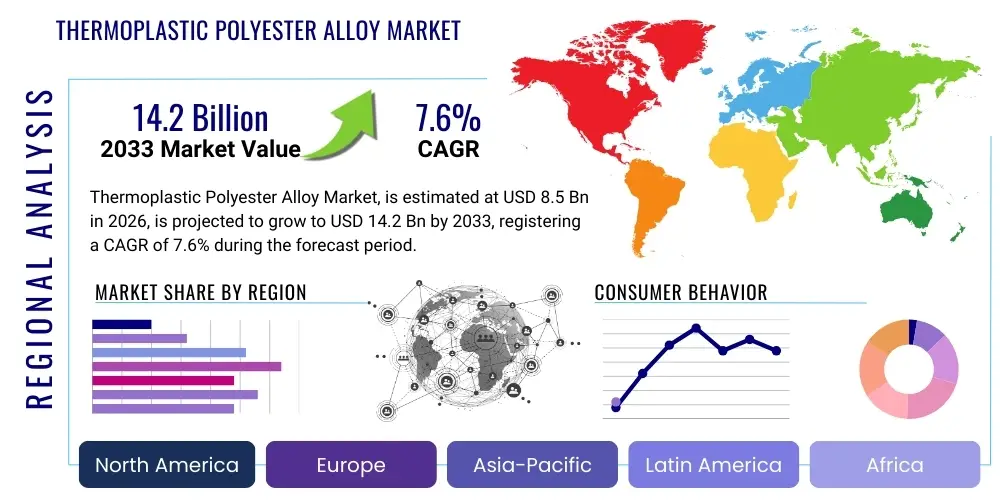

Thermoplastic Polyester Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438572 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thermoplastic Polyester Alloy Market Size

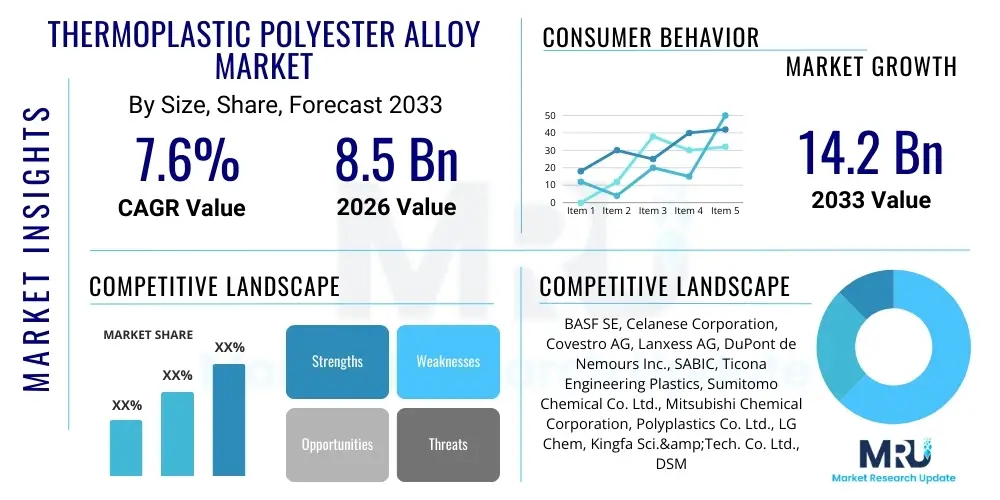

The Thermoplastic Polyester Alloy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 14.2 Billion by the end of the forecast period in 2033.

Thermoplastic Polyester Alloy Market introduction

Thermoplastic Polyester Alloys represent a critical class of high-performance engineering plastics formed by blending two or more distinct thermoplastic polyesters, such as Polybutylene Terephthalate (PBT) and Polyethylene Terephthalate (PET), often incorporating modifiers or other polymers like polycarbonate (PC) or elastomers to achieve enhanced properties. These sophisticated blends are engineered to overcome the limitations of individual polymers, resulting in materials that exhibit superior mechanical strength, excellent dimensional stability, high heat deflection temperatures, and remarkable chemical resistance. Their inherent versatility allows for tailored formulations that meet stringent requirements across diverse industries, positioning them as essential materials in modern manufacturing, particularly in sectors demanding durability and performance under harsh operating conditions. The ability to precisely tune properties like impact resistance and processability makes thermoplastic polyester alloys a preferred choice over traditional metals and standard plastics in demanding applications.

The primary applications driving the consumption of thermoplastic polyester alloys span the automotive, electrical and electronics (E&E), consumer goods, and industrial machinery sectors. In the automotive industry, these alloys are crucial for lightweighting initiatives, being utilized in under-the-hood components, interior parts, and exterior body panels where high stiffness, temperature resistance, and resistance to automotive fluids are necessary for prolonged operational life. Within the E&E sector, their excellent dielectric properties and flame retardancy make them indispensable for connectors, switches, circuit breakers, and other housing components. Furthermore, the material’s aesthetic appeal, combined with its robust mechanical characteristics, drives its adoption in durable consumer goods, including power tools and small appliances, ensuring product reliability and enhancing user experience.

Key driving factors accelerating market expansion include the increasing demand for lighter and more fuel-efficient vehicles, necessitating the replacement of metal components with high-performance plastics. Furthermore, the rapid growth of the electronics industry, particularly in Asia Pacific, coupled with the miniaturization trend in electronic devices, elevates the need for materials offering superior insulation and thermal management. The inherent benefits of these alloys—such as excellent processability via injection molding, allowing for complex geometries and faster production cycles—further solidify their market position. Ongoing research and development efforts focusing on bio-based and recyclable thermoplastic polyester alloys are also contributing significantly to market growth, aligning with global sustainability mandates and consumer preferences for eco-friendly material solutions.

Thermoplastic Polyester Alloy Market Executive Summary

The Thermoplastic Polyester Alloy market is characterized by robust business trends centered on technological innovation, strategic capacity expansions, and intense focus on application-specific formulations, particularly those catering to the electric vehicle (EV) segment and high-voltage electronics. Business strategies are increasingly prioritizing mergers, acquisitions, and strategic partnerships aimed at securing feedstock supplies, diversifying product portfolios, and gaining access to specialized blending technologies. Manufacturers are investing heavily in compounding facilities capable of producing highly customized alloys with enhanced flame retardancy (meeting strict UL standards) and improved flow characteristics for intricate parts. The competitive landscape is shifting towards providers who can offer integrated solutions and ensure stringent quality control, crucial for safety-critical automotive and medical applications, fostering consolidation among smaller regional players and larger global chemical conglomerates.

Regionally, the Asia Pacific (APAC) stands out as the undisputed powerhouse, driven by massive manufacturing output in China, South Korea, and Japan, especially across the automotive and consumer electronics supply chains. While APAC provides the volume, North America and Europe lead in terms of innovation and the demand for ultra-high-performance and sustainable (recycled content) alloys, often mandated by stricter regulatory frameworks like the European Union’s End-of-Life Vehicle directive. These developed regions exhibit higher average selling prices due to the premium nature of the required alloys. Emerging economies within APAC and Latin America are seeing rapid capacity build-up, shifting the geographical concentration of both production and consumption, making localized supply chain efficiency a key determinant of market success.

Segment trends emphasize the escalating demand for PBT/PC blends due to their excellent balance of mechanical properties and impact strength, widely adopted in automotive lighting systems and internal structural components. Furthermore, the segment focusing on specialty alloys, particularly those engineered for high dielectric strength necessary for EV battery housings and charging infrastructure components, is showing the highest growth trajectory. The compounding segment is evolving to integrate advanced reinforcement materials, such as long glass fibers and carbon nanotubes, to achieve lightweight structural composites. Sustainability is also a dominant segment trend, compelling vendors to certify recycled PBT and PET content, thus optimizing the cost structure and enhancing market appeal in environmentally conscious end-use sectors.

AI Impact Analysis on Thermoplastic Polyester Alloy Market

Common user questions regarding AI's impact on the Thermoplastic Polyester Alloy market frequently revolve around how artificial intelligence can accelerate the material discovery process, optimize complex compounding recipes, and improve operational efficiency in polymer manufacturing plants. Users are keen to understand if AI can effectively predict the performance characteristics of novel polyester blends, thereby reducing the lengthy and expensive process of traditional trial-and-error experimentation. Key concerns also center on AI’s role in managing raw material volatility—specifically predicting price fluctuations of key monomers like PTA and BDO—and optimizing complex global supply chains to mitigate risks. Furthermore, there is significant interest in how AI-powered quality control systems can enhance the consistency and reliability of specialized alloys, crucial for zero-defect standards in safety-critical sectors like medical devices and electric vehicle components.

The core themes emerging from these inquiries highlight an expectation that AI will fundamentally transform the R&D lifecycle, moving towards predictive material informatics. By analyzing vast datasets encompassing molecular structures, processing parameters, and resulting material performance, AI algorithms can identify optimal alloy compositions for specific application requirements much faster than conventional methods. This paradigm shift minimizes waste, speeds up time-to-market for innovative products, and allows manufacturers to respond rapidly to changing regulatory and technical demands. Integrating AI tools into simulation and modeling platforms is expected to become standard practice, enabling virtual testing of alloy robustness before physical production begins, representing a critical leap in efficiency and intellectual property generation.

Operationally, AI’s greatest immediate impact is projected in optimizing manufacturing processes, particularly injection molding and extrusion. Machine learning models can analyze real-time sensor data from compounding lines to predict equipment failures, adjust temperature and pressure profiles dynamically to maintain material consistency, and reduce energy consumption. This leads to higher throughput, lower operational costs, and superior product uniformity, which is essential when producing materials that require extremely tight tolerances, such as those used in precision electrical components. Predictive maintenance schedules derived from AI analysis prevent costly unplanned downtime, reinforcing the industry's profitability and reliability in meeting high-volume, global demand.

- AI-driven Polymer Formulation: Utilizing machine learning to predict optimal blend ratios and additive packages, drastically reducing R&D time.

- Predictive Quality Control: Implementing computer vision and sensor fusion for real-time defect detection and quality assurance during compounding and molding.

- Supply Chain Optimization: Employing AI algorithms to forecast demand, manage complex logistics, and optimize inventory levels for raw materials and finished alloys.

- Process Parameter Optimization: Dynamically adjusting extrusion and injection molding settings (temperature, pressure, speed) for maximum efficiency and energy savings.

- Sustainable Material Development: Accelerating the identification of viable pathways for incorporating high percentages of recycled or bio-based content into alloys without compromising performance.

DRO & Impact Forces Of Thermoplastic Polyester Alloy Market

The dynamics of the Thermoplastic Polyester Alloy market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces influencing market trajectory. The primary drivers are strongly linked to macro-economic trends such as the global focus on vehicle electrification and automotive lightweighting, which necessitates materials offering superior strength-to-weight ratios compared to traditional components. This is coupled with the sustained expansion of the electronics sector, particularly the demand for high-reliability components that require excellent thermal and electrical insulation, pushing manufacturers towards advanced alloy solutions. These drivers create a compelling demand pull for engineered polyesters that can withstand higher operating temperatures and challenging chemical environments characteristic of modern industrial and mobility applications.

Conversely, the market faces significant restraints, chiefly rooted in the volatility of raw material prices, specifically petrochemical-derived monomers like PTA (Purified Terephthalic Acid) and BDO (1,4-Butanediol). Fluctuations in crude oil prices and disruptions in the global chemical supply chain directly impact the manufacturing cost of polyester polymers, posing profitability challenges for compounders and end-users alike. Furthermore, the specialized nature of these alloys often results in higher initial material costs compared to general-purpose plastics, requiring substantial capital expenditure for processing and tooling, which can deter adoption in price-sensitive applications. Regulatory complexity concerning the use of certain additives, particularly flame retardants, also represents a hurdle, necessitating continuous reformulation and testing to ensure compliance with global standards, such as RoHS and REACH.

Despite these restraints, vast opportunities exist, particularly in developing high-performance alloys specifically tailored for the burgeoning electric vehicle market, including specialized grades for battery cooling systems and high-voltage interconnects. Another significant opportunity lies in capitalizing on the circular economy trend by investing in advanced recycling technologies that enable the efficient recovery and reuse of thermoplastic polyester alloy scrap, allowing manufacturers to offer closed-loop material solutions. The expansion into new applications, such as medical device housings and sustainable packaging solutions requiring enhanced barrier properties, further broadens the market scope. Collectively, the Impact Forces indicate a market characterized by high innovation dependency and sensitivity to both automotive sector performance and petrochemical price stability, making strategic sourcing and R&D capability vital for long-term growth.

Segmentation Analysis

The Thermoplastic Polyester Alloy market is highly segmented based on the type of base polymer, the specific blend utilized, the additives incorporated (such as reinforcement materials and flame retardants), and the primary end-use application. This segmentation reflects the material’s adaptability and the industry’s need for customized performance profiles. Understanding these segments is crucial for stakeholders, as growth rates vary significantly across different blend types, driven by distinct application requirements. For instance, blends reinforced with glass fiber target high-strength structural applications, while elastomer-modified blends focus on enhanced impact resistance and flexibility. The rigorous demands of the automotive industry dictate specific segmentation focusing on heat resistance and chemical inertness, contrasting with the segmentation driven by electrical safety and dimensional stability in the electronics sector.

- By Base Polymer Type

- Polybutylene Terephthalate (PBT) Alloys

- Polyethylene Terephthalate (PET) Alloys

- Polyethylene Naphthalate (PEN) Alloys

- Liquid Crystal Polymer (LCP) Alloys

- By Alloy Type (Blend)

- PBT/PC Blends (Polycarbonate)

- PBT/ASA, PBT/ABS, PBT/SMA Blends

- PET/PBT Blends

- Elastomer-Modified Alloys (TPE/PBT)

- By Reinforcement Type

- Glass Fiber Reinforced

- Mineral Filled

- Carbon Fiber Reinforced

- Unreinforced

- By Application

- Automotive (Under-the-Hood, Exterior, Interior)

- Electrical and Electronics (Connectors, Switches, Housing)

- Consumer Goods (Appliances, Power Tools)

- Industrial Machinery (Pumps, Bearings)

- Medical Devices

Value Chain Analysis For Thermoplastic Polyester Alloy Market

The value chain for the Thermoplastic Polyester Alloy market is highly structured, beginning with the upstream supply of monomers and basic polymers and extending through compounding, distribution, and ultimately, utilization by end-product manufacturers. The upstream segment is dominated by petrochemical producers supplying key raw materials—namely Purified Terephthalic Acid (PTA), Ethylene Glycol (EG), 1,4-Butanediol (BDO), and other monomers required for synthesizing PBT, PET, and PC. This stage is highly capital-intensive and concentrated, with global oil and gas prices exerting a direct and significant influence on the cost structure of the resulting thermoplastic polyesters. Efficient, long-term contractual sourcing and backward integration into monomer production are crucial for maintaining competitive pricing and ensuring supply stability in this foundational phase.

The core manufacturing process involves the polymerization of these monomers to create base polyester resins (PBT, PET) and the subsequent compounding phase, where these resins are blended with other polymers (like PC or ABS) and specialized additives (such as glass fibers, impact modifiers, and flame retardants) to form the finished thermoplastic alloy pellets. This compounding stage is the point of highest value addition, as it requires specialized technical expertise and sophisticated extrusion equipment to ensure homogeneous dispersion and consistent material properties necessary for high-performance applications. Direct sales and technical support from compounders to major automotive or E&E manufacturers facilitate customization and quality assurance, often bypassing standard commodity distribution channels.

The downstream segment includes distribution channels and end-user consumption. Distribution typically involves a mix of direct sales to large, established clients and indirect sales through specialized distributors and regional agents who manage smaller orders and provide localized technical support. Direct channels are preferred for high-volume, highly customized materials, offering greater control over pricing and delivery. Indirect channels extend market reach, particularly in fragmented geographies or for specialized niche applications. The final stage involves the utilization of these alloys in injection molding or extrusion processes by OEMs and tier suppliers across sectors like automotive, which dictates the highest quality and stringent technical specifications, making performance verification a key part of the downstream relationship.

Thermoplastic Polyester Alloy Market Potential Customers

The primary consumers and potential buyers of Thermoplastic Polyester Alloys are organizations within high-reliability and performance-driven manufacturing sectors that require materials capable of withstanding extreme environmental or mechanical stresses. Automotive Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers constitute the largest customer base, purchasing these alloys for critical under-the-hood components, structural parts (such as mirror housings and handles), and high-heat lamp sockets. Their buying rationale is dominated by the need for lightweighting, enhanced crash performance, dimensional stability under varying temperatures, and resistance to aggressive fluids like brake fluid and gasoline, making PBT/PC blends particularly attractive for these demanding uses.

Another major segment comprises manufacturers of Electrical and Electronics (E&E) components, including producers of circuit protection devices, connectors, relays, and power supply housings. These customers prioritize alloys with exceptional dielectric strength, high comparative tracking index (CTI), and inherent flame retardancy to meet rigorous electrical safety standards (e.g., IEC and UL certifications). The miniaturization trend in electronics necessitates materials that can be precisely molded while maintaining strength and heat dissipation capabilities, leading them to favor high-flow, reinforced thermoplastic polyester alloys that ensure reliable long-term performance in confined spaces.

Beyond the core automotive and E&E industries, potential customers include manufacturers of high-end Consumer Goods, particularly those producing durable appliances, power tools, and complex filtration systems. These buyers seek materials that combine aesthetic appeal, ergonomic design capabilities, chemical resistance to cleaning agents, and resilience against repeated impact and wear. The rationale here is maximizing product lifespan and minimizing warranty claims through the use of robust engineering polymers. Additionally, the growing medical device sector, requiring biocompatibility and sterilizability, presents a specialized customer segment for highly certified and traceable thermoplastic polyester alloys used in instrument handles and specialized medical housings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.2 Billion |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Celanese Corporation, Covestro AG, Lanxess AG, DuPont de Nemours Inc., SABIC, Ticona Engineering Plastics, Sumitomo Chemical Co. Ltd., Mitsubishi Chemical Corporation, Polyplastics Co. Ltd., LG Chem, Kingfa Sci.&Tech. Co. Ltd., DSM Engineering Materials (now part of Lanxess), Toray Industries Inc., A. Schulman (now LyondellBasell), Eurotec Engineering Plastics, Sinopec Corporation, RTP Company, Ascend Performance Materials, Entec Polymers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermoplastic Polyester Alloy Market Key Technology Landscape

The technological landscape of the Thermoplastic Polyester Alloy market is defined by advancements in polymer compounding, reactive extrusion, and formulation science, all aimed at achieving superior material homogeneity and performance. Reactive extrusion technology is paramount, enabling the in-situ modification of polymer chains during the blending process, which significantly improves the compatibility between inherently immiscible polymers, such as PBT and PC. This technology utilizes functionalized oligomers or compatibilizers that chemically bridge the two phases, resulting in alloys with exceptional mechanical properties, particularly enhanced impact strength, which is vital for automotive safety components. Continuous innovation in extruder design, including high-torque twin-screw extruders, ensures precise control over shear rates and temperature profiles, critical for processing temperature-sensitive polyesters and achieving uniform dispersion of high-aspect-ratio reinforcing fibers like long glass fibers.

Another crucial technological area involves the development and integration of novel additive packages, particularly high-performance flame retardant (FR) systems and nucleating agents. With increasing regulatory pressure to phase out halogenated FRs, the focus has shifted to phosphorus-based or melamine-based non-halogenated systems that maintain excellent fire safety ratings (UL94 V-0) without compromising the mechanical or thermal stability of the alloy. Furthermore, the use of advanced nucleating agents and crystal promoters helps control the crystallization rate of the polyester matrix, which is essential for minimizing warpage and shrinkage, thereby ensuring the dimensional accuracy required for precision electronics and connectors molded from these alloys. The ability to manage these complex crystallization kinetics through chemical additives represents a significant competitive advantage.

Digitalization and simulation technologies also play a pivotal role, complementing physical manufacturing processes. Manufacturers are increasingly utilizing sophisticated computational fluid dynamics (CFD) and Finite Element Analysis (FEA) software to model the flow behavior of highly viscous, reinforced polyester alloys during injection molding. This preemptive simulation capability helps optimize mold designs, predict potential defects (like weld lines or voids), and ensure optimal mechanical performance of the final part, substantially reducing prototyping costs and accelerating product development cycles. The integration of advanced testing methodologies, such as dynamic mechanical analysis (DMA) and thermal analysis (TGA/DSC), provides comprehensive data on the material’s viscoelastic behavior and heat stability, further solidifying the technical reliability of these specialized thermoplastic alloys for demanding applications.

Regional Highlights

The regional consumption and production dynamics of the Thermoplastic Polyester Alloy market are highly correlated with the geographic distribution of global manufacturing, especially in the automotive and electronics sectors. Asia Pacific (APAC) leads the market by a substantial margin, driven by its expansive and rapidly growing production base, particularly in China, India, Japan, and South Korea, which are major hubs for vehicle manufacturing and consumer electronics assembly. The regional growth in APAC is further supported by governmental initiatives promoting domestic manufacturing and rising domestic demand for durable goods.

North America and Europe represent mature markets characterized by high demand for specialized, high-performance, and sustainable (recycled or bio-based) alloys. These regions maintain a strong focus on stringent regulatory compliance, leading to higher adoption rates of innovative, non-halogenated flame retardant materials in electrical applications and premium-grade alloys for high-end automotive platforms, particularly in the rapidly expanding EV infrastructure.

- Asia Pacific (APAC): Dominates market volume due to high production capacity in China and rapid adoption in the region's expanding automotive and E&E industries; focus on cost-effective, high-volume production.

- North America: Strong demand for lightweight materials in automotive and aerospace sectors; emphasis on advanced compounding technologies and localized supply chain resilience.

- Europe: Leading the transition towards sustainable and circular economy materials; strict environmental regulations drive the adoption of recycled content and non-halogenated blends in vehicles and electrical equipment.

- Latin America (LATAM): Emerging market with increasing industrialization, particularly in Brazil and Mexico; growth driven by foreign investment in automotive assembly plants.

- Middle East and Africa (MEA): Smallest regional share, primarily driven by infrastructure and minor automotive production; opportunities tied to local manufacturing diversification efforts and construction projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermoplastic Polyester Alloy Market.- BASF SE

- Celanese Corporation

- Covestro AG

- Lanxess AG

- DuPont de Nemours Inc.

- SABIC

- Ticona Engineering Plastics

- Sumitomo Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Polyplastics Co. Ltd.

- LG Chem

- Kingfa Sci.&Tech. Co. Ltd.

- DSM Engineering Materials (now part of Lanxess)

- Toray Industries Inc.

- A. Schulman (now LyondellBasell)

- Eurotec Engineering Plastics

- Sinopec Corporation

- RTP Company

- Ascend Performance Materials

- Entec Polymers

Frequently Asked Questions

Analyze common user questions about the Thermoplastic Polyester Alloy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary performance advantages of Thermoplastic Polyester Alloys over standard polyesters?

Thermoplastic Polyester Alloys offer significantly enhanced mechanical and thermal properties, primarily through blending immiscible polymers (like PBT and PC) using compatibilizers. This results in superior impact resistance, higher deflection temperatures, improved chemical resistance, and better dimensional stability, making them suitable for structural and high-heat automotive applications where pure polyester often fails.

How is the electric vehicle (EV) sector influencing demand for these alloys?

The EV sector is a major growth catalyst, driving demand for specialized alloys with high dielectric strength and heat resistance for components like battery module housings, charging plugs, and high-voltage connectors. These alloys provide the necessary insulation and thermal management while contributing to the overall lightweighting of the vehicle, which is critical for extending battery range and efficiency.

What role does PBT/PC blending play in the Thermoplastic Polyester Alloy market?

PBT/PC blends constitute one of the largest and most critical segments. This combination marries the excellent chemical resistance of PBT with the superior impact strength and stiffness of PC, yielding a balanced, high-performance material widely used in exterior automotive parts (e.g., bumper fascia) and electrical enclosures requiring robustness and resistance to various fluids and environments.

Are Thermoplastic Polyester Alloys sustainable, and how is the market addressing environmental concerns?

The industry is actively moving towards sustainability by developing alloys incorporating post-consumer recycled (PCR) PET and PBT, often derived from packaging waste. Furthermore, manufacturers are investing in bio-based polyester feedstocks and implementing advanced chemical recycling technologies to create closed-loop systems, aligning product offerings with circular economy mandates, especially in Europe.

What are the key technical challenges facing manufacturers of these specialized alloys?

Manufacturers face challenges in achieving perfect compatibility between disparate polymers to ensure consistent mechanical performance. Other significant hurdles include managing the volatile cost of petrochemical monomers and ensuring the uniform dispersion of high filler loads (e.g., 50%+ glass fiber) during the compounding process without degrading the polymer chains, all while meeting stringent application-specific regulatory requirements like flame retardancy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager