Thorium reactor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434164 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Thorium reactor Market Size

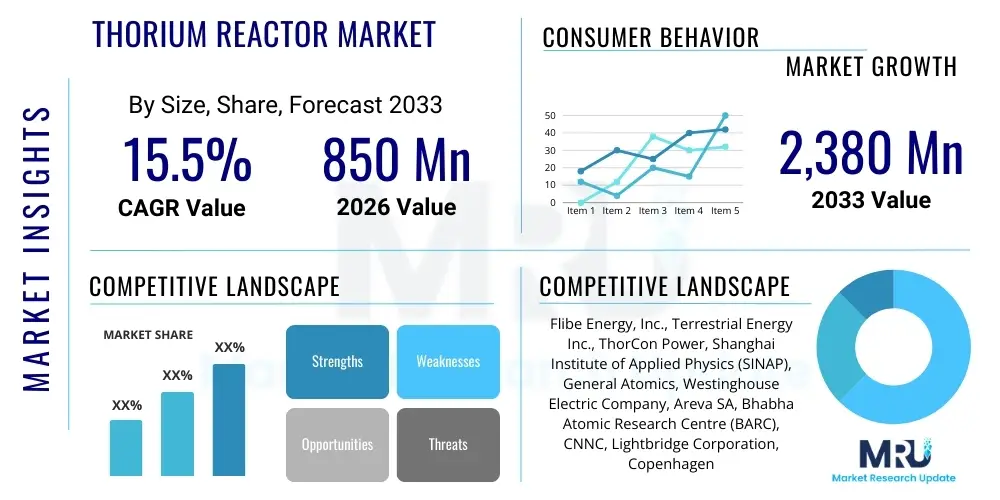

The Thorium reactor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $850 million USD in 2026 and is projected to reach $2,380 million USD by the end of the forecast period in 2033.

Thorium reactor Market introduction

The Thorium reactor market encompasses the research, development, and eventual commercial deployment of advanced nuclear fission systems utilizing thorium-232 as the fertile material, which transmutes into fissile uranium-233. These reactors, primarily in the form of Molten Salt Reactors (MSRs), High-Temperature Gas Reactors (HTGRs), and Heavy Water Reactors, offer significant advantages over traditional uranium-based systems, specifically in terms of enhanced safety features, reduced long-lived radioactive waste, and proliferation resistance. Thorium is abundant globally, offering a long-term, sustainable energy source capable of meeting escalating global electricity and industrial heat demands while minimizing carbon emissions, aligning perfectly with global decarbonization goals.

Major applications for Thorium reactor technology include large-scale, baseload electricity generation, decentralized power grids, and high-temperature process heat supply for industrial sectors such as hydrogen production, steel manufacturing, and desalination. A key benefit driving market interest is the inherent safety profile of designs like the Molten Salt Reactor, which often operate at atmospheric pressure and utilize passive cooling mechanisms, virtually eliminating the risk of catastrophic failure. The market is driven by increasing energy security concerns, the necessity for reliable non-intermittent clean energy sources, and technological advancements validating the economic viability and operational efficiency of thorium fuel cycles, moving this technology from theoretical potential to practical application.

Thorium reactor Market Executive Summary

The Thorium reactor market is experiencing a crucial transition phase characterized by accelerated private sector investment and supportive governmental policies aimed at diversifying nuclear portfolios. Current business trends indicate a strong focus on the development of Small Modular Reactors (SMRs) based on Molten Salt Reactor (MSR) technology, favored for their scalability, standardized design, and rapid deployment capabilities. Regionally, Asia Pacific, led by initiatives in China and India, dominates the current research landscape due to urgent energy demand and extensive thorium reserves, while North America and Europe are focusing heavily on regulatory streamlining and advanced reactor demonstration projects. Segment trends reveal that the MSR type remains the most researched and commercially promising category, driven by its liquid fuel advantages and inherent safety mechanisms.

The market faces ongoing challenges related to complex regulatory pathways, high initial R&D expenditure, and the necessity of establishing a novel thorium fuel cycle infrastructure. However, the pervasive global push towards Net-Zero goals and increasing recognition of nuclear power's role in achieving energy resilience provide substantial long-term opportunities. The technology's ability to potentially consume existing fissile waste from traditional reactors also positions it uniquely as a dual-purpose solution for energy generation and environmental remediation. Overall, the market is poised for significant growth post-2030, pending successful demonstration and licensing of the initial commercial prototypes.

AI Impact Analysis on Thorium reactor Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Thorium reactor domain frequently center on optimizing reactor design parameters, predicting component lifespan under extreme operational conditions, and enhancing regulatory compliance speed. Key concerns revolve around the safety implications of autonomous control systems and the reliable management of the complex chemistry inherent in Molten Salt Reactors (MSRs). Users anticipate that AI and machine learning will drastically reduce the R&D cycle time by simulating millions of possible design configurations, optimizing fuel management strategies for maximum efficiency, and allowing for predictive maintenance that minimizes downtime, thereby addressing the high initial costs associated with advanced nuclear technologies. The consensus is that AI is essential for managing the dynamic, real-time data flow in liquid fuel reactors and ensuring their safe, economical operation.

AI's primary influence is expected in two main areas: accelerating the materials science necessary for containing the corrosive liquid salts and optimizing the complex physics and chemistry of the reactor core itself. Machine learning algorithms are crucial for identifying optimal materials resistant to neutron radiation and chemical corrosion, a persistent hurdle for MSR deployment. Furthermore, advanced AI systems can monitor thousands of sensor inputs simultaneously, predict anomalies long before they become critical, and optimize real-time operational adjustments, vastly improving plant efficiency and reducing the need for human intervention in hazardous environments, thereby raising safety standards beyond current conventional nuclear benchmarks.

- AI-driven optimization of Molten Salt Reactor (MSR) chemistry and thermal hydraulics simulation, drastically reducing physical prototyping needs.

- Machine learning algorithms applied to predictive maintenance schedules, enhancing component longevity and minimizing plant downtime.

- Accelerated discovery of radiation- and corrosion-resistant materials using generative AI modeling and high-throughput screening.

- Enhanced regulatory modeling and simulation (digital twin technology) speeding up licensing and approval processes.

- Autonomous control systems development for passive safety response and real-time operational efficiency adjustment.

DRO & Impact Forces Of Thorium reactor Market

The Thorium reactor market is profoundly influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively shape the impact forces (IF). A key driver is the unparalleled energy density and sustainability offered by thorium fuel, providing substantially less long-lived waste compared to uranium fuel cycles, addressing major public and environmental concerns associated with nuclear power. Simultaneously, the market is restrained significantly by the regulatory burden; existing nuclear safety frameworks were designed for solid fuel reactors and are often ill-suited or overly restrictive for novel designs like MSRs, creating extensive delays and inflated costs in the pre-commercialization phase. However, the opportunity for energy independence, particularly in nations with large domestic thorium reserves like India and Australia, offers a powerful incentive for sustained government investment and technological push, fueling the market’s underlying momentum.

Another major driver includes the enhanced proliferation resistance of the thorium-U233 fuel cycle, making the technology appealing for international deployment under stringent non-proliferation treaties. This factor significantly eases export controls compared to traditional weapon-grade fissile material pathways. Conversely, a critical restraint is the need for entirely new reprocessing and fabrication facilities dedicated solely to thorium fuel, requiring immense capital investment before any commercial reactor becomes operational. These high barrier-to-entry costs limit the number of active participants. The dominant impact force influencing the market trajectory is the increasing geopolitical emphasis on energy security and the concurrent need for high-temperature, non-carbon emitting process heat, positioning thorium reactors as a strategic asset capable of solving both environmental and security challenges simultaneously.

Furthermore, the inherent safety advantage, particularly the 'freeze plug' mechanism in Molten Salt Reactors which allows passive draining of fuel salt in case of overheating, acts as a crucial driver, boosting public acceptance and reducing insurance liability costs, which have traditionally plagued conventional nuclear projects. The technological novelty, however, acts as a major restraint; overcoming the materials compatibility challenge—finding reliable alloys that can withstand corrosive fluoride or chloride salts at high temperatures for decades—requires extensive, time-consuming testing. The primary opportunity remains the integration of these SMR designs into existing fossil fuel infrastructure sites, utilizing brownfield locations and established grid connections, significantly accelerating deployment compared to greenfield projects.

Segmentation Analysis

The Thorium reactor market segmentation is primarily defined by the core technology type, the operational capacity (which often dictates the application), and the specific fuel cycle employed. This segmentation reflects the diverse technological pathways currently being pursued globally to realize commercial thorium utilization. Technology classification helps differentiate the safety profiles and material requirements of systems such as Molten Salt Reactors (MSRs) versus High-Temperature Gas Reactors (HTGRs). Capacity segmentation, particularly the focus on Small Modular Reactors (SMRs) versus large-scale utility plants, reflects current commercialization strategies aimed at addressing localized and decentralized energy needs efficiently. The complexity of handling liquid fuel salts or specialized solid fuels necessitates distinct operational procedures and regulatory frameworks for each segment, thereby influencing investment decisions and market adoption rates across various geographical regions.

Analysis of these segments reveals that MSR technology, specifically the Liquid Fluoride Thorium Reactor (LFTR) concept, currently commands the greatest research investment due to its promise of superior fuel utilization and passive safety features inherent to liquid fuel operation. However, the solid fuel segments, particularly HTGRs, leverage existing high-temperature materials expertise from gas-cooled reactor programs, offering a potentially quicker route to demonstration, although they do not capture the same fuel efficiency benefits as MSRs. The Application segmentation clearly demonstrates a pivot away from purely electricity generation towards combined heat and power (CHP) applications, driven by the realization that high-temperature process heat represents a critical, underserved market vital for deep decarbonization efforts in hard-to-abate industrial sectors.

- By Reactor Type:

- Molten Salt Reactors (MSRs)

- Liquid Fluoride Thorium Reactors (LFTR)

- Molten Chloride Fast Reactors (MCFR)

- High-Temperature Gas Reactors (HTGRs)

- Heavy Water Reactors (HWRs - utilizing thorium blankets)

- Molten Salt Reactors (MSRs)

- By Capacity:

- Small Modular Reactors (SMRs - up to 300 MWe)

- Large-Scale Reactors (LSRs - above 300 MWe)

- By Fuel Cycle:

- Closed Thorium Fuel Cycle (Full recycling of U-233)

- Open Thorium Fuel Cycle (Once-through use)

- By Application:

- Electricity Generation (Baseload power)

- Industrial Heat & Steam (e.g., hydrogen, chemical processing, steel)

- Desalination

- Naval Propulsion (Research Phase)

Value Chain Analysis For Thorium reactor Market

The value chain for the Thorium reactor market is distinct from the established uranium nuclear industry, involving unique upstream processes focused on mining, refining, and specialized fuel fabrication, particularly for the creation of breeding blankets or initial fissile load (U-235 or Pu-239). The upstream segment is characterized by the relatively low cost and high availability of thorium ore (often a byproduct of rare earth mining), requiring specialized extraction and purification techniques before it can be used in reactor blankets or salt formulations. Unlike uranium, thorium processing infrastructure is currently nascent, representing a critical bottleneck. Key activities involve the production of high-purity thorium metal or salts suitable for nuclear application, which demands stringent quality control and specialized chemical engineering expertise.

The downstream segment revolves primarily around reactor deployment, operation, and eventual fuel reprocessing and waste management. Deployment involves highly specialized engineering, procurement, and construction (EPC) firms capable of handling liquid salt or high-temperature systems. Distribution channels are currently direct, involving government agencies, national labs, and utility companies engaging directly with reactor developers (OEMs) and engineering firms. Due to the strategic national importance of this technology, the indirect channel is minimal, though partnerships with established energy conglomerates facilitate financing and grid integration. The long-term efficiency of the value chain relies heavily on the success of the closed fuel cycle, wherein the bred U-233 is chemically separated and recycled back into the reactor, dramatically reducing the requirement for fresh thorium input and minimizing waste volume.

The inherent safety and modularity of the emerging Thorium reactor designs are expected to streamline the construction and deployment phases (downstream). Standardization through SMR designs will allow for factory fabrication of core components, improving cost control and shortening construction timelines compared to traditional gigawatt-scale nuclear plants. However, establishing the necessary supply chain for specialized materials—especially nickel alloys or refractory metals needed for long-term containment of hot, corrosive fuel salts—remains a major area of risk and opportunity in the midstream and downstream segments, demanding strong technological partnerships between materials scientists, nuclear engineers, and component manufacturers.

Thorium reactor Market Potential Customers

The primary potential customers for Thorium reactor technology are large utility companies and independent power producers (IPPs) seeking reliable, high-capacity, low-carbon baseload energy sources to replace aging fossil fuel infrastructure or complement intermittent renewable sources. These buyers are primarily motivated by long-term fuel sustainability, operational cost predictability, and the mandate to meet stringent decarbonization targets. State-owned utilities in energy-hungry nations, particularly across Asia and Africa, represent a significant customer base due to their control over national energy planning and substantial domestic thorium reserves, simplifying the strategic adoption process.

Beyond the electrical grid, a rapidly expanding segment of potential customers includes heavy industrial end-users requiring continuous, high-temperature process heat (above 500°C) that cannot be economically supplied by current non-nuclear clean energy technologies. This includes major players in hydrogen production (via high-temperature electrolysis), petrochemical refining, and ammonia/fertilizer synthesis. The inherent ability of advanced reactors like HTGRs and MSRs to deliver heat directly makes them highly attractive to these sectors, moving the technology beyond traditional power generation markets and diversifying the customer profile.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million USD |

| Market Forecast in 2033 | $2,380 million USD |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flibe Energy, Inc., Terrestrial Energy Inc., ThorCon Power, Shanghai Institute of Applied Physics (SINAP), General Atomics, Westinghouse Electric Company, Areva SA, Bhabha Atomic Research Centre (BARC), CNNC, Lightbridge Corporation, Copenhagen Atomics, Kairos Power, X-energy, Transatomic Power, Elysium Industries, OKBM Afrikantov, Moltex Energy, Zvezdochka, StarCore Nuclear, General Electric-Hitachi Nuclear Energy (GEH) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thorium reactor Market Key Technology Landscape

The technological landscape of the Thorium reactor market is dominated by research and development surrounding Molten Salt Reactor (MSR) designs, which represent the most radical departure from traditional Pressurized Water Reactor (PWR) technology. MSRs utilize fuel dissolved directly into a circulating liquid salt coolant, such as lithium-beryllium fluoride (FLiBe), eliminating the need for solid fuel fabrication and pressure vessels operating at extremely high pressures. This liquid core technology facilitates continuous reprocessing and refueling, dramatically improving fuel utilization efficiency and potentially achieving a near-zero waste system through the consumption of the generated U-233. The critical technological challenges being addressed include developing robust, corrosion-resistant containment alloys (like Hastelloy N derivatives or newer refractory metals) that can withstand the high-temperature, chemically aggressive environment over decades of operation.

Another major technological pathway involves High-Temperature Gas Reactors (HTGRs) utilizing thorium within Tristructural Isotropic (TRISO) fuel particles. While this approach uses solid fuel, it leverages thorium’s superior material properties to achieve very high operating temperatures (up to 950°C), making it ideal for high-efficiency electricity generation via gas turbines (Brayton cycle) and, critically, supplying industrial process heat. The key technological advantage of TRISO fuel is its robust multi-layer containment structure, which provides unparalleled safety by trapping fission products even if the reactor overheats. The market is also exploring hybrid solutions, where thorium blankets are used in conjunction with conventional fast reactors (e.g., Sodium-cooled Fast Reactors) or Heavy Water Reactors (HWRs), aiming to breed U-233 using existing reactor infrastructure, though this pathway offers less intrinsic safety enhancement than pure MSR or HTGR designs.

The integration of advanced simulation and modeling tools, often powered by AI, is paramount in the current technological landscape. These tools are indispensable for mastering the complex neutronics and thermal dynamics of the reactor core, especially in MSRs where fuel composition changes continuously. Furthermore, the development of specialized remote handling and maintenance equipment is critical for the long-term viability of thorium reactors, particularly liquid fuel systems, due to the presence of highly radioactive fission products and the need to manage the fuel salt remotely. Successful commercialization hinges on standardizing these complex designs into manufacturable, licenseable SMR formats, proving that these advanced technologies can be deployed rapidly and economically outside of national laboratory settings.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Thorium reactor market, primarily driven by massive, sustained energy demand from rapidly industrializing economies and the extensive availability of domestic thorium reserves, particularly in India and China. China is currently leading global deployment efforts with the ambitious Molten Salt Reactor Program (TMSR), aiming for a 2 MW prototype operational by 2025/2026, positioning the region as the technological frontrunner. India's three-stage nuclear power program, centered on utilizing its vast reserves of monazite sand (a source of thorium), places significant long-term emphasis on commercializing HWRs and eventually fast breeder reactors utilizing the thorium cycle. The region benefits from strong government commitment and centralized, long-term energy planning, which mitigates some of the financial risks inherent in R&D-intensive projects, creating a highly conducive environment for demonstration and commercialization.

- North America (US and Canada): North America represents a dynamic market segment characterized by substantial private sector innovation and significant governmental backing through advanced reactor demonstration programs. The United States Department of Energy (DOE) is heavily investing in next-generation reactor concepts, with several private companies focused on MSR and HTGR designs securing crucial funding for demonstration projects (e.g., Kairos Power, Terrestrial Energy). The region’s strength lies in its established nuclear regulatory framework (albeit one that requires adaptation for advanced designs) and a strong venture capital environment supporting energy technology startups. Regulatory streamlining under initiatives like the Nuclear Energy Innovation and Modernization Act (NEIMA) is crucial for accelerating the licensing timelines of Thorium-based SMRs, making this region critical for market adoption and export strategy.

- Europe: The European Thorium reactor market is driven primarily by long-term environmental policy goals and the urgent need to secure energy independence. Scandinavian countries and the UK are prominent proponents of advanced nuclear, supporting companies like Moltex Energy and Copenhagen Atomics, which focus on MSR and stable salt reactor designs. While regulatory harmonization across the EU remains a challenge, the commitment to Net-Zero targets ensures that nuclear energy, including advanced fuel cycles like thorium, is being actively considered as a vital component of the future energy mix. European research institutions maintain strong expertise in materials science and reactor physics, crucial for solving the technical hurdles associated with long-term MSR operation.

- Latin America and Middle East & Africa (MEA): These regions show emerging potential, primarily driven by the long-term promise of energy security and process heat for water desalination (MEA). Countries in the MEA region, seeking reliable, non-intermittent power sources to fuel rapid urbanization and industrial growth, are exploring modular reactor options. The sustainability and proliferation resistance of the thorium cycle are particularly appealing in geopolitically sensitive areas. While R&D is currently limited, partnerships with leading technology providers from APAC and North America are expected to facilitate market entry later in the forecast period, especially once SMR designs achieve standardized commercial viability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thorium reactor Market.- Flibe Energy, Inc.

- Terrestrial Energy Inc.

- ThorCon Power

- Shanghai Institute of Applied Physics (SINAP)

- General Atomics

- Westinghouse Electric Company

- Areva SA

- Bhabha Atomic Research Centre (BARC)

- China National Nuclear Corporation (CNNC)

- Lightbridge Corporation

- Copenhagen Atomics

- Kairos Power

- X-energy

- Transatomic Power

- Elysium Industries

- OKBM Afrikantov

- Moltex Energy

- Zvezdochka

- StarCore Nuclear

- General Electric-Hitachi Nuclear Energy (GEH)

Frequently Asked Questions

Analyze common user questions about the Thorium reactor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary safety advantage of Thorium reactors compared to traditional nuclear plants?

The primary safety advantage, especially in Molten Salt Reactor (MSR) designs, is inherent passive safety. The fuel is already liquid, eliminating the risk of a meltdown of solid fuel rods. MSRs often feature a freeze plug mechanism that, upon power loss or overheating, passively melts and drains the fuel salt into safe, passively cooled storage tanks, preventing catastrophic failure and eliminating the need for large external cooling systems.

How does the Thorium fuel cycle address the long-term nuclear waste problem?

The Thorium fuel cycle generates significantly less long-lived, high-level radioactive waste compared to the uranium-plutonium cycle. By breeding U-233 from Thorium-232 and utilizing a closed loop system, the reactor effectively "burns" most of its own minor actinides and long-lived fission products, reducing the volume and radiotoxicity of final waste that requires geological disposal.

What is the current regulatory status of Thorium reactor technology globally?

Thorium reactor technology is currently in the demonstration and pre-licensing phase. Regulatory bodies, such as the US Nuclear Regulatory Commission (NRC), are actively developing new, performance-based regulatory frameworks specifically tailored for advanced non-light water reactor designs like MSRs and HTGRs, moving away from prescriptive rules designed for traditional solid-fuel reactors.

Is Thorium technology more proliferation resistant than Uranium technology?

Yes, the Thorium-U-233 cycle offers enhanced proliferation resistance. The U-233 bred from thorium is almost always contaminated with U-232, which decays rapidly and emits strong gamma radiation, making it extremely difficult and dangerous to handle or process for weapon material without extensive protection, thereby deterring diversion.

What role do Small Modular Reactors (SMRs) play in the commercialization of Thorium technology?

SMRs are crucial for Thorium reactor commercialization because their standardized, factory-built designs reduce construction time, lower initial capital risks, and facilitate decentralized deployment. The inherently safer MSR and HTGR designs are particularly suited for modular scaling, accelerating market entry by making these advanced nuclear solutions economically viable for a wider range of customers, including industrial users and smaller utility grids.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager