Tigecycline Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435955 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Tigecycline Market Size

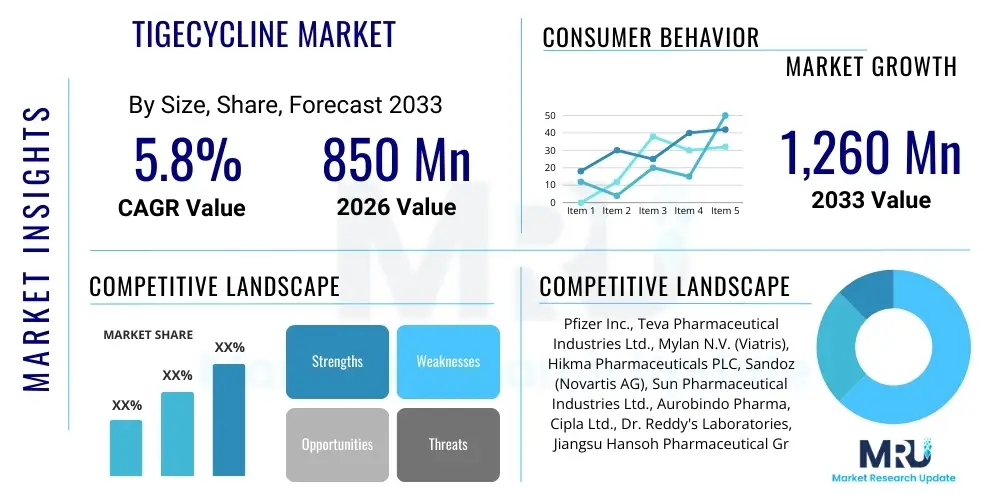

The Tigecycline Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1,260 Million by the end of the forecast period in 2033. This consistent, moderate growth trajectory is indicative of Tigecycline's established role as a crucial reserve antibiotic, balancing its effectiveness against severe multi-drug resistant (MDR) infections with regulatory constraints and the competitive pressure from generic alternatives. The valuation reflects the high cost associated with treating complex, hospital-acquired infections (HAIs) and the premium placed on therapies that maintain efficacy in environments where resistance is widespread. The market size calculation incorporates sales data from both the originator product (Tygacil) and its various generic equivalents across major regulated and emerging pharmaceutical markets. The forecast period anticipates sustained, albeit restricted, clinical need, driven specifically by the failure rates of common broad-spectrum antibiotics, ensuring Tigecycline remains a vital therapeutic tool in critical care settings globally.

Tigecycline Market introduction

Tigecycline, marketed by its originator as Tygacil, is a bacteriostatic injectable antibiotic belonging to the glycylcycline class, a novel subgroup of tetracyclines. Its primary distinction lies in its broad-spectrum activity which encompasses Gram-positive pathogens, including methicillin-resistant Staphylococcus aureus (MRSA) and vancomycin-resistant Enterococci (VRE), as well as significant Gram-negative bacteria, crucially including various strains of extended-spectrum beta-lactamase (ESBL) producing organisms. Tigecycline circumvents the traditional tetracycline resistance mechanisms—ribosomal protection and efflux pump activity—making it highly effective against pathogens that have developed resistance to earlier generations of antibiotics. Approved indications predominantly cover complicated skin and skin structure infections (cSSSI) and complicated intra-abdominal infections (cIAI). Its pharmacokinetic profile, characterized by rapid clearance and extensive distribution into tissues rather than plasma, necessitates specific dosing strategies and careful patient monitoring, particularly in cases of severe sepsis or septic shock.

The imperative for Tigecycline arises directly from the escalating global public health crisis of antimicrobial resistance (AMR), which renders conventional therapies obsolete in an increasing number of clinical scenarios. It serves as a necessary component of the clinical armamentarium, often employed empirically when infection source and susceptibility are initially unknown, or as a targeted therapy once resistance to other agents has been confirmed by laboratory testing. Despite its indisputable efficacy against a challenging spectrum of pathogens, the utilization of Tigecycline is tempered by regulatory warnings, notably the FDA’s boxed warning concerning increased all-cause mortality, particularly in off-label uses such as ventilator-associated pneumonia (VAP). This regulatory environment mandates that healthcare providers adhere to stringent antimicrobial stewardship programs, reserving Tigecycline exclusively for the most critically ill patients where other therapeutic options are either contraindicated or ineffective, thereby influencing the volume but ensuring the high value of prescriptions.

The market is predominantly driven by continuous epidemiological shifts, particularly the increased incidence of hospital-acquired multi-drug resistant infections (e.g., carbapenem-resistant Acinetobacter baumannii and CRE) in tertiary care facilities globally. Demographic factors, including an aging population with increasing comorbidities and higher rates of complex surgical procedures, further contribute to the pool of vulnerable patients requiring such potent treatments. Major benefits include its reliable coverage of specific anaerobic bacteria and its potency against hard-to-treat polymicrobial infections often found in cIAI. In addition to clinical drivers, driving factors also encompass strategic supply chain management by generic manufacturers who have successfully scaled up production post-patent expiration, ensuring widespread access in cost-sensitive markets, while maintaining the high quality demanded by injectable pharmaceutical standards. Continuous medical education and guideline updates for infectious disease specialists also play a vital role in dictating appropriate utilization patterns across different geopolitical jurisdictions.

Tigecycline Market Executive Summary

The Tigecycline market demonstrates a strategic segmentation between the high-value specialty market, where the originator product retains brand preference and market loyalty in developed nations, and the high-volume generic market, dominated by APAC manufacturers offering substantial price reductions. Business trends indicate a shift towards risk-sharing agreements between pharmaceutical suppliers and large hospital purchasing organizations, aiming to link drug performance (e.g., lower re-infection rates) to favorable pricing structures. Furthermore, companies are investing in reformulation R&D, attempting to develop stable liquid formulations or enhanced lyophilized versions that require less reconstitution time and exhibit greater stability, addressing operational inefficiencies frequently reported in high-pressure critical care environments. Consolidation among generic players through mergers and acquisitions is also a noticeable trend, aimed at achieving economies of scale necessary to compete effectively in price-sensitive global tenders for essential medicines.

Regional dynamics highlight a bifurcation in growth momentum. While North America and Western Europe provide the established revenue base, characterized by premium pricing and highly disciplined prescribing due to strict stewardship, the fastest market acceleration is evident in emerging economies, particularly China, India, and Southeast Asia. This APAC resurgence is fueled by the alarming rate of AMR emergence—where Tigecycline acts as a frontline defense against prevalent resistant strains—coupled with substantial governmental investment in modernizing hospital infrastructure and expanding healthcare access. Conversely, market growth in mature economies is primarily sustained by population growth, specific outbreaks, and the necessity of managing increasingly complex polymicrobial infections in an elderly population, rather than volume expansion, which is restricted by the aforementioned safety warnings and clinical guidelines.

Segment trends underscore the continued dominance of institutional end-users; Tigecycline remains almost exclusively a hospital drug, limiting its penetration into ambulatory care settings. Within applications, while cSSSI and cIAI are the backbone, growing clinical off-label usage in severe hospital-acquired pneumonia (HAP) and treatment of highly resistant Gram-negative bacteremia contributes significantly to revenue, despite the regulatory risk profile. The generic segment now accounts for a majority of the volume sold globally, putting intense downward pressure on average selling prices (ASP). This pricing dynamic forces originator companies to strategically differentiate through superior clinical data supporting specific subgroups or investing in enhanced product presentation and logistical reliability. Future segment growth is heavily reliant on successful clinical outcomes for new indications or combination regimens that might help mitigate resistance development and improve the therapeutic index.

AI Impact Analysis on Tigecycline Market

The integration of Artificial Intelligence and Machine Learning (ML) into the clinical and pharmaceutical ecosystem is fundamentally altering the strategic outlook for mature antibiotics like Tigecycline. User inquiries frequently probe AI's capability to solve the critical dilemma surrounding Tigecycline: maximizing its use against life-threatening resistant infections while minimizing the risk associated with its safety profile, especially the mortality signal. Clinical users are keen on AI-driven decision support systems (DSS) that can analyze patient comorbidities, local resistance epidemiology, and pharmacogenetic markers in real-time to recommend optimal dosing and predict patient response, ensuring Tigecycline is administered only to patients who stand to benefit significantly, thereby optimizing stewardship and mitigating adverse outcomes. This precision medicine approach, powered by AI, promises to enhance the risk-benefit ratio for the drug, potentially influencing future updates to prescribing guidelines and expanding confidence in its appropriate use.

Furthermore, AI plays a transformative role in pharmaceutical research and manufacturing. On the R&D front, users seek information on AI models accelerating the identification of synergistic drug combinations that, when paired with Tigecycline, could overcome resistance without increasing toxicity. Predictive modeling of resistance evolution allows companies to anticipate future market needs and develop preemptive strategies to extend the lifespan of this critical antibiotic. In manufacturing, AI algorithms optimize complex synthesis pathways for the API, ensuring batch-to-batch consistency and minimizing the risk of impurities—a critical requirement for injectable medications. Supply chain efficiency is also bolstered by AI, predicting demand fluctuations in hospital systems based on seasonal infection trends and localized outbreak data, guaranteeing continuous, reliable supply to critical care units worldwide, thus reducing market volatility stemming from stock shortages.

The widespread adoption of AI-enabled surveillance and diagnostics significantly impacts the demand structure for Tigecycline. By enabling faster, more accurate pathogen identification and resistance profiling, AI reduces the duration of empirical, broad-spectrum therapy. While this may slightly decrease the overall volume prescribed initially, it increases the quality and necessity of the Tigecycline prescriptions, shifting value from generic, indiscriminate use to targeted, high-value therapy. Therefore, the future market success of Tigecycline is increasingly tied to the ecosystem of AI tools that support responsible antibiotic utilization, enabling healthcare systems to conserve its potency as a vital societal resource against escalating antimicrobial threats. Investment in proprietary AI platforms for pharmacovigilance and outcomes analysis is rapidly becoming a competitive differentiator for leading market players.

- AI-driven personalized dosing optimization and risk stratification for patients receiving Tigecycline, improving therapeutic index.

- Machine learning models accelerating the identification of novel drug targets to overcome Tigecycline resistance mechanisms (e.g., efflux pump inhibitors).

- Predictive analytics enhancing antimicrobial stewardship programs, ensuring appropriate use of Tigecycline as a last-resort agent against documented MDRs.

- Natural Language Processing (NLP) tools analyzing global pharmacovigilance data to better monitor, categorize, and report adverse events associated with the drug post-marketing.

- AI optimizing clinical trial recruitment and data analysis for combination therapies involving Tigecycline, speeding up regulatory timelines and reducing associated R&D costs.

- Automation and sensor technology utilizing computer vision and ML for contamination detection and quality assurance in parenteral formulation manufacturing.

- Integration of AI with Electronic Health Records (EHR) systems to provide real-time clinical alerts regarding drug-drug interactions and patient contraindications specific to Tigecycline.

DRO & Impact Forces Of Tigecycline Market

The core drivers propelling the Tigecycline market center on the failure of conventional antibiotic pipelines to keep pace with resistance development, forcing reliance on existing potent agents. The global spread of pan-drug resistant (PDR) and extremely drug-resistant (XDR) strains of key Gram-negative pathogens, such as Klebsiella pneumoniae and Acinetobacter baumannii, creates an acute and often life-saving necessity for Tigecycline, especially in regions with poor infection control. This clinical urgency is augmented by consistent governmental and non-profit funding directed toward combating AMR, which encourages pharmaceutical companies to maintain production and invest in stewardship-focused R&D. Furthermore, the increasing complexity of hospital patient profiles—those with multiple chronic conditions, immunocompromised states, or lengthy stays—directly translates into higher rates of severe, resistant infections requiring agents with Tigecycline's unique broad-spectrum capability.

Major restraints significantly curb the market’s volume potential, foremost among them being the regulatory constraints imposed by major agencies like the FDA, centered on the confirmed signal of increased mortality in non-approved indications, severely limiting off-label use. This risk profile mandates tight clinical restrictions, capping volume growth. Economically, the market is restrained by the steep price erosion caused by the rapid entry and proliferation of generic alternatives in major markets, which compresses profit margins for all competitors and reduces the incentive for substantial long-term investment in post-approval clinical studies or formulation enhancements. Additionally, the need for intravenous administration and associated hospital resources means Tigecycline is not suitable for outpatient treatment, confining the market strictly to the institutional setting and restricting its potential market breadth compared to oral antibiotics.

Opportunities for market growth and differentiation primarily lie in innovation adjacent to the existing molecule. This includes the development of novel combination regimens—for instance, pairing Tigecycline with new beta-lactamase inhibitors or efflux pump blockers—to restore susceptibility against highly resistant strains while potentially improving the overall safety profile. Geographical market penetration into high-demand, under-served regions in Latin America and Southeast Asia offers immediate volume growth, provided manufacturers can navigate complex regulatory approvals and distribution logistics. Furthermore, leveraging advanced diagnostic technologies that prove the necessity of Tigecycline quickly and accurately provides a critical market advantage, supporting clinicians in adhering to stewardship while justifying the use of a high-risk, high-reward therapy. The balance of high clinical efficacy against severe risks ensures a persistently volatile but necessary market position.

Segmentation Analysis

The meticulous segmentation of the Tigecycline market is essential for accurately assessing competitive dynamics and identifying high-growth clinical niches. Segmentation by Application highlights the FDA-approved indications—cSSSI and cIAI—which form the foundational revenue streams, reflecting areas where robust clinical trial data support its efficacy over alternative agents. The cIAI segment, often involving complex polymicrobial infections stemming from surgical procedures or severe bowel perforations, demonstrates high revenue density due to the acute nature of the infections and the frequent involvement of MDR Gram-negative pathogens. Non-approved indications, such as severe respiratory tract infections involving drug-resistant Acinetobacter, represent a significant, though clinically controversial, revenue source, underscoring the gap in effective therapeutic alternatives for these critical conditions.

From an End-User perspective, hospitals remain the sole dominant consumption center, encompassing tertiary care centers with specialized ICUs, trauma centers, and major surgical units. These settings possess the required infrastructure for intravenous drug administration, intensive patient monitoring, and sophisticated microbiology laboratories necessary for susceptibility testing. The consumption patterns are highly concentrated within hospital formularies; demand is driven by centralized purchasing agreements and heavily influenced by the P&T committee decisions, which prioritize both cost and clinical outcome data. This concentration necessitates focused marketing and educational efforts targeting institutional leadership and infectious disease specialists, rather than fragmented retail channels.

Segmentation by Product Type or Dosage Form primarily focuses on the lyophilized powder, which requires highly controlled manufacturing and precise preparation before administration. The market is slowly exploring the viability of ready-to-use liquid formulations, which, if successfully commercialized with stability parity, would represent a significant technological leap. Such formulations could simplify hospital workflow, reduce medication errors, and potentially improve safety outcomes. The Distribution Channel segmentation further reinforces the institutional focus, relying almost exclusively on direct distribution networks and specialized pharmaceutical wholesalers capable of managing controlled substance logistics and temperature-sensitive storage, ensuring rapid delivery to hospital pharmacies and critical care wards.

- By Application:

- Complicated Skin and Skin Structure Infections (cSSSI): Largest segment, driven by broad coverage of MRSA and severe tissue penetration characteristics.

- Complicated Intra-abdominal Infections (cIAI): High growth segment, linked to increasing complexity of surgical interventions and polymicrobial resistance.

- Treatment of Multi-Drug Resistant Organisms (MDRs): Critical application against CRE and MDR Acinetobacter, often used off-label but driving high-value demand.

- Hospital-Acquired Pneumonia (HAP) / Ventilator-Associated Pneumonia (VAP): Controversial segment due to mortality risk, but necessary in severe resistant cases.

- By End-User:

- Hospitals (Tertiary and Secondary Care): Primary customers, high-volume purchasers for ICUs and surgical wards.

- Critical Care Units (CCUs) and Intensive Care Units (ICUs): Highest per-unit consumption rate due to patient acuity.

- Specialty Clinics and Ambulatory Surgical Centers: Negligible usage, limited to follow-up care.

- Research and Academic Institutions: Small volume for clinical trials and resistance surveillance.

- By Dosage Form:

- Lyophilized Powder for Injection: Standard formulation, requiring reconstitution prior to use.

- Ready-to-Use Liquid Formulations (Emerging): Potential future segment focusing on stability and ease of administration.

- By Distribution Channel:

- Hospital Pharmacies and Direct Procurement: Dominant, reflecting the drug’s strict control and institutional use.

- Specialized Pharmaceutical Wholesalers: Crucial for supply chain management and logistical support.

Value Chain Analysis For Tigecycline Market

The initial stage of the Tigecycline value chain, the upstream segment, is characterized by highly sophisticated chemical synthesis of the API. This process is chemically intensive, involving multiple complex reaction steps necessary to attach the unique t-butylglycylamido group to the tetracycline core, a modification essential for bypassing bacterial resistance mechanisms. Key suppliers of raw materials, largely specialized chemical producers, feed into the API manufacturing sites, which are predominantly located in regions capable of large-scale, low-cost, high-purity production, such as India, China, and certain specialized facilities in Europe. Maintaining proprietary knowledge regarding optimized synthesis routes, even for generic versions, is a critical competitive lever upstream, as regulatory bodies demand exceptional purity standards for injectable compounds. This phase requires substantial capital investment in specialized reactors and quality control infrastructure, forming a significant barrier to entry.

The midstream phase focuses on transforming the API into the finished pharmaceutical product (FPP), predominantly as a sterile lyophilized powder for injection. Activities include precision weighing, dissolution, filtration, aseptic filling into vials, and the lyophilization (freeze-drying) cycle, which stabilizes the chemically labile Tigecycline molecule. Stringent regulatory compliance (cGMP) and validation of aseptic processes are non-negotiable requirements in this stage, impacting operational costs significantly. Quality assurance testing, including sterility, potency, and impurity profiling, is crucial before batch release. Companies differentiate themselves midstream through efficient lyophilization processes that maximize yield and minimize cycle time, optimizing manufacturing throughput to meet global demand, especially when responding to pandemic-related surges in critical care admissions.

The downstream value chain is dominated by highly centralized distribution through institutional channels. The product is not typically stocked by retail pharmacies; rather, it moves from manufacturers to large national and regional wholesalers who maintain the necessary cold-chain infrastructure for transport and storage, as the reconstituted solution is temperature-sensitive. Direct sales agreements with large hospital systems (Group Purchasing Organizations or GPOs in North America) are common, allowing manufacturers to negotiate favorable formulary placement in exchange for volume commitments. Marketing and sales efforts downstream are highly specialized, focusing on clinical data dissemination to infectious disease specialists, pharmacoeconomic data presentation to P&T committees, and intensive educational programs centered on responsible antibiotic stewardship and safe administration protocols, addressing the significant clinical concerns surrounding the product's safety profile.

Tigecycline Market Potential Customers

The core potential customer base for Tigecycline remains centered on the institutional healthcare sector, specifically those facilities operating advanced critical care services. Primary customers include tertiary and quaternary referral hospitals that manage the most complex patient cases, such as transplant recipients, severe burn victims, and patients requiring prolonged mechanical ventilation, all highly susceptible to MDR infections. These institutions utilize Tigecycline as a cornerstone of their MDR treatment protocol, justifying high-volume, continuous purchasing. Procurement decisions are highly institutionalized, involving multi-disciplinary committees (Infectious Disease, Pharmacy, Critical Care Medicine), necessitating manufacturers to provide robust data on clinical efficacy, cost-effectiveness analyses, and comparative outcomes against other last-resort agents like Colistin or novel beta-lactam/beta-lactamase inhibitor combinations.

A secondary, high-value customer segment comprises military health systems and government agencies globally that engage in strategic stockpiling of essential antibiotics. In the face of potential bioterrorism threats or large-scale infectious disease outbreaks, Tigecycline is often prioritized due to its broad coverage and reliability against atypical pathogens. These contracts are characterized by large, infrequent tenders with intense focus on supply chain redundancy and long shelf-life formulations. Furthermore, specialized reference laboratories and public health monitoring networks, such as those run by the CDC or equivalent national bodies, serve as indirect customers, using the drug for resistance monitoring and epidemiological studies, influencing future treatment guidelines and policy decisions regarding antibiotic conservation.

The emerging market customer base, particularly in APAC and Latin America, represents significant future potential. Here, the driver is volume growth stemming from increasing accessibility and necessity, rather than premium pricing. Manufacturers target private hospital chains that cater to affluent populations and governmental procurement bodies that seek low-cost generic alternatives to rapidly address burgeoning resistance rates within public hospitals. Successfully penetrating these emerging markets requires adapting packaging, providing local language training materials, and navigating often protracted regulatory approval processes, demonstrating that the customer strategy must be highly tailored based on regional economic and clinical maturity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Hikma Pharmaceuticals PLC, Sandoz (Novartis AG), Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Cipla Ltd., Dr. Reddy's Laboratories, Jiangsu Hansoh Pharmaceutical Group Co. Ltd., Qilu Pharmaceutical Co. Ltd., Zydus Cadila, Fresenius Kabi, Intas Pharmaceuticals Ltd., Luye Pharma Group, Baxter International Inc., Shanghai Pharma, Apotex Inc., Zentiva, Generico |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tigecycline Market Key Technology Landscape

The core technology underpinning the Tigecycline market involves specialized chemical synthesis and advanced sterile manufacturing techniques essential for producing a high-quality, stable, injectable product. Given the instability of the molecule in aqueous solution, lyophilization (freeze-drying) technology is crucial, representing a significant technological capability barrier for new entrants. Manufacturers utilize state-of-the-art aseptic processing lines, often incorporating robotic automation and sophisticated environmental monitoring, to meet global pharmacopoeial standards and prevent contamination, which is paramount for parenteral drugs intended for critically ill patients. Advances in process analytical technology (PAT) are continuously integrated into API synthesis and formulation to ensure real-time quality control, driving down waste and ensuring high potency across all batches, particularly vital for generics competing on price while maintaining mandated quality levels.

Technological innovation is increasingly focused on the periphery of the molecule, enhancing its deployment and maximizing clinical benefit. Rapid diagnostic technologies, including Point-of-Care (POC) molecular diagnostics and mass spectrometry platforms, are perhaps the most influential technological factor. These tools drastically reduce the time needed to identify the causative pathogen and its specific resistance profile (e.g., presence of NDM-1 or KPC carbapenemase genes). This swift confirmation allows clinicians to escalate to Tigecycline sooner when needed, or de-escalate if a narrower-spectrum antibiotic is appropriate, directly supporting strict stewardship goals and improving patient outcomes. The accuracy of these diagnostics directly correlates with the confidence clinicians have in using a restricted antibiotic like Tigecycline appropriately.

In addition to diagnostics, the rising utilization of health informatics and specialized software platforms is optimizing prescribing behavior. Clinical decision support systems (CDSS) embedded within hospital EHRs use complex algorithms to cross-reference patient data (renal function, liver status, concurrent medications) against established Tigecycline guidelines and potential side effects, flagging high-risk prescriptions to the stewardship team. Furthermore, research technology, specifically high-throughput screening and computational chemistry, is used to identify chemical adjuvants that could potentially mitigate the toxicity concerns associated with Tigecycline or identify novel resistance-modifying agents to be co-administered. This integrated technological environment ensures that Tigecycline's clinical utility is preserved and maximized within a responsible, data-driven framework.

Regional Highlights

North America, spearheaded by the extensive healthcare ecosystem of the United States, represents the epicenter of Tigecycline revenue generation. The market here is defined by high per-unit pricing for both originator and generic versions, reflecting the sophisticated reimbursement landscape and the concentration of high-acuity critical care units. Demand is highly stable but tightly controlled, owing to well-enforced antimicrobial stewardship programs and stringent adherence to the FDA boxed warning. Competitive strategy in this region focuses on demonstrating superior clinical outcomes data for approved indications, securing favorable placement on large GPO contracts, and providing comprehensive logistical support to manage the cold chain requirements efficiently. Canada maintains similar regulatory stringency, though procurement is often more centralized at the provincial level, impacting pricing negotiation strategies.

The European market presents a complex tapestry of national healthcare policies. Western European nations (Germany, France, UK) exhibit high demand fueled by advanced healthcare systems and robust AMR surveillance networks. However, the influence of state-controlled pricing mechanisms, coupled with strong generic competition after regulatory exclusivities expired, results in substantially lower average selling prices compared to the US. In contrast, Central and Eastern European countries often face higher rates of MDR infections and varying access to novel treatments, positioning Tigecycline as a critically necessary, though sometimes budget-constrained, therapeutic option. Success in Europe hinges on generating strong pharmacoeconomic evidence to convince national health technology assessment (HTA) bodies of the drug's value proposition against competing therapies.

Asia Pacific (APAC) is the key growth engine for the forecast period, primarily due to the severe clinical need resulting from widespread antibiotic misuse and high resistance rates, particularly in China and India. These nations are concurrently global manufacturing hubs for generic APIs and finished products, leading to high-volume market activity. The rapid urbanization, coupled with massive patient populations accessing improving tertiary care facilities, creates an explosive demand for effective last-line agents. While pricing is significantly lower than in the West, the sheer volume of prescriptions compensates, driving overall revenue acceleration. Market players must navigate unique challenges, including local clinical trial requirements and fragmented distribution channels, requiring localized sales and marketing strategies focused on basic access and availability.

Latin America (LATAM) and the Middle East and Africa (MEA) are characterized by emerging market potential driven by infrastructure investments and rising healthcare expenditures. LATAM markets, notably Brazil and Mexico, show increasing reliance on Tigecycline in private sector hospitals battling rising rates of CRE. MEA, particularly the GCC countries, represents a high-potential, high-value segment where modern hospitals are keen to adopt Western clinical standards and utilize advanced, potent antibiotics to manage severe infection outbreaks. However, political instability, currency volatility, and complex customs processes pose ongoing challenges to establishing reliable and consistent supply chains across these diverse regions, demanding that successful market players prioritize robust risk management and localization strategies.

- North America (US and Canada): Dominant revenue generator; high premium pricing; stability governed by strict stewardship and FDA boxed warning enforcement.

- Europe (Germany, UK, France): Mature, highly regulated market; strong price sensitivity due to generic competition and national HTA body influence; high demand for pharmacoeconomic justification.

- Asia Pacific (China, India, Japan): Fastest-growing region globally; driven by critical AMR levels and high patient volume; generic manufacturing hubs ensure high availability and low pricing points.

- Latin America (Brazil, Mexico, Argentina): Emerging growth potential, fueled by private sector investment and necessity in combating regional resistance patterns; logistical complexity remains a key hurdle.

- Middle East & Africa (GCC, South Africa, Turkey): Strong growth in highly funded regions; focus on rapidly adopting international critical care protocols; requires specialized supply chain solutions due to geographical and political fragmentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tigecycline Market.- Pfizer Inc. (Originator and leader in specialty product branding)

- Teva Pharmaceutical Industries Ltd. (Major global generic player)

- Mylan N.V. (Viatris) (Significant generic presence globally)

- Hikma Pharmaceuticals PLC (Strong focus on injectable generics, particularly in MEA and US)

- Sandoz (Novartis AG) (Global leader in biosimilars and high-value generics)

- Sun Pharmaceutical Industries Ltd. (Leading Indian generic manufacturer with significant international reach)

- Aurobindo Pharma (Key player in API and generic finished product supply)

- Cipla Ltd. (Strong presence in emerging markets and cost-effective generic offerings)

- Dr. Reddy's Laboratories (Focus on specialty generics and complex formulations)

- Jiangsu Hansoh Pharmaceutical Group Co. Ltd. (Major Chinese pharmaceutical innovator and generic producer)

- Qilu Pharmaceutical Co. Ltd. (Key competitor in the Chinese and international generic injectable market)

- Zydus Cadila (Indian multinational focused on cost-effective essential medicines)

- Fresenius Kabi (Specialist in infusion therapies and parenteral nutrition/drugs)

- Intas Pharmaceuticals Ltd. (Growing presence in complex generics and biosimilars)

- Luye Pharma Group (Focus on innovative drug delivery systems and international expansion)

- Baxter International Inc. (Provides drug delivery systems and hospital solutions, indirect market influence)

- Shanghai Pharma (Significant state-owned enterprise with massive domestic distribution)

- Apotex Inc. (North American generic pharmaceutical leader)

- Zentiva (European generic specialist)

- Generico

Frequently Asked Questions

Analyze common user questions about the Tigecycline market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Tigecycline and why is it reserved for last-resort use?

Tigecycline, a glycylcycline, inhibits bacterial protein synthesis by binding to the 30S ribosomal subunit. It is critical because it bypasses common resistance mechanisms (efflux pumps, ribosomal protection) that defeat older tetracyclines. Use is restricted (last-resort) due to the necessity of preserving its efficacy against multi-drug resistant (MDR) pathogens like MRSA and CRE, coupled with regulatory warnings concerning increased all-cause mortality in certain non-approved indications, necessitating strict adherence to antimicrobial stewardship protocols.

How does the generic entry affect the Tigecycline market pricing and adoption rates globally?

The introduction of generic alternatives post-patent expiration has led to severe price erosion, significantly decreasing the Average Selling Price (ASP) for Tigecycline, particularly in volume-driven markets like APAC. While this dampens overall revenue growth for originators, it has simultaneously increased accessibility and volume adoption in emerging economies facing high rates of antimicrobial resistance, thereby expanding the drug's global therapeutic reach within critical care settings.

Which specific types of infections drive the highest demand for Tigecycline and where is the clinical controversy located?

The dominant demand stems from FDA-approved indications: complicated skin and skin structure infections (cSSSI) and complicated intra-abdominal infections (cIAI) caused by specific resistant pathogens. The clinical controversy, which significantly impacts prescribing volume, centers on its use for respiratory tract infections, particularly hospital-acquired pneumonia (HAP) or ventilator-associated pneumonia (VAP), where clinical trials showed inferior outcomes and higher mortality rates compared to comparator drugs, leading to the regulatory boxed warning.

What are the major supply chain challenges Tigecycline manufacturers face in the global market?

Manufacturers face significant challenges in managing the cold chain requirements necessary for storing and transporting the lyophilized powder, ensuring product stability and efficacy upon delivery to hospitals worldwide. Additionally, reliance on specialized, complex API synthesis pathways in a limited number of global chemical hubs creates supply fragility, requiring robust inventory management and redundancy planning to prevent stock-outs in critical care environments.

How is AI specifically being utilized to mitigate the risks associated with Tigecycline prescription?

Artificial Intelligence is employed primarily through Clinical Decision Support Systems (CDSS) that analyze patient physiological data and comorbidities in real-time to personalize dosing, optimize drug exposure, and predict the risk of adverse events. By filtering out high-risk patients and supporting appropriate use against validated resistant pathogens identified via AI-enhanced diagnostics, the technology helps mitigate the mortality risk associated with the drug and reinforces adherence to stewardship guidelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager