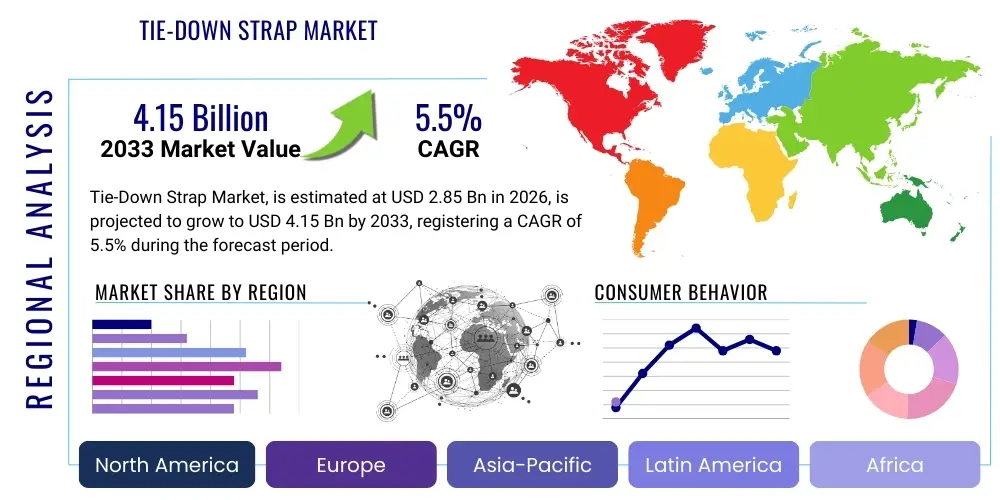

Tie-Down Strap Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436156 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tie-Down Strap Market Size

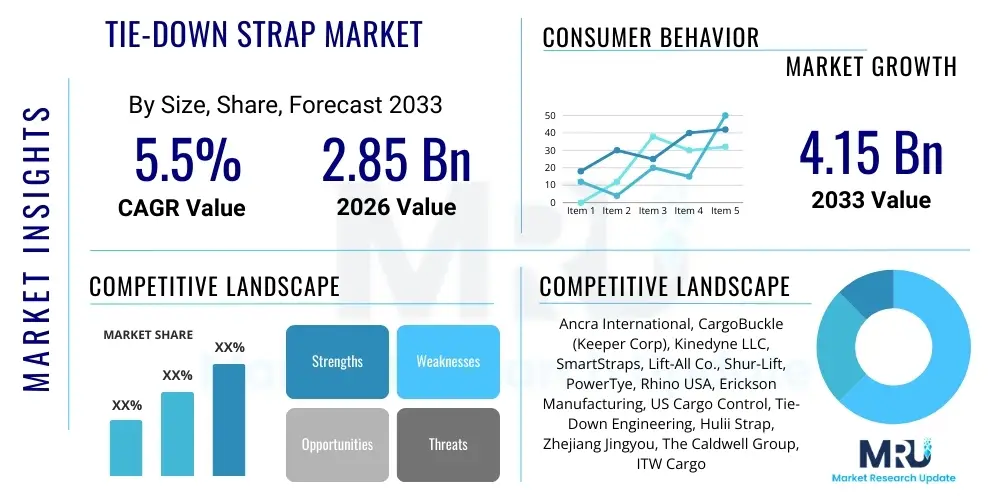

The Tie-Down Strap Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $2.85 Billion in 2026 and is projected to reach $4.15 Billion by the end of the forecast period in 2033.

Tie-Down Strap Market introduction

The Tie-Down Strap Market encompasses the global trade of load securement devices essential for stabilizing cargo during transit or storage. These straps, typically made from high-strength synthetic materials like polyester or nylon, are crucial components in logistics, construction, automotive, and military sectors, ensuring compliance with stringent safety regulations. The primary function of a tie-down strap is to create tension, preventing movement and damage to the secured items, thereby enhancing operational safety and reducing potential insurance liabilities associated with cargo shifting.

Product diversity within this market is substantial, ranging from heavy-duty ratchet straps designed for industrial machinery and large vehicles to lighter cam buckle straps used for recreational equipment and minor freight. Key applications include securing goods in trucks, railcars, maritime containers, and air freight pallets. The inherent durability, flexibility, and high working load limits (WLL) of modern tie-down solutions drive their adoption across diverse heavy-duty industries, offering significant advantages over traditional ropes or chains in terms of efficiency and consistency of tensioning.

The market benefits significantly from the continued expansion of global trade and e-commerce, which necessitates efficient and reliable cargo handling across complex supply chains. Furthermore, stricter governmental regulations regarding load securement, particularly in North America and Europe, mandate the use of certified and high-quality tie-down systems, acting as a crucial driving factor. The ongoing focus on workplace safety and minimizing economic losses due to damaged goods solidifies the indispensable role of robust tie-down straps in the modern industrial landscape.

Tie-Down Strap Market Executive Summary

The global Tie-Down Strap Market is characterized by steady growth, primarily fueled by robust expansion in the global logistics sector and heightened regulatory scrutiny concerning cargo safety. Business trends indicate a strong shift towards advanced synthetic materials offering higher tensile strength and weather resistance, enhancing the overall lifespan and performance of the straps. Key players are focusing on product differentiation through ergonomic designs (e.g., improved ratchet mechanisms) and integration of smart technologies to monitor tension and load stability in real-time, responding to the demand for superior compliance and efficiency in complex supply chains.

Regionally, the Asia Pacific (APAC) market is poised for the most rapid expansion, driven by massive infrastructure projects, burgeoning manufacturing capabilities, and rapid urbanization leading to increased freight movement. North America and Europe maintain leading market shares, primarily due to established transportation networks and rigorous enforcement of load securement standards (like those set by FMCSA in the US). Market consolidation through strategic partnerships and mergers and acquisitions remains a persistent strategy, particularly as companies seek to dominate specialized segments such as military-grade or highly customized industrial applications.

Segment trends highlight the dominance of polyester ratchet straps due to their excellent balance of cost, strength, and low elongation properties. However, the cam buckle segment is experiencing accelerated growth driven by consumer and light commercial applications where speed of operation is prioritized over maximum tension. The logistics and transportation end-use sector remains the largest consumer, but demand is also accelerating significantly within the renewable energy sector for securing large components like wind turbine blades during transport, necessitating highly specialized and oversized strap solutions.

AI Impact Analysis on Tie-Down Strap Market

Common user questions regarding AI's impact on the Tie-Down Strap Market frequently center on whether intelligent systems can automate load securement, how AI ensures compliance with safety standards, and if predictive maintenance can extend the life of equipment. Users are deeply interested in the integration of AI-driven sensors for continuous load monitoring and tension optimization, seeking answers on costs versus safety benefits, and the future role of human labor in cargo securement processes. The overarching expectation is that AI will move the market from reactive safety measures to proactive, data-informed securement protocols, fundamentally transforming how loads are managed across long-haul transportation routes and specialized logistics operations.

While AI does not directly manufacture the physical strap, its influence is transformative in the adjacent areas of quality control, logistics optimization, and preventive maintenance. AI algorithms, when integrated with sensor-equipped straps or cargo systems (often referred to as 'Smart Straps'), can analyze vibration data, environmental conditions, and tension metrics in real-time. This capability allows logistics managers to receive immediate alerts if a load shifts or if tension drops below critical thresholds, significantly reducing the likelihood of catastrophic failure and subsequent liability. Furthermore, AI-driven routing and load planning software utilize data on strap specifications, cargo weight distribution, and vehicle dynamics to recommend optimal securement strategies, minimizing material waste and maximizing safety compliance.

The implementation of machine learning models is also critical for manufacturing efficiency. AI is used in factories to detect minute defects in webbing materials or stitching patterns, ensuring that the straps produced meet stringent safety certifications. Beyond manufacturing, predictive maintenance algorithms analyze usage patterns and environmental exposure (such as UV radiation or extreme temperatures) of straps to predict their remaining service life accurately, enabling fleet operators to retire compromised equipment before failure. This transition towards data-backed securement processes elevates the value proposition of high-quality, sensor-ready tie-down systems.

- AI-driven sensor integration allows for real-time load monitoring and tension adjustments.

- Machine learning optimizes load securement patterns, enhancing compliance and efficiency.

- Predictive maintenance models forecast strap wear and replacement cycles, increasing operational safety.

- Automated visual inspection using computer vision improves quality control during manufacturing of webbing and hardware.

- AI systems analyze environmental factors (temperature, vibration) to calculate dynamic Working Load Limits (WLL).

DRO & Impact Forces Of Tie-Down Strap Market

The market dynamics of the Tie-Down Strap industry are shaped by a complex interplay of macroeconomic drivers, necessary regulatory restraints, and technological opportunities, all mediated by critical impact forces that dictate market entry and profitability. Key drivers include the accelerated growth of global supply chains and stringent governmental safety mandates for transport and construction safety. Conversely, price volatility in synthetic raw materials and persistent competition from non-certified, low-cost alternatives serve as primary restraints. The most significant opportunities lie in the development and commercialization of IoT-enabled 'Smart Straps' and expansion into specialized niche markets such as aerospace and extreme weather logistics, presenting pathways for premium revenue generation and technological leadership.

The structural forces impacting the market involve intense buyer bargaining power, particularly from large logistics enterprises demanding bulk purchases at competitive rates, and the moderate threat of substitution, mainly from advanced cargo nets or integrated vehicle securement systems. Supplier bargaining power is notable in specialized hardware (ratchet mechanisms) but less so in standard webbing materials. These combined forces mandate continuous innovation in material science and hardware design to maintain competitive advantage. Firms must effectively navigate these forces by securing robust supply chains for high-grade polyester and developing patented, tamper-proof tensioning devices that justify a higher price point compared to generic offerings.

The regulatory environment acts as a pivotal impact force, disproportionately favoring manufacturers capable of obtaining and maintaining certifications such as the European EN 12195-2 standard or North American DOT requirements. This regulatory barrier to entry elevates the cost structure for new players but offers established, certified vendors a significant market advantage. Furthermore, increasing global awareness regarding workplace safety and corporate liability ensures that high-quality, certified straps are non-negotiable for reputable logistics providers, solidifying the market's trajectory towards premium, reliable products over generic substitutes.

- Drivers:

- Global expansion of logistics and e-commerce requiring constant cargo securement solutions.

- Stringent governmental regulations globally mandating certified load securement for commercial transport.

- Increased infrastructure development and construction activity worldwide demanding heavy-duty securement.

- Restraints:

- High volatility in the pricing and supply of petrochemical-derived raw materials (polyester, nylon).

- Intense price competition from low-quality, uncertified manufacturers, primarily in emerging economies.

- Limited lifespan of straps necessitating frequent replacement, creating disposal and sustainability concerns.

- Opportunity:

- Development and adoption of 'Smart Straps' integrating IoT sensors for real-time monitoring of load tension and integrity.

- Expansion into customized, niche markets such as offshore energy transport and specialized military logistics.

- Recycling initiatives and development of sustainable, bio-based webbing materials to meet environmental mandates.

- Impact Forces:

- Regulatory Compliance: High adherence required to regional transport safety standards (e.g., FMCSA, EN 12195-2).

- Buyer Power: Significant, especially from large fleet operators negotiating bulk contracts.

- Technological Disruption: Integration of advanced materials and embedded electronics reshaping product offerings.

Segmentation Analysis

The Tie-Down Strap Market is systematically segmented based on material, type, and end-use application, reflecting the diverse requirements across industrial and consumer sectors. The segmentation by material is crucial, as the performance characteristics such as Working Load Limit (WLL), UV resistance, and chemical compatibility are directly tied to whether the strap is constructed from polyester, nylon, or polypropylene. Polyester dominates the industrial segment due to its low elongation and superior strength, whereas nylon is often preferred for applications requiring higher elasticity and shock absorption. Understanding these material-based nuances allows manufacturers to align production capabilities with specific market demands, from maritime transport to general freight.

Segmentation by strap type, primarily ratchet straps versus cam buckle straps, delineates the market based on required tensioning power and ease of use. Ratchet straps are indispensable for heavy cargo, providing mechanical advantage to achieve extremely high tension, making them the standard in commercial trucking and construction. Conversely, cam buckle straps offer speed and simplicity, favored in lighter-duty applications such as securing recreational gear, consumer goods on roof racks, and smaller internal logistics operations where excessive tension could potentially damage the cargo. The growing demand for specialized hybrid systems, integrating features from both primary types, also represents an emerging sub-segment focusing on ergonomic efficiency and rapid deployment in logistics hubs.

The end-use application segment is the largest determinant of market volume and specification requirements. The logistics and transportation sector constitutes the largest consumer base, reflecting the massive scale of global shipping. Other critical segments include construction (securing heavy machinery and materials), military and defense (requiring highly durable, specialized equipment), and the automotive sector (vehicle tie-down during manufacturing and transport). The diversification of end-users demands varying product life cycles, load ratings, and environmental resistance features, compelling manufacturers to maintain broad product portfolios tailored to the unique regulatory and operational environments of each application.

- By Material:

- Polyester

- Nylon

- Polypropylene

- Other High-Performance Fibers (e.g., Dyneema)

- By Type:

- Ratchet Straps (Heavy-Duty and Medium-Duty)

- Cam Buckle Straps

- Bungee Cords and Straps (Non-Webbing Securement)

- Winch Straps

- By End-Use Application:

- Logistics and Transportation (Trucking, Rail, Maritime, Air Freight)

- Construction and Heavy Equipment

- Automotive (Vehicle Transport and Manufacturing)

- Military and Defense

- Recreational and Consumer

- Agriculture

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Tie-Down Strap Market

The value chain for the Tie-Down Strap Market begins with the upstream procurement of raw materials, primarily synthetic polymers such as polyethylene terephthalate (PET) for polyester webbing, and high-strength steel or alloys for the ratchet mechanisms and end fittings (hooks, D-rings). Key upstream players are chemical companies and metal processors whose pricing and quality directly influence the manufacturing cost base. Efficiency in this stage is critical, as material quality dictates the strap's certified Working Load Limit (WLL) and compliance with international standards. Manufacturers often establish long-term contracts with specialized webbing mills to ensure consistent supply of high-tenacity yarn, forming the foundation of the product's quality profile.

The midstream focuses on manufacturing and assembly, encompassing two core processes: webbing production (weaving and dyeing) and hardware production (stamping, casting, and assembly of ratchets and hooks). Value-added activities in this stage include heat treatment, UV coating, and meticulous stitching and labeling to meet regulatory requirements (WLL, break strength). Companies differentiate themselves through patented hardware designs that offer superior ergonomics, durability, and corrosion resistance. Quality control measures, often integrated using automated inspection systems, are paramount to mitigating liability associated with product failure in transit, making precision engineering a key value driver.

The downstream distribution channel involves a mix of direct sales to large fleet operators and indirect distribution through industrial supply houses, wholesale distributors, specialized cargo control retailers, and increasingly, major e-commerce platforms. Large, specialized manufacturers often maintain direct sales teams for customized industrial solutions, offering consulting on load securement best practices. For standard, high-volume products, the indirect channel provides wider market access. End-users, including commercial truckers, construction firms, and logistics providers, prioritize immediate availability and certified compliance, making efficient inventory management and geographically dispersed distribution networks critical success factors in the final stage of the value chain.

Tie-Down Strap Market Potential Customers

Potential customers for the Tie-Down Strap Market are highly diverse but converge in sectors requiring the safe, efficient, and compliant transportation of goods or equipment. The primary customer segment comprises major third-party logistics (3PL) providers and large commercial trucking fleets that manage vast quantities of domestic and international freight, demanding standardized, high-volume ratchet straps that meet stringent operational durability and safety certifications. These buyers prioritize total cost of ownership, strap longevity, and rapid fulfillment capabilities from their suppliers, often signing multi-year volume contracts for customized lengths and load ratings specific to their fleet requirements.

A second major customer category includes organizations within the construction, infrastructure development, and heavy equipment leasing industries. These end-users require extremely robust, weather-resistant winch straps and tie-down assemblies capable of securing oversized, non-standard loads such as excavators, cranes, and building modules. Their purchasing decisions are heavily influenced by the guaranteed break strength and corrosion resistance of the hardware, as failure in these applications can lead to catastrophic consequences and high asset loss. Specialized products, such as those with unique fittings for flatbed trailers or those designed for high-abrasion environments, command premium pricing in this segment.

Finally, the growing e-commerce and retail distribution networks, along with the consumer DIY market, represent a high-growth segment, particularly for cam buckle and lighter-duty ratchet straps. E-commerce fulfillment centers utilize these straps internally for palletizing and securing small loads during last-mile delivery. The consumer segment, accessed primarily through major retailers and online platforms, seeks ease of use, intuitive design, and sufficient strength for personal transport needs, such as securing recreational vehicles or camping gear. Customer retention in this segment is driven by brand recognition, safety features, and the provision of clear, user-friendly instructions and certifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.85 Billion |

| Market Forecast in 2033 | $4.15 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ancra International, CargoBuckle (Keeper Corp), Kinedyne LLC, SmartStraps, Lift-All Co., Shur-Lift, PowerTye, Rhino USA, Erickson Manufacturing, US Cargo Control, Tie-Down Engineering, Hulii Strap, Zhejiang Jingyou, The Caldwell Group, ITW Cargo Systems, Load Trail, Deltex, Durbin Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tie-Down Strap Market Key Technology Landscape

The core technology in the Tie-Down Strap Market centers on material science advancements and the engineering of robust, ergonomic tensioning mechanisms. Significant innovation is focused on enhancing the strength-to-weight ratio of webbing through high-tenacity polyester and proprietary weaving techniques that minimize stretch while maximizing abrasion and UV resistance. Coating technologies, such as polyurethane treatments, are increasingly employed to protect the webbing from harsh chemicals and excessive friction, extending the operational life of the product in challenging environments like maritime transport or heavy construction sites. Furthermore, material traceability via integrated identifiers or QR codes is becoming standard, leveraging digital technology to track the product history and verify compliance across the supply chain, a critical requirement for high-liability applications.

Hardware technology development is equally pivotal, focusing on improving the ratchet mechanisms and end fittings. Modern ratchet designs emphasize safety features, such as ergonomic handles that reduce operator strain, and fail-safe locking mechanisms that prevent accidental release under dynamic load conditions. Corrosion resistance, achieved through advanced zinc plating or powder coating on steel components, is a key differentiator, especially for products used in coastal or corrosive industrial environments. The integration of specialized hardware, such as flat hooks, wire hooks, or specific vehicle chassis fittings, requires high-precision metal fabrication and stringent load testing protocols, demanding continuous investment in specialized manufacturing machinery and stress analysis software.

The most transformative technology landscape emerging is the integration of IoT and sensor technology, leading to the development of "Smart Straps." These systems embed miniaturized, resilient sensors—either within the webbing itself or the ratchet housing—to continuously measure tension and transmit data wirelessly via Bluetooth or cellular networks to a centralized logistics platform. This real-time data allows fleet managers to proactively identify under-secured loads or equipment fatigue, moving beyond static, manual checks. While currently a niche, high-cost solution, this integration represents the future of premium cargo securement, offering unparalleled data granularity for regulatory compliance and risk mitigation in high-value logistics operations.

Regional Highlights

- North America: Market Maturity and Regulatory Enforcement

- North America, particularly the United States, represents a mature and highly regulated market driven by the Federal Motor Carrier Safety Administration (FMCSA) standards. The market size is substantial, characterized by high adoption rates of heavy-duty ratchet and winch straps necessitated by the vast distances and high volumes of commercial freight transport. Demand is concentrated in the logistics, oil and gas, and construction sectors. Manufacturers prioritize achieving and demonstrating compliance with high Working Load Limits (WLL) and ensuring product availability through established distribution networks. The trend here is leaning towards smart, durable products that reduce liability and maintenance costs for major fleet operators.

- Europe: Focus on EN Standards and Sustainability

- The European market is governed by the stringent EN 12195-2 standard, emphasizing verifiable quality and safety documentation. Germany, France, and the UK are key contributors, driven by robust cross-border trucking and industrial manufacturing. European consumers increasingly demand products with documented environmental credentials, prompting manufacturers to explore sustainable materials and long-life designs. Innovation is centered on ergonomic hardware for faster, safer load handling and sophisticated systems for load restraint within multimodal transport containers, reflecting Europe's dense and integrated transport infrastructure.

- Asia Pacific (APAC): Rapid Growth and Infrastructure Investment

- APAC is projected to be the fastest-growing region, fueled by massive government investments in infrastructure, escalating manufacturing output, and explosive growth in the e-commerce sector, particularly in China, India, and Southeast Asia. The demand is currently high for cost-effective, medium-duty straps for general logistics, but the increasing sophistication of automotive manufacturing and large-scale industrial projects is accelerating the demand for certified, heavy-duty straps. Market dynamics are highly competitive, with a mix of large international players and local manufacturers focusing on volume and competitive pricing, though quality standards are rapidly improving due to increasing safety mandates.

- Latin America (LATAM): Urbanization and Evolving Standards

- Growth in LATAM is closely linked to resource extraction (mining, agriculture) and expanding urbanization, increasing the need for reliable transport securement. Brazil and Mexico are leading markets, driven by regional trade agreements and internal consumption. The market is moderately fragmented, with a growing shift away from uncertified solutions towards compliant products, spurred by increasing international trade and associated regulatory pressures. Affordability remains a significant purchasing factor, but long-term durability is gaining importance in key industrial sectors.

- Middle East and Africa (MEA): Energy and Construction Demand

- The MEA region, particularly the GCC countries, sees demand largely driven by large-scale construction projects, oil and gas logistics, and the development of new ports and trade hubs. Products must withstand extreme temperatures, sand abrasion, and high humidity, placing a premium on corrosion-resistant hardware and UV-stabilized webbing. The demand for highly specialized, often military-grade, securement equipment for critical energy infrastructure projects is a characteristic segment of this region, attracting high-end international suppliers focused on superior material performance and reliability under harsh conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tie-Down Strap Market.- Ancra International

- CargoBuckle (Keeper Corp)

- Kinedyne LLC

- SmartStraps

- Lift-All Co.

- Shur-Lift

- PowerTye

- Rhino USA

- Erickson Manufacturing

- US Cargo Control

- Tie-Down Engineering

- Hulii Strap

- Zhejiang Jingyou

- The Caldwell Group

- ITW Cargo Systems

- Load Trail

- Deltex

- Durbin Industrial

- Bishop Lifting Products

- Wesco Industrial Products

Frequently Asked Questions

Analyze common user questions about the Tie-Down Strap market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for heavy-duty ratchet straps?

The primary factor driving demand is the significant expansion of commercial logistics, especially long-haul trucking and intermodal shipping, combined with increasingly stringent governmental safety regulations (like FMCSA and EN standards) mandating certified, high-WLL (Working Load Limit) securement systems to prevent cargo shifting and liability risks.

How is the integration of IoT technology influencing the Tie-Down Strap Market?

IoT integration is leading to the development of 'Smart Straps' equipped with sensors that monitor load tension, temperature, and vibration in real-time. This technology allows logistics managers to proactively ensure load integrity, optimize securement efficiency, and transition from manual safety checks to data-driven predictive maintenance, improving overall operational safety.

Which material segment holds the largest market share and why?

The Polyester segment holds the largest market share. Polyester webbing is favored across industrial and commercial applications due to its excellent balance of high tensile strength, minimal elongation (stretch), superior resistance to UV degradation compared to nylon, and cost-effectiveness, making it ideal for robust cargo securement.

What are the main regional growth opportunities for manufacturers in this market?

The Asia Pacific (APAC) region presents the greatest growth opportunity, driven by massive investments in infrastructure development, rapid growth in regional logistics networks, and rising safety standards in manufacturing and construction sectors across countries like China and India, necessitating bulk purchases of certified tie-down equipment.

What is the key difference between ratchet straps and cam buckle straps in terms of application?

Ratchet straps are designed for heavy-duty industrial applications requiring maximum tension and securement force, such as securing heavy machinery on flatbeds. Cam buckle straps are utilized for lighter-duty, non-critical applications where speed and ease of use are prioritized over achieving extreme tension, suitable for securing consumer goods or recreational equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager