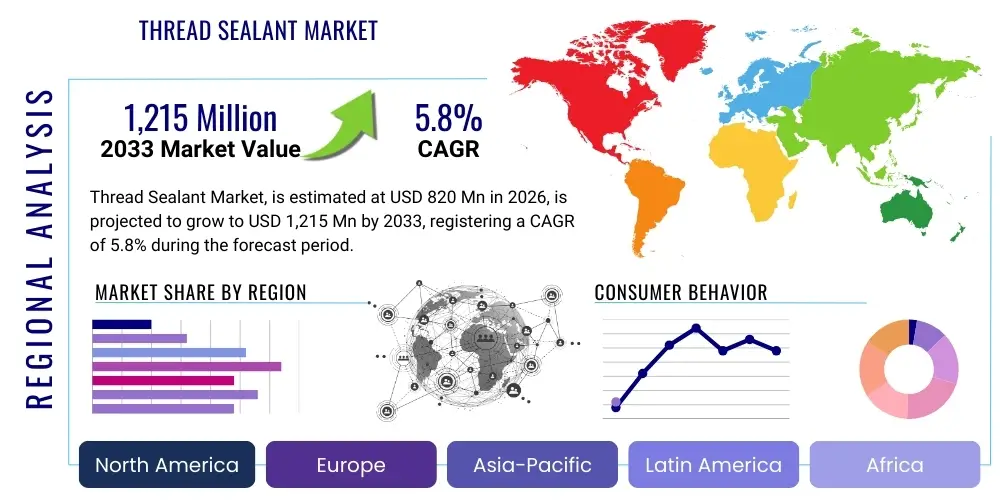

Thread Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438402 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Thread Sealant Market Size

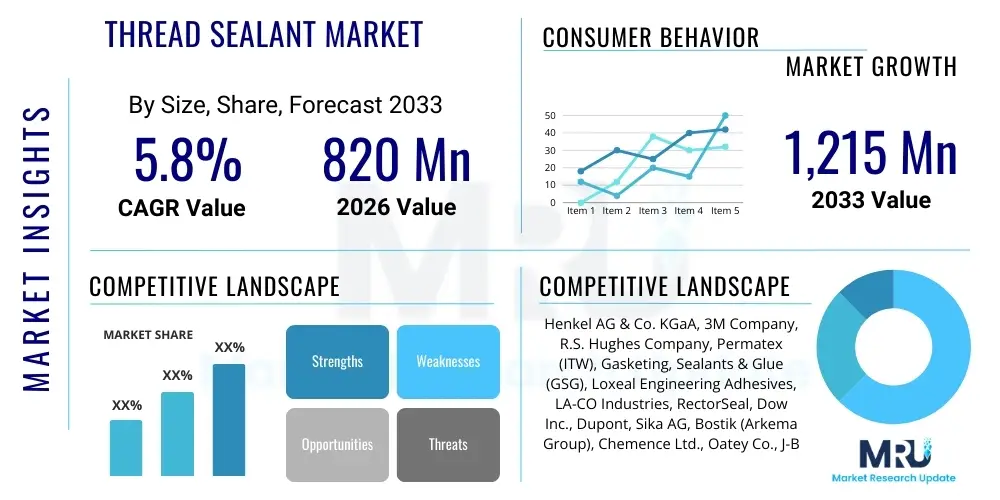

The Thread Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 820 Million in 2026 and is projected to reach USD 1,215 Million by the end of the forecast period in 2033.

Thread Sealant Market introduction

Thread sealants are specialized chemical compounds or materials designed to prevent fluid or gas leakage through threaded pipe connections and fittings. These products are essential in maintaining the integrity of industrial systems where pressure, temperature, and chemical exposure are critical factors. The primary function of a thread sealant is to fill the gaps and imperfections inherent in metal-to-metal or plastic-to-plastic threading, ensuring a durable, leak-proof seal that can withstand operational stresses.

The product portfolio encompasses various chemistries, including Polytetrafluoroethylene (PTFE) tapes, liquid anaerobic sealants, silicone compounds, and specialized pastes. Major applications span across heavy industries such as oil and gas, where high-pressure integrity is paramount, to consumer-facing sectors like plumbing and HVAC systems. The consistent demand stems from the necessity of reliable sealing solutions in infrastructure maintenance, new construction projects, and the manufacturing of machinery.

Key benefits driving market adoption include resistance to vibration loosening, chemical inertness against a wide range of media, temperature stability, and ease of application compared to traditional sealing methods. Driving factors include rapid global industrialization, stringent regulatory mandates regarding environmental pollution (especially leakage of hazardous materials), and increasing investment in oil and gas pipeline infrastructure and sophisticated automotive fluid systems.

Thread Sealant Market Executive Summary

The global Thread Sealant Market exhibits robust growth driven primarily by escalating demands from the energy and automotive sectors, coupled with significant modernization of aging infrastructure across developed economies. Business trends indicate a strong pivot towards high-performance anaerobic and specialized PTFE-based liquid sealants, which offer superior durability and cure speed compared to conventional tapes and pastes. Manufacturers are focusing on developing eco-friendly, volatile organic compound (VOC)-compliant formulations to meet evolving global environmental standards, thus influencing product innovation and market positioning.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market due to rapid industrial expansion, particularly in China and India, focusing on manufacturing, construction, and petrochemical processing plants. North America and Europe maintain substantial market shares, characterized by high adoption rates of premium, technologically advanced sealants essential for precision engineering in automotive and aerospace industries. Investment in sustainable sealants and smart dispensing technologies is a key focus area in these mature markets, enhancing application efficiency and reducing material waste.

Segment trends underscore the dominance of liquid thread sealants, particularly the anaerobic type, owing to their ability to provide a complete seal and resistance to vibration loosening in critical assemblies. The oil and gas application segment remains the largest revenue generator, dictated by ongoing exploration and production activities requiring absolute seal reliability under extreme pressure and temperature conditions. Furthermore, the burgeoning electric vehicle (EV) sector is subtly influencing demand, requiring specialized, electrically non-conductive sealants for battery cooling systems and high-voltage connections.

AI Impact Analysis on Thread Sealant Market

Common user questions regarding AI's impact on the thread sealant market often revolve around optimizing the formulation process, predicting material performance under varied operational stress, and streamlining the supply chain for raw chemical precursors. Users are particularly keen on understanding how Artificial Intelligence can accelerate the development of next-generation, high-temperature, or chemically resistant sealants without extensive manual laboratory testing. Key themes summarizing user concerns include the cost-effectiveness of integrating AI into R&D workflows, the ethical implications of data privacy in shared performance databases, and the potential for AI-driven predictive maintenance to affect aftermarket demand cycles by extending equipment lifespan. The consensus expectation is that AI will primarily enhance efficiency in manufacturing quality control and inventory management, offering optimized production scheduling based on real-time market demand signals.

- AI-driven material informatics accelerates the discovery and testing of novel chemical formulations, reducing R&D cycles for high-performance sealants.

- Predictive maintenance algorithms utilize sensor data to forecast potential leakage points, optimizing the timing and quantity of sealant application in industrial settings.

- Supply chain optimization through AI minimizes inventory holding costs for raw materials, dynamically adjusting procurement based on manufacturing forecasts and geopolitical risks.

- Enhanced quality control systems use machine vision and machine learning to detect defects in sealant application or curing processes on assembly lines, ensuring product reliability.

- AI models analyze environmental and operational data (temperature, pressure, vibration) to recommend the optimal sealant product for specific application criteria, improving sales efficiency.

DRO & Impact Forces Of Thread Sealant Market

The Thread Sealant Market dynamics are shaped by a complex interplay of foundational industrial growth drivers, regulatory pressures, and material limitations. The core driver is the essential need for leak prevention in critical infrastructure, mandated by safety regulations in energy and chemical sectors. This demand is moderated by the limitations of chemical compatibility, where a single sealant type cannot fulfill all operational requirements, necessitating a broad and diverse product portfolio from manufacturers. The market's attractiveness is significantly amplified by the rising global investment in sophisticated fluid handling systems, offering substantial opportunities for specialized, high-margin products.

Drivers include the expansion of the natural gas pipeline network globally, particularly in emerging economies, and the continuous growth of the automotive sector, requiring specialized sealants for engine, transmission, and braking systems. Restraints predominantly involve the volatile pricing and supply chain instability of key chemical raw materials, such as specific monomers and polymers, impacting production costs and overall profitability. Furthermore, the inherent complexity in standardizing sealant performance across vastly different thread materials (e.g., brass versus stainless steel) and varying tolerance levels presents a technical challenge that must be continually addressed through rigorous product development.

Opportunities for market growth are strongly tied to the development of bio-based or biodegradable thread sealants, addressing sustainability demands, and the penetration of advanced liquid anaerobic sealants into applications traditionally dominated by PTFE tapes. The key impact forces are primarily governmental regulations—for example, environmental protection agency standards demanding zero leakage of volatile compounds—which act as both a driver for quality improvements and a restraint on certain legacy products. The competitive intensity is high, characterized by a few global chemical giants setting the technology pace and a multitude of regional players competing aggressively on price and localized distribution networks.

Segmentation Analysis

The Thread Sealant Market is rigorously segmented based on product chemistry, physical form, and target application, allowing manufacturers to tailor solutions for specific industry needs, ranging from plumbing to heavy aerospace engineering. This segmentation provides a granular view of market dynamics, revealing varying growth rates based on technological maturity and regional industrialization levels. The analysis shows a continued trend of application specialization, where general-purpose sealants are gradually being replaced by formulations engineered for extreme conditions, such as ultra-high pressure or exposure to aggressive chemicals.

The market structure reflects a preference for liquid and anaerobic sealants due to their rapid curing capabilities and superior vibrational resistance compared to traditional tape products. However, PTFE tapes remain ubiquitous in general plumbing and low-pressure utility applications due to their low cost and ease of installation. Understanding these segment trends is crucial for strategic planning, enabling companies to prioritize investment in high-growth segments like advanced anaerobic resins demanded by the expanding global manufacturing base, especially in high-precision fluid power systems.

- By Product Type:

- Polytetrafluoroethylene (PTFE)

- Anaerobic

- Silicone

- Acrylic

- Others (e.g., Polyurethane, Epoxy)

- By Form:

- Liquid

- Tape

- Paste/Compound

- By Application:

- Oil & Gas

- Automotive & Transportation

- General Industry & Manufacturing

- HVAC (Heating, Ventilation, and Air Conditioning)

- Water Management & Plumbing

- Chemical Processing

- Aerospace & Marine

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Thread Sealant Market

The value chain for the Thread Sealant Market begins with upstream activities focused on the sourcing and processing of specialty chemical raw materials, which are predominantly monomers, resins, polymers (like PTFE), and various curing agents and additives. Key upstream suppliers are major chemical companies providing specialized acrylics, silicones, and methacrylates, whose pricing volatility significantly influences the final product cost structure. Efficiency in this stage relies heavily on long-term supplier contracts and optimization of chemical synthesis processes to ensure purity and consistency, crucial for the reliable performance of the final sealant.

The midstream involves manufacturing and formulation, where chemical producers convert raw materials into finished thread sealant products—tapes, liquids, or compounds. This stage involves complex R&D activities focused on enhancing performance characteristics such as temperature resistance, pressure rating, and chemical compatibility. Quality control and packaging efficiency are paramount here. Downstream activities involve distribution and sales, where products are channeled to a diverse customer base, including Maintenance, Repair, and Operations (MRO) distributors, Original Equipment Manufacturers (OEMs) in automotive and machinery, and specialized industrial supply houses.

Distribution channels are categorized into direct sales (typically high-volume contracts with major OEMs or large energy companies) and indirect sales through a robust network of industrial distributors, hardware stores, and specialized chemical resellers. Indirect channels are critical for reaching the vast MRO market. The effectiveness of the value chain is measured by the ability to manage raw material volatility, maintain stringent product quality under regulatory scrutiny, and efficiently deliver the specialized product through optimized logistics to widely dispersed industrial end-users globally.

Thread Sealant Market Potential Customers

The potential customers for the thread sealant market are highly diversified, encompassing any industry that utilizes pressurized fluid or gas transfer systems, ranging from small-scale plumbing contractors to multinational petrochemical corporations. The primary end-users are firms engaged in the construction, operation, and maintenance of machinery, pipelines, and fluid control systems, prioritizing longevity, safety, and operational efficiency. The demand profile is bifurcated, with OEMs requiring bulk quantities integrated into initial assembly processes, and MRO customers generating continuous, recurring demand for repair and maintenance activities.

Key buyer groups include manufacturers of hydraulic equipment, pneumatic tools, and heavy machinery (e.g., construction equipment, agricultural vehicles) who utilize thread sealants to prevent internal leaks in fluid power circuits. Furthermore, utility companies and municipal organizations focused on water distribution, sewage treatment, and gas supply represent substantial buyers, where the reliability of sealed connections directly impacts public safety and service continuity. These customers value products that offer certified compliance with industry-specific standards, such as those governing drinking water systems or high-pressure gas lines, often requiring specialized third-party approvals.

The most demanding potential customers are found in the Oil & Gas, Chemical Processing, and Aerospace sectors. These environments expose seals to extreme temperature fluctuations, corrosive chemicals, and high mechanical stress, necessitating premium-priced, high-performance anaerobic and PTFE products. Procurement decisions in these sectors are driven less by cost and more by specification adherence, failure prevention, and compatibility with exotic materials, making technical support and reliable performance data critical differentiators for sealant suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 820 Million |

| Market Forecast in 2033 | USD 1,215 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, 3M Company, R.S. Hughes Company, Permatex (ITW), Gasketing, Sealants & Glue (GSG), Loxeal Engineering Adhesives, LA-CO Industries, RectorSeal, Dow Inc., Dupont, Sika AG, Bostik (Arkema Group), Chemence Ltd., Oatey Co., J-B Weld Company, Master Bond Inc., Delo Industrial Adhesives, Hylomar Ltd., Wanhua Chemical Group, Zettex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thread Sealant Market Key Technology Landscape

The technology landscape of the Thread Sealant Market is primarily defined by continuous innovation in polymer chemistry aimed at enhancing resistance to extreme operational parameters. A key technological focus remains on developing advanced anaerobic methacrylates that cure rapidly in the absence of air and in the presence of metal ions, providing high-strength, durable seals that resist dynamic loads and thermal cycling. Manufacturers are actively pursuing micro-encapsulation technology, where curing agents are encapsulated within the sealant matrix and released only upon application, significantly extending shelf life and ensuring consistent performance across diverse environments. This approach addresses challenges related to sealant migration and premature curing.

Another crucial technological frontier is the formulation of specialized PTFE variants. While standard PTFE tape remains prevalent, advanced liquid PTFE formulations, often combined with carriers or specialized thickeners, are gaining traction. These liquids conform more readily to imperfect threads than tapes, offering superior volumetric fill and preventing the shredded tape remnants that can contaminate sensitive fluid systems. Furthermore, the push towards green chemistry is driving the development of solvent-free and low-VOC (Volatile Organic Compound) liquid sealants, utilizing advanced hybrid polymer systems that offer equivalent or superior performance characteristics without the environmental footprint associated with traditional solvent-based products.

The integration of smart technologies is also subtly impacting the landscape, particularly through packaging and application tools. Dosing systems now utilize precise, automated dispensing equipment to ensure optimal sealant quantity and coverage, reducing material waste and improving quality assurance in high-volume assembly operations. Research is ongoing in integrating nanotechnologies, such as incorporating specialized nanoparticles into the sealant matrix, to potentially enhance thermal conductivity, increase resistance to specific chemical degradation, and improve overall mechanical strength, pushing the operational limits of threaded connections.

Regional Highlights

- Asia Pacific (APAC): Characterized by aggressive infrastructural development, particularly in China, India, and Southeast Asia. The region is the primary engine of global demand growth, driven by massive investments in manufacturing, automotive production, and expanding oil and gas infrastructure. While cost sensitivity remains high, the increasing adoption of high-performance sealants in sectors like electronics and precision machinery is elevating the overall market quality.

- North America: A mature market focused on MRO activities and technological advancement. Demand is driven by strict regulatory requirements (e.g., pipeline safety standards) and the high penetration of sophisticated anaerobic and specialized silicone sealants in the automotive, aerospace, and advanced manufacturing sectors. Emphasis is placed on certified products and supply chain reliability.

- Europe: Growth is steady, strongly influenced by environmental regulations (e.g., REACH), driving the shift toward low-VOC and sustainable sealant formulations. Key demand stems from the automotive (especially EV manufacturing), chemical processing, and sophisticated general engineering industries. Germany, France, and the UK are major consumption hubs, prioritizing technical specifications and certified product origin.

- Latin America (LATAM): Primarily driven by resource extraction (mining, oil & gas) and agricultural machinery maintenance. The market exhibits growth potential contingent on political and economic stability, with demand favoring balanced cost-performance ratios, often utilizing traditional PTFE tapes alongside mid-range liquid sealants.

- Middle East and Africa (MEA): Dominated by the vast requirements of the Oil & Gas sector, demanding extremely high-temperature and high-pressure resistant sealants for upstream and downstream operations. Investments in new petrochemical plants and energy pipelines across the GCC countries are major demand stimulants.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thread Sealant Market.- Henkel AG & Co. KGaA

- 3M Company

- R.S. Hughes Company

- Permatex (ITW)

- Gasketing, Sealants & Glue (GSG)

- Loxeal Engineering Adhesives

- LA-CO Industries

- RectorSeal

- Dow Inc.

- Dupont

- Sika AG

- Bostik (Arkema Group)

- Chemence Ltd.

- Oatey Co.

- J-B Weld Company

- Master Bond Inc.

- Delo Industrial Adhesives

- Hylomar Ltd.

- Wanhua Chemical Group

- Zettex

- Weicon GmbH & Co. KG

- ND Industries Inc.

- Huntsman Corporation

- M. Buttkereit GmbH

- Hernon Manufacturing Inc.

Frequently Asked Questions

Analyze common user questions about the Thread Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key advantages of liquid anaerobic thread sealants over PTFE tape?

Liquid anaerobic sealants cure into a solid plastic, providing a superior, vibration-resistant seal that fills all micro-gaps, unlike PTFE tape, which relies on physical deformation and is susceptible to shredding and vibration failure. Anaerobics are often preferred for high-pressure, critical assemblies.

Which application segment drives the highest demand in the thread sealant market?

The Oil & Gas application segment consistently drives the highest demand due to the rigorous requirements for high-pressure integrity, chemical resistance, and temperature stability in drilling, processing, and transportation infrastructure, necessitating premium sealant products.

How do environmental regulations influence the formulation of new thread sealants?

Environmental regulations, particularly those concerning VOC emissions and hazardous substances (like REACH in Europe), mandate manufacturers to develop solvent-free, low-VOC, and potentially bio-degradable formulations. This drives R&D towards water-based or advanced hybrid polymer chemistries.

What is the projected Compound Annual Growth Rate (CAGR) for the Thread Sealant Market?

The Thread Sealant Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period from 2026 to 2033, driven by industrial maintenance cycles and global infrastructure investment.

What role does digitalization play in the thread sealant supply chain?

Digitalization, leveraging AI and IoT, primarily optimizes the supply chain by predicting fluctuating demand for raw materials, automating quality control in manufacturing, and optimizing distribution logistics to ensure just-in-time delivery to large industrial MRO clients.

Future Market Trajectory and Strategic Recommendations

The future trajectory of the Thread Sealant Market is inextricably linked to global energy transition efforts and advancements in precision manufacturing technologies. As industries worldwide pivot towards higher efficiency and zero-leak environments, the demand for highly specialized sealants capable of functioning reliably under extreme conditions will accelerate. Specifically, the expansion of hydrogen transportation and storage infrastructure requires sealants engineered for extremely small molecular size and high-pressure resistance, representing a significant untapped market segment. Furthermore, the increasing complexity of machinery, particularly in robotics and advanced fluidics, necessitates sealants that offer not only structural integrity but also precise, non-contaminating application capabilities, pushing manufacturers toward advanced cartridge systems and automated dispensing solutions.

Strategic success in this evolving landscape will require manufacturers to intensify investment in materials science R&D, focusing specifically on novel polymer backbones that combine the chemical resistance of PTFE with the adhesion and quick curing properties of anaerobic resins. Companies must also proactively address sustainability demands by phasing out older, high-VOC products and aggressively marketing certified low-environmental impact alternatives, particularly in regulated markets like Europe and North America. Differentiation will increasingly rely on technical support and application expertise, where suppliers offer training and diagnostic services to ensure optimal sealant selection and correct installation procedures across diverse industrial settings.

Regional strategies should prioritize market penetration in APAC through localized manufacturing and robust distribution networks to capitalize on the region's intense construction and manufacturing growth. Concurrently, in mature markets, the focus must shift towards high-margin, specialized MRO products tailored for aging industrial plants and high-tech sectors such as aerospace and electric vehicle battery systems. The competitive advantage will belong to firms that can effectively integrate data analytics into their formulation processes, allowing for faster response times to emerging industrial needs and regulatory changes, thereby maintaining a technological lead over regional competitors.

Deep Dive into Key Segments

Anaerobic Thread Sealants Segment Analysis

Anaerobic thread sealants dominate the high-performance segment of the market, valued for their ability to cure only when confined between metal surfaces and starved of oxygen, making them ideal for assembly line use where precise curing control is essential. Their primary advantage lies in forming a solid, thermoset plastic seal that locks threads together, preventing loosening due to vibration or thermal expansion, a critical requirement in automotive engines, heavy machinery, and high-pressure hydraulic systems. This segment's growth is strongly correlated with global automotive production and the demand for increasingly durable and maintenance-free machinery, as anaerobic compounds replace mechanical locking devices like lock washers, simplifying assembly and reducing parts inventory.

The technological evolution within this segment focuses on enhancing ancillary properties, such as oil tolerance, allowing the sealant to cure effectively even on slightly contaminated surfaces, and improving removal torque, which determines how easily the connection can be disassembled for future maintenance without damaging the threads. Furthermore, specialized formulations for stainless steel and passive metals, which typically require an activator for rapid cure, are becoming more prevalent. The long-term durability and reliability offered by these sealants command a premium price point, positioning them as the preferred choice for safety-critical applications where failure is highly costly.

- Key Attributes: High strength, vibration resistance, controlled cure speed, full thread contact.

- Primary Applications: Engine assembly, hydraulic fittings, pneumatic systems, heavy equipment manufacturing.

- Technological Focus: Increased temperature resistance (up to 200°C+), oil-tolerant formulations, reduced volatile components.

- Market Driver: Trend toward miniaturization and high-density fluid power systems requiring absolute sealing reliability in tight spaces.

PTFE Thread Sealant Segment Analysis

PTFE (Polytetrafluoroethylene) sealants, primarily in the form of tape, constitute the largest volume segment of the market, recognized for their universal chemical compatibility and ease of use, particularly in low-pressure and general utility applications. PTFE tape offers a cost-effective, non-curing solution that lubricates the threads during assembly, allowing for easy connection tightening while providing a robust, non-stick seal. Its chemical inertness makes it indispensable in environments handling highly corrosive media, such as chemical processing plants and specific food and beverage applications where regulatory non-contamination is mandatory.

Despite its widespread use, traditional PTFE tape faces competition from liquid and paste thread sealants due to installation inconsistencies and the potential for tape fragmentation, which can clog valves and sensitive instruments downstream. This challenge has spurred innovation within the segment, leading to the development of higher-density, thicker tapes that offer improved sealing performance and reduce the risk of material contamination. Additionally, liquid PTFE formulations, combining the inertness of PTFE particles with an adhesive carrier, provide a superior alternative for applications requiring precise application and complete filling of thread voids without the bulk or handling issues of tape.

- Key Attributes: Excellent chemical resistance, wide temperature range, non-stick, simple application, low cost.

- Primary Applications: General plumbing, low-pressure gas lines, fire suppression systems, chemical handling lines.

- Technological Focus: High-density tapes, liquid PTFE formulations, color-coding for specific applications (e.g., yellow for gas, pink for potable water).

- Market Driver: Continued high volume demand from the residential and commercial construction sector globally.

Oil & Gas Application Segment Analysis

The Oil & Gas segment represents the most demanding end-use industry for thread sealants, necessitating products that can withstand extreme pressures (often exceeding 10,000 psi), highly corrosive mixtures (including hydrogen sulfide and high concentrations of brines), and severe temperature fluctuations encountered in drilling, hydraulic fracturing, and subsea operations. Reliability in this segment is paramount, as equipment failure can lead to catastrophic environmental damage and significant financial losses, driving the adoption of premium, certified anaerobic, and specialized high-temperature graphite or ceramic-filled compounds.

Market growth in this application area is directly tied to global crude oil and natural gas prices, and subsequent upstream exploration and midstream pipeline construction activity. Sealant consumption is extensive in both new capital projects and routine MRO activities associated with valve maintenance, pipeline repair, and pump installation. Companies operating here often require products meeting stringent API (American Petroleum Institute) specifications and ISO standards, favoring suppliers with strong technical data and proven field performance in hostile environments.

- Key Attributes: Extreme pressure resistance, chemical resistance to hydrocarbons and solvents, compliance with API standards.

- Product Preference: High-strength anaerobic liquids, metal-filled pastes, and specialized high-density PTFE.

- Regional Concentration: Middle East, North America (Permian Basin), and Russia/CIS regions.

- Market Driver: Expansion of deep-water drilling and increasing complexity of hydraulic systems used in modern resource extraction.

Automotive Application Segment Analysis

The automotive industry is a critical consumer of thread sealants, utilizing them extensively in engine assembly, transmission components, braking systems, and, increasingly, in battery and cooling systems for Electric Vehicles (EVs). In traditional combustion engines, sealants prevent leaks in oil, fuel, and coolant lines, and are essential for locking fasteners against vibration loosening. The trend towards lighter, higher-performing engines requires sealants capable of handling higher operating temperatures and pressures within tighter tolerances.

The transition to electromobility introduces new technical requirements, specifically the need for electrically non-conductive sealants for battery packs and thermal management systems, as well as sealants resistant to specialized EV cooling fluids. This necessity drives innovation toward advanced silicone and specialized acrylic sealants optimized for these unique electrochemical environments. OEMs demand high volume, automated application solutions, making liquid anaerobic products the preferred choice for rapid assembly lines. Quality and consistency are managed through IATF 16949 standards, emphasizing zero defects.

- Key Attributes: Vibration resistance, specific fluid compatibility (oil, brake fluid, EV coolants), fast cure time for assembly.

- Product Preference: Medium to high-strength anaerobic liquids, specialized silicone compounds.

- Growth Catalyst: Global shift toward electric vehicles requiring new sealing solutions for battery thermal management.

- Buyer Focus: Original Equipment Manufacturers (OEMs) and high-volume aftermarket parts suppliers (Tier 1/Tier 2).

Competitive Landscape Analysis

The global Thread Sealant Market is characterized by intense competition, dominated by a few multinational chemical giants who possess extensive R&D capabilities, strong global distribution networks, and established brand loyalty among industrial customers. These market leaders, such as Henkel and 3M, focus on innovation in high-margin anaerobic and high-performance polymer sealants, leveraging their technology portfolio to offer comprehensive solutions across multiple end-user segments. Their competitive strategy often involves acquiring smaller, niche technology providers to rapidly integrate specialized chemistries or expand into new geographic markets, maintaining pressure on mid-sized competitors.

Mid-tier and regional companies, while facing barriers to entry due to stringent regulatory approvals and the high cost of raw material sourcing, compete primarily on price, localized customer service, and specialized regional distribution expertise. These firms often focus on specific segments, such as general plumbing or regional MRO, where brand recognition is less critical than immediate availability and cost-effectiveness. The competitive intensity is also heightened by the presence of private label manufacturers supplying large industrial distributors, further compressing margins in the commodity segments like standard PTFE tape and general-purpose paste sealants.

To sustain growth, key players are heavily investing in digitalization to enhance operational efficiency, from smart inventory management based on predictive demand models to implementing automated quality control systems in production. Furthermore, securing proprietary technology through patents related to cure speed, temperature resistance, and solvent compatibility remains a critical strategy to defend market share in the premium sealant categories. Future competitive differentiation will increasingly depend on a verifiable sustainability profile, including the use of renewable resources and demonstrable reduction of VOCs in product lines, aligning with global corporate environmental mandates.

Emerging Market Opportunities

Several significant market opportunities are emerging, driven by macro-economic trends and technological shifts in industrial sectors. The accelerated global investment in semiconductor manufacturing, often referred to as the "chip race," presents a niche but high-value opportunity. Semiconductor fabrication requires ultra-high purity fluid systems (Ultra-Pure Water, specialty gases) where sealants must not outgas or contaminate sensitive processes. This necessitates the development of specialized, non-particulate, and high-purity PTFE or fluoropolymer seals, often at premium prices due to strict cleanliness requirements.

Furthermore, the global focus on enhancing energy efficiency in buildings drives substantial demand within the HVAC segment. High-efficiency HVAC and refrigeration systems operate under tighter pressures and often utilize new, more aggressive refrigerants (e.g., HFOs) which can degrade standard sealants. Manufacturers must rapidly innovate to provide compounds specifically resistant to these modern refrigerants and capable of maintaining integrity in variable temperature chiller and heat pump installations, offering a fertile ground for high-specification silicone and anaerobic compounds.

Finally, the growing market for specialized MRO kits tailored for specific industrial equipment (e.g., turbine maintenance, robotic arm repair) offers manufacturers an avenue for product bundling and value-added service provision. Instead of selling bulk product, providing application-specific, pre-packaged sealant solutions enhances user convenience and ensures the correct product is used for critical repair tasks, capturing higher margins and securing long-term customer loyalty in the crucial aftermarket segment.

Market Challenges and Mitigation Strategies

The Thread Sealant Market faces continuous challenges, primarily centered on raw material price volatility and the technical complexity of ensuring product performance consistency across diverse substrate materials. The chemical inputs, such as specialized acrylic monomers and fluoropolymers, are often subject to global commodity market fluctuations and geopolitical supply chain disruptions. This volatility directly impacts production costs, making long-term fixed-price contracting difficult and eroding profitability, particularly for products in the highly commoditized segments.

A significant technical hurdle involves the standardization of application and performance across varying industrial standards and material combinations. A sealant designed for use on stainless steel may cure too slowly or fail to adhere properly when used on brass or specific plastics, leading to potential field failures and liability issues. This mandates manufacturers to maintain complex product lines and provide detailed compatibility charts, requiring extensive customer education and technical support, which increases operational overhead.

Mitigation strategies include adopting diversified sourcing strategies, including establishing regional supply chain hubs to minimize the impact of localized geopolitical risks. Manufacturers must also invest heavily in advanced analytical chemistry to rapidly characterize and adjust formulations based on slight variations in raw material purity without compromising the final product's performance specifications. Furthermore, utilizing smart packaging (e.g., single-dose containers) and automated application equipment serves to minimize user error in the field, helping to ensure that the sealant performs as intended, thereby addressing the challenge of application consistency and reducing warranty claims.

Regulatory Environment and Compliance

The regulatory environment profoundly shapes the Thread Sealant Market, particularly concerning safety, environmental impact, and contact with potable water or food substances. Key regulations include the European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, which governs the production and use of chemical substances and requires extensive documentation regarding the chemical composition and hazard profile of sealants sold in Europe. This pushes manufacturers toward compliant, low-toxicity formulations.

In the United States, regulations such as NSF/ANSI standards (e.g., NSF/ANSI 61 for drinking water components) dictate the acceptability of sealants used in water systems, preventing leaching of contaminants. Products intended for use in gas pipelines must often comply with specific standards set by organizations like the American Gas Association (AGA) or regional safety boards. Compliance requires rigorous third-party testing and continuous auditing, adding complexity and cost to the R&D and manufacturing phases.

Compliance serves as a high barrier to entry, effectively separating established global players who can afford the certification processes from smaller competitors. Strategic success involves maintaining an agile regulatory affairs department capable of monitoring evolving global standards, particularly those relating to emerging materials like new refrigerants and the sustainability mandates imposed by various governmental bodies aiming for reduced industrial pollution and improved worker safety regarding volatile organic compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager