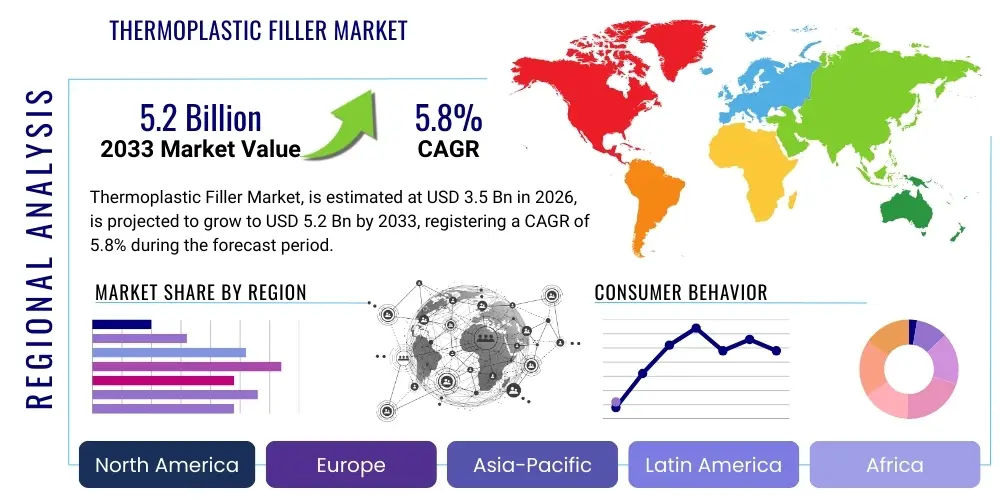

Thermoplastic Filler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438616 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thermoplastic Filler Market Size

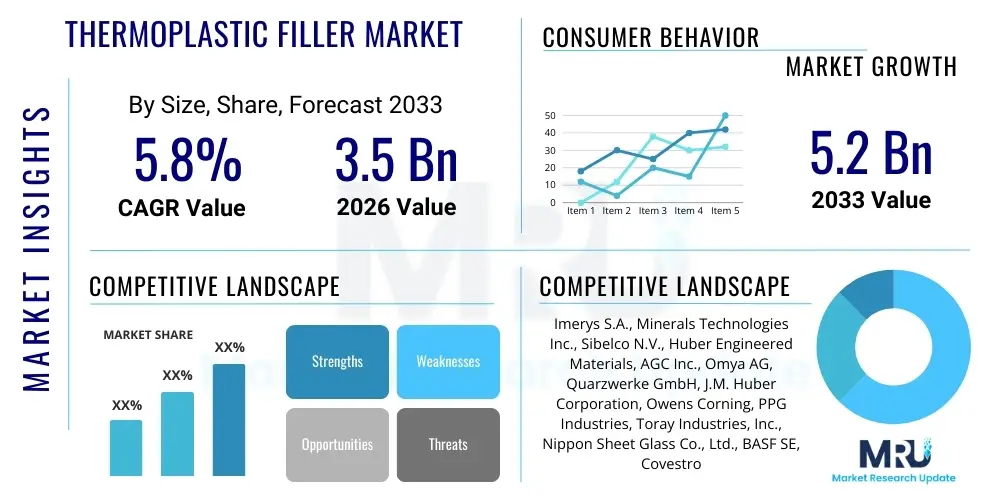

The Thermoplastic Filler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Thermoplastic Filler Market introduction

The Thermoplastic Filler Market encompasses the production and distribution of various inorganic and organic materials incorporated into thermoplastic polymers to enhance specific mechanical, thermal, electrical, and aesthetic properties. These materials, which include mineral fillers like talc, calcium carbonate, and mica, as well as synthetic fibers such as glass and carbon fibers, are critical components in compounding processes. The primary objective of using fillers is often twofold: to improve the performance characteristics of the base resin, such as stiffness, strength, dimensional stability, and flame retardancy, and simultaneously to reduce the overall material cost of the final product. The integration of high-performance fillers allows manufacturers to tailor materials precisely for demanding applications across several key industries.

Thermoplastic fillers are widely utilized across a spectrum of major applications, predominantly in the automotive, construction, electrical and electronics (E&E), and packaging sectors. In the automotive industry, fillers improve the impact resistance and stiffness of interior and exterior components, contributing to vehicle lightweighting and fuel efficiency. For the construction sector, they enhance the durability and weather resistance of piping, profiles, and decking materials. Key benefits derived from the incorporation of these fillers include superior wear resistance, increased hardness, improved processing characteristics, and controlled thermal expansion. The ability to modify rheological properties during processing makes fillers indispensable for complex injection molding and extrusion operations.

The market growth is fundamentally driven by the escalating demand for high-performance, lightweight materials, particularly within the automotive and aerospace industries seeking to comply with stringent environmental and fuel economy regulations. Furthermore, the rapid expansion of the construction sector in emerging economies fuels the consumption of basic mineral fillers, while the miniaturization trend in the E&E sector necessitates specialized fillers offering enhanced dielectric properties and thermal management capabilities. Technological advancements in surface treatment and nanoscience, leading to the development of highly specialized nanofillers, are opening new frontiers for material optimization, solidifying the critical role of fillers in modern material science and industrial manufacturing.

Thermoplastic Filler Market Executive Summary

The global Thermoplastic Filler Market is currently characterized by robust expansion, primarily steered by the paradigm shift toward material lightweighting and performance enhancement across key end-use industries. Business trends indicate a strong focus on sustainability, driving demand for naturally derived and recycled fillers, such as wood flour and bio-based fibers. Major thermoplastic compounders are increasingly investing in sophisticated compounding technologies, including twin-screw extruders and reactive extrusion methods, to achieve optimal filler dispersion and adhesion, which are critical for maximizing mechanical property improvements. Furthermore, strategic collaborations between raw material suppliers, filler producers, and final product manufacturers are becoming common, aimed at co-developing customized filler solutions tailored for niche applications like electric vehicle battery housings and high-temperature industrial parts. Pricing dynamics remain competitive, influenced heavily by energy costs, mineral resource extraction efficiency, and logistics infrastructure, necessitating optimized supply chain management.

Regional trends reveal that the Asia Pacific (APAC) region dominates the market, exhibiting the highest growth rate due to massive industrial expansion, particularly in China and India, focusing on infrastructure development, automotive manufacturing, and consumer electronics production. North America and Europe, while mature markets, show steady growth driven by the stringent regulatory environment promoting high-performance engineering plastics and the rapid adoption of specialized fillers in demanding high-value applications, such as medical devices and specialized aerospace components. Europe, in particular, leads the way in the application of recycled polymer matrices blended with performance fillers, aligning with the region’s circular economy mandates. Investments in research and development concerning surface modification of fillers are significantly higher in these developed economies to unlock superior performance attributes.

Segmentation trends highlight the preeminence of mineral fillers, particularly Calcium Carbonate and Talc, due to their low cost, wide availability, and effectiveness in general-purpose applications. However, the fastest growth is observed in high-performance segments, specifically Glass Fiber and Carbon Fiber, driven by their unmatched strength-to-weight ratio, making them indispensable for structural components in the aerospace and advanced automotive sectors. In terms of application, the Automotive segment continues to be the largest consumer, while the Electrical and Electronics (E&E) segment is forecast to display an accelerating CAGR, fueled by the demand for thermally conductive and electrically insulating fillers necessary for heat dissipation in sophisticated electronic devices and components used in 5G infrastructure. Market participants are adjusting their product portfolios to cater specifically to these burgeoning high-growth segments, often through the introduction of masterbatches containing high filler concentrations for easier processing.

AI Impact Analysis on Thermoplastic Filler Market

Common user inquiries regarding AI’s influence on the Thermoplastic Filler Market frequently center on predictive quality control, optimization of compounding formulas, and automation of material inspection processes. Users are keen to understand how AI-driven simulation tools can accelerate the material development lifecycle by accurately predicting the performance of new filler/polymer combinations without extensive physical testing. Key concerns revolve around the capital investment required for adopting AI-enabled systems and the need for specialized data scientists within traditional polymer manufacturing environments. Expectations are high regarding AI’s capability to minimize material waste, optimize energy consumption during compounding, and ensure consistency in filler dispersion, which is notoriously challenging to manage using conventional methods. The overarching theme is leveraging AI and machine learning (ML) for enhanced efficiency, personalized material design, and superior quality assurance in high-volume production.

- AI algorithms optimize filler loading levels and dispersion kinetics, reducing material wastage.

- Predictive maintenance schedules for compounding machinery are generated by AI, minimizing downtime and increasing operational efficiency.

- Machine learning models simulate the final mechanical and thermal properties of filled plastics, significantly accelerating the research and development phase.

- Computer vision systems, powered by AI, enable high-speed, accurate quality inspection of filler morphology and particle size distribution.

- AI-driven supply chain management forecasts demand fluctuations for specific fillers and raw materials, optimizing procurement strategies.

- Enhanced customization of thermoplastic compounds is facilitated by ML, allowing precise formulation based on complex application requirements.

DRO & Impact Forces Of Thermoplastic Filler Market

The Thermoplastic Filler Market is propelled by several robust drivers, most notably the pervasive trend toward vehicle lightweighting mandated by stringent governmental regulations aimed at reducing carbon emissions and improving fuel economy. Fillers, especially high-performance variants like glass and carbon fibers, enable the replacement of heavier metallic parts with reinforced plastic components without compromising structural integrity. Secondly, the rapid urbanization and infrastructure development in emerging economies, particularly across the APAC region, have created a massive demand for construction materials, increasing the consumption of commodity mineral fillers such as calcium carbonate and talc for PVC pipes and window profiles. Furthermore, the rising need for flame-retardant materials in the E&E sector and public transport infrastructure further drives the adoption of specialized mineral and synthetic fillers.

However, the market faces significant restraints. Volatility in the price and supply chain of key raw materials, including crude oil (which affects synthetic polymer prices) and extracted minerals, poses a challenge to stable production costs and pricing strategies. Regulatory hurdles related to mineral extraction and processing, particularly environmental restrictions concerning silica dust exposure and wastewater management, increase operational complexity and costs. Moreover, achieving optimal dispersion of fillers, especially nanoscale fillers, within the polymer matrix remains a technical challenge; poor dispersion can lead to reduced mechanical performance, undermining the primary purpose of filler addition. The need for specialized compounding equipment and expertise further restricts market entry for smaller players.

Significant opportunities are present in the expansion of high-growth niche applications, particularly the burgeoning market for electric vehicles (EVs), which require advanced thermoplastic composites for battery enclosures, structural frames, and thermal management systems, necessitating fillers with superior electrical insulation or conductivity properties. The development and commercialization of bio-based and sustainable fillers, such as recycled carbon fibers and natural fibers (e.g., cellulose, hemp), represent a major avenue for future growth, aligning with global sustainability goals and consumer preferences. The major impact forces governing the market include technological advancements in surface modification techniques, which significantly improve the interfacial adhesion between the filler and the polymer matrix, thereby unlocking superior material performance. Secondly, global macroeconomic stability directly impacts construction and automotive production, acting as a crucial external force influencing overall market demand.

Segmentation Analysis

The Thermoplastic Filler Market is extensively segmented based on the type of material, the form in which it is supplied, the specific thermoplastic resin used, and the primary end-use industry application. Understanding these segmentations is vital for manufacturers to tailor product offerings and market strategies effectively, targeting high-growth areas. The market exhibits a clear bifurcation between commodity mineral fillers, which account for the largest volume due to their cost-effectiveness and broad application base, and performance-driven synthetic fillers, which capture higher value despite lower volume, owing to their specialized properties necessary for demanding technical applications like aerospace and high-end automotive components. Geographic segmentation further differentiates demand profiles, with mature markets focusing on specialized, high-cost performance fillers, while developing regions prioritize high-volume mineral fillers for infrastructure development.

- By Type:

- Mineral Fillers

- Calcium Carbonate (Ground and Precipitated)

- Talc

- Mica

- Kaolin

- Wollastonite

- Silica

- Glass Fibers

- Chopped Strands

- Continuous Filaments

- Milled Fibers

- Natural Fibers

- Wood Flour

- Cellulose

- Jute, Hemp, and Flax Fibers

- Synthetic Fibers and Others

- Carbon Fiber

- Aramid Fiber

- Metallic Fillers

- Conductive Carbon Black

- By Form:

- Powder/Granules

- Fibers

- Beads/Spheres (e.g., Glass Microspheres)

- By Application/End-Use Industry:

- Automotive (Interior, Exterior, Under-the-Hood Components)

- Construction (Pipes, Profiles, Roofing)

- Electrical and Electronics (E&E) (Housings, Connectors, Insulation)

- Packaging (Films, Rigid Containers)

- Industrial/Consumer Goods

- Aerospace and Defense

- By Thermoplastic Resin:

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- High-Performance Thermoplastics (PEEK, PPS)

Value Chain Analysis For Thermoplastic Filler Market

The value chain for the Thermoplastic Filler Market begins with the upstream processes involving the extraction and refinement of raw materials. This includes mining operations for mineral fillers (e.g., limestone for calcium carbonate, talc deposits, silica sand) and the manufacturing of synthetic base materials (e.g., glass production for glass fibers, precursor synthesis for carbon fibers). The efficiency and purity achieved during this extraction and initial processing stage are critical determinants of the final filler quality and cost. Key challenges in the upstream sector involve compliance with environmental regulations, securing stable mineral supply, and managing the high energy intensity required for processes like calcination or fiber drawing. Specialized chemical treatment providers also form part of the upstream segment, offering coupling agents and surface modifiers necessary to ensure optimal compatibility between the filler and the polymer matrix, which is a vital step for performance enhancement.

The midstream of the value chain is dominated by filler processing and compounding activities. Filler producers refine, size, coat, and often micronize or nanonize the raw materials to meet specific particle size and surface area requirements of the polymer compounders. Compounders then mix the fillers with thermoplastic resins (e.g., PP, PA, PVC) in precise ratios using high-shear mixing equipment, such as twin-screw extruders, to produce ready-to-use compounds, masterbatches, or reinforced pellets. This compounding stage is technically intensive, requiring rigorous quality control over dispersion homogeneity and thermal stability. Downstream operations involve the utilization of these filled thermoplastic compounds by fabricators and molders, who use techniques like injection molding, extrusion, or blow molding to produce final components for end-use industries such as automotive parts, construction profiles, or electronic housings. Performance validation and certification of these final components are integral to the downstream process, ensuring they meet application-specific standards.

The distribution channel utilizes a mix of direct and indirect sales methods. Direct sales are prevalent for large-volume, customized orders, particularly those involving high-performance fillers sold directly from compounders to Tier 1 automotive suppliers or major construction material manufacturers. This allows for detailed technical support and tailored logistics solutions. Indirect distribution involves leveraging specialized chemical distributors and regional agents who manage inventory, warehousing, and delivery of standard filler grades and masterbatches to smaller molders and processors. The choice of channel depends on factors like geographical reach, product complexity, and volume requirements. Effective logistics, particularly for bulky mineral fillers, is crucial to manage transportation costs, which significantly influence the final product price delivered to the end-user fabrication plants globally.

Thermoplastic Filler Market Potential Customers

The potential customers for the Thermoplastic Filler Market are highly diverse, spanning various industrial and manufacturing sectors that require engineered materials for structural integrity, cost reduction, or specific functional attributes. The largest segment of potential buyers is the automotive manufacturing ecosystem, comprising original equipment manufacturers (OEMs) and their network of Tier 1 and Tier 2 suppliers. These customers purchase high volumes of filled plastics, primarily Polypropylene (PP) and Polyamide (PA) reinforced with talc, glass fibers, or carbon fibers, for components ranging from dashboards, bumpers, and engine covers to critical structural brackets and electric vehicle battery enclosures. Their purchasing criteria are dominated by material performance consistency, compliance with global safety standards, and adherence to lightweighting targets, making them highly demanding customers for advanced filler solutions.

Another major segment includes the construction and infrastructure industries, where potential customers are manufacturers of piping systems, window and door profiles, exterior cladding, and composite decking materials. These buyers primarily consume commodity mineral fillers, such as calcium carbonate and kaolin, incorporated into PVC and polyethylene (PE) matrices to enhance stiffness, increase impact resistance, and lower raw material costs. Their purchasing decisions are heavily influenced by bulk pricing, regional availability, and ease of processing. Furthermore, the Electrical and Electronics (E&E) sector represents a high-value customer base, requiring specialized fillers, including high-purity silica, boron nitride, and certain grades of carbon black, for applications demanding superior dielectric properties, effective thermal management, or electromagnetic shielding in components like connectors, circuit board substrates, and server housings.

Finally, the packaging sector, particularly manufacturers producing rigid containers, films, and blow-molded bottles, represents a constant high-volume customer base for cost-effective fillers. These customers use fillers to modify barrier properties, improve film stiffness, and reduce overall resin usage. Additionally, specialized markets such as aerospace, medical device manufacturing, and sporting goods production constitute niche, high-margin customers demanding the absolute highest performance, often requiring exotic or highly specialized fillers like high-modulus carbon fibers, aramid fibers, or medical-grade barium sulfate for specific applications where performance cannot be compromised. Meeting the needs of these diverse customers requires filler suppliers to offer a broad portfolio, coupled with strong technical application support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., Minerals Technologies Inc., Sibelco N.V., Huber Engineered Materials, AGC Inc., Omya AG, Quarzwerke GmbH, J.M. Huber Corporation, Owens Corning, PPG Industries, Toray Industries, Inc., Nippon Sheet Glass Co., Ltd., BASF SE, Covestro AG, Saint-Gobain, Unimin Corporation, Mondo Minerals, The Chemours Company, Evonik Industries AG, Cabot Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermoplastic Filler Market Key Technology Landscape

The technological landscape of the Thermoplastic Filler Market is highly dynamic, centered on enhancing the performance interface between the filler and the polymer matrix while optimizing processing efficiency. A primary technological focus is on surface modification and treatment of filler particles. This involves chemically functionalizing the filler surface using coupling agents, such as silanes, titanates, or specialized polymeric compatibilizers. These treatments significantly improve the wettability and interfacial adhesion between the typically hydrophilic inorganic fillers and the hydrophobic thermoplastic resins. Improved adhesion prevents phase separation under stress, leading directly to substantial gains in mechanical properties, including tensile strength, flexural modulus, and impact resistance. Advanced coating technologies are also employed to impart specific functionalities, such as conductivity, anti-microbial properties, or UV stabilization, directly onto the filler material before compounding.

Compounding technology represents another critical area of innovation. High-performance compounding relies heavily on sophisticated twin-screw extrusion systems, which offer superior control over shear rate, residence time, and temperature profiles. Modern extruders feature optimized screw geometries designed specifically to achieve high dispersion energy necessary for uniform distribution of ultrafine or nano-sized fillers without causing fiber breakage or thermal degradation of the polymer. Reactive extrusion is an emerging process where chemical reactions (e.g., grafting or polymerization) occur simultaneously during the compounding phase, enabling in-situ modification of the polymer or filler, leading to highly engineered composite materials with tailored properties. These processing advancements are essential for translating the potential benefits of new filler materials into commercial reality, ensuring consistent quality and maximizing throughput.

Furthermore, nanotechnology is profoundly influencing the market, with ongoing research into nanofillers such as carbon nanotubes (CNTs), graphene, and nanoclays. These materials offer unprecedented improvements in mechanical stiffness, electrical conductivity, and barrier properties at very low loading concentrations compared to conventional micron-sized fillers. The challenge remains the industrial-scale production and effective dispersion of these nanomaterials within highly viscous thermoplastic melts. Technological developments in masterbatch formulation—producing highly concentrated filler pellets—are simplifying the downstream processing for molders, ensuring safer handling of fine powders, and guaranteeing consistent dosing. Continuous process monitoring using advanced sensors and data analytics is also being adopted to maintain tighter control over particle size, morphology, and filler distribution during manufacturing, supporting the industry's shift towards Industry 4.0 principles.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed epicenter of growth in the Thermoplastic Filler Market, driven by robust industrial policies and massive investments in infrastructure and manufacturing capabilities, particularly in China, India, and Southeast Asian countries. The massive production volume of automotive components, coupled with aggressive expansion in consumer electronics and construction sectors, fuels the demand for both commodity mineral fillers (for cost control in large-scale applications) and high-performance glass and carbon fibers (for premium applications). Furthermore, the regional trend of localizing manufacturing and the emergence of strong regional compounders contribute significantly to the high consumption rates observed in APAC. Governments in countries like China are also promoting the use of lightweight materials to meet national environmental targets, boosting the usage of specialized composite fillers.

North America maintains a strong position as a key market, characterized by a focus on high-specification, technologically advanced applications. The stringent safety and performance regulations in the automotive and aerospace sectors necessitate the use of premium and high-performance fillers, such as specialized carbon fibers and advanced mineral grades, for lightweighting and enhanced thermal and electrical properties. The region exhibits high spending on research and development, particularly targeting fillers for niche markets like medical devices and high-end consumer goods, where performance and regulatory compliance are paramount. The presence of major global polymer producers and compounders further stimulates technological innovation and high-value product development within the region.

Europe represents a mature yet dynamic market, heavily influenced by circular economy initiatives and sustainability mandates. The demand in Europe is increasingly skewed toward sustainable options, including bio-based fillers, recycled polymer composites, and fillers designed for enhanced recyclability of the final product. While the automotive industry remains a major consumer, the focus is shifting towards electric vehicle platforms, demanding specialized conductive or thermally insulating fillers for battery systems. Regulatory frameworks like REACH significantly impact the use and classification of certain mineral fillers, pushing manufacturers towards safer, more traceable material sourcing and processing methods. The regional market shows strong uptake of customized masterbatch solutions to improve processing and reduce volatile organic compound (VOC) emissions.

- Asia Pacific (APAC): Dominates market volume and growth, driven by expansion in infrastructure, automotive production, and electronics manufacturing; characterized by high consumption of calcium carbonate and glass fibers.

- North America: Focuses on high-value, performance-driven applications in aerospace, advanced automotive (including EV battery components), and medical devices; high adoption rate of specialized carbon and glass fibers.

- Europe: Driven by sustainability and circular economy targets; strong demand for bio-based fillers, recycled content composites, and specialized fire-retardant grades for construction and rail applications.

- Latin America: Emerging growth market, primarily driven by construction activities and localized automotive assembly; significant opportunity for commodity mineral fillers.

- Middle East and Africa (MEA): Growth tied closely to infrastructure projects, especially in the Gulf Cooperation Council (GCC) countries; increasing demand for fillers in piping and insulation materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermoplastic Filler Market.- Imerys S.A.

- Minerals Technologies Inc.

- Sibelco N.V.

- Huber Engineered Materials

- AGC Inc.

- Omya AG

- Quarzwerke GmbH

- J.M. Huber Corporation

- Owens Corning

- PPG Industries

- Toray Industries, Inc.

- Nippon Sheet Glass Co., Ltd.

- BASF SE

- Covestro AG

- Saint-Gobain

- Unimin Corporation (part of Sibelco)

- Mondo Minerals (now part of Elementis Plc)

- The Chemours Company

- Evonik Industries AG

- Cabot Corporation

- O. Schoenenberger & Co. GmbH

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Thermoplastic Filler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the growth of the Thermoplastic Filler Market?

The primary drivers include the escalating global demand for lightweight materials in the automotive industry to meet fuel efficiency standards, significant growth in construction and infrastructure development, and the increasing need for high-performance, heat-resistant components in the Electrical and Electronics (E&E) sector.

How do mineral fillers like Talc and Calcium Carbonate differ from synthetic fillers such as Glass Fiber in terms of application?

Mineral fillers (Talc, CaCO3) are primarily used for cost reduction, stiffness enhancement, and improving dimensional stability in high-volume, general-purpose applications like PVC pipes and commodity plastics. Synthetic fillers (Glass Fiber, Carbon Fiber) are utilized for superior mechanical strength, high impact resistance, and structural integrity in specialized, high-performance engineering applications, such particularly in structural automotive parts and aerospace components.

Which region currently leads the global market in terms of consumption volume for thermoplastic fillers?

The Asia Pacific (APAC) region currently dominates the market consumption volume, driven by high industrial manufacturing output, massive infrastructure projects, and the expanding automotive and consumer electronics sectors across key economies like China and India.

What is the main technical challenge faced by manufacturers when incorporating nanofillers into thermoplastic resins?

The main technical challenge is achieving optimal dispersion of nanoscale fillers within the highly viscous polymer matrix. Poor dispersion results in agglomeration, which severely compromises the mechanical and physical property enhancements expected from these advanced materials.

What is the role of surface treatment technologies in the performance optimization of thermoplastic fillers?

Surface treatment technologies, such as applying coupling agents (e.g., silanes), chemically modify the filler surface. This modification significantly improves the interfacial adhesion between the filler and the polymer matrix, which is crucial for maximizing the transfer of stress and ensuring superior mechanical properties of the final composite material.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager