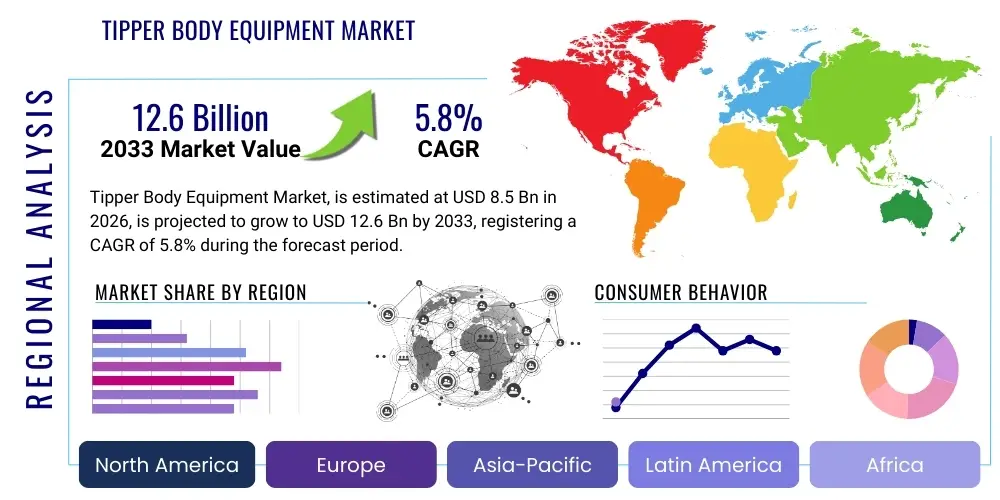

Tipper Body Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438196 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Tipper Body Equipment Market Size

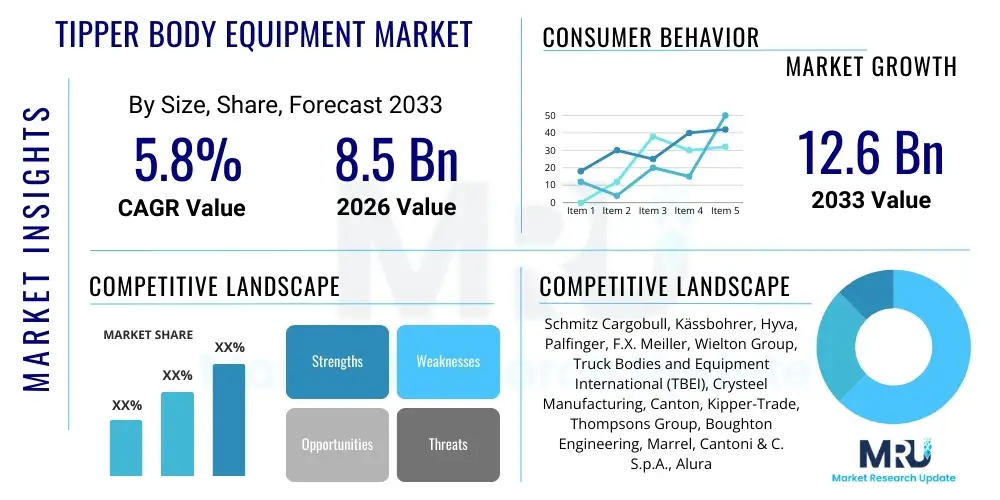

The Tipper Body Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033.

Tipper Body Equipment Market introduction

The Tipper Body Equipment Market encompasses the manufacturing, distribution, and utilization of specialized body systems designed for heavy and medium commercial vehicles primarily used for transporting bulk materials such as sand, gravel, soil, coal, and construction debris. Tipper bodies, characterized by a mechanism that allows the vehicle's body to tilt or dump its contents, are indispensable across core industrial sectors, particularly construction, mining, and waste management. These systems typically utilize robust hydraulic or pneumatic mechanisms to facilitate efficient unloading, significantly improving logistical turnaround times on project sites. The intrinsic benefits of modern tipper bodies include enhanced payload capacity through the use of lightweight, high-tensile materials like specialized aluminum alloys, improved operational safety via advanced electronic controls, and increased durability to withstand harsh operating environments. Driving factors propelling market expansion include massive global governmental investments in infrastructure development, rapid urbanization leading to increased residential and commercial construction activities, and the growing demand for efficient waste collection and material transport solutions in emerging economies, necessitating robust and reliable transport equipment.

Tipper Body Equipment Market Executive Summary

The global Tipper Body Equipment Market is characterized by a significant shift toward technology integration and material innovation aimed at improving fuel efficiency and regulatory compliance. Current business trends heavily favor modular and customized tipper solutions tailored for specific load types and chassis configurations, while also prioritizing the integration of telematics for asset tracking and predictive maintenance. Regionally, the Asia Pacific (APAC) stands as the dominant market, driven by unprecedented large-scale infrastructure projects in India, China, and Southeast Asian nations, although North America and Europe are showing strong growth in specialized segments focused on regulatory adherence and sustainability, particularly related to electric vehicle compatibility. Segment trends indicate a rising preference for lightweight aluminum tipper bodies over traditional steel bodies, primarily due to the benefits of higher permissible payloads and reduced operational wear, coupled with sustained demand for rear-tippers in standard construction and side-tippers in highly restricted or specialized mining environments, underlining a market that values efficiency, material innovation, and safety above all else.

AI Impact Analysis on Tipper Body Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) will transform the operational safety and efficiency of tipper bodies, focusing particularly on automated load management, intelligent tipping sequence control, and predictive maintenance protocols. The general expectation centers on AI's ability to minimize human error during complex maneuvers, thereby reducing accident rates, and optimizing fleet utilization by preemptively addressing mechanical failures. Key user concerns revolve around the integration costs of sophisticated sensor arrays and AI processing units into traditional heavy-duty equipment, questions of cybersecurity for connected tipper fleets, and the reliability of AI models in unpredictable, rugged off-road operating conditions typical of mining and construction sites. Furthermore, industry stakeholders are keenly interested in AI’s role in optimizing the loading distribution within the tipper body itself, ensuring legal weight limits are adhered to automatically, and maximizing fuel efficiency across the vehicle lifecycle.

The implementation of AI algorithms in the Tipper Body Equipment Market is set to revolutionize several operational facets, moving the industry toward 'smart dumping' systems. AI will primarily facilitate advanced monitoring of hydraulic pressure, chassis inclination, and payload kinetics in real-time, allowing the system to automatically adjust tipping angles and speed based on material viscosity and ground stability. This integration leads to a dramatic decrease in the risk of rollovers, which are a major safety concern in the industry. Moreover, AI-driven predictive maintenance scheduling will utilize machine learning models trained on sensor data (vibration, heat, usage cycles) to forecast potential failures in critical components like hydraulic cylinders and hinge mechanisms, significantly extending component life and minimizing unplanned downtime, a critical factor for high-utilization assets.

In addition to safety and maintenance, AI is optimizing the commercial aspect of tipper operations. AI-powered routing and scheduling systems, informed by real-time fleet data and project timelines, ensure that tippers operate along the most efficient paths, thereby reducing fuel consumption and operational expenditure. Furthermore, integrated machine vision and weight sensors, processed by AI, ensure accurate compliance with axle load regulations globally. This capability not only prevents costly fines but also protects infrastructure from unnecessary wear and tear. The increasing complexity of regulatory environments, especially concerning emissions and load limits, makes AI integration a crucial component for futureproofing tipper body designs and achieving operational excellence across geographically diverse fleet deployments.

- AI-driven predictive failure analysis optimizes maintenance schedules for hydraulic and structural components.

- Intelligent tipping systems utilize sensor fusion and AI to prevent rollovers by dynamically adjusting tilt based on ground stability and load movement.

- Automated load distribution monitoring ensures precise weight compliance and maximizes payload efficiency, avoiding regulatory penalties.

- Machine learning enhances route optimization for tipper fleets, minimizing idle time and fuel consumption in dynamic project environments.

- AI facilitates the development of self-diagnosing tipper systems, reducing the reliance on manual inspections and specialized technicians.

DRO & Impact Forces Of Tipper Body Equipment Market

The Tipper Body Equipment Market's trajectory is primarily driven by extensive global government spending on critical infrastructure projects, particularly in developing nations, coupled with continuous population shift towards urban centers demanding massive construction inputs. Restraining the market are stringent governmental regulations regarding vehicle weight and emissions, which necessitate costly material and design modifications, alongside the high initial capital investment required for specialized, heavy-duty tipper chassis and equipment. Opportunities are abundant in the adoption of advanced materials (carbon fiber composites, high-strength low-alloy steel) for weight reduction, the integration of advanced telematics and IoT devices for real-time monitoring, and the surging demand for tippers compatible with electric and hydrogen-powered commercial vehicles. These forces collectively shape a market environment focused intensely on maximizing efficiency, improving operator safety, and ensuring environmental compliance.

Segmentation Analysis

The Tipper Body Equipment Market is highly fragmented and segmented based on multiple technical and application-specific criteria, reflecting the diverse material transport needs across industries such as mining, construction, and waste management. Analysis of these segments is crucial for understanding specific market dynamics, technological adoption rates, and regional demand patterns. Key segmentation focuses on the body type, defining whether the tipping occurs primarily to the rear (most common) or to the side (specialized maneuverability), the materials used in construction (which directly impact payload and durability), and the mechanism employed for lifting the body (hydraulic systems being the industry standard). The increasing emphasis on sustainable practices is also creating a viable sub-segment for specialized bodies designed for green waste transport or recycling logistics. These segments often experience varying growth rates influenced by local regulatory frameworks and specific commodity prices globally.

Detailed examination of the market reveals that segmentation by application, particularly mining versus standard construction, dictates the required robustness and size of the equipment, with mining tippers demanding much higher tensile strength and capacity. Furthermore, the segmentation by load capacity—light-duty, medium-duty, and heavy-duty—is directly linked to the chassis size and the target industry, with heavy-duty segments consistently showing higher revenue concentration due to high-value extraction projects. The adoption rate of advanced materials, such as specific grades of hardened steel versus advanced aluminum alloys, serves as a significant differentiator within the market, especially where strict weight-to-payload ratios are enforced by local traffic authorities. This comprehensive segmentation allows manufacturers to target specific niche requirements, offering bespoke solutions ranging from narrow-body underground mine haulers to large volume highway-legal transport units.

- By Body Type:

- Rear Tipper/End Tipper

- Side Tipper

- Three-Way Tipper

- Roll-off Tipper (Hooklift)

- By Material:

- Steel (High Tensile Steel, Wear-Resistant Steel)

- Aluminum Alloys (Lightweight, Corrosion Resistant)

- Other Composites

- By Mechanism:

- Hydraulic Tipping Mechanism (Most Dominant)

- Pneumatic Tipping Mechanism

- By Application:

- Construction (Civil and Infrastructure)

- Mining and Quarrying

- Waste Management and Recycling

- Logistics and Transport (Bulk Commodities)

- By Load Capacity:

- Light Duty (Below 10 Ton)

- Medium Duty (10-25 Ton)

- Heavy Duty (Above 25 Ton)

Value Chain Analysis For Tipper Body Equipment Market

The value chain for the Tipper Body Equipment Market begins with upstream activities involving the sourcing of raw materials, primarily high-strength steel, aluminum, and advanced hydraulic components (pumps, cylinders, and valves). Key suppliers in this stage include specialized metal processors and hydraulic system manufacturers, whose pricing and quality directly influence the final product cost and performance. Following material sourcing, manufacturers engage in design, cutting, welding, and assembly, often leveraging sophisticated robotic welding techniques and computer-aided design to ensure structural integrity and precise dimensioning. Midstream activities encompass the manufacturing process itself, where specialization occurs in body lining (e.g., polymer lining for sticky materials) and customization to fit various chassis brands and regulatory standards globally. Efficient supply chain management at this stage is crucial due to the large, bulky nature of the components and the customization required for specific end-user applications.

The downstream segment focuses on distribution, sales, and aftermarket services. Tipper bodies are distributed through several channels: direct sales to major fleet operators or large government contractors, indirect sales via established commercial vehicle dealerships (who often integrate the body onto the chassis), and specialized equipment distributors. The choice between direct and indirect channels often depends on the geographic reach and the scale of the customer. Direct channels facilitate extensive customization and maintenance contracts, while indirect channels provide wider market access and financing options. Aftermarket services, including maintenance, repair, and replacement part supply (especially wear parts like floor plates and tailgates), represent a critical revenue stream and contribute significantly to customer retention and brand loyalty throughout the equipment's long operational life.

Integration of distribution channels is evolving, with digital platforms increasingly used for ordering standardized parts and conducting initial inquiries. Direct distribution is common for large fleet orders where extensive technical consultation is required to match the tipper body specifications precisely to the vehicle chassis and the intended use case, often involving complex weight distribution calculations. Indirect channels, relying on global dealership networks of commercial vehicle manufacturers (e.g., Volvo, Daimler, MAN), remain vital as they offer local support, financing packages, and integrated sales solutions, making it simpler for smaller and medium-sized enterprises to acquire the necessary equipment. The overall value chain emphasizes vertical integration to control material quality and complexity of assembly, ensuring the final product meets the rigorous safety and durability standards demanded by construction and mining environments.

Tipper Body Equipment Market Potential Customers

Potential customers for Tipper Body Equipment are predominantly concentrated within heavy industrial sectors characterized by high-volume bulk material handling requirements and demanding operational cycles. The primary end-users are large civil engineering and infrastructure development companies, which require fleets of heavy-duty tippers for excavation, land development, and road construction projects. Mining and quarrying operators, dealing with high-density materials like ore, coal, and aggregates, represent another critical customer segment, demanding specialized bodies designed for extreme durability and resistance to abrasion. Furthermore, municipal and private waste management services rely heavily on tippers, including roll-off and compacting variants, for efficient trash collection and recycling logistics across urban centers. These customers prioritize equipment reliability, maximum payload capacity, minimal downtime, and adherence to regional safety standards.

The procurement decisions within these customer groups are often complex, driven by total cost of ownership (TCO) rather than initial purchase price alone. Fleet managers analyze factors such as material durability (steel versus aluminum), fuel efficiency gains from reduced body weight, expected equipment lifespan, and the ease and cost of obtaining replacement parts. Secondary customer segments include agricultural operations that utilize smaller tippers for grain and produce transport, and specialized logistics providers handling industrial materials. The shift towards sustainable and lighter equipment is influencing procurement, with many large customers now prioritizing manufacturers who offer low-emission, telematics-enabled, and structurally optimized tipper bodies to meet corporate sustainability goals and operational efficiency mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schmitz Cargobull, Kässbohrer, Hyva, Palfinger, F.X. Meiller, Wielton Group, Truck Bodies and Equipment International (TBEI), Crysteel Manufacturing, Canton, Kipper-Trade, Thompsons Group, Boughton Engineering, Marrel, Cantoni & C. S.p.A., Alura Body Builders, PT. Tambang Tracindo, Besko, KH-Kipper, Trans-Tech, Hardox Wearparts |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tipper Body Equipment Market Key Technology Landscape

The Tipper Body Equipment Market is undergoing a rapid technological evolution driven by demands for increased safety, operational efficiency, and environmental compliance. The most prominent technological development is the widespread adoption of high-strength, lightweight materials, particularly advanced grades of aluminum alloys and specialized wear-resistant steel (such as Hardox). These materials enable manufacturers to significantly reduce the tare weight of the tipper body, directly translating into higher payload capacity per trip, thereby optimizing logistics and reducing fuel consumption. Furthermore, innovation in hydraulic systems is crucial; modern hydraulic pumps and cylinders are designed for faster cycling times and increased efficiency, often featuring multi-stage telescopic cylinders that offer better stability during the lifting process. Sensor technology and integrated telematics represent a core advancement, allowing for real-time monitoring of critical parameters such as payload weight, tire pressure, and chassis inclination, transmitting data back to fleet management systems for predictive maintenance and safety auditing.

Another significant technological focus is on safety and automation. Advanced electronic control units (ECUs) are increasingly integrated into the tipping mechanism, providing interlocks that prevent accidental tipping if the vehicle is improperly parked or the ground is uneven. These systems often include integrated roll stability programs and audible warnings. Furthermore, the development of intelligent body liners made from durable, low-friction polymers is mitigating common operational challenges, especially when handling sticky materials like clay or moist aggregates, ensuring the entire load slides out efficiently and safely without manual intervention. The industry is also seeing prototypes incorporating electric actuation mechanisms, particularly for smaller and medium-duty tippers, aimed at reducing reliance on traditional hydraulic oil systems, aligning with the broader commercial vehicle shift toward electrification and cleaner operations.

Digitalization extends deeply into the design and manufacturing phases, utilizing sophisticated Finite Element Analysis (FEA) software to simulate stress, strain, and fatigue under various load conditions. This allows manufacturers to optimize the structural design, placing reinforcement only where critically needed, thus saving weight without compromising durability. This digital twin approach accelerates product development and ensures compliance with stringent European and North American safety standards regarding structural integrity and crash resistance. Looking ahead, the convergence of IoT, 5G connectivity, and AI processing capabilities is paving the way for fully autonomous tipper operations in controlled environments such as large open-pit mines, where operational efficiency and safety are paramount, showcasing a highly sophisticated technological future for this essential equipment sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for tipper body demand, primarily due to relentless infrastructure expansion, including massive railway networks, urban development projects, and industrial corridors in China, India, and Southeast Asia (Indonesia, Vietnam). The region's vast mining sector, particularly for coal, iron ore, and aggregates, drives demand for high-capacity, heavy-duty tippers. Local manufacturers dominate the volume segment, but global players are increasing their presence by offering specialized, high-quality, and lighter-weight bodies to address regional axle-load restrictions and increasing demands for fuel efficiency.

- North America: This region is characterized by high average tipper body size and a strong focus on regulatory compliance, particularly related to safety standards and environmental mandates. Demand is robust, driven by extensive highway maintenance, oil and gas extraction, and residential construction booms. The market exhibits a strong trend toward specialized equipment, such as dump trailers and gravel trains, and early adoption of telematics and AI-enhanced features for fleet management and safety protocols. High labor costs necessitate equipment that maximizes efficiency and minimizes manual intervention.

- Europe: The European market emphasizes innovation in lightweight materials (aluminum) and electric vehicle (EV) compatibility, largely driven by strict EU emissions regulations and sustainability targets. Central and Western Europe show high demand for three-way tippers and compact bodies suitable for urban construction sites and demolition work where maneuverability is critical. Eastern European countries, while focused on infrastructure catch-up, are increasingly prioritizing high-quality, corrosion-resistant bodies capable of withstanding harsh weather conditions and prolonged operational use.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity cycles, particularly mining (Chile, Peru, Brazil) and agricultural exports, creating fluctuating but strong demand for robust, reliable tipper equipment. Infrastructure investments are concentrated around port development and inter-regional transport corridors. The market often favors simple, durable designs that are easy to maintain and repair locally, although higher-end equipment is being adopted in large-scale international mining operations.

- Middle East and Africa (MEA): The Middle East market is driven by mega-projects (e.g., smart city development, large-scale tourism infrastructure) and oil & gas operations, requiring heavy-duty and highly customized tippers resistant to extreme heat and sand abrasion. Africa's demand is driven by raw material extraction and critical infrastructure development, with South Africa and North African nations leading in adoption. The region faces challenges related to maintenance infrastructure but shows high potential growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tipper Body Equipment Market.- Schmitz Cargobull

- Kässbohrer

- Hyva

- Palfinger

- F.X. Meiller

- Wielton Group

- Truck Bodies and Equipment International (TBEI)

- Crysteel Manufacturing

- Canton

- Kipper-Trade

- Thompsons Group

- Boughton Engineering

- Marrel

- Cantoni & C. S.p.A.

- Alura Body Builders

- PT. Tambang Tracindo

- Besko

- KH-Kipper

- Trans-Tech

- Hardox Wearparts (SSAB)

Frequently Asked Questions

Analyze common user questions about the Tipper Body Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Tipper Body Equipment Market?

The primary driver is the significant and sustained global investment in public and private infrastructure projects, including road construction, bridge building, and large-scale urbanization initiatives, particularly across the Asia Pacific region.

How are environmental regulations affecting the design of modern tipper bodies?

Environmental regulations, particularly stringent emission and axle-load limits, necessitate the increased use of lightweight materials like aluminum alloys to maximize payload capacity while minimizing fuel consumption and compliance risks.

What are the key technological advancements observed in tipper body manufacturing?

Key advancements include the integration of advanced telematics and IoT for real-time fleet monitoring, the use of AI-enabled systems for preventing rollovers, and the widespread adoption of high-strength, wear-resistant steel and aluminum materials for durability.

Which material segment holds the largest share in the Tipper Body Equipment Market?

Steel remains the dominant material segment due to its superior durability and lower cost, especially in heavy-duty mining and quarrying applications. However, aluminum is growing rapidly due to demands for greater payload efficiency.

What is the total market valuation projected for the Tipper Body Equipment Market by 2033?

The Tipper Body Equipment Market is projected to reach a valuation of approximately USD 12.6 Billion by the end of the forecast period in 2033, growing at a robust CAGR of 5.8%.

The imperative for maximizing efficiency in material transport across the globe continues to fuel demand for advanced tipper body solutions. The integration of digital technologies, particularly telematics and predictive diagnostics, is no longer a niche feature but a standard requirement for major fleet operators seeking to reduce total cost of ownership (TCO) and ensure maximum uptime. Manufacturers are focusing heavily on modular designs that can be rapidly customized to different chassis types and specific industry needs, ensuring versatility and ease of maintenance. This customization capability is becoming a critical competitive differentiator, especially in markets where specialized logistics or extreme operating conditions prevail, such as transporting abrasive materials in arid environments or navigating complex urban construction sites with strict dimensional constraints. The technological evolution is pushing the boundaries of material science, favoring composites and innovative welding techniques that enhance structural rigidity without adding significant weight, addressing the constant conflict between durability and payload optimization.

In terms of competitive landscape, the market exhibits a clear bifurcation between large multinational corporations offering fully integrated solutions and smaller, regional specialists known for highly localized customization and rapid service response. Mergers and acquisitions are common as large players seek to absorb niche expertise or expand geographic footprint, particularly in high-growth areas like Southeast Asia and Eastern Europe. Price pressure remains a constant factor, particularly in the standard steel tipper segment, making operational efficiency and manufacturing scale essential for profitability. However, in the high-end specialized segments (e.g., three-way tippers for municipal use or ultra-light aluminum bodies for long-haul bulk transport), innovation, quality, and certification adherence allow for higher price realization. The push towards sustainable logistics means that manufacturers who can effectively demonstrate the lifecycle advantages and lower carbon footprint of their products, often through lightweighting and EV compatibility, will capture significant future market share and command premium pricing. Furthermore, the role of independent service providers and body repair specialists is vital in extending the life of the assets, contributing significantly to the aftermarket revenue pool of the overall ecosystem.

Future market growth will be intrinsically linked to the regulatory landscape concerning vehicle automation and safety standards. Many regions are introducing stricter requirements for roll-over protection and payload monitoring systems, automatically increasing the complexity and necessary technology embedded within the tipper body itself. This regulatory pressure acts as a barrier to entry for smaller, less technologically advanced manufacturers but provides a substantial opportunity for global leaders who can afford the necessary R&D. The transition to electric commercial vehicles poses a unique challenge and opportunity: while electric trucks eliminate tailpipe emissions, the weight of the batteries often infringes upon payload capacity. This necessitates extremely light tipper body designs, making advanced aluminum and composite materials indispensable for the future electric fleet. Therefore, the strategic focus for manufacturers over the next decade will be on developing zero-emission compatible, highly durable, and intelligently monitored tipper solutions that seamlessly integrate with the digital fleet management platforms favored by modern logistics and construction firms, solidifying the market's trajectory towards digitalization and sustainability.

Segmentation analysis by application reveals deep specialized requirements that dictate market trends. The mining sector, for instance, requires bodies engineered with extreme abrasion resistance and high payload stability, often utilizing specific liner materials to facilitate the quick and complete discharge of sticky or challenging ores. These bodies are typically heavy-duty steel and operate under highly demanding off-road conditions, prioritizing ruggedness over highway efficiency. Conversely, the waste management segment increasingly demands highly sealed, sometimes refrigerated, tipper bodies to comply with environmental and sanitary regulations, focusing on leak prevention and odor control, often integrating compaction features or hook-lift systems (Roll-off). The construction segment, being the largest consumer, covers a broad spectrum, from standard rear-tippers for aggregate haulage to three-way tippers required for tight urban delivery sites, illustrating the heterogeneous nature of demand driven by project type and geographical constraints. Understanding these specific application needs is critical for manufacturers to tailor their production lines and marketing strategies effectively.

The complexity of the hydraulic mechanism is another vital point of differentiation. While the vast majority of tippers rely on hydraulic power takeoff (PTO) systems from the truck engine, technological advancements are being made in efficiency and fluid management. Modern hydraulic systems feature enhanced filtration and cooling mechanisms to ensure reliability under continuous heavy-duty operation. The development of remote control and proximity sensing for the tipping operation significantly enhances worker safety by allowing operators to stand clear of potential hazards during unloading. Furthermore, the market for pneumatic tipping mechanisms, though smaller, exists primarily in niche applications or lighter-duty vehicles where payload sensitivity or rapid cycling is necessary. The choice of mechanism directly impacts maintenance complexity and operational noise levels, factors that are highly relevant in densely populated operational areas in Europe and North America.

Value chain stability relies heavily on resilient sourcing of primary metals. Fluctuations in global steel and aluminum prices directly impact the cost of goods sold for tipper body manufacturers, necessitating sophisticated hedging strategies and long-term procurement agreements. Upstream suppliers are increasingly pressured to provide certified, high-grade materials with verifiable environmental credentials. Midstream production is shifting towards automated welding and painting processes to ensure uniformity and reduce labor costs, which is crucial for maintaining profitability in volume manufacturing. Manufacturers who have invested in advanced robotic welding cells demonstrate higher quality control and faster production times. Downstream, the sales process is evolving, with specialized consultants assisting clients in choosing the optimal body specification (e.g., chassis fitment, body volume, material thickness) that maximizes profitability under specific regulatory limits, ensuring that the sales function transitions from simply product provision to integrated fleet consulting and management, adding significant value beyond the physical equipment sale.

The aftermarket service ecosystem, supported by reliable spare parts logistics and specialized repair centers, is fundamentally important for the end-user. Since tipper bodies are high-wear assets, the accessibility and cost of replacement parts—especially hydraulic cylinders, hinge pins, floor sheets, and tailgate mechanisms—can heavily influence the end-user's selection of a brand. Manufacturers offering guaranteed parts availability and extensive service networks gain a significant competitive edge, reducing vehicle downtime which is critical in time-sensitive operations like construction and mining. This emphasis on robust aftermarket support reinforces the necessity for manufacturers to maintain strong direct and indirect distribution relationships, ensuring consistent global access to maintenance expertise and genuine parts. The shift towards telematics also facilitates proactive maintenance, where service centers receive real-time operational data, allowing them to prepare necessary parts and schedule service appointments before a catastrophic failure occurs, shifting the business model from reactive repair to predictive reliability management.

The regional analysis showcases distinct market dynamics tied to economic development levels and regulatory stringency. In North America, the focus is increasingly on custom solutions for vocational trucks, including specialized snow and ice control bodies and highly durable dump bodies for logging and aggregate hauling, reflecting the diversity of the economy. The emphasis on high safety ratings (FMVSS standards) drives quality and design complexity. In contrast, the rapid expansion of infrastructure in APAC places a premium on high volume production and cost-effectiveness, although rising labor costs and increasing environmental awareness in countries like Japan and South Korea are pushing towards greater adoption of automated and high-technology equipment. The emerging markets in Africa and Latin America often require equipment that can withstand minimal maintenance and challenging road conditions, favoring mechanical simplicity and extreme durability over digital sophistication, although major mining operations in these regions frequently adopt the most advanced international equipment standards.

The impact of electric vehicles (EVs) is projected to be more pronounced in urban and light-to-medium-duty segments first, affecting waste management and city construction tippers in Europe and North America. Manufacturers are actively partnering with electric chassis developers to design optimized tipper bodies that compensate for battery weight while maximizing available volume. This includes redesigning subframes and integrating the hydraulic pump systems with the EV's electric power supply rather than relying on a traditional PTO, leading to silent operation and zero localized emissions. This technological shift, though currently representing a small segment, is poised to redefine urban material handling logistics over the next decade. Furthermore, standardization efforts across the industry, particularly regarding mounting interfaces and electronic communication protocols between the chassis and the tipper body, are streamlining the integration process and reducing conversion lead times, making it easier for fleet operators to switch suppliers or customize their fleet composition efficiently.

Finally, the competitive landscape is defined not only by product quality but also by financial stability and global reach. Key players like Hyva and Palfinger, known for their hydraulic systems expertise, leverage this core competency to offer complete, integrated tipper solutions. Others, such as Schmitz Cargobull, focus on trailer and semi-trailer configurations, capitalizing on long-haul bulk transport efficiency. The market remains competitive, with constant pressure to innovate in areas such as aerodynamics, anti-corrosion treatments, and operational telematics to maintain a technological edge. The ability to provide integrated after-sales support globally is a major differentiating factor, ensuring customer confidence in equipment designed for continuous, harsh, and mission-critical operations. The future success of market participants hinges on their capacity to balance robust, enduring physical design with sophisticated digital integration, meeting the evolving dual demands of high performance and regulatory compliance efficiently and sustainably.

The evolution of the Tipper Body Equipment Market is intrinsically tied to global economic cycles, particularly the construction and commodities supercycles. During periods of robust economic expansion, demand surges for high-capacity, heavy-duty units needed for major civil works. Conversely, economic slowdowns often prompt fleet operators to delay replacements, shifting market focus towards the aftermarket for repairs and refurbishment. However, the secular trend toward urbanization and necessary maintenance of aging infrastructure provides a baseline level of demand that stabilizes the market against cyclical downturns. Government stimulus packages, often directed towards infrastructure spending as a means of economic recovery, serve as powerful, albeit short-term, drivers, creating peaks in demand for tipper equipment globally. These macro-economic factors necessitate manufacturers to maintain flexible production capabilities and diverse geographic footprints to mitigate risks associated with regional economic volatility and capitalize on diverse growth opportunities across continents. The continuous need for housing, transportation links, and waste management systems ensures the long-term vitality of this essential equipment sector.

The stringent safety requirements imposed by regulatory bodies, such as OSHA in North America and similar organizations globally, are consistently elevating the standards for tipper body design, particularly concerning operator visibility, stability control, and load securing mechanisms. Manufacturers are integrating advanced proximity sensors, specialized cameras, and automated body position monitoring systems to minimize accidents during loading, transport, and tipping. This focus on preventative safety is not merely a compliance issue but is increasingly marketed as a core value proposition, appealing to risk-averse companies and insurance carriers. Furthermore, training and standardization of operational procedures related to tipper usage are becoming mandatory components of the sales process, ensuring that the sophisticated equipment is used correctly, maximizing both safety and longevity, thereby enhancing the overall value derived by the end-user. The combination of mandatory compliance and voluntary safety enhancement pushes the technological boundaries, ensuring continuous innovation in ergonomics and operational control systems within the tipper cabin environment.

Addressing the complex intersection of globalization and regional specialization remains a central challenge for market participants. While standardization of certain components (like hydraulic fittings or basic body interfaces) benefits manufacturing scale, the need for regional compliance—such as unique size and weight restrictions for different European countries, or specific material requirements for handling tropical soil in Southeast Asia—requires deep localization capabilities. This results in global manufacturers operating modular production lines capable of high volume output combined with rapid regional customization. This strategy ensures that while core components benefit from economies of scale, the final product remains perfectly adapted to the local operating and regulatory environment. The success of large manufacturers is often predicated on their ability to manage this global-local balance effectively, utilizing centralized R&D for core technology while decentralizing final assembly and customization to optimize logistics and speed-to-market in key regions.

Finally, the growing trend toward equipment-as-a-service (EaaS) models is subtly impacting the tipper body market, particularly for small-to-medium enterprises that prefer operational leasing over outright purchase. Under EaaS models, maintenance, insurance, and technological upgrades are bundled, shifting the risk and complexity of ownership from the customer back to the equipment provider or specialized leasing firm. This model encourages the deployment of higher-specification, technologically advanced tippers, as the cost is amortized over the lease term and the responsibility for lifecycle management falls on the provider. Manufacturers must adapt by partnering with finance and leasing companies, providing long-term reliability guarantees, and ensuring their telematics and diagnostic systems are robust enough to support continuous remote monitoring required by these service agreements, further cementing the role of digital technology in future market transactions and overall fleet management strategies.

The integration of additive manufacturing (3D printing) is also beginning to emerge, particularly in the production of complex, low-volume, or highly customized small components and fixtures used within the tipper mechanism. While not yet used for large structural components, 3D printing accelerates prototyping and allows for rapid delivery of specialized or obsolete replacement parts in the aftermarket, drastically reducing lead times and improving service delivery, especially in remote operational locations. This technology holds promise for future customized tooling and specialized lightweight brackets, contributing to weight reduction efforts. Furthermore, the development of corrosion-resistant coatings and advanced paint systems specifically formulated for the high-impact environment of a tipper body is extending the aesthetic and structural life of the equipment, enhancing resale value and protecting the asset investment against harsh chemical and physical wear throughout its intensive operational life cycle.

The competitive dynamics within the Tipper Body Equipment Market are characterized by intense competition among European, North American, and increasingly, Asian manufacturers, each leveraging distinct competitive advantages. European firms often excel in sophisticated lightweight design, hydraulic technology, and compliance with stringent EU safety standards. North American companies focus on massive scale, local customization for vocational markets, and robust after-sales service networks across vast geographic areas. Asian manufacturers, particularly from China and India, compete aggressively on cost and volume, quickly adopting high-tensile steel technology to offer durable, cost-effective solutions for rapidly growing domestic and export markets. This global rivalry drives continuous price-performance optimization and accelerates the diffusion of technological innovations, such as advanced tipping stabilizers and modular quick-change body systems, across all major manufacturing regions, benefiting the end-user with better, safer, and more efficient material transport tools.

As sustainability becomes a central corporate metric, manufacturers are increasingly expected to demonstrate the environmental footprint of their products, not just in operation but throughout the material supply chain and manufacturing process. This includes tracking the source of raw materials (e.g., recycled content in steel or aluminum) and minimizing energy consumption during fabrication. Tipper bodies designed for specific recycling streams (e.g., specialized compartments for mixed municipal solid waste) are seeing increased investment and are positioned as environmentally crucial equipment. This commitment to 'green manufacturing' and sustainable product design is becoming a prerequisite for securing large municipal contracts and for gaining favor with environmentally conscious mining and construction clients who are implementing rigorous supplier sustainability scorecards. Ultimately, the future success in this market will depend on delivering equipment that not only maximizes payload and minimizes downtime but also demonstrably reduces environmental impact across its entire lifecycle.

The shift towards digital maintenance is transforming how tipper bodies are serviced. Advanced sensors monitor parameters such as hydraulic fluid contamination, hinge wear, and body stress, flagging potential issues before mechanical failure occurs. This data-driven approach moves away from fixed maintenance intervals to condition-based monitoring, reducing unnecessary service costs and dramatically improving asset utilization rates. Fleet managers are now demanding tipper bodies that integrate seamlessly with existing digital dashboards and fleet management software, requiring manufacturers to develop standardized APIs and communication protocols (e.g., CAN bus integration). This seamless digital integration is vital for large fleet operators who manage thousands of assets across diverse geographic locations, needing unified data insights to optimize operational performance and ensure regulatory compliance efficiently and accurately in real-time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tipper Body Equipment Market Size Report By Type (Roll-off Tipper Body, Three-Way Tipper Body, Rear Tipper Body), By Application (Mining, Construction, Agriculture, Sludge Treatment, Waste Management, Marine Services, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Tipper Body Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Roll-off Tipper Body, Three-Way Tipper Body, Rear Tipper Body), By Application (Mining, Construction, Agriculture, Sludge Treatment, Waste Management, Marine Services, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager