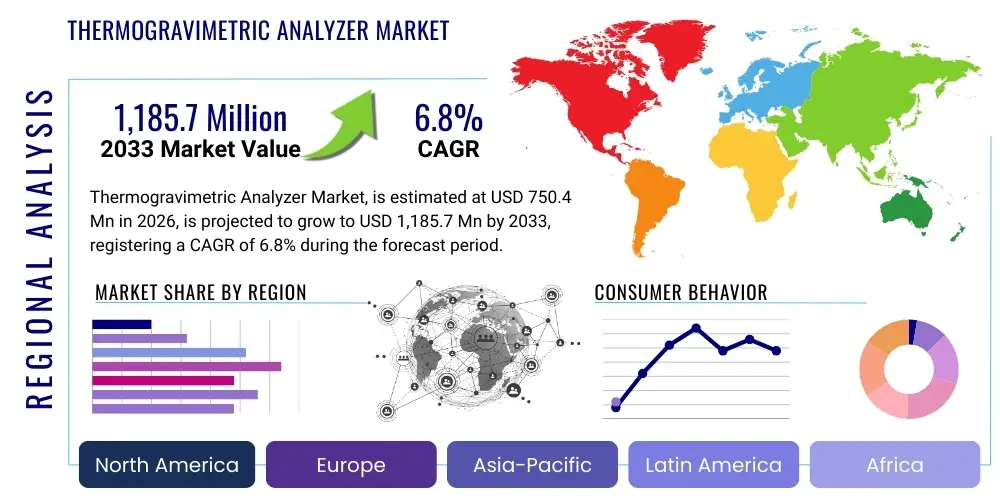

Thermogravimetric Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438490 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Thermogravimetric Analyzer Market Size

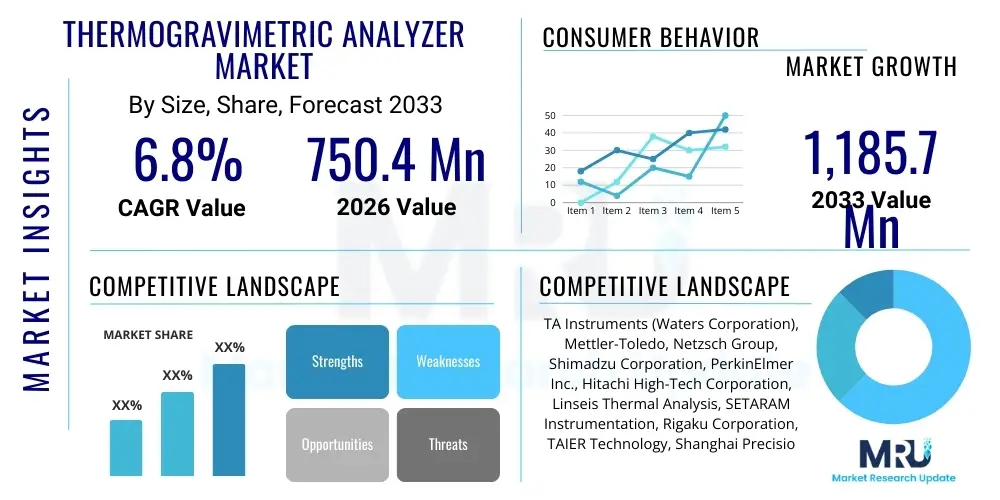

The Thermogravimetric Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750.4 Million in 2026 and is projected to reach $1,185.7 Million by the end of the forecast period in 2033.

Thermogravimetric Analyzer Market introduction

The Thermogravimetric Analyzer (TGA) Market encompasses instruments used for measuring changes in the weight of a substance as a function of temperature or time in a controlled atmosphere. TGA instruments are vital tools in materials science, chemistry, and engineering for characterizing materials, determining thermal stability, decomposition kinetics, and the composition of complex mixtures. The core product description involves high-precision microbalances coupled with furnaces and gas flow control systems, enabling measurements under diverse experimental conditions, including inert gas, oxidative environments, or vacuum. These advanced analytical capabilities make TGA indispensable across various research and industrial sectors.

Major applications of TGA span pharmaceuticals, polymers and plastics, food and beverage testing, minerals analysis, and environmental monitoring. In the polymer industry, TGA is critical for quality control by determining filler content, volatile components, and degradation temperatures, ensuring product performance and compliance. For pharmaceutical analysis, it helps in moisture content determination and assessing the purity and stability of drug compounds. The primary benefits derived from using TGA include highly accurate compositional analysis, rapid testing cycles, and the ability to simulate real-world thermal processes, providing crucial data for R&D and manufacturing optimization.

The market is primarily driven by the escalating demand for advanced material characterization techniques across global R&D activities and stringent regulatory requirements mandating precise quality assurance in end-user industries such as automotive and aerospace. Increased funding for nanotechnology research, where precise thermal stability measurements of nanoparticles are necessary, further propels the adoption of TGA systems. Furthermore, technological advancements leading to the development of hyphenated techniques, such as TGA-FTIR or TGA-MS, which provide simultaneous information on mass loss and the chemical identity of evolved gases, significantly enhance the utility and value proposition of these instruments, fueling sustained market expansion.

Thermogravimetric Analyzer Market Executive Summary

The Thermogravimetric Analyzer market is experiencing robust growth driven by accelerating digitalization in laboratories and the increasing complexity of materials requiring rigorous thermal analysis. Key business trends indicate a strong move toward integrated, high-throughput TGA systems, often bundled with sophisticated software for kinetic analysis and predictive modeling. Strategic collaborations between instrument manufacturers and specialized research institutions are becoming prominent, focusing on developing application-specific TGA solutions for emerging fields like battery technology and advanced ceramics. Furthermore, companies are prioritizing modular systems that allow users to easily integrate complementary techniques (like Differential Scanning Calorimetry or Mass Spectrometry) to offer comprehensive analytical platforms, thereby maximizing customer investment and expanding the instrument’s research scope.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to massive investments in chemical manufacturing, pharmaceutical R&D, and government initiatives promoting advanced materials research in countries like China, India, and South Korea. North America and Europe, while mature, maintain dominance in terms of technology adoption and high-end instrument sales, driven by established regulatory frameworks and high levels of academic research funding. The shift of manufacturing bases toward APAC necessitates localized support and service networks, influencing global distribution channel strategies. Regulatory convergence and standardization efforts worldwide also impact regional market dynamics, pushing for globally validated TGA methods.

Segment trends reveal that the most significant growth is projected in the Pharmaceutical and Biotechnology segment, spurred by the need for precise moisture analysis and polymorphism studies of complex drug formulations. By product type, the demand for TGA integrated systems (Hyphenated TGA) is significantly outpacing standalone TGA units, reflecting the industry's need for simultaneous, multi-parameter analysis. Instrument manufacturers are focusing R&D efforts on enhancing sensor sensitivity and temperature range capabilities to cater to demanding applications in metallurgy and high-performance engineering materials, ensuring segment growth across high-temperature TGA variants.

AI Impact Analysis on Thermogravimetric Analyzer Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Thermogravimetric Analyzer Market frequently revolve around automation capabilities, data interpretation efficiency, and predictive maintenance. Common concerns center on whether AI can accurately model complex decomposition kinetics faster than traditional methods, the necessary data infrastructure for AI deployment in laboratories, and the potential for AI to standardize TGA methodologies across different geographical locations. Expectations are high regarding AI’s ability to handle the large datasets generated by hyphenated TGA systems, automatically detect anomalies, and optimize experimental parameters, thereby reducing human error and accelerating research timelines. The overarching theme is the integration of machine learning algorithms to transform raw thermal data into actionable material insights with minimal user intervention, moving TGA from a purely measurement tool to a powerful predictive analytical platform.

AI's primary influence is expected in enhancing the operational efficiency and analytical depth of TGA instruments. Machine learning algorithms can be trained on vast thermal data libraries to identify patterns related to material decomposition pathways, stability profiles, and additive effects that might be obscure to manual analysis. This capability drastically reduces the time required for method development and validation, particularly crucial in high-throughput environments like quality control labs or materials screening facilities. Furthermore, AI can enable automated calibration routines and diagnostics, ensuring the instrument maintains optimal performance and reducing unscheduled downtime, which is a major factor in maintaining laboratory productivity.

Beyond data processing, AI systems are beginning to integrate into the TGA instrument control layer, offering smart scheduling and adaptive experimentation. For instance, based on preliminary TGA data, an AI system could autonomously adjust heating rates, gas flows, or even switch to a complementary technique (like MS or FTIR) to maximize the information yield from a single sample run. This transition towards 'smart labs' significantly accelerates the pace of materials innovation, especially in emerging areas such as battery material cycling studies where thousands of thermal tests are required to optimize performance and longevity. The combination of high-precision TGA hardware with intelligent software represents the next paradigm shift in thermal analysis.

- Accelerated Kinetic Modeling: AI facilitates faster, more accurate prediction of decomposition kinetics and activation energy.

- Automated Data Interpretation: Machine learning algorithms enable automatic classification of thermal events and compositional analysis from complex thermograms.

- Predictive Maintenance: AI monitors instrument health, predicting potential hardware failures and optimizing service schedules.

- Smart Experiment Design: Autonomous optimization of heating profiles, atmosphere control, and sample preparation parameters.

- Enhanced Quality Control: AI enables real-time anomaly detection in manufacturing quality control processes using TGA data signatures.

- Integration with Digital Twins: Creation of virtual material models based on TGA data for simulating real-world performance under thermal stress.

DRO & Impact Forces Of Thermogravimetric Analyzer Market

The dynamics of the Thermogravimetric Analyzer market are shaped by a confluence of driving factors, operational restraints, technological opportunities, and significant impact forces. Key drivers include the exponential increase in global research and development expenditure, particularly in emerging economies focused on high-tech manufacturing, and the stringent global standardization of quality testing protocols in regulated industries like aerospace and pharmaceuticals. The pervasive need for detailed material characterization to ensure product safety and performance, coupled with the rapid innovation cycle in advanced materials (e.g., composites, high-temperature alloys), fundamentally fuels the demand for high-performance TGA systems. This sustained industrial and research requirement forms the primary momentum driving market growth globally.

Despite strong driving forces, the market faces significant restraints, notably the substantial initial investment required for purchasing and installing advanced TGA and hyphenated systems. The high capital expenditure can be prohibitive for smaller academic institutions or start-up laboratories, particularly in developing regions. Furthermore, the operation and maintenance of these sophisticated instruments require highly skilled technical personnel, contributing to high operational costs and creating a barrier to widespread adoption. While manufacturers are attempting to simplify user interfaces, the complexity of interpreting kinetic and thermodynamic data remains a constraint, necessitating continuous, specialized user training.

Opportunities for market expansion are abundant, primarily centered around the rise of additive manufacturing (3D printing), which necessitates rigorous thermal analysis of powdered materials and resins before and after processing. The booming electric vehicle (EV) market presents a massive opportunity for TGA application in characterizing battery components (anodes, cathodes, electrolytes) for thermal stability and safety testing. Technological evolution, particularly miniaturization and the development of portable TGA systems for field use or rapid industrial checks, also opens new market segments. The principal impact forces affecting the market include technological advancements in sensor technology (improving resolution and sensitivity), globalization leading to increased competition and pricing pressure, and regulatory shifts, such especially those impacting pharmaceutical quality control (ICH guidelines), which mandates specific thermal stability testing requirements.

Segmentation Analysis

The Thermogravimetric Analyzer market is systematically segmented based on product type, application, end-user, and operating temperature range, allowing for a precise understanding of industry demand patterns and technological needs. Product segmentation primarily differentiates between standalone TGA units, which are cost-effective and suitable for basic analysis, and the more advanced hyphenated TGA systems (such as TGA-MS and TGA-FTIR), which provide unparalleled simultaneous chemical and thermal data. Application segmentation highlights the crucial roles of TGA across diverse fields, where the analysis methods are customized for specific material types, ranging from polymeric decomposition studies to inorganic residue analysis, influencing instrument design specifications and sensor requirements across the board.

The End-User segment provides insight into the major consumer sectors driving procurement decisions, dominated by industrial entities like chemical and materials manufacturing firms, followed closely by academic and government research institutions. Industrial users prioritize robustness, high throughput, and compliance with quality standards, whereas research institutions focus on high sensitivity, broad temperature ranges, and compatibility with experimental flexibility. Furthermore, the market is differentiated by the operating temperature range, with high-temperature TGA systems catering to specialized industrial applications like ceramics and metallurgy, requiring instrumentation capable of reaching up to 1500°C or higher, significantly impacting the component materials used in furnace construction.

This comprehensive segmentation allows market players to tailor their product development and marketing strategies to specific niches. For instance, the high growth expected in the pharmaceutical segment mandates instruments with precise weight control and regulated environment features, aligning with Good Manufacturing Practices (GMP). Conversely, the demand from the environmental testing sector focuses on TGA's ability to analyze pollutants, residues, and waste materials effectively. The segmentation underscores the versatility of TGA technology and its customized utility across various industrial landscapes, driving targeted innovation in specific product categories.

- Product Type:

- Standalone TGA

- Hyphenated TGA (TGA-MS, TGA-FTIR, TGA-GC)

- Integrated TGA (TGA/DSC or TGA/DTA)

- Application:

- Material Characterization

- Thermal Stability Analysis

- Compositional Analysis

- Decomposition Kinetics

- Moisture and Volatile Content Determination

- End-User:

- Chemical and Petrochemical Industry

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Polymer and Plastic Manufacturing

- Food and Beverage Industry

- Metals and Mining

- Temperature Range:

- Standard Temperature TGA (Up to 1000°C)

- High Temperature TGA (1000°C and above)

Value Chain Analysis For Thermogravimetric Analyzer Market

The value chain for the Thermogravimetric Analyzer market begins with the upstream suppliers, focusing heavily on specialized component manufacturing. This includes suppliers of high-precision microbalances, often manufactured with proprietary technology to achieve nanogram sensitivity, high-temperature furnace materials (like specialized ceramics and refractory metals), and highly accurate temperature and gas flow control systems. The performance and reliability of the final TGA instrument are critically dependent on the quality and precision of these specialized upstream components. Key strategic considerations at this stage involve securing stable supply chains for proprietary materials and maintaining robust quality control over precision mechanical and electronic components.

The core of the value chain involves instrument manufacturing and assembly, where raw components are integrated with proprietary software and electronics. Major TGA manufacturers focus heavily on R&D for developing advanced sensor technology, improving software for complex kinetic analysis, and creating user-friendly interfaces. Distribution channels play a critical role; due to the high value and technical complexity of TGA systems, direct distribution via the manufacturer's specialized sales team is common, particularly for large industrial and government contracts. However, indirect distribution through regional distributors and specialized scientific equipment dealers is also essential for reaching smaller academic labs and providing localized support, especially in emerging markets.

The downstream segment encompasses the installation, training, application support, and after-sales services, which contribute significantly to the total cost of ownership and customer satisfaction. Given the complexity of applications like hyphenated TGA or high-temperature analysis, specialized application scientists are often required to provide in-depth training and method development support to end-users. The downstream value is enhanced by ongoing software updates, predictive maintenance services, and calibration contracts. This emphasis on post-sales support ensures instrument longevity and maximizes utility, reinforcing the manufacturer's relationship with the end-user and creating a crucial competitive differentiator in this technologically intensive market.

Thermogravimetric Analyzer Market Potential Customers

Potential customers for Thermogravimetric Analyzers are diverse, spanning multiple high-value industries where precise material thermal characterization is non-negotiable for safety, quality, and performance. The primary segment consists of large Chemical and Petrochemical corporations that utilize TGA for analyzing polymer stability, catalyst performance, and residue content in oil samples. These corporations are high-volume buyers, often requiring multiple units for centralized R&D facilities and decentralized quality control labs, prioritizing robustness and ease of integration into existing lab information management systems (LIMS).

Another crucial end-user segment is the Pharmaceutical and Biotechnology industry. Buyers here, including both multinational pharmaceutical giants and specialized Contract Research Organizations (CROs), use TGA extensively for moisture sorption analysis, solvent residue determination, and assessing the thermal degradation of Active Pharmaceutical Ingredients (APIs) and excipients. Regulatory compliance (e.g., FDA, EMA standards) dictates procurement decisions, focusing on instruments that offer validation documentation, traceable calibration, and adherence to GLP/GMP requirements.

Academic institutions, government research laboratories, and material science centers form a significant third category of buyers. These customers prioritize instruments with advanced features, high flexibility, and compatibility with various research techniques, often favoring hyphenated TGA systems for cutting-edge studies in nanotechnology, advanced composites, and renewable energy materials (like fuel cells and batteries). While their purchasing power may be lower than large corporations, their collective demand for specialized, high-sensitivity instrumentation drives technological advancements in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.4 Million |

| Market Forecast in 2033 | $1,185.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TA Instruments (Waters Corporation), Mettler-Toledo, Netzsch Group, Shimadzu Corporation, PerkinElmer Inc., Hitachi High-Tech Corporation, Linseis Thermal Analysis, SETARAM Instrumentation, Rigaku Corporation, TAIER Technology, Shanghai Precision & Scientific Instrument Co., Skalar Analytical, Thermo Fisher Scientific, Malvern Panalytical (Spectris), Bio-Rad Laboratories, Metrohm AG, Anton Paar, Teledyne Technologies, Bruker Corporation, Agilent Technologies. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermogravimetric Analyzer Market Key Technology Landscape

The technological landscape of the Thermogravimetric Analyzer market is characterized by ongoing advancements focused on improving sensitivity, expanding operational range, and enhancing analytical capability through integration. A foundational technology involves the use of highly sensitive magnetic suspension balances or cantilever balances, essential for accurately measuring minute weight changes, often in the microgram or nanogram range, which is critical for analyzing small or precious samples. Coupled with this is sophisticated furnace technology, employing materials like silicon carbide or platinum rhodium windings, capable of achieving exceptional temperature uniformity and rapid heating/cooling rates while maintaining precise temperature control, vital for accurate kinetic studies. Recent innovations focus on reducing thermal lag and improving baseline stability across wide temperature scans.

The most significant technological trend is the proliferation of hyphenated techniques. TGA is increasingly coupled with Mass Spectrometry (TGA-MS) and Fourier-Transform Infrared Spectroscopy (TGA-FTIR). TGA-MS is utilized to identify the molecular weight and structure of evolved gases during material decomposition, providing chemical insight into the degradation process. TGA-FTIR offers functional group identification of these volatile products. This synergistic approach, integrating thermal and chemical analysis, transforms the TGA from a purely quantitative tool into a powerful qualitative and diagnostic instrument, substantially increasing the quality and depth of data obtained, particularly for complex polymeric or composite materials.

Furthermore, the market is seeing advancements in software and automation. Modern TGA systems utilize advanced data processing software incorporating machine learning algorithms for automatic method optimization and kinetic analysis (e.g., using isoconversional methods). Automation features, such as robotic sample changers, are becoming standard in industrial quality control labs, enabling high-throughput analysis and reducing manual intervention. Another emerging technology involves simultaneous TGA/Differential Scanning Calorimetry (TGA/DSC) integration, allowing for the concurrent measurement of mass change and heat flow (enthalpy changes), providing a complete picture of thermal events like melting, crystallization, and decomposition from a single sample run, which is highly valued in the polymer and pharmaceutical industries.

Regional Highlights

The Thermogravimetric Analyzer Market exhibits distinct regional dynamics influenced by industrial development, research funding, and regulatory environments. North America, particularly the United States, commands a substantial market share, driven by a large, well-funded pharmaceutical and biotechnology sector, stringent regulatory requirements in material testing (especially in aerospace and defense), and the presence of major key market players. High demand for cutting-edge hyphenated systems and substantial investment in academic research facilities ensure continuous market momentum. The focus in this region is on developing high-precision, automated systems capable of meeting complex R&D demands, particularly in battery technology and advanced composite manufacturing for automotive light-weighting initiatives.

Europe represents another key region, characterized by robust regulatory frameworks (such as REACH) and a strong emphasis on high-quality manufacturing standards across Germany, France, and the UK. The European market sees strong adoption of TGA systems in the chemical, polymer, and food safety sectors. Innovation is often concentrated around green chemistry and sustainability initiatives, requiring TGA to analyze bio-based materials and degradation products effectively. The shift towards circular economy models mandates precise compositional analysis of recycled materials, boosting demand for robust TGA instrumentation capable of detailed residue and filler content analysis. Investment is consistently high in both industrial R&D centers and public research consortia.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is primarily attributable to significant government investments in scientific infrastructure, the increasing presence of multinational manufacturing facilities, and the booming domestic pharmaceutical and chemical industries in countries like China and India. The demand in APAC is twofold: large-scale industrial quality control requiring reliable, high-throughput standalone TGA units, and advanced research laboratories investing in sophisticated hyphenated TGA systems for materials innovation. Low manufacturing costs and rapidly increasing R&D spending position APAC as the future hub for both production and consumption of TGA instruments. Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer emerging growth opportunities driven by expanding oil and gas exploration (requiring TGA for geological sample analysis) and developing pharmaceutical manufacturing sectors seeking to meet international standards.

- North America: Dominant market for high-end, hyphenated TGA systems, driven by advanced pharma R&D, defense, and aerospace sectors.

- Europe: Strong presence owing to strict environmental regulations and high manufacturing standards in the chemical and automotive industries.

- Asia Pacific (APAC): Fastest growing region due to massive government and private sector investment in infrastructure, chemistry, and battery technology R&D.

- Latin America: Emerging growth supported by expanding industrial base and increased investment in local quality control laboratories and academic institutions.

- Middle East & Africa (MEA): Growth driven by petrochemical analysis and local pharmaceutical manufacturing efforts aimed at achieving self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermogravimetric Analyzer Market.- TA Instruments (Waters Corporation)

- Mettler-Toledo

- Netzsch Group

- Shimadzu Corporation

- PerkinElmer Inc.

- Hitachi High-Tech Corporation

- Linseis Thermal Analysis

- SETARAM Instrumentation

- Rigaku Corporation

- TAIER Technology

- Shanghai Precision & Scientific Instrument Co.

- Skalar Analytical

- Thermo Fisher Scientific

- Malvern Panalytical (Spectris)

- Bio-Rad Laboratories

- Metrohm AG

- Anton Paar

- Teledyne Technologies

- Bruker Corporation

- Agilent Technologies

Frequently Asked Questions

Analyze common user questions about the Thermogravimetric Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Thermogravimetric Analyzer (TGA)?

The primary function of a TGA is to measure the change in the mass or weight of a sample as a function of temperature or time under a controlled atmosphere. This measurement determines thermal stability, decomposition temperatures, moisture content, and the composition of materials.

Why are hyphenated TGA systems (TGA-MS, TGA-FTIR) gaining traction in the market?

Hyphenated TGA systems are crucial because they offer simultaneous chemical identification of the gases evolved during thermal decomposition (using Mass Spectrometry or FTIR). This integration provides comprehensive qualitative and quantitative data, essential for detailed kinetic and material composition analysis.

Which end-user segment drives the highest demand for advanced TGA instrumentation?

The Pharmaceutical and Biotechnology sector, alongside the Polymer and Advanced Materials industry, drives the highest demand for advanced TGA. These sectors require high-precision TGA for critical quality control, ensuring product stability, purity, and compliance with strict regulatory standards (e.g., cGMP).

What is the impact of Artificial Intelligence (AI) on the future of TGA technology?

AI integration is expected to revolutionize TGA by enabling automated data interpretation, accelerating complex kinetic modeling, optimizing experimental parameters autonomously, and facilitating predictive maintenance, thereby significantly increasing laboratory throughput and analytical depth.

What are the key growth opportunities for TGA manufacturers in the near future?

Key opportunities lie in catering to the booming Electric Vehicle (EV) battery R&D market for characterizing anode/cathode materials, supporting the rapid expansion of additive manufacturing (3D printing) material analysis, and developing compact, portable TGA units for field and quality control applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager