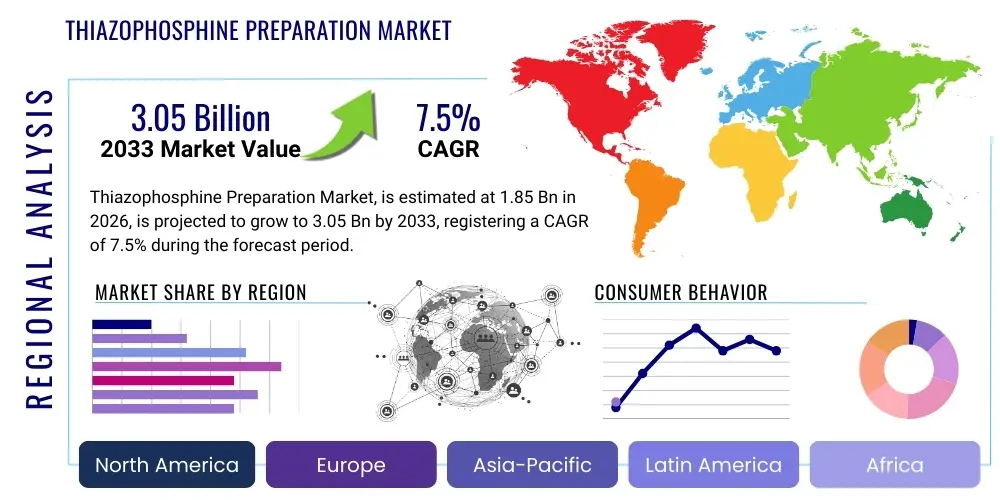

Thiazophosphine Preparation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440486 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Thiazophosphine Preparation Market Size

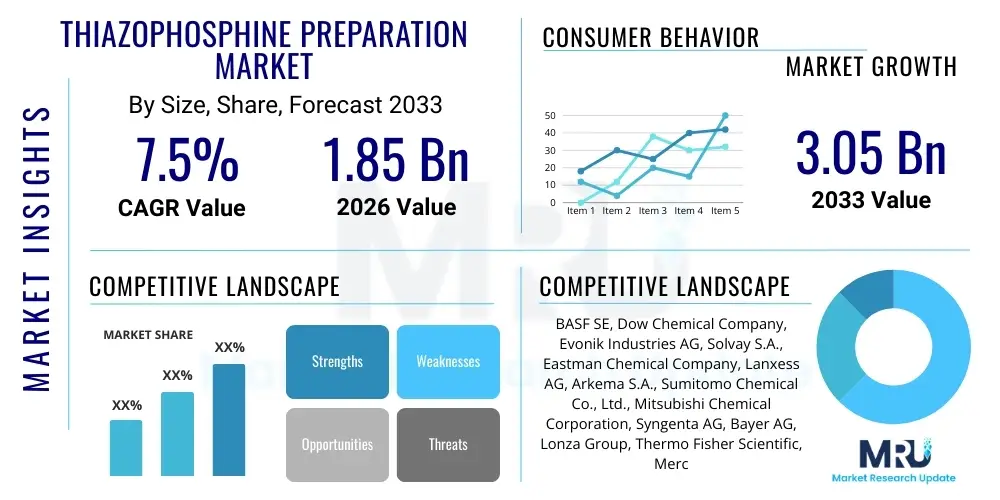

The Thiazophosphine Preparation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 3.05 billion by the end of the forecast period in 2033.

Thiazophosphine Preparation Market introduction

The Thiazophosphine Preparation Market encompasses the synthesis, manufacturing, and distribution of a specialized class of organic compounds characterized by a phosphorus atom bonded to a sulfur and nitrogen-containing heterocyclic ring, typically a thiazole. These unique chemical structures imbue thiazophosphines with versatile properties, making them invaluable intermediates and active ingredients across a spectrum of industrial applications. The intricate synthesis pathways often involve sophisticated organic chemistry techniques, including multi-step reactions, catalysis, and purification processes, ensuring high purity and yield for specific end-use requirements. Their utility spans critical sectors due to their ability to act as ligands, catalysts, pharmaceutical precursors, agrochemical intermediates, and components in specialty materials, driving continuous innovation in their preparation methods.

Major applications for thiazophosphines are predominantly found in the pharmaceutical industry, where they serve as building blocks for active pharmaceutical ingredients (APIs), facilitating the creation of novel drug candidates and existing therapeutic agents. In agrochemicals, they contribute to the synthesis of advanced pesticides, herbicides, and fungicides, enhancing crop protection and agricultural productivity. Furthermore, their role as potent ligands in homogeneous catalysis is significant, enabling more efficient and selective chemical reactions in various industrial syntheses, leading to reduced waste and improved process economics. The inherent benefits of thiazophosphines, such as their high reactivity, tunable electronic properties, and conformational flexibility, underscore their strategic importance in modern chemical synthesis, offering solutions for complex molecular architectures and enabling the development of high-performance products across diverse industries.

The market is primarily driven by the escalating demand for advanced materials and specialized chemicals from burgeoning end-user sectors, coupled with continuous research and development efforts aimed at discovering new applications and improving synthesis efficiency. Increased investment in pharmaceutical and agrochemical R&D, particularly in emerging economies, further propels the need for sophisticated intermediates like thiazophosphines. Technological advancements in synthetic methodologies, including greener chemistry approaches and automation, are also playing a pivotal role in expanding market accessibility and reducing production costs, thereby fostering market growth and innovation. The push for more sustainable and efficient chemical processes worldwide continues to be a significant driving force.

Thiazophosphine Preparation Market Executive Summary

The Thiazophosphine Preparation Market is experiencing dynamic growth, propelled by robust demand from the pharmaceutical and agrochemical sectors, alongside increasing applications in advanced catalysis and specialty chemicals. Key business trends indicate a strong focus on strategic collaborations, particularly between chemical manufacturers and R&D institutions, to accelerate the development of novel synthesis routes and expand product portfolios. Innovation in sustainable chemistry and process optimization is paramount, with companies investing in green synthesis technologies to reduce environmental impact and improve cost-efficiency. There is also a growing trend towards customization and high-purity product offerings to meet stringent regulatory requirements and specific application needs of end-users, reflecting a market that values precision and quality. The competitive landscape is characterized by both established chemical giants and specialized niche players, all striving for differentiation through technological advancements and market responsiveness.

Regionally, the Asia Pacific market is poised for significant expansion, driven by rapid industrialization, increasing pharmaceutical and agrochemical production capabilities, and supportive government initiatives promoting domestic chemical manufacturing. Emerging economies in this region, such as China and India, are becoming major production and consumption hubs. North America and Europe, while mature, continue to be innovation centers, leading in advanced research, high-value applications, and the adoption of stringent quality standards and sustainable practices. Latin America, the Middle East, and Africa are showing promising growth, attributed to increasing foreign investments in manufacturing and a rising demand for specialty chemicals to support their developing industrial bases. These regions present significant opportunities for market penetration and expansion, particularly as local industries mature and seek advanced chemical inputs.

Segmentation trends highlight a growing preference for specific types of thiazophosphine derivatives that offer enhanced selectivity and reactivity for targeted applications, especially in chiral synthesis. The application segment is dominated by pharmaceuticals and agrochemicals, which collectively account for a substantial share of market revenue, driven by ongoing R&D in drug discovery and crop protection. However, the use of thiazophosphines in advanced materials, electronics, and industrial catalysis is steadily gaining traction, opening new avenues for market diversification. Furthermore, there is an increasing demand for high-purity grades to meet the rigorous standards of sensitive applications, pushing manufacturers to refine their purification techniques and quality control measures. These trends collectively shape a market that is evolving towards higher specialization, efficiency, and sustainability, continuously adapting to the complex needs of its diverse end-user industries.

AI Impact Analysis on Thiazophosphine Preparation Market

The integration of Artificial Intelligence (AI) is set to revolutionize the Thiazophosphine Preparation Market by addressing critical user concerns regarding efficiency, cost, and discovery. Common user questions revolve around how AI can accelerate the synthesis process, optimize reaction conditions, predict new molecular structures with desired properties, and enhance safety in laboratories. Users are also keen to understand the potential for AI to reduce development timelines and overall production costs, while improving the environmental footprint of chemical manufacturing. The overarching expectation is that AI will act as a transformative tool, pushing the boundaries of what is possible in complex organic synthesis and enabling a new era of innovation and operational excellence within the specialized chemical industry. This predictive and analytical power is crucial for a niche market like thiazophosphines, where precision and novel compound discovery are paramount.

AI's influence is anticipated to manifest through several key areas, primarily focusing on accelerating the research and development lifecycle. By leveraging machine learning algorithms to analyze vast datasets of chemical reactions, material properties, and synthesis parameters, AI can predict optimal reaction pathways for novel thiazophosphine derivatives, significantly reducing the trial-and-error often associated with traditional synthetic chemistry. This not only speeds up the discovery of new compounds but also identifies more efficient and sustainable routes for existing ones. Furthermore, AI-driven automation in laboratory settings, such as robotic synthesis platforms guided by intelligent algorithms, can enable high-throughput experimentation, allowing for the rapid screening and optimization of countless reaction conditions, leading to faster scale-up and commercialization.

Beyond discovery and R&D, AI will profoundly impact process optimization and quality control in the manufacturing of thiazophosphines. Predictive modeling can be used to monitor and control reaction variables in real-time, anticipating potential deviations and adjusting parameters to maintain optimal conditions for yield, purity, and safety. This minimizes batch variations, reduces waste, and enhances overall product quality, addressing critical concerns for end-users in pharmaceuticals and agrochemicals. Moreover, AI's ability to analyze complex data patterns can identify bottlenecks and inefficiencies in the production chain, suggesting improvements that lead to significant cost reductions and a more sustainable manufacturing footprint. The shift towards data-driven decision-making, enabled by AI, empowers manufacturers to respond more agilely to market demands and maintain a competitive edge.

- Accelerated Research and Development: AI algorithms can rapidly sift through chemical literature and experimental data to propose novel thiazophosphine structures and predict their properties. This significantly shortens the lead time for drug discovery, catalyst design, and agrochemical development by identifying promising candidates more efficiently. Machine learning models can predict the outcome of various reaction conditions, allowing chemists to focus on the most viable pathways. The ability to model complex interactions at a molecular level empowers researchers to design more effective and selective compounds from the outset, reducing the need for extensive empirical testing.

- Optimized Synthesis Pathways: AI-driven tools can analyze reaction kinetics, thermodynamics, and solvent effects to identify the most efficient and cost-effective synthetic routes for thiazophosphine preparation. This leads to higher yields, reduced by-product formation, and lower energy consumption. Predictive analytics can optimize parameters such as temperature, pressure, and catalyst loading, ensuring maximum efficiency and minimal waste. Such optimization is critical for scaling up production from laboratory to industrial levels, maintaining product quality and consistency across batches, and adhering to strict regulatory standards, especially for high-purity applications.

- Enhanced Quality Control and Process Monitoring: AI can implement real-time monitoring of manufacturing processes, utilizing sensors and data analytics to detect deviations from optimal conditions. This proactive approach ensures consistent product quality, minimizes batch failures, and enhances operational safety. By continuously learning from production data, AI systems can refine their monitoring capabilities, identifying subtle patterns that might indicate impending issues. This level of oversight is invaluable in producing high-purity thiazophosphines required for sensitive applications, ensuring that every batch meets the precise specifications demanded by pharmaceutical and specialty chemical industries, thereby reducing the risk of costly recalls or rejections.

- Predictive Maintenance of Equipment: AI-powered predictive maintenance can monitor the health of manufacturing equipment, anticipating potential failures before they occur. This reduces downtime, extends the lifespan of machinery, and lowers maintenance costs, contributing to overall operational efficiency. Machine learning models analyze sensor data, such as vibration, temperature, and pressure, to forecast equipment degradation and schedule maintenance proactively. In the complex chemical synthesis environment, where specialized reactors and purification systems are critical, avoiding unexpected breakdowns is paramount for maintaining continuous production and preventing disruptions in the supply chain.

- Improved Safety Protocols: By analyzing historical incident data and process parameters, AI can identify potential safety risks in thiazophosphine preparation processes, suggesting preventative measures. This includes optimizing reagent handling, reaction containment, and emergency response protocols. AI can also simulate hazardous scenarios, allowing operators to train for critical situations without real-world risk. The ability to predict and mitigate risks associated with reactive chemicals and high-pressure reactions is crucial for protecting personnel and facilities. This proactive safety management fosters a safer working environment and reduces the likelihood of costly and dangerous accidents, ensuring compliance with strict industrial safety regulations.

DRO & Impact Forces Of Thiazophosphine Preparation Market

The Thiazophosphine Preparation Market is significantly shaped by a complex interplay of Drivers, Restraints, Opportunities, and a variety of Impact Forces. Drivers primarily stem from the escalating demand for highly specialized chemical intermediates across critical end-user industries, particularly pharmaceuticals and agrochemicals, which continuously seek novel and more effective compounds. The ongoing global research and development efforts in material science and synthetic chemistry also fuel the market, as thiazophosphines offer unique properties for advanced applications. Technological advancements in synthesis methodologies, including the adoption of green chemistry principles and catalytic innovations, further propel market growth by enabling more efficient and sustainable production, thereby lowering costs and expanding accessibility for various industries. These factors collectively create a fertile ground for market expansion.

However, the market also faces considerable restraints, including the high cost associated with the research, development, and complex multi-step synthesis of high-purity thiazophosphines. The availability and fluctuating prices of key raw materials, often specialized and subject to supply chain disruptions, pose significant challenges to consistent production and cost management. Stringent regulatory frameworks governing chemical manufacturing, especially in pharmaceutical and agrochemical sectors, necessitate rigorous testing and compliance, adding to the operational burden and time-to-market. Furthermore, environmental concerns related to chemical waste and solvent usage during synthesis processes require significant investment in waste treatment and greener alternatives, impacting profitability and requiring continuous innovation to meet sustainability targets. These restraints demand strategic planning and significant capital investment to overcome.

Opportunities in the thiazophosphine market are abundant, particularly in the exploration of emerging applications beyond traditional uses, such as in advanced materials for electronics, organic light-emitting diodes (OLEDs), and specialized polymers. The growing focus on sustainable and green chemistry offers a substantial avenue for innovation, pushing manufacturers to develop environmentally friendly synthesis routes, which can also provide a competitive edge. Strategic collaborations and partnerships between research institutions, raw material suppliers, and end-users can foster innovation and accelerate the commercialization of novel thiazophosphine derivatives and their applications. Furthermore, the expansion of pharmaceutical and agrochemical industries in developing economies presents new geographical markets for specialized chemical intermediates, driven by increasing populations and demand for advanced healthcare and food security solutions. These opportunities are vital for long-term market growth and diversification.

Various impact forces continuously shape the Thiazophosphine Preparation Market. Technological shifts, such as the advent of AI and machine learning in chemical synthesis, are transforming R&D efficiency and process optimization, fundamentally altering how new compounds are discovered and manufactured. Economic growth and stability in key industrial regions directly influence the demand for specialty chemicals, impacting investment in new production capacities and R&D. The global regulatory landscape, including evolving environmental protection laws and chemical safety standards, dictates manufacturing practices and product development. Additionally, geopolitical factors can affect raw material supply chains and trade policies, leading to price volatility and market disruptions. Environmental mandates, driving the adoption of greener chemistry, compel manufacturers to innovate and invest in sustainable practices, influencing market trends and competitive strategies. These forces collectively create a dynamic and challenging environment, requiring constant adaptation and strategic foresight from market players.

Segmentation Analysis

The Thiazophosphine Preparation Market is comprehensively segmented to provide a detailed understanding of its diverse facets, allowing for precise market analysis and strategic planning. These segmentations typically include categorization by type of preparation method, which outlines the various synthetic routes employed to produce thiazophosphine derivatives; by application, detailing the end-use industries where these compounds find utility; and by purity grade, reflecting the specific quality requirements for different applications. This multi-dimensional approach ensures that each segment's unique characteristics, growth drivers, and challenges are thoroughly examined. Understanding these distinctions is critical for manufacturers to tailor their production, for suppliers to target their distribution, and for end-users to identify the most suitable products for their specific needs, thereby optimizing market strategies across the entire value chain.

The segmentation by type of preparation method highlights the technological diversity in synthesizing thiazophosphines. This includes traditional multi-step organic synthesis, which is often labor-intensive but allows for complex molecular architectures, alongside more advanced techniques such as catalytic methods that enhance reaction efficiency and selectivity. Newer approaches like flow chemistry or microwave-assisted synthesis, which offer advantages in terms of reaction speed, safety, and scalability, also form distinct sub-segments. Each method has its own cost implications, environmental footprint, and suitability for producing specific thiazophosphine derivatives, influencing manufacturers' investment decisions and competitive positioning. As green chemistry principles become more prevalent, innovative and environmentally benign synthesis methods are gaining increasing market share and research focus, driving a shift in production techniques.

Furthermore, the segmentation by application is crucial for understanding demand patterns and market penetration. The pharmaceutical sector, driven by ongoing drug discovery and development, constitutes a major application segment, utilizing thiazophosphines as key intermediates for APIs and chiral catalysts. The agrochemical industry also heavily relies on these compounds for the synthesis of advanced crop protection agents. Beyond these dominant sectors, thiazophosphines are finding increasing use in specialized industrial catalysis, advanced materials (e.g., in electronics or polymers), and academic research. Each application demands specific properties and purity levels, thereby influencing production specifications and market strategies. The diversity in applications underscores the versatile chemical nature of thiazophosphines and their growing importance across various high-value industries, offering significant opportunities for market expansion and diversification as new uses are discovered.

- By Type of Preparation Method:

- Traditional Multi-step Synthesis

- Catalytic Synthesis (e.g., Transition Metal Catalysis)

- Flow Chemistry Synthesis

- Microwave-Assisted Synthesis

- Green Chemistry Approaches (e.g., Solvent-free, Aqueous Media)

- By Application:

- Pharmaceutical Intermediates

- Agrochemical Intermediates

- Catalyst Ligands

- Specialty Chemicals

- Research & Development

- By Purity Grade:

- Pharmaceutical Grade

- Technical Grade

- Research Grade

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Thiazophosphine Preparation Market

The value chain for the Thiazophosphine Preparation Market begins with the upstream analysis, which primarily involves the sourcing and production of foundational raw materials. These include various phosphorus compounds (e.g., phosphorus trichloride, phosphorus pentasulfide), amines, sulfur compounds, and a range of organic solvents and catalysts. Suppliers in this segment provide the basic chemical building blocks that are essential for the synthesis of complex thiazophosphine structures. The quality and consistent supply of these raw materials are critical, as they directly impact the yield, purity, and overall cost-effectiveness of the final thiazophosphine products. Relationships with reliable raw material vendors are therefore paramount for manufacturers in ensuring a stable and cost-efficient production process.

Moving downstream, the value chain involves the synthesis and purification of thiazophosphines, often undertaken by specialized chemical manufacturers or contract manufacturing organizations (CMOs). These entities transform raw materials into intermediate and finished thiazophosphine products using a variety of sophisticated preparation methods, ranging from traditional multi-step organic synthesis to advanced catalytic and green chemistry techniques. After synthesis, rigorous purification processes are employed to achieve the desired purity grades, which are often critical for sensitive applications in pharmaceuticals and agrochemicals. The next stage involves the distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to large-scale end-users such as major pharmaceutical companies or agrochemical producers, often through dedicated sales teams and technical support. This allows for closer customer relationships and customized product offerings, particularly for high-volume or specialized orders.

Indirect distribution channels typically involve a network of distributors, wholesalers, and specialized chemical suppliers who serve a broader range of smaller to medium-sized customers, including research institutions, niche chemical companies, and contract research organizations (CROs). These intermediaries provide market access, logistical support, and often technical expertise, facilitating wider market penetration. Both direct and indirect channels play crucial roles in ensuring the efficient flow of thiazophosphine products from manufacturers to diverse end-users globally. The effectiveness of these distribution networks is key to market reach and responsiveness, influencing customer satisfaction and overall market share. Understanding and optimizing each link in this value chain is essential for stakeholders to maximize efficiency, reduce costs, and maintain a competitive edge in the complex Thiazophosphine Preparation Market.

Thiazophosphine Preparation Market Potential Customers

The potential customers for the Thiazophosphine Preparation Market are primarily end-users who require these specialized compounds as critical intermediates or active components in their manufacturing processes. The largest segment of buyers includes pharmaceutical manufacturers, who utilize thiazophosphines as key building blocks for synthesizing Active Pharmaceutical Ingredients (APIs) for a wide range of therapeutic drugs. Their demand is driven by ongoing drug discovery efforts, the need for chiral synthesis, and the development of new drug candidates that often incorporate complex heterocyclic structures. The stringent quality and purity requirements of the pharmaceutical industry make it a high-value customer segment, requiring specialized and high-grade thiazophosphine derivatives.

Another significant group of potential customers comprises agrochemical companies, which leverage thiazophosphines in the development and production of advanced pesticides, herbicides, and fungicides. These compounds are essential for creating more effective and environmentally friendly crop protection solutions that enhance agricultural yields and protect against pests and diseases. The continuous need for innovation in agriculture, driven by global food security concerns and evolving environmental regulations, ensures a steady demand from this sector. Furthermore, specialty chemical manufacturers, particularly those involved in catalysis, advanced materials, and electronics, represent a growing customer base. Thiazophosphines serve as versatile ligands in various catalytic processes, enabling more selective and efficient chemical transformations, which are critical for producing high-performance materials and complex fine chemicals. Research institutions and academic laboratories also constitute an important segment, acquiring thiazophosphines for experimental studies, new compound synthesis, and fundamental research in organic and organometallic chemistry. These diverse end-users underscore the broad utility and strategic importance of thiazophosphines across multiple high-tech and essential industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.05 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Evonik Industries AG, Solvay S.A., Eastman Chemical Company, Lanxess AG, Arkema S.A., Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Corporation, Syngenta AG, Bayer AG, Lonza Group, Thermo Fisher Scientific, Merck KGaA, Albemarle Corporation, Wacker Chemie AG, Daicel Corporation, TCI Chemicals (India) Pvt. Ltd., Tokyo Chemical Industry Co., Ltd., Chem-Impex International, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thiazophosphine Preparation Market Key Technology Landscape

The Thiazophosphine Preparation Market is characterized by a sophisticated and evolving technological landscape, driven by the need for enhanced efficiency, selectivity, and sustainability in chemical synthesis. Key technologies include advanced catalytic synthesis, which often employs transition metal catalysts (e.g., palladium, rhodium, iridium) to facilitate precise bond formations and achieve high enantioselectivity, particularly crucial for pharmaceutical and agrochemical applications requiring chiral compounds. Flow chemistry has emerged as a transformative technology, enabling continuous synthesis processes that offer advantages such as improved reaction control, enhanced safety, rapid optimization, and simplified scale-up compared to traditional batch methods. This allows for more efficient and consistent production of thiazophosphines, reducing reaction times and increasing throughput.

Another significant technological advancement is microwave-assisted synthesis, which utilizes microwave irradiation to rapidly heat reaction mixtures, significantly accelerating reaction rates and often improving yields and purity. This technique is particularly valuable for reactions that are slow or require harsh conditions under conventional heating. Furthermore, the market is increasingly adopting green chemistry approaches, focusing on minimizing environmental impact through the use of benign solvents (e.g., water, supercritical CO2), solvent-free reactions, and atom-economical processes. These sustainable technologies aim to reduce waste generation, lower energy consumption, and enhance safety, aligning with global environmental regulations and corporate sustainability goals. The development of automated synthesis platforms, often integrated with AI and robotics, is also gaining traction, enabling high-throughput experimentation and accelerating the discovery and optimization of new thiazophosphine derivatives and their synthesis routes. This holistic embrace of innovative technologies is crucial for meeting the stringent demands of modern chemical manufacturing and fostering continued market growth.

Regional Highlights

- North America: North America represents a mature yet highly innovative market for thiazophosphine preparation, characterized by substantial investments in research and development, particularly in the pharmaceutical and specialty chemicals sectors. The presence of leading pharmaceutical companies, robust academic research institutions, and a strong emphasis on advanced materials contributes significantly to the demand for high-purity and specialized thiazophosphines. The region benefits from a well-established infrastructure and a skilled workforce, facilitating complex chemical synthesis and product development. Additionally, stringent regulatory standards, especially in the pharmaceutical industry, drive the demand for high-quality and well-characterized compounds, pushing manufacturers towards advanced preparation methods and rigorous quality control.

- Europe: Europe is another key region in the Thiazophosphine Preparation Market, driven by its well-developed chemical industry, strong regulatory framework, and a concerted focus on sustainable chemistry and innovation. Countries like Germany, Switzerland, and the UK are at the forefront of pharmaceutical and agrochemical research, creating a consistent demand for advanced chemical intermediates. The European Union's REACH regulations and other environmental policies encourage the development of greener synthesis routes and safer chemical products, prompting manufacturers to invest in environmentally friendly preparation technologies. This regulatory environment, while challenging, also fosters a culture of innovation and high-quality production, maintaining Europe's competitive edge.

The region benefits from a rich scientific heritage and a collaborative ecosystem involving universities, research institutions, and industrial players, facilitating the continuous development of novel thiazophosphine derivatives and their applications. Demand for specialized catalytic ligands from the fine chemicals sector also contributes significantly to the market. Although facing competition from rapidly industrializing Asian markets, Europe continues to excel in high-value, low-volume specialty chemicals, where precision and quality are paramount. The ongoing transition towards circular economy principles and bio-based chemical production further influences the market dynamics, opening new opportunities for sustainable synthesis methods within the thiazophosphine domain.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as the largest and fastest-growing market for thiazophosphine preparation, primarily due to its booming pharmaceutical and agrochemical industries, rapid industrialization, and favorable manufacturing costs. Countries such as China, India, Japan, and South Korea are major hubs for chemical manufacturing, with significant investments in expanding production capacities and R&D capabilities. China, in particular, dominates the regional market, driven by its massive chemical production base, increasing domestic demand, and growing export capabilities. The rising population and expanding middle class in countries like India are fueling demand for both healthcare products and agricultural produce, directly impacting the need for pharmaceutical and agrochemical intermediates.

The region is also witnessing increased adoption of advanced synthesis technologies and a greater focus on quality improvement to meet international standards. Government support for domestic chemical industries, coupled with lower labor costs, makes APAC an attractive destination for manufacturing and processing thiazophosphines. While environmental regulations are tightening in some parts of the region, the overall growth trajectory remains robust. Japan and South Korea contribute significantly through their advanced material science research and high-tech manufacturing, particularly in electronics and specialized polymers where thiazophosphines find niche applications. This dynamic market is characterized by intense competition, continuous innovation, and strategic expansions by both local and international players seeking to capitalize on the region's immense growth potential.

- Latin America: The Latin American market for thiazophosphine preparation is characterized by steady growth, driven by an expanding pharmaceutical sector, modernization of agricultural practices, and increasing foreign investments in chemical manufacturing. Brazil and Mexico are leading the regional market, with growing domestic demand for specialty chemicals and pharmaceutical ingredients. The agricultural sector across Latin America, a major global food producer, constantly seeks advanced agrochemicals to improve crop yields and combat pests, thus creating a consistent demand for thiazophosphine intermediates. This agricultural dependency forms a strong underlying driver for market expansion in the region.

While the region faces challenges related to economic volatility and infrastructure development, increasing foreign direct investment and partnerships are helping to bolster local manufacturing capabilities and improve access to advanced technologies. The push for greater self-sufficiency in chemical production and the development of local R&D centers are also contributing to market growth. As pharmaceutical and agrochemical industries in the region mature, there is an increasing emphasis on adopting higher quality standards and more efficient synthesis methods for complex intermediates like thiazophosphines. This evolving landscape offers significant opportunities for manufacturers willing to invest in regional production and distribution networks, catering to a growing and developing industrial base.

- Middle East and Africa (MEA): The Middle East and Africa region presents an emerging market for thiazophosphine preparation, primarily influenced by growing investments in pharmaceutical manufacturing, diversification efforts away from oil economies, and agricultural expansion. Countries in the Gulf Cooperation Council (GCC) are investing heavily in developing their petrochemical and specialty chemical industries, aiming to become regional manufacturing hubs. This strategic diversification is creating new demand for various chemical intermediates, including thiazophosphines. Similarly, in Africa, increasing healthcare expenditure and efforts to boost agricultural productivity are driving the need for pharmaceutical and agrochemical inputs.

The market in MEA is currently smaller compared to other regions but is poised for significant growth, supported by government initiatives to industrialize and attract foreign investment. The adoption of advanced chemical synthesis technologies is still in nascent stages but is gradually increasing as the region develops its industrial infrastructure and technical expertise. Challenges such as political instability in certain areas, limited local R&D infrastructure, and reliance on imports for specialized chemicals currently restrain market growth. However, the long-term potential remains strong, especially with ongoing projects to establish new industrial complexes and enhance local manufacturing capabilities, promising a gradual but significant expansion in the demand for thiazophosphine preparations across the region.

The U.S. remains the dominant country within North America, largely due to its extensive biotechnology and pharmaceutical industries, coupled with significant spending on R&D. Canada also contributes to the market, albeit on a smaller scale, with growing emphasis on sustainable chemistry and specialized chemical production. The market here is also influenced by the adoption of automation and AI in chemical synthesis, leading to more efficient and cost-effective production processes. While growth rates may be more modest compared to emerging markets, the high-value nature of applications and continuous innovation ensure a stable and significant market share for North America. Focus on intellectual property and advanced manufacturing techniques further cements its position.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thiazophosphine Preparation Market.- BASF SE

- Dow Chemical Company

- Evonik Industries AG

- Solvay S.A.

- Eastman Chemical Company

- Lanxess AG

- Arkema S.A.

- Sumitomo Chemical Co., Ltd.

- Mitsubishi Chemical Corporation

- Syngenta AG

- Bayer AG

- Lonza Group

- Thermo Fisher Scientific

- Merck KGaA

- Albemarle Corporation

- Wacker Chemie AG

- Daicel Corporation

- TCI Chemicals (India) Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Chem-Impex International, Inc.

Frequently Asked Questions

Analyze common user questions about the Thiazophosphine Preparation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are thiazophosphines and their primary applications?

Thiazophosphines are a class of organic compounds containing a phosphorus atom bonded within a sulfur and nitrogen-containing heterocyclic ring, such as thiazole. They are primarily used as versatile intermediates in the synthesis of active pharmaceutical ingredients (APIs), agrochemicals (pesticides, herbicides), and as ligands in advanced catalytic processes. Their unique chemical structure imparts specific reactivity and selectivity, making them valuable in complex organic synthesis and material science.

What factors are driving the growth of the Thiazophosphine Preparation Market?

Market growth is primarily driven by the increasing demand for specialized chemical intermediates from the pharmaceutical and agrochemical industries, fueled by continuous R&D in drug discovery and crop protection. Advancements in synthetic methodologies, including catalytic and green chemistry approaches that enhance efficiency and sustainability, also play a crucial role. Additionally, the expansion of industrial catalysis and emerging applications in advanced materials contribute significantly to market expansion.

What are the key challenges or restraints in the Thiazophosphine Preparation Market?

Key challenges include the high cost associated with the research, development, and complex multi-step synthesis of high-purity thiazophosphines. Fluctuating prices and availability of specialized raw materials, stringent regulatory frameworks governing chemical manufacturing, and increasing environmental concerns regarding waste and solvent usage also act as significant restraints. These factors demand substantial investment in R&D and sustainable practices.

How is Artificial Intelligence (AI) impacting the Thiazophosphine Preparation Market?

AI is set to significantly impact the market by accelerating research and development through predictive modeling of novel structures and optimal synthesis pathways. It enhances process optimization and quality control by enabling real-time monitoring and adjustments in manufacturing. AI also contributes to improved safety protocols and predictive maintenance of equipment, leading to increased efficiency, reduced costs, and faster commercialization of new thiazophosphine derivatives.

Which regions are leading in the Thiazophosphine Preparation Market and why?

The Asia Pacific (APAC) region is currently leading and experiencing the fastest growth, driven by robust pharmaceutical and agrochemical industries, rapid industrialization, and favorable manufacturing costs, particularly in China and India. North America and Europe also hold significant market shares, characterized by strong R&D, advanced manufacturing infrastructure, and a focus on high-value, specialized applications and sustainable chemical production. These regions benefit from established industries and stringent quality standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager