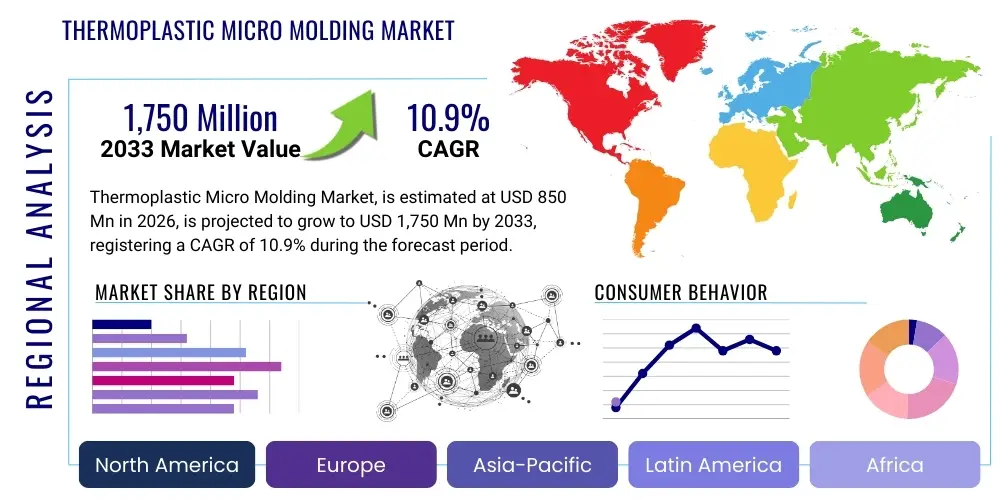

Thermoplastic Micro Molding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438492 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thermoplastic Micro Molding Market Size

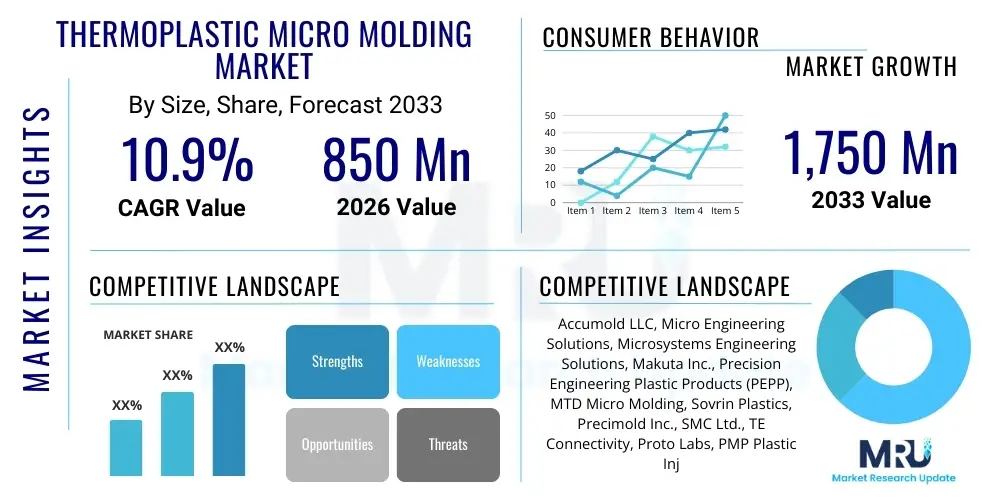

The Thermoplastic Micro Molding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.9% between 2026 and 2033. The market is estimated at $850 Million USD in 2026 and is projected to reach $1,750 Million USD by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for miniaturized, high-precision components across critical sectors such as medical devices, automotive electronics, and consumer communications. The requirement for tighter tolerances and complex geometries, coupled with the shift towards less invasive medical procedures, fundamentally underpins this accelerated growth trajectory.

Thermoplastic Micro Molding Market introduction

The Thermoplastic Micro Molding Market involves the specialized manufacturing process of producing highly intricate plastic components weighing mere milligrams, often featuring complex microstructures, tight tolerances, and dimensions measured in micrometers. This precision technology utilizes various engineering and high-performance thermoplastics, including Liquid Crystal Polymers (LCP), Polyether Ether Ketone (PEEK), and various polycarbonates, tailored specifically for demanding applications. The resulting products, such as microfluidic chips, sensor components, micro-gears, and specialized drug delivery mechanisms, are integral to the functionality of modern, miniaturized electronic and medical devices. The primary characteristic distinguishing micro molding is the extremely small shot size and the need for specialized injection molding machines designed to handle material volumes below one cubic centimeter, ensuring exceptional repeatability and component quality crucial for mission-critical uses.

Major applications of thermoplastic micro molded parts span the healthcare sector, specifically in minimally invasive surgical tools, hearing aids, and continuous glucose monitoring systems; the automotive industry, where they are utilized in miniaturized sensors for advanced driver-assistance systems (ADAS) and powertrain management; and the consumer electronics domain, serving as connectors and internal structural components in smart devices and wearables. The key benefits of employing thermoplastic micro molding include significant cost savings through mass production capabilities, superior material compatibility with sterilization processes, reduced component weight, and the ability to consolidate multiple component functions into a single molded part, thus simplifying assembly and enhancing reliability. The process also offers excellent surface finishes and dimensional accuracy previously attainable only through costly subtractive manufacturing techniques.

Key driving factors accelerating market adoption include relentless technological progress towards device miniaturization, which necessitates smaller, more functional components, particularly in the Internet of Things (IoT) landscape. Furthermore, stringent regulatory requirements in the medical sector demand high material purity and precision, favoring established micro molding processes. The increasing use of high-performance engineered resins that can withstand extreme temperatures, chemical exposure, and mechanical stress further expands the applicability of thermoplastic micro molding. The global rise in chronic diseases also fuels the demand for innovative, disposable medical diagnostic tools and therapeutic devices that rely heavily on micro molded components for their core functionality.

Thermoplastic Micro Molding Market Executive Summary

The Thermoplastic Micro Molding Market is characterized by intense innovation focused on materials science and machine precision, particularly driven by the medical device and automotive electronics sectors. Current business trends indicate a significant consolidation among specialized micro molders seeking to acquire proprietary expertise in tooling and automation, thereby offering vertically integrated services to end-users. The rising adoption of advanced metrology and quality control systems, often leveraging machine vision and statistical process control (SPC), is essential for validating sub-millimeter tolerances, reinforcing the market’s focus on zero-defect manufacturing. Furthermore, manufacturers are increasingly exploring bio-absorbable and biocompatible materials for niche medical applications, diversifying their material portfolio beyond standard high-performance resins like PEEK and LCP. This shift reflects a strategic move toward higher-margin, complex component production, minimizing competition from conventional injection molding techniques.

Regionally, North America and Europe currently dominate the market, primarily due to the concentration of leading medical device manufacturers and stringent regulatory environments that favor established, high-quality production methods. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, fueled by rapid industrialization, burgeoning electronics manufacturing bases, and substantial governmental investment in healthcare infrastructure, particularly in China and India. These developing economies are seeing increased outsourcing of high-precision component manufacturing, driving investment in micro molding capabilities locally. Specifically, the demand for complex automotive sensors and communication micro components is surging across APAC, providing a fertile ground for market expansion.

Segmentation trends highlight the dominance of high-performance engineered materials, especially LCP and PEEK, due to their superior thermal stability and mechanical strength required in medical and aerospace applications. In terms of application, the Medical and Healthcare segment maintains the largest market share, driven by the continuous launch of new micro-invasive devices, diagnostic consumables, and wearable health technology. Within the automotive sector, the increasing complexity and volume of electronic control units (ECUs) and sensor arrays, essential for electric vehicles (EVs) and autonomous driving systems, are propelling the demand for micro connectors and sensor housings. The integration of advanced automation and robotic handling systems within the micro molding process is becoming a key trend across all segments, ensuring efficiency and cost-effectiveness while maintaining micron-level precision.

AI Impact Analysis on Thermoplastic Micro Molding Market

Common user questions regarding AI's impact on the Thermoplastic Micro Molding Market center on optimizing the complex, high-variability processes inherent to producing ultra-small components. Users frequently inquire about AI's role in predictive maintenance for specialized micro molding machines and tooling, reducing expensive downtime, and how machine learning algorithms can ensure dimensional stability and quality control for parts with micron tolerances. There is significant interest in using AI for real-time process monitoring—adjusting parameters like melt temperature, injection speed, and mold temperature dynamically to compensate for minor material or environmental fluctuations. Furthermore, users explore the potential of Generative Design AI to optimize component structure and material usage early in the design phase, particularly for microfluidics and complex sensor geometries, minimizing iterative prototyping cycles and speeding up time-to-market. The consensus expectation is that AI will transition micro molding from a highly specialized, experience-dependent craft into a more standardized, data-driven, and highly automated manufacturing science.

- AI-powered Predictive Maintenance: Analyzing machine sensor data to anticipate tooling wear, reducing unscheduled downtime and extending tool life, critical for high-cost micro molds.

- Real-time Quality Control: Implementing machine learning algorithms and computer vision systems for rapid, automated inspection of micro components, exceeding human capability in detecting sub-micron defects.

- Process Parameter Optimization: Using prescriptive AI to dynamically adjust injection parameters (pressure, temperature, flow rate) based on historical data and real-time sensor feedback, ensuring consistent quality across high-volume runs.

- Generative Design Optimization: Applying AI tools during the R&D phase to create highly efficient, lightweight micro component designs, especially complex lattice structures or microfluidic channels, maximizing performance while minimizing material usage.

- Supply Chain and Inventory Management: Leveraging AI for predictive forecasting of material demand (high-performance resins), optimizing stocking levels, and mitigating supply chain risks associated with specialized thermoplastics.

- Automated Data Analysis: Processing vast amounts of metrology and production data faster than conventional methods, enabling swift identification of subtle process variations that impact micro component performance.

DRO & Impact Forces Of Thermoplastic Micro Molding Market

The dynamics of the Thermoplastic Micro Molding Market are profoundly shaped by a combination of strong drivers stemming from technological advancements and market demand, counterbalanced by significant constraints related to manufacturing complexity and cost, while substantial opportunities emerge from new application areas. The primary driver is the pervasive trend of device miniaturization across medical and consumer electronics, demanding component sizes and tolerances only achievable through micro molding. However, a major restraint is the extremely high initial capital expenditure required for specialized micro injection molding machines, advanced tooling, and cleanroom facilities, coupled with the scarcity of highly skilled engineers capable of designing and maintaining micron-tolerance molds. These forces collectively dictate the entry barriers and competitive landscape. The principal impact forces driving market evolution include the regulatory environment, particularly stringent standards in the healthcare sector, and continuous innovation in material science that enables molding of increasingly difficult, high-performance polymers.

Drivers primarily revolve around expanding application scopes. The transition to minimally invasive surgery has created an insatiable demand for micro components used in catheters, implants, and robotic surgery tools. Similarly, the automotive shift towards electrification and autonomous driving requires thousands of micro-sensors and connectors for data processing and safety systems. Furthermore, micro molding offers significant material waste reduction compared to machining, aligning with global sustainability initiatives. These inherent advantages position micro molding as the preferred method for high-volume, precision manufacturing where component reliability is paramount.

Restraints are complex and technical. Tooling for micro molding is incredibly precise, costly, and time-intensive to produce, making design iterations prohibitively expensive. Material handling of small pellets and powders also poses challenges, necessitating specialized feeding systems to prevent contamination and maintain dosing accuracy. Opportunities, conversely, are abundant, particularly in niche segments such as drug delivery systems (e.g., microneedle arrays), advanced optical components, and micro-electromechanical systems (MEMS) packaging. Expanding the use of thermoplastic micro molding in emerging fields like aerospace for lightweight satellite components and defense applications provides new avenues for strategic growth, leveraging the high-strength and low-weight characteristics of micro molded parts.

The interaction of these forces creates a highly competitive yet segmented market. Only firms that can master the combination of material science, specialized machinery, precision tooling, and rigorous metrology standards will thrive. The impact forces ensure that quality and compliance remain non-negotiable, compelling manufacturers to invest heavily in advanced automation and quality assurance systems, thus solidifying the market structure towards high-value, specialized producers.

Segmentation Analysis

The Thermoplastic Micro Molding Market is structurally segmented based on material type, application, and end-use, providing a detailed view of demand dynamics across various industrial sectors. The segmentation by material is crucial, as the choice of polymer dictates the performance characteristics of the final component, particularly in environments requiring high thermal, chemical, or mechanical resistance. High-performance engineering plastics constitute the largest and fastest-growing material segment, primarily due to their essential use in demanding medical and aerospace applications. Segmentation by application highlights the medical and healthcare industry as the dominant consumer, driven by continuous innovation in diagnostic and surgical devices. Geographically, the market analysis reveals distinct consumption patterns and technological adoption rates across North America, Europe, and the rapidly industrializing Asia Pacific region, influencing investment in manufacturing capacity.

Within the materials category, polymers like PEEK and LCP command premium pricing and high market value due to their biocompatibility and ability to maintain dimensional stability under harsh conditions, making them indispensable for implantable devices and sterilization cycles. Standard engineering plastics, such as Polycarbonate and Polyamide, are widely used in consumer electronics and automotive segments where cost-effectiveness and good mechanical properties are primary requirements. The evolving regulatory landscape and focus on sustainability are driving increased research into bio-absorbable and recycled thermoplastics suitable for micro molding, potentially shifting future material segmentation dynamics. Understanding these material preferences is vital for suppliers and processors optimizing their manufacturing strategies.

- Material Type:

- Polyether Ether Ketone (PEEK)

- Liquid Crystal Polymer (LCP)

- Polycarbonate (PC)

- Polyamide (Nylon)

- Polyethyleneimine (PEI)

- Others (COC, COP, ABS, PP, etc.)

- Application:

- Medical and Healthcare (Diagnostics, Surgical Components, Drug Delivery, Wearables)

- Automotive (Sensors, Connectors, Powertrain Components, ADAS Modules)

- Electronics and Telecommunications (Micro-Connectors, Fiber Optic Components, Sensor Housings)

- Industrial (Micro-Gears, Valves, Flow Meters)

- Aerospace and Defense (Lightweight Structural Components, Interconnects)

- End-Use:

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturing Organizations (CMOs)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Thermoplastic Micro Molding Market

The value chain for the Thermoplastic Micro Molding Market is highly specialized and knowledge-intensive, beginning with sophisticated upstream activities involving material and tooling suppliers, progressing through highly technical processing stages, and culminating in downstream distribution to demanding end-use industries. Upstream analysis focuses on specialized polymer producers providing high-purity, often custom-compounded engineering resins (like medical-grade PEEK or specialized LCPs) and precision toolmakers who use advanced techniques such as micro-machining and wire EDM to create multi-cavity molds with micron tolerances. These initial stages are capital-intensive and critical, as tool quality directly dictates component precision and lifespan, representing a significant barrier to entry for new market players. Material selection and supply chain stability are paramount due to the specialized nature and cost of high-performance thermoplastics.

The processing stage, which forms the core of the value chain, involves specialized micro molders operating highly precise micro injection molding machines, often in cleanroom environments, coupled with sophisticated metrology and automation systems. This stage adds the highest value through intellectual property related to process control, automation, and quality assurance protocols (e.g., ISO 13485 compliance for medical parts). Midstream players focus on optimizing cycle times and achieving zero-defect rates. Downstream activities involve distribution channels tailored to specific industrial requirements. Direct channels are predominantly used for large OEM customers, especially in the medical and automotive sectors, where molders often act as long-term strategic partners, managing rigorous technical specifications and supply security.

Indirect distribution involves specialized distributors or sales representatives who cater to smaller volume or niche industrial customers. However, given the technical complexity and the need for close collaboration on design and material validation, the market relies heavily on direct engagement between the micro molder and the end-user. This integrated approach ensures seamless communication regarding design changes, regulatory adherence, and final component performance. The overall efficiency and resilience of the value chain hinge on the synergy between material science expertise, ultra-precision tooling capabilities, and advanced manufacturing process control. Furthermore, the role of Contract Manufacturing Organizations (CMOs) is increasingly important, acting as integrated partners, taking responsibility for the entire production and assembly process for medical and electronic OEMs.

Thermoplastic Micro Molding Market Potential Customers

The potential customer base for the Thermoplastic Micro Molding Market is concentrated among large Original Equipment Manufacturers (OEMs) and specialized Contract Manufacturing Organizations (CMOs) operating in regulated, high-reliability sectors. The primary buyers are R&D departments and procurement teams within global medical device companies who require micro components for critical applications such as cardiovascular stents, neuro-stimulators, surgical robotics, and in-vitro diagnostics kits. These customers prioritize vendors demonstrating ISO 13485 certification, robust validation protocols, material traceability, and proven expertise in biocompatible polymers like PEEK and implantable silicones. The increasing complexity and frequency of disposable diagnostic tools further solidify the medical sector as the largest consumer of micro molded parts.

Another significant customer segment includes automotive Tier 1 and Tier 2 suppliers focused on developing advanced electronic systems for electric vehicles and autonomous driving. These customers require high-precision micro connectors, intricate sensor housings, and micro-gears capable of enduring harsh engine environments and meeting stringent functional safety standards (e.g., ASIL levels). The shift toward miniaturization in vehicles means traditional component suppliers are increasingly seeking out specialized micro molders. Finally, major consumer electronics and telecommunications companies are important buyers, requiring micro molded components for high-density interconnects, fiber optic alignments, and internal mechanisms in wearables, smartphones, and sophisticated camera systems, valuing high throughput and geometric repeatability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million USD |

| Market Forecast in 2033 | $1,750 Million USD |

| Growth Rate | 10.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Accumold LLC, Micro Engineering Solutions, Microsystems Engineering Solutions, Makuta Inc., Precision Engineering Plastic Products (PEPP), MTD Micro Molding, Sovrin Plastics, Precimold Inc., SMC Ltd., TE Connectivity, Proto Labs, PMP Plastic Injection Molding, Stack Plastics, Nolato AB, Injectplast S.r.l., Genesis Plastics, VEM Tooling, HTI Plastics, C&J Industries, Medical Molding |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermoplastic Micro Molding Market Key Technology Landscape

The technology landscape of the Thermoplastic Micro Molding Market is defined by continuous advancements aimed at achieving higher precision, faster cycle times, and greater material flexibility. Central to this landscape are specialized micro injection molding machines, which differ significantly from conventional machines by featuring ultra-low volume screw/plunger mechanisms, often utilizing two-stage shooting pots or highly responsive electric drives to control injection velocity and pressure with extreme accuracy. Key technological developments include machines designed with interchangeable molding inserts, allowing for rapid prototype changes and material trials without incurring the cost of entirely new tools. Furthermore, sophisticated thermal management systems for tooling are essential, employing techniques like conformal cooling channels fabricated via additive manufacturing, which drastically reduce cycle times and minimize warpage in micro components by ensuring uniform temperature distribution across the complex mold geometry.

Tooling technology is equally pivotal; modern micro molds frequently incorporate automated demolding techniques, such as micro-robotics or advanced pneumatic systems, necessary because the components are too fragile and small to be handled manually. The use of exotic tool materials, surface treatments (like PVD coatings), and sensor integration directly within the mold cavity (cavity pressure sensing) allows for real-time monitoring and feedback, enabling proactive adjustments to the process. Advances in micro-machining, including ultra-precision five-axis CNC milling and advanced grinding techniques, are crucial for achieving the necessary surface finish and dimensional fidelity on core pins and cavities that must be accurate to within 1-2 micrometers. These technologies underpin the repeatable and scalable production of millions of identical micro components.

Crucially, the metrology and quality assurance technology landscape has evolved significantly to validate the output. Traditional inspection methods are inadequate for micron-scale parts, necessitating the widespread adoption of high-resolution, non-contact measuring systems, primarily based on optical microscopy, laser scanning, and sophisticated coordinate measuring machines (CMMs) equipped with micro probes. The integration of Statistical Process Control (SPC) software with these measuring systems is standard practice, providing full traceability and validation documentation required by stringent regulatory bodies like the FDA. The future technological trajectory is geared towards leveraging automation and AI, integrating these precise machines and metrology systems into fully automated, lights-out manufacturing cells, further reducing labor costs and improving consistency.

Regional Highlights

- North America: North America holds a dominant position in the Thermoplastic Micro Molding Market, attributed primarily to the massive presence of leading medical device manufacturers and the strong emphasis on R&D investment, particularly in advanced diagnostics and surgical robotics. The stringent regulatory environment necessitates high-quality, verified manufacturing processes, favoring highly specialized micro molders. The United States acts as the epicenter, driving demand for high-performance resins like PEEK and LCP for implantable devices and advanced sensors. The automotive sector, particularly in the production of high-value electronic modules for EVs, further contributes to market growth, maintaining the region's lead in technology adoption and market value.

- Europe: Europe is a highly mature market, characterized by strong demand from the automotive, industrial, and medical sectors, especially in countries like Germany, Switzerland, and Ireland. Germany, known for its engineering excellence, is a hub for precision tooling and advanced automation, driving innovation in micro molding machine technology. Regulatory standards, such as the EU's Medical Device Regulation (MDR), demand high levels of traceability and validation, reinforcing the market for specialized, certified micro molders. The European market focuses heavily on sustainable manufacturing practices and is exploring bio-based and recycled thermoplastics for micro components.

- Asia Pacific (APAC): The APAC region is projected to register the fastest growth rate globally, driven by rapid expansion of the electronics manufacturing base, significant government investments in healthcare infrastructure, and the growing automotive industry, particularly in China, South Korea, and Japan. While Japan has historically focused on micro molding for consumer electronics, China is rapidly developing its capabilities, moving beyond large-scale contract manufacturing to high-precision component production. Increasing outsourcing activities and the massive local consumer base for medical consumables and smart wearables are key accelerators for market penetration in this region.

- Latin America (LATAM): The LATAM market remains relatively nascent but exhibits potential, primarily centered in Brazil and Mexico. Growth is driven by the expansion of local automotive assembly plants and gradual improvements in local healthcare infrastructure. However, the market often relies on imported specialized tooling and high-performance resins. The primary customer base involves smaller scale medical device assembly and automotive component manufacturing operations seeking localized supply chains.

- Middle East and Africa (MEA): The MEA region is the smallest market segment, characterized by limited local manufacturing capabilities for high-precision micro components. Market demand is largely concentrated in the petrochemical and specialized defense sectors, with component requirements typically fulfilled through imports from Europe and North America. Efforts to diversify economies, particularly in the Gulf Cooperation Council (GCC) countries, are expected to slowly stimulate local manufacturing, but infrastructure gaps remain a constraint.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermoplastic Micro Molding Market.- Accumold LLC

- Micro Engineering Solutions

- Microsystems Engineering Solutions

- Makuta Inc.

- Precision Engineering Plastic Products (PEPP)

- MTD Micro Molding

- Sovrin Plastics

- Precimold Inc.

- SMC Ltd.

- TE Connectivity

- Proto Labs

- PMP Plastic Injection Molding

- Stack Plastics

- Nolato AB

- Injectplast S.r.l.

- Genesis Plastics

- VEM Tooling

- HTI Plastics

- C&J Industries

- Medical Molding

Frequently Asked Questions

Analyze common user questions about the Thermoplastic Micro Molding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between micro molding and standard injection molding?

Micro molding focuses on producing extremely small components, typically weighing less than a gram, often requiring sub-micron tolerances and utilizing specialized machinery with precise shot-size control (micro-screws or plungers), distinguishing it from standard injection molding which handles larger volumes and lower precision requirements.

Which high-performance thermoplastics are most critical for micro molding applications?

Liquid Crystal Polymer (LCP) and Polyether Ether Ketone (PEEK) are critical. LCP offers exceptional flow characteristics for thin walls and high-temperature resistance, while PEEK provides biocompatibility and strength, making both essential for medical, aerospace, and high-reliability automotive parts.

How does tooling complexity impact the cost of thermoplastic micro molded components?

Tooling is the largest initial cost driver in micro molding due to the need for extreme precision (micron level) and specialized fabrication techniques (micro-machining, EDM). The complexity and required lifespan of the tool directly determine the overall cost, often necessitating specialized mold steels and expensive surface coatings.

Which market segment currently drives the largest demand for thermoplastic micro molding?

The Medical and Healthcare segment currently drives the largest demand, primarily due to the increasing adoption of minimally invasive surgical devices, advanced diagnostic kits, continuous monitoring systems, and other critical components requiring high precision, material purity, and regulatory compliance.

What role does automation play in ensuring quality in micro molding?

Automation is vital for quality control, handling, and consistency. Micro-robotics are used for degating and part removal (parts are too small for manual handling), while automated metrology systems (optical and laser scanning) ensure 100% inspection and real-time process monitoring to achieve zero-defect manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager