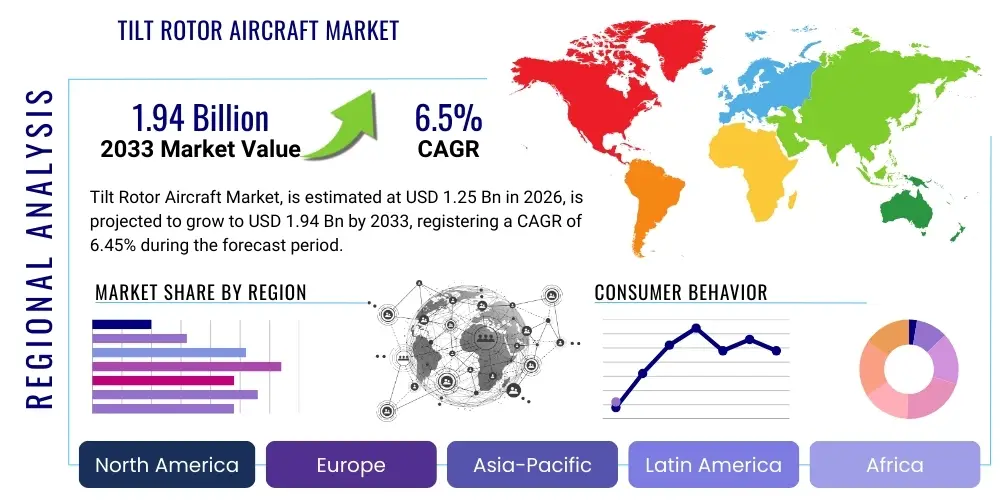

Tilt Rotor Aircraft Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437641 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Tilt Rotor Aircraft Market Size

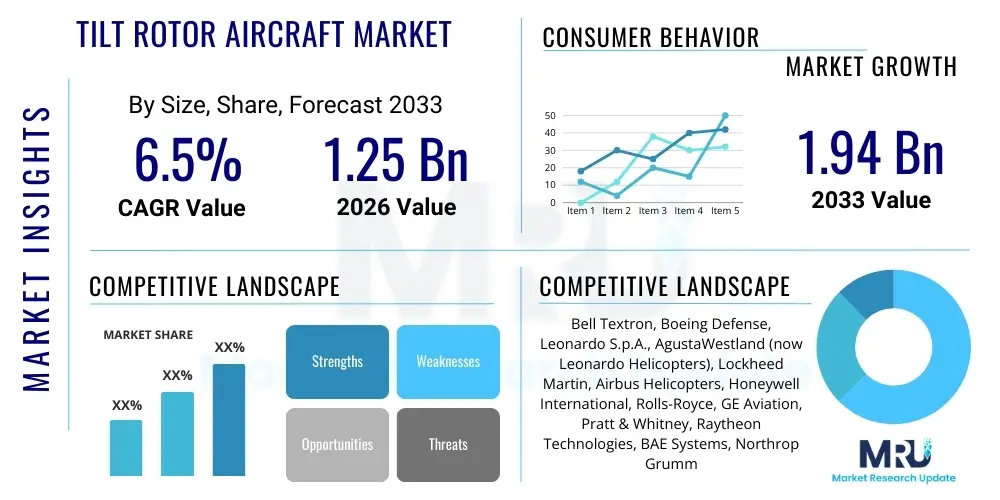

The Tilt Rotor Aircraft Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.45% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.94 Billion by the end of the forecast period in 2033. This consistent growth is primarily fueled by increasing military demand for Vertical Take-Off and Landing (VTOL) capabilities combined with the speed and range of fixed-wing aircraft, especially in specialized operations requiring rapid deployment and covert insertion.

Tilt Rotor Aircraft Market introduction

Tilt Rotor Aircraft represent a revolutionary aerospace technology combining the operational flexibility of a helicopter with the high speed and efficiency of a turboprop airplane. These aircraft achieve this duality through rotors mounted on wingtips that can be tilted vertically for takeoff and landing (helicopter mode) and horizontally for high-speed cruise (airplane mode). This unique capability fundamentally alters mission profiles, allowing access to unprepared landing zones while drastically reducing transit times compared to conventional rotary-wing platforms.

The primary applications of tilt rotor technology currently center heavily on military operations, including troop transport, special operations forces (SOF) insertion and extraction, search and rescue (SAR), and combat logistics. However, the market is gradually expanding into nascent civil applications, particularly in emergency medical services (EMS), offshore energy logistics, and high-net-worth individual transport, where rapid point-to-point travel in congested urban areas or challenging terrains offers a distinct competitive advantage. Key benefits driving adoption include significantly increased range and speed over traditional helicopters, reduced acoustic signature during certain flight phases, and improved survivability due to higher operating altitudes and speeds.

Major driving factors influencing market dynamics encompass the ongoing modernization of global military fleets, particularly in NATO and APAC nations seeking multi-role platforms capable of operating in contested environments. Furthermore, advancements in composite materials, integrated avionics, and flight control systems (specifically fly-by-wire technology) are reducing operational complexities and enhancing the safety profile of these complex machines. The growing interest in commercial applications, though currently limited by certification costs and public perception, acts as a long-term growth opportunity, promising diversified revenue streams beyond traditional defense contracts.

Tilt Rotor Aircraft Market Executive Summary

The Tilt Rotor Aircraft Market is characterized by high barriers to entry, dominated by a few established defense contractors focusing on large, multi-year procurement contracts, predominantly from the U.S. Department of Defense (DoD). Key business trends involve significant investments in next-generation platforms, such as Future Vertical Lift (FVL) programs, which prioritize enhanced range, speed, and connectivity. Market consolidation around major defense primes continues, while technological advancements focus on hybrid electric propulsion systems and autonomous flight capabilities to improve efficiency and reduce pilot workload. Supply chain resilience remains a critical focus area due to the specialized nature of components like transmissions and rotor assemblies.

Regionally, North America maintains overwhelming dominance, largely attributable to the enduring V-22 Osprey program and substantial R&D expenditure by the U.S. government on successor platforms. Europe and the Asia Pacific region are emerging as secondary growth centers, driven by increased defense spending, geopolitical tensions necessitating rapid response capabilities, and a growing recognition of the operational gaps that tilt rotor technology can fill. Specifically, APAC countries are exploring these platforms for maritime surveillance and island hopping logistics, while European nations are participating in collaborative research initiatives focused on next-generation VTOL concepts.

Segment trends highlight the Military segment’s continued lead, with the primary revenue generated from Transport and Utility applications. The development of smaller, potentially unmanned tilt rotor variants is gaining traction, signaling a shift towards versatile platforms adaptable for reconnaissance and light attack roles. The Civil segment, while small, is projected to see the highest relative growth rate as specialized operations, particularly high-speed inter-city connectivity for executive transport and critical organ delivery (EMS), begin to mature and gain regulatory acceptance, eventually reducing the reliance solely on defense budget cycles for market health.

AI Impact Analysis on Tilt Rotor Aircraft Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Tilt Rotor Aircraft Market often revolve around three core themes: enhancement of autonomous capabilities, optimization of flight safety and maintenance, and reduction of pilot burden during complex transitions (vertical to horizontal flight). Users are concerned about how AI-driven systems will manage the complex aerodynamics inherent in tilt rotor operations, particularly during brownout landings or turbulent conditions. Expectations are high regarding AI's ability to process vast sensor data in real-time to predict mechanical failures and schedule proactive maintenance, thereby increasing mission readiness and reducing the total cost of ownership (TCO). Furthermore, the integration of AI for advanced mission planning and dynamic route optimization is frequently questioned, especially concerning operations in contested or GPS-denied environments.

The integration of AI is transforming the operational envelope and sustainment lifecycle of tilt rotor platforms. AI algorithms are crucial for developing advanced diagnostic and prognostic health management systems (PHM), enabling condition-based maintenance (CBM) that predicts component failure, notably in the high-stress gearbox and rotor systems. This transition from reactive to predictive maintenance significantly boosts aircraft availability. Operationally, AI is enhancing flight control stability and precision, providing better handling qualities during the high-workload conversion phase, and aiding pilots in managing complex sensor inputs and tactical decision-making in multi-domain operations. This paves the way for reduced crew requirements and eventually, fully autonomous operations for specific missions like cargo resupply or surveillance.

- AI-Driven Prognostic Health Management (PHM) for critical component failure prediction (e.g., transmissions).

- Autonomous flight control systems facilitating safer transitions between helicopter and fixed-wing modes.

- Enhanced situational awareness via AI processing of complex sensor data for threat detection and avoidance.

- Advanced mission planning tools utilizing machine learning for dynamic route optimization in complex terrain.

- Reduction of pilot cognitive load through intelligent automation of routine flight tasks and system monitoring.

- Enabling of Unmanned Tilt Rotor Systems (UTRS) for high-risk logistics and reconnaissance missions.

DRO & Impact Forces Of Tilt Rotor Aircraft Market

The Tilt Rotor Aircraft Market is simultaneously driven by urgent military requirements for high-speed VTOL capabilities, restrained by the high initial acquisition and operational costs associated with complex engineering, and presented with significant opportunities arising from emerging civil applications and the development of next-generation propulsion systems. The complex interplay of these forces dictates the slow yet steady expansion of the market, which is highly sensitive to national defense spending cycles and global geopolitical instability. Impact forces include intense regulatory scrutiny, particularly concerning noise abatement in urban environments, and the competitive threat posed by advanced conventional helicopters offering better payload capacity, albeit at lower speeds.

Key drivers include the global imperative for fleet modernization, especially the replacement of aging conventional helicopters with platforms offering extended operational reach and reduced response times. Technological maturity, evidenced by the V-22 Osprey’s long service record, has also fostered confidence in the reliability and capability of the tilt rotor concept. Conversely, the market is restrained by the sheer complexity of the airframe, which translates into specialized maintenance requirements, substantial training costs for ground crews and pilots, and comparatively higher cost per flight hour than traditional rotary-wing aircraft. Furthermore, safety incidents, although decreasing, often attract significant negative public and regulatory attention, impacting potential civil adoption.

Opportunities reside in the potential for hybrid-electric tilt rotor designs, promising reduced fuel consumption and lower acoustic footprints, making them more palatable for civil use, such as urban air mobility (UAM) in premium segments. The strong focus on military R&D, particularly within the U.S. Future Vertical Lift ecosystem, ensures a continuous pipeline of technological advancements that can eventually trickle down to commercial variants. Impact forces, driven by Porter’s Five Forces analysis, indicate high supplier power due to specialized component manufacturing, high barriers to entry for new competitors, and moderate rivalry among existing players (Bell, Boeing, Leonardo) vying for limited defense contracts, ensuring price stability remains a significant factor.

Segmentation Analysis

The Tilt Rotor Aircraft Market is segmented primarily based on end-user (Military and Civil), application (Transport, SAR, Attack/Reconnaissance), and component (Airframe, Avionics, Propulsion System). The segmentation reflects the current dominance of government defense spending, which dictates technology progression and market volume. Analyzing these segments provides critical insights into revenue streams, allowing manufacturers and suppliers to tailor their strategies, focusing on the high-volume military logistics sector while cautiously investing in the high-growth, albeit smaller, civil and commercial market segments.

The component segmentation highlights the disproportionate value held by specialized subsystems, particularly the complex proprotor assemblies and gearboxes necessary for the conversion mechanism, which represent significant cost drivers and technological hurdles. The dominance of the Military segment is expected to continue throughout the forecast period due to large-scale modernization programs like the U.S. FVL, although the nascent Civil segment, particularly for specialized logistics and premium transport, is anticipated to accelerate post-2030 as operational costs decrease and regulatory acceptance widens, diversifying the market's revenue base away from reliance on defense appropriations.

- By End-User:

- Military

- Civil/Commercial

- By Application:

- Transport (Troop and Cargo Logistics)

- Search and Rescue (SAR) / Emergency Medical Services (EMS)

- Attack and Reconnaissance

- Special Operations Forces (SOF) Missions

- By Component:

- Airframe and Structure

- Propulsion Systems (Engines and Gearboxes)

- Avionics and Flight Control Systems (Fly-by-Wire)

- Rotor and Proprotor Assemblies

- Landing Gear Systems

Value Chain Analysis For Tilt Rotor Aircraft Market

The value chain for the Tilt Rotor Aircraft Market is characterized by highly specialized, capital-intensive activities with significant integration risks. Upstream activities are dominated by highly skilled suppliers focusing on advanced composite materials manufacturing, precision machining of specialized components (e.g., transmissions and gearboxes), and the development of complex turboshaft engines capable of high torque output. These suppliers often operate under stringent defense standards (AS9100) and require deep collaboration with primary manufacturers due to the low-volume, high-complexity nature of the components, granting them substantial bargaining power.

Midstream activities involve the Original Equipment Manufacturers (OEMs) like Bell, Boeing, and Leonardo, who are responsible for integration, final assembly, rigorous testing, and airworthiness certification. This phase represents the highest value addition, encompassing critical design and engineering expertise, particularly concerning the fly-by-wire flight control systems required to manage the aerodynamic complexities of the conversion phase. The procurement process is often government-led, involving competitive bidding and lengthy contractual negotiations typical of major defense programs.

Downstream activities include distribution, which is predominantly direct-to-government (military contracts) or through specialized defense logistics channels. Post-sales support and maintenance, repair, and overhaul (MRO) services form a critical and highly profitable part of the downstream market. Due to the proprietary nature and complexity of the technology, MRO is often executed or heavily overseen by the OEMs themselves, sometimes under long-term Performance-Based Logistics (PBL) contracts. Indirect distribution channels, such as leasing arrangements for civil applications, remain minimal but represent a future pathway for expanding commercial access.

Tilt Rotor Aircraft Market Potential Customers

The primary customer base for the Tilt Rotor Aircraft Market is unequivocally national defense establishments, specifically the branches requiring rapid insertion/extraction capabilities over long distances, such as the U.S. Marine Corps (USMC), U.S. Special Operations Command (USSOCOM), and naval forces globally seeking shipboard VTOL capabilities. These military buyers prioritize operational performance, reliability in harsh conditions, and interoperability with existing defense architectures, leading to multi-billion-dollar long-term procurement agreements.

A secondary, but increasingly strategic, customer segment includes paramilitary and governmental agencies involved in Homeland Security, border patrol, and high-altitude Search and Rescue missions where the speed and range characteristics of tilt rotor platforms are highly advantageous over traditional helicopters. Furthermore, high-net-worth individuals and corporate flight departments represent the frontier of civil adoption, focusing on premium, high-speed travel between city centers, particularly if future, smaller variants (like the AW609) gain full commercial certification and establish a reliable safety track record, validating the platform's suitability for sophisticated civilian transport needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.94 Billion |

| Growth Rate | 6.45% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bell Textron, Boeing Defense, Leonardo S.p.A., AgustaWestland (now Leonardo Helicopters), Lockheed Martin, Airbus Helicopters, Honeywell International, Rolls-Royce, GE Aviation, Pratt & Whitney, Raytheon Technologies, BAE Systems, Northrop Grumman, Safran S.A., Aviation Industry Corporation of China (AVIC), Kratos Defense & Security Solutions, MD Helicopters, Sikorsky (a Lockheed Martin Company). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tilt Rotor Aircraft Market Key Technology Landscape

The technological landscape of the Tilt Rotor Aircraft Market is dominated by advancements in complex electromechanical and aerodynamic systems crucial for reliable and safe flight envelope expansion. Central to this technology is the integration of advanced fly-by-wire (FBW) flight control systems. FBW systems are indispensable because they manage the highly dynamic transition phase, seamlessly blending rotary-wing and fixed-wing flight characteristics, compensating for aerodynamic instabilities that are inherent when the proprotors are transitioning from the vertical to the horizontal position. Continuous software refinement and redundancy in these electronic controls are paramount to meeting stringent airworthiness standards and improving pilot workload, especially in adverse weather conditions.

Another crucial area involves propulsion and transmission technology. Tilt rotor aircraft require specialized transmissions (gearboxes) capable of operating efficiently and reliably under extreme loads, routing engine power both to the rotors for vertical flight and to the propellers for forward flight, often requiring complex cross-shafting mechanisms to ensure engine redundancy. Recent technological focus includes the development of more powerful, fuel-efficient turboshaft engines and the integration of Prognostic Health Management (PHM) sensors directly into the gearboxes to monitor stress and vibration, predicting potential failures long before catastrophic events, thereby significantly improving the safety profile and reducing unscheduled maintenance downtime.

Looking ahead, the market is heavily investing in composite materials for airframe construction to reduce weight, increase payload capacity, and improve radar cross-section (RCS) characteristics for military variants. Furthermore, significant research is being directed towards hybrid and fully electric propulsion concepts. These future systems aim to dramatically lower noise emissions, making urban operations viable, and potentially reducing the complexity and cost associated with mechanical transmissions by utilizing distributed electric propulsion (DEP) concepts, which would revolutionize the form factor and operational flexibility of next-generation tilt rotor platforms beyond current design limitations.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most technologically advanced market globally, driven almost entirely by substantial defense spending and the ongoing sustainment and upgrade programs for the V-22 Osprey (Bell/Boeing). The region serves as the primary hub for R&D, hosting key government initiatives such as the Future Vertical Lift (FVL) program, which aims to develop the next generation of high-speed, long-range vertical lift aircraft, ensuring sustained market leadership and technological primacy throughout the forecast period.

- Europe: Europe is characterized by collaborative research and a rising interest in indigenous tilt rotor capabilities, often driven by multi-national defense projects. Key drivers include requirements for rapid deployment capabilities in conflict zones and search and rescue missions across vast maritime territories. While procurement volumes are smaller than in the US, European manufacturers (like Leonardo with the AW609) are focusing heavily on securing civil certification, positioning the region as a critical testbed for commercial market expansion, particularly in high-end corporate transport and specialized EMS.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, fueled by escalating geopolitical tensions, particularly in maritime disputes, leading to aggressive defense budget increases. Countries like Japan, South Korea, and Australia are actively seeking high-speed VTOL platforms to enhance island defense, naval logistics, and rapid disaster response capabilities. The region provides a substantial opportunity for manufacturers through Foreign Military Sales (FMS) and local manufacturing partnerships aimed at supporting complex regional security requirements and modernizing aging helicopter fleets.

- Latin America & Middle East and Africa (MEA): These regions represent niche markets currently focused on conventional platforms but show future potential, especially in MEA, where military customers require long-range SAR, patrol, and logistical transport capabilities across vast, harsh desert or coastal environments. Procurement in these regions is heavily reliant on defense alliances and specific counter-insurgency requirements, driving demand for platforms offering enhanced speed, range, and operational altitude capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tilt Rotor Aircraft Market.- Bell Textron Inc.

- Boeing Defense, Space & Security

- Leonardo S.p.A. (including Leonardo Helicopters)

- Lockheed Martin Corporation

- Airbus Helicopters

- Rolls-Royce plc

- GE Aviation

- Pratt & Whitney (Raytheon Technologies)

- Safran S.A.

- Honeywell International Inc.

- BAE Systems plc

- Northrop Grumman Corporation

- Kratos Defense & Security Solutions

- AgustaWestland (now part of Leonardo)

- Oshkosh Defense

- Triumph Group

- Parker Hannifin Corporation

- L3Harris Technologies

- Aviation Industry Corporation of China (AVIC)

- Sikorsky Aircraft Corporation (A Lockheed Martin Company)

Frequently Asked Questions

Analyze common user questions about the Tilt Rotor Aircraft market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary operational advantages of tilt rotor aircraft compared to conventional helicopters?

Tilt rotor aircraft offer superior speed and range, effectively bridging the gap between rotary-wing and fixed-wing performance. They can achieve cruise speeds up to 300 knots and cover significantly greater distances than traditional helicopters, while retaining the essential capability of Vertical Take-Off and Landing (VTOL) for operations in confined or unprepared landing zones.

Why are acquisition and operational costs for tilt rotor aircraft significantly high?

High costs stem primarily from the inherent complexity of the conversion mechanism, requiring highly specialized transmissions, robust cross-shafting systems, and advanced, redundant fly-by-wire flight control systems. These specialized components necessitate intensive R&D, low-volume precision manufacturing, and highly specialized maintenance, driving up both the initial acquisition price and the cost per flight hour.

How is the market addressing safety concerns related to the complex transition phase?

Safety is being enhanced through continuous technological refinement, focusing on advanced automated flight control systems (fly-by-wire) that automatically manage aerodynamic instabilities during the transition between vertical and horizontal flight. Additionally, sophisticated Prognostic Health Management (PHM) systems are integrated to monitor component health in real-time, predicting failures, especially in high-stress components like the gearboxes.

Which regions are expected to drive future demand for tilt rotor technology?

North America will continue to dominate due to ongoing military modernization programs (FVL), but the Asia Pacific (APAC) region is projected to register the fastest growth. APAC demand is driven by increasing defense spending, maritime security requirements, and the necessity for rapid logistical transport across island chains, making the long-range, high-speed capabilities of tilt rotors highly desirable.

What role will hybrid electric propulsion play in the future of tilt rotor aircraft?

Hybrid electric propulsion is crucial for unlocking the commercial potential of tilt rotors. By replacing or supplementing traditional turboshaft engines, hybrid systems aim to significantly reduce noise emissions and fuel consumption, thereby lowering operational costs and making the technology viable for noise-sensitive civil applications like executive transport and eventual integration into advanced Urban Air Mobility (UAM) ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager