Tile Grout Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431942 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Tile Grout Market Size

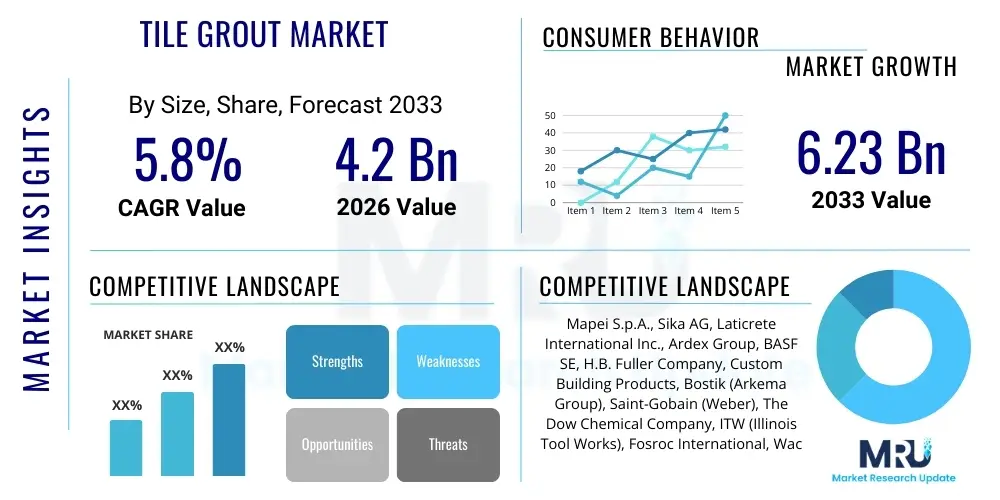

The Tile Grout Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $6.23 Billion by the end of the forecast period in 2033.

Tile Grout Market introduction

The Tile Grout Market encompasses the global supply and demand dynamics for materials used to fill the joints between tiles, providing structural integrity, aesthetic finishing, and resistance against moisture penetration. Tile grout is a highly specialized construction material, primarily composed of a binder (cement, epoxy, or polymers), aggregates (sand), and various additives (pigments, accelerators, plasticizers). The functionality of modern grout extends beyond simple filling; it must withstand thermal cycling, chemical exposure, and mechanical abrasion, making material science advancements a key driver in product differentiation.

Major applications of tile grout span the residential, commercial, and industrial construction sectors. In residential settings, grout is essential for bathrooms, kitchens, and living areas, enhancing durability and appearance. Commercial applications, such as hospitals, airports, and shopping centers, demand high-performance, non-porous, and chemical-resistant grouts, typically epoxy-based, due to high foot traffic and stringent cleaning protocols. Industrial uses often require specialized formulations capable of resisting harsh chemicals and extreme temperatures.

Key driving factors include the global boom in renovation and remodeling activities, particularly in mature economies, coupled with rapid urbanization and infrastructure development in emerging markets like the Asia Pacific region. Furthermore, increasing consumer awareness regarding sustainable building materials and low-Volatile Organic Compound (VOC) formulations is forcing manufacturers to innovate, offering opportunities for advanced polymer-modified and eco-friendly cementitious products that offer superior performance and ease of application.

Tile Grout Market Executive Summary

The Tile Grout Market is characterized by a stable but accelerating growth trajectory, driven primarily by favorable macroeconomic factors such as sustained growth in the global construction industry and a significant focus on refurbishing aging infrastructure. Business trends indicate a strong shift toward high-performance and specialty grouts, particularly those formulated with epoxy and polyurethane resins, which offer superior durability, stain resistance, and mold mitigation compared to traditional cementitious products. Manufacturers are heavily investing in R&D to develop dust-reduced, rapid-setting, and self-cleaning formulations, addressing both application challenges and long-term maintenance concerns for end-users, thus commanding premium pricing and bolstering overall market value growth.

Regionally, the Asia Pacific (APAC) dominates the market share due to massive governmental investments in residential housing and commercial real estate projects in China, India, and Southeast Asian nations. However, North America and Europe are exhibiting high growth rates for premium segments, spurred by stringent building codes favoring low-emission materials (AEO/GEO optimization for "low-VOC grout" and "sustainable construction") and a pronounced consumer preference for aesthetic versatility, driving demand for colored and metallic-finish grouts. This regional divergence emphasizes a dual market structure: high volume in APAC for standard cementitious products, and high value/innovation in Western markets for specialized chemical grouts.

Segment trends reveal that while cementitious grout remains the largest volume segment due to its low cost and widespread availability, the epoxy segment is projected to record the highest CAGR over the forecast period. This accelerated growth is attributed to epoxy’s superior functional attributes, making it the preferred choice for demanding environments like industrial kitchens, laboratories, and high-end residential applications requiring maximum resistance to staining and bacterial growth. Furthermore, the residential application segment retains the largest share, although the commercial sector’s rising demand for quick-cure and heavy-duty solutions represents a pivotal area for future market expansion and product innovation.

AI Impact Analysis on Tile Grout Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Tile Grout Market frequently revolve around optimizing complex chemical formulations, enhancing supply chain transparency, and predicting material failure or consumption rates on large construction sites. Users are keen to understand how AI algorithms can shorten the R&D cycle for new, high-performance additives, particularly for achieving novel combinations of rapid setting times, high tensile strength, and reduced porosity without compromising workability. Concerns often surface about the initial cost of implementing AI-driven quality control systems in manufacturing plants, but this is tempered by the expectation that predictive maintenance and optimized inventory management will deliver significant long-term cost efficiencies and lead to superior product consistency across various production batches. Furthermore, AI's role in analyzing complex environmental data to guide the development of truly sustainable, low-carbon grout solutions is a growing area of interest for environmentally conscious stakeholders.

- AI-driven Predictive Formulation: Utilizing machine learning to optimize the ratios of polymers, cement, and aggregates for specific performance criteria (e.g., maximizing compressive strength while minimizing shrinkage).

- Automated Quality Control (AQC): Implementing vision systems and neural networks on production lines to detect deviations in color, texture, and mixture homogeneity in real-time, ensuring stringent quality standards.

- Demand Forecasting and Inventory Optimization: Employing AI to analyze construction pipeline data, seasonal trends, and regional purchasing patterns to precisely manage raw material procurement and finished product inventory, reducing waste and logistics costs.

- Smart Application Guidance: Developing mobile applications powered by AI that provide installers with project-specific recommendations for grout type, mixing instructions, and curing times based on environmental conditions (temperature, humidity).

- Sustainability Modeling: Using AI to simulate the environmental impact of various raw material substitutions (e.g., incorporating recycled content) to accelerate the development of low-carbon footprint and LEED-compliant products.

DRO & Impact Forces Of Tile Grout Market

The dynamics of the Tile Grout Market are shaped by a complex interplay of positive growth drivers, market-limiting restraints, and strategic opportunities, collectively defining the overall impact forces. Key drivers include a sustained global focus on residential and commercial repair, renovation, and maintenance (RRM) activities, which naturally necessitates the re-grouting or installation of new tiles. This activity, coupled with global regulatory pressures favoring non-toxic, low-VOC, and green building materials, compels manufacturers to innovate, creating a positive feedback loop for higher-value, specialized products. Conversely, the market faces significant restraints from volatile commodity pricing, particularly for petrochemical derivatives used in epoxy and polymer-modified cementitious grouts, alongside increasing concerns over skilled labor shortages in the tiling and construction sectors, making easier-to-apply, foolproof grouts highly desirable.

Opportunities for market expansion are significant, primarily centered on technological innovation such as the development of hybrid polymer grouts that offer the cost-effectiveness of cementitious materials combined with the performance attributes of epoxy. Penetrating emerging markets with robust, localized product offerings, especially those addressing humid or high-alkaline environments, represents a core growth strategy. The growing trend toward large-format and thin tiles also necessitates specialized, flexible grout formulations that prevent cracking and provide adequate bond strength, opening niche but high-value product lines. The combined impact forces strongly suggest a market that will continue to premiumize, prioritizing application efficiency and long-term durability over initial material cost.

Impact forces such as competitive intensity driven by global giants like Mapei and Sika, and the bargaining power of distributors in highly consolidated regional markets, influence pricing and market access. Furthermore, shifting environmental regulations and the increasing importance of green certifications act as regulatory forces that mandate product compliance, subtly pushing out smaller players who cannot afford the necessary R&D for sustainable formulations. The overall net effect of these forces is the maturation of the market toward specialized, high-performance chemical solutions, moving away from commoditized, basic cement fillers in many developed geographies.

Segmentation Analysis

The Tile Grout Market is comprehensively segmented based on material type, application, and end-use, providing a detailed framework for understanding specific demand drivers and competitive dynamics within different product categories. Material segmentation is crucial, differentiating between the low-cost, high-volume cementitious products and the high-performance, premium epoxy, and polyurethane formulations, each serving distinct functional requirements and price points. Application segmentation distinguishes between the high-wear, structurally critical commercial and industrial installations versus the aesthetic and moisture-control needs of residential projects. This segmentation analysis is vital for targeted marketing and strategic product development, ensuring alignment with specific construction needs and regulatory compliance across diverse geographical regions.

- By Material Type:

- Cementitious Grout (Standard, Polymer-Modified)

- Epoxy Grout (High-Performance, Chemical Resistant)

- Polyurethane Grout

- Furan Grout

- Others (Acrylic, Silicone Sealants used as substitutes)

- By Application:

- Flooring Grout

- Wall Grout

- Countertop/Specialty Grout

- By End-Use Sector:

- Residential (New Construction, Renovation & Repair)

- Commercial (Hospitals, Hotels, Retail, Offices)

- Industrial (Processing Plants, Warehouses, Laboratories)

- By Technology:

- Ready-to-Use (Pre-mixed)

- Powdered (Requires Mixing)

Value Chain Analysis For Tile Grout Market

The value chain for the Tile Grout Market begins with the highly specialized sourcing and preparation of essential raw materials. Upstream analysis focuses on procuring key components such as high-purity silica sand (aggregates), specialized cements (Portland or blended), polymer additives (latex, acrylic, or epoxy resins), and performance chemicals (pigments, stabilizers, anti-fungal agents). The cost and quality of these raw materials, particularly the epoxy resins and high-grade polymers, significantly influence the final product pricing and manufacturing margins. Due to the reliance on petrochemical derivatives, fluctuations in oil and gas prices directly impact the production cost of high-performance grouts, making secure and diversified sourcing strategies critical for market participants.

The midstream stage involves manufacturing and blending, where precision chemistry is paramount to achieve specified performance attributes like cure time, flexibility, and color consistency. Large multinational corporations leverage advanced automated blending equipment and strict quality control processes to produce both powdered (requiring on-site mixing) and ready-to-use liquid/paste formulations. Distribution channels are highly fragmented yet critical for market penetration. Direct channels involve supplying bulk materials to large commercial contractors or major tile distributors, ensuring consistent supply for large-scale projects. Indirect channels heavily utilize specialized construction material retailers, DIY home improvement stores (e.g., Home Depot, Lowe's), and independent tile showrooms, which are crucial for reaching the residential and small-to-mid-sized contractor market. This two-tiered distribution system optimizes reach and caters to varying consumer expertise levels.

Downstream analysis centers on the professional tiler and the end-user (homeowner or commercial facility manager). Ease of application, long-term performance (stain and mold resistance), and aesthetic options are the primary determinants of downstream adoption. The importance of technical support and installer training provided by manufacturers cannot be overstated, especially for complex epoxy and chemical grouts. The efficiency of the entire value chain is currently being improved through digital integration, utilizing platforms to optimize logistics from plant to point-of-sale and providing digital resources for installers, thereby reducing application errors and improving overall customer satisfaction. The high initial capital expenditure in R&D and manufacturing capacity favors large, established players, creating significant barriers to entry for smaller competitors.

Tile Grout Market Potential Customers

The potential customer base for the Tile Grout Market is broad, categorized primarily into three major segments: residential end-users, commercial institutions, and industrial facilities. Residential customers constitute the largest volume market, encompassing both new home builders purchasing materials for mass installations and individual homeowners or remodeling contractors engaged in repair, renovation, and maintenance (RRM) projects. These buyers prioritize aesthetic variety, ease of use (favoring ready-mix products), and cost-effectiveness, with a growing interest in low-maintenance, stain-resistant features for high-traffic areas like kitchens and bathrooms. The buying decision in this segment is often influenced by retail advice and product visibility in large DIY stores.

Commercial customers, including hotel chains, healthcare facilities, educational institutions, and large retail centers, represent the highest-value segment, demanding specialized high-performance grouts. Their primary purchasing criteria are extreme durability, chemical resistance (to harsh cleaning agents), non-porosity to meet hygiene standards (especially critical in healthcare and food service), and compliance with stringent fire and safety regulations. These buyers typically procure through long-term contracts with large specialized distributors or directly from major manufacturers, emphasizing technical specifications and certification over general consumer preference. The requirement for minimal downtime in commercial settings drives demand for rapid-curing and high-early-strength products.

Industrial buyers, such as chemical processing plants, food and beverage manufacturers, and heavy-duty workshops, require the most robust and specialized grouts, typically relying on furan or pure epoxy systems designed to withstand highly corrosive chemicals, high temperatures, and constant heavy machinery traffic. Procurement decisions are based strictly on technical performance data, long-term lifecycle cost, and chemical compatibility, often requiring detailed consultations with material science experts. These customers represent a smaller volume but are critical adopters of the most technologically advanced and expensive formulations available in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $6.23 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mapei S.p.A., Sika AG, Laticrete International Inc., Ardex Group, BASF SE, H.B. Fuller Company, Custom Building Products, Bostik (Arkema Group), Saint-Gobain (Weber), The Dow Chemical Company, ITW (Illinois Tool Works), Fosroc International, Wacker Chemie AG, Henkel AG & Co. KGaA, C-Cure, Quikrete Holdings Inc., Sakrete, Tile Redi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tile Grout Market Key Technology Landscape

The Tile Grout Market's technological evolution is rapidly moving away from basic cement-based mixtures toward sophisticated chemical formulations, driven by demands for enhanced durability, application speed, and specific functional properties like mold resistance and stain-proofing. A major area of advancement is in polymer modification technology, specifically the use of advanced redispersible polymer powders (RDPs) and liquid latex additives in cementitious grouts. These polymers significantly improve water resistance, flexibility, and adhesion characteristics, making standard cement grout suitable for more challenging environments and large-format tile installations where slight substrate movement must be accommodated. This focus on polymer science is critical for bridging the performance gap between traditional and chemical grouts.

Another pivotal technological trend involves the development of hybrid grout systems and specialized epoxy chemistry. Hybrid grouts, often based on high-performance cement combined with specialized epoxy or polyurethane components, aim to provide the superior performance of epoxies (stain resistance, chemical inertia) while retaining the user-friendly application and extended pot life of cementitious products. Furthermore, advancements in 100% solids epoxy chemistry are leading to formulations with enhanced UV stability, lower toxicity, and faster cure times, crucial for minimizing project disruption in commercial settings. The integration of hydrophobic and oleophobic additives is a key innovation, providing superior stain resistance against common household liquids and oils without the need for periodic sealing, directly addressing consumer pain points in maintenance.

Finally, the technology landscape is being shaped by environmental sustainability and user safety. Manufacturers are investing heavily in reducing crystalline silica dust through encapsulation technologies and developing non-hazardous, low-VOC or zero-VOC formulations to comply with rigorous indoor air quality standards such as LEED and WELL Building certifications. The emergence of color-fast technologies that prevent efflorescence and fading, utilizing specialized UV-resistant pigments, also constitutes a significant technological leap, satisfying the growing consumer demand for long-lasting aesthetic appeal. These combined technological efforts are redefining industry benchmarks for both performance and environmental responsibility.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to monumental infrastructure spending, rapid urbanization, and a continuous surge in residential construction, particularly in China, India, and Southeast Asia. The demand here is primarily volume-driven, focusing on cost-effective, readily available cementitious and polymer-modified cement grouts for mass housing and commercial complex developments. However, rising affluence and multinational commercial investments are steadily increasing the demand for high-performance epoxy grouts in specialized applications like hospitals and food processing facilities.

- North America: This region is characterized by high adoption rates of premium, specialty, and technologically advanced grouts. Growth is primarily driven by extensive repair, renovation, and remodeling (RRM) activities, strong consumer preference for DIY-friendly and ready-to-use products, and strict regulatory adherence to low-VOC standards. The market emphasizes aesthetics, driving demand for colored, metallic, and specialized high-flexibility grouts suitable for luxury residential and high-end commercial projects.

- Europe: The European market is highly mature and innovation-focused, propelled by stringent environmental regulations (e.g., REACH compliance) and a strong emphasis on sustainable construction practices. Manufacturers must adhere to rigorous performance standards and low-emission protocols, favoring high-quality polymer-modified and eco-friendly epoxy systems. Germany, France, and the UK are key markets, showing robust demand for specialized grouts suitable for retrofitting older buildings and meeting passive house standards.

- Latin America (LATAM): Growth in LATAM is sporadic but promising, tied to stabilizing economic conditions and increasing foreign investment in commercial infrastructure, notably in Brazil and Mexico. The market is price-sensitive, with cementitious products dominating, but there is an emerging niche for mid-range polymer-modified grouts driven by a rising awareness of durability requirements in areas prone to seismic activity or high humidity.

- Middle East and Africa (MEA): This region exhibits high demand volatility but massive potential, fueled by large-scale government-led development projects (e.g., hospitality, retail, and major urban construction in the GCC countries). The challenging climatic conditions (extreme heat and humidity) necessitate high-durability, weather-resistant, and UV-stable epoxy and specialized cementitious grouts, creating a strong market for premium, heavy-duty formulations for both internal and external tiling applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tile Grout Market.- Mapei S.p.A.

- Sika AG

- Laticrete International Inc.

- Ardex Group

- BASF SE

- H.B. Fuller Company

- Custom Building Products

- Bostik (Arkema Group)

- Saint-Gobain (Weber)

- The Dow Chemical Company

- ITW (Illinois Tool Works)

- Fosroc International

- Wacker Chemie AG

- Henkel AG & Co. KGaA

- C-Cure

- Quikrete Holdings Inc.

- Sakrete

- Tile Redi

Frequently Asked Questions

Analyze common user questions about the Tile Grout market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cementitious and epoxy grout?

Cementitious grout is porous, cost-effective, and suitable for standard applications, requiring sealing for stain protection. Epoxy grout is non-porous, highly durable, chemical resistant, and superior for commercial/wet areas, offering permanent stain resistance without sealing, though it is significantly more expensive and difficult to install.

Which material type is experiencing the fastest growth rate?

Epoxy grout and advanced polymer-modified cementitious grouts are experiencing the fastest growth. This acceleration is driven by the global demand for high-performance, low-maintenance, and stain-resistant solutions, particularly in commercial food service and high-end residential renovations.

How do low-VOC regulations affect product development in the Tile Grout Market?

Low-VOC (Volatile Organic Compound) regulations, especially in North America and Europe, mandate manufacturers to reformulate products to minimize solvent emissions, promoting the use of water-based epoxy, polyurethane, and advanced polymer additives that ensure superior indoor air quality and compliance with green building standards like LEED.

What are the main distribution channels used in the market?

The primary distribution channels include specialized building material wholesalers for large commercial projects, major DIY and home improvement retail chains (catering to contractors and homeowners), and direct sales channels focusing on high-volume industrial clients requiring technical support.

What is the role of RRM activities in driving market growth?

Repair, Renovation, and Maintenance (RRM) activities constitute a crucial driver, particularly in mature economies. As existing tile installations age, re-grouting and renovation projects ensure sustained demand, often prompting an upgrade from standard to high-performance, premium grout materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager