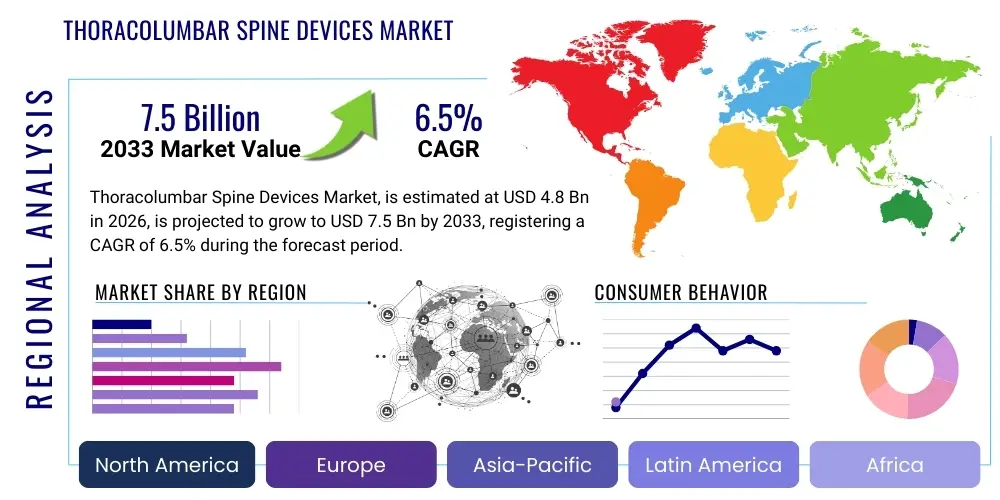

Thoracolumbar Spine Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437018 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Thoracolumbar Spine Devices Market Size

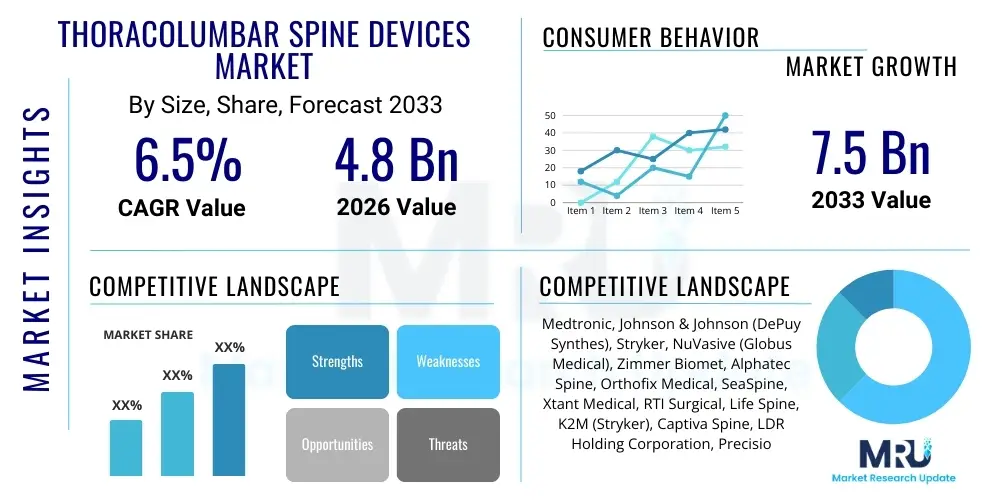

The Thoracolumbar Spine Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Thoracolumbar Spine Devices Market introduction

The Thoracolumbar Spine Devices Market encompasses a diverse portfolio of specialized medical implants and instruments utilized in surgical procedures targeting the thoracic and lumbar segments of the spine. These devices are crucial for stabilizing the spine, correcting deformities, alleviating nerve compression, and facilitating fusion following trauma, degenerative diseases, tumors, or infections. Key products include pedicle screws, rods, interbody cages, plates, and various decompression instruments designed to restore biomechanical integrity and patient mobility. The increasing prevalence of chronic back pain, coupled with an aging global population susceptible to spinal degenerative disorders like spondylolisthesis and spinal stenosis, forms the fundamental demand driver for this market segment. Continuous innovation focusing on minimally invasive surgical (MIS) techniques and the development of advanced biocompatible materials are pivotal in expanding the market reach and improving patient outcomes, thereby sustaining robust growth projections throughout the forecast period.

Major applications of thoracolumbar spine devices primarily revolve around fusion surgeries, which constitute the largest procedural volume. These devices are indispensable in procedures such as Posterior Lumbar Interbody Fusion (PLIF), Transforaminal Lumbar Interbody Fusion (TLIF), and Extreme Lateral Interbody Fusion (XLIF), offering durable solutions for instability and chronic discogenic pain. Beyond fusion, these implants are increasingly used in motion preservation and dynamic stabilization systems, although fusion remains the gold standard for severe cases. The primary benefits associated with modern thoracolumbar devices include enhanced stabilization, reduced post-operative pain through MIS approaches, faster recovery times, and improved long-term functional results for patients. Furthermore, the integration of advanced imaging and navigation systems during surgical implantation ensures higher precision, minimizing risks associated with nerve damage or misplaced hardware.

Driving factors for the substantial expansion of the Thoracolumbar Spine Devices Market include the global demographic shift towards an older population segment, which inherently requires more orthopedic interventions, and the rising awareness among both patients and healthcare providers regarding advanced treatment options for spinal disorders. Furthermore, technological advancements, particularly in smart implants, porous titanium structures that promote osseointegration, and robotics-assisted surgical systems, are making spinal procedures safer and more accessible. Favorable reimbursement policies across developed economies, coupled with expanding healthcare infrastructure in emerging regions like the Asia Pacific, are further accelerating the adoption rate of premium thoracolumbar implants. The shift from conventional open surgeries to MIS techniques, which rely heavily on specialized, high-cost instrumentation and implants, also contributes significantly to market value growth.

Thoracolumbar Spine Devices Market Executive Summary

The Thoracolumbar Spine Devices Market is currently characterized by intense competition driven by technological superiority and procedural innovation, especially concerning minimally invasive spinal surgery (MIS) techniques. Business trends show a strong emphasis on strategic acquisitions and partnerships, where large multinational corporations are absorbing smaller, innovative device manufacturers specializing in biomaterials and specific procedural segments, thereby consolidating market share and achieving economies of scale in distribution. Furthermore, there is a pronounced shift towards value-based healthcare models globally, compelling manufacturers to demonstrate the long-term clinical and economic effectiveness of their devices, favoring products that reduce hospital stay duration and complication rates. Emerging business models also include subscription services for specialized surgical robotics and navigation software, integrating the device sales with comprehensive digital ecosystem support for surgeons.

Regional trends indicate that North America, particularly the United States, maintains market dominance due to high healthcare expenditure, sophisticated surgical infrastructure, and rapid adoption of premium technologies like specialized interbody cages and robotic navigation systems. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by increasing medical tourism, rapidly improving access to advanced medical care, and a massive, underserved patient pool suffering from spinal trauma and degenerative conditions. European markets are characterized by stringent regulatory environments and a focus on cost-effectiveness, favoring established, proven technologies but also demonstrating early adoption of dynamic stabilization systems. The integration of local manufacturing capabilities in emerging economies is also a notable regional trend aimed at reducing supply chain vulnerabilities and offering competitive pricing.

Segmentation trends highlight that the fusion devices segment, encompassing rods, screws, and cages, retains the largest market share by product type, underpinned by the high volume of spinal fusion procedures performed globally. Within fusion, the material composition of interbody cages is evolving rapidly, with porous titanium and PEEK alternatives gaining traction due to superior osseointegration properties. Procedure-wise, MIS techniques are rapidly outpacing open surgeries, driving the demand for specialized instruments and smaller, percutaneously deliverable implants. By end-user, hospitals remain the primary consumers, but Ambulatory Surgical Centers (ASCs) are emerging as high-growth centers, particularly in the U.S., due to their focus on cost-efficient elective procedures, influencing device design towards easier handling and shorter operating times suitable for outpatient settings. This structural shift necessitates device manufacturers to tailor their marketing and distribution strategies specifically for the ASC environment.

AI Impact Analysis on Thoracolumbar Spine Devices Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming surgical precision, personalized implant design, and post-operative monitoring within the thoracolumbar spine sector. Key concerns center on AI's role in mitigating surgical errors, optimizing pre-operative planning, and improving patient selection criteria for complex spinal procedures. The consensus expectation is that AI will dramatically enhance diagnostic capabilities, allowing for earlier and more accurate identification of specific pathologies requiring surgical intervention. Furthermore, users are keenly interested in the application of ML algorithms to analyze vast datasets of surgical outcomes, aiming to predict device success rates and failure points, thereby leading to the iterative improvement of implant design and surgical protocols. The most impactful themes revolve around AI-driven navigation systems, predictive analytics for complication reduction, and the automated design of patient-specific instrumentation and 3D-printed implants, suggesting a future where spinal surgery becomes significantly less invasive and highly customized.

- AI-Enhanced Pre-operative Planning: Utilization of machine learning algorithms to analyze patient anatomy (CT/MRI scans) and model biomechanical loads, optimizing surgical trajectories and predicting the required size and placement of pedicle screws and interbody cages with millimeter accuracy.

- Robotic Guidance Systems Integration: AI algorithms providing real-time intraoperative data analysis, feeding precision instructions to robotic systems to ensure highly accurate screw placement and minimally invasive access, dramatically reducing fluoroscopy exposure and procedural time.

- Personalized Implant Design: Implementation of generative design AI to create customized, 3D-printable interbody fusion devices and rods tailored to the patient's specific spinal curvature and bone density, improving load sharing and fusion rates.

- Predictive Outcome Analytics: ML models analyzing electronic health records (EHRs), demographic data, and intraoperative variables to forecast the likelihood of successful fusion, adjacent segment disease, and potential complications, aiding surgeons in treatment decisions.

- Automated Image Processing and Diagnosis: AI assisting radiologists and orthopedic specialists in rapidly detecting subtle spinal fractures, early signs of degeneration, or implant loosening through automated segmentation and anomaly detection in diagnostic images.

DRO & Impact Forces Of Thoracolumbar Spine Devices Market

The dynamics of the Thoracolumbar Spine Devices Market are shaped by a strong interplay between compelling clinical needs, technological advancements, and restrictive regulatory and economic factors. The primary drivers are the escalating global burden of spinal degenerative disorders attributed to sedentary lifestyles, obesity, and the aging populace, coupled with a growing demand for effective, rapid surgical solutions. Significant market momentum is derived from the continuous development and commercialization of advanced materials, such as porous titanium coatings and specialized PEEK variations, which promise improved osteointegration and reduced risk of rejection. However, the market faces considerable restraints, including the high procedural cost associated with complex spine surgeries, the steep learning curve required for adopting advanced robotic and navigation technologies, and intense regulatory scrutiny concerning new implant approvals, which often lengthens time-to-market. Furthermore, budget constraints imposed by healthcare payers, particularly in national healthcare systems, often favor conservative treatment protocols over surgical interventions unless absolutely necessary, thereby tempering the volume growth of elective procedures.

Opportunities for exponential growth are concentrated in the rapid commercial expansion of MIS techniques, which currently boast superior patient outcomes and reduced recovery periods compared to traditional open surgery. Manufacturers can capitalize on the development of smart, sensor-enabled implants capable of monitoring real-time load bearing, temperature, and fusion progression, integrating these data into comprehensive digital health platforms. Another significant opportunity lies in the underserved patient populations in emerging markets, where improving economic conditions are enabling greater access to private healthcare and advanced spinal care. Focusing on educational programs for surgeons in these regions and establishing localized production facilities to offer cost-competitive devices represents a strong pathway for sustained growth. Additionally, the development of non-fusion and dynamic stabilization devices presents a lucrative niche, particularly for younger, more active patients who prioritize maintaining range of motion.

The impact forces influencing this market are predominantly high, driven by the indispensable nature of these devices in restoring quality of life and preventing permanent disability. Demand elasticity is relatively low for essential, trauma-related spinal interventions, but higher for elective degenerative procedures, making reimbursement policies a powerful influence. The threat of substitutes is moderate; while non-surgical treatments (physical therapy, pharmacological interventions) delay surgery, they rarely replace the need for surgical stabilization in advanced pathology. Supplier power is generally moderate to high, concentrated among specialized biomaterial and component suppliers, whereas buyer power remains strong, mainly exerted by large hospital networks and Group Purchasing Organizations (GPOs) demanding standardized pricing and volume discounts. Technological shifts, particularly the adoption rate of robotics and navigation, represent the highest impact force, continually redefining surgical standards and market competitiveness.

Segmentation Analysis

The Thoracolumbar Spine Devices Market is highly fragmented and segmented based on multiple criteria including Product Type, Procedure Type, Material, and End-User, reflecting the complexity and specialization required for treating diverse spinal pathologies. Product segmentation is crucial, differentiating between fixation devices (pedicle screws, rods), interbody devices (cages), and decompression instruments, each addressing specific surgical needs within the thoracolumbar region. The ongoing technological evolution within these segments, particularly the shift towards minimally invasive implants, dictates competitive advantage. Furthermore, the market is structurally influenced by the material used, with PEEK (Polyetheretherketone) and metallic alloys (Titanium) constituting the largest segments, though innovative biomaterials and hybrid composites are steadily gaining market traction due to their enhanced osteoconductive properties.

Procedure Type analysis reveals that fusion surgeries—both traditional and minimally invasive approaches—dominate the revenue landscape, driven by their established efficacy in treating chronic instability and severe deformities. However, the non-fusion segment, including dynamic stabilization systems and artificial discs, is projected to register a higher compound annual growth rate, reflecting a patient preference for motion preservation technologies where clinically appropriate. This sub-segment requires significant R&D investment but promises superior long-term functional outcomes for a select group of patients. Market players are strategically positioning themselves by offering comprehensive procedural solutions, ranging from access instruments to specialized implant kits, ensuring compatibility across different surgical approaches (e.g., PLIF, TLIF, DLIF).

Geographic segmentation remains paramount, defining adoption rates and pricing structures. Mature markets in North America and Western Europe are characterized by high device ASPs and a preference for cutting-edge, often robotic-assisted, procedures. In contrast, high-growth markets in Asia Pacific and Latin America are focused on increasing accessibility and managing cost, often leading to greater demand for established, lower-cost metallic implants. Understanding these segmentation nuances allows manufacturers to tailor their product offerings, regulatory strategies, and clinical training programs to specific regional demands, optimizing resource allocation and maximizing market penetration across diverse economic landscapes.

- By Product Type:

- Fusion Devices

- Rods and Hooks

- Pedicle Screw Systems (Polyaxial and Monoaxial)

- Plates and Cages (Interbody Cages: PEEK, Titanium, Hybrid)

- Vertebral Body Replacement (VBR) Devices

- Non-Fusion Devices

- Dynamic Stabilization Systems

- Artificial Discs (Total Disc Replacement)

- Facet Replacement Devices

- Vertebroplasty and Kyphoplasty Devices

- Spinal Biologics (Bone Graft Substitutes, BMPs)

- Fusion Devices

- By Procedure Type:

- Open Surgery

- Minimally Invasive Surgery (MIS)

- By Material:

- Metallic Implants (Titanium, Stainless Steel)

- Polymer Implants (PEEK, CFR-PEEK)

- Bioabsorbable Materials

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialized Orthopedic Clinics

Value Chain Analysis For Thoracolumbar Spine Devices Market

The value chain for Thoracolumbar Spine Devices is intricate, starting from the procurement of highly specialized raw materials and extending through complex manufacturing, regulatory approval, distribution, and final usage in healthcare facilities. Upstream analysis focuses heavily on the procurement of critical materials, primarily medical-grade titanium alloys, PEEK polymers, and advanced ceramics. Suppliers in this segment hold moderate leverage, as the quality and purity requirements for biocompatible materials used in long-term implants are extremely stringent, demanding specialized processing capabilities and rigorous quality control. Manufacturers must maintain deep, often exclusive, relationships with these suppliers to ensure material consistency and volume availability, especially for innovative materials like porous structures or composite polymers designed to enhance osseointegration.

The core manufacturing and assembly stage involves high-precision machining, additive manufacturing (3D printing), and sterilization processes. Significant value addition occurs here through proprietary design elements, such as self-tapping screw threads, expansion mechanisms in interbody cages, and specific surface treatments. Companies heavily invest in R&D to optimize device geometries for anatomical fit and biomechanical performance. Downstream activities are dominated by sales, marketing, and distribution. Given the high-cost nature and surgical specificity of these products, the sales process is highly technical, involving expert sales representatives who often provide hands-on support and training to surgical teams during procedures. Effective inventory management and robust logistics networks are essential to ensure timely delivery of sterile implants and instruments to operating rooms globally.

Distribution channels in this market are critical for success. The majority of products move through indirect channels, utilizing specialized medical device distributors or authorized agents who possess strong regional hospital relationships and expertise in inventory consignment models. Direct sales forces are primarily used by market leaders in high-volume, established regions (e.g., North America) to manage relationships with key opinion leaders and large Integrated Delivery Networks (IDNs). Indirect channels are preferred in fragmented or geographically challenging markets. The rise of centralized procurement departments in major hospitals and GPOs increases the negotiating power of buyers, pushing manufacturers towards competitive pricing models and consignment inventory agreements, thereby impacting overall channel profitability and requiring optimized supply chain responsiveness.

Thoracolumbar Spine Devices Market Potential Customers

The primary end-users and potential customers for thoracolumbar spine devices are institutional healthcare providers that perform complex orthopedic and neurosurgical procedures. Hospitals, particularly large tertiary and quaternary care centers with dedicated spinal surgery units, represent the largest customer segment. These facilities handle the highest volume of trauma cases, complex deformity corrections, and revision surgeries, often requiring premium, multi-component fixation and fusion systems. Their purchasing decisions are driven by factors such as clinical efficacy demonstrated through peer-reviewed data, compatibility with existing surgical systems (e.g., robotics), product portfolio breadth, and the availability of comprehensive surgeon training and technical support provided by the device manufacturers. Procurement decisions in major hospitals are increasingly centralized, favoring manufacturers who can offer bundled solutions across multiple device categories.

Ambulatory Surgical Centers (ASCs) constitute the fastest-growing customer segment, particularly in markets like the United States, where there is a strong shift toward performing elective spine procedures (especially less complex fusions and decompression procedures) in outpatient settings. ASCs prioritize cost-efficiency, streamlined inventory, and devices that facilitate shorter operating times and faster patient discharge. Manufacturers are developing specific product lines, focusing on efficient instrument sets and standardized, user-friendly implants tailored for the ASC environment, appealing directly to the needs of spine surgeons who operate primarily in these centers. The shift to ASCs is driven by favorable reimbursement policies and lower overhead costs compared to traditional hospitals, making them crucial targets for market penetration efforts.

Specialized orthopedic and neurosurgical clinics, particularly those affiliated with academic institutions or focused research hospitals, also represent a key customer base. These customers often act as early adopters for novel and high-technology devices, such as artificial discs or advanced dynamic stabilization systems, and frequently participate in clinical trials. Targeting these specialized centers is essential for validating new products and generating clinical evidence needed for broader market acceptance. Additionally, government and military hospitals, which require reliable and standardized surgical equipment for handling large volumes of trauma-related spinal injuries, form a distinct, though smaller, customer segment whose purchasing is often governed by stringent contractual requirements and competitive bidding processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (DePuy Synthes), Stryker, NuVasive (Globus Medical), Zimmer Biomet, Alphatec Spine, Orthofix Medical, SeaSpine, Xtant Medical, RTI Surgical, Life Spine, K2M (Stryker), Captiva Spine, LDR Holding Corporation, Precision Spine, ATEC Spine, ZT Medical, Spineart, TiGenix, Ulrich Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thoracolumbar Spine Devices Market Key Technology Landscape

The technological landscape of the Thoracolumbar Spine Devices Market is defined by continuous innovation aimed at enhancing surgical precision, improving implant longevity, and accelerating patient recovery. A primary focus lies in the widespread adoption of advanced navigation and robotics systems, such as the Mazor X (Medtronic) and the ROSA Spine (Zimmer Biomet), which integrate pre-operative planning software with intraoperative guidance. These systems allow surgeons to execute highly accurate pedicle screw placements and trajectory planning with sub-millimeter precision, reducing the reliance on conventional fluoroscopy and mitigating radiation exposure for both the patient and the surgical team. The integration of 3D imaging (like O-arm systems) provides real-time anatomical confirmation, further solidifying the standard of care in complex spinal reconstruction. Manufacturers are rapidly developing implants specifically optimized for these robotic platforms, ensuring seamless integration and maximizing procedural efficiency. This technological convergence is driving capital expenditure among leading hospitals globally, repositioning surgical capability as a critical differentiator.

Concurrently, there is a paradigm shift in material science, moving beyond standard titanium and PEEK towards next-generation biomaterials. Porous titanium technology, manufactured through Electron Beam Melting (EBM) or other additive manufacturing techniques (3D printing), is gaining immense popularity. These structures are designed to mimic the trabecular architecture of human bone, promoting faster and more robust osseointegration by allowing bone ingrowth into the implant surface, thus improving long-term fusion rates and stability. Furthermore, composite materials, such as Carbon Fiber Reinforced PEEK (CFR-PEEK), offer superior radiolucency and mechanical properties that approximate bone stiffness, reducing stress shielding compared to traditional metallic implants. The ability to customize porosity and surface roughness through additive manufacturing represents a significant technological leap, allowing for implants that are not only structurally sound but also biologically active in promoting fusion.

Another crucial technological development involves the sophistication of Minimally Invasive Surgery (MIS) instrument sets and implants. MIS requires specialized retraction, illumination, and visualization tools, along with percutaneously placed rod and screw systems. Technological advancements here include expandable interbody cages that are inserted at a compressed profile through a small incision and then expanded in situ, restoring disc height and sagittal alignment with minimal disruption to surrounding soft tissues. Dynamic stabilization and motion preservation devices, which utilize flexible rods and complex linkage mechanisms, represent the forefront of non-fusion technology, offering alternatives for patients with early-stage degenerative conditions. The continuous miniaturization and functional enhancement of these tools are paramount, enabling surgeons to tackle increasingly complex pathologies through smaller incisions, thereby addressing the crucial market need for reduced morbidity and quicker patient return to daily activities.

Regional Highlights

- North America: This region, led by the United States, commands the largest market share globally due to its advanced healthcare infrastructure, high per capita healthcare spending, and favorable reimbursement landscape for complex spinal surgeries, including the rapid adoption of new, high-cost technologies like robotic navigation and customized 3D-printed implants. The market is characterized by high procedural volumes for both degenerative conditions and spinal trauma. Intense competition among major industry players drives continuous technological advancement and strong emphasis on MIS techniques and premium-priced fusion devices, particularly in the Ambulatory Surgical Center setting, which is expanding rapidly across the U.S.

- Europe: Western European countries, particularly Germany, France, and the UK, represent a mature yet highly regulated market. Demand is steady, driven by an aging population and increasing rates of spine-related disabilities. While European countries show strong clinical acceptance of innovative devices, pricing pressures from national health services (NHS in the UK, centralized procurement in Germany) lead to slower adoption of the highest-cost technologies compared to the U.S. However, Europe is a strong hub for clinical research and the early incorporation of dynamic stabilization systems and cutting-edge biomaterials, focusing heavily on proven long-term clinical data to justify device costs.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market globally. This exponential growth is primarily fueled by improving economic conditions, massive population growth, increasing accessibility to medical insurance, and the rapid development of specialized spine centers in countries like China, India, and South Korea. While the market historically favored conventional, lower-cost metallic implants, there is a pronounced shift towards adopting international standards, including MIS techniques and high-quality PEEK and titanium cages, driven by medical tourism and increasing disposable incomes allowing patients to seek premium care. Significant opportunities exist for localized manufacturing and focused surgeon training programs.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, presents strong potential but is constrained by variable economic stability and fragmented healthcare systems. Growth is primarily driven by private healthcare sectors catering to higher-income populations. The demand for essential trauma and basic degenerative fixation devices is strong, but the adoption of sophisticated robotic and navigation systems is slow due to high initial capital investment requirements and lack of widespread reimbursement coverage for these technologies. Manufacturers often rely on local distributors to navigate complex import tariffs and regulatory pathways.

- Middle East and Africa (MEA): The MEA region is characterized by contrasting market dynamics. The Gulf Cooperation Council (GCC) countries exhibit high spending power and invest heavily in state-of-the-art medical infrastructure, driving demand for premium devices and specialized spinal care, often relying on imported European and American technologies. Conversely, the African continent remains largely underdeveloped in terms of specialized spinal care, focusing mostly on basic fixation for trauma cases. Political stability and government investment in healthcare infrastructure are key determinants of market penetration success in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thoracolumbar Spine Devices Market.- Medtronic plc

- Johnson & Johnson (DePuy Synthes)

- Stryker Corporation

- Globus Medical (including NuVasive operations)

- Zimmer Biomet Holdings, Inc.

- Alphatec Holdings, Inc. (ATEC Spine)

- Orthofix Medical Inc.

- SeaSpine Holdings Corporation

- Xtant Medical Holdings, Inc.

- RTI Surgical (Montagu Private Equity)

- Life Spine, Inc.

- Captiva Spine, Inc.

- Precision Spine, Inc.

- Spineart SA

- Ulrich Medical

- ATEC Spine

- Vertebral Technologies, Inc.

- Globus Medical, Inc.

- Tides Medical

- Synergy Spine Solutions

Frequently Asked Questions

Analyze common user questions about the Thoracolumbar Spine Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Thoracolumbar Spine Devices Market?

The market growth is primarily accelerated by the global increase in the aging population and the associated high prevalence of spinal degenerative diseases (e.g., spinal stenosis, spondylolisthesis). Additionally, the continuous technological advancements in Minimally Invasive Surgery (MIS) techniques and the development of superior biomaterials, such as porous titanium implants that enhance fusion rates, are major growth catalysts, offering better patient outcomes and faster recovery times.

Which product segment holds the largest share in the Thoracolumbar Spine Devices Market?

The Fusion Devices segment, which includes pedicle screw systems, rods, plates, and interbody cages (PEEK and Titanium), currently dominates the market share. This dominance is attributed to the high volume of spinal fusion procedures performed globally, as fusion remains the established gold standard for treating severe instability, chronic discogenic pain, and major deformities in the thoracic and lumbar spine regions.

How is the adoption of robotic surgery influencing the thoracolumbar device market?

Robotic and navigation systems are significantly impacting the market by enhancing surgical precision, especially in complex screw placement and trajectory planning. This adoption is driving demand for specialized, compatible implants and instruments, resulting in premium pricing and increasing the overall average selling price (ASP) of devices, thereby promoting safer and more consistent surgical results.

What role do Ambulatory Surgical Centers (ASCs) play as end-users in this market?

ASCs are a crucial and rapidly expanding customer segment, particularly in the United States. They focus on performing cost-effective elective spine procedures, such as single-level fusions and decompressions, in an outpatient setting. This shift drives demand for streamlined, efficient implant kits and systems designed for quick turnaround and reduced hospital stay duration, influencing manufacturers to develop ASC-specific product lines.

Which geographical region is anticipated to exhibit the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This exponential growth is underpinned by significant improvements in healthcare infrastructure, rapidly increasing healthcare expenditure, expanding medical insurance coverage, and a large, untapped patient base across major economies like China, India, and South Korea, leading to increasing adoption of advanced spinal care solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager