Tile Levelling Kits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435599 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Tile Levelling Kits Market Size

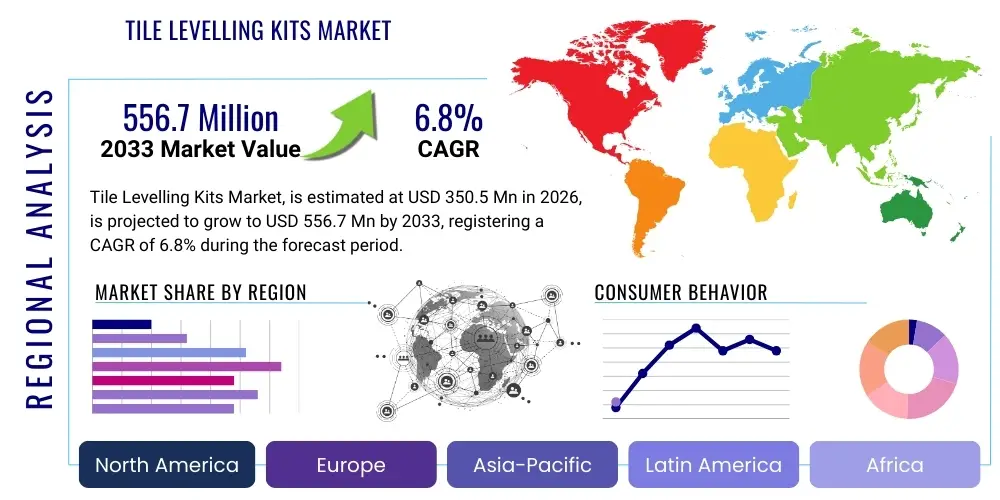

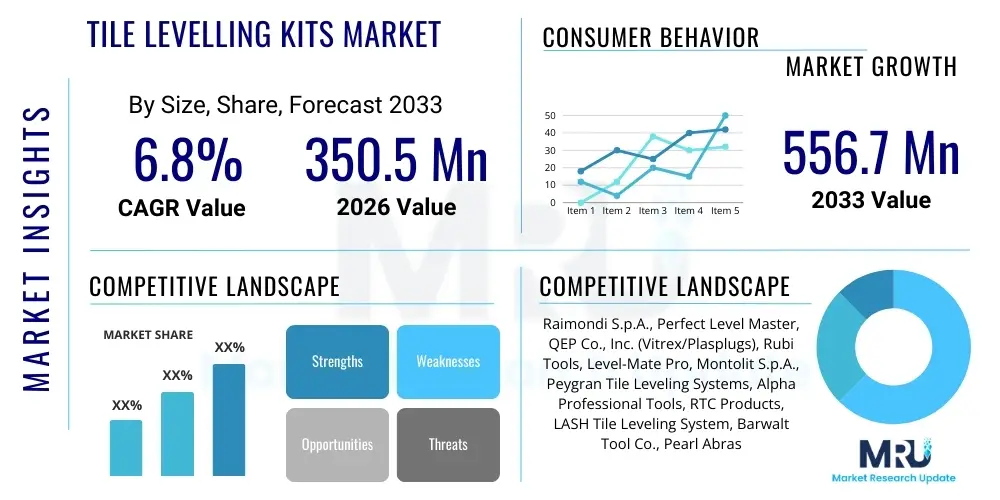

The Tile Levelling Kits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 556.7 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing global demand for large format tiles and porcelain slabs, which necessitates precise installation methods to achieve a seamless, lippage-free finish. Market growth is also supported by the rising residential construction sector and the growing popularity of DIY home improvement projects, where levelling systems significantly simplify complex tiling tasks.

Tile Levelling Kits Market introduction

The Tile Levelling Kits Market encompasses tools and systems designed to ensure adjacent tiles are installed perfectly flat and level, thereby eliminating "lippage" (uneven edges) during the curing process of the adhesive. These kits typically consist of disposable clips or straps that fit between the tiles, reusable wedges or caps that tighten the assembly, and specialized pliers or tensioning tools. The primary product objective is to provide professional tile setters and amateur installers with an efficient, reliable solution for achieving high-quality surface finishes, particularly when handling heavy, large format, or irregularly shaped ceramic, porcelain, or stone tiles.

Major applications of tile levelling kits span residential remodeling, new commercial construction, and specialized industrial flooring projects. Benefits derived from their usage include enhanced aesthetic appeal, reduced installation time, significant minimization of costly rework, and improved durability of the tiled surface. Key driving factors propelling market expansion include stringent aesthetic demands from consumers, the structural shift towards larger tile formats (e.g., 60x60 cm and larger), and continued growth in global construction investment, particularly in Asia Pacific and North America. The kits act as a critical quality assurance tool, making high-precision tiling accessible to a wider pool of installers.

The market environment is characterized by steady technological refinements focusing on material durability, ease of use, and cost-effectiveness. Manufacturers are concentrating on developing advanced ergonomic pliers and sustainable, reusable components to address professional contractor needs. Furthermore, the proliferation of online DIY resources and video tutorials has democratized the use of these tools, stimulating demand from the retail consumer segment. The overall trajectory suggests sustained growth driven by quality consciousness in tiling practices across developed and emerging economies.

Tile Levelling Kits Market Executive Summary

The Tile Levelling Kits Market is undergoing robust expansion, characterized by a fundamental shift in business trends towards sustainable and ergonomic systems, coupled with increased penetration in the retail DIY channel. Regionally, North America and Europe maintain dominance due to high labor costs and stringent quality standards requiring lippage-free installations, while the Asia Pacific region is emerging as the fastest-growing market, driven by rapid urbanization and massive infrastructure development projects utilizing modern construction techniques. Segment trends highlight that the clip-and-wedge systems currently hold the largest market share owing to their proven effectiveness and affordability, but reusable cap systems are gaining traction due to their long-term cost savings and reduced environmental impact, especially among high-volume commercial contractors. Material segmentation indicates a growing reliance on high-density, durable plastics and specialized resins to enhance the tensile strength of disposable clips, ensuring they withstand the pressure required for effective levelling, even with thick adhesives and heavy tiles.

Strategic advancements among key players involve vertical integration and expansion of global distribution networks, targeting both professional supply houses and large home improvement retail chains. The competitive landscape is moderately fragmented, with specialized tool manufacturers competing aggressively on system design patents, user interface simplification, and bulk pricing for professional users. The increasing adoption of tile heating systems and waterproof membranes further integrates the use of levelling kits, as the underlying subfloor preparations require precision, thereby bolstering the need for accurate surface alignment. Manufacturers are also increasingly leveraging digital marketing and e-commerce platforms to reach niche installer communities and capitalize on direct-to-consumer sales, optimizing their supply chain responsiveness.

AI Impact Analysis on Tile Levelling Kits Market

User inquiries regarding AI's impact primarily revolve around automated tiling robots, predictive analytics for supply chain optimization, and AI-driven quality control during large-scale projects. Users frequently ask if AI will eliminate manual installation and whether intelligent systems can predict adhesive curing times to optimize the removal of levelling components. The general expectation is that AI will not replace the fundamental manual task of tile setting but will enhance efficiency through job site automation, precise material requirement calculations, and advanced logistical planning. Concerns focus on the cost of integrating AI systems into standard construction practices and the technical skills required to operate them, indicating a need for simpler, low-barrier AI tools tailored for small to medium-sized contractors.

- AI-Powered Robotics: Integration into automated tiling machines, reducing labor intensity for repetitive tasks in commercial settings.

- Predictive Logistics: Utilizing machine learning to forecast demand for specific kit components (clips, wedges) based on regional construction activity and material trends.

- Quality Control (QC): AI vision systems used in manufacturing to instantly detect flaws or inconsistencies in the precision molding of clips and wedges.

- Optimized Installation Guides: AI-driven apps providing real-time, personalized advice to installers on the optimal quantity, spacing, and tensioning required for specific tile sizes and subfloor conditions.

- Inventory Management: Automated reordering and stock level alerts for distributors and large contractors, minimizing downtime related to component shortages.

- Training and Simulation: Development of virtual reality (VR) and AI-enhanced simulation tools for training new installers on lippage prevention techniques.

DRO & Impact Forces Of Tile Levelling Kits Market

The dynamics of the Tile Levelling Kits Market are heavily influenced by a confluence of driving forces related to construction standards and aesthetic demands, counterbalanced by restraints stemming from high material costs and the learning curve for specialized systems. Opportunities are centered on emerging markets and the development of eco-friendly and highly reusable component designs. The primary drivers include the global adoption of large-format tiles, which inherently demand levelling systems for professional installation quality, and the rising consumer expectation for flawless, seamless flooring and wall finishes. Restraints involve the recurring cost of disposable components, which can deter cost-sensitive contractors, and the significant market presence of traditional, low-tech manual alignment techniques that require no specialized tools. The major opportunity lies in expanding the product reach into developing economies where construction is booming but professional tooling adoption is still nascent. These forces create a compelling market environment where innovation in material science and system ergonomics dictates competitive advantage and overall market growth trajectory.

Impact forces dictate that market participants must continually invest in patent protection and material engineering to maintain performance superiority. The threat of substitutes, while present (e.g., traditional suction cups and shims), is mitigated by the unmatched precision and efficiency offered by modern clip-and-wedge systems, especially for perimeter alignment and large slab installation. Regulations regarding construction waste are increasingly pressuring manufacturers to transition towards fully recyclable or predominantly reusable kits, shifting the investment focus from disposable plastics to durable polymers and metal alloys. The bargaining power of buyers remains moderate, influenced by the fragmentation of the contractor market, but large home improvement retailers exert significant influence over pricing and product placement, necessitating competitive pricing strategies and robust promotional support from manufacturers.

Segmentation Analysis

The Tile Levelling Kits Market is comprehensively segmented based on System Type, Component Type, Application, Material Type, and End-User, allowing for a detailed analysis of market dynamics across various niches. System types primarily include Clip-and-Wedge, Reusable Cap, and Screw-Cap systems, each catering to different preferences regarding installation speed, ease of use, and budget. Component types differentiate between the consumable elements (clips/straps) and the reusable elements (wedges/caps/tensioning tools). Application segmentation highlights the division between Floor Tiling and Wall Tiling projects, recognizing the different forces and precision requirements involved. Material differentiation focuses on the high-grade plastics (HDPE, PP, Nylon) used for structural components. Understanding these segments is crucial for manufacturers to tailor their product offerings and marketing strategies effectively, targeting high-volume professional users versus intermittent DIY consumers.

- System Type

- Clip-and-Wedge Systems (Dominant Share)

- Reusable Cap Systems (Fastest Growth)

- Screw-Cap Systems

- Other Mechanical Systems

- Component Type

- Disposable Clips/Straps

- Reusable Wedges/Caps

- Tensioning Tools/Pliers

- Material Type

- Plastic Levelling Kits (Polypropylene, Nylon)

- Metal Levelling Kits (Steel, Aluminum Components for Tools)

- Application

- Floor Levelling

- Wall Levelling

- Countertop and Specialty Installation

- End-User

- Professional Contractors and Builders

- DIY/Home Consumers

Value Chain Analysis For Tile Levelling Kits Market

The value chain for the Tile Levelling Kits Market commences with the Upstream Analysis, which involves the procurement of raw materials, primarily specialized high-density plastics and resins (Polypropylene, HDPE, Nylon) used for manufacturing the clips, wedges, and caps, alongside high-grade steel for tensioning tools. Key activities at this stage include material engineering to ensure high tensile strength and resilience against shear forces exerted during installation. Efficient sourcing and quality control of these raw materials are paramount, as component failure during use can lead to significant construction delays and quality issues. Manufacturers often negotiate long-term contracts with resin suppliers to stabilize production costs, which are sensitive to petrochemical price fluctuations. Strategic partnerships with specialized mold makers are also essential for achieving the precision required in the interlocking designs of the systems.

The midstream segment involves manufacturing, assembly, and quality assurance. This stage is highly automated, relying on precision injection molding processes. Focus is placed on minimizing waste, optimizing molding cycle times, and ensuring that disposable components break cleanly below the surface line after curing. Distribution Channel analysis highlights a bifurcated pathway: Direct channels serve large commercial contractors and major construction firms through specialized sales teams, offering bulk discounts and customized logistics solutions. Indirect channels dominate the DIY and small contractor segment, relying on strong relationships with construction supply wholesalers, national home improvement retail giants (like Home Depot or Lowe's), and e-commerce platforms. The profitability of the product line is often determined by the efficiency of this distribution network and the ability to manage inventory across geographically dispersed retail locations.

Downstream analysis focuses on the end-users—professional tile setters and DIY consumers—and post-sales support. Customer acquisition strategies involve product demonstrations, trade show participation, and leveraging online visual content (videos) to showcase the ease and effectiveness of the systems, crucial for convincing traditional installers to adopt new methods. Post-sales service is vital for reusable kits, involving warranties on tensioning tools and easy access to replacement parts. The increasing reliance on e-commerce means that packaging and fulfillment logistics have become critical competitive differentiators, with successful companies offering high-volume, cost-effective shipping options to maintain price competitiveness against traditional brick-and-mortar suppliers.

Tile Levelling Kits Market Potential Customers

The primary end-users and potential customers for Tile Levelling Kits are professional ceramic and stone tile setters, general contractors involved in residential and commercial finishing, and the rapidly growing segment of dedicated Do-It-Yourself (DIY) enthusiasts. Professional tile setters represent the core market, valuing speed, reliability, and precision, particularly as they increasingly work with high-value, large-format, and thin-profile porcelain tiles where lippage is highly visible and unacceptable. These contractors require bulk purchasing options and high-durability reusable tools that can withstand daily heavy use across multiple job sites. Their purchasing decisions are heavily influenced by ergonomic design, system effectiveness across different tile thicknesses, and favorable wholesale pricing structures offered by supply houses.

The DIY consumer segment represents the fastest-growing customer base, driven by accessibility of products in retail stores and online tutorials that simplify complex installation tasks. DIYers prioritize ease of use, clear instructions, and kits packaged specifically for smaller, single-room projects. While they purchase less volume per transaction, the sheer number of home renovation projects provides a massive, sustained revenue stream for retailers carrying levelling systems. Beyond these core groups, secondary potential customers include specialized floor installers working with epoxy or self-levelling compounds where a perfectly flat substrate is mandatory, and architects or interior designers who mandate the use of levelling systems in project specifications to ensure aesthetic quality standards are met by all subcontractors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 556.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Raimondi S.p.A., Perfect Level Master, QEP Co., Inc. (Vitrex/Plasplugs), Rubi Tools, Level-Mate Pro, Montolit S.p.A., Peygran Tile Leveling Systems, Alpha Professional Tools, RTC Products, LASH Tile Leveling System, Barwalt Tool Co., Pearl Abrasive Co., Marshalltown Company, Walteza Tools, Spin Doctor Tile Leveling System, Daltile, T-Lock Leveling System, Sure-Loc, DTA USA, MLT System. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tile Levelling Kits Market Key Technology Landscape

The technology landscape of the Tile Levelling Kits Market is characterized by continuous refinement in materials engineering and ergonomic design rather than disruptive digital innovations. The core technology centers on precision injection molding used to produce high-tolerance plastic components, particularly the disposable clips, which must break cleanly and consistently below the tile surface without compromising the bond line or leaving jagged edges. Recent technological advancements focus on developing clips with improved sheer strength and thinner base plates to accommodate minimal grout lines increasingly favored by modern design trends. Furthermore, manufacturers are investing in specialized polymer blends that offer enhanced resistance to chemical degradation from tile cleaning agents and longevity for reusable components, ensuring a reduced rate of tool replacement for professionals.

Another crucial technological area involves the design of tensioning tools and pliers. Modern tools are increasingly ergonomic, featuring adjustable torque settings and comfortable grip materials (often incorporating rubber or specialized composites) to reduce installer fatigue during high-volume application. The innovation in screw-cap systems focuses on creating systems with faster threading and visual indicators to ensure installers achieve consistent and optimal pressure across all tiles. Proprietary interlocking designs and patented thread geometries are common competitive technological advantages that improve speed and reliability. The integration of 3D printing in the rapid prototyping phase also allows companies to quickly iterate on new designs tailored for niche applications, such as installations involving extremely thin or irregularly shaped tiles.

The market also sees technology integration related to construction sustainability. This includes developing fully biodegradable or bio-based polymer clips that address environmental concerns related to the volume of single-use plastics generated by large construction projects. Reusable systems, such as screw-cap and cap-and-strap types, are gaining technological sophistication through better anti-slip features and more robust locking mechanisms to ensure the system maintains pressure effectively over extended periods without loosening, which is crucial during the prolonged curing times of modified thin-set mortars and large-format tile adhesives.

Regional Highlights

- North America: This region holds a significant market share, characterized by high labor costs, leading to a strong emphasis on tools that boost efficiency and minimize costly callbacks. The widespread adoption of large-format tiles (LVT, porcelain slabs) in both commercial and high-end residential construction drives demand. Key markets include the United States and Canada, where stringent professional standards and a strong DIY culture ensure steady consumption. Investment in multi-family housing and commercial infrastructure also fuels continuous demand for bulk levelling solutions.

- Europe: Europe is a mature market, particularly Western European countries like Germany, Italy, and the UK, which have a deeply ingrained culture of quality craftsmanship in tiling. Europe is a major hub for tile manufacturing (especially Italy and Spain), leading to rapid adoption of levelling systems designed for new, innovative tile formats. Regulatory pressure regarding construction waste is higher here, accelerating the shift towards reusable and ecologically responsible levelling technologies.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to unprecedented urbanization, massive infrastructural investments (especially in China, India, and Southeast Asia), and rising disposable incomes leading to higher quality housing standards. While cost sensitivity remains a factor, the increasing employment of skilled contractors and the shift from traditional materials to modern tiles are rapidly boosting market penetration for levelling kits, transitioning from manual shimming techniques to standardized systems.

- Latin America (LATAM): The LATAM market, while generally smaller, shows promising growth, driven by expanding construction sectors in economies like Brazil and Mexico. Market adoption is currently concentrated in major metropolitan areas and luxury housing projects, with growing opportunities as international construction standards are gradually adopted. Price sensitivity and inconsistent distribution channels are major regional challenges.

- Middle East and Africa (MEA): This region is characterized by substantial commercial and residential construction spending, particularly in the Gulf Cooperation Council (GCC) countries. High-profile, large-scale luxury developments often mandate the highest quality finishes, driving premium product demand. Extreme climatic conditions necessitate specialized installation materials, further enhancing the need for precision tools like levelling kits to ensure long-term structural integrity and aesthetic alignment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tile Levelling Kits Market.- Raimondi S.p.A.

- Perfect Level Master

- QEP Co., Inc. (Vitrex/Plasplugs)

- Rubi Tools

- Level-Mate Pro

- Montolit S.p.A.

- Peygran Tile Leveling Systems

- Alpha Professional Tools

- RTC Products

- LASH Tile Leveling System

- Barwalt Tool Co.

- Pearl Abrasive Co.

- Marshalltown Company

- Walteza Tools

- Spin Doctor Tile Leveling System

- Daltile

- T-Lock Leveling System

- Sure-Loc

- DTA USA

- MLT System

Frequently Asked Questions

Analyze common user questions about the Tile Levelling Kits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Tile Levelling Kits Market?

The primary driver is the widespread global adoption of large format tiles and porcelain slabs (often exceeding 60x60 cm). These larger, heavier tiles are highly susceptible to lippage (uneven edges), making precision installation tools like levelling kits mandatory to achieve professional, lippage-free aesthetic finishes and prevent trip hazards.

Are tile levelling systems designed only for professional contractors or for DIY users as well?

Tile levelling systems cater to both segments. Professional contractors utilize high-volume, durable systems (often reusable cap or screw systems) for speed and cost efficiency. DIY users benefit significantly from user-friendly, starter clip-and-wedge kits that drastically lower the skill requirement needed to successfully install large tiles without lippage, widely available through major retail channels.

What are the main types of levelling kit systems currently available on the market?

The market is segmented primarily into three main system types: Clip-and-Wedge systems (most common, disposable clips with reusable wedges), Reusable Cap systems (utilizing specialized tension caps over disposable bases), and Screw-Cap systems (using threaded posts and nuts for precise tensioning). Each type offers different trade-offs in terms of speed, cost, and reusability.

Which geographic region exhibits the highest growth potential for tile levelling kits?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR). This is attributable to massive investment in residential and commercial infrastructure, accelerating urbanization, and the region's increasing adoption of modern construction techniques and higher quality finishing materials, displacing traditional manual installation methods.

What is the key technological focus for manufacturers in the levelling kits market?

The key technological focus is two-fold: material science, enhancing the sheer strength and clean-break properties of disposable plastic clips, and ergonomic design, developing tensioning tools that reduce installer strain, improve speed, and provide consistent, reliable pressure across various tile thicknesses and adhesive types.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager