packs for pharmaceutical tablets and capsules requiring validated security, and durable transparent protective cases for high-value consumer electronics and complex medical devices.

The primary benefits driving the widespread adoption of thermoforming technology include enhanced product shelf life achieved through superior moisture and oxygen barrier properties, optimized material usage leading to reduced packaging waste compared to conventional methods like injection molding, and substantial efficiency gains due to customized sizing for optimized logistics. Key driving factors encompass stringent governmental regulations emphasizing food safety, traceability, and tamper-evidence, the pervasive societal shift toward convenient, ready-to-eat and processed foods requiring reliable protective packaging, and the relentless technological evolution incorporating advanced automation, precise digital control systems, and integration capabilities for recyclable and bio-based polymers to satisfy growing sustainability mandates worldwide.

Thermoforming Packaging Machines Market Executive Summary

The Thermoforming Packaging Machines Market exhibits strong positive business trends, primarily fueled by the accelerating integration of sophisticated Industry 4.0 principles, including comprehensive process digitalization, predictive maintenance utilizing real-time monitoring via IoT sensors, and seamless vertical integration with high-level Enterprise Resource Planning (ERP) and Manufacturing Execution Systems (MES). Contemporary machine vendors are focusing their research and development efforts on engineering high-throughput, modular machine architectures that permit rapid tooling and format changeovers, significantly minimizing costly downtime and directly addressing the modern production requirements for extreme flexibility and efficiency in diversified product portfolios. Furthermore, there is a pronounced and strategic industry shift towards developing machines specifically capable of handling advanced mono-material structures (such as enhanced PET/PE replacements) to align proactively with global circular economy objectives, establishing sustainability competence as a core and unavoidable competitive differentiator among all market-leading equipment suppliers.

From a geographical perspective, the Asia Pacific (APAC) region continues to distinguish itself as the highest-growth area, poised for remarkable expansion driven by rapidly burgeoning populations, escalating economic prosperity, large-scale industrialization programs, and substantial governmental and private sector investment directed towards upgrading pharmaceutical manufacturing and modern food processing infrastructure, particularly evident in major economies such as China, India, and the rapidly modernizing Southeast Asian nations. Conversely, North America and Europe collectively maintain the largest market share in terms of current revenue, attributed to the early and extensive adoption of advanced automation technologies, adherence to strict regulatory frameworks necessitating high-precision, validated packaging solutions, and the entrenched presence of major global consumer goods and pharmaceutical corporations demanding continuous upgrades to state-of-the-art machinery featuring advanced safety and efficiency protocols. European vendors, in particular, lead global efforts in developing specialized machinery focused on advanced aseptic packaging and high-barrier film processing formats.

Detailed segment trends analysis reveals that the Fully Automatic machine type category indisputably dominates the global revenue landscape, driven by the uncompromising requirements of large-scale pharmaceutical production and high-volume food manufacturing seeking maximum production rates, minimized human intervention, and highly validated operational consistency. In terms of end-use application, the Food & Beverages sector unequivocally holds the largest single market share, a trend strongly correlated with global shifts in dietary habits, the rapid proliferation of packaged snack items, and consumer reliance on ready-to-eat convenience foods. Within the technical segmentation by forming type, traditional vacuum forming remains widely utilized for simpler, less complex packaging structures, while pressure forming technology is rapidly gaining significant traction across the market due to its proven capacity to create more detailed, precise, dimensionally accurate, and structurally robust finished products, which is essential for specialized applications such as high-end consumer electronics protective housing or sophisticated sterile medical device packaging systems requiring tight tolerances and high material utilization rates.

AI Impact Analysis on Thermoforming Packaging Machines Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) in the specialized thermoforming sector frequently center around achieving higher degrees of machine autonomy, ensuring absolute consistency in quality control accuracy, and quantifying the potential for significant operational cost reduction through optimization. Users are intensely interested in understanding how AI can facilitate a transition beyond basic, fixed automation to enable truly self-optimizing production cycles—specifically, how advanced AI algorithms can analyze complex, multivariate sensor data to instantaneously adjust critical parameters such as heating element profiles, precise vacuum levels, and tailored cooling times in real-time. This adaptive capability is vital for compensating automatically for slight, unavoidable variations in raw material thickness, ambient environmental conditions, or tooling wear, thereby achieving substantial minimization of scrap rates, maximizing overall material yield, and guaranteeing consistent product quality at unprecedented speeds.

Key concerns users often raise revolve around the significant initial complexity and potentially prohibitive cost of successfully integrating sophisticated machine learning models into the existing installed base of legacy equipment and the necessity of ensuring robust data security and intellectual property protection for sensitive, proprietary production metrics and operating formulas. Despite these concerns, market expectations are exceptionally high regarding the industry-wide implementation of industrial computer vision systems powered by deep learning algorithms for ultra-fast, entirely non-destructive defect detection and measurement. These systems are expected to comprehensively replace traditional, subjective human inspection or simpler, less reliable sensor-based methods. Furthermore, AI is expected to revolutionize maintenance by precisely predicting potential machine component failures many cycles before they materialize, allowing for optimized scheduling of proactive, non-disruptive maintenance interventions, dramatically improving Overall Equipment Effectiveness (OEE).

The successful integration of AI is fundamentally transforming thermoforming packaging machines from rigidly fixed-process mechanical systems into intelligent, highly adaptive, and continuous-learning manufacturing units. Machine learning algorithms are proving crucial for implementing next-generation predictive maintenance programs, meticulously analyzing vast streams of vibration, temperature, acoustic, and electrical load data captured across millions of production cycles to pinpoint component wear or deviation with extremely high accuracy. This capability drastically reduces the frequency and duration of unplanned downtime events and optimizes maintenance scheduling. Additionally, AI-driven process optimization systems empower machines to 'learn' and recall the optimal operating parameters for specific plastic polymers, film gauges, and complex mold configurations, facilitating significantly faster setup times and validation processes, particularly when high flexibility is required for switching between diverse stock materials or bespoke product designs. This adaptive, self-tuning intelligence is indispensable for managing the increasing proliferation of high-mix, low-volume production scenarios, which are becoming standard in contract packaging services and highly specialized pharmaceutical production runs.

- AI-driven Predictive Maintenance: Utilizing real-time sensor data and historical performance metrics to accurately forecast potential equipment failure, thereby increasing average machine uptime by a projected 15% to 25%.

- Real-Time Process Optimization: Deployment of advanced machine learning algorithms to instantaneously adjust critical forming parameters (heat, pressure, cycle times) based on material feedback, ensuring maximum throughput while minimizing material scrap and energy waste.

- Computer Vision Quality Control: Implementation of deep learning models for high-resolution vision systems capable of detecting minute surface defects, inconsistencies in material distribution, and incomplete seals at extremely high production line speeds.

- Automated Material Tracking and Inventory: Utilization of AI to optimize polymer sheet inventory procurement and management based on precise, dynamically forecasted production schedules and historical price volatility analysis.

- Energy Consumption Reduction: AI systems optimizing motor loads and precisely controlling heating element usage profiles based on instantaneous load requirements and material-specific thermal needs, significantly decreasing operational power costs.

- Enhanced Customization and Tooling: AI assisting in the rapid, iterative prototyping process and virtual simulation of new mold designs, predicting material flow characteristics and compatibility with sustainable polymers before physical tooling fabrication begins.

DRO & Impact Forces Of Thermoforming Packaging Machines Market

The sophisticated dynamics of the Thermoforming Packaging Machines Market are profoundly shaped by a complex and interacting interplay of key market Drivers (D), inherent industry Restraints (R), and compelling technological and geographic Opportunities (O), which collectively define the overarching Impact Forces influencing market structure and future growth trajectories. A primary and unwavering driver is the accelerating global demand for maximum consumer convenience, reflected in the surging volume of pre-packaged meals and processed snack foods, which correlates directly with rapid global urbanization, shifting demographics, and increasingly busy consumer lifestyles, necessitating high-volume, reliable, and hygienic packaging machinery. Simultaneously, the pharmaceutical industry’s uncompromising and strict regulatory requirements for validated sterile barrier packaging, a requirement overwhelmingly fulfilled by high-precision thermoformed blister packs and sterile medical trays, provides a stable, resilient, and consistently expanding demand base for high-specification equipment. These fundamental market drivers are further reinforced by continuous technological advancements leading to the development of substantially faster, more energy-efficient machines featuring advanced, rapid, and often automated tooling changeover capabilities.

However, the market capitalization and expansion efforts face several significant restraints that require careful strategic management. Chief among these restraints is the persistent and escalating cost volatility of critical plastic raw materials (including essential polymers like PET, PVC, PP, and PS), which directly increases the operational expenditure burden for end-users, frequently leading to delays or outright cancellations of non-critical capital investment decisions for new machinery acquisitions or large-scale facility upgrades. Furthermore, the global proliferation of stringent environmental regulations, explicitly aimed at drastically reducing the use of single-use plastics and aggressively promoting material circularity and reuse, presents a substantial and complex long-term technical challenge for all machinery manufacturers. This regulatory pressure necessitates substantial, front-loaded R&D investment to rapidly ensure comprehensive machine compatibility with novel sustainable polymers, such as bio-plastics or certified compostable materials, which often present specialized and demanding processing conditions related to heat tolerance and dimensional stability.

Compelling opportunities for exponential market growth are strategically concentrated in rapidly industrializing emerging economies, particularly across APAC and Latin America, where the rapid development of sophisticated cold chain logistics networks and the proliferation of modern, large-format retail infrastructure are driving a foundational need for entirely new packaging machinery infrastructure. Moreover, the industry-wide push towards developing and utilizing advanced high-barrier thermoforming materials integrated with next-generation smart packaging features (e.g., embedded RFID tags, time-temperature indicators, cloud-connected traceability systems) presents a significant potential pathway for market premiumization and strategic expansion into specialized high-security medical and sensitive electronics packaging sectors. Consequently, the cumulative impact forces are heavily weighted towards continuous innovation in the twin pillars of sustainability and automation, compelling leading manufacturers to rapidly pivot their product development towards eco-friendly machine designs and fully integrated smart factory solutions to maintain a competitive advantage and effectively meet the complex demands of evolving global legislative mandates and sophisticated consumer preferences for ecologically responsible packaging.

Segmentation Analysis

The Thermoforming Packaging Machines Market is extensively segmented across multiple critical dimensions, including machine type, specific packaging technology employed, the target application industry, and distinct geographic regions, enabling market analysts to achieve a highly granular understanding of intricate market dynamics, assess competitive intensity, and formulate precise, targeted investment strategies. The segmentation by machine type establishes clear divisions, ranging from highly complex, high-volume fully automatic systems designed for non-stop mass production to simpler, lower-cost semi-automatic and manual setups that are optimally suited for smaller enterprises, specialized niche operations, or facilities in regions with lower labor costs. The subsequent segmentation by packaging type, which encompasses blister packaging, skin packaging, clamshells, and trays/containers, directly reflects the diverse functional, structural, and aesthetic requirements mandated across various end-use industries, with robust blister packaging consistently maintaining a dominant position, particularly in the highly regulated pharmaceutical sector where dosage security, integrity, and tamper evidence are absolutely paramount.

The application segmentation clearly identifies the Food & Beverages industry as the undisputed largest single consumer of thermoforming machinery, utilizing these versatile systems extensively for high-volume packaging of dairy products, fresh and processed meats, prepared meals, and bakery items, with an overriding emphasis on achieving maximum speed, maintaining stringent hygiene standards (e.g., aseptic capabilities), and ensuring extended product shelf life through superior barrier properties. Conversely, the Pharmaceutical sector requires machines built to the highest specifications, demanding maximum precision, comprehensive regulatory compliance (cGMP), and extensive validation protocols. The inherent technological complexity associated with efficiently handling and forming different material types—such as stiff PET, rigid PVC, durable PP, and specialized high-barrier films—further segments the machine market, driving intense specialization among machinery manufacturers who must continually adapt their advanced heating, forming, and cooling systems to meticulously optimize performance for the varying physical and thermal characteristics of each polymer, thereby ensuring absolute structural integrity and optimal optical clarity of the finally formed package.

A significant, ongoing trend involves the sophisticated integration of advanced vision systems, high-speed robotics, and specialized handling technologies directly into the core thermoforming process, which is actively creating lucrative new micro-segments specifically focused on delivering high-specification automation, minimal waste generation, and enhanced traceability features. The sustained demand for robust, continuous operation, high-throughput machines in globally recognized major manufacturing hubs, driven by massive corporations, sharply contrasts with the burgeoning need for highly flexible, lower-throughput semi-automatic systems in rapidly industrializing developing regions. This dichotomy strongly underscores the strategic necessity for global vendors to diligently maintain a technologically broad, adaptable, and cost-effective product portfolio to successfully capture the diverse range of global market opportunities presented across all identified segments, ensuring both current relevance and future scalability.

- By Type: Fully Automatic, Semi-Automatic, Manual

- By Forming Type: Vacuum Forming, Pressure Forming, Mechanical Forming

- By Packaging Type: Blister Packaging, Skin Packaging, Clamshell Packaging, Trays & Containers

- By Operation: Roll-Fed Thermoforming (Web-Fed), Cut-Sheet Thermoforming (Thin and Thick Gauge)

- By End-Use Application: Food & Beverages (Dairy, Meat, Prepared Foods, Bakery, Confectionery), Pharmaceuticals (Tablets, Capsules, Medical Devices, Diagnostics), Consumer Goods (Electronics, Toys, Household Items), Personal Care & Cosmetics (Single-use items, travel kits), Industrial Goods (Hardware, Automotive Parts)

Value Chain Analysis For Thermoforming Packaging Machines Market

The comprehensive value chain for the Thermoforming Packaging Machines Market begins with the Upstream Activities, primarily involving a highly specialized ecosystem of raw material suppliers and component manufacturers. These entities provide essential high-performance metals (like stainless steel and specialized aluminum alloys) crucial for durable machine construction and precision engineering components, including advanced electronics, high-speed PLCs, servo motors and drives, precise pneumatic and hydraulic systems, and sophisticated, custom precision tooling (molds and cutting dies). The ultimate functional efficiency, long-term durability, and overall reliability of the finished thermoforming machine are critically dependent on the uncompromising quality, performance consistency, and rapid technological readiness of these upstream components. Consequently, machine manufacturers increasingly rely on establishing close, strategic, and long-term partnerships with select component vendors to ensure a stable supply chain, access to cutting-edge automation hardware, and accelerated adoption of proprietary software enhancements that dictate the machine’s maximum speed, formation precision, and overall user-friendliness.

The central and most capital-intensive stage encompasses the Machinery Manufacturing and Final Assembly phase, where Original Equipment Manufacturers (OEMs) execute the core processes of conceptual design, detailed fabrication, complex assembly, rigorous testing, and final commissioning of the thermoforming units. This stage demands extensive and continuous Research and Development (R&D) investment, with a strategic focus on optimizing energy efficiency, adhering strictly to hygienic design standards (especially critical for complex food and pharma applications), and integrating highly efficient, rapid tooling changeover mechanisms. Following production, Distribution Channels come into play, which are typically bifurcated into two primary approaches: Direct and Indirect sales. Direct sales are generally favored for the largest, most custom-engineered, and complex fully automatic systems, involving direct contract negotiation, professional installation, extensive validation, and long-term, comprehensive service agreements established directly with major multinational end-users or global contract packagers. Indirect sales utilize a network of regional distributors, certified agents, and specialized system integrators to effectively penetrate highly fragmented or niche markets and efficiently service smaller-to-medium enterprises seeking standardized semi-automatic or standardized lower-throughput machine models.

Downstream Activities are critical for sustaining market presence and customer satisfaction, encompassing highly specialized machine installation, comprehensive operator training, ongoing technical support, and the provision of essential Aftermarket Services. These services include the timely supply of replacement and spare parts, execution of routine preventative maintenance contracts, and the specialized fabrication and refurbishment of high-precision tooling (molds and dies). The long-term profitability and revenue stability of machine vendors are significantly enhanced by robust, margin-rich aftermarket service offerings, which are instrumental in ensuring sustained, validated machine performance, maximizing equipment lifespan, and fostering strong customer loyalty throughout the typically long lifecycle of industrial packaging machinery. The ultimate end-users/buyers operate these procured machines to efficiently package their final finished goods (e.g., pharmaceutical blisters, ready-to-eat meals), forming the absolute final link in the extended value chain. Operational efficiency at this terminal stage is stringently measured by metrics such as low scrap rates, maximum output rates (parts per minute), and consistent compliance with all established packaging standards, making continuous, high-quality operational support an absolutely critical element of competitive differentiation.

Thermoforming Packaging Machines Market Potential Customers

The core customer base for Thermoforming Packaging Machines is highly diversified across a broad spectrum of major industrial sectors, with each sector possessing distinct functional requirements that fundamentally define their investment criteria, procurement process, and preferred machine specifications. Within the expansive Food & Beverages sector, crucial potential customers include large multinational food processing conglomerates, specialized dairy manufacturers, highly regulated prepared meal producers, and local or regional co-packers and private label manufacturers. These entities place paramount importance on procuring machines offering extremely high throughput rates, uncompromising compliance with stringent hygiene standards (e.g., high IP ratings, comprehensive wash-down capability), and the proven ability to seamlessly process advanced, multi-layer barrier films necessary for successfully extending the shelf life of highly perishable goods. The driving force in this segment is clearly volume, speed, and validated sanitation, necessitating investment in fully automatic, integrated thermoforming, filling, and sealing lines capable of reliable, continuous 24/7 operation often within demanding, temperature-controlled, high-humidity production environments.

The second most significant cohort comprises Pharmaceutical and specialized Medical Device manufacturers. For these highly regulated potential buyers, the central purchasing drivers are absolute precision, comprehensive regulatory compliance (e.g., FDA 21 CFR Part 11, EMA requirements), extensive validation protocols (IQ/OQ/PQ), and the proven capability to accurately produce tamper-evident, sterile blister packs or custom trays for sensitive surgical instruments and diagnostic kits. These customers typically invest exclusively in high-specification, closed-loop automatic systems that incorporate sophisticated integrated serialization, aggregation, and advanced vision inspection systems, invariably prioritizing machine reliability, exhaustive validation documentation, and long-term service support far above the initial capital cost. Contract Manufacturing Organizations (CMOs) and Contract Packaging Organizations (CPOs) that service both the pharmaceutical and food sectors also constitute a rapidly growing and substantial customer segment, placing immense value on highly flexible, modular machines capable of rapid, validated product changeovers and accommodating diverse, often unpredictable client demands and material requirements.

Furthermore, consumer goods manufacturers (specializing in small electronics, toys, hardware) and industrial packagers constitute an accelerating growth segment of potential customers. These specific buyers seek machines that can efficiently produce visually appealing, structurally sound clamshell or skin packaging utilizing highly transparent materials, with a strong focus on maximizing structural durability, ensuring product visibility, and optimizing retail presentation aesthetics. The investment decision-making process for these customers often involves a careful balancing act between maximizing machine efficiency and maintaining high material flexibility, allowing them to rapidly adapt to emerging retail merchandising trends and corporate material sustainability pledges. Consequently, machinery designed with inherent support for emerging bio-based materials, thinner gauges, and complex recycled polymer structures is viewed highly favorably in their strategic procurement considerations, marking a clear path for future machine specialization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Multivac Sepp Haggenmüller SE & Co. KG, ILLIG Maschinenbau GmbH & Co. KG, Kiefel GmbH, ULMA Packaging S. Coop., SencorpWhite, GEISS AG, WM Thermoforming Machines SA, Bosch Packaging Technology GmbH (Syntegon Technology), O.M.G. s.r.l., GN Thermoforming Equipment, Formech International Ltd., Marchesini Group S.p.A., LoeschPack Verpackungstechnik GmbH & Co. KG, Corematic Packaging Systems, Gabler Thermoform GmbH & Co. KG, MEAF Machines B.V., Robatech AG, SABA Packaging Systems, Pactiv Evergreen Inc., Brown Machine Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermoforming Packaging Machines Market Key Technology Landscape

The contemporary technological evolution within the Thermoforming Packaging Machines Market is centrally focused on aggressively pursuing higher levels of functional automation, maximizing forming precision, and achieving comprehensive material sustainability compatibility across all machine platforms. One critically important technological advancement is the fundamental market-wide shift towards advanced servo-driven systems, which are rapidly replacing older, less efficient pneumatic and hydraulic drives. Servo technology provides superior operational speed, markedly improved energy efficiency, extremely precise and repeatable control over complex forming depth and temperature profiles, and significantly reduced periodic maintenance needs. This newfound level of precision is absolutely essential for successfully handling complex tooling geometries and working with thinner gauge materials or those with tight thermal windows without compromising the structural integrity or dimensional accuracy of the final package. Furthermore, sophisticated closed-loop control systems, leveraging high-performance Programmable Logic Controllers (PLCs) and intuitive Human-Machine Interface (HMI) touchscreens, allow expert operators to continuously monitor and instantaneously adjust all critical parameters in real-time, thereby ensuring consistent, validated quality across massive, high-volume production runs.

Another dominant technological trend involves substantially enhancing the machine's inherent capability to reliably handle challenging sustainable and advanced barrier materials. This imperative includes the development and integration of specialized pre-heating stations, optimized tooling designs, and adaptive cooling mechanisms that can successfully manage the unique thermal properties, rapid cooling cycles, and potential shrinkage rates associated with materials like APET, high-content recycled PET (rPET), and PLA (Polylactic Acid), facilitating a seamless and efficient transition away from older, less recyclable polymers such as PVC. The development of advanced high-barrier forming techniques, such such as integrating complex multi-layer film processing capabilities and in-mold labeling, is also critically important, particularly for highly sensitive food and pharmaceutical applications that require maximum extended protection against oxygen, moisture ingress, and light degradation. This necessitates the use of state-of-the-art sealing and precision cutting mechanisms that maintain absolute seal integrity and tamper evidence even when working with complex, co-extruded films and varying film thicknesses.

Digitalization, comprehensive connectivity, and data analytics, core tenets of the overarching Industry 4.0 paradigm, rigorously define the modern technology landscape for packaging machinery. Features like remote diagnostics, continuous condition monitoring via integrated Internet of Things (IoT) sensors, and seamless enterprise connectivity enable machine manufacturers and end-users to precisely track and optimize machine utilization (OEE) and perform proactive, predictive maintenance interventions, drastically reducing unforeseen operational stoppages. The increased reliance on modular tooling systems, standardized interfaces, and automated changeover routines, often facilitated by integrated robotic assistance for handling heavy molds, further minimizes the non-productive time required to switch between vastly different product formats or sizes, thereby maximizing operational flexibility and responsiveness to dynamic market demands. Ultimately, the continuous development and adoption of such advanced technologies are now established as key differentiators in high-stakes capital purchasing decisions within the competitive thermoforming market globally.

Regional Highlights

Geographically, the Thermoforming Packaging Machines Market exhibits distinct and varying growth patterns and consumption rates, heavily influenced by regional disparities in economic development, the regulatory framework governing packaging materials, industrial maturity levels, and population growth across major continents. The Asia Pacific (APAC) region currently and decisively dominates global market growth in terms of installed volume and projected Compound Annual Growth Rate (CAGR), primarily propelled by massive, sustained expansion in the food processing, domestic pharmaceutical manufacturing, and the rapidly scaling consumer goods manufacturing sectors across densely populated nations like the People's Republic of China, the Republic of India, and the rapidly modernizing economies of Indonesia and Vietnam. The rapid growth of the affluent middle-class population, accelerating urbanization rates, and the subsequent massive demand for hygienic, safety-assured, pre-packaged consumer goods are compelling local manufacturers across the region to rapidly adopt advanced packaging automation, often allowing them to strategically bypass outdated technologies and move directly to installing high-speed, state-of-the-art, fully automatic thermoforming lines. Significant governmental initiatives aimed at supporting and modernizing core manufacturing infrastructure further bolster and sustain this robust regional growth trajectory.

Europe represents a highly mature but exceptionally innovative market, consistently holding a substantial portion of global revenue share, characterized by the implementation of stringent packaging waste reduction directives (e.g., the EU Packaging and Packaging Waste Regulation) and a deeply entrenched focus on maximizing material sustainability and circularity. European market demand is predominantly centered on acquiring premium, highly precise machinery capable of efficiently processing novel sustainable materials (ee.g., fully recyclable mono-materials, molded pulp-based fibers, and compostable films) while simultaneously adhering to the absolute highest standards of food safety, validated pharmaceutical traceability, and rigorous hygienic design principles. Consequently, the European market expansion is driven less by sheer volume growth and more intensively by the compelling requirement for enhanced technical capabilities, superior energy efficiency, and mandatory machine compliance upgrades to meet ever-evolving legislation. Key European nations such as Germany, Italy, and Switzerland host numerous leading global thermoforming machinery manufacturers, thereby continuously driving and setting international R&D and engineering standards.

North America maintains a highly robust and essential market position, primarily driven by the massive regional presence of global pharmaceutical giants, large-scale consumer packaged goods corporations, and major food processing entities. Demand in this region is characterized by a persistent focus on high-capacity, high-reliability machinery that is seamlessly integrated with sophisticated robotic handling, advanced serialization systems, and high-speed inspection systems, all designed to effectively mitigate high domestic labor costs and ensure stringent product security and validation. Capital investment is heavily directed towards implementing AI and Industrial IoT platforms for proactive operational efficiency improvements and predictive maintenance execution. Conversely, Latin America and the Middle East & Africa (MEA) are emerging regions currently experiencing moderate but steady growth, primarily spurred by the expansion of modern retail sectors, increased foreign direct investment, and internal industrialization efforts, leading to a rising requirement for cost-effective entry-level and reliable semi-automatic systems, before a planned transition to full automation as local manufacturing scale and complexity increase significantly.

- North America: Exhibits high adoption rates of fully automated, technologically sophisticated machinery; driven by massive demand from the dominant pharmaceutical and specialized medical device sectors; intense strategic emphasis on integrating complex robotic handling and vision systems to manage efficiency and labor costs.

- Europe: Characterized by an uncompromising focus on sustainable machinery development, optimized for efficiently processing recyclable, mono-material, and advanced bio-based polymers; leadership in advanced aseptic and complex high-barrier packaging technologies; all purchases are heavily driven by mandatory compliance with stringent EU environmental and waste reduction regulations.

- Asia Pacific (APAC): Identified as the fastest-growing major region globally; growth is fueled by unprecedented industrial expansion across the food, pharmaceutical, and consumer electronics supply chains; sustained high capital investment in building entirely new, high-volume manufacturing facilities in crucial economies such as China, India, and Vietnam.

- Latin America: Experiencing consistent growth spurred by the rapid expansion of modern retail infrastructure and increasing local capacity in food processing and manufacturing capabilities; observed preference shift is accelerating from manual operations towards reliable semi-automatic and entry-level automatic equipment.

- Middle East and Africa (MEA): Demonstrating moderate but strategic growth linked directly to rapid urbanization rates, diversification away from oil, and significant governmental investment in local food security initiatives; initial primary focus remains on acquiring cost-effective, easily maintainable, and highly durable machinery suitable for basic protective packaging needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermoforming Packaging Machines Market. These profiles analyze business overview, financial performance, product portfolio, geographical presence, and recent strategic developments such as mergers, acquisitions, and technology launches. Leading global vendors are continuously investing in modular machine design and integrating Industry 4.0 technologies to enhance operational efficiency and maintain a competitive edge. Strategic focus areas include developing systems compliant with emerging sustainability mandates and ensuring superior energy consumption profiles. The competitive landscape is characterized by a mix of large, diversified packaging machinery corporations and specialized firms focusing solely on advanced thermoforming solutions.- Multivac Sepp Haggenmüller SE & Co. KG

- ILLIG Maschinenbau GmbH & Co. KG

- Kiefel GmbH

- ULMA Packaging S. Coop.

- SencorpWhite (Packaging Division)

- GEISS AG

- WM Thermoforming Machines SA

- Bosch Packaging Technology GmbH (Syntegon Technology)

- O.M.G. s.r.l.

- GN Thermoforming Equipment

- Formech International Ltd.

- Marchesini Group S.p.A.

- LoeschPack Verpackungstechnik GmbH & Co. KG

- Corematic Packaging Systems

- Gabler Thermoform GmbH & Co. KG

- Pneumatic Scale Angelus (Barry-Wehmiller Companies)

- Brown Machine Group

- EASYPACK GmbH

- Vakum Pak Ambalaj Makineleri A.Ş.

- Cannon Thermoforming Equipment

- AdvanPack Solutions

- Plastisystems S.A.

Frequently Asked Questions

Analyze common user questions about the Thermoforming Packaging Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for fully automatic thermoforming machines?

The primary driver is the critical need for maximizing production speed, achieving minimized labor costs, and ensuring enhanced consistency and validation in high-volume, continuous applications, particularly within the highly regulated pharmaceutical and large-scale, mass food packaging industries requiring guaranteed consistency and high Overall Equipment Effectiveness (OEE).

How are sustainability regulations impacting the design of new thermoforming machines?

Environmental regulations, particularly stringent directives in Europe, are mandating that manufacturers design machines capable of efficiently and reliably handling challenging mono-material plastics (like rPET) and emerging bio-based polymers. This necessitates advanced, adaptive heating controls, precision cooling elements, and specialized tooling to effectively manage the unique thermal properties and reduced material gauges of these sustainable films.

Which application segment holds the largest share in the thermoforming packaging machines market?

The Food & Beverages segment comprehensively holds the largest market share in terms of revenue and volume. This dominance is directly attributable to the enormous, consistent global consumption of processed and prepared meals, fresh meat, and dairy products, all of which rely extensively on thermoformed trays, cups, and high-barrier containers for ensuring product safety and achieving necessary extended shelf life.

What role does Artificial Intelligence (AI) play in modern thermoforming operations?

AI is strategically implemented for advanced predictive maintenance (accurately forecasting component failure), real-time operational process optimization (instantly adjusting forming parameters based on material inputs to minimize scrap), and ultra-reliable, high-speed quality control via specialized computer vision systems, significantly improving operational yield, reducing energy consumption, and maximizing machine uptime.

Which geographic region is expected to demonstrate the highest growth rate (CAGR) by 2033?

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR) through the forecast period ending in 2033. This accelerating growth is directly attributed to rapid urbanization, massive infrastructure investment in new manufacturing capacities for food and pharma, and the increasing consumer adoption of high-quality packaged goods across the region's major developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager