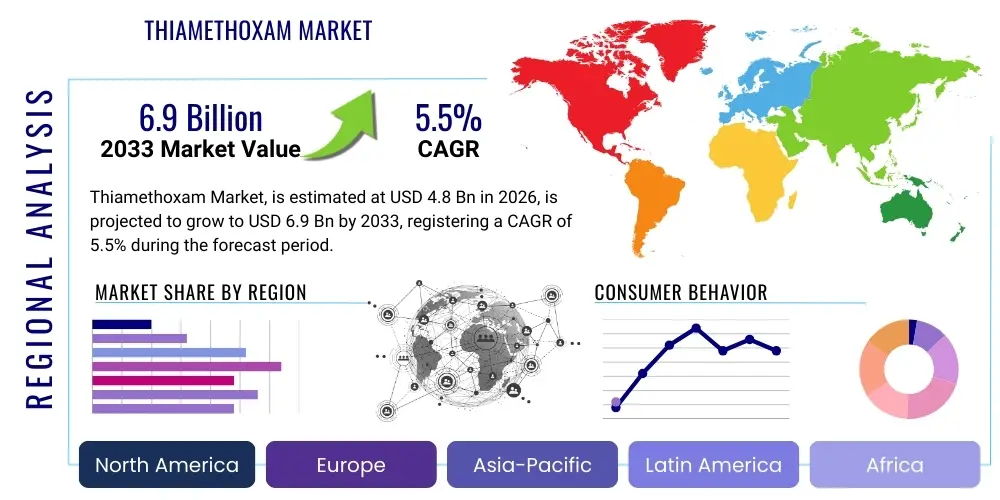

Thiamethoxam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435921 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Thiamethoxam Market Size

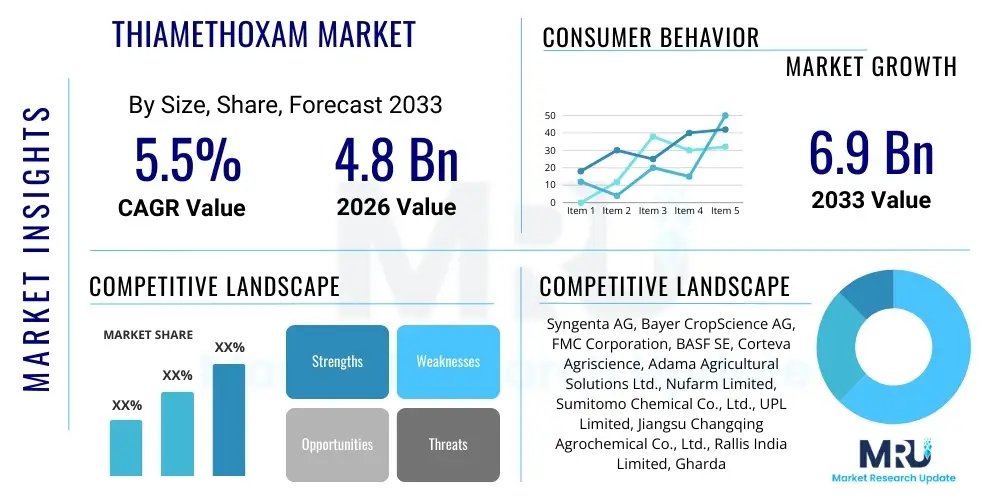

The Thiamethoxam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.9 Billion by the end of the forecast period in 2033.

Thiamethoxam Market introduction

Thiamethoxam is a potent, second-generation systemic neonicotinoid insecticide belonging to the chemical class of thianicotinyls. It functions primarily as a broad-spectrum insecticide, highly effective against sucking and chewing insects, including aphids, whiteflies, thrips, rice hoppers, and coleopteran pests. As a systemic compound, it is absorbed by the plant and transported throughout the foliage, providing comprehensive protection, especially critical in early plant growth stages. This characteristic makes it highly versatile across various application methods, including seed treatment, soil application, and foliar spray, ensuring long-lasting pest control.

The primary applications of Thiamethoxam span major agricultural sectors, notably cereals, grains, oilseeds, fruits, and vegetables. Its mechanism of action involves interfering with the insect's central nervous system by binding to the nicotinic acetylcholine receptors (nAChRs), leading to paralysis and eventual death. The significant benefits derived from its use include high efficacy at low dosage rates, excellent residual activity, and effective management of insecticide-resistant pests, particularly those exhibiting resistance to pyrethroids and organophosphates. This robust performance profile contributes substantially to yield protection and quality enhancement in high-value crops globally.

Driving factors for market expansion include the increasing global demand for food security, which necessitates advanced crop protection solutions to mitigate yield losses caused by persistent insect infestations. Furthermore, the shift towards precise and preventive pest management practices, where seed treatment plays a crucial role, significantly boosts the demand for systemic insecticides like Thiamethoxam. Despite regulatory scrutiny concerning non-target organism effects, ongoing research into targeted application technologies and resistance management strategies continues to solidify its position as a cornerstone chemical in modern integrated pest management (IPM) programs worldwide.

Thiamethoxam Market Executive Summary

The Thiamethoxam market is characterized by moderate but stable growth, primarily driven by increasing agricultural intensification in emerging economies and the necessity for high-efficiency insecticides in commercial farming. Business trends indicate a focus on developing specialized formulations, particularly water-dispersible granules (WDG) and suspension concentrates (SC), which improve handling safety and application efficiency. Strategic alliances between major agrochemical manufacturers and seed companies are becoming prominent, emphasizing integrated solutions where Thiamethoxam is pre-applied to seeds, capturing value early in the crop cycle. Furthermore, companies are investing in lifecycle extension strategies, including combination products that pair Thiamethoxam with fungicides or other insecticides to provide broader spectrum control and manage resistance development effectively.

Regionally, the Asia Pacific (APAC) market remains the dominant revenue generator due to vast agricultural acreage, especially for rice, cotton, and oilseeds, coupled with high pest pressure necessitating constant chemical intervention. North America and Europe, while representing high-value markets, face stricter regulatory hurdles, which constrain growth in certain application areas, driving innovation towards precision delivery systems. Conversely, Latin America, particularly Brazil and Argentina, shows accelerated growth fueled by large-scale soybean and maize production, where effective protection against key pests like the corn leafhopper and soybean aphid is essential for maintaining export competitiveness. These regional dynamics necessitate tailored market entry and product positioning strategies.

Segment trends reveal that the seed treatment application method continues to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the move towards preventative and environmentally localized application techniques that minimize off-target exposure. By crop type, cereals and grains, followed closely by fruits and vegetables, command the largest market shares due to the sheer volume of global production and the continuous threat posed by systemic pests. Formulation-wise, the demand is shifting towards sophisticated, user-friendly formulations like WDG, which offer better stability and reduced dust exposure compared to older wettable powder formats, aligning with global standards for occupational safety in agriculture.

AI Impact Analysis on Thiamethoxam Market

User queries regarding AI’s influence on the Thiamethoxam market predominantly center on how artificial intelligence can optimize usage, predict pest outbreaks, manage resistance, and enhance regulatory compliance. Key concerns include whether AI-driven precision agriculture systems will reduce overall insecticide volumes, thereby impacting market size, or if they will increase efficiency, driving demand for premium, data-compatible products. Users are highly interested in AI’s role in developing resistance management protocols, particularly through predictive modeling of pest population dynamics and genetic mutations. The consensus expectation is that AI will shift the market from generalized scheduled applications to highly localized, variable-rate treatments, significantly improving efficacy while potentially mitigating environmental impacts associated with broad-scale usage.

- AI-Powered Precision Application: Enables variable rate application of Thiamethoxam based on real-time field data, minimizing overuse and maximizing efficacy per unit area.

- Predictive Pest Modeling: Utilization of machine learning algorithms to forecast pest infestation levels and timing, allowing for proactive, optimized chemical treatments rather than reactive spraying.

- Resistance Management Optimization: AI analyzes genetic sequencing data and historical application records to predict resistance evolution pathways, guiding the strategic rotation or combination of Thiamethoxam with other active ingredients.

- Supply Chain and Inventory Management: Optimizing the production, distribution, and inventory levels of Thiamethoxam formulations through demand forecasting and supply chain visibility facilitated by AI tools.

- Drone and Robotics Integration: AI governs the autonomous application of foliar Thiamethoxam sprays using drones, ensuring highly accurate targeting and reduced labor costs in large-scale farming operations.

- Regulatory Compliance Monitoring: AI platforms assist manufacturers in tracking and analyzing global regulatory changes and compliance requirements for neonicotinoid usage, facilitating faster market adaptation.

DRO & Impact Forces Of Thiamethoxam Market

The dynamics of the Thiamethoxam market are shaped by a complex interplay of Drivers, Restraints, and Opportunities. Primary drivers include the necessity for increased global food production to feed a growing population, coupled with the proven efficacy of Thiamethoxam in controlling highly destructive sap-sucking pests that are difficult to manage with conventional chemistries. The systemic nature of the product, which provides internal plant protection, makes it invaluable, especially in seed treatment applications which are gaining regulatory acceptance as a targeted delivery method. Technological advancements in formulation science, leading to safer and more effective products, further accelerate market penetration. These driving forces emphasize the product's role as a fundamental tool in maximizing agricultural productivity under intense pest pressure.

Conversely, the market faces significant restraints, chiefly stemming from environmental concerns and associated regulatory pressures. Thiamethoxam, like other neonicotinoids, has been scrutinized for its potential impact on non-target organisms, particularly pollinators such as bees. This has led to outright bans or severe restrictions on its usage in major agricultural regions, notably within the European Union, creating considerable market uncertainty and necessitating complex product reformulation or withdrawal strategies. Furthermore, the increasing incidence of pest resistance development to Thiamethoxam, primarily in continuously farmed areas, poses a long-term technical challenge that requires continuous research and development investment to manage, potentially increasing the cost of integrated pest management programs.

Despite these restraints, significant opportunities exist for market expansion. The largest opportunity lies in developing countries across Asia and Africa, where food security concerns are paramount, and the regulatory environment is often less stringent, allowing for broader application. Moreover, the integration of Thiamethoxam into novel resistance management strategies, often involving stacking with biopesticides or incorporating it into advanced capsule delivery systems, offers a path to premiumization and market differentiation. The burgeoning field of smart agriculture and precision farming also opens opportunities for highly localized, data-driven application of Thiamethoxam, demonstrating reduced environmental exposure while maintaining efficacy, which may help alleviate some regulatory concerns and justify its continued use in essential crop protection scenarios. These countervailing forces define the strategic roadmap for manufacturers in this chemical class.

Segmentation Analysis

The Thiamethoxam market is structurally segmented based on how the product is applied, the crops it protects, and the physical form in which it is sold. Understanding these segmentations is critical for market stakeholders to tailor their product development, marketing, and distribution strategies effectively. The performance of Thiamethoxam is highly dependent on its mode of application; for instance, seed treatment provides early protection and minimizes environmental spread, contrasting with foliar spray which offers immediate curative action. Analyzing the split across crop types reveals the dependency of major food production systems on this active ingredient, highlighting areas of highest consumption and highest regulatory risk exposure. The shift in formulation types reflects the industry's continuous effort to enhance product safety, handling, and bioavailability for the end-user.

- By Application Method:

- Seed Treatment: Highly targeted, preventative application absorbed by the germinating seed, providing systemic protection during vulnerable early stages.

- Foliar Spray: Applied directly to the plant foliage for immediate control of existing pest populations.

- Soil Treatment (Granular/Drench): Applied directly to the soil near the root zone, allowing the pesticide to be taken up systemically by the plant.

- By Crop Type:

- Cereals & Grains (e.g., Rice, Wheat, Maize): Dominant segment due to large acreage and continuous threat from pests like aphids and hoppers.

- Fruits & Vegetables (e.g., Citrus, Tomatoes, Potatoes): High-value segment requiring stringent quality control and effective control of sucking pests like whiteflies and thrips.

- Oilseeds & Pulses (e.g., Soybeans, Canola, Cotton): Critical segment, especially for protection against resistant aphids and bollworms.

- Other Crops (e.g., Ornamentals, Sugar Beet): Niche applications for specific localized pest problems.

- By Formulation Type:

- Water Dispersible Granules (WDG): Preferred format offering good storage stability and easy, safe mixing properties.

- Wettable Powder (WP): Older formulation type, still used but declining due to dust exposure risks.

- Suspension Concentrate (SC): Liquid formulation widely used for foliar and seed treatment applications, offering high active ingredient content.

- Other Formulations (e.g., Flowable Concentrate, Granules): Tailored formats for specific regional or application needs.

Value Chain Analysis For Thiamethoxam Market

The Thiamethoxam value chain begins with the upstream synthesis of the active ingredient, which is highly centralized, relying on complex chemical manufacturing processes primarily conducted by a few multinational agrochemical companies and specialized chemical intermediate producers in regions like China and India. The upstream activities involve the sourcing of raw materials, including pyridine derivatives and specialized chemical precursors, which are subject to stringent quality control and commodity price volatility. This stage is capital-intensive and requires high technological expertise for managing chemical reactions and ensuring the purity of the technical grade Thiamethoxam.

Following synthesis, the midstream segment involves the formulation and packaging of the insecticide into various commercial products, such as WDG, SC, or seed treatment solutions. Formulators add inert ingredients, surfactants, and dispersants to optimize the product's biological performance, stability, and user safety. This phase is crucial for product differentiation and depends heavily on proprietary formulation technology. The finished products then move into the distribution network, which is characterized by a mix of direct sales to large commercial farming operations and indirect distribution through a complex web of national distributors, regional wholesalers, and local retailers or cooperative societies.

The downstream segment encompasses the final sale and application by end-users, primarily large commercial farms, smallholder farmers, and agricultural service providers (applicators). Direct channels are often utilized for high-volume transactions with major plantation companies or strategic partners, such as large seed companies incorporating Thiamethoxam into their offerings. Indirect channels, relying on extensive retailer networks, ensure market penetration into remote or less developed agricultural areas. The efficiency of the downstream segment is highly dependent on logistics infrastructure, local agricultural advisory services, and the effectiveness of technical support provided to ensure proper dosage, resistance management, and adherence to local regulatory requirements for safe and effective use.

Thiamethoxam Market Potential Customers

The primary end-users and buyers of Thiamethoxam are diverse groups within the agricultural ecosystem, all seeking reliable solutions for crop protection and yield optimization. The largest purchasing segment comprises large-scale commercial farming enterprises, particularly those specializing in the cultivation of commodity crops like corn, soybean, rice, and cotton, where the economic incentive to prevent pest-induced yield losses is substantial. These operations often engage in forward purchasing and prefer customized bulk formulations or pre-treated seeds that integrate the active ingredient, prioritizing efficiency and reliable systemic protection over broad-spectrum foliar treatments.

A secondary, yet rapidly growing, customer segment includes the integrated seed manufacturing industry. Seed companies act as critical intermediaries, buying large quantities of Thiamethoxam to apply directly to their planting seeds before sale. This process transforms the insecticide into an integrated input, preferred by farmers for its convenience and the early-stage protection it provides. Furthermore, specialized agricultural input cooperatives and chemical distributors represent significant purchasing power, aggregating demand from thousands of small to medium-sized farmers and regional applicators, requiring a wide array of formulation types and package sizes to meet localized agricultural needs and pest spectrums.

Finally, governmental agricultural bodies and non-profit organizations focused on public health and vector control also represent a niche customer segment, particularly where Thiamethoxam-based products are utilized in non-crop applications, such as controlling disease vectors or managing pests in stored grains, though the primary volume remains firmly rooted in broad-acre crop protection. The purchasing decision for all these buyers is heavily influenced by efficacy demonstrated through field trials, price competitiveness relative to alternative chemistries, local regulatory approvals, and the availability of technical support for resistance stewardship.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syngenta AG, Bayer CropScience AG, FMC Corporation, BASF SE, Corteva Agriscience, Adama Agricultural Solutions Ltd., Nufarm Limited, Sumitomo Chemical Co., Ltd., UPL Limited, Jiangsu Changqing Agrochemical Co., Ltd., Rallis India Limited, Gharda Chemicals Limited, Willowood Chemicals Private Limited, Sinochem Group, Huapont Life Sciences Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thiamethoxam Market Key Technology Landscape

The technological landscape surrounding the Thiamethoxam market is continually evolving, driven primarily by the need to enhance product safety, improve efficacy, and counteract regulatory limitations. A key focus is on advanced formulation technologies, specifically the development of micronized and encapsulated systems. Microencapsulation involves embedding the active ingredient within polymer shells, which facilitates controlled, slow release of the Thiamethoxam over an extended period. This mechanism reduces the instantaneous concentration of the active ingredient in the environment following application, potentially lowering environmental toxicity risk while ensuring sustained systemic protection for the crop, thereby improving the product's sustainability profile and longevity in the market.

Another pivotal area of technological advancement is in sophisticated seed treatment processes. Modern seed coating technologies utilize highly specialized polymers and binders to ensure optimal adhesion, minimal dusting during planting, and precise dosing of the Thiamethoxam. This ensures that the insecticide is delivered directly to the target area (the developing seedling) with high precision, minimizing loss to the soil or surrounding environment. Integration with biological seed enhancers, such as microbial inoculants or biostimulants, is also a growing trend, creating synergistic seed treatments that offer combined pest control, nutrient uptake enhancement, and stress tolerance, moving beyond standalone chemical protection.

Furthermore, digital agriculture platforms and sensor technology are increasingly intertwined with Thiamethoxam application. High-resolution satellite imagery, drone-based surveying, and in-field sensors generate data that, when processed by AI algorithms, dictate variable-rate application maps. This precision technology ensures that Thiamethoxam is only applied where and when specific pest thresholds are met, achieving optimized control with lower overall input volumes. These technological improvements are crucial for maintaining the relevance of Thiamethoxam in highly regulated Western markets where the focus is shifting towards integrated, data-driven pest management strategies that prioritize sustainability and reduced chemical footprint.

Regional Highlights

- Asia Pacific (APAC): The dominant and fastest-growing region, fueled by large agricultural economies like China, India, and Southeast Asian countries. High pest intensity, particularly for rice and cotton cultivation, combined with relatively less restrictive regulations compared to Western counterparts, drives massive consumption volumes. The increasing adoption of cash crops and the imperative for food security contribute significantly to the high demand for effective systemic insecticides like Thiamethoxam, particularly in seed treatment applications for cereals and pulses.

- North America: A high-value market characterized by large-scale commercial farming, primarily focused on maize, soybeans, and wheat. Demand is stable, heavily reliant on sophisticated seed treatment solutions for early-season protection against rootworm and corn flea beetle. However, strict Environmental Protection Agency (EPA) scrutiny and localized state-level restrictions necessitate manufacturers to focus heavily on compliance, stewardship programs, and the continuous demonstration of the product's economic benefit versus environmental risk.

- Europe: Represents the most challenging market due to widespread regulatory restrictions, particularly the partial or full bans on neonicotinoids across the European Union concerning their use on flowering crops attractive to bees. Consequently, the market here is significantly constrained, focusing mainly on non-flowering crops or specialized closed-system uses under Emergency Use Authorizations (EUAs). Innovation is geared towards ultra-low dosage rates and highly protected application methods to meet stringent regulatory thresholds.

- Latin America: Exhibits rapid market expansion, especially in Brazil and Argentina, driven by the massive acreage dedicated to soybean, corn, and sugarcane. The region faces severe pressure from rapidly evolving pest resistance (e.g., in soybean loopers and various whitefly strains), driving continuous demand for high-efficacy, broad-spectrum neonicotinoids. The market is dynamic, highly responsive to commodity price fluctuations, and utilizes both seed treatment and extensive foliar application methods across various crop cycles.

- Middle East and Africa (MEA): An emerging market with strong growth potential, primarily driven by the expansion of protected agriculture (greenhouses) and the need for reliable crop protection in challenging arid climates. High temperatures and water stress increase plant susceptibility to pests like whiteflies and thrips, making systemic protection critical. Market growth is concentrated in key agricultural hubs like South Africa, Egypt, and Turkey, requiring regionalized product strategies adapted to diverse local farming practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thiamethoxam Market.- Syngenta AG

- Bayer CropScience AG

- FMC Corporation

- BASF SE

- Corteva Agriscience

- Adama Agricultural Solutions Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- UPL Limited

- Jiangsu Changqing Agrochemical Co., Ltd.

- Rallis India Limited

- Gharda Chemicals Limited

- Willowood Chemicals Private Limited

- Sinochem Group

- Huapont Life Sciences Co., Ltd.

- Cheminova A/S (now part of FMC)

- Hailir Pesticides and Chemicals Group Co., Ltd.

- Isagro S.p.A.

- Bailing Agrochemical Co., Ltd.

- Sichuan Lier Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Thiamethoxam market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Thiamethoxam?

Thiamethoxam operates as a systemic insecticide that targets the central nervous system of insects. It acts as an agonist for the nicotinic acetylcholine receptors (nAChRs), disrupting nerve transmission and causing rapid paralysis and subsequent death in susceptible pests.

Which application method drives the highest growth in the Thiamethoxam market?

The Seed Treatment application method demonstrates the highest Compound Annual Growth Rate (CAGR). This method is favored for its targeted, preventative protection against early-season pests, efficiency, and reduced environmental exposure compared to broad foliar spraying.

How do regulatory changes in the European Union (EU) affect the global Thiamethoxam market?

Regulatory restrictions and bans in the EU, driven by concerns over pollinator health, significantly constrain Thiamethoxam market growth in high-value Western markets. This forces manufacturers to concentrate growth strategies in less regulated regions like APAC and Latin America, and to invest heavily in specialized, low-exposure application technologies.

What are the key drivers for Thiamethoxam demand in the Asia Pacific (APAC) region?

Key drivers in APAC include the imperative for greater food production, high insect pressure on staple crops like rice and cotton, and the extensive adoption of cost-effective, high-efficacy crop protection solutions across major agricultural economies such as India and China.

How is precision agriculture impacting the future use of Thiamethoxam?

Precision agriculture, utilizing AI and digital tools, is shifting Thiamethoxam use from scheduled, broad-scale application to highly optimized, variable-rate treatments. This maximizes efficacy, reduces overall volume usage, and aids in meeting stricter environmental stewardship requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager