Tiller Machinery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435808 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Tiller Machinery Market Size

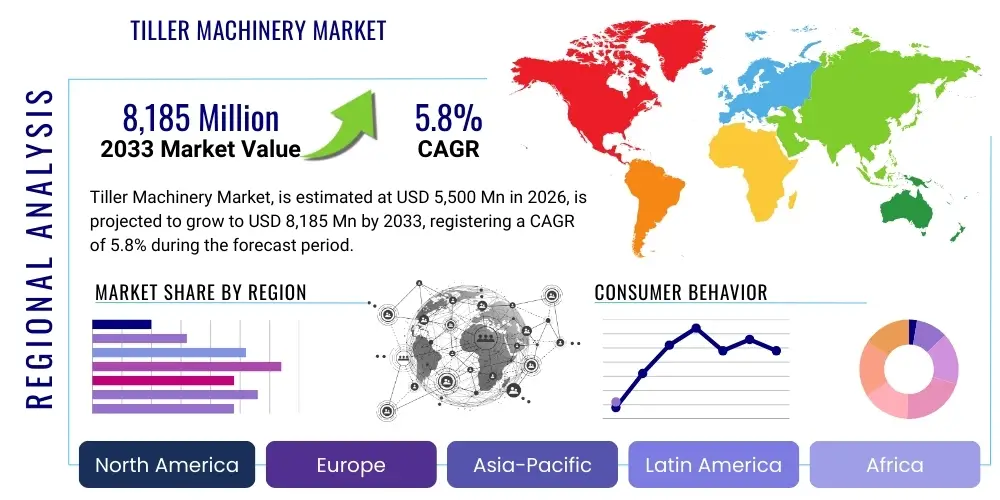

The Tiller Machinery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5,500 Million in 2026 and is projected to reach USD 8,185 Million by the end of the forecast period in 2033.

Tiller Machinery Market introduction

The Tiller Machinery Market encompasses a wide range of agricultural and gardening equipment designed for secondary tillage, primarily involving the preparation of soil for planting by churning it up and mixing in organic matter. This machinery includes rotary tillers, cultivators, and power tillers, categorized based on size, power source (electric, gasoline, diesel), and application scale (small garden, commercial farm). These tools are essential for optimizing soil structure, improving drainage, controlling weeds, and ensuring a favorable seedbed environment, thereby significantly enhancing crop yields and operational efficiency for farmers and horticulturalists globally.

The core products within this market, such as walk-behind tillers and tractor-mounted rotary tillers, serve diverse applications, ranging from small-scale farming and landscaping to large-scale commercial agriculture. The major applications include seedbed preparation in row cropping, specialized cultivation in orchards and vineyards, and general soil conditioning in urban and commercial gardens. Key benefits derived from the adoption of advanced tiller machinery include reduced labor costs, faster field preparation times, superior soil aeration, and the ability to accurately incorporate fertilizers and crop residue, contributing directly to sustainable farming practices.

Driving factors propelling market expansion are primarily the increasing global focus on agricultural modernization, rising demand for high-efficiency farming practices, and the shrinking availability of manual labor in many developed and developing regions. Additionally, government subsidies and initiatives promoting mechanized farming, particularly in Asia Pacific and Latin America, are accelerating the adoption of power tillers, especially among small and marginal farmers who require versatile and cost-effective alternatives to traditional tractors. The continuous innovation in engine efficiency and integration of precision farming technologies further cement the market's growth trajectory.

Tiller Machinery Market Executive Summary

The global Tiller Machinery Market demonstrates robust business trends characterized by a shift towards lightweight, fuel-efficient, and multipurpose equipment suitable for diverse topographical and climatic conditions. Key market players are prioritizing mergers and acquisitions to consolidate market share and expanding their product portfolios to include battery-powered and autonomous tillers, addressing the growing environmental concerns and demand for quieter operation. Furthermore, the commercial farming segment continues to dominate demand, driven by the necessity for high-output machinery capable of handling intensive tilling operations across expansive fields, while the residential and gardening segment shows promising growth due to increasing interest in home gardening and landscaping projects post-pandemic.

Regionally, Asia Pacific maintains its stronghold as the dominant market, largely due to extensive agricultural land, substantial government support for farm mechanization, and the high concentration of small farms relying heavily on power tillers and small-scale rotary cultivators. North America and Europe, however, lead in terms of technological adoption, exhibiting high demand for sophisticated, heavy-duty rotary tillers and specialized cultivators integrated with GPS and sensor technology for precision agriculture. Emerging regional trends indicate rapid growth in Latin America and the Middle East & Africa, fueled by investments in agricultural infrastructure and the expansion of cash crop cultivation, necessitating reliable and durable tillage equipment.

In terms of segmentation trends, the rotary tiller segment holds the largest market share due to its versatility and superior soil preparation capabilities compared to simple cultivators. Segmentation by power source shows a stable dominance of diesel-powered tillers, particularly in commercial applications requiring high torque and long operational hours, although the battery-powered and electric segment is projected to exhibit the highest CAGR, reflecting the industry's pivot toward sustainable energy solutions. The distribution channel analysis reveals that direct sales and specialized dealership networks remain crucial for providing maintenance and aftermarket support, although e-commerce platforms are gaining traction for smaller, consumer-grade gardening tillers.

AI Impact Analysis on Tiller Machinery Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Tiller Machinery Market frequently center on themes of autonomy, operational efficiency, and predictive maintenance. Users are concerned about how AI will integrate into traditional mechanical systems, asking whether future tillers will be entirely autonomous, optimizing tilling depth and speed in real-time based on soil analysis. Key expectations revolve around using machine learning algorithms to process sensor data (soil moisture, nutrient levels, topography) to automatically generate optimal tilling patterns, thereby maximizing yield and minimizing fuel consumption. There is also significant user interest in AI-driven diagnostic tools that can predict mechanical failures or maintenance requirements, shifting the industry from reactive repairs to proactive equipment management.

The primary concern amongst farmers and equipment operators relates to the cost and complexity of integrating these advanced AI systems. Users seek confirmation that AI-enhanced tillers will offer a substantial Return on Investment (ROI) and that the technology will be user-friendly, rather than requiring specialized IT expertise for basic operation and calibration. Furthermore, questions arise concerning data ownership and security, as AI systems rely heavily on collecting and analyzing vast amounts of proprietary agricultural data, highlighting the need for robust data governance frameworks within the market ecosystem.

The integration of AI is not aimed at replacing the tiller itself, but rather transforming its functionality from a simple mechanical device into an intelligent, adaptive tool capable of performing variable-rate tillage. This transition leverages AI to process environmental inputs and historical yield data, allowing the tiller to apply different tilling strategies across sub-sections of a field, optimizing resource use, and significantly reducing environmental impact. This shift is critical for future sustainable farming models, making AI a strategic rather than peripheral element of tiller machinery development.

- Enhanced Autonomy: AI enables autonomous tilling operations, requiring minimal human intervention.

- Precision Tillage: Machine learning optimizes tilling depth and intensity based on real-time soil data (moisture, texture).

- Predictive Maintenance: AI algorithms analyze operational data to forecast equipment failures, minimizing downtime.

- Route Optimization: Advanced path planning reduces overlap and fuel consumption during field work.

- Variable Rate Application: Integration with mapping software allows for precise incorporation of inputs (e.g., fertilizer) during tilling.

DRO & Impact Forces Of Tiller Machinery Market

The Tiller Machinery Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and market trajectory. The key drivers are rooted in the global need for increased food production efficiency and reduced reliance on manual labor, particularly in rapidly industrializing agricultural economies. However, market growth faces notable restraints, primarily high initial capital investment costs associated with advanced machinery and the fragmented nature of land ownership in developing nations, making large-scale machinery adoption challenging. Opportunities abound in the development of lightweight, specialized equipment tailored for niche applications like horticulture and vineyard management, as well as the exponential growth expected from the electric and battery-powered tiller segment.

The most compelling impact force driving demand is technological advancement, specifically the push toward precision agriculture. Modern tillers are increasingly equipped with sophisticated sensors and telematics, allowing them to integrate seamlessly into farm management systems, thus improving operational efficiency and input management. Furthermore, global demographic trends, including the aging farming population in developed regions, create an inherent market necessity for mechanized solutions like advanced tillers to maintain productivity levels. Conversely, fluctuating raw material prices (steel, components) and stringent emission regulations in North America and Europe exert a restraining impact, forcing manufacturers to innovate under cost pressure.

Opportunities for market growth are strongly tied to governmental support mechanisms, such as farm loan schemes and subsidies designed to encourage mechanization adoption, particularly in APAC and Africa. The increasing focus on sustainable and conservation agriculture also presents a dual-edged force: while traditional aggressive tillage is sometimes restricted, the demand for minimum tillage or specialized strip-till equipment (which are technically advanced tillers/cultivators) is skyrocketing. The market equilibrium is maintained by balancing the high R&D costs required for precision technology (Restraint) against the immense economic benefits derived from improved efficiency and yield (Driver).

Segmentation Analysis

The Tiller Machinery Market is comprehensively segmented based on product type, power source, application, and end-user, providing a granular view of market dynamics and targeted demand sectors. Understanding these segments is critical for strategic planning, as distinct consumer needs drive the uptake of different machinery types. For instance, commercial large-scale farming predominantly drives the demand for heavy-duty, tractor-mounted rotary tillers, while the smaller residential segment favors lightweight, electric, or gasoline-powered walk-behind models for garden and landscaping tasks. This heterogeneity requires manufacturers to maintain diverse product portfolios catering to various power requirements and operational scales.

Analysis by product type reveals that rotary tillers dominate the market share due to their superior efficiency in soil preparation across different soil types and their adaptability to diverse crops. The power source segmentation is experiencing a transformative shift, with conventional diesel and gasoline engines retaining current market dominance but facing increasingly fierce competition from advanced electric and battery-powered solutions. The high initial torque and zero-emission profile of electric tillers make them increasingly attractive for controlled environment agriculture and niche applications, predicting significant future market growth in this segment.

The segmentation by application clearly delineates the market into agricultural and non-agricultural (e.g., landscaping, forestry) uses, where agricultural applications account for the bulk of demand, driven by staple crop cultivation. End-user segmentation further clarifies that commercial farming operations, due to their scale and intensive machinery usage, are the primary revenue generators. However, the rapidly expanding residential and small farming segments, supported by affordable and user-friendly compact tillers, represent critical high-growth areas for manufacturers seeking to broaden their consumer base.

- By Product Type:

- Rotary Tillers

- Cultivators (Power Tillers)

- Vertical Tillers

- Other Tillage Equipment

- By Power Source:

- Diesel Powered

- Gasoline Powered

- Electric/Battery Powered

- By Application:

- Agriculture (Row Crops, Orchards, Vineyards)

- Non-Agriculture (Landscaping, Gardening, Turf Management)

- By End User:

- Commercial Farmers

- Small & Marginal Farmers

- Residential/Hobby Farmers

Value Chain Analysis For Tiller Machinery Market

The value chain of the Tiller Machinery Market begins with the upstream activities centered on raw material procurement, including high-grade steel, complex cast iron components, engines (diesel, gasoline, electric motors), and sophisticated hydraulic systems. Key upstream players include major metal processors, engine manufacturers, and specialized component suppliers who provide critical drive train elements and gearboxes. Efficiency and quality control at this stage are paramount, as the durability and performance of the final tiller machinery are heavily dependent on the robustness and resilience of the procured materials, particularly those exposed to abrasive soil conditions and heavy operational loads. Manufacturers typically establish long-term relationships with certified engine and steel suppliers to ensure a steady, reliable, and cost-effective supply chain, managing risks associated with commodity price volatility.

The core midstream segment involves manufacturing, assembly, and testing. This stage includes sophisticated engineering processes such as precision welding, painting, final assembly of chassis and implements, and rigorous quality assurance testing for safety and performance compliance. Major manufacturers often employ highly automated production lines to achieve economies of scale and maintain product consistency. Following production, the machinery moves into the downstream phase, which involves distribution and sales. This distribution network is typically multi-tiered, involving central warehousing, specialized dealers, local retailers, and, increasingly, direct-to-consumer online channels, particularly for smaller, residential-grade equipment. The effectiveness of the distribution channel is heavily reliant on logistics efficiency and the ability to handle large, heavy machinery.

The distribution channel structure differentiates between direct and indirect sales. Direct sales are often utilized for large commercial clients or governmental procurement programs, allowing manufacturers to maintain direct contact, negotiate bulk pricing, and offer customized solutions. Indirect channels, primarily relying on agricultural equipment dealers and distributors, dominate the market, providing essential localized services such as sales consultation, financing options, maintenance, spare parts supply, and post-sales technical support. Dealers act as crucial intermediaries, especially in remote agricultural regions, where their specialized knowledge and ability to offer immediate service are indispensable to the end-user. The aftermarket services component—including repairs, maintenance contracts, and spare parts sales—forms a significant and profitable part of the downstream value chain, ensuring long-term customer engagement and brand loyalty.

Tiller Machinery Market Potential Customers

Potential customers for Tiller Machinery span a broad spectrum of agricultural, horticultural, and specialized land management entities, ranging from multinational corporate farms to individual hobby gardeners. The primary end-users are large-scale commercial farming operations, which require powerful, high-throughput rotary tillers mounted on high-horsepower tractors for extensive acreage preparation in staple crops like corn, wheat, and soybean. These commercial entities prioritize durability, operational speed, integration capabilities with precision farming systems (GPS, guidance), and low total cost of ownership (TCO), making them the largest and most demanding customer segment.

The second major customer segment comprises small and marginal farmers, particularly prevalent across Asia Pacific and Africa. These farmers often utilize smaller, walk-behind power tillers (or two-wheel tractors) which offer a cost-effective, multi-functional alternative to full-sized tractors. Their purchasing decisions are highly sensitive to initial price, fuel efficiency, ease of maintenance, and the availability of local spare parts. Government subsidies and micro-financing schemes significantly influence the purchasing power and adoption rates within this critical demographic, making it a key focus area for manufacturers targeting growth in emerging markets.

Beyond traditional agriculture, the market serves specialized end-users, including vineyard and orchard managers who require narrow, high-clearance tillers for inter-row cultivation; landscaping companies needing medium-sized tillers for residential and commercial site preparation; and turf management professionals. Finally, the residential and consumer segment, composed of home gardeners and hobby farmers, represents a stable market for smaller, often electric or gasoline-powered mini-tillers. This segment values ease of use, compact storage, and minimal environmental impact, driving demand for battery-powered variants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5,500 Million |

| Market Forecast in 2033 | USD 8,185 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deere & Company, Kubota Corporation, CNH Industrial N.V., AGCO Corporation, The Toro Company, Honda Motor Co., Ltd., Yanmar Holdings Co. Ltd., Husqvarna AB, Alamo Group Inc., Mahindra & Mahindra Ltd., TAFE - Tractors and Farm Equipment Limited, CLAAS KGaA mbH, SCHILLER Grounds Care, Inc., Maschio Gaspardo S.p.A., BCS S.p.A., Zhejiang Qianli Machinery Co., Ltd., Falcon Agricultural Implements, Kirloskar Oil Engines Ltd., Jiangsu Woda Agricultural Equipment Co., Ltd., and Earth Tools Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tiller Machinery Market Key Technology Landscape

The Tiller Machinery Market is currently undergoing significant technological evolution, moving beyond basic mechanical improvements toward digital integration and alternative power sources. A critical technological trend is the development of variable-rate tillage systems, which utilize sensors (e.g., soil moisture, density, organic matter sensors) mounted on the tiller to dynamically adjust parameters such as tilling depth and rotor speed. This allows farmers to perform specific, targeted tillage rather than uniform application across the entire field, dramatically improving soil health, optimizing energy consumption, and reducing the incidence of soil compaction and erosion, aligning with modern conservation farming principles.

Another dominant technological shift involves the integration of connectivity and telematics. Modern commercial tillers are now equipped with GPS capabilities for precise guidance and mapping, allowing for highly accurate pass-to-pass operation and overlap reduction. Telematics systems allow manufacturers and farmers to remotely monitor machine performance, track operational hours, diagnose faults proactively, and manage entire fleets efficiently. This connectivity enables sophisticated data logging and analysis, forming the backbone for predictive maintenance and optimizing machine lifespan, thereby providing substantial value addition to high-end tiller models.

The third major technological focus area is the transition toward electric and hybrid power trains. Driven by stricter emission standards and the demand for quieter operation in residential and sensitive environments, manufacturers are heavily investing in lithium-ion battery technology to power compact and medium-sized tillers. While diesel remains dominant for high-torque applications, the electric segment offers superior energy efficiency, reduced maintenance, and zero local emissions. Furthermore, research is ongoing in developing autonomous or semi-autonomous tilling units, leveraging sensor fusion (Lidar, cameras, radar) and sophisticated path planning algorithms to enable self-driving tillage operations, particularly for repetitive tasks in large fields.

Regional Highlights

The Tiller Machinery Market exhibits pronounced regional variations driven by differing agricultural practices, economic development levels, and governmental support structures. Asia Pacific (APAC) dominates the global market, both in terms of volume and value, primarily owing to the massive agricultural base in countries like China, India, and Southeast Asian nations. The region’s reliance on small-to-medium landholdings makes power tillers (two-wheel tractors) an indispensable tool, favored for their low cost and versatility in tight spaces. Government initiatives promoting mechanization and providing subsidies fuel the demand for affordable, reliable machinery, sustaining APAC’s market leadership and driving localized manufacturing strength.

North America and Europe represent the mature markets, characterized by demand for large, high-capacity, and technologically advanced machinery. The focus in these regions is heavily skewed toward precision agriculture, necessitating tractor-mounted rotary tillers and specialized cultivators equipped with GPS and real-time monitoring systems. Manufacturers targeting these regions must comply with stringent environmental regulations and offer premium features such as durability, high fuel efficiency, and seamless integration with existing farm management software. The slow adoption rate of large, conventional tillers, driven by the shift towards no-till or minimum-till farming, is counterbalanced by the high investment in specialized precision tillage tools.

Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions. Latin America, propelled by the expansion of large-scale commercial farming (soybean, sugarcane) in countries like Brazil and Argentina, shows increasing demand for heavy-duty, robust tillers capable of operating across challenging soil conditions. MEA is witnessing rapid mechanization adoption, particularly in South Africa, Nigeria, and Egypt, supported by international development aid and domestic policies aimed at improving food security. These regions prioritize durable, easy-to-maintain equipment that can handle rough operational environments, presenting significant opportunities for manufacturers of diesel-powered and basic rotary tillers.

- Asia Pacific (APAC): Market leader due to small farm reliance on power tillers; strong governmental support for mechanization in India and China; demand focused on affordability and versatility.

- North America: Driven by precision agriculture and heavy-duty, connected rotary tillers; high investment in advanced sensor technology; focus on fuel efficiency and low emissions.

- Europe: High adoption of specialized equipment for vineyards and horticulture; strong regulatory push for electric and environmentally compliant machinery; mature replacement market.

- Latin America: Rapid growth fueled by large-scale commercial cash crop farming; demand for high-torque, durable equipment for challenging soil types.

- Middle East & Africa (MEA): Emerging market with increasing mechanization rates; demand driven by food security initiatives and agricultural development projects; opportunity for reliable, basic, and mid-sized tillers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tiller Machinery Market.- Deere & Company

- Kubota Corporation

- CNH Industrial N.V.

- AGCO Corporation

- The Toro Company

- Honda Motor Co., Ltd.

- Yanmar Holdings Co. Ltd.

- Husqvarna AB

- Alamo Group Inc.

- Mahindra & Mahindra Ltd.

- TAFE - Tractors and Farm Equipment Limited

- CLAAS KGaA mbH

- SCHILLER Grounds Care, Inc.

- Maschio Gaspardo S.p.A.

- BCS S.p.A.

- Zhejiang Qianli Machinery Co., Ltd.

- Falcon Agricultural Implements

- Kirloskar Oil Engines Ltd.

- Jiangsu Woda Agricultural Equipment Co., Ltd.

- Earth Tools Inc.

Frequently Asked Questions

Analyze common user questions about the Tiller Machinery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the shift toward electric tiller machinery?

The shift towards electric tillers is primarily driven by stricter global environmental regulations, the demand for quieter operations (especially in residential areas and greenhouses), lower maintenance requirements compared to combustion engines, and the rising availability of high-density lithium-ion battery technology, offering comparable power output for small to medium-scale operations.

How does precision agriculture technology impact the Tiller Machinery Market?

Precision agriculture fundamentally transforms the market by integrating tillers with GPS, sensors, and telematics systems. This enables variable-rate tillage, allowing the machine to automatically adjust depth and intensity based on real-time soil data, maximizing efficiency, optimizing input use, and reducing soil degradation and fuel consumption.

Which geographical region holds the largest market share for tiller machinery?

Asia Pacific (APAC) holds the largest market share, driven by the region's massive agricultural base, the prevalence of small and fragmented landholdings requiring high-volume usage of affordable power tillers, and robust government subsidies promoting farm mechanization across countries like India and China.

What is the difference between a rotary tiller and a power tiller?

A rotary tiller generally refers to the implement used for secondary tillage, often attached to a tractor (tractor-mounted). A power tiller (or two-wheel tractor) is a self-propelled, walk-behind machine that integrates the engine and the tilling attachment into one unit, commonly used by small farmers for general field and transport tasks.

What restraints are currently limiting the large-scale adoption of advanced tiller machinery?

The key restraints include the high initial capital expenditure required for sophisticated, connected machinery, the lack of sufficient technical knowledge among smallholder farmers to operate and maintain high-tech equipment, and the pervasive issue of fragmented land ownership, which hinders the economical use of very large, high-capacity tillers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager