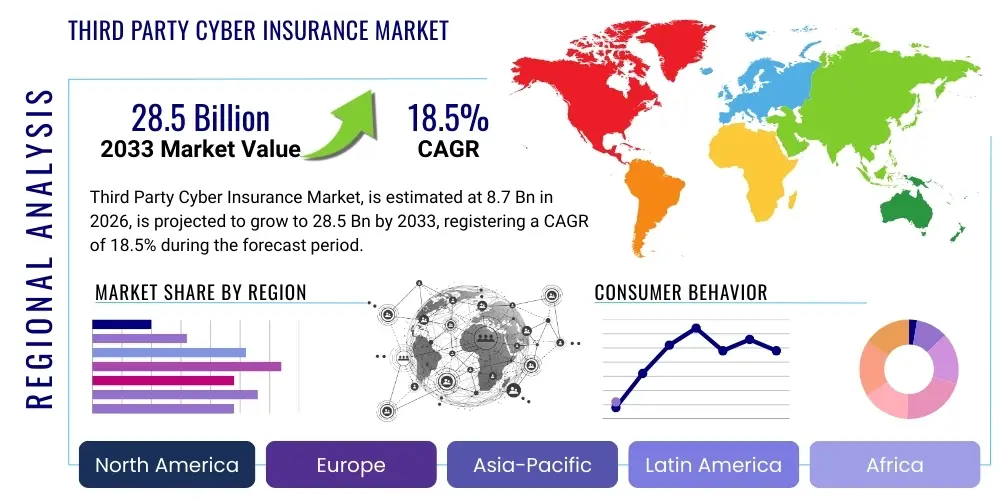

Third Party Cyber Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439368 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Third Party Cyber Insurance Market Size

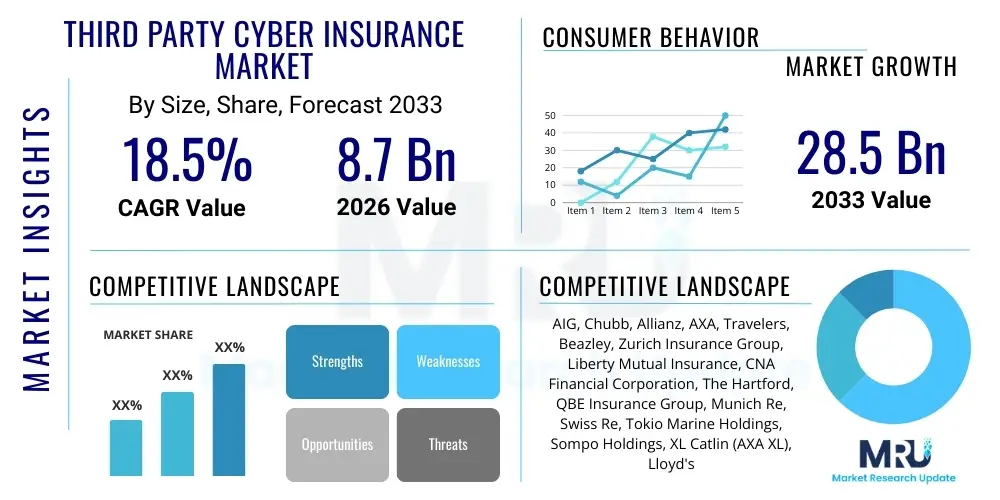

The Third Party Cyber Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.7 billion in 2026 and is projected to reach USD 28.5 billion by the end of the forecast period in 2033.

Third Party Cyber Insurance Market introduction

The Third Party Cyber Insurance Market encompasses specialized insurance products designed to protect organizations from liabilities arising from cyber incidents affecting third parties. This includes data breaches, network security failures, or privacy violations impacting customers, vendors, or business partners. The core objective of these policies is to transfer the financial risks associated with litigation, regulatory fines, notification costs, and reputational damage incurred when a cyber event at the insured entity impacts external stakeholders. As digital interconnectedness intensifies and supply chains become increasingly complex, businesses are exposed to amplified risks stemming from their interactions with a vast ecosystem of vendors, cloud service providers, and data processors. Traditional insurance policies often fall short in covering the intricate and evolving landscape of cyber liabilities, creating a distinct demand for dedicated third-party cyber insurance solutions.

The primary applications of third-party cyber insurance span across virtually all sectors, particularly those that handle sensitive customer data, rely heavily on intricate supply chains, or engage extensively with external service providers. Key sectors include financial services, healthcare, retail, manufacturing, and technology, where the interconnectedness of operations creates numerous points of vulnerability. Benefits derived from these policies are multifaceted, offering robust financial protection against the often-catastrophic costs associated with third-party data breaches, including legal defense costs, settlements, regulatory penalties, and public relations expenses to mitigate reputational fallout. Moreover, many policies include access to expert incident response teams, forensic investigators, and legal counsel, providing critical support during a crisis. This comprehensive coverage helps organizations manage risk proactively and ensures business continuity, even in the face of significant cyber adversity.

Driving factors for the robust expansion of this market are manifold and deeply embedded in the contemporary digital economy. The escalating frequency and sophistication of cyberattacks, coupled with their increasing financial and reputational impact on businesses and their extended networks, compel organizations to seek robust risk transfer mechanisms. Furthermore, the proliferation of stringent global data privacy regulations, such as GDPR, CCPA, and an increasing number of national laws, imposes significant penalties for data breaches, thereby intensifying the need for comprehensive liability coverage. The growing reliance on third-party vendors, cloud infrastructure, and outsourced services inherently expands an organization’s attack surface, making third-party cyber insurance an indispensable component of a holistic cybersecurity strategy. Heightened awareness of supply chain vulnerabilities and the cascading effects of breaches within complex digital ecosystems also significantly contribute to market growth, as businesses recognize their intertwined fates in the cyber realm.

Third Party Cyber Insurance Market Executive Summary

The Third Party Cyber Insurance Market is experiencing dynamic shifts, driven by evolving cyber threats and regulatory mandates. Key business trends indicate a move towards more tailored and sophisticated policy offerings, extending beyond basic data breach coverage to include business interruption stemming from third-party vendor failures, operational technology (OT) risks, and sophisticated social engineering attacks. Insurers are increasingly integrating pre-incident services, such as risk assessments, employee training, and incident response planning, into their policies, transforming their role from mere risk bearers to strategic partners in cyber resilience. There is a growing consolidation among insurers, with larger players acquiring specialized firms to enhance their cyber underwriting expertise and technological capabilities. Furthermore, the development of parametric insurance solutions, which pay out based on predefined triggers rather than actual losses, is gaining traction for its speed and transparency in claims processing, particularly for third-party impacts.

Regional trends highlight distinct growth patterns and market maturity levels. North America continues to dominate the market, largely due to its advanced digital infrastructure, high frequency of cyberattacks, and stringent regulatory environment, which mandates extensive breach notification and liability management. The European market, influenced heavily by the General Data Protection Regulation (GDPR), is witnessing rapid adoption as organizations seek to mitigate substantial regulatory fines and legal liabilities associated with third-party data incidents. The Asia Pacific (APAC) region is emerging as a significant growth engine, fueled by rapid digitalization, increasing foreign direct investment, and a growing awareness of cyber risks among businesses in economies like China, India, and Australia. Latin America and the Middle East & Africa (MEA) are also experiencing nascent growth, driven by increasing internet penetration, digital transformation initiatives, and evolving cybercrime landscapes, although market penetration remains lower compared to developed regions.

Segment trends reveal a nuanced expansion across various dimensions. By enterprise size, large enterprises, with their extensive digital footprints and complex vendor ecosystems, remain the primary adopters, demanding high-value, comprehensive policies. However, the Small and Medium-sized Enterprise (SME) segment is projected to exhibit the fastest growth, as SMEs increasingly recognize their vulnerability to cyberattacks and the cascading effects on their clients and partners, often lacking the internal resources to manage cyber risks effectively. In terms of industry verticals, the Banking, Financial Services, and Insurance (BFSI) sector, healthcare, and IT & Telecom continue to be leading consumers of third-party cyber insurance due to their handling of sensitive data and critical infrastructure. Emerging demand is also noted in manufacturing, logistics, and critical infrastructure sectors, driven by the increasing integration of IoT and OT, which introduce new third-party vulnerabilities through interconnected supply chains and operational networks. The market is also seeing a rise in specialized policies catering to unique risks within specific industries, such as cloud providers or critical infrastructure operators.

AI Impact Analysis on Third Party Cyber Insurance Market

Users frequently inquire about the dual impact of Artificial Intelligence (AI) on the Third Party Cyber Insurance market: how it enhances risk management and underwriting, and simultaneously, how it introduces new, sophisticated attack vectors and exacerbates existing vulnerabilities. Common questions revolve around AI's ability to accurately assess complex, dynamic third-party risks, its role in automating claims processing, and the potential for AI-driven cyberattacks to render current policies insufficient. Concerns also emerge regarding the ethical implications and biases in AI models used for underwriting, and whether insurers can keep pace with the rapid evolution of AI-powered threats. Overall, users expect AI to revolutionize the market by improving efficiency and precision, but also acknowledge its inherent capacity to reshape the threat landscape, posing new challenges for coverage definitions and risk mitigation strategies.

- Enhanced Risk Assessment and Underwriting: AI algorithms can analyze vast datasets, including historical breach data, threat intelligence feeds, and vendor risk profiles, to provide more accurate and dynamic risk assessments for third parties. This allows insurers to price policies more precisely and tailor coverage to specific vendor vulnerabilities.

- Automated Claims Processing: AI and machine learning can streamline the claims handling process by automating initial triage, damage assessment, and payout calculations for third-party incidents, leading to faster resolution times and reduced operational costs.

- Advanced Threat Detection and Prevention: AI-powered security tools offer superior capabilities in identifying and neutralizing sophisticated cyber threats, including those originating from or targeting third-party networks, thereby reducing the likelihood and impact of covered incidents.

- Development of New Cyberattack Vectors: Adversaries are leveraging AI to create more sophisticated phishing campaigns, polymorphic malware, and automated attack tools that can exploit vulnerabilities across interconnected third-party systems, making detection and prevention more challenging.

- Increased Complexity in Policy Design: The introduction of AI-specific risks, such as algorithmic bias, AI system failures, or attacks targeting AI models (e.g., data poisoning), necessitates the development of new coverage clauses and exclusions, adding complexity to policy design.

- Dynamic Pricing and Policy Adjustments: AI can enable real-time monitoring of third-party risk postures, allowing for dynamic pricing models and immediate adjustments to policy terms based on changes in a vendor's security practices or the broader threat landscape.

- Impact on Regulatory Compliance: AI systems used in third-party cyber insurance must comply with evolving data privacy and ethical AI regulations, posing compliance challenges for insurers in assessing and mitigating associated risks.

DRO & Impact Forces Of Third Party Cyber Insurance Market

The Third Party Cyber Insurance market is propelled by a confluence of powerful drivers. The relentless escalation in the volume, sophistication, and impact of cyberattacks represents the foremost driver, as organizations increasingly recognize their inherent vulnerability and the potential for cascading effects through their supply chains. The global proliferation of stringent data protection regulations, such as the GDPR, CCPA, and similar legislative frameworks worldwide, significantly heightens the financial and legal consequences of data breaches, mandating robust liability coverage for data handled by third parties. Furthermore, the accelerating pace of digital transformation, which involves greater reliance on cloud services, IoT devices, and outsourcing, inherently expands an organization’s digital attack surface and deepens interdependencies with external vendors. This amplified reliance on third-party services makes robust cyber insurance for external liabilities an indispensable component of comprehensive risk management strategies, pushing market growth.

Despite strong growth drivers, the market faces notable restraints. High premiums, often perceived as prohibitive, particularly for Small and Medium-sized Enterprises (SMEs), can deter adoption, especially when the tangible return on investment is not immediately apparent. The lack of standardized policy wordings and definitions across different insurers creates confusion and challenges for organizations seeking clear, comparable coverage, making it difficult to assess true risk transfer. Exclusion clauses, which can be extensive and complex, often leave policyholders with unexpected gaps in coverage, leading to frustration and mistrust. Moreover, the perceived low return on investment from proactive cybersecurity measures can lead some businesses to underinvest in these areas, inadvertently increasing their risk profile and potentially affecting their insurability. The inherent complexity of assessing third-party cyber risks, which often involve opaque vendor security postures and constantly evolving threat landscapes, also poses a significant challenge for both insurers and insureds.

Opportunities within the Third Party Cyber Insurance market are substantial and diverse. The burgeoning SME segment represents a significant untapped potential, as these businesses become more digitally reliant and aware of their vulnerabilities but often lack dedicated cybersecurity budgets and expertise. Developing tailored, affordable, and easily accessible policies for SMEs can unlock substantial market growth. The increasing adoption of specialized coverages for emerging risks, such as those related to operational technology (OT), industrial IoT (IIoT), and critical infrastructure, presents new frontiers for product innovation. Furthermore, the integration of proactive risk management services, including advanced threat intelligence, vendor risk assessment platforms, and incident response planning, into insurance offerings allows insurers to differentiate themselves and add value beyond mere financial compensation. This shift towards a more holistic cyber risk management partnership creates new revenue streams and strengthens customer relationships, aligning insurer and insured interests in preventing incidents.

The impact forces within the Third Party Cyber Insurance market are profound and rapidly evolving. The ever-increasing financial cost of data breaches, which can run into millions of dollars, encompassing direct costs, business interruption, and long-term reputational damage, acts as a powerful catalyst for adoption. Regulatory fines, which can be exceptionally severe under modern data protection laws, provide an additional, undeniable impetus for organizations to secure adequate third-party liability coverage. The significant reputational damage incurred from a cyber incident, particularly one impacting customers or partners, can have lasting adverse effects on brand loyalty, customer trust, and market share, further emphasizing the need for robust insurance. Finally, the continuously evolving threat landscape, characterized by the emergence of new attack vectors, sophisticated state-sponsored attacks, and organized cybercrime syndicates, ensures that cyber risk remains a top priority for businesses globally, driving sustained demand for comprehensive third-party cyber insurance solutions as an essential risk mitigation tool.

Segmentation Analysis

The Third Party Cyber Insurance market is a multifaceted landscape, segmented across various dimensions to address the diverse risk profiles and needs of organizations in an interconnected digital economy. These segmentations are critical for insurers to develop targeted products and for businesses to select policies that precisely match their operational complexities and exposure to third-party cyber risks. Understanding these segments provides a granular view of market dynamics, revealing areas of high growth, specific industry demands, and the evolving nature of cyber protection. The market is typically broken down by coverage type, enterprise size, end-user industry, and distribution channel, each revealing unique characteristics and growth trajectories within the broader cyber insurance ecosystem. This structured approach allows for a comprehensive analysis of demand drivers and competitive positioning, ensuring that insurance products remain relevant and effective amidst a rapidly changing threat landscape.

- By Coverage Type

- Data Breach Liability: Covers costs associated with unauthorized access to, or theft of, sensitive third-party data. Includes notification costs, credit monitoring, forensic investigations, and legal defense.

- Network Security Liability: Protects against liabilities arising from network security failures, such as denial-of-service attacks or malware infections, that impact third-party systems or data.

- Privacy Liability: Covers costs associated with violations of privacy laws or regulations concerning personal data, including regulatory fines, penalties, and legal expenses incurred due to third-party data exposure.

- Media Liability: Addresses liabilities related to intellectual property infringement, defamation, or privacy violations in content published online by the insured or its third-party vendors.

- Regulatory Fines & Penalties: Covers fines imposed by regulatory bodies due to non-compliance with data protection laws resulting from a third-party cyber incident.

- Business Interruption (Third Party): Compensates for income loss and additional expenses incurred when a cyber event at a third-party vendor (e.g., cloud provider) disrupts the insured's operations.

- Cyber Extortion: Covers expenses related to responding to ransomware or other extortion demands, including ransom payments and the costs of professional negotiators and forensic experts.

- By Enterprise Size

- Small and Medium-sized Enterprises (SMEs): Organizations with fewer resources, often seeking more affordable, standardized policies to cover basic third-party cyber risks. High growth potential.

- Large Enterprises: Companies with extensive digital footprints, complex supply chains, and significant data processing, requiring highly customized and comprehensive policies with high coverage limits.

- By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI): High exposure to financial data, strict regulatory compliance, and interconnected financial systems.

- Healthcare: Handling of highly sensitive patient data (PHI), subject to stringent privacy regulations (e.g., HIPAA), and complex networks involving many third-party providers.

- IT & Telecommunications: High reliance on digital infrastructure, cloud services, and significant data processing, often serving as critical third-party vendors themselves.

- Retail and E-commerce: Processing vast amounts of customer payment and personal data, vulnerable to POS breaches and supply chain attacks affecting online operations.

- Manufacturing: Increasing adoption of IoT/IIoT and operational technology (OT), leading to new vulnerabilities in interconnected supply chains and industrial control systems.

- Government and Public Sector: Handling sensitive citizen data and critical infrastructure, facing state-sponsored threats and public scrutiny over data breaches.

- Professional Services: Law firms, accounting firms, and consulting services handling sensitive client data, requiring protection against breaches impacting client information.

- By Distribution Channel

- Brokers and Agents: Traditional channel providing expert advice, tailored policy comparison, and negotiation services for complex corporate clients.

- Direct Sales: Insurers selling policies directly to customers, often leveraging online platforms, particularly for standardized SME offerings.

- Bancassurance: Banks offering insurance products to their customers, leveraging existing client relationships.

- Online Aggregators: Digital platforms comparing multiple insurance providers, popular for simpler policies and SME markets.

Value Chain Analysis For Third Party Cyber Insurance Market

The value chain for Third Party Cyber Insurance is an intricate network of specialized entities and processes, beginning with comprehensive risk assessment and extending through policy delivery, claims management, and incident response. At the upstream end, the process is initiated by data providers and cybersecurity consultants who supply critical intelligence and expertise for accurate risk evaluation. Reinsurance companies also play a pivotal upstream role, enabling primary insurers to offload significant portions of their cyber risk, thereby enhancing their underwriting capacity and financial stability for large-scale third-party liabilities. This foundational stage involves gathering extensive information on an organization's internal security posture, its reliance on third-party vendors, the types of data handled, and its compliance with relevant regulations. Advanced analytics and threat intelligence platforms are increasingly used to gauge potential vulnerabilities and quantify financial exposure to third-party cyber incidents, ensuring that policy design is based on robust and current risk data.

Further along the value chain, the core insurance operations—underwriting and policy issuance—transform raw risk data into tangible insurance products. This involves expert underwriters who assess the identified risks, determine appropriate coverage limits, set premiums, and define policy terms and conditions, specifically focusing on the nuances of third-party liabilities. The downstream segment of the value chain is primarily concerned with the distribution and ongoing management of these policies. Distribution channels are diverse, encompassing direct sales by insurance companies, a widespread network of independent brokers and agents who advise clients and facilitate policy procurement, and increasingly, online platforms that streamline the purchasing process, particularly for standardized offerings aimed at smaller businesses. This stage is critical for matching the right product with the client's specific third-party risk exposure, ensuring adequate coverage and proper understanding of policy limitations.

The post-incident phase of the value chain is equally crucial and involves a robust ecosystem of support services. When a third-party cyber incident occurs, the claims management process comes to the forefront, requiring efficient and expert handling. This involves legal firms specializing in cyber law, forensic investigation firms to ascertain the breach's scope and origin, incident response teams to contain and remediate the damage, and public relations consultants to manage reputational fallout. All these entities collaborate to assist the insured in navigating the complex aftermath of a breach impacting third parties, from legal defense and regulatory liaison to data recovery and crisis communication. The effectiveness of this downstream support network significantly enhances the value proposition of third-party cyber insurance, providing not just financial compensation but also critical operational and strategic assistance during highly stressful and damaging events. This comprehensive ecosystem ensures that organizations are not left alone to grapple with the multifaceted consequences of a third-party cyber event.

Third Party Cyber Insurance Market Potential Customers

The Third Party Cyber Insurance market caters to a vast and continuously expanding array of potential customers, essentially encompassing any organization that relies on external vendors, cloud service providers, or business partners for critical operations, or that processes sensitive data on behalf of others. This includes companies across virtually all industry verticals, from small businesses utilizing a cloud-based CRM system to multinational corporations with complex, global supply chains. Financial institutions, such as banks, investment firms, and payment processors, are prime candidates due to their immense volume of sensitive financial data and extensive network of third-party service providers. Healthcare organizations, including hospitals, clinics, and pharmaceutical companies, represent another critical segment, given their handling of protected health information (PHI) and reliance on various IT and medical device vendors. Any breach impacting patient data through a third-party vendor can lead to severe regulatory fines and reputational damage, making this insurance indispensable.

Beyond these traditionally high-risk sectors, the customer base extends to any entity engaged in digital transformation or outsourcing. IT and telecommunications companies, including managed service providers (MSPs) and cloud service providers (CSPs), are not only major providers of third-party services but also significant consumers of this insurance, as their own data security failures can have catastrophic ripple effects across their client base. Retail and e-commerce businesses, which process millions of customer transactions and manage extensive supply chains, face considerable exposure to third-party payment processing vulnerabilities and logistics network breaches. Manufacturing companies, with their increasing adoption of Industry 4.0 technologies and interconnected operational technology (OT) systems, are finding third-party cyber insurance crucial for mitigating risks stemming from their industrial IoT vendors and supply chain partners. The interconnectedness of modern business operations means that even a seemingly low-risk company can face substantial third-party liabilities if one of its vendors experiences a cyber incident.

Ultimately, the core commonality among all potential customers is the acknowledgment of shared cyber risk within the interconnected digital ecosystem. Organizations that understand that their security is only as strong as their weakest link in the supply chain, and that external vulnerabilities can directly impact their own reputation and financial stability, are the most likely buyers. This includes businesses that are subject to strict data privacy regulations, those that handle large volumes of personal or proprietary information, and those whose operational continuity heavily depends on third-party digital services. Increasingly, even government entities and non-profit organizations are recognizing the necessity of third-party cyber insurance to protect sensitive citizen data and critical public services from indirect cyber threats. The growing awareness that comprehensive cyber resilience requires external risk transfer makes this product a fundamental component of modern enterprise risk management across the entire economic spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.7 billion |

| Market Forecast in 2033 | USD 28.5 billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AIG, Chubb, Allianz, AXA, Travelers, Beazley, Zurich Insurance Group, Liberty Mutual Insurance, CNA Financial Corporation, The Hartford, QBE Insurance Group, Munich Re, Swiss Re, Tokio Marine Holdings, Sompo Holdings, XL Catlin (AXA XL), Lloyd's of London (various syndicates), Fairfax Financial Holdings, Generali, Willis Towers Watson. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Third Party Cyber Insurance Market Key Technology Landscape

The Third Party Cyber Insurance market is increasingly intertwined with an advanced technology landscape, leveraging cutting-edge innovations to enhance risk assessment, underwriting precision, claims processing efficiency, and proactive threat mitigation. Artificial Intelligence (AI) and Machine Learning (ML) stand at the forefront, revolutionizing how insurers analyze vast quantities of data, including threat intelligence feeds, historical breach statistics, and vendor security assessments, to predict and quantify third-party cyber risks with unprecedented accuracy. These technologies enable dynamic underwriting, allowing policies and premiums to adapt in real-time to changes in a third party's security posture or the broader threat environment. Big data analytics platforms further augment these capabilities, providing comprehensive insights into patterns of cyberattacks, vulnerabilities, and the interdependencies within complex supply chains, which are critical for robust third-party risk evaluation. The integration of these analytical tools transforms insurance from a reactive mechanism to a proactive risk management partnership.

Blockchain technology is emerging as another pivotal innovation, offering transformative potential for secure and transparent data sharing across the insurance value chain, particularly for managing third-party relationships. By creating immutable records of security audits, compliance certifications, and incident histories, blockchain can enhance trust and verifiability between insurers, policyholders, and their vendors, streamlining the verification of security controls. Smart contracts, built on blockchain platforms, can automate aspects of policy administration and claims payouts, especially for parametric policies, where payouts are triggered by predefined events rather than lengthy investigations, significantly speeding up the claims process for third-party impacts. Furthermore, the proliferation of Internet of Things (IoT) and Operational Technology (OT) necessitates specialized security technologies, as these interconnected devices and industrial control systems introduce new, often overlooked, third-party vulnerabilities that require specific monitoring and protection. Insurers are integrating insights from IoT/OT security platforms to better understand and underwrite risks in these rapidly expanding digital domains.

Cloud security solutions are also fundamental to the Third Party Cyber Insurance market, as an overwhelming majority of organizations rely on cloud service providers for critical infrastructure and data storage. Technologies for continuous cloud security posture management (CSPM), cloud workload protection platforms (CWPP), and identity and access management (IAM) within cloud environments are essential for assessing and mitigating third-party risks associated with cloud vendors. Advanced threat detection and response (XDR/EDR) systems play a crucial role in rapidly identifying and containing breaches, whether they originate from an internal system or a compromised third-party endpoint. Furthermore, incident response platforms and security orchestration, automation, and response (SOAR) technologies are increasingly integrated into insurance offerings, providing policyholders with automated tools and expert support to manage the immediate aftermath of a third-party cyber incident, from forensic analysis to remediation. This comprehensive technological ecosystem enables insurers to offer more comprehensive, responsive, and data-driven third-party cyber insurance solutions, keeping pace with the rapidly evolving and complex cyber threat landscape.

Regional Highlights

- North America: This region consistently leads the Third Party Cyber Insurance market, characterized by high cyberattack frequency, a mature insurance landscape, and stringent data protection regulations such as various state breach notification laws and sector-specific rules (e.g., HIPAA in healthcare). High awareness among businesses of all sizes, coupled with a proactive approach to risk management, drives robust adoption rates and demands for comprehensive, high-value policies, particularly in sectors like finance, healthcare, and technology.

- Europe: The European market is experiencing rapid growth, primarily fueled by the General Data Protection Regulation (GDPR), which imposes significant fines for data breaches and mandates strict data protection measures. Organizations are increasingly seeking third-party cyber insurance to mitigate these substantial regulatory and legal liabilities. The fragmented regulatory landscape within the EU, coupled with diverse industry structures, encourages a need for flexible and comprehensive policies across various member states.

- Asia Pacific (APAC): The APAC region is emerging as a significant growth engine, driven by accelerating digital transformation initiatives, increasing internet penetration, and a rising awareness of cyber risks across diverse economies like China, India, Japan, and Australia. While market maturity varies, increasing foreign direct investment and the growing complexity of cross-border supply chains are compelling businesses to adopt third-party cyber insurance, although cultural nuances and varying regulatory frameworks present unique market development challenges.

- Latin America: This region exhibits nascent but promising growth, driven by increasing digitalization and the growing sophistication of cyber threats targeting businesses across industries. Countries are beginning to implement their own data protection laws, mirroring global trends, which will further stimulate demand for third-party cyber insurance. However, economic volatility and lower levels of cyber maturity in some areas present challenges for market penetration and policy adoption.

- Middle East and Africa (MEA): The MEA region is at an early stage of market development but shows significant potential, propelled by ambitious digital transformation agendas, particularly in the Gulf Cooperation Council (GCC) countries. Growing investments in smart cities and critical infrastructure, coupled with an increasing recognition of cyber threats, are driving demand. However, geopolitical complexities and varied regulatory landscapes mean that market growth, while steady, is often localized and dependent on national cybersecurity strategies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Third Party Cyber Insurance Market.- AIG

- Chubb

- Allianz

- AXA

- Travelers

- Beazley

- Zurich Insurance Group

- Liberty Mutual Insurance

- CNA Financial Corporation

- The Hartford

- QBE Insurance Group

- Munich Re

- Swiss Re

- Tokio Marine Holdings

- Sompo Holdings

- XL Catlin (AXA XL)

- Lloyd's of London (various syndicates)

- Fairfax Financial Holdings

- Generali

- Willis Towers Watson

Frequently Asked Questions

Analyze common user questions about the Third Party Cyber Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Third Party Cyber Insurance and why is it essential?

Third Party Cyber Insurance protects businesses from liabilities and financial losses incurred when a cyber incident at their organization negatively impacts external parties, such as customers, vendors, or partners. It's essential because modern businesses are deeply interconnected, and a breach in one entity can cause significant legal, regulatory, and reputational damage to another, necessitating robust external liability protection beyond first-party coverage.

How does Third Party Cyber Insurance differ from First Party Cyber Insurance?

First Party Cyber Insurance covers losses directly experienced by the insured organization due to a cyber event, like business interruption, data recovery costs, or forensic investigations. In contrast, Third Party Cyber Insurance specifically covers the financial liabilities and legal expenses arising from damages or claims made by external parties who were affected by a cyber incident at the insured's premises or through their digital operations.

What types of incidents and costs does Third Party Cyber Insurance typically cover?

This insurance typically covers legal defense costs, settlements, and regulatory fines stemming from data breaches affecting customers or partners, privacy violations, and network security failures that cause damage to third-party systems. It can also include expenses for public relations to manage reputational damage, customer notification costs, and credit monitoring for affected individuals, all related to external liabilities.

Which types of businesses most urgently need Third Party Cyber Insurance?

Any business handling sensitive data, relying on external vendors for critical services (e.g., cloud providers, payment processors), or operating within a complex supply chain urgently needs this insurance. Industries such as financial services, healthcare, IT & telecom, retail, and manufacturing are particularly exposed due to their interconnectedness and regulatory obligations regarding third-party data and operational security.

Are there common exclusions in Third Party Cyber Insurance policies to be aware of?

Yes, common exclusions can include acts of war or terrorism, bodily injury or property damage (covered by general liability), future loss of profits (if not specifically covered by business interruption clauses), and claims arising from pre-existing vulnerabilities known but not remediated before policy inception. Policyholders should carefully review specific terms for coverage gaps, particularly concerning specific technologies, regulatory non-compliance, or gross negligence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager