Three-Phase Energy Storage Inverter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435864 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Three-Phase Energy Storage Inverter Market Size

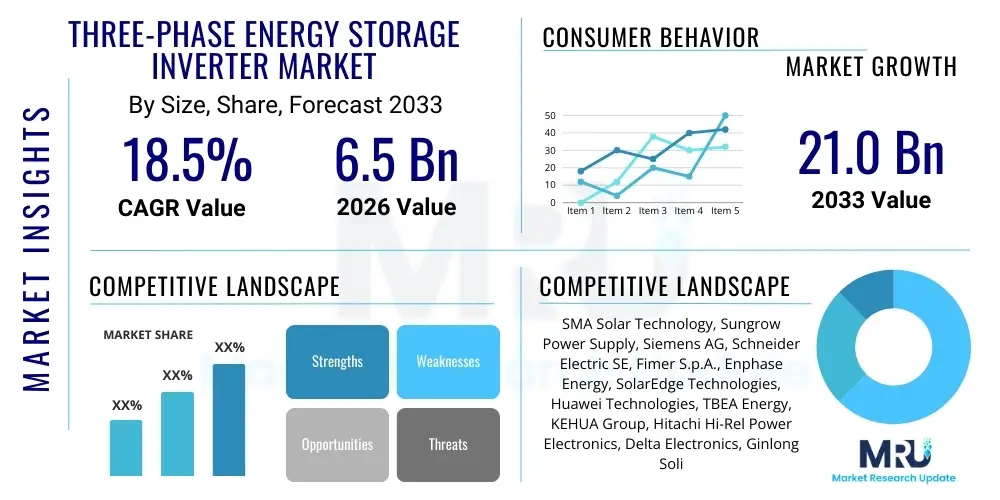

The Three-Phase Energy Storage Inverter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 21.0 Billion by the end of the forecast period in 2033.

Three-Phase Energy Storage Inverter Market introduction

The Three-Phase Energy Storage Inverter Market encompasses sophisticated power electronic devices essential for converting DC electricity, typically stored in large battery banks, into high-quality AC power suitable for grid injection or powering commercial and industrial (C&I) loads. These inverters are specifically designed for applications requiring high power output, superior efficiency, and robust grid management capabilities, distinguishing them from their single-phase counterparts predominantly used in residential settings. The inherent structural advantage of three-phase systems allows for smoother power delivery, better voltage stability, and reduced copper losses over long distances, making them indispensable for utility-scale projects, large C&I facilities, and microgrid applications where reliability and power quality are paramount.

The core function of a three-phase storage inverter extends beyond simple DC-AC conversion; modern units incorporate advanced control algorithms for managing energy flow dynamically, optimizing charge and discharge cycles based on grid signals, electricity tariffs, and system health. Major applications driving demand include peak shaving, load shifting, frequency regulation, and providing ancillary services to the transmission grid. These systems are integral components of modern renewable energy infrastructure, ensuring that intermittent sources like solar and wind can be buffered and dispatched reliably. The increasing global mandates for renewable portfolio standards and the urgent need for enhanced grid resilience against natural disasters and aging infrastructure are significantly bolstering the adoption of three-phase energy storage solutions.

Key benefits of deploying three-phase storage inverters include enhanced system efficiency, often exceeding 98%, enabling minimal energy wastage during conversion. They facilitate seamless integration with existing medium and high-voltage distribution infrastructure, simplifying large-scale deployment. Furthermore, their superior capability in handling reactive power and providing instantaneous grid support services (such as black start capability) makes them critical assets for grid operators seeking to maintain stability in grids increasingly populated by variable renewable generation. Driving factors for market acceleration include the rapidly decreasing cost of lithium-ion batteries, supportive governmental policies, favorable tax incentives, and the increasing electrification across various industrial sectors seeking reliable and sustainable power sources.

Three-Phase Energy Storage Inverter Market Executive Summary

The Three-Phase Energy Storage Inverter Market is undergoing a rapid transformation, driven by robust governmental support for renewable energy integration and the escalating demand for grid stability services globally. Business trends indicate a significant shift towards modular, high-power density inverter solutions leveraging advanced semiconductor technologies like Silicon Carbide (SiC) and Gallium Nitride (GaN), enhancing efficiency and reducing the overall footprint of energy storage systems (ESS). Furthermore, fierce competition among manufacturers is fostering innovation in software platforms that enable complex energy management tasks, such as Virtual Power Plant (VPP) aggregation and predictive maintenance protocols, positioning these inverters as intelligent grid assets rather than mere hardware components. Mergers and acquisitions focusing on vertical integration, particularly involving battery manufacturers and power electronics providers, are defining the competitive landscape, aiming to offer turnkey, optimized ESS solutions to C&I and utility customers.

Regional trends highlight the Asia Pacific (APAC) region, led by China and India, as the primary growth engine, fueled by massive utility-scale storage projects aimed at addressing rapid industrialization and electrification needs, alongside ambitious national targets for carbon neutrality. Europe is characterized by strong adoption driven by stringent regulatory frameworks promoting grid modernization and decarbonization, with Germany, the UK, and Italy leading in commercial and residential three-phase installations. North America, particularly the US, exhibits high market value, primarily driven by lucrative federal and state incentives (like the Investment Tax Credit) and the urgent need for resilience storage in regions prone to extreme weather events, accelerating utility-scale deployment in capacity-constrained zones like California and Texas.

Segment trends reveal that the utility-scale segment, comprising systems above 1MW, maintains the largest market share due to substantial capital investment in large battery parks requiring high-power three-phase central inverters. However, the commercial and industrial (C&I) segment is projected to exhibit the fastest growth rate, fueled by enterprises seeking energy cost reduction through peak shaving and demand charge management, particularly with string and modular inverter designs ranging from 30kW to 250kW. Technological segmentation shows a growing preference for hybrid inverters capable of managing both renewable generation (e.g., PV) and battery storage inputs simultaneously, streamlining system architecture. The trend towards higher DC-to-AC ratios in ESS mandates that inverters handle increasingly complex power flows, driving innovation in thermal management and fault tolerance.

AI Impact Analysis on Three-Phase Energy Storage Inverter Market

User inquiries regarding AI's influence on the Three-Phase Energy Storage Inverter Market frequently revolve around optimized operational efficiency, enhanced predictive maintenance capabilities, and the role of machine learning (ML) in real-time grid interaction. Common questions address how AI algorithms can maximize revenue generation from storage assets by accurately forecasting energy prices and load profiles (arbitrage), and whether AI-driven control systems can prolong battery life through smarter charging strategies. Users are also keen on understanding how AI facilitates integration into complex, decentralized grid structures, particularly in VPPs, where thousands of distributed energy resources (DERs) must be coordinated instantly. The core expectation is that AI will transform three-phase inverters from conversion hardware into smart, autonomous energy managers.

The implementation of Artificial Intelligence and Machine Learning algorithms is fundamentally changing the functional parameters of three-phase inverters. AI models embedded within or connected to these systems allow for highly sophisticated, non-linear optimization of power dispatch. For instance, instead of relying on static scheduling, AI continuously analyzes weather patterns, historical demand data, and real-time grid frequency deviations to determine the optimal moment to charge, discharge, or hold capacity. This capability significantly enhances the economic viability of energy storage projects by maximizing participation in lucrative ancillary services markets, thereby improving the internal rate of return (IRR) for asset owners and contributing to superior return on investment (ROI) by minimizing operational costs and maximizing energy throughput.

Furthermore, AI plays a crucial role in maintaining the health and reliability of the overall ESS, which is vital for high-power, three-phase systems. Predictive maintenance analytics, powered by ML models, process vast amounts of operational data—including temperature, current harmonics, voltage fluctuations, and component wear indicators—to forecast potential failures in critical inverter components, such as IGBTs (Insulated Gate Bipolar Transistors) or cooling systems, long before they occur. This transition from reactive or scheduled maintenance to predictive maintenance drastically reduces downtime, lowers replacement costs, and ensures the continuous availability of the high-power asset. The integration of AI also enhances cybersecurity measures by monitoring network traffic and detecting anomalous behavior specific to the inverter's control environment, which is increasingly exposed to external threats as it becomes more connected to the grid and cloud infrastructure.

- AI enables real-time dynamic pricing arbitrage, maximizing storage asset profitability.

- Machine Learning optimizes battery state-of-charge (SoC) management, extending the operational lifespan of the battery system.

- Predictive maintenance algorithms reduce inverter downtime by forecasting power electronics and cooling system failures.

- AI-driven control systems facilitate seamless participation in Virtual Power Plants (VPPs) and complex frequency regulation markets.

- Advanced algorithms enhance fault detection and isolation, improving the safety and operational reliability of high-voltage three-phase installations.

- AI optimizes power quality management by instantaneously adjusting reactive power output based on real-time grid conditions, crucial for grid stability.

- Deep Learning models improve solar and wind generation forecasting accuracy, leading to better resource scheduling and reduced curtailment losses.

DRO & Impact Forces Of Three-Phase Energy Storage Inverter Market

The Three-Phase Energy Storage Inverter Market is shaped by a powerful interplay of accelerating drivers and constraining factors, balanced by significant technological opportunities that collectively define the industry's trajectory. Key drivers include the global energy transition necessitating robust integration of renewable energy sources, the steep decline in battery pack costs making ESS economically competitive against traditional peaking power plants, and favorable regulatory mandates focused on grid modernization and decarbonization targets across developed and emerging economies. These forces exert a substantial upward pressure on market demand, particularly for high-capacity, reliable three-phase solutions essential for large-scale integration. However, the market faces headwinds primarily related to the high initial capital investment required for complete storage systems, often complex and protracted regulatory approval and interconnection processes, and the inherent technical challenges associated with managing power quality and ensuring islanding capability in decentralized grids, which can slow project deployment timelines and increase soft costs significantly.

Major driving forces fueling the market growth center on the concept of energy independence and grid resilience. As grids become more decentralized, three-phase inverters provide the necessary control interface to manage bi-directional power flow reliably, enabling critical functions like microgrid formation and black start capability, essential following grid disturbances. Furthermore, the commercial profitability derived from storage assets through ancillary services—such as fast frequency response and reserve capacity—is becoming increasingly attractive to investors, directly driving the demand for high-efficiency inverters capable of rapid response times and complex grid interactions. Technological maturation, specifically the move towards modular string inverters in C&I applications and higher voltage central inverters in utility settings, allows for greater scalability and redundancy, reducing operational risk and enhancing system flexibility.

Despite these favorable conditions, restraints such as complex permitting processes and long lead times for grid interconnection agreements can severely bottleneck project development, particularly in highly regulated jurisdictions. The supply chain volatility for key components, notably power semiconductors (SiC/GaN chips) and magnetic components, poses risks to manufacturing scalability and cost stability. Opportunities, nonetheless, abound in the development of next-generation thermal management systems to handle increased power density, the refinement of hybrid inverter designs that seamlessly integrate solar PV, batteries, and even hydrogen fuel cells, and the expansion into emerging markets such as Africa and Southeast Asia, where significant grid infrastructure investment is underway. The integration of Vehicle-to-Grid (V2G) technology, utilizing three-phase charging infrastructure, also presents a novel and substantial long-term growth opportunity, leveraging electric vehicle fleets as distributed storage assets coordinated by intelligent inverters.

- Drivers:

- Aggressive global targets for renewable energy penetration requiring robust storage infrastructure.

- Substantial cost reduction in lithium-ion battery technology achieving energy storage grid parity.

- Growing necessity for grid resilience and reliability against extreme weather and infrastructure aging.

- Increasing commercial and industrial (C&I) sector adoption driven by high electricity tariffs and demand charge management needs.

- Government incentives and supportive regulatory frameworks (e.g., ITC in the US, storage mandates in Europe).

- Restraints:

- High initial capital expenditure required for integrated three-phase ESS deployments.

- Complexity and duration of regulatory approval and grid interconnection processes.

- Supply chain constraints and price volatility for specialized power semiconductor components.

- Technical challenges related to cybersecurity and ensuring seamless power quality in islanded operational modes.

- Opportunities:

- Expansion of Virtual Power Plant (VPP) and microgrid deployments utilizing distributed three-phase inverters.

- Development and commercialization of hybrid inverters capable of managing multiple energy inputs (PV, storage, grid).

- Adoption of advanced SiC and GaN semiconductor technologies for higher efficiency and smaller footprints.

- Integration of three-phase inverters with Vehicle-to-Grid (V2G) applications for managed EV charging and discharge.

- Impact Forces:

- High: Renewable integration mandates and declining battery costs are the primary sustained market accelerators.

- Medium: Regulatory hurdles and capital costs pose ongoing, though manageable, barriers to rapid deployment.

- Emerging: AI integration and VPP capabilities are creating new, high-value revenue streams for storage asset owners.

Segmentation Analysis

The Three-Phase Energy Storage Inverter Market is segmented primarily based on power rating, application, and technology, reflecting the diverse requirements across the energy ecosystem. Segmentation by power rating is critical as it dictates the required capacity, form factor (string vs. central), and the complexity of grid integration; ratings typically span from medium commercial units (tens of kilowatts) to massive utility-scale installations (megawatts). The application segmentation differentiates between the drivers, technical specifications, and regulatory compliance needed for utility-scale projects, which focus heavily on grid services, versus C&I applications, which prioritize energy bill management and backup power. This granular segmentation allows manufacturers to tailor product specifications—such as voltage level, communication protocols, and auxiliary functions—to meet the specific needs of distinct customer groups, ensuring optimal performance and cost-effectiveness for varied deployment environments.

In terms of technology, the market is broadly divided between battery-coupled inverters (AC-coupled) and hybrid inverters (DC-coupled). AC-coupled systems offer flexibility for retrofitting existing AC infrastructure and are often preferred for storage additions to already commissioned solar farms, requiring two separate inverters (one for PV, one for storage). Conversely, DC-coupled or hybrid inverters integrate the PV array and battery storage into a single management platform, often leading to better system efficiency, reduced balance-of-system (BOS) costs, and simpler installation, particularly attractive for new commercial installations aiming for maximum solar self-consumption. The continuous innovation in these architectural approaches reflects the market’s responsiveness to installer preference and specific project technical constraints.

The fastest growing segment remains the C&I application sector, driven by small and medium enterprises seeking to mitigate punitive demand charges and secure energy continuity. This segment predominantly utilizes three-phase string inverters ranging from 30 kW to 250 kW, characterized by their modularity, ease of maintenance, and ability to be scaled flexibly based on the facility’s evolving energy needs. However, the largest volume deployment continues to reside in the utility-scale segment (above 500 kW/1 MW), particularly in emerging markets where massive grid stability projects are prioritized. Geographic segmentation remains crucial, with high-power density inverters tailored for space-constrained, high-land-cost regions like Europe and highly resilient, durable units designed for the harsh environmental conditions encountered in desert or tropical utility environments dominating regional product preferences.

- By Power Rating:

- Low Power (10 kW – 100 kW): Primarily utilized for small commercial establishments and decentralized energy applications.

- Medium Power (100 kW – 500 kW): Standard for large C&I facilities and small community-scale storage projects.

- High Power (> 500 kW): Dominant in utility-scale battery energy storage systems (BESS).

- By Application:

- Utility Scale: Focusing on grid stabilization, frequency regulation, and transmission congestion relief.

- Commercial and Industrial (C&I): Focused on peak shaving, demand charge reduction, and backup power.

- Microgrids and Off-Grid Systems: Providing energy independence and black start capabilities.

- By Connection Type:

- Grid-Tied Systems: Connected directly to the main electricity grid.

- Off-Grid/Hybrid Systems: Incorporating battery storage with generators or other sources for independent operation.

- By Technology/Topology:

- Central Inverters: Large, high-capacity units for utility installations, prioritizing cost per kW and efficiency.

- String Inverters: Modular units for C&I applications, offering redundancy and flexibility.

- Hybrid Inverters (DC-Coupled): Integrated management of both PV input and battery charge/discharge.

Value Chain Analysis For Three-Phase Energy Storage Inverter Market

The value chain for the Three-Phase Energy Storage Inverter Market is complex and involves several specialized stages, commencing with the sourcing of highly technical raw materials and concluding with system integration and post-sales services. The upstream analysis is dominated by the procurement and manufacturing of specialized components, particularly power semiconductors (IGBTs, MOSFETs, and increasingly SiC/GaN devices), magnetic components (inductors and transformers), and high-performance microcontrollers and digital signal processors (DSPs). Reliability and performance hinge critically on the quality and robustness of these upstream components, necessitating strong relationships with specialized electronics suppliers and rigorous quality control in the manufacturing phase. Volatility in the semiconductor supply chain has a direct and profound impact on the cost and production capacity of inverter manufacturers, emphasizing the strategic importance of secure sourcing and dual-sourcing strategies.

Midstream activities involve the design, assembly, and testing of the inverters themselves. Manufacturers differentiate themselves through proprietary firmware, thermal management systems (which are crucial given the high power densities), and compliance with varied international grid codes (e.g., IEEE, IEC standards). The assembly process often requires high levels of automation and cleanroom environments, particularly for integrating sensitive power electronics. System integrators play a pivotal role here, bundling the inverter with batteries, switchgear, protection equipment, and sophisticated monitoring software to create a complete, ready-to-deploy Energy Storage System (ESS). The efficiency of this integration determines the overall project cost and operational performance, making system design expertise a key competitive advantage.

Downstream analysis focuses on deployment and end-user engagement, encompassing distribution channels, installation, commissioning, and long-term service agreements. Distribution is highly segmented: utility-scale projects typically involve direct sales and procurement through large EPC (Engineering, Procurement, and Construction) firms, while C&I installations utilize authorized dealers, distributors, and certified installers. Direct sales facilitate complex, custom-engineered solutions required for utility environments, while indirect channels provide the necessary reach and localized support for distributed C&I markets. Post-sales service, including remote monitoring, firmware updates, and maintenance contracts, is increasingly important, driven by the longevity expectation of storage assets. Potential customers—ranging from electric utilities and independent power producers (IPPs) to large manufacturing plants and data centers—place a premium on reliability, responsiveness, and long-term system performance guarantees.

Three-Phase Energy Storage Inverter Market Potential Customers

The potential customer base for the Three-Phase Energy Storage Inverter Market is diverse, characterized by organizations with significant energy consumption needs, critical load requirements, or those actively involved in managing power infrastructure. The primary customers are large electric utilities and Independent Power Producers (IPPs) who deploy these inverters in multi-megawatt configurations to enhance grid stability, manage peak demand, and maximize the integration of large-scale renewable energy farms. These utility customers prioritize high capacity, exceptional reliability, long operational life, and seamless compliance with stringent grid interconnection codes. Their purchasing decisions are often based on large-scale procurement tenders and require proven track records in delivering robust grid-forming or grid-following capabilities, which are essential for maintaining system frequency and voltage.

A second major customer category encompasses Commercial and Industrial (C&I) facility owners, including manufacturing plants, hospitals, data centers, universities, and large commercial campuses. These buyers utilize three-phase storage inverters (typically in the 50 kW to 500 kW range) primarily for economic reasons, such as mitigating punitive demand charges levied during peak usage hours, and for resilience, ensuring continuity of operations during grid outages. For this segment, the focus is on achieving rapid ROI through energy savings, coupled with ease of installation and maintenance, and integration with existing building management systems (BMS). The modularity and sophisticated software intelligence provided by modern inverters allow these enterprises to actively participate in local demand response programs, further subsidizing their investment.

Finally, specialized customers include Microgrid Developers, Remote Mining and Industrial Operations, and entities involved in large EV Charging Infrastructure deployment. Microgrid developers rely on three-phase inverters capable of sophisticated islanding and synchronization, ensuring reliable power supply in isolated or poorly served locations. As large-scale electric vehicle charging hubs become more prevalent, three-phase storage inverters are essential for smoothing load spikes and buffering energy withdrawal from the grid, ensuring infrastructure stability. In all cases, the end-user seeks a comprehensive energy solution where the inverter acts as the intelligent bridge between the volatile energy source (battery) and the stable load (grid or facility), demanding robust communications and high cyber security standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 21.0 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMA Solar Technology, Sungrow Power Supply, Siemens AG, Schneider Electric SE, Fimer S.p.A., Enphase Energy, SolarEdge Technologies, Huawei Technologies, TBEA Energy, KEHUA Group, Hitachi Hi-Rel Power Electronics, Delta Electronics, Ginlong Solis, GoodWe Power Supply Technology, KSTAR New Energy, Dynapower, Parker Hannifin, Eaton Corporation, Mitsubishi Electric, ABB Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Three-Phase Energy Storage Inverter Market Key Technology Landscape

The technological landscape of the Three-Phase Energy Storage Inverter Market is rapidly advancing, primarily driven by the imperative for higher power density, increased conversion efficiency, and enhanced grid functionality. A cornerstone of this evolution is the pervasive adoption of Wide Bandgap (WBG) semiconductors, particularly Silicon Carbide (SiC) and, to a lesser extent, Gallium Nitride (GaN). SiC MOSFETs enable inverters to operate at much higher switching frequencies and temperatures compared to traditional Silicon IGBTs, resulting in significantly reduced size, lower cooling requirements, and efficiency gains typically exceeding 98.5%. This technological shift is crucial for utility and large C&I installations where minimizing the physical footprint and maximizing energy throughput are critical performance metrics. Furthermore, the robust nature of SiC components allows manufacturers to design inverters with superior reliability and extended operational lifecycles under extreme environmental conditions, directly addressing the demands of remote and high-stress deployment sites.

Another major technological focus is the development of highly sophisticated control algorithms embedded within the inverter firmware, shifting the device's role towards an intelligent grid asset. Modern three-phase inverters utilize advanced Digital Signal Processors (DSPs) to execute complex algorithms necessary for ancillary services, such as extremely fast voltage and frequency regulation (Fast Frequency Response, or FFR) measured in milliseconds. Crucially, this includes grid-forming capability, which allows the inverter to establish an independent, stable AC voltage source and frequency reference, essential for microgrid operation and supporting black start sequences after a grid failure. This capability elevates the inverter from being merely grid-following (reacting to the existing grid) to grid-forming (creating the grid), a key enabler for high penetration of renewables and decentralized energy resources (DERs).

The modularity and communication standards also define the modern technology landscape. The trend in the C&I sector favors modular three-phase string inverters, which offer enhanced system redundancy and simplify maintenance compared to single central inverters. These modular systems rely on advanced communication protocols (e.g., Modbus TCP/IP, CAN bus, proprietary cloud APIs) to aggregate performance data and allow for real-time remote control and monitoring. Furthermore, integration technologies are accelerating the adoption of hybrid inverter architectures that seamlessly manage PV power harvesting, battery charging, and grid interaction through integrated Maximum Power Point Tracking (MPPT) for both solar and storage inputs. The integration of advanced cybersecurity measures, including hardware-level encryption and secure boot processes, is also becoming a standard feature to protect these critical infrastructure assets from increasing network vulnerabilities, ensuring data integrity and control autonomy in highly connected environments.

Regional Highlights

The global Three-Phase Energy Storage Inverter Market exhibits varied growth profiles influenced by regional policy environments, grid modernization needs, and renewable energy adoption rates. Asia Pacific (APAC) dominates the market in terms of installed capacity volume and projected growth. This leadership is driven primarily by China’s massive national energy storage deployment targets and its significant manufacturing capabilities, which supply a substantial portion of the global market. Countries like India, South Korea, and Australia are also contributing heavily through utility-scale projects aimed at integrating substantial solar and wind resources. In these regions, the emphasis is often on central inverters (above 1 MW) to minimize costs per kilowatt-hour, driven by large, government-backed infrastructure initiatives focused on national energy security and pollution reduction. APAC’s continuous build-out of new grid infrastructure positions it as the center of gravity for high-power inverter demand throughout the forecast period.

Europe represents a highly advanced and regulated market, prioritizing technological innovation and distributed energy resources (DERs). Driven by the European Green Deal and national energy storage mandates, the region shows robust demand across both utility and C&I sectors. Germany, the UK, and Italy are notable for their high penetration of three-phase storage in C&I settings, often utilizing sophisticated hybrid and string inverters to maximize self-consumption and participate in active ancillary service markets, such as the UK’s frequency response mechanisms. European regulations often demand superior efficiency, advanced grid synchronization capabilities, and comprehensive cybersecurity features. The regulatory push for higher renewable penetration necessitates significant investment in high-quality three-phase inverters capable of providing essential stability services, ensuring the region remains a key area for high-value technological deployment.

North America, led by the United States, is a high-value market characterized by robust policy support, such as the federal Investment Tax Credit (ITC), which has accelerated both front-of-the-meter (utility) and behind-the-meter (C&I) projects. The market is particularly influenced by regional factors, such as California’s aggressive decarbonization goals and the critical need for resilience in weather-vulnerable areas like Texas and the Northeast. Utility-scale deployments are extensive, but the C&I segment is experiencing exponential growth, fueled by concerns over grid reliability and escalating electricity costs. Manufacturers serving North America must meet rigorous UL certification standards and often tailor products to accommodate specific state-level grid codes. Latin America and the Middle East & Africa (MEA) represent emerging, high-potential markets, where three-phase storage inverters are essential for creating microgrids in remote areas and supporting large-scale, green hydrogen projects, which require significant power conditioning and conversion infrastructure.

- Asia Pacific (APAC): Market volume leader; driven by utility-scale BESS projects in China, India, and Australia; focus on cost-efficiency and mass deployment.

- Europe: Technology leader; high adoption rates in Germany and UK; strong regulatory environment favoring DERs, VPPs, and high-efficiency C&I storage.

- North America: High-value market; driven by federal incentives (ITC) and demand for grid resilience in the US; significant growth in utility and large C&I segments.

- Latin America: Emerging market with high potential in grid infrastructure upgrades and utilizing storage to manage solar penetration in countries like Brazil and Chile.

- Middle East and Africa (MEA): Growth driven by massive infrastructure projects, renewable energy mandates (e.g., NEOM in Saudi Arabia), and off-grid microgrid solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Three-Phase Energy Storage Inverter Market.- SMA Solar Technology

- Sungrow Power Supply

- Siemens AG

- Schneider Electric SE

- Fimer S.p.A.

- Enphase Energy

- SolarEdge Technologies

- Huawei Technologies

- TBEA Energy

- KEHUA Group

- Hitachi Hi-Rel Power Electronics

- Delta Electronics

- Ginlong Solis

- GoodWe Power Supply Technology

- KSTAR New Energy

- Dynapower

- Parker Hannifin

- Eaton Corporation

- Mitsubishi Electric

- ABB Ltd.

Frequently Asked Questions

Analyze common user questions about the Three-Phase Energy Storage Inverter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes three-phase from single-phase energy storage inverters?

Three-phase inverters are designed for high-power commercial, industrial, and utility applications, offering superior efficiency, higher voltage output, and robust grid interaction capabilities (like reactive power control) necessary for large loads and grid stabilization services, unlike smaller, residential single-phase units.

How do three-phase inverters contribute to grid stability and ancillary services?

They provide critical ancillary services, including fast frequency regulation and voltage support, by rapidly injecting or absorbing reactive power. Modern units incorporate grid-forming capabilities, enabling them to establish the grid frequency and voltage independently, essential for microgrids and supporting grid reliability.

What impact are SiC and GaN semiconductors having on inverter design?

Silicon Carbide (SiC) and Gallium Nitride (GaN) enable three-phase inverters to achieve higher switching frequencies, resulting in conversion efficiencies above 98.5%, significantly reduced physical size and weight (higher power density), and improved thermal performance, lowering overall operational costs.

Which application segment is driving the fastest growth in the market?

The Commercial and Industrial (C&I) segment is showing the fastest growth rate. This is driven by businesses utilizing three-phase storage for economic optimization, primarily peak shaving, demand charge reduction, and securing energy resilience against increasing grid instability.

What is the primary role of AI in modern three-phase energy storage inverter systems?

AI is primarily used for optimizing power dispatch, maximizing revenue through predictive energy arbitrage based on real-time market conditions, and implementing predictive maintenance to forecast component failures, thereby reducing downtime and extending the lifespan of the entire storage asset.

Are three-phase inverters capable of managing both solar PV and battery storage?

Yes, hybrid (DC-coupled) three-phase inverters are specifically designed to manage power flow simultaneously from a solar PV array, the battery bank, and the electricity grid, maximizing energy efficiency and simplifying the overall system architecture for new installations.

What are the key certification requirements for three-phase inverters in North America?

In North America, key certifications include UL 1741 (for grid interconnection and functional safety) and specific requirements related to utility interaction, often requiring compliance with standards like IEEE 1547, ensuring safe and reliable grid integration of high-power systems.

How does the value chain manage the sourcing of critical inverter components?

The upstream value chain focuses on securing reliable supplies of advanced power semiconductors (SiC/GaN), high-grade magnetics, and specialized microcontrollers. Strategic partnerships and dual-sourcing are common to mitigate risks associated with semiconductor supply chain volatility and ensure continuous production capacity.

What is the significance of the shift toward modular string inverters in C&I applications?

Modular string inverters enhance system redundancy, meaning the failure of one unit does not halt the entire system. They also simplify installation, offer greater scalability to match varying load requirements, and improve maintainability compared to older, centralized three-phase designs.

Which global region is currently leading in installed capacity for three-phase storage inverters?

Asia Pacific (APAC), led by substantial government-backed utility-scale projects in China and Australia, currently dominates the market in terms of installed capacity volume and deployment scale, focusing primarily on large-scale grid infrastructure support.

What major regulatory factor is driving market growth in Europe?

Market growth in Europe is significantly driven by the European Green Deal, stringent decarbonization mandates, and specific national regulations requiring grid modernization and the deployment of energy storage to manage high penetration levels of intermittent renewable energy sources.

What is the main financial restraint impacting large-scale three-phase inverter deployment?

The primary financial restraint is the high initial capital expenditure (CapEx) required for the complete Energy Storage System (ESS), including the large battery bank and associated balance-of-system (BOS) costs, although falling battery prices are steadily mitigating this barrier.

How are three-phase inverters used in Vehicle-to-Grid (V2G) applications?

In V2G applications, robust three-phase inverters are essential for managing the high power requirements of commercial EV charging hubs, allowing the vehicle batteries to both absorb power from the grid and discharge stored energy back into the grid, turning the fleet into a distributed energy resource.

Define the concept of grid-forming versus grid-following capabilities in these inverters.

Grid-following inverters synchronize their output with the existing grid frequency and voltage. Grid-forming inverters, conversely, are capable of creating the stable AC waveform autonomously, making them critical for microgrids and providing black start services without relying on external grid power.

What is the role of digital signal processors (DSPs) in modern inverters?

DSPs are high-speed microcontrollers that execute the complex, real-time control algorithms necessary for power quality management, fast switching of power electronics, and precise synchronization needed for advanced grid services, ensuring instantaneous reaction to grid conditions.

How do three-phase storage inverters manage peak shaving for C&I customers?

They monitor the facility's instantaneous power demand and automatically discharge stored battery energy during periods when demand approaches or exceeds a pre-set threshold, effectively lowering the maximum recorded peak demand and substantially reducing expensive utility demand charges.

What is the projected Compound Annual Growth Rate (CAGR) for this market?

The Three-Phase Energy Storage Inverter Market is projected to grow at a strong CAGR of 18.5% between the years 2026 and 2033, reflecting the accelerated global transition toward sustainable and resilient energy infrastructure.

Who are the primary potential customers in the utility-scale segment?

Primary potential customers in the utility segment include electric utilities (Transmission System Operators/Distribution System Operators) and Independent Power Producers (IPPs) responsible for building and operating large-scale battery energy storage systems (BESS) for grid optimization.

How is competition intensifying among key market players?

Competition is intensifying through technological differentiation, particularly the adoption of SiC/GaN, software intelligence (AI/ML integration), and vertical integration strategies aimed at providing complete, optimized, and turnkey energy storage solutions encompassing both batteries and inverters.

Why is enhanced thermal management essential for high-power inverters?

High-power three-phase inverters generate significant heat, especially when operating at peak capacity. Enhanced thermal management (e.g., liquid cooling systems) is essential to maintain optimal operating temperatures for semiconductors, preventing efficiency degradation and extending the reliable life of the costly electronic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager