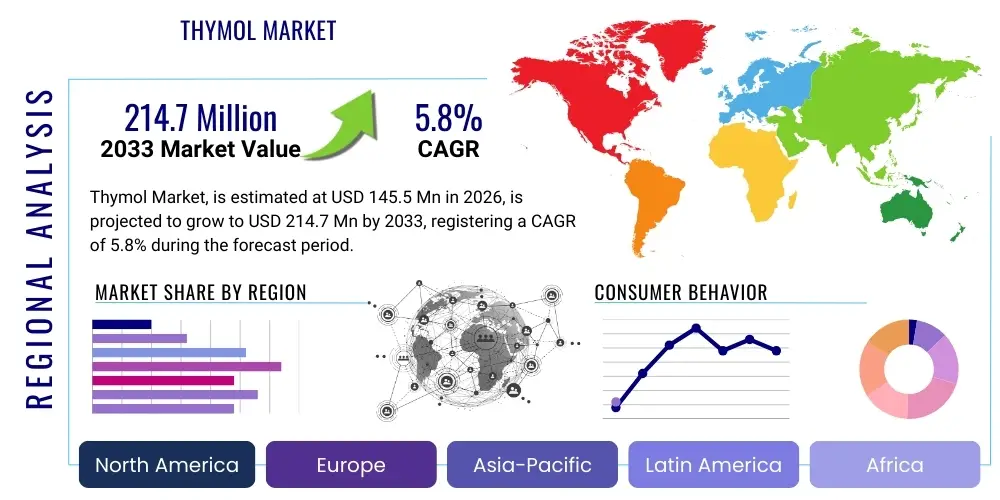

Thymol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437590 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Thymol Market Size

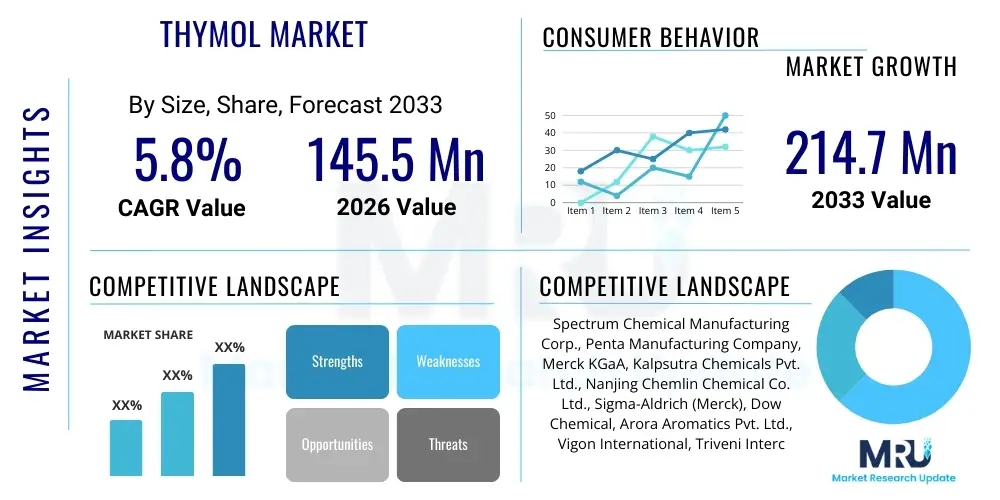

The Thymol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 145.5 Million in 2026 and is projected to reach USD 214.7 Million by the end of the forecast period in 2033. This growth is primarily fueled by the increasing application of thymol as a natural antimicrobial and preservative across multiple industries, including pharmaceuticals, cosmetics, and the burgeoning animal feed sector.

Thymol Market introduction

Thymol, or 2-isopropyl-5-methylphenol, is a natural monoterpene phenol derivative of cymene, C10H14O, found in oil of thyme and derived from the thyme herb (Thymus vulgaris). Known for its distinctive pleasant aromatic odor and powerful antiseptic properties, thymol is a highly sought-after chemical compound in various industrial applications. Historically, it has been recognized for its therapeutic qualities, particularly in dentistry and as an antiparasitic agent. The modern market utilizes both naturally extracted thymol and synthetically produced variants to meet the rising global demand, driven by consumer preference for natural ingredient alternatives over synthetic counterparts in food and personal care products.

The major applications of thymol span across pharmaceuticals, where it is used in cough suppressants, mouthwashes, and antifungal treatments; flavoring and fragrance, contributing a specific aroma profile to specific food items and beverages; and agriculture, where its antimicrobial and antiparasitic capabilities are critical for animal health, especially in poultry and beekeeping (acaricide). The inherent benefits of thymol, such as its broad-spectrum antimicrobial activity, relatively low toxicity profile compared to some synthetic preservatives, and efficacy against antibiotic-resistant strains, position it as a critical ingredient in the push towards clean-label solutions.

Driving factors for the market include stringent regulations against synthetic additives in foods and animal feed, increased awareness regarding hygiene and infection control globally following recent health crises, and significant growth in the flavor and fragrance industry, particularly in developing economies. Furthermore, research into new delivery mechanisms and formulations that enhance thymol’s bioavailability and stability is continuously expanding its market penetration, ensuring sustained demand throughout the forecast period.

Thymol Market Executive Summary

The global Thymol market is characterized by robust growth, underpinned by fundamental shifts in consumer preferences toward natural and sustainable chemical inputs. Key business trends indicate a strong move toward vertical integration among major producers to secure raw material supply (natural thymol relies on consistent thyme cultivation or specific tree oils) and maintain cost competitiveness against synthetic producers. Strategic alliances focusing on R&D for enhanced extraction efficiency and new application development in veterinary medicine are defining the competitive landscape. Furthermore, the market is experiencing increasing scrutiny regarding purity standards, especially for USP/EP grade thymol used in critical pharmaceutical formulations.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, primarily due to rapid expansion in the pharmaceutical manufacturing sector, coupled with high demand for natural animal feed additives driven by booming livestock production in countries like China and India. North America and Europe, representing mature markets, maintain significant market share, focusing heavily on high-value applications in cosmetics and functional foods, responding directly to clean-label movements. Regulatory differences between regions regarding the approved dosage and application scope of thymol significantly influence localized market dynamics and entry strategies.

Segment trends reveal that the Pharmaceuticals application segment continues to dominate the market share due to the established usage of thymol as an antiseptic and antiparasitic agent. However, the Agriculture and Animal Feed segment is anticipated to exhibit the highest Compound Annual Growth Rate, driven by global efforts to phase out antibiotic growth promoters in livestock, positioning thymol and other essential oil components as effective natural alternatives. The Synthetic source segment holds a large volume share due to cost-effectiveness, but the Natural source segment is experiencing rapid value growth fueled by premium pricing and consumer demand for naturally derived ingredients.

AI Impact Analysis on Thymol Market

User queries regarding AI's influence on the Thymol market primarily focus on optimizing extraction processes, predicting yield stability based on environmental factors, and accelerating drug discovery using thymol derivatives. Common concerns revolve around whether AI can significantly lower the cost of natural extraction, thus challenging synthetic thymol’s dominance, and how AI-driven predictive modeling can manage supply chain volatility associated with agricultural inputs. Users are keenly interested in AI’s role in screening potential synergistic compounds involving thymol for enhanced antimicrobial efficacy, specifically targeting antibiotic-resistant bacteria, and optimizing new product formulations in cosmetics and personal care for better stability and shelf-life prediction.

AI’s integration is moving beyond simple data aggregation and is now actively used in refining chemical synthesis routes for synthetic thymol, aiming for higher purity and lower waste generation. In natural extraction, machine learning algorithms are being deployed to monitor environmental conditions (soil pH, temperature, humidity) and plant genetics, leading to optimized harvesting schedules and maximization of essential oil yield from thyme crops. This technological application addresses the inherent volatility and lack of standardization often associated with natural product supply chains, ensuring a more stable and predictable material source for downstream manufacturers.

Furthermore, in the pharmaceutical domain, AI and computational chemistry are enabling rapid in-silico screening of thymol analogs for novel biological targets, significantly reducing the time and cost associated with traditional drug discovery. AI-powered predictive maintenance in large-scale manufacturing facilities ensures optimal operational efficiency, minimizing downtime and energy consumption during the processing and crystallization of thymol. This operational enhancement, coupled with AI-driven inventory management that anticipates demand fluctuations across diverse application sectors, contributes significantly to market stabilization and competitive advantage for early adopters.

- AI optimizes natural thymol extraction efficiency by predicting optimal harvest timing and environmental conditions.

- Machine learning algorithms accelerate the discovery of novel thymol derivatives for pharmaceutical and pesticidal applications.

- AI-driven supply chain management enhances stability and reduces volatility in raw material procurement (e.g., cresol for synthetic production or thyme oil for natural).

- Predictive modeling assists in formulating stable cosmetic and food preservative systems utilizing thymol, forecasting shelf-life accurately.

- Computational chemistry aids in refining synthetic manufacturing processes for high-purity, reduced-waste thymol production.

DRO & Impact Forces Of Thymol Market

The Thymol market is primarily driven by escalating consumer demand for natural ingredients, propelled by health consciousness and concerns regarding synthetic preservatives and antibiotics. The inherent antimicrobial, antifungal, and antiseptic properties of thymol make it highly valuable across multiple sectors, particularly in the healthcare and personal care industries. Significant growth opportunities arise from its increased use as a natural alternative to antibiotic growth promoters (AGPs) in livestock feed, driven by global regulatory pressures and consumer rejection of antibiotic overuse in agriculture. However, the market faces constraints related to price volatility of raw materials, particularly the essential oils used for natural extraction (like thyme oil or oregano oil), and stringent regulatory requirements regarding permissible limits in food and drug applications, which vary significantly by region. These dynamics create a complex interplay of opportunities and restraints that shape strategic investment decisions and market penetration.

The primary driver is the demonstrable effectiveness of thymol against a broad spectrum of pathogens, including various strains resistant to conventional antibiotics. This efficacy is highly valued in pharmaceutical formulations (e.g., topical antiseptics, dental products) and in innovative agricultural practices aimed at maintaining animal health without resorting to conventional antibiotics. Restraints predominantly center on the reliance of the synthetic route on petrochemical derivatives (like m-cresol) whose pricing fluctuates with global crude oil markets, and the inconsistent quality and supply of natural thyme oil, which is vulnerable to agricultural production cycles and climate change. Furthermore, competition from other natural antimicrobials, such as carvacrol, eugenol, and various plant extracts, poses a continuous challenge, necessitating ongoing research into superior formulations.

The impactful opportunity lies in leveraging thymol's synergistic potential when combined with other natural compounds or drug molecules, enhancing overall efficacy in treating complex infections or infestations (such as Varroa destructor mites in honeybees). Impact forces include strong regulatory frameworks favoring natural preservatives in the EU and North America, which substantially accelerate market adoption. Conversely, the potential for skin or mucosal irritation at high concentrations acts as a restraining force on application limits. Overall, the market impact is positive, driven by the global imperative to transition toward sustainable, natural, and effective antimicrobial solutions, making the opportunities significantly outweigh the restraints over the long term, provided supply chain stability can be managed effectively.

Segmentation Analysis

The Thymol market is comprehensively segmented based on its Source (Natural and Synthetic), Application (Pharmaceuticals, Flavoring & Fragrance, Cosmetics & Personal Care, and Agriculture & Animal Feed), and Grade (USP/EP Grade and Technical Grade). This segmentation provides a granular view of market dynamics, revealing varying growth rates and demand drivers across different product types and end-use industries. The synthetic segment currently holds the largest share due to its cost-effectiveness and scalability, but the natural segment is rapidly gaining ground, fueled by the premiumization trend and regulatory push for naturally derived ingredients, especially in consumer-facing products. Each application segment exhibits unique purchasing behaviors and regulatory compliance requirements, necessitating tailored marketing and distribution strategies.

The market structure is largely influenced by the stringent quality demands of the Pharmaceutical segment, which mandates the highest purity (USP/EP Grade). Conversely, the Agriculture and Technical Grade segments prioritize cost-efficiency and large volume procurement. Understanding these segment-specific requirements is critical for manufacturers aiming to optimize production portfolios. For instance, the rapid expansion of the animal feed sector demanding alternatives to antibiotics creates an immediate high-volume opportunity for Technical Grade thymol, whereas the cosmetic industry seeks natural, highly refined thymol for sensitive formulations.

The geographical diversity in regulatory acceptance also significantly influences segmentation penetration. For example, countries with strict 'natural' labeling standards see a higher penetration of naturally sourced thymol, even at a higher cost. This intricate market structure allows players to specialize in either high-volume, cost-sensitive production (synthetic, technical grade) or low-volume, high-value extraction (natural, USP grade), contributing to a dynamic and competitive environment.

- Source:

- Natural

- Synthetic

- Application:

- Pharmaceuticals (Antiseptics, Cough Syrups, Dentistry)

- Flavoring & Fragrance (Food, Beverages)

- Cosmetics & Personal Care (Mouthwash, Soaps, Deodorants)

- Agriculture & Animal Feed (Antimicrobial Additives, Beekeeping Acaricide)

- Grade:

- USP/EP Grade

- Technical Grade

Value Chain Analysis For Thymol Market

The value chain for the Thymol market begins with upstream activities involving raw material procurement, which significantly differs based on the source. For natural thymol, this involves cultivating and harvesting thyme or sourcing cresol-containing essential oils (like ajwain or oregano), followed by steam distillation or solvent extraction. For synthetic thymol, the upstream phase involves sourcing petrochemical precursors, primarily m-Cresol, which is subjected to chemical synthesis, purification, and subsequent crystallization. Supply chain stability in the synthetic route is tied to global oil and chemical commodity prices, whereas the natural route is sensitive to agricultural yields and climatic conditions. Effective upstream management is crucial for cost control and quality assurance, particularly for high-purity pharmaceutical grades.

The midstream process focuses on manufacturing, purification, and refinement. Manufacturers must employ advanced purification techniques, such as fractional distillation or recrystallization, to meet the stringent purity standards required for USP/EP grade products. Packaging and quality control are also critical midstream activities, ensuring compliance with international regulatory bodies. Specialized blending and formulation activities occur here, particularly when thymol is incorporated into intermediate products like concentrated flavors or proprietary animal feed blends. Efficiency in this stage determines the competitiveness of the final product.

The downstream sector encompasses distribution and end-user consumption. Distribution channels are highly specialized, often relying on global chemical distributors for bulk sales to pharmaceutical and agriculture giants, or specialized flavor and fragrance houses for consumer applications. Direct distribution is common for high-volume, technical-grade sales to large animal feed producers. End-users span hospitals and pharmaceutical companies, food and beverage manufacturers, cosmetic formulation laboratories, and agricultural enterprises. The final value captured is significantly influenced by branding, regulatory approval, and the complexity of the formulation in which thymol is incorporated, often achieving the highest margins in niche pharmaceutical and high-end cosmetic applications.

Thymol Market Potential Customers

Potential customers for thymol are highly diversified, reflecting the compound's broad utility as an antimicrobial, flavorant, and fragrance agent. The largest volume consumers are typically the pharmaceutical and animal health industries. Pharmaceutical manufacturers utilize high-purity thymol in over-the-counter and prescription products, including expectorants, lozenges, and topical antifungal creams, making regulatory compliance and purity the key determinants for procurement. Dental product manufacturers, producing specialized mouthwashes and varnishes, also represent a significant demand base due to thymol’s efficacy against oral pathogens. These customers seek guaranteed supply continuity and stringent quality documentation.

Another major segment consists of manufacturers in the agriculture and animal feed sector, particularly those involved in poultry, swine, and aquaculture. These customers are driven by the need for cost-effective, natural additives to enhance gut health, prevent disease outbreaks, and improve feed efficiency, thereby serving as a natural replacement for conventional antibiotic growth promoters. Beekeepers and pest control operators also constitute a crucial niche market, utilizing thymol formulations as an effective acaricide against mites. Procurement decisions here are heavily influenced by efficacy, regulatory approval for veterinary use, and bulk pricing.

The third significant group includes the Flavoring & Fragrance and Cosmetics & Personal Care industries. Food and beverage companies use thymol minimally as a flavor enhancer, whereas cosmetics manufacturers incorporate it into soaps, deodorants, and particularly high-end natural mouthwash formulations. These end-users often prioritize the natural source of thymol, driven by consumer marketing trends toward essential oil-based and clean-label products. Their purchasing criteria often revolve around odor profile consistency, color stability, and the ability to seamlessly blend with complex formulations, requiring specialized, often naturally sourced, material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 214.7 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectrum Chemical Manufacturing Corp., Penta Manufacturing Company, Merck KGaA, Kalpsutra Chemicals Pvt. Ltd., Nanjing Chemlin Chemical Co. Ltd., Sigma-Aldrich (Merck), Dow Chemical, Arora Aromatics Pvt. Ltd., Vigon International, Triveni Interchem, S. C. Johnson & Son, Glentham Life Sciences, Advanced Biotech, Wuhan Xinrong New Materials Co., Hunan Chem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thymol Market Key Technology Landscape

The technology landscape governing the production and application of thymol is categorized into synthesis methods and advanced delivery systems. For synthetic thymol, the primary manufacturing process involves the alkylation of m-Cresol with propylene. Key technological advancements in this area focus on process optimization to improve yield, reduce the formation of unwanted isomers, and enhance the overall purity profile, often utilizing highly efficient catalysts and continuous flow reactors. For the natural segment, key technologies involve advanced, high-yield extraction methods, such as supercritical fluid extraction (SFE) using carbon dioxide, which offers superior purity and minimizes thermal degradation compared to traditional steam distillation. SFE technology allows for the precise separation of thymol from complex essential oil matrices, meeting the increasing demand for high-quality, residue-free natural ingredients.

Beyond basic manufacturing, a crucial technological area is the development of novel encapsulation and stabilization techniques. Thymol is volatile and prone to degradation under specific environmental conditions, limiting its incorporation into certain matrixes, particularly in food and feed. Microencapsulation technologies, including spray drying, coacervation, and liposome encapsulation, are employed to protect the thymol molecule, control its release kinetics, and mask its strong odor profile, thereby enhancing its efficacy and shelf life in complex applications like animal feed and water treatment. These advanced delivery systems are critical for maintaining the functionality of thymol throughout the digestive tract of livestock, ensuring maximum therapeutic effect.

Furthermore, analytical technologies play a pivotal role in maintaining market standards. High-performance liquid chromatography (HPLC) and gas chromatography-mass spectrometry (GC-MS) are indispensable for rigorous quality control, ensuring that both synthetic and natural thymol products meet global pharmacopeial standards (USP/EP) and confirming the absence of harmful impurities or solvent residues. Research is also intensifying in green chemistry principles for synthesizing thymol analogs, exploring biological pathways using genetically engineered yeasts or bacteria for fermentation-based production, which could offer a more sustainable and environmentally friendly alternative to traditional petrochemical routes in the future.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to escalating demand from emerging economies like China, India, and Southeast Asian nations. Rapid industrialization, expansion of domestic pharmaceutical manufacturing capabilities, and significant investments in livestock farming (driving demand for natural feed additives) are the primary growth catalysts. India and China are major consumption hubs for both synthetic and natural thymol, serving extensive domestic markets and acting as global export centers for essential oils and bulk chemicals.

- North America: This region holds a substantial market share, driven primarily by established pharmaceutical and personal care industries, particularly the strong emphasis on oral hygiene products. Strict regulatory frameworks regarding antibiotic use in meat production in the US and Canada favor the adoption of natural alternatives like thymol in animal feed. Innovation in functional foods and dietary supplements containing natural antimicrobials also contributes significantly to sustained demand.

- Europe: Europe represents a mature market with high consumption rates, heavily regulated by the European Medicines Agency (EMA) and the European Food Safety Authority (EFSA). The EU’s decisive ban on most antibiotic growth promoters has created a robust market for essential oil components, making the Agriculture and Animal Feed application segment a key driver. Furthermore, the strong consumer preference for certified natural and organic ingredients in cosmetics ensures high demand for naturally sourced, high-purity thymol.

- Latin America (LATAM): The LATAM market is experiencing moderate growth, primarily driven by expanding agricultural activities, especially in Brazil and Argentina, where thymol is increasingly adopted in aquaculture and livestock health management. Economic instability and fluctuating local currencies can affect import costs for synthetic raw materials, favoring local production or supply chain partnerships focused on essential oil extraction.

- Middle East and Africa (MEA): This region is characterized by nascent market development, with growth concentrated in rapidly developing urban centers and healthcare infrastructure projects. Demand is largely concentrated in pharmaceutical and sanitation applications. Challenges include fragmented supply chains and varying levels of regulatory standardization across different countries, though opportunities exist in essential oil production in certain African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thymol Market.- Spectrum Chemical Manufacturing Corp.

- Penta Manufacturing Company

- Merck KGaA

- Kalpsutra Chemicals Pvt. Ltd.

- Nanjing Chemlin Chemical Co. Ltd.

- Sigma-Aldrich (Merck)

- Dow Chemical

- Arora Aromatics Pvt. Ltd.

- Vigon International

- Triveni Interchem

- S. C. Johnson & Son

- Glentham Life Sciences

- Advanced Biotech

- Wuhan Xinrong New Materials Co.

- Hunan Chem.

- BASF SE

- Symrise AG

- Givaudan SA

- Robertet Group

- Finetech Industry Limited

Frequently Asked Questions

Analyze common user questions about the Thymol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Thymol Market?

The primary growth drivers are the Pharmaceutical industry, utilizing thymol for its antiseptic and antifungal properties, and the Agriculture/Animal Feed sector, where it serves as an effective natural alternative to conventional antibiotic growth promoters (AGPs) in livestock.

How do Natural and Synthetic Thymol segments differ in market value and volume?

Synthetic thymol typically commands higher market volume due to its cost-effectiveness and scalable production from petrochemical precursors, while Natural thymol generally holds a higher market value per unit, driven by consumer preference and premium pricing in the cosmetics and certified natural products sectors.

Which region is expected to show the highest growth rate in the Thymol market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the rapid expansion of the pharmaceutical industry, significant growth in animal livestock farming, and increasing domestic demand for personal care and flavoring products in countries like China and India.

What is the main restraining factor affecting the stable supply of Thymol?

The main restraining factor is the price volatility of key raw materials. For synthetic thymol, this relates to fluctuations in petrochemical derivative prices (m-Cresol), and for natural thymol, it relates to the inconsistent agricultural yields and climate-dependent supply of thyme essential oils.

How is AI impacting the manufacturing and efficiency of Thymol production?

AI is primarily used to optimize efficiency by predicting optimal harvest times for natural sources, refining synthetic chemical reaction parameters for higher purity, and enabling predictive maintenance in manufacturing facilities, thereby ensuring more stable and higher-quality output.

What is the significance of USP/EP Grade Thymol?

USP/EP (United States Pharmacopeia/European Pharmacopoeia) Grade signifies the highest purity standard required for thymol used in critical pharmaceutical applications, guaranteeing minimal impurities and consistent efficacy for drug manufacturing and human consumption products like mouthwashes and cough treatments.

Can Thymol be used as a natural preservative in food products?

Yes, thymol is recognized for its potent antimicrobial and antifungal properties and is increasingly utilized as a natural food preservative, especially in sauces, baked goods, and beverages, responding to the industry trend favoring clean-label ingredients over traditional synthetic preservatives.

What role does regulatory pressure play in the Thymol market?

Regulatory pressures, particularly the globally increasing restrictions and bans on the use of conventional antibiotics as growth promoters in animal feed (such as those enforced by the EU), strongly accelerate the adoption of natural compounds like thymol as viable substitutes in the agriculture sector.

What are the key technological advancements concerning Thymol delivery systems?

Key advancements focus on encapsulation technologies, such as microencapsulation using liposomes or spray drying, which protect thymol from degradation, mask its strong flavor, and enable controlled release, critical for enhancing its stability and therapeutic efficacy in animal feed and specialized cosmetic applications.

Which end-user segment utilizes Technical Grade Thymol?

Technical Grade Thymol, which is generally less pure than USP/EP grade, is predominantly utilized by high-volume consumers in the Agriculture and Animal Feed industries, as well as certain industrial cleaning and technical applications where purity specifications are less stringent than those for pharmaceutical use.

Is there a competitive threat to Thymol from other natural compounds?

Yes, Thymol faces competition from other potent natural monoterpenoids like Carvacrol (found in oregano oil) and Eugenol (from clove oil). Market players continuously differentiate based on specific application performance, cost-efficacy, and regulatory acceptance of each compound.

How does the value chain for Natural Thymol differ from Synthetic Thymol?

The Natural Thymol value chain is intrinsically linked to agriculture (cultivation, harvesting), and extraction technologies (distillation, SFE), making it vulnerable to climate risk. The Synthetic Thymol chain relies on chemical synthesis from petrochemical feedstocks (m-Cresol), tying its costs to global commodity prices.

In which niche market is Thymol highly critical as an antiparasitic?

Thymol is highly critical in the beekeeping industry, where its formulations are effectively used as an acaricide to control Varroa destructor mites, which are a major threat to global honeybee populations, making this a vital niche application.

What factors influence the procurement decisions of pharmaceutical companies?

Pharmaceutical companies prioritize high-purity (USP/EP) grade, stringent quality control documentation, auditability, consistent supply continuity, and compliance with Good Manufacturing Practices (GMP) and global pharmacopeial standards when procuring thymol.

How is the Flavoring and Fragrance segment using Thymol?

In the Flavoring and Fragrance segment, thymol is utilized in small, carefully controlled concentrations to contribute a specific herbaceous, warm, or medicinal note to food products, beverages, and cosmetic fragrances, often enhancing complexity and perceived freshness.

What is the projection for the Thymol market size by 2033?

The Thymol market is projected to reach an estimated value of USD 214.7 Million by the end of the forecast period in 2033, growing from USD 145.5 Million in 2026.

How does Latin America contribute to the global Thymol demand?

Latin America contributes significantly through its expanding agriculture and aquaculture sectors, particularly in major producing nations like Brazil, which increasingly adopt thymol as a natural additive for disease control and gut health in livestock production.

What specific cosmetic products heavily feature Thymol?

Cosmetic and personal care products heavily featuring thymol include therapeutic mouthwashes, specialized natural soaps, topical antiseptics, and certain high-end dental varnishes, where its potent antimicrobial action is actively sought and marketed.

What are the key considerations for manufacturers seeking to enter the Thymol market?

Entrants must strategically decide between high-volume, cost-competitive synthetic production or high-value, naturally sourced extraction, necessitating substantial investment in advanced purification technologies and rigorous quality control measures to meet international standards.

How does the volatile nature of Thymol influence its commercial application?

Thymol's volatility necessitates the use of advanced stabilization and microencapsulation technologies, especially in applications requiring long shelf-life or precise delivery, such as in animal feed supplements or time-release pharmaceutical formulations, to ensure its effectiveness is maintained.

What is the primary chemical derivation method for Synthetic Thymol?

The primary method for synthetic thymol involves the alkylation of m-Cresol (meta-cresol) with propylene, using a suitable catalyst, followed by purification and crystallization to achieve the desired technical or pharmaceutical grade product.

What impact does the "Clean Label" movement have on Thymol usage?

The "Clean Label" movement significantly boosts the demand for naturally sourced thymol, as consumers and manufacturers prioritize ingredients derived from botanical sources over synthetic chemical additives in food, beverages, and personal care products, often resulting in premium pricing for the natural segment.

In the regional analysis, what differentiates North American consumption?

North American consumption is characterized by high adoption in established pharmaceutical and dental markets, coupled with strong regulatory pushback against antibiotic use in agriculture, leading to a robust, technologically driven market focused on high-quality, standardized products.

How are new thymol formulations addressing antibiotic resistance?

New thymol formulations are being developed, often involving synergistic combinations with other compounds or nanoparticles, to enhance their efficacy against increasingly common antibiotic-resistant bacterial strains, positioning thymol as a component in future combination therapies.

What grade of thymol is typically used in industrial cleaning products?

Industrial cleaning and disinfection products, prioritizing cost and bulk volume, typically utilize Technical Grade Thymol due to its effective antiseptic properties, where the ultra-high purity required for internal consumption (USP/EP grade) is unnecessary.

Which segment is expected to show the highest CAGR among applications?

The Agriculture and Animal Feed application segment is expected to show the highest Compound Annual Growth Rate (CAGR) during the forecast period, driven by global efforts to replace prophylactic antibiotics with natural feed additives like thymol for enhanced animal health.

How critical is the role of quality control in the Thymol supply chain?

Quality control is extremely critical, especially for USP/EP grade material, requiring rigorous analytical testing (HPLC, GC-MS) to confirm purity, detect impurities, and ensure regulatory compliance, directly impacting product approval and end-user safety.

What strategic move are manufacturers making to ensure raw material stability?

Manufacturers are increasingly engaging in backward integration, either through securing long-term contracts with key m-Cresol suppliers for synthetic production or investing in agricultural partnerships to control the cultivation and consistent supply of thyme essential oils for natural extraction.

What environmental factors pose a threat to the Natural Thymol supply?

Environmental factors such as climate change, unpredictable weather patterns, and regional droughts significantly impact the yield and quality of thyme crops, posing a threat to the stable supply and consistent pricing of naturally sourced thymol.

How does the odor profile of Thymol influence its use in Fragrance applications?

Thymol's strong, pungent, medicinal, and herbal odor profile means it is used judiciously in fragrance applications, often in trace amounts or specifically in products like therapeutic balms and antiseptic sprays where the medicinal note is desired or tolerable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bromothymol Blue Market Statistics 2025 Analysis By Application (Research Laboratory, Hospital, School), By Type (Solution, Powder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thymol Market Statistics 2025 Analysis By Application (L-Menthol Production, Pharmaceutical/Biotechnology, Animal Health and Feedstuff, Flavor & Fragrances), By Type (Natural Thymol, Synthetic Thymol), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Thymol Blue Market Statistics 2025 Analysis By Application (Pharmaceutical, Acid Base Indicator), By Type (Purity?99%, Purity?99%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager