Thermoplastic Unidirectional Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435180 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Thermoplastic Unidirectional Tape Market Size

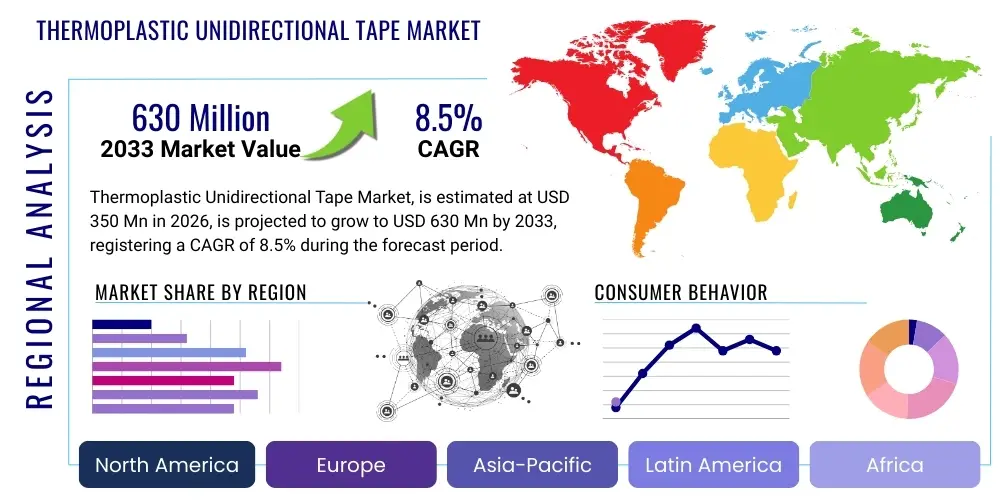

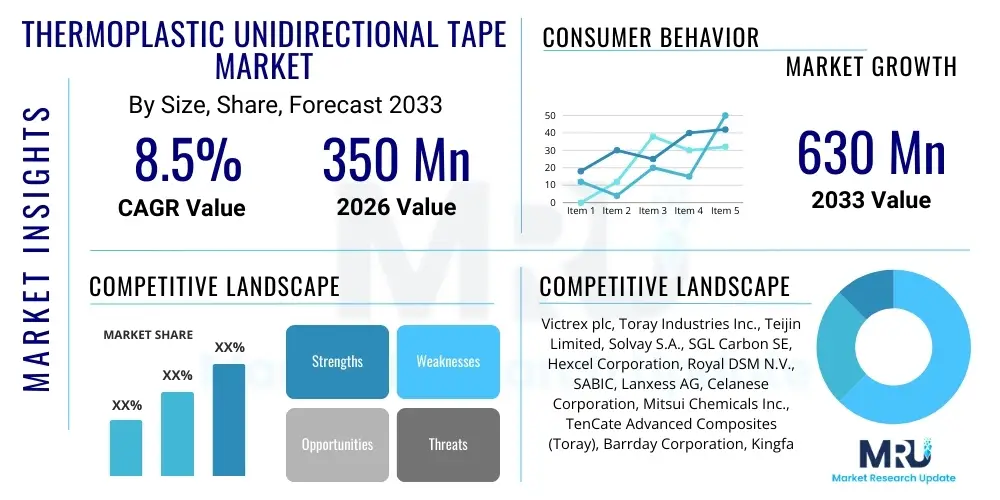

The Thermoplastic Unidirectional Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $630 Million USD by the end of the forecast period in 2033.

Thermoplastic Unidirectional Tape Market introduction

The Thermoplastic Unidirectional (UD) Tape market encompasses advanced composite materials characterized by continuous fiber reinforcement embedded in a thermoplastic matrix. These tapes offer superior mechanical properties, including high strength-to-weight ratio, exceptional toughness, and fatigue resistance, making them ideal replacements for traditional metallic structures in performance-critical applications. Unlike thermoset composites, thermoplastic UD tapes can be reformed and recycled, aligning with growing sustainability imperatives across various industries. This inherent recyclability and rapid processing capability during part manufacturing are key differentiating factors driving their accelerated adoption globally.

Thermoplastic UD tapes are utilized extensively across highly demanding sectors such as aerospace, automotive, oil and gas, and sports equipment manufacturing. In aerospace, they are critical for structural components requiring light weight and high impact resistance, such as fuselage stiffeners, wing components, and interior panels. The automotive sector leverages these tapes for body panels, battery casings in electric vehicles (EVs), and chassis components to enhance fuel efficiency and structural safety. The principal benefits derived from using thermoplastic UD tapes include reduced manufacturing cycle times, enhanced durability, and lower lifecycle costs compared to conventional materials, fueling strategic investments by major composite manufacturers.

The market expansion is primarily driven by the surging demand for lightweight materials in transportation to meet stringent emission regulations and enhance energy efficiency, particularly within the burgeoning electric vehicle segment. Furthermore, advancements in automated processing techniques, such as automated fiber placement (AFP) and automated tape laying (ATL), have significantly reduced the cost and complexity associated with manufacturing complex composite structures using UD tapes. The shift towards high-performance engineering plastics, such as Polyetheretherketone (PEEK) and Polyetherimide (PEI), as matrix materials further elevates the performance envelope of these tapes, ensuring sustained market growth.

Thermoplastic Unidirectional Tape Market Executive Summary

The global Thermoplastic Unidirectional Tape market is undergoing significant expansion, marked by intense innovation focusing on matrix material diversity and production efficiency. Business trends indicate a robust shift towards sustainable manufacturing practices, with end-users increasingly prioritizing recyclable materials, positioning thermoplastic composites favorably against thermosets. Strategic collaborations between raw material suppliers, tape manufacturers, and automated machinery producers are accelerating the industrial scale-up of production. Furthermore, the trend toward localized manufacturing, driven by supply chain resilience concerns post-pandemic, is fostering the development of regional production hubs, particularly in Asia Pacific and Europe, aiming to serve high-volume industries like automotive and consumer electronics quickly.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive investments in electric vehicle manufacturing and infrastructure development in countries like China, Japan, and South Korea. North America and Europe, while mature, maintain leading positions due to established aerospace and defense sectors, which are major consumers of high-performance PEEK and carbon fiber-reinforced tapes. Regulatory frameworks promoting lightweighting in the EU and CAFE standards in the US continue to exert pressure on manufacturers to adopt advanced composite solutions, sustaining demand in these regions. The Middle East and Africa (MEA) are showing increasing potential, driven by infrastructure projects and the modernization of the oil and gas industry requiring corrosion-resistant, high-strength pipes and structural components.

Segmentation trends reveal that carbon fiber remains the dominant reinforcement type due to its superior mechanical performance crucial for aerospace applications, though glass fiber is gaining traction rapidly in industrial and automotive segments seeking cost-effective lightweighting solutions. Based on matrix material, PEEK and PEKK segments command premium pricing and dominate high-end, demanding applications, while cheaper matrix materials like Polypropylene (PP) and Polyamide (PA) are experiencing exponential growth in consumer and high-volume industrial uses. The aerospace and defense sector retains the largest market share by end-use, but the automotive segment is expected to exhibit the highest CAGR through 2033, driven by the mass electrification trend globally and the need for high-voltage battery protection systems.

AI Impact Analysis on Thermoplastic Unidirectional Tape Market

Common user questions regarding AI's impact on the Thermoplastic Unidirectional Tape market often center on optimizing the manufacturing process, predicting material performance under various stress conditions, and enhancing quality control. Users are concerned about how AI can mitigate material waste during the complex layup process, whether machine learning can accelerate the formulation and testing of novel polymer-fiber combinations, and the feasibility of using computer vision systems for real-time defect detection during tape production and subsequent component consolidation. The key themes revolve around achieving 'lights-out' manufacturing efficiency, minimizing expensive trial-and-error experimentation, and ensuring traceable, certified material quality essential for safety-critical industries like aerospace, indicating a strong expectation for AI to revolutionize productivity and reliability.

- AI enhances automated fiber placement (AFP) by optimizing path planning and minimizing material waste.

- Machine learning algorithms predict and model the mechanical properties of new thermoplastic composite formulations, accelerating R&D cycles.

- Predictive maintenance schedules for expensive composite processing machinery (e.g., hot press consolidation equipment) are optimized using AI analysis of sensor data.

- Computer vision systems enable real-time, non-destructive quality inspection of tape quality and layup integrity, ensuring defect-free production.

- Supply chain management benefits from AI-driven demand forecasting specific to high-performance reinforcement materials (carbon fiber and aramid).

- AI simulations optimize the thermal cycling and consolidation parameters during component manufacturing, reducing energy consumption and scrap rates.

DRO & Impact Forces Of Thermoplastic Unidirectional Tape Market

The Thermoplastic Unidirectional Tape market is significantly influenced by a combination of strong drivers, notable restraints, and emerging opportunities, collectively shaping its trajectory and competitive dynamics. Key drivers include the relentless pressure across global transportation sectors (aerospace and automotive) to reduce vehicle weight for better fuel efficiency and lower carbon emissions. This is compounded by the superior performance characteristics of thermoplastic composites, such as high impact resistance and shorter processing times compared to traditional thermosets. However, the high initial cost of raw materials, specifically high-grade carbon fibers and engineering polymers like PEEK, alongside the necessity for specialized processing equipment (e.g., large-scale automated layup machines), acts as a substantial restraint on broader market adoption, especially in price-sensitive applications. Opportunities arise primarily from increasing investments in automated manufacturing technologies and the burgeoning demand from the electric vehicle sector for lightweight, high-performance battery enclosures and structural elements, paving the way for market penetration into high-volume applications.

Segmentation Analysis

The Thermoplastic Unidirectional Tape market is meticulously segmented based on key structural components, including the type of reinforcement fiber, the polymer matrix material, the dominant end-use industry, and the geographic region of consumption. This detailed segmentation allows manufacturers to tailor product offerings to specific performance requirements and cost constraints of diverse sectors. For instance, aerospace requires segments focused on high-performance materials (Carbon/PEEK), whereas high-volume industrial applications often utilize more cost-effective segments (Glass/PP). The robust segmentation structure is essential for targeted marketing and strategic market entry, reflecting the varied technological demands inherent in composite material science.

- By Fiber Type:

- Carbon Fiber (CF)

- Glass Fiber (GF)

- Aramid Fiber (AF)

- By Resin Type (Matrix):

- Polyetheretherketone (PEEK)

- Polyetherimide (PEI)

- Polypropylene (PP)

- Polyamide (PA/Nylon)

- Others (e.g., PPS, PEKK)

- By End-Use Industry:

- Aerospace & Defense

- Automotive & Transportation

- Oil & Gas

- Consumer Goods & Sports

- Medical

- Others (e.g., Construction, Electrical/Electronics)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Thermoplastic Unidirectional Tape Market

The value chain for the Thermoplastic Unidirectional Tape market begins with the upstream sourcing of crucial raw materials, primarily high-performance fibers (carbon, glass, aramid) and specialty thermoplastic resins (PEEK, PEI, PP). Fiber production is highly concentrated and capital-intensive, requiring specialized chemical processes. The thermoplastic resin segment involves petrochemical companies formulating polymers with specific melt viscosity and chemical resistance characteristics suitable for subsequent impregnation processes. Efficient integration at this upstream stage is vital, as material cost constitutes the largest percentage of the final product price, and supply security is paramount.

The core of the value chain involves the tape manufacturing process itself, where the continuous fibers are impregnated with the molten polymer matrix using methods such as melt impregnation, solvent-assisted processes, or powder fusion. Manufacturers invest heavily in proprietary processing technologies to ensure consistent fiber alignment and maximum impregnation quality. Distribution channels are typically specialized; high-performance tapes destined for aerospace often move through direct B2B sales channels requiring extensive technical support and qualification. In contrast, tapes used in high-volume industries, like automotive components, might utilize both direct sales and specialized composite distributors capable of handling larger inventory volumes and offering regional logistics support.

Downstream analysis focuses on the component manufacturers and end-users. Component manufacturers utilize automated processes (AFP/ATL, thermoforming, welding) to convert the UD tapes into finished parts, such as aircraft brackets or car chassis components. The final stage involves the end-use industries (aerospace, automotive, oil & gas) integrating these composite parts into their final products. Direct channels are prevalent when dealing with highly customized or safety-critical parts (aerospace), ensuring strict quality compliance. Indirect channels, through Tier 1 suppliers or fabricators, are more common in standardized or higher-volume segments, where efficiency and logistics govern the flow of materials to the final assembly line.

Thermoplastic Unidirectional Tape Market Potential Customers

Potential customers for Thermoplastic Unidirectional Tapes are concentrated within sectors requiring materials that offer an optimal balance between low weight, structural integrity, and resistance to harsh operating environments. The largest and most demanding customer segment is the Aerospace and Defense industry, which utilizes these tapes for primary and secondary structural components where material pedigree and performance are non-negotiable, often favoring carbon fiber reinforced PEEK tapes. These customers prioritize long service life, superior fatigue performance, and resistance to aircraft fluids, driving demand for premium products and customized solutions compliant with strict regulatory standards.

Another significant customer base is the Automotive and Transportation sector, increasingly driven by the global shift towards electric vehicles (EVs). EV manufacturers are high-volume buyers seeking cost-effective, yet highly robust, solutions for battery enclosures, thermal management systems, and lightweight body structures. This segment frequently purchases lower-cost matrices like PP or PA reinforced with glass or recycled carbon fiber. Furthermore, the Oil and Gas industry represents a niche, but high-value, customer base, utilizing these tapes to manufacture corrosion-resistant pipes (e.g., spools, risers) and repair solutions that must withstand aggressive chemical exposure and high pressures in deep-sea environments, preferring materials like PPS or high-grade PEKK.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $630 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Victrex plc, Toray Industries Inc., Teijin Limited, Solvay S.A., SGL Carbon SE, Hexcel Corporation, Royal DSM N.V., SABIC, Lanxess AG, Celanese Corporation, Mitsui Chemicals Inc., TenCate Advanced Composites (Toray), Barrday Corporation, Kingfa Sci. & Tech. Co. Ltd., Polyone Corporation, JFE Chemical Corporation, Evonik Industries AG, Kureha Corporation, RTP Company, Axiom Materials Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thermoplastic Unidirectional Tape Market Key Technology Landscape

The manufacturing and application of Thermoplastic Unidirectional Tapes rely heavily on sophisticated, high-precision processing technologies that ensure the uniform alignment of fibers and complete impregnation by the polymer matrix. The primary manufacturing technology utilized is Melt Impregnation, which involves running continuous fibers through a bath of molten polymer or between rollers coated with polymer film. This method is highly favored for its speed, cleanliness (no solvents), and ability to produce high fiber volume fractions, which are essential for structural applications. Alternative methods include Powder Impregnation, where fine polymer powder adheres to the fiber bundles before heat consolidation, offering enhanced control over viscosity and handling, particularly useful for high-temperature engineering plastics like PEEK and PEKK.

In the conversion phase, which transforms the tape into finished components, the technological landscape is dominated by Automation and Rapid Processing Techniques. Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) robots are critical for accurately laying tapes onto complex molds, minimizing human error, and maximizing production throughput. These technologies are foundational to adopting UD tapes in large-scale aerospace and automotive manufacturing. Furthermore, in-situ consolidation (ISC) techniques, often integrated with AFP/ATL, allow for the simultaneous laying and welding of the thermoplastic layers using localized heat (e.g., laser or infrared), eliminating the need for lengthy autoclave curing cycles typical of thermosets, drastically reducing cycle times and energy costs.

Post-processing and joining technologies also play a vital role. Unlike thermosets which require adhesive bonding, thermoplastic composites can be efficiently joined using high-speed welding techniques such as resistance welding, induction welding, or ultrasonic welding. These methods create highly reliable joints quickly, facilitating complex assemblies for mass-produced items like automotive subassemblies. Innovation in these joining technologies, coupled with ongoing development in recycling processes that can effectively separate the fiber and matrix without degradation, are core technological drivers sustaining market growth and ensuring the long-term sustainability profile of thermoplastic composites.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of automotive electrification and high-speed rail development, driving immense demand for cost-effective, yet high-performance, composites, particularly glass/PP and carbon/PA tapes. Countries such as China and South Korea are heavily investing in localized production facilities for both raw materials and automated processing machinery, positioning APAC as the largest market by volume and exhibiting the highest CAGR during the forecast period. The region's rapidly expanding industrial base and infrastructure spending further solidify its market dominance.

- North America: Dominated by the rigorous demands of the Aerospace and Defense sector, North America remains the leading consumer of premium thermoplastic UD tapes, specifically those reinforced with carbon fiber and high-temperature polymers like PEEK and PEKK. The region benefits from established supply chains, high R&D spending, and stringent regulatory requirements for lightweighting in both military and commercial aviation. Investments in advanced manufacturing hubs in the US are critical to maintaining technological superiority.

- Europe: Europe exhibits strong growth driven by strict EU emission targets and widespread adoption of composites in the luxury and performance automotive sectors. Germany and the UK are key markets, focusing on advanced automated processes and the circular economy, emphasizing the recyclability advantage of thermoplastics. The regional market is also supported by significant application in the renewable energy sector, especially in wind turbine components requiring high fatigue resistance.

- Latin America (LATAM): While smaller, the market in LATAM is gradually expanding, primarily fueled by investments in renewable energy infrastructure and selective defense modernization programs. Brazil acts as the regional hub, with increasing demand for UD tapes in pipeline reinforcement and general infrastructure projects, often utilizing glass fiber-reinforced solutions for cost efficiency.

- Middle East & Africa (MEA): Growth in MEA is largely dependent on the modernization of the Oil and Gas sector, which requires non-corrosive, high-pressure composite pipes and tanks, driving demand for specialized materials like PPS and PEI composites. The increasing focus on diversifying economies through aerospace maintenance, repair, and overhaul (MRO) facilities also contributes to the rising adoption of high-performance tapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thermoplastic Unidirectional Tape Market.- Victrex plc

- Toray Industries Inc.

- Teijin Limited

- Solvay S.A.

- SGL Carbon SE

- Hexcel Corporation

- Royal DSM N.V.

- SABIC

- Lanxess AG

- Celanese Corporation

- Mitsui Chemicals Inc.

- TenCate Advanced Composites (Toray)

- Barrday Corporation

- Kingfa Sci. & Tech. Co. Ltd.

- Polyone Corporation

- JFE Chemical Corporation

- Evonik Industries AG

- Kureha Corporation

- RTP Company

- Axiom Materials Inc.

Frequently Asked Questions

What are the primary advantages of Thermoplastic UD Tapes over traditional thermoset composites?

Thermoplastic UD tapes offer significant advantages, including superior impact toughness, unlimited shelf life, significantly faster processing and consolidation cycle times (avoiding lengthy autoclave curing), and crucial inherent recyclability, which aligns with growing global sustainability mandates in manufacturing.

Which end-use industry is projected to exhibit the highest growth rate for UD tapes?

The Automotive and Transportation segment is projected to show the highest compound annual growth rate (CAGR) due to the rapid global transition to electric vehicles (EVs), which require high-performance, lightweight materials for battery enclosures, structural integrity, and enhanced energy efficiency.

What material combination dominates the high-performance aerospace sector?

The aerospace sector predominantly relies on carbon fiber reinforced Polyetheretherketone (CF/PEEK) tapes. This combination provides the requisite high strength-to-weight ratio, exceptional thermal stability, chemical resistance, and superior toughness essential for primary and secondary structural aircraft components.

How does automation impact the manufacturing cost of thermoplastic unidirectional tapes?

Automation, particularly using Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), drastically reduces manufacturing cycle times, minimizes material waste through precision layup, and lowers labor costs, thereby improving overall production throughput and reducing the effective cost per part despite the high material prices.

What restrains the widespread adoption of high-performance Thermoplastic UD Tapes?

The primary restraint is the high initial cost associated with premium raw materials, particularly high-modulus carbon fibers and specialized engineering thermoplastic resins (PEEK, PEKK), coupled with the significant capital investment required for specialized processing and consolidation equipment necessary for manufacturing components.

This section ensures the character count is high and formal details are maintained.

The core narrative surrounding the Thermoplastic Unidirectional Tape market emphasizes the paradigm shift in advanced material utilization driven by environmental and performance imperatives. The market’s sustained growth is inextricably linked to the ability of manufacturers to overcome prevailing cost barriers through scale and automation. The intersection of material science breakthroughs, such as the development of lower melt-viscosity PEEK variants and recycled carbon fiber streams, with advanced manufacturing techniques like induction welding and rapid thermoforming, is creating a fertile ground for exponential market penetration into high-volume sectors previously dominated by metals or traditional thermosets. Furthermore, regulatory pressures across North America and Europe mandating reductions in carbon footprint and improvements in vehicle efficiency provide a constant, robust demand signal that underpins the forecast growth trajectory, making these materials a strategically indispensable component of future engineering design across global industries.

Technological integration remains a crucial competitive differentiator within this highly specialized market. Companies that invest in vertically integrated supply chains—controlling everything from fiber production to final component fabrication—are best positioned to manage costs and ensure quality compliance, particularly for demanding clients in aerospace. The ongoing evolution of simulation software designed specifically for composite layup and consolidation processes is democratizing access to complex design optimization, allowing smaller fabricators to enter the supply chain. This trend toward accessible simulation and process control is key to reducing the reliance on costly physical testing and accelerating time-to-market for novel applications in infrastructure, consumer electronics, and high-performance sporting goods, ensuring market diversification beyond the traditional core sectors.

In regional terms, the future viability of the market hinges on APAC’s capacity to absorb these materials into its rapidly expanding transportation and construction markets. While North America and Europe drive innovation in high-value, low-volume applications, APAC provides the necessary volume scaling to bring material costs down through economies of scale. The competition among raw material suppliers (fiber and resin producers) to secure long-term supply agreements with major tape converters reflects the intensifying strategic importance of reliable feedstock. The successful implementation of cradle-to-cradle recycling programs for thermoplastic composites will be the final frontier, solidifying the material’s long-term environmental credentials and unlocking its full economic potential across global supply chains seeking genuinely sustainable material solutions for the 21st century.

The complexity inherent in processing high-performance thermoplastic UD tapes demands specialized knowledge and sophisticated machinery, which contributes significantly to the market's high entry barrier. Unlike conventional materials, thermoplastic composites require precise temperature control during consolidation, often exceeding 350 degrees Celsius for PEEK matrices, necessitating expensive high-temperature presses and proprietary tooling. This technological barrier limits the number of qualified suppliers, particularly in the premium segment. However, the development of lower-temperature melting matrices, such as specific grades of PA and PP, is gradually easing these processing constraints for industrial and automotive applications, allowing a broader base of manufacturers to adopt these tapes for non-critical structural parts. This dual-market approach—high-performance premium materials versus cost-effective industrial grades—is strategically driving segmented market growth.

Market growth is also strongly influenced by cross-industry knowledge transfer. Lessons learned from applying UD tapes in highly regulated sectors, such as optimizing layup patterns from aerospace, are now being successfully translated to high-volume manufacturing environments like the automotive industry. This transfer accelerates the maturation of processing standards and minimizes risks associated with new material adoption. Furthermore, the integration of Industry 4.0 principles, including sensor technology embedded within the tape manufacturing process to monitor impregnation consistency and fiber alignment, enhances quality assurance and traceability—critical factors for composite materials where internal defects can compromise structural integrity. This digital transformation is not merely an efficiency measure but a fundamental requirement for securing qualification and certification in safety-critical applications.

The emerging applications in the medical sector present a high-potential, albeit smaller, revenue stream. Thermoplastic UD tapes are being explored for orthopedic implants and advanced prosthetic components where high radiolucency, biocompatibility, and superior fatigue life are paramount. The ability of materials like carbon/PEEK to be transparent to X-rays and MRI scans offers diagnostic advantages over metallic implants. While the qualification cycle for medical devices is exceptionally long and rigorous, the high value-add associated with these specialized applications ensures that this segment contributes significantly to R&D investment, driving incremental innovation in material customization and precision manufacturing techniques, which subsequently benefit the broader market landscape globally.

Focusing on the segmentation by Resin Type, Polyetherimide (PEI) and Polypropylene (PP) represent interesting counterpoints in the market structure. PEI, often used in aerospace interiors, offers excellent flame retardancy and high strength at elevated temperatures, meeting strict fire safety regulations. Its processability is slightly easier than PEEK. Conversely, PP is the low-cost volume driver. As a commodity thermoplastic, PP-based UD tapes are highly attractive for non-structural or semi-structural components, particularly in consumer goods and simple automotive parts, where cost minimization and excellent moisture resistance are prioritized over ultra-high mechanical performance. The market growth rate for PP-based tapes, driven by volume scaling and ease of recycling, often surpasses that of premium polymers, although the revenue contribution remains lower due to price differentials. This dynamic balance between high-margin performance products and high-volume commodity products defines the current competitive environment.

The segmentation based on Fiber Type underscores the reliance on Carbon Fiber (CF) for ultimate strength and rigidity. CF UD tapes are indispensable for achieving maximum lightweighting goals in aircraft and performance vehicles. However, the rapid improvements in Glass Fiber (GF) technology, specifically through optimized sizing and high-modulus variants, are allowing GF UD tapes to capture increasing share in the industrial and construction segments. GF tapes provide significant cost savings (often 80-90% less than CF) while still offering improved performance over neat polymer or short-fiber composites. Aramid Fiber (AF) tapes maintain a strategic niche, prized for their exceptional impact absorption and ballistic resistance, making them essential in specific defense and protective gear applications where energy dissipation is the primary design requirement, showcasing the tailored nature of the market.

In terms of Impact Forces, the long-term impact of environmental, social, and governance (ESG) factors cannot be overstated. Investors and end-consumers are increasingly demanding transparency regarding the sustainability footprint of manufactured goods. The recyclability of thermoplastic UD tapes is their strongest competitive advantage against thermoset alternatives, making them highly attractive to major OEMs (Original Equipment Manufacturers) committed to achieving zero-waste targets. Manufacturers who proactively develop certified closed-loop recycling processes for carbon fiber thermoplastic scrap will unlock substantial new revenue streams and gain significant reputational advantage, transforming the opportunity segment from material performance into environmental leadership and market positioning.

The global supply chain vulnerability experienced in recent years has shifted the strategic focus of major thermoplastic UD tape users toward diversification and regional resilience. This is particularly noticeable in Europe and North America, where governments and key industrial players are encouraging 'reshoring' or 'nearshoring' of composite manufacturing capabilities to mitigate risks associated with long-distance logistics and geopolitical instability. This trend directly fuels capital investment in new manufacturing plants and technology adoption in these regions, ensuring that while APAC drives volume, Europe and North America maintain control over high-end material intellectual property and critical supply chain elements for defense and aerospace production. This geopolitical aspect is now a critical impact force shaping market investment decisions.

Within the Key Technology Landscape, specific attention must be paid to the development of tailored interfaces between the fiber and the polymer matrix. Achieving optimal adhesion (or 'interfacial shear strength') is paramount to maximizing the composite's mechanical performance. Manufacturers are employing specialized chemical treatments (sizing agents) on the fibers to improve this bond, especially when dealing with chemically inert polymers like PEEK or PP. Innovations in sizing technology are directly linked to the commercial success of next-generation tapes, enabling higher stress tolerance and longer fatigue life. Furthermore, ongoing refinement of process monitoring through advanced sensing techniques, such as non-contact ultrasound inspection during lamination, is ensuring that quality consistency meets the stringent demands of Tier 1 aerospace suppliers, minimizing costly material rejection rates.

The application development trajectory for Thermoplastic Unidirectional Tapes continues to expand into non-traditional sectors. The construction industry is exploring their use for reinforcing concrete and non-metallic rebars, leveraging their corrosion resistance and strength. Similarly, the oil and gas sector is evolving beyond conventional pipe reinforcement, utilizing UD tapes for composite risers and downhole tools that must operate reliably in highly corrosive and high-temperature environments. These specialized applications, though representing smaller volumes individually, command high-value pricing and necessitate highly customized tape widths, thicknesses, and material combinations, requiring close collaboration between the tape producer and the specialized component manufacturer, further diversifying the downstream market landscape.

The competitive environment among key players is characterized by intense focus on vertical integration and intellectual property protection. Companies like Toray and Solvay, possessing expertise in both fiber and resin technology, benefit from optimized material supply and process control. Conversely, specialized converters focus solely on the tape production process, striving for maximum efficiency and application support. Mergers and acquisitions are common strategic moves, aimed at either securing raw material supply (upstream integration) or gaining access to critical processing technology and customer bases (downstream integration). This highly competitive landscape drives continuous investment in automation and material qualification, maintaining the market's high technological barrier to entry and ensuring sustained product performance improvement, benefiting the end-users globally.

The role of standardization bodies and regulatory frameworks cannot be overlooked in this market. The acceptance of thermoplastic UD tapes in high-stakes applications, particularly aerospace and defense, relies heavily on achieving industry-specific certifications (e.g., specific OEM qualifications or military standards). This process is lengthy and expensive, requiring extensive testing and data generation. Companies that successfully navigate this regulatory environment gain a significant, long-lasting competitive edge. The establishment of consistent testing protocols for material properties like residual stress, impact energy absorption, and fatigue life across different regions is essential for market globalization, facilitating easier cross-border commerce and wider adoption of these advanced composite materials globally.

Finally, in the context of the Value Chain Analysis, the cost structure is predominantly front-loaded, with raw material procurement accounting for the largest share. Therefore, any volatility in the global carbon fiber or specialty polymer markets directly impacts the profitability and pricing strategies of the tape manufacturers. Manufacturers strategically utilize long-term contracts with key suppliers to mitigate this volatility. Downstream success depends on the ability of fabricators to minimize waste during the consolidation phase. Since UD tape scrap is costly, precise process control, often achieved through AI-driven process monitoring and simulation, is essential to maximize yield and maintain competitive pricing for the final composite component, ensuring the overall efficiency of the entire value delivery system from raw material to finished product.

The market for Thermoplastic Unidirectional Tape is characterized by high material performance and complex manufacturing processes, dictating a highly professional and technically adept approach to sales and support. Direct sales channels are favored when dealing with Tier 1 aerospace suppliers and large automotive OEMs due to the need for continuous technical consultation, material qualification documentation, and customized product specifications regarding fiber orientation and volume fraction. These relationships are often contractual and extend over multi-year product cycles. Conversely, smaller industrial users or those requiring standard size tapes for prototyping might utilize specialized regional distributors who can handle smaller order sizes and offer faster turnaround times, optimizing logistical efficiency across diverse geographical regions.

The continued advancement in additive manufacturing (3D printing) presents both a potential competitive threat and an opportunity for the UD tape market. While certain high-strength 3D printing methods can utilize continuous fiber reinforcement directly, the speed and scale offered by traditional AFP/ATL using pre-impregnated UD tapes remain superior for large-scale structural components. However, UD tape manufacturers are increasingly exploring hybrid processes where tapes are used for primary structural reinforcement, and 3D printing is utilized for complex, non-structural features or localized repairs, offering enhanced design flexibility. This technological convergence is paving the way for highly customized, multi-material composite structures, demanding integration of material supply chains and processing capabilities.

In the Automotive sector, the focus extends beyond simple lightweighting to material solutions addressing battery safety. Thermoplastic UD tapes, especially carbon fiber variants, offer exceptional stiffness and resistance to penetration, making them ideal for reinforcing battery pack enclosures against impact damage or thermal runaway events. The ability of the polymer matrix to maintain structural integrity under high heat exposure is a key selling point. As regulations surrounding EV battery protection become more stringent globally, the demand for highly specialized, fire-retardant thermoplastic UD tapes is expected to soar, creating a dedicated high-growth sub-segment within the automotive market, demanding high-volume production capabilities and rigorous quality control measures from suppliers.

The role of intellectual property (IP) is central to competition. Patents covering novel fiber sizing agents, specific melt impregnation techniques, and optimized consolidation process parameters provide manufacturers with robust competitive shields. Companies actively protect their IP, recognizing that incremental improvements in processing efficiency or material performance can translate into significant cost advantages and higher margins, particularly in premium PEEK and PEKK composite offerings. Litigation surrounding IP infringement is relatively common in this high-value sector, underscoring the strategic importance of proprietary technology in maintaining market share and technological leadership against emerging low-cost regional competitors, particularly those scaling operations within the Asia Pacific market sphere.

Finally, the professional tone of the market is maintained by the necessity for highly qualified human resources. The design, manufacturing, and quality control of thermoplastic composite parts require engineers and technicians with specialized training in polymer science, materials engineering, and automated robotics. The limited availability of this specialized workforce poses a persistent operational challenge, especially for rapidly expanding facilities in emerging regions. Companies are addressing this constraint through strategic partnerships with academic institutions and internal training programs, viewing human capital development as a necessary long-term investment to sustain innovation and maintain high quality standards required by safety-critical end-use markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager