Timing Cover Gasket Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440015 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Timing Cover Gasket Market Size

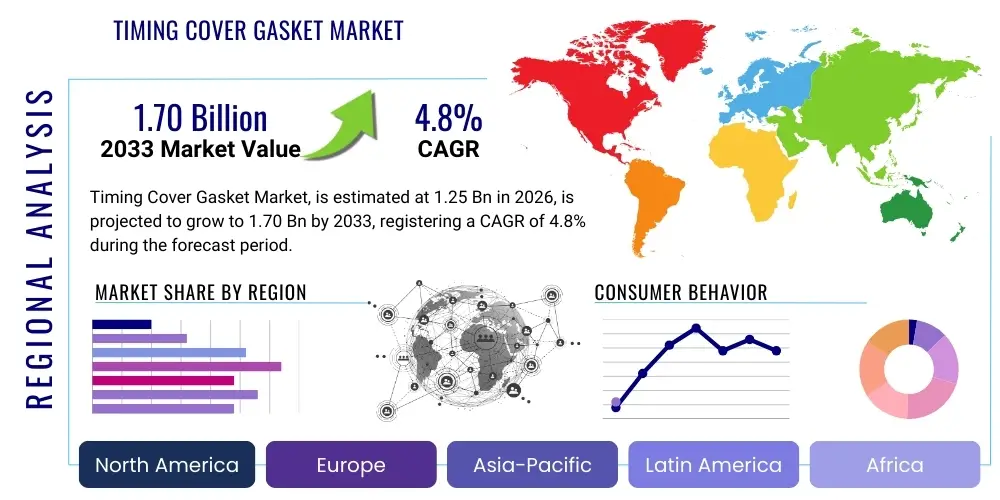

The Timing Cover Gasket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.70 Billion by the end of the forecast period in 2033. This growth is underpinned by a consistent demand in the automotive sector, driven by both new vehicle production and the expansive aftermarket for maintenance and repair of internal combustion engine vehicles globally. The market's resilience is further supported by advancements in material science and manufacturing processes, leading to more durable and efficient gasket solutions that enhance engine longevity and performance, contributing to its steady expansion.

Timing Cover Gasket Market introduction

The Timing Cover Gasket Market encompasses the manufacturing, distribution, and sales of sealing components specifically designed for the timing cover of internal combustion engines. These gaskets are crucial for maintaining engine integrity by preventing the leakage of oil and coolant from the timing chain or belt housing, while simultaneously protecting critical timing components from external contaminants such as dirt, debris, and moisture. The product's fundamental role ensures the proper lubrication and operational efficiency of the engine, directly impacting vehicle reliability and environmental compliance through leak prevention. Major applications span across a vast spectrum of vehicles, including passenger cars, light commercial vehicles, heavy-duty trucks, and various industrial equipment powered by internal combustion engines, making them an indispensable component in the global automotive and machinery industries.

The primary benefit of a high-quality timing cover gasket lies in its ability to securely seal the engine's timing system, which is paramount for the engine's long-term health and performance. By effectively containing lubricating fluids, these gaskets prevent costly repairs associated with oil starvation or contamination of the timing mechanism, thereby extending the lifespan of engine components and reducing maintenance frequency. Key driving factors for this market include the sustained global production of internal combustion engine vehicles, the increasing average age of the operational vehicle parc necessitating replacement parts, and the continuous demand for enhanced engine efficiency and reliability. Furthermore, stringent environmental regulations aimed at reducing fluid leaks and emissions also act as a significant driver, pushing manufacturers towards developing more durable and effective sealing solutions to meet evolving industry standards and consumer expectations.

Timing Cover Gasket Market Executive Summary

The Timing Cover Gasket Market is characterized by dynamic shifts influenced by global automotive production trends, regional economic development, and evolving technological landscapes. Business trends indicate a strong focus on advanced material development, particularly high-performance rubber and silicone compounds, to meet increasing demands for durability and resistance to extreme engine conditions. Consolidation within the supplier base is also observed, as larger entities acquire specialized manufacturers to expand their product portfolios and geographical reach. Furthermore, the market experiences a dual demand structure with robust growth in the OEM segment driven by new vehicle sales, complemented by a substantial and growing aftermarket segment fueled by vehicle aging and routine maintenance cycles, leading to consistent revenue streams across both channels. This balance necessitates flexible manufacturing and distribution strategies to cater to the distinct requirements of each market.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, propelled by burgeoning automotive manufacturing hubs in countries like China, India, and Southeast Asian nations, coupled with a rapidly expanding middle class and increasing vehicle ownership. Mature markets such as North America and Europe, while experiencing slower new vehicle growth, contribute significantly through their expansive aftermarket sectors and demand for premium, long-lasting replacement parts, often influenced by stringent regulatory frameworks for vehicle emissions and safety. Segment-wise, the market sees a steady preference for high-quality, engineered materials that offer superior sealing performance and extended service life. The original equipment manufacturer (OEM) segment prioritizes precision engineering and cost-effectiveness for mass production, while the aftermarket segment increasingly seeks reliable, durable, and easily installable solutions that promise longevity and minimal rework for service centers and individual consumers alike. This segmentation underscores the diverse needs within the market and the strategic importance of tailoring products and services to specific end-user categories for sustained competitive advantage.

AI Impact Analysis on Timing Cover Gasket Market

The integration of Artificial intelligence (AI) is poised to significantly transform various facets of the Timing Cover Gasket Market, addressing common user questions related to manufacturing precision, material innovation, product reliability, and supply chain efficiency. Users frequently inquire about how AI can enhance the durability of gaskets, predict their lifespan, and optimize production costs. The general expectation is that AI will lead to smarter manufacturing processes, enabling the development of next-generation sealing solutions that are more resilient to harsh engine environments and capable of intelligent monitoring. This technological shift is anticipated to streamline operations from design to end-use, ultimately delivering higher quality, more reliable timing cover gaskets to both original equipment manufacturers and the aftermarket, thereby elevating overall engine performance and maintenance predictability.

- AI-driven material science for developing advanced, durable gasket compounds, optimizing properties like heat resistance, elasticity, and chemical inertness.

- Optimized manufacturing processes through AI-powered robotics, predictive analytics for equipment maintenance, and enhanced quality control systems for defect detection.

- Predictive maintenance algorithms for early gasket failure detection in vehicles, leading to proactive replacements and reduced engine damage.

- Enhanced supply chain management and inventory optimization using AI analytics to forecast demand, manage logistics, and mitigate risks.

- AI-assisted design and simulation for improved gasket geometry, fitment accuracy, and sealing performance under various operational conditions.

- Automated inspection systems utilizing computer vision and machine learning to ensure high-precision manufacturing and adherence to stringent quality standards.

- Personalized product development and customization capabilities based on specific engine requirements or regional environmental factors, guided by AI-driven insights.

DRO & Impact Forces Of Timing Cover Gasket Market

The Timing Cover Gasket Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and competitive landscape. Key drivers include the sustained global production of internal combustion engine (ICE) vehicles, particularly in emerging economies where automotive demand continues to rise, and the ever-growing average age of vehicles in operation, which consistently fuels the aftermarket for replacement parts. Furthermore, an increasing emphasis on engine longevity, fuel efficiency, and stricter environmental regulations compelling manufacturers to prevent oil leaks are significant factors pushing demand for high-performance and reliable sealing solutions. These drivers collectively ensure a foundational demand for timing cover gaskets across both original equipment and service segments, maintaining market stability and encouraging innovation in product design and materials.

Conversely, significant restraints challenge the market's expansion, most notably the accelerating global transition towards electric vehicles (EVs), which inherently possess fewer or no traditional engine gaskets, posing a long-term threat to demand. Volatility in raw material prices, particularly for critical polymers like silicone and rubber, directly impacts manufacturing costs and profit margins. Additionally, the market faces intense competition from both established players and new entrants, leading to pricing pressures and a continuous need for product differentiation and cost efficiency. Opportunities within this landscape arise from the ongoing development of advanced, high-performance materials such as fluoroelastomers and enhanced silicones that offer superior durability and sealing capabilities, catering to demanding engine environments. Expansion into emerging automotive markets, particularly in Asia Pacific and Latin America, presents untapped growth potential. Moreover, the aftermarket segment offers lucrative opportunities for premium replacement parts that provide extended warranties and improved performance over standard components. The overarching impact forces include rapid technological advancements in material science and manufacturing processes, evolving regulatory mandates concerning vehicle emissions and safety, global economic conditions influencing automotive sales and consumer spending, and potential disruptions in global supply chains that affect raw material availability and production schedules. Navigating these forces requires strategic foresight, continuous innovation, and adaptable business models to sustain growth and maintain market relevance.

Segmentation Analysis

The Timing Cover Gasket Market is meticulously segmented across various critical dimensions, providing a granular understanding of its dynamics and diverse consumer needs. These segments include the types of materials used in gasket manufacturing, the specific vehicle types they are designed for, and the primary sales channels through which they reach end-users. This detailed segmentation is crucial for stakeholders to identify lucrative niches, tailor product development, refine marketing strategies, and optimize distribution networks. By analyzing these distinct categories, market participants can better understand the unique demands and competitive landscapes within each segment, enabling them to strategically position their offerings and capitalize on specific growth opportunities in a rapidly evolving automotive industry. The material segment reflects technological advancements and performance requirements, while vehicle type and sales channel segments highlight demand patterns and market access strategies, respectively.

- By Material:

- Rubber (Nitrile Rubber (NBR), Ethylene Propylene Diene Monomer (EPDM), Fluorocarbon Rubber (Viton))

- Silicone

- Cork and Cork-Rubber Composites

- Composites (Fiber-based, Multi-layered Steel (MLS) variants for specific applications)

- Other Advanced Polymers and Elastomers

- By Vehicle Type:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks, Minivans)

- Commercial Vehicles (Light Commercial Vehicles, Medium and Heavy-Duty Trucks, Buses, Coaches)

- Industrial and Off-Highway Vehicles (Construction Equipment, Agricultural Machinery, Marine Engines)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Independent Aftermarket (IAM), Original Equipment Service (OES), Retail Stores, Online Platforms)

Value Chain Analysis For Timing Cover Gasket Market

A comprehensive Value Chain Analysis for the Timing Cover Gasket Market begins with the upstream activities centered on raw material procurement and processing. This stage involves suppliers of specialized polymers such as various types of rubber (e.g., NBR, EPDM, Viton), silicone compounds, cork, and composite materials, along with manufacturers of metal inserts or reinforcing fibers. Key factors at this stage include material quality, cost-effectiveness, supply chain reliability, and adherence to environmental and performance specifications. The consistency and quality of these foundational materials directly impact the final gasket's durability and sealing efficacy, making strong supplier relationships and rigorous quality control paramount for timing cover gasket manufacturers.

Moving downstream, the value chain encompasses the manufacturing process, which involves precision molding, stamping, cutting, and assembly of the gaskets, often utilizing advanced automated techniques. Following manufacturing, products move through various distribution channels to reach end-users. Direct distribution channels primarily involve sales to Original Equipment Manufacturers (OEMs), where gaskets are supplied directly to automotive and engine assembly plants for integration into new vehicles. This channel demands high volumes, stringent quality controls, and just-in-time delivery capabilities. Indirect distribution channels cater to the aftermarket, comprising sales through large automotive parts wholesalers, national and regional distributors, specialized retailers, and a growing segment of online e-commerce platforms. These channels often require different packaging, branding, and inventory management strategies to effectively reach independent repair shops, fleet operators, and individual consumers. The efficiency of both direct and indirect distribution networks is critical for market penetration and timely product availability, influencing the overall customer satisfaction and market share for timing cover gasket suppliers.

Timing Cover Gasket Market Potential Customers

The Timing Cover Gasket Market serves a diverse range of potential customers, primarily segmented by their role in the automotive and industrial ecosystems. The largest segment of end-users comprises Original Equipment Manufacturers (OEMs) of automobiles, including major global car, truck, and bus manufacturers, as well as specialized engine manufacturers for industrial, marine, and power generation applications. These customers require high volumes of precisely engineered gaskets that meet strict performance, durability, and cost specifications for integration into new vehicle and engine assemblies. Establishing long-term supply agreements and demonstrating consistent quality are critical to serving the OEM segment, which often involves collaborative design and rigorous validation processes to ensure seamless integration and optimal engine performance.

Beyond the OEM segment, a substantial portion of the market caters to the aftermarket, addressing the replacement and repair needs of existing vehicles and machinery. Key buyers in this segment include large automotive aftermarket distributors and wholesalers who supply parts to an extensive network of independent auto repair shops, franchised service centers, and specialized garages. Fleet operators, who manage large numbers of vehicles for commercial purposes, also represent significant end-users, requiring reliable and readily available replacement parts for their maintenance schedules. Furthermore, a growing segment of individual vehicle owners engaging in do-it-yourself (DIY) repairs, often facilitated by online retail platforms, constitutes another important customer group. Each of these customer categories possesses unique purchasing criteria, ranging from price and brand reputation to product availability and ease of installation, requiring tailored marketing and distribution strategies from timing cover gasket suppliers to effectively capture their diverse demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dana Incorporated, Tenneco (Federal-Mogul), Freudenberg Sealing Technologies, ElringKlinger AG, Victor Reinz (Dana), Nippon Leakless Corporation, Trelleborg AB, Cooper Standard, James Walker & Co Ltd, Datwyler Holding AG, Ishikawa Gasket Co., Ltd., Athena S.p.A., Ajusa, Corteco (Freudenberg), MAHLE GmbH, NOK Corporation, Parker Hannifin Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Timing Cover Gasket Market Key Technology Landscape

The Timing Cover Gasket Market is significantly influenced by a constantly evolving technological landscape, driven by the need for enhanced durability, improved sealing performance, and cost-effectiveness in diverse engine environments. A pivotal aspect of this landscape is advanced material science, focusing on the development of high-performance elastomeric compounds such as specialized nitriles, EPDM, and fluorocarbon rubbers like Viton, which offer superior resistance to extreme temperatures, aggressive engine oils, and various chemicals. Silicones, known for their excellent flexibility and heat stability, continue to be refined for specific applications. Moreover, the integration of composite materials, including cork-rubber blends and fiber-reinforced polymers, is crucial for creating gaskets that can withstand dynamic stresses and provide consistent sealing over extended periods, addressing the challenges posed by modern engine designs that operate at higher temperatures and pressures.

Beyond material innovation, precision manufacturing technologies play a critical role in producing high-quality timing cover gaskets. This includes advanced molding techniques, such as injection molding and compression molding, which ensure precise dimensions and intricate geometries for optimal fitment and sealing integrity. Automated cutting technologies, like waterjet or laser cutting, allow for high accuracy and consistency in gasket profiles, minimizing material waste and enhancing production efficiency. Furthermore, surface treatment technologies applied to gasket materials or mating surfaces are gaining prominence, aiming to improve adhesion, reduce friction, and enhance the overall sealing interface. The adoption of computer-aided design (CAD) and finite element analysis (FEA) for virtual prototyping and performance simulation allows manufacturers to optimize gasket designs before physical production, accelerating development cycles and ensuring that new products meet the rigorous demands of modern engines, thereby reinforcing the market's technological advancement.

Regional Highlights

- North America: A mature market characterized by a strong aftermarket segment driven by an aging vehicle parc and consumer preference for premium replacement parts. The region also features significant OEM presence with a focus on high-performance and durable components. Strict environmental regulations and a culture of proactive vehicle maintenance contribute to stable demand.

- Europe: Demand is shaped by stringent emission standards, pushing for innovative sealing solutions that prevent leaks and contribute to engine efficiency. The European market emphasizes advanced materials and precision engineering, with a strong focus on both the OEM and sophisticated aftermarket sectors. Germany, France, and the UK are key contributors.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by robust automotive production in countries like China, India, and Japan, alongside a rapidly expanding vehicle parc. Economic growth, increasing disposable incomes, and urbanization are driving both new vehicle sales and a booming aftermarket demand for timing cover gaskets.

- Latin America: An emerging market experiencing increasing vehicle production and a growing aftermarket due to an expanding middle class and industrial development. The region presents opportunities for suppliers focused on cost-effective yet reliable gasket solutions, with Brazil and Mexico being significant automotive manufacturing hubs.

- Middle East and Africa (MEA): This region exhibits gradual growth, primarily driven by expanding automotive sales and infrastructure development, particularly in GCC countries and South Africa. The market is largely reliant on imported vehicles and parts, with a developing local aftermarket demand influenced by vehicle maintenance cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Timing Cover Gasket Market.- Dana Incorporated

- Tenneco (Federal-Mogul)

- Freudenberg Sealing Technologies

- ElringKlinger AG

- Victor Reinz (a brand of Dana Incorporated)

- Nippon Leakless Corporation

- Trelleborg AB

- Cooper Standard

- James Walker & Co Ltd

- Datwyler Holding AG

- Ishikawa Gasket Co., Ltd.

- Athena S.p.A.

- Ajusa

- Corteco (part of Freudenberg)

- MAHLE GmbH

- NOK Corporation

- Parker Hannifin Corporation

Frequently Asked Questions

What is a timing cover gasket and why is it important?

A timing cover gasket is a critical sealing component in internal combustion engines that prevents oil and coolant leaks from the timing chain or belt housing. Its importance lies in protecting the engine's vital timing components from contaminants and ensuring proper lubrication, which is essential for engine longevity and efficient operation.

What are the common symptoms of a bad timing cover gasket?

Common symptoms of a failing timing cover gasket include visible oil leaks around the front of the engine, often accumulating on the ground beneath the vehicle. Other signs can include a noticeable burning oil smell, engine oil levels dropping more quickly than usual, and in severe cases, engine overheating if coolant is also leaking from the timing cover area.

How often should a timing cover gasket be replaced?

The replacement frequency for a timing cover gasket is not typically set by a strict maintenance schedule but rather by its condition. It is generally replaced when signs of leakage appear or when other major engine work, such as timing chain replacement, necessitates its removal. Factors like vehicle age, mileage, and driving conditions can influence its lifespan, making regular inspections advisable.

What materials are typically used for timing cover gaskets?

Timing cover gaskets are commonly made from various materials, including rubber (such as Nitrile, EPDM, or Viton), silicone, cork, and composite materials like cork-rubber blends or fiber-based compounds. The choice of material depends on specific engine requirements, operating temperatures, chemical resistance needs, and the overall design for optimal sealing performance.

Can I replace a timing cover gasket myself?

Replacing a timing cover gasket is generally considered a complex automotive repair that requires specialized tools, significant mechanical knowledge, and attention to detail. It involves removing multiple engine components to access the timing cover. While possible for experienced DIY mechanics, it is often recommended that this repair be performed by a certified professional to ensure proper installation and prevent further engine damage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager