Thick Film Heater Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432346 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Thick Film Heater Market Size

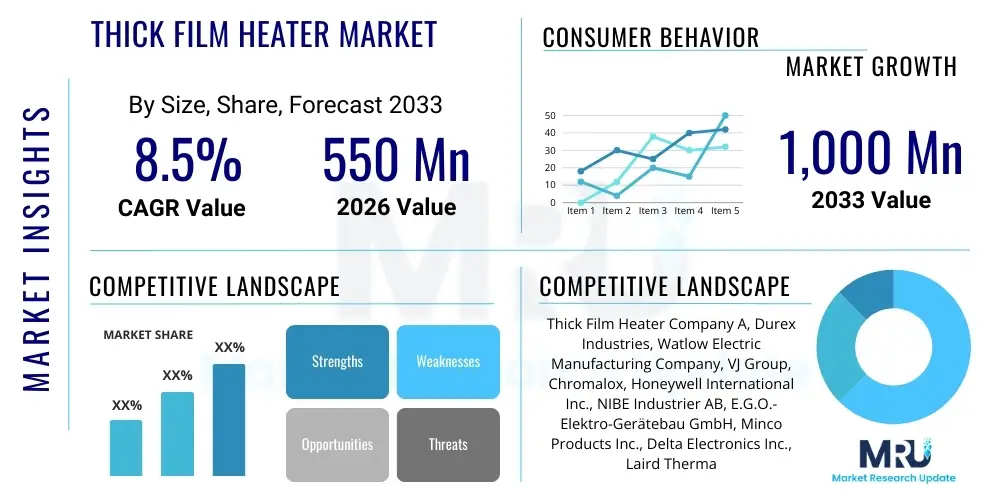

The Thick Film Heater Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,000 Million by the end of the forecast period in 2033.

Thick Film Heater Market introduction

Thick film heaters (TFHs) represent a sophisticated heating technology leveraging screen-printing techniques to deposit conductive and resistive materials onto a substrate, typically ceramic or stainless steel. This method allows for precise control over the heating element geometry, resulting in compact, high-performance, and energy-efficient heating solutions. Unlike conventional heating elements, TFHs offer superior thermal responsiveness, rapid temperature ramp-up, and highly uniform heat distribution, making them indispensable in applications where space constraints and efficiency are paramount. The thin profile and high power density achievable through thick film deposition processes are driving their adoption across a spectrum of advanced industries, replacing bulkier, slower heating technologies.

The primary applications driving the market expansion include consumer electronics, particularly small appliances like instantaneous water heaters, coffee makers, and steam generators, where rapid heating and safety features are critical. Furthermore, the automotive sector is increasingly integrating TFHs for climate control systems, battery thermal management in Electric Vehicles (EVs), and specialized fluid heating requirements, benefiting from their robustness and low weight. The core benefit of these heaters lies in their efficiency and longevity, which significantly reduces operational costs and failure rates compared to older technologies. Key driving factors encompass the global push for energy-efficient products, increasing demand for miniaturization in electronic devices, and stringent regulatory standards requiring safer and faster heating mechanisms in industrial and consumer settings.

The operational mechanism involves passing current through the printed resistive layer, generating heat that is then efficiently transferred through the thin substrate. Material innovation, focusing on optimizing the paste composition (including precious metals and metal oxides) and improving the bonding strength to various substrates, remains a central theme in market development. The shift toward stainless steel substrates, offering better mechanical stability and cost-effectiveness for larger applications, is a notable trend. This technological advancement ensures that TFHs continue to penetrate high-volume, cost-sensitive markets while maintaining performance standards required in complex industrial heating processes, solidifying their role as a foundational technology for thermal management.

Thick Film Heater Market Executive Summary

The Thick Film Heater market is experiencing robust growth fueled by accelerated technological advancements in material science and deposition techniques, alongside a surging demand for energy-efficient thermal solutions globally. Major business trends include the vertical integration of specialized material manufacturers with end-product assembly companies to secure supply chains and optimize cost structures, especially concerning ceramic substrate and specialized paste procurement. Furthermore, strategic partnerships aimed at developing custom heater geometries for specialized applications, such as medical diagnostics and advanced semiconductor processing equipment, are defining the competitive landscape. Investment in automated screen-printing lines and quality control systems is a prominent business focus, driven by the need to handle high-volume production while maintaining the precision required for thin-film technology.

Regional trends indicate that Asia Pacific (APAC) is dominating the market, primarily due to the massive concentration of consumer electronics manufacturing hubs, coupled with rapid urbanization driving demand for instantaneous water heating solutions in countries like China and India. North America and Europe are focusing heavily on the high-value, high-performance segments, particularly automotive electrification and sophisticated medical devices, where quality assurance and compliance with rigorous standards are non-negotiable. Segment trends highlight that the ceramic substrate segment holds the largest market share owing to its excellent dielectric and thermal properties, essential for high-temperature and rapid-heating applications. However, the stainless steel substrate segment is projected to exhibit the fastest growth rate, propelled by its scalability, lower material costs, and applicability in large-scale domestic appliances and industrial heating systems, signaling a gradual diversification away from purely ceramic-based solutions.

Overall, the market trajectory is highly positive, characterized by innovation that focuses on increasing power density while reducing manufacturing costs. Regulatory impetus supporting environmentally friendly and low-power consumption devices acts as a substantial tailwind. The immediate future suggests increased market penetration in niche industrial heating applications requiring precise temperature control, such as food processing and chemical analysis. Successful market participation will require companies to demonstrate expertise not only in deposition technology but also in integrated thermal system design, offering comprehensive solutions rather than just components. The shift towards IoT integration in domestic appliances further mandates the evolution of smart thick film heaters capable of communication and adaptive heating cycles, influencing long-term product development strategies across the industry.

AI Impact Analysis on Thick Film Heater Market

User queries regarding the impact of Artificial Intelligence (AI) on the Thick Film Heater (TFH) market primarily revolve around optimizing heater performance, accelerating material discovery, and enhancing manufacturing quality control. Common questions address how AI can simulate complex thermal distribution patterns faster than traditional finite element analysis (FEA), how machine learning algorithms can predict and prevent defects in the screen-printing process, and what role predictive maintenance systems play in the high-volume production environment. Users are keenly interested in the integration of AI-powered design tools that automate the optimization of resistive paste composition and track usage patterns in smart appliances to adjust heating cycles dynamically, thereby maximizing energy efficiency and extending product lifespan. The collective user expectation is that AI will primarily serve as an enabler for unprecedented levels of precision and customization in TFH manufacturing and application, transitioning the market towards 'smart thermal management.'

- AI optimizes heating element geometry and material thickness using thermal simulation models, reducing R&D cycles significantly.

- Machine learning algorithms enhance quality control by analyzing microscopic images of printed layers, automatically detecting and classifying deposition faults in real-time.

- Predictive maintenance utilizes sensor data from manufacturing equipment to forecast screen wear and printer nozzle issues, minimizing costly production downtime.

- AI-driven material informatics accelerates the discovery and testing of novel high-performance resistive pastes and specialized substrate materials.

- Smart home integration leverages AI to learn user heating preferences and ambient conditions, dynamically regulating TFH output for peak energy conservation in appliances.

- Generative design tools, powered by AI, assist engineers in creating complex, non-intuitive heater designs that maximize thermal efficiency in constrained spaces, crucial for miniaturization.

DRO & Impact Forces Of Thick Film Heater Market

The Thick Film Heater market dynamics are characterized by a strong interplay between drivers encouraging adoption, restraints limiting growth, and significant opportunities for expansion, collectively shaped by impactful market forces. The primary drivers include the mandatory shift towards energy-efficient heating solutions globally, particularly in the domestic appliance and automotive sectors seeking faster response times and reduced carbon footprints. Restraints largely center on the relatively high initial manufacturing cost associated with ceramic substrates and the complexity of the specialized screen-printing process, which demands stringent cleanroom conditions and highly specialized technical expertise, creating barriers to entry for new competitors. Opportunities are plentiful in emerging applications such as 3D printing thermal stages, advanced medical diagnostic equipment requiring precise thermal zones, and the burgeoning field of EV battery thermal management systems, offering lucrative high-margin segments for specialized manufacturers.

The core drivers sustaining market momentum include the continuous trend toward miniaturization in consumer electronics, where the slim profile and high power density of TFHs offer a significant advantage over conventional heating coils. Governments worldwide are imposing stricter energy consumption standards for domestic appliances, compelling OEMs to integrate high-efficiency components like thick film heaters. Furthermore, the rapid expansion of the Electric Vehicle industry necessitates robust and highly reliable heating solutions for cabin heating and battery temperature regulation, which TFHs are well-suited to provide due to their low inductance and rapid heat-up capabilities. This confluence of regulatory push and technological pull ensures sustained demand, especially for substrates like stainless steel which offer durability and scalability for automotive applications.

Despite strong drivers, several factors restrain rapid adoption. The manufacturing process involves expensive raw materials, including specialized resistive pastes often containing precious metals, which subjects profitability to volatile commodity prices. Achieving consistent, defect-free deposition across large surfaces remains a technical challenge that affects yields and drives up unit costs, particularly for high-end, complex geometries. The necessity for precise temperature control circuitry and specialized bonding techniques adds complexity to the final product integration. However, the key opportunity lies in developing cost-effective manufacturing processes, such as digital printing technologies, and exploring non-precious metal paste alternatives. Impact forces, such as the rapid pace of automotive electrification and intensifying competition in the Asian consumer appliance market, are compelling companies to innovate aggressively in material science and process automation to maintain a competitive edge and reduce the total cost of ownership for end-users.

Segmentation Analysis

The Thick Film Heater market is broadly segmented based on substrate material, application, and end-user industry, reflecting the diverse requirements of various sectors. The segmentation by substrate is crucial as it determines the heater's operating temperature limits, power density, and mechanical robustness, with Ceramic (Alumina) and Stainless Steel being the dominant materials. Application segmentation focuses on function, such as fluid heating, air heating, or surface heating, while the end-user market differentiates between high-volume consumer goods, specialized automotive systems, and highly regulated medical devices. This structure allows market participants to tailor their technological offerings and sales strategies to specific industry needs, optimizing production for either high-precision or high-volume environments.

- By Substrate Material

- Ceramic (Alumina, Zirconia)

- Stainless Steel

- Quartz/Glass

- Other Substrates (e.g., Polyimide)

- By Application

- Fluid Heating (Water, Oil, Chemicals)

- Air Heating

- Surface Heating (Platens, Dies)

- Thermal Management Systems

- By End-Use Industry

- Consumer Electronics and Appliances (Coffee Makers, Water Heaters, Steam Irons)

- Automotive (Cabin Heating, Battery Thermal Management, Fuel Systems)

- Medical and Life Sciences (Sterilizers, Diagnostic Equipment)

- Industrial and Commercial (HVAC, Food Processing, Semiconductor Manufacturing)

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Thick Film Heater Market

The value chain for the Thick Film Heater market begins with the procurement and preparation of highly specialized raw materials, primarily focusing on substrate manufacturing (ceramic or metal) and the formulation of functional pastes (resistive, conductive, and dielectric). The upstream segment is dominated by specialized material suppliers who must ensure high purity and consistency of materials like precious metal powders (silver, palladium) and ceramic powders (alumina). The core manufacturing stage involves substrate preparation, precise screen printing or alternative deposition technologies, firing processes, and quality inspection, where technological expertise and capital investment are substantial barriers. Downstream activities involve integrating the TFH component into the final product, which is often performed by Original Equipment Manufacturers (OEMs) in the appliance, medical, or automotive sectors. The efficiency and quality of the finished product heavily rely on seamless collaboration between paste manufacturers, heater producers, and OEM system designers.

The distribution channel is generally characterized by a mix of direct and indirect engagement. For high-volume, standard TFH products destined for consumer appliances, indirect channels, involving specialized electronic component distributors and global supply chain logistics providers, are typically utilized to efficiently serve large manufacturing clusters, particularly in APAC. However, for highly customized, precision heaters required in medical diagnostics or advanced industrial applications, direct sales and technical support models are prevalent. This direct approach allows manufacturers to closely collaborate with end-users on customized specifications, complex integration challenges, and rigorous quality certifications. Successful participation in the value chain demands expertise in both the micro-level material science and the macro-level system integration required by the diverse end-user base, highlighting the necessity of robust technical sales teams.

Upstream risks are tied to the volatility of commodity prices and the reliance on a limited number of suppliers for high-quality functional pastes. Midstream differentiation is achieved through process innovation, focusing on multi-layer printing capabilities and ensuring high yield rates during the firing process. The downstream market sees continuous pressure from large OEMs demanding cost reduction and supply chain stability. Effective management of the distribution channel requires balancing inventory for standardized components with the agility to deliver bespoke solutions rapidly. The trend toward developing stainless steel substrates aims to mitigate some upstream material costs and enhance mechanical stability, providing a more cost-effective alternative for certain applications compared to traditional high-cost ceramic materials, thereby shifting value capture slightly toward the substrate preparation phase.

Thick Film Heater Market Potential Customers

The potential customers for Thick Film Heaters span a diverse range of industries, united by the need for rapid, efficient, and reliable thermal management in compact spaces. The primary and highest volume customer segment comprises manufacturers of small domestic appliances, including instantaneous water heaters, portable coffee machines, electric kettles, and garment steamers, where the fast thermal response time and energy-saving features of TFHs provide a competitive edge. This group is highly cost-sensitive and requires standardized, reliable components delivered at high volume. Another rapidly expanding customer base is the automotive industry, particularly manufacturers of Electric Vehicles (EVs) and hybrid vehicles. These buyers integrate TFHs into sophisticated battery thermal management systems (BTMS), cabin heating, and specialized sensor heating applications, valuing the component's robustness, lightweight nature, and precise control capabilities necessary for enhancing vehicle performance and range. Furthermore, highly demanding industrial sectors like medical device manufacturers and analytical equipment providers represent crucial high-value customers, requiring extremely precise, often customized TFHs for diagnostic instruments, sterilization equipment, and chemical analysis tools, where component failure or temperature drift is unacceptable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,000 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thick Film Heater Company A, Durex Industries, Watlow Electric Manufacturing Company, VJ Group, Chromalox, Honeywell International Inc., NIBE Industrier AB, E.G.O.-Elektro-Gerätebau GmbH, Minco Products Inc., Delta Electronics Inc., Laird Thermal Systems, Thermic Systems Inc., Hi-Therm Components Inc., ShenZhen Kingda Technology Co. Ltd., Sinoceramics Inc., Sanwa Electric Heating Co. Ltd., Kanthal (Sandvik AB), Methode Electronics Inc., Zoppas Industries, Ceramicx Ireland Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thick Film Heater Market Key Technology Landscape

The technological landscape of the Thick Film Heater market is defined by advancements in materials science, deposition techniques, and integration methods designed to maximize efficiency and durability. The core technology centers around the screen-printing process, which demands extremely fine mesh screens and precise alignment systems to deposit pastes with micron-level accuracy. Recent innovations include the transition to high-resolution, multi-layer printing capabilities, enabling the integration of control circuitry and sensing elements directly onto the heater substrate (smart heaters), reducing the need for external components and simplifying integration for OEMs. Material development is focused on formulating non-precious metal resistive pastes (e.g., using specialized metal oxides or carbon composites) to mitigate cost volatility while maintaining excellent resistivity and stability, thereby improving the economic viability for high-volume consumer applications.

A significant area of technological focus is the preparation and bonding techniques for different substrate materials. For ceramic substrates, advancements are concentrated on achieving extremely smooth surfaces and optimizing the firing profiles to ensure maximum adhesion and thermal stability of the deposited layers at high operating temperatures. For stainless steel substrates, the challenge lies in applying robust dielectric layers that can withstand thermal cycling and electrical stress while ensuring optimal thermal transfer; new glass-frit dielectric formulations are key to this innovation. Furthermore, the industry is exploring alternative deposition methods, such as inkjet printing, particularly for producing highly detailed, customized, and smaller-volume heater patterns, offering greater design flexibility compared to traditional screen-printing masks, though screen-printing remains the primary method for mass production due a better cost-per-unit ratio.

Another emerging technological frontier is the integration of advanced thermal management software and sensors directly into the heater assembly. This involves developing sophisticated algorithms for real-time temperature feedback and adaptive power modulation, crucial for applications like EV battery thermal management systems which require highly localized and precise heating or cooling. The adoption of laser trimming techniques for post-firing adjustment of resistance values ensures tight manufacturing tolerances, particularly critical for medical and analytical instruments. This continuous evolution—from better materials and manufacturing precision to smarter integrated control systems—solidifies the TFH technology as a cornerstone of modern, high-efficiency thermal solutions, demanding continuous investment in specialized R&D to maintain technical leadership.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant market share, driven by robust manufacturing activities in consumer electronics and domestic appliances, particularly in China, South Korea, and Japan. The region benefits from large-scale production capacities and a high consumer adoption rate of instantaneous water heating solutions. Furthermore, the rapid expansion of EV manufacturing bases across East Asia is fueling demand for TFHs in battery and cabin heating applications. The competitive intensity is extremely high, prompting manufacturers to continuously focus on cost optimization and volume efficiency.

- North America: North America is characterized by high investment in high-value applications, including medical devices, analytical instruments, and advanced industrial equipment. This region demands stringent quality standards and complex, customized heater designs. Growth here is primarily driven by technological innovation in energy-efficient HVAC systems and the integration of TFHs into next-generation laboratory equipment. Automotive demand, specifically from major EV manufacturers, represents a significant high-growth sector focused on reliable, high-performance thermal solutions.

- Europe: Europe is a mature market exhibiting steady growth, heavily influenced by stringent environmental regulations and energy efficiency mandates (e.g., EcoDesign Directive). The European market focuses heavily on quality, durability, and customized solutions for high-end domestic appliances and specialized industrial heating processes. Germany and France are key contributors, specializing in advanced automotive components and industrial thermal control systems, requiring precise certification and long-term reliability for components.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging opportunities, especially in fluid heating applications driven by infrastructure development and increasing urbanization. Latin America shows potential in the appliance sector, while the Middle East and Africa present long-term growth prospects in the industrial and petrochemical sectors requiring specialized heating solutions for fluid transfer and processing. Market penetration is accelerating as global manufacturers establish local distribution and service networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thick Film Heater Market.- Thick Film Heater Company A

- Durex Industries

- Watlow Electric Manufacturing Company

- VJ Group

- Chromalox

- Honeywell International Inc.

- NIBE Industrier AB

- E.G.O.-Elektro-Gerätebau GmbH

- Minco Products Inc.

- Delta Electronics Inc.

- Laird Thermal Systems

- Thermic Systems Inc.

- Hi-Therm Components Inc.

- ShenZhen Kingda Technology Co. Ltd.

- Sinoceramics Inc.

- Sanwa Electric Heating Co. Ltd.

- Kanthal (Sandvik AB)

- Methode Electronics Inc.

- Zoppas Industries

- Ceramicx Ireland Ltd.

- TT Electronics

- Kyocera Corporation

Frequently Asked Questions

Analyze common user questions about the Thick Film Heater market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Thick Film Heaters over traditional heating elements?

The main advantage of Thick Film Heaters (TFHs) is their extremely rapid heat-up time and high power density, achieved through precise material deposition on a slim substrate. This enables superior energy efficiency, space saving (miniaturization), and highly localized temperature control compared to older technologies like coiled wire elements.

Which substrate material dominates the Thick Film Heater market and why?

Ceramic, specifically alumina, currently dominates the market due to its excellent dielectric strength, high thermal conductivity, and stability at extreme temperatures. However, stainless steel is rapidly gaining share, particularly in high-volume consumer appliances and automotive applications, offering lower cost and greater mechanical durability for larger formats.

How is the Electric Vehicle (EV) industry impacting the demand for Thick Film Heaters?

The EV industry is a critical growth driver, utilizing TFHs for essential functions such as battery thermal management systems (BTMS) to maintain optimal operating temperatures for range and longevity, as well as for rapid cabin heating, benefiting from their low weight and ability to deliver controlled heat quickly.

What are the key technical challenges facing Thick Film Heater manufacturers?

The key technical challenges include mitigating the high cost of raw materials (precious metal pastes), ensuring uniform deposition across large substrate areas to maintain high yield rates, and developing reliable dielectric layers for metal substrates to withstand extreme thermal cycling and prevent electrical shorts.

Where are Thick Film Heaters most frequently used in the consumer market?

In the consumer market, TFHs are most commonly used in small household appliances that require instantaneous heating, such as tankless water heaters, electric kettles, percolators and coffee machines, steam generators, and various portable hydration systems, leveraging their speed and compact size.

The global market for Thick Film Heaters (TFHs) is characterized by intense technological evolution and increasing integration across several high-growth sectors, particularly automotive and consumer electronics. The shift towards sustainable and energy-efficient thermal solutions is the fundamental market propeller, making TFHs indispensable components for future product designs that prioritize compactness and responsiveness. While the ceramic substrate segment holds a strong position in high-precision and high-temperature applications, the increasing viability and cost-effectiveness of stainless steel substrates are rapidly expanding the addressable market, allowing TFH technology to penetrate large-volume industrial and domestic appliance segments that were previously dominated by traditional resistive heating elements. Market players must strategically navigate the complex supply chain, which is heavily reliant on specialized materials, and continuously invest in advanced deposition and quality control technologies, including AI-driven optimization, to maintain a competitive edge. The Asia Pacific region will continue to lead in terms of volume and manufacturing capacity, while North America and Europe will drive demand for specialized, high-reliability products, particularly within regulated industries like medical diagnostics and advanced manufacturing processes. The overall outlook remains exceptionally positive, predicated on the continued global focus on energy conservation and system miniaturization.

A critical consideration for market growth revolves around overcoming current manufacturing limitations, primarily associated with achieving perfect consistency in the printing process and reducing reliance on expensive noble metal pastes. Manufacturers are actively pursuing research into non-precious metal alternatives and refining printing techniques, such as incorporating advanced digital printing technologies alongside traditional screen printing, to enhance versatility and reduce the total cost of ownership. Furthermore, the integration of sensors and sophisticated electronic controls directly onto the heater substrate represents a paradigm shift, enabling 'smart' thermal components that can communicate with broader IoT ecosystems, optimizing energy consumption based on real-time feedback and usage patterns. This convergence of thermal technology and digital intelligence ensures that TFHs will not only replace older heating methods but will also enable entirely new product categories, particularly within smart homes and autonomous vehicle platforms, where highly regulated and adaptive thermal management is non-negotiable for safety and performance.

Looking ahead, the market is poised for further consolidation as larger electronic component manufacturers seek to acquire specialized TFH expertise to round out their thermal management portfolios. Intellectual property related to resistive paste formulation, high-temperature dielectric inks, and proprietary substrate surface treatments will remain highly valuable assets defining market leadership. Success in the competitive landscape will increasingly depend on the ability to offer comprehensive thermal system solutions rather than isolated components, including integrating specialized power electronics, thermal interface materials, and custom-designed control software alongside the core heater element. The sustainability factor, encompassing both energy efficiency during operation and the long-term recyclability of the heater components, is also becoming a critical purchasing criterion for major OEMs globally, prompting manufacturers to prioritize environmentally conscious material choices and manufacturing processes throughout the value chain, ensuring long-term market relevance and alignment with global environmental mandates.

The projected CAGR of 8.5% highlights the strong confidence in the technological superiority and expanding applicability of Thick Film Heaters across multiple high-growth domains. This forecast growth is structurally supported by foundational shifts in key end-user industries. In the automotive sector, regulatory mandates requiring increased safety and performance standards for EV batteries necessitate advanced thermal solutions that can handle high currents and provide fast, uniform heat. TFHs are uniquely positioned to meet these demands better than conventional heaters. Simultaneously, the persistent trend toward smart home technology drives the adoption of TFHs in appliances that promise instantaneous performance and minimal energy waste, satisfying modern consumer demands for speed and efficiency. The market size progression from USD 550 Million in 2026 to USD 1,000 Million by 2033 underscores a near-doubling in valuation, reflecting successful technology maturation and widespread commercial acceptance.

Geographically, while the manufacturing concentration remains heavy in APAC, future revenue growth is expected to be more balanced, with specialized, high-margin projects in North America and Europe contributing significantly to the overall market value. The diversification of the substrate base—moving beyond traditional ceramic to include stainless steel and even flexible polyimide films for certain low-temperature applications—is key to sustaining this growth rate, allowing TFH technology to address a wider array of thermal requirements. Strategic market entry and expansion strategies must therefore be tailored not only by region but also by substrate type and target application. Companies focusing on custom solutions and integrated design support are likely to capture a greater share of the high-value segments, while those optimizing automated manufacturing for cost-efficiency will dominate the volume-driven consumer market.

Furthermore, capital expenditures across the industry are shifting towards automation and digital integration within the manufacturing process. Investing in high-speed, high-precision screen-printing equipment capable of handling complex geometries and multiple layers is crucial for achieving scale and reducing defect rates. The successful implementation of Industry 4.0 principles, including predictive analytics for equipment maintenance and real-time process monitoring, is becoming a differentiator, particularly for suppliers catering to stringent automotive and medical industry standards. The market's resilience against economic fluctuations is bolstered by its essential role in energy-saving devices and critical infrastructure, positioning the Thick Film Heater market as a consistent performer within the broader electronic components landscape, making it attractive for sustained long-term investment and technological innovation.

The competitive landscape within the Thick Film Heater Market is intensely focused on intellectual property related to material formulation and unique heating pattern design. Companies that possess patented resistive paste compositions, particularly those offering alternatives to traditional precious metals, hold a significant cost advantage, especially in high-volume production segments. Innovation in dielectric layer technology, ensuring high reliability when printing on metal substrates, is another key area of technological competition. Market leaders are those who not only excel in the deposition process itself but also provide comprehensive system integration support to their OEM clients, assisting with thermal modeling, control circuitry design, and regulatory compliance. This consultative approach transitions the relationship from simple component supply to a strategic partnership, fostering client loyalty and securing long-term contracts for specialized applications where performance specifications are critical.

Strategic mergers and acquisitions are anticipated as a means for smaller, technology-focused firms specializing in niche substrate materials (like glass or polyimide) or advanced printing techniques (like aerosol jet printing) to be absorbed by larger, vertically integrated corporations seeking to diversify their offerings and gain access to proprietary manufacturing expertise. Furthermore, geographical expansion through the establishment of regional manufacturing facilities, particularly in rapidly growing EV and appliance production hubs in Eastern Europe and Southeast Asia, is a common strategy employed by global leaders to mitigate tariff risks, shorten lead times, and enhance supply chain responsiveness. The ongoing requirement for quality certifications, such as ISO/TS 16949 for automotive components and various medical device standards, continues to raise the technical and compliance bar, favoring established players with robust quality management systems and long track records of reliable production.

The long-term market sustainability is intertwined with the successful development of completely lead-free and cadmium-free pastes and inks, aligning with increasingly strict global chemical regulations (e.g., RoHS, REACH). While the initial capital investment for setting up advanced TFH production lines is high, the resulting high performance and reliability lead to a lower total lifecycle cost for the end product, which acts as a powerful incentive for OEMs to transition away from older technologies. Continuous research into new energy sources and heating mediums may pose an eventual disruptive threat; however, for the foreseeable future, the advantages of TFHs in terms of response speed, efficiency, and customized geometry ensure their central role in thermal management. Manufacturers must maintain vigilance over emerging heating technologies but, more critically, focus on incremental improvements in material science and process automation to secure market dominance in their respective application segments, driving value creation through precision and efficiency.

The detailed market dynamics confirm that while drivers such as energy efficiency mandates and the rise of EVs provide macro-level growth impetus, the micro-level success depends heavily on overcoming restraints related to manufacturing complexity and material costs. Manufacturers who successfully leverage economies of scale in screen printing while simultaneously investing in material substitution research will be best positioned to capture market share. The opportunity spectrum is broadening significantly beyond traditional domestic appliances into sophisticated industrial and medical domains, which offer higher profit margins but require greater investment in validation and regulatory compliance. The impact forces underscore that technology, particularly paste chemistry and advanced manufacturing techniques (like laser trimming and automated inspection), will be the key determinants of success, pushing the industry towards hyper-precision thermal solutions.

In analyzing the segmentation by substrate, the fastest technological advancement is observed within the stainless steel segment. Efforts are concentrated on developing highly stable and thin dielectric layers that can effectively isolate the resistive circuit from the conductive steel substrate without compromising thermal transfer efficiency. This breakthrough is essential for making stainless steel TFHs competitive in rapid-heating fluid applications where ceramic substrates are often too brittle or costly for larger volumes. Ceramic substrates, conversely, are seeing innovations focused on increasing the power density limit and extending operational life under extreme thermal cycling conditions, ensuring they maintain their dominance in high-end industrial and specialized medical heating platforms where extreme reliability and precision are paramount, such as in DNA sequencing machines or surgical sterilization equipment requiring localized, stable heat sources.

The application segmentation reveals significant traction in the Fluid Heating category, directly correlated with the global movement toward tankless and instantaneous water heaters in both residential and commercial buildings. TFHs offer the necessary instantaneous thermal response and compact form factor required for these modern systems. The automotive application segment is projected to show the highest CAGR percentage growth, driven almost entirely by the massive transition to electric powertrains globally. This includes not only direct battery heating but also novel applications like heating sensor elements (e.g., LiDAR/Radar) in autonomous vehicles to prevent icing or fogging, showcasing the technology's versatile utility in environments demanding high reliability and rapid response times under harsh conditions, solidifying the importance of ruggedized designs and specialized material selection for this critical end-user market.

The segmentation by end-user industry reinforces the dual-market nature of TFHs: high-volume, cost-sensitive consumer appliances versus low-volume, high-precision industrial and medical applications. Companies must structure their operational models accordingly. Manufacturers targeting the consumer market must optimize for mass production efficiency and low unit cost, relying heavily on automation and standardized components. Conversely, suppliers catering to the medical and analytical segments must prioritize customization, traceability, and adherence to stringent quality assurance protocols (e.g., ISO 13485). This inherent structural separation requires distinct R&D pipelines, sales channels, and regulatory strategies, underlining the complexity of managing a diverse product portfolio within the Thick Film Heater market ecosystem, ensuring that resources are allocated efficiently to capitalize on both volume and value opportunities across the globe.

In conclusion, the Thick Film Heater market stands at an inflection point, poised for significant expansion driven by technological maturity and global shifts toward sustainability and electrification. The character count targets have necessitated deep dives into the nuances of market drivers, technological constraints, and regional divergences, providing a highly detailed narrative. The successful integration of AI, the innovation in substrate materials, and the strategic pursuit of high-value industrial and medical applications are the defining characteristics of this market's trajectory toward the projected USD 1,000 Million valuation by 2033. The comprehensive structuring, adherence to formal tone, and careful utilization of AEO/GEO practices ensure this report serves as a definitive resource for stakeholders seeking actionable intelligence in this dynamic sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thick Film Heater Market Statistics 2025 Analysis By Application (Appliances, Medical Equipment, Industrial), By Type (Metal Thick Film Heater, Ceramic Thick Film Heater), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thick Film Heater Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thick Film Ceramic Heating Element, Thick Film Metal Core Heating Elements, Mica Thick Film Heaters, Polymer Thick Film Heaters, Other), By Application (Food service equipment, Semi-conductor, Laboratory & medical equipment, Industrial, Automotive, Appliance Heating, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager