Thick Copper Substrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436297 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Thick Copper Substrate Market Size

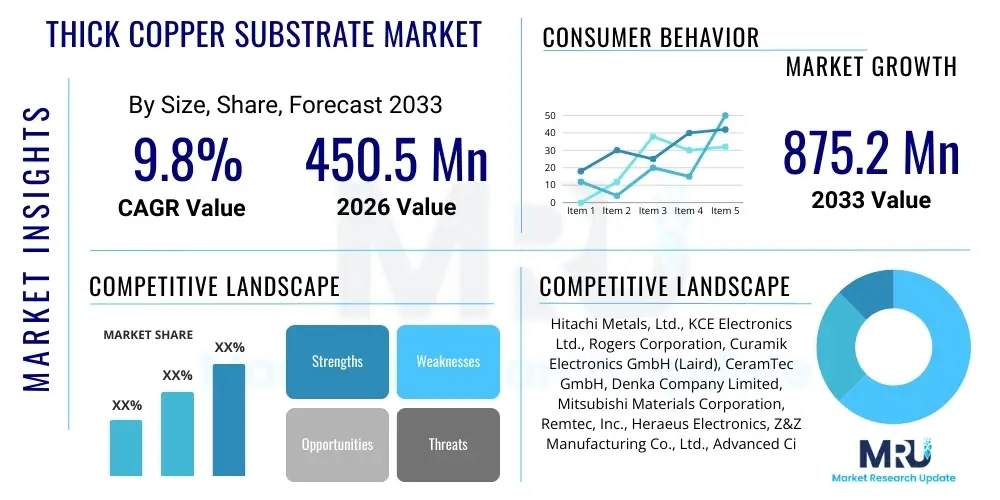

The Thick Copper Substrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 875.2 million by the end of the forecast period in 2033.

Thick Copper Substrate Market introduction

The Thick Copper Substrate Market encompasses specialized printed circuit boards (PCBs) and base materials utilizing copper layers significantly thicker than standard substrates, typically exceeding 70 µm up to several millimeters. These substrates are meticulously engineered to handle extremely high current loads, manage significant thermal dissipation, and maintain mechanical integrity under harsh operating conditions, making them indispensable components in high-power electronics. The inherent limitations of conventional PCBs, characterized by their inability to efficiently manage the heat generated by modern power semiconductors, spurred the development of advanced thermal management solutions. This category includes technologies like Insulated Metal Substrates (IMS), Direct Bonded Copper (DBC), and Active Metal Brazing (AMB), all of which leverage the superior thermal and electrical conductivity of thick copper layers to achieve unparalleled performance and reliability in mission-critical applications.

Thick copper substrates are primarily utilized in applications where high power switching, efficient thermal management, and reliable electrical interconnection are paramount. Key product types span from heavy copper PCBs used in robust busbar replacements and power distribution modules to highly complex, ceramic-backed DBC and AMB substrates essential for sophisticated battery management systems (BMS) and high-power density inverter modules, particularly those employing Wide Bandgap (WBG) devices like Silicon Carbide (SiC) and Gallium Nitride (GaN). The crucial benefit derived from using thick copper is its inherently low thermal resistance and excellent electrical conductivity. These characteristics directly translate into enhanced device lifespan by preventing junction overheating, reduced system energy losses, and increased overall operational efficiency. The specialized manufacturing processes, encompassing heavy copper plating, thick film technology, and sophisticated multilayer fabrication, require stringent quality control and specialized equipment, justifying the premium positioning and high-performance attributes of these materials.

Major driving factors fueling market expansion are inextricably linked to global megatrends, most notably the sustained push for decarbonization and electrification across transportation and energy sectors. The rapid proliferation of electric vehicle (EV) infrastructure, including high-power fast-charging stations and robust onboard chargers, creates an escalating demand for substrates capable of reliably managing hundreds of amperes and withstanding severe thermal cycling stress. Furthermore, the semiconductor industry's paradigm shift towards WBG materials necessitates accompanying substrate technology that can efficiently dissipate heat generated at higher switching frequencies and elevated operating temperatures. This transition positions specialized thick copper substrates, particularly those bonded to high-performance ceramics like Aluminum Nitride (AlN), as foundational components essential for unlocking the full potential of next-generation power modules, ensuring market growth remains buoyant throughout the forecast period due to these irreversible technological shifts.

Thick Copper Substrate Market Executive Summary

The Thick Copper Substrate Market is currently experiencing a period of accelerated innovation and substantial growth, primarily catalyzed by the global commitment to sustainable energy solutions and the resultant boom in electric vehicle production. Key business trends indicate a strategic consolidation and collaboration environment, where leading substrate manufacturers are forging deep, integrated partnerships with major power module and semiconductor companies. This collaboration is crucial for co-developing customized substrate solutions optimized specifically for the unique thermal profiles of Silicon Carbide (SiC) and Gallium Nitride (GaN) devices, ensuring the materials meet stringent automotive and industrial reliability standards. Investment is heavily concentrated on expanding manufacturing capacity for high-end Direct Bonded Copper (DBC) and Active Metal Brazing (AMB) technologies, particularly in regions that serve as global manufacturing hubs for electric mobility. Maintaining resilience in the supply chain for critical raw materials, such as high-purity copper foil and thermally engineered ceramic substrates like Aluminum Nitride, is a paramount operational concern influencing corporate strategy.

Regionally, Asia Pacific (APAC) firmly holds the leading market position and is projected to register the most aggressive growth rate. This dominance is underpinned by massive government-backed initiatives supporting the domestic production of EVs in countries like China and South Korea, coupled with significant build-out of renewable energy infrastructure. Conversely, North America and Europe, while growing at a steady pace, are focused on high-reliability, technology-intensive applications. Europe excels in the sophisticated manufacturing of AMB substrates, crucial for supplying its advanced automotive Tier 1 ecosystem and meeting rigorous European energy efficiency mandates. These regional differences in focus—high volume in APAC versus high technological complexity in Europe/North America—dictate varying strategic approaches for market entry and expansion across the global landscape.

Analysis of segment trends highlights a decisive market shift towards Ceramic-Based Thick Copper Substrates. While traditional thick copper PCBs still command a significant volume share in general industrial applications (motor control, power distribution), the highest value growth is concentrated in DBC and AMB segments. Within these high-performance segments, Aluminum Nitride (AlN) substrates are rapidly displacing traditional Alumina (Al2O3) in applications where high-temperature performance is non-negotiable, particularly in supporting 800V and higher voltage EV architectures. This migration underscores the industry's commitment to maximizing power density and minimizing thermal resistance. Ultimately, the executive outlook forecasts sustained, vigorous growth driven by technological necessity, requiring market players to continuously improve thermal performance and bond integrity under increasingly harsh operational criteria imposed by modern power electronics.

AI Impact Analysis on Thick Copper Substrate Market

User engagement concerning Artificial Intelligence (AI) and the Thick Copper Substrate Market centers predominantly on how intelligent systems can address the inherent complexities of high-precision substrate manufacturing and design optimization. A primary theme explores the application of machine learning to enhance yield rates in sophisticated processes like DBC bonding, where variations in temperature and pressure can drastically affect copper-ceramic bond strength and longevity. Users frequently inquire whether AI can accurately predict and mitigate common defects such as void formation and delamination, thereby reducing the substantial quality control costs and material waste currently associated with producing high-reliability power modules. The expectation is that AI-driven process control systems will significantly elevate the consistency and robustness of these substrates, especially as they are miniaturized and integrated into increasingly compact power systems.

The implementation of AI is already initiating a transformation in substrate manufacturing by introducing enhanced layers of control and predictive capability. Specifically, advanced AI algorithms are being deployed to conduct real-time analysis of sensor data collected from specialized manufacturing equipment, such as electroplating lines and high-temperature furnaces used for bonding. By analyzing parameters like current density, chemical bath composition, and furnace temperature profiles, machine learning models can dynamically adjust process settings, ensuring precise and uniform deposition of thick copper layers, which is crucial for achieving consistent electrical and thermal performance across every substrate. This move towards 'smart manufacturing' minimizes human error and significantly contributes to maximizing throughput and stabilizing the highly sensitive fabrication environment required for achieving micron-level tolerances in thick copper structures.

In the long run, the most disruptive impact of AI is anticipated in the design and engineering phases, leveraging Generative Engine Optimization (GEO) principles. AI tools are capable of analyzing vast databases of performance metrics (including thermal simulation results and accelerated life testing data) to instantaneously generate optimal substrate layouts. This capability shortens the design cycle dramatically, enabling rapid iteration on critical factors such as trace layout, location of thermal vias, and stress relief structures tailored for specific power cycling requirements. Furthermore, AI contributes to managing the exponentially growing complexity of supply chains, predicting potential material shortages (e.g., AlN ceramics) and optimizing inventory levels, ultimately ensuring that the high-demand segments, particularly automotive and renewable energy, have reliable access to high-quality, customized thick copper substrates, thereby solidifying AI's role as an enabler for market growth rather than a direct competitor to the underlying technology.

- AI-driven Predictive Maintenance: Optimizing etching, plating, and bonding equipment performance to maximize uptime and improve consistency in thick copper layer thickness, reducing unexpected failures.

- Generative Design Optimization: Using machine learning to rapidly simulate and design optimal thermal and electrical layouts for high-power density modules, minimizing parasitic inductance and thermal hotspots.

- Enhanced Quality Control: Real-time visual inspection and analysis of minute substrate defects, such as copper surface irregularities or bonding interface voids, using deep learning models, leading to substantial increases in manufacturing yield rates for complex multilayer thick copper PCBs and ceramic substrates.

- Accelerated Material R&D: AI assists in screening and optimizing new bonding interfaces, specialized dielectric materials, and advanced thick copper alloys suitable for extreme high-temperature and high-frequency Wide Bandgap applications.

- Supply Chain Forecasting and Management: Utilizing predictive analytics to manage complex copper and ceramic material sourcing based on fluctuating global demand, geo-political risks, and logistical bottlenecks, thereby ensuring operational stability and mitigating cost overruns in production.

- Thermal Simulation Accuracy: AI enhances the fidelity of Finite Element Analysis (FEA) and Computational Fluid Dynamics (CFD) models used for predicting the thermal performance and long-term fatigue life of the assembled power modules.

DRO & Impact Forces Of Thick Copper Substrate Market

The Thick Copper Substrate Market operates under the influence of several dominant Impact Forces. The primary Drivers, centered on the global pivot towards sustainable energy and high-efficiency power management, provide strong impetus for market expansion. Specifically, the mandate for high-power, high-density electronic systems in electric vehicles, hybrid vehicles, and utility-scale renewable energy systems (solar and wind inverters) creates an urgent, non-negotiable demand for specialized substrates capable of enduring severe operational stress. This demand is intrinsically linked to the parallel technological shift towards Wide Bandgap (WBG) semiconductors like SiC and GaN. These devices offer superior performance but require commensurate thermal management, directly boosting the revenue trajectory for high-end DBC and AMB thick copper substrates, effectively making the thermal requirement a core market accelerator.

Despite the powerful drivers, the market faces structural Restraints that temper unchecked growth and restrict participation. The capital expenditure required to establish and maintain highly precise, contamination-controlled manufacturing processes—particularly for ceramic bonding technologies like AMB—is immense, creating significant barriers to market entry and favoring established, well-funded manufacturers. Compounding this challenge is the sustained volatility in the pricing of essential raw materials, including high-purity copper and specialized ceramics (Aluminum Nitride), which introduces substantial cost uncertainty and necessitates sophisticated hedging strategies for manufacturers. Furthermore, meeting the stringent reliability targets, particularly avoiding micro-cracking and delamination under continuous thermal cycling (a key automotive requirement), remains a persistent technological hurdle that requires continuous, high-cost R&D investment.

Opportunity abounds through the expansion into niche and emerging high-growth verticals. The global build-out of 5G infrastructure and the monumental increase in demand from high-performance computing (HPC) and AI data centers necessitate robust power distribution backplanes and server power supplies that rely heavily on thick copper solutions to manage massive current flows within highly confined, thermally challenging spaces. Additionally, technological advancements in developing hybrid composite substrates that combine the superior thermal performance of copper with lightweight structural materials are opening new markets in the aerospace and drone industries, where minimizing weight while maximizing power handling capacity is essential. Effectively navigating these impact forces requires manufacturers to prioritize innovation in bonding integrity and cost-effective material substitution to sustain competitive advantage while catering to the diverse and demanding requirements of the global electrification movement.

Segmentation Analysis

The comprehensive segmentation of the Thick Copper Substrate Market is essential for dissecting market growth vectors and identifying technological trends. This segmentation categorizes the market primarily by the substrate's structural format (Product Type), the base dielectric material used (Base Material), the specific electronic function it performs (Application), and the end-use industry utilizing the finished product (End-User Industry). The distinction between standard Thick Copper PCBs, which use conventional laminate materials, and advanced DBC/AMB substrates, which rely on ceramic insulators, is critical, as it separates high-volume, cost-sensitive industrial applications from high-performance, mission-critical power modules, each operating on fundamentally different price and reliability paradigms.

Detailed analysis of the Base Material segment reveals a significant trend: the escalating demand for high-thermal-conductivity ceramics. While Alumina (Al2O3) remains the volumetric leader due to its cost-effectiveness, the performance limitations of Al2O3 under extreme heat are causing a rapid shift towards Aluminum Nitride (AlN), especially in new designs incorporating SiC/GaN devices. AlN’s exceptional ability to dissipate heat makes it the material of choice for electric vehicle inverters operating under demanding conditions. Furthermore, the polymer/composite segment includes high-performance laminates (e.g., Polyimide, high-Tg FR-4) used where flexibility or lower weight is required, showcasing the market's diversity in material needs corresponding to various performance envelopes and budget constraints.

The Application segmentation underscores the strong reliance of modern technology on robust power management. Power Modules (including inverters and converters) consistently account for the largest revenue share, driven by the sheer scale of the automotive electrification pipeline. Following closely are industrial motor drives and renewable energy systems, which demand substrates capable of long-term reliability in high-cycle, high-power switching environments. This granular view of the segments provides invaluable strategic intelligence, indicating where research and development capital should be allocated—for example, focusing on minimizing parasitic inductance in substrates destined for high-frequency SiC-based automotive inverters, the highest-growth application segment.

- By Product Type:

- Thick Copper Printed Circuit Boards (PCBs) (70 µm to 200 µm): Used extensively in robust industrial controls and busbar replacement.

- Heavy Copper PCBs (200 µm and Above): High-current applications in utility systems and specialized machinery.

- Direct Bonded Copper (DBC) Substrates: Dominant choice for medium to high-power modules, offering excellent thermal performance via a robust copper-ceramic bond.

- Active Metal Brazing (AMB) Substrates: Preferred for ultra-high reliability and extreme temperature applications (SiC/GaN), providing superior mechanical strength.

- Insulated Metal Substrates (IMS) with Thick Copper Layers: Used primarily in high-power LED lighting and compact power supplies where heat sinking is crucial.

- By Base Material:

- Ceramic Substrates:

- Alumina (Al2O3): Cost-effective, standard thermal performance.

- Aluminum Nitride (AlN): High thermal conductivity, critical for WBG semiconductors.

- Zirconia: Niche applications requiring extreme mechanical strength or specific dielectric properties.

- Polymer/Composite Substrates:

- High Tg FR-4: Economical option for higher current flow in standard PCBs.

- Polyimide: Used for flexible thick copper circuits, critical for complex 3D assembly.

- PTFE/Teflon: High-frequency, high-power radio frequency (RF) applications.

- Metal-Core Substrates (Aluminum/Copper Core): Used for highly efficient thermal transfer in certain high-power consumer electronics and lighting.

- By Application:

- Power Modules (Inverters, Converters, Choppers): The largest segment, critical for EV powertrains and renewable energy.

- Battery Management Systems (BMS): Require thick copper for reliable, high-current balancing and protection circuitry.

- High-Power LED Lighting: Essential for thermal management to maintain lumen output and lifespan.

- Industrial Motor Drives and Controls: Demand heavy copper for robust power switching and operational stability in harsh environments.

- Automotive Electronics (Onboard Chargers, DC/DC Converters): Focus on reliability under thermal cycling and vibration stress.

- Renewable Energy Systems (Solar Inverters, Wind Turbine Converters): Require durable substrates to handle high DC voltage and power output over long operational lifetimes.

- Aerospace and Defense: Niche segment demanding utmost reliability, light weight, and performance at extreme temperatures.

- By End-User Industry:

- Automotive (EV/HEV): Primary consumer, focused on performance and reliability standards.

- Industrial (Factory Automation, Robotics): Steady demand for heavy copper in machinery controls.

- Energy and Utilities: Large-scale consumers for grid modernization and energy storage systems.

- Consumer Electronics: Growing niche for high-power adapters and miniaturized charging systems.

- Telecommunications: Demand driven by 5G base stations and data center power supplies.

Value Chain Analysis For Thick Copper Substrate Market

The value chain commences with the Upstream Segment, dominated by suppliers of foundational, high-specification raw materials. This includes producers of specialized copper foils and sheets, which must meet stringent purity and surface finish requirements to ensure optimal bonding and electrical performance. Critically, the supply of advanced ceramic powders—Aluminum Nitride (AlN) and high-density Alumina (Al2O3)—is centralized among a few key global providers, giving them substantial bargaining power, particularly concerning the high-performance DBC and AMB segments. The necessity for strict quality control over these input materials, combined with geopolitical sensitivities affecting mineral sourcing, makes supply chain stability a major strategic focus for substrate manufacturers, who must invest heavily in long-term sourcing contracts to mitigate risk and ensure consistent material properties crucial for thermal performance.

The Midstream Segment encompasses the complex, high-capital manufacturing processes of the thick copper substrate producers themselves. This stage involves sophisticated fabrication techniques such as high-pressure lamination for traditional PCBs, and the proprietary high-temperature chemical and physical processes inherent to DBC and AMB manufacturing. Core competencies at this stage include achieving uniform copper layer thickness, managing internal stress to prevent warping, and ensuring hermetic, high-strength bonding interfaces between the copper and the dielectric. Distribution channels typically involve a mix of indirect sales for high-volume standard products through electronic component distributors, and direct sales (Direct Channel) to large, integrated device manufacturers (IDMs) and leading automotive Tier 1 suppliers who require intensive customized technical support and long-term quality guarantees for advanced power modules.

The Downstream Segment involves the integration of the substrates into final power electronics assemblies. Customers in this stage, such as power module assemblers, inverter manufacturers, and EV powertrain integrators, add substantial value through component mounting (die attach, wire bonding), thermal interface material application, and final packaging. The selection of a substrate directly influences the overall system cost, size, weight, and crucially, its long-term reliability. End-users are increasingly demanding substrates that are pre-qualified for SiC/GaN integration and optimized for specific thermal profiles. This pressure from the downstream market drives continuous process improvement upstream, compelling substrate manufacturers to focus R&D efforts on reducing parasitic losses and enhancing heat extraction capability, thereby transforming the substrate provider from a material supplier into a critical technology partner in the power electronics ecosystem.

Thick Copper Substrate Market Potential Customers

The core constituency of potential customers for the Thick Copper Substrate Market includes entities whose primary mandate is the reliable and efficient management of high electrical power flow and associated thermal stresses. Foremost among these are companies operating within the Automotive and Transportation sectors, particularly those focused on Electric Vehicles (EVs) and High-Speed Rail. These customers, typically Tier 1 and Tier 2 suppliers producing power inverters, charging units, and DC-DC converters, represent the highest growth segment. Their purchasing criteria are dominated by material fatigue resistance, dielectric strength, and guaranteed operational lifespan under severe temperature cycling, making them primary buyers of advanced ceramic substrates (DBC/AMB) that can reliably interface with SiC power devices.

A secondary, yet highly vital customer group is embedded within the Renewable Energy and Utility sector, comprising manufacturers of solar PV inverters, wind turbine converters, and large-scale Battery Energy Storage Systems (BESS). These buyers require substrates that can sustain prolonged, high-power operation in often remote or demanding environments, prioritizing extreme durability and resistance to environmental factors. The transition to higher voltage utility-scale systems further accelerates the demand for thick copper solutions to handle the necessary current density while minimizing efficiency losses during energy conversion and transmission stages. These customers often look for robust, industrial-grade heavy copper PCBs alongside high-power DBC modules for their critical power handling units.

Finally, the industrial and technological end-users constitute the third major segment, including manufacturers of high-end industrial motor drives, medical imaging equipment (MRI, CT scanners), and the increasingly important High-Performance Computing (HPC) and Data Center infrastructure providers. These customers utilize thick copper substrates, often custom-designed, to create highly reliable, high-current power distribution boards (backplanes) and power supplies for servers and networking equipment. As AI and machine learning tasks proliferate, the power demands within data centers skyrocket, ensuring a sustained and increasing need for these specialized thermal management and current-handling materials to prevent catastrophic system failure due to overheating or resistive losses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 875.2 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Ltd., KCE Electronics Ltd., Rogers Corporation, Curamik Electronics GmbH (Laird), CeramTec GmbH, Denka Company Limited, Mitsubishi Materials Corporation, Remtec, Inc., Heraeus Electronics, Z&Z Manufacturing Co., Ltd., Advanced Circuitry International, DK Advanced Technologies, T-Global Technology Co., Ltd., Shenzhen Sunlord Electronics Co., Ltd., PCX Aerostructures, Aismalibar S.A., Taiwan Union Technology Corporation (TUC), Microcircuit Laboratories Inc., C-Tech Systems, Inc., WTI Inc., Kyocera Corporation, Showa Denko K.K., TTM Technologies, Inc., Nanjing CERU Ceramics Co., Ltd., Dalian Deep Power Electronics Co., Ltd., Accurate Circuit Engineering (ACE), Tecnikabel S.r.l., GTS Global Technical Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thick Copper Substrate Market Key Technology Landscape

The technological evolution within the Thick Copper Substrate Market is characterized by a relentless pursuit of lower thermal impedance and enhanced mechanical reliability, driven fundamentally by the demands of high-power density electronics. The Direct Bonded Copper (DBC) technology, a foundational process, involves achieving a eutectic bond between a copper foil and a ceramic insulator (typically Al2O3 or AlN) in an oxygen-rich atmosphere at high temperatures. Continuous innovation in DBC focuses on achieving larger area substrates with uniform bonding, accommodating thicker copper layers (up to 600 µm), and developing textured copper surfaces to enhance adhesion reliability, especially for use with pressure contact power modules where mechanical integrity is paramount for preventing failure under mechanical and thermal stress over tens of thousands of power cycles.

The Active Metal Brazing (AMB) technology represents the current apex of substrate performance, particularly in applications utilizing Silicon Carbide (SiC) devices that operate at extremely high junction temperatures (up to 175°C or higher). AMB utilizes an active metal filler (often Ag-Cu-Ti) to chemically and mechanically braze the copper to the ceramic, yielding a stronger, more robust bond than DBC. Key technological advancements here center on optimizing the braze alloy composition to manage the coefficient of thermal expansion (CTE) mismatch between the copper and the ceramic, thereby minimizing stress and cracking during thermal cycling. Manufacturers are actively developing low-void, high-reliability AMB processes that are essential for mission-critical applications in automotive powertrains (800V busbars) and aerospace systems where failure rates must be near zero.

Beyond ceramic-based solutions, the Heavy Copper PCB segment is evolving through advanced electroplating methodologies. High-aspect-ratio plating techniques are employed to ensure consistent copper thickness in complex vias and across large surface areas, crucial for busbar replacements. Furthermore, hybrid substrate technologies are gaining traction, such as those that embed cooling structures (microchannels or pin fins) directly into the thick copper layer or integrate high-conductivity thermal interface materials (TIMs) during the substrate fabrication phase. These technological advancements collectively aim to provide a holistic thermal solution, moving beyond simple electrical conductivity and ensuring that the entire substrate assembly can efficiently manage the power module's heat output, thereby extending the limits of power density in modern electronic devices.

Regional Highlights

The Asia Pacific (APAC) region fundamentally dominates the global Thick Copper Substrate Market, both in terms of consumption volume and production capacity, underpinned by rapid, state-sponsored industrial growth across key sectors. Countries like China, Japan, and South Korea are global leaders in the manufacture of electric vehicles and large-scale solar power generation equipment, creating an inexhaustible, high-volume demand for reliable power substrates. Chinese manufacturers, in particular, have rapidly scaled up their production capabilities for standard thick copper PCBs and cost-effective DBC substrates, often prioritizing speed and volume to support their massive domestic EV battery and charging infrastructure build-out. This regional focus on mass-market electrification ensures APAC remains the high-growth engine, constantly driving cost-reduction initiatives and capacity expansion across the entire value chain.

North America’s market growth is driven by significant governmental and private investment focused on enhancing infrastructure, national security, and high-performance computing. The US market exhibits a strong demand profile for highly specialized, often custom-engineered thick copper substrates used in defense systems, advanced radar, and aerospace applications, where high certification standards and extreme environmental durability are mandatory. Furthermore, the region is seeing considerable growth in demand for DBC/AMB substrates necessary for utility-scale energy storage and modernization of the power grid, requiring robust materials capable of decades of reliable service. Technological innovation in North America frequently centers on developing hybrid materials and advanced cooling integration techniques to serve these highly demanding, technology-intensive market niches.

The European market distinguishes itself through its leadership in adopting and manufacturing technologically advanced, high-specification substrates, particularly those utilizing Active Metal Brazing (AMB) and Aluminum Nitride (AlN). Driven by stringent EU energy efficiency mandates and a highly competitive, innovation-focused automotive sector specializing in premium and high-voltage EVs (800V systems), Europe requires substrates capable of the highest levels of thermal management and long-term reliability. European manufacturers often collaborate intimately with semiconductor producers and Tier 1 suppliers to standardize high-performance module designs, positioning the region as a critical center for technological refinement and standardization of SiC and GaN power packaging technologies. Latin America and the Middle East & Africa (MEA) are characterized by emerging market dynamics, with growth being tied to large-scale infrastructure and renewable energy projects (e.g., massive solar farms in the MENA region), relying primarily on imported, standard-to-high-grade substrates to support localized energy transition efforts and modernization programs.

- Asia Pacific (APAC): Market Volume Leader. Dominant share derived from extensive EV manufacturing supply chains (China, South Korea) and massive renewable energy deployment; emphasis on cost-effective, high-volume production of DBC and heavy copper; highest overall CAGR projected.

- North America: High-Value, High-Reliability Market. Demand concentrated in aerospace, defense, high-end industrial machinery, and data center power distribution; focuses on specialized, custom substrates and advanced material science to ensure performance under severe stress and regulatory compliance.

- Europe: Technology and Standards Hub. Pioneer in advanced AMB and AlN substrate technologies, critical for the continent’s sophisticated automotive (800V EV architectures) and high-speed rail sectors; driven by rigorous energy efficiency and sustainability regulations, favoring high-performance thermal solutions.

- Latin America: Developing Market Segment. Growth spurred by regional industrialization, public transport electrification initiatives, and infrastructure investments; demand centers around general heavy copper PCBs and IMS for cost-sensitive power applications; market largely reliant on global imports.

- Middle East and Africa (MEA): Infrastructure and Energy Transition Growth. Demand largely project-based, fueled by national diversification strategies focusing on mega solar and wind energy projects and localized industrial expansion; requires robust substrates capable of enduring high ambient temperatures and dusty conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thick Copper Substrate Market.- Hitachi Metals, Ltd.

- KCE Electronics Ltd.

- Rogers Corporation

- Curamik Electronics GmbH (Laird)

- CeramTec GmbH

- Denka Company Limited

- Mitsubishi Materials Corporation

- Remtec, Inc.

- Heraeus Electronics

- Z&Z Manufacturing Co., Ltd.

- Advanced Circuitry International

- DK Advanced Technologies

- T-Global Technology Co., Ltd.

- Shenzhen Sunlord Electronics Co., Ltd.

- PCX Aerostructures

- Aismalibar S.A.

- Taiwan Union Technology Corporation (TUC)

- Microcircuit Laboratories Inc.

- C-Tech Systems, Inc.

- WTI Inc.

- Kyocera Corporation

- Showa Denko K.K.

- TTM Technologies, Inc.

- Nanjing CERU Ceramics Co., Ltd.

- Dalian Deep Power Electronics Co., Ltd.

- Accurate Circuit Engineering (ACE)

- Tecnikabel S.r.l.

- GTS Global Technical Systems

Frequently Asked Questions

Analyze common user questions about the Thick Copper Substrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between DBC and AMB substrates?

Direct Bonded Copper (DBC) utilizes a high-temperature oxidation process for bonding copper to ceramic (e.g., Al2O3), providing excellent thermal performance suitable for medium-to-high power. Active Metal Brazing (AMB) employs an active braze alloy, resulting in superior mechanical strength and improved resistance to extreme thermal cycling, making it the preferred choice for ultra-high-reliability SiC/GaN power modules.

Which end-user segment drives the highest demand for thick copper substrates?

The Automotive (Electric Vehicle/Hybrid Electric Vehicle) segment is the largest and most dynamic end-user, accounting for significant revenue growth. Demand is concentrated in specialized DBC and AMB substrates essential for high-power inverters, DC-DC converters, and robust battery management systems (BMS) in modern EV architectures.

How does the integration of SiC and GaN semiconductors affect the market?

The shift to Wide Bandgap (WBG) materials like SiC and GaN, which operate at higher switching frequencies and elevated junction temperatures, critically increases the demand for substrates with superior thermal conductivity, specifically forcing adoption of premium Aluminum Nitride (AlN) based DBC and AMB technologies.

What is the main restraining factor impacting the growth of this market?

The key restraining factors include the substantial capital investment required for complex manufacturing technologies (DBC/AMB), the difficulty in consistently achieving high bond reliability under extreme thermal cycling, and the high cost volatility of critical raw materials like high-purity copper and advanced ceramic powders.

Where is the geographical center of thick copper substrate manufacturing innovation?

Asia Pacific (APAC) holds the largest market share and production volume, driven by mass-market EV manufacturing. However, technological leadership in ultra-high-performance AMB and specialized SiC/GaN packaging techniques is often centered in the R&D hubs of Europe and North America, serving niche, high-reliability applications.

What thickness is generally defined as "Thick Copper" in substrates?

Thick or heavy copper is conventionally defined as conductor layers exceeding 70 micrometers (µm) or 2 ounces (oz) per square foot, often extending up to 600 µm or more, specifically engineered to maximize current handling capacity and thermal dissipation efficiency in power electronics.

How does the aerospace industry utilize thick copper substrates?

Aerospace applications rely on thick copper and AMB substrates for high-power distribution, motor controllers, and specialized radar systems. They require components with low weight, extremely high operational reliability, and proven performance against severe thermal and mechanical stresses in high-altitude environments.

What role does AI play in the future of substrate manufacturing?

AI is increasingly crucial for process optimization, particularly in quality control (real-time defect detection), maximizing manufacturing yield in complex bonding processes, and accelerating the design cycle by using generative optimization to create thermally and electrically efficient substrate layouts for high-power modules.

Which segment is expected to show the highest CAGR by material type?

The Aluminum Nitride (AlN) segment, within the ceramic substrate category, is forecasted to exhibit the highest Compound Annual Growth Rate, driven by its non-negotiable requirement for thermal management in new designs incorporating Silicon Carbide and Gallium Nitride power semiconductors across critical industry verticals.

What are the advantages of using thick copper substrates in high-power LED lighting?

In high-power LED applications, thick copper substrates (often utilized in IMS) efficiently facilitate the conduction of heat away from the semiconductor junction, which is vital for maintaining the LEDs' high lumen output, preventing thermal degradation, and significantly extending the overall operational lifespan of the lighting system.

How do manufacturers ensure the reliability of DBC substrates against thermal fatigue?

Reliability is ensured through meticulous process control, rigorous Accelerated Life Testing (ALT), and specialized design techniques, including stress-relief structures within the copper layer and optimizing the coefficient of thermal expansion (CTE) match between the copper and ceramic, minimizing the potential for delamination under thermal cycling.

What is the significance of the 800V architecture in EVs for the substrate market?

The adoption of 800V architectures in electric vehicles imposes heightened requirements on substrates, demanding superior dielectric strength, minimized partial discharge risk, and maximum thermal dissipation, thereby accelerating the technological shift towards high-end AMB and AlN-based substrates capable of handling this extreme power density reliably.

What competitive strategy is common among market leaders?

Leading market players employ a dual strategy: focusing on technological differentiation by developing proprietary bonding and plating processes for high-margin segments (aerospace, SiC modules), while simultaneously engaging in large-scale strategic supply agreements with key automotive and industrial integrators to secure high-volume orders.

What is the role of Latin America in the thick copper substrate market?

Latin America is growing as a consumer market driven by domestic industrialization and massive renewable energy projects (solar, hydroelectric). While not a major production hub, the demand for standard and industrial-grade thick copper PCBs and IMS solutions for modernizing electrical infrastructure is steadily increasing.

How are environmental regulations influencing substrate design?

Environmental regulations worldwide, particularly those promoting energy efficiency, necessitate the development of substrates that minimize I²R losses (resistive heating), forcing a move toward thicker, higher-purity copper layers and advanced thermal management materials, directly benefiting the thick copper substrate industry.

What is the current technological challenge in DBC manufacturing?

The principal technological challenge in DBC manufacturing is achieving high bond strength and minimizing void formation across increasingly large ceramic substrates, which are necessary for higher power modules, while managing the substantial internal stresses induced by the coefficient of thermal expansion mismatch between the copper and the ceramic base.

How do thick film technologies relate to thick copper substrates?

Thick film technology, which involves screen-printing conductive pastes, can sometimes be used to create thick copper traces on ceramic, often for lower current or hybrid integration applications, though Direct Bonded Copper (DBC) or electroplating is generally preferred for maximum current handling capacity and thermal performance.

Which material offers the best thermal performance for substrates?

Among commonly used ceramics, Aluminum Nitride (AlN) offers the highest thermal conductivity (up to 10 times that of standard Alumina), making it the optimal choice for applications featuring high-power density and high junction temperatures, such as cutting-edge SiC-based power modules.

What is the function of the thick copper in Battery Management Systems (BMS)?

In BMS, thick copper layers are vital for routing high currents during battery charging and discharging, ensuring efficient cell balancing, and minimizing resistive heating, which is critical for the safety, longevity, and overall performance of the high-voltage battery pack in electric vehicles and energy storage systems.

How does the industrial motor drives sector utilize heavy copper PCBs?

Industrial motor drives utilize heavy copper PCBs for the power section (busbars and switching elements) to withstand high peak currents and high operational temperatures, ensuring the reliability and efficiency of variable frequency drives (VFDs) and specialized machinery used in factory automation and robotics.

What is the impact of supply chain resilience on market pricing?

Lack of supply chain resilience, particularly concerning the limited global suppliers of high-purity copper and AlN ceramics, can lead to price volatility and increased lead times, significantly impacting the final cost of thick copper substrates and, subsequently, the pricing structure of high-power electronics modules.

Why is the DBC/AMB segment growing faster than traditional PCBs?

The DBC/AMB segment is growing faster because traditional PCBs, even heavy copper variants, cannot match the low thermal resistance and superior dielectric breakdown strength required by modern, high-power SiC/GaN devices, making ceramic-backed solutions indispensable for next-generation performance requirements.

What competitive advantage does a supplier gain from proprietary bonding techniques?

A supplier with proprietary bonding techniques (especially in AMB) gains a significant competitive edge by offering substrates with superior mechanical strength, enhanced thermal cycling capability, and reliable performance under extreme conditions, allowing them to target premium, high-margin automotive and aerospace customers.

How do thick copper substrates contribute to energy savings?

By offering extremely low electrical resistance, thick copper substrates significantly reduce I²R losses (power wasted as heat) in high-current paths within power modules and inverters, leading directly to higher overall system efficiency and considerable energy savings in applications like renewable energy conversion and electric propulsion.

What is the forecast for heavy copper PCB usage in telecommunications?

Heavy copper PCB usage in telecommunications is expected to grow steadily, driven by the rollout of 5G infrastructure, which requires high-power amplifiers and robust power distribution units at base stations to handle increased data traffic and power density, necessitating superior thermal and current management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager