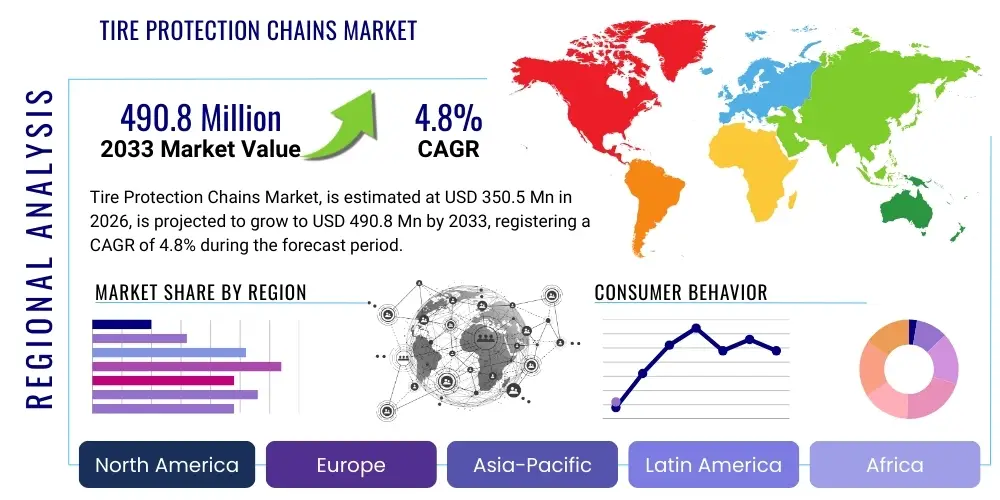

Tire Protection Chains Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437498 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tire Protection Chains Market Size

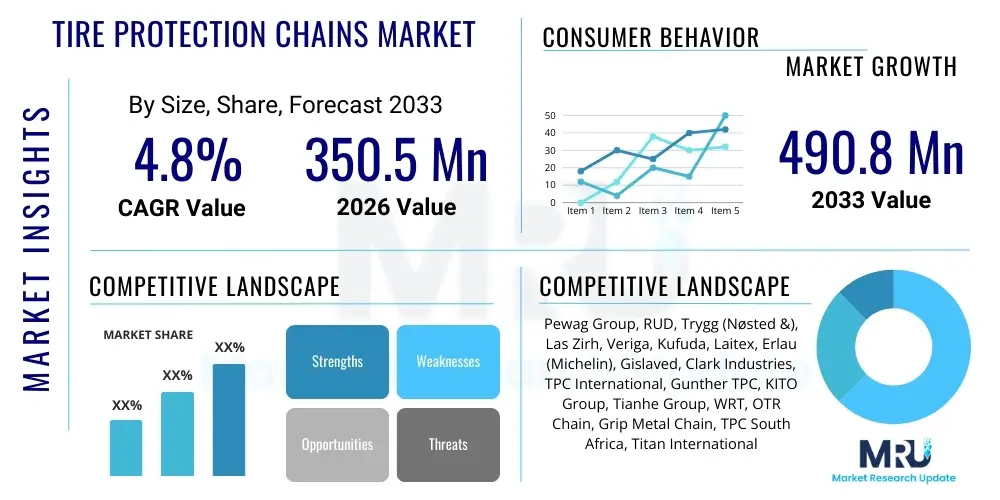

The Tire Protection Chains Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 490.8 Million by the end of the forecast period in 2033.

Tire Protection Chains Market introduction

The Tire Protection Chains (TPC) market encompasses specialized steel mesh systems designed to shield the tires of heavy machinery, particularly those operating in extreme, abrasive environments such as open-pit mining, quarrying, construction, and forestry. These chains are critical for mitigating damage caused by sharp rocks, debris, high temperatures, and uneven terrain, which drastically reduces tire wear and tear. TPC systems are integral components for large vehicles like wheel loaders, articulated dump trucks, and underground mining equipment, extending tire lifespan and significantly improving operational uptime in sectors where replacement costs for specialized off-the-road (OTR) tires are exceptionally high.

Product descriptions typically emphasize material science, focusing on high-grade alloy and manganese steel constructions that offer superior hardness and resilience. Major applications span across resource extraction industries, driven by the continuous global demand for minerals and aggregates. The primary benefits derived from the adoption of TPCs include enhanced safety, reduced maintenance expenses, and an optimization of total cost of ownership (TCO) for heavy equipment fleet managers. Furthermore, TPCs contribute to environmental stewardship by reducing the frequency of tire disposal, aligning with corporate sustainability goals.

Driving factors for market expansion include the intensified global focus on infrastructure development, particularly in emerging economies, which necessitates increased quarrying and construction activities. Moreover, the increasing depth and complexity of mining operations, which expose tires to harsher conditions, amplify the necessity for robust protective solutions. Technological advancements in chain link design, metallurgical composition, and quick-fitting systems are further catalyzing market growth, making TPCs more efficient and easier to integrate into existing operational protocols.

Tire Protection Chains Market Executive Summary

The Tire Protection Chains (TPC) Market is characterized by steady growth, underpinned by non-cyclical demand from the global mining and construction industries. Current business trends indicate a strong move toward advanced, high-tensile strength alloy steel TPCs that offer improved weight-to-protection ratios, enhancing fuel efficiency without compromising safety. Key manufacturers are focusing on developing smart chain solutions incorporating sensors for monitoring tension and wear remotely, aligning with the broader Industry 4.0 movement in heavy machinery management. Supply chain resilience remains a critical factor, with geopolitical stability influencing the pricing and availability of core raw materials such, as specialized steel and ferroalloys. Sustainability mandates are also reshaping market dynamics, pushing manufacturers to offer recyclable materials and explore modular designs for easier component replacement, thus reducing waste.

Regionally, the market exhibits bifurcation: mature markets like North America and Europe focus on replacement cycles, premium solutions, and sophisticated maintenance services, whereas Asia Pacific (APAC) and Latin America drive volume growth due to rapid infrastructure investment and burgeoning mining exploration activities. Specifically, countries with vast mineral resources, such as Australia, Brazil, China, and India, represent primary growth vectors. Economic volatility in certain resource-dependent nations can introduce short-term fluctuations, but the long-term forecast remains robust, driven by urbanization mega-trends and energy transition demands requiring substantial mineral inputs. Competition is intense, characterized by a mix of specialized global players and strong regional manufacturers providing customized solutions.

Segmentation trends reveal that the Link Type and Net Type chains dominate the market, favored for their flexibility and comprehensive sidewall protection, respectively. The Mining application segment remains the largest consumer due to the extreme severity of operating conditions in subterranean and open-pit mines, where tire replacement costs can exceed USD 100,000 per unit. Manganese steel, known for its work-hardening properties, is increasingly preferred over standard alloy steel in high-abrasion environments. Furthermore, a growing demand is observed for specialized TPCs tailored for equipment used in waste handling and recycling, indicating market diversification beyond traditional heavy industries.

AI Impact Analysis on Tire Protection Chains Market

User inquiries regarding AI's impact on the Tire Protection Chains market primarily revolve around predictive maintenance, operational optimization, and supply chain efficiency. Users frequently question how machine learning algorithms can anticipate chain failure or excessive wear before it becomes critical, thereby maximizing the lifespan of the chain and the underlying OTR tire. Another key concern is the integration of AI-driven telematics systems with TPC usage data to optimize equipment routing and operator behavior in real-time, reducing unnecessary stress on the protective chains. There is also significant user interest in how AI can optimize inventory management for replacement components, ensuring high-wear items are available precisely when needed across remote operational sites. The consensus expectation is that AI will transform TPCs from passive protection systems into actively managed, data-generating assets integral to overall heavy machinery performance monitoring systems, driving down unexpected downtimes.

The implementation of Artificial Intelligence within the TPC domain focuses on enhancing operational visibility and proactive intervention. AI systems process continuous data streams from sensors embedded in the chains or monitored by surrounding equipment telematics, analyzing variables such as operational hours, load factors, speed, ground conditions, and vibration patterns. This sophisticated analysis moves beyond simple hour-metering, allowing fleet managers to receive highly accurate remaining useful life (RUL) estimates for their protective chains. The immediate consequence is a shift from time-based or visual inspection-based maintenance schedules to highly efficient condition-based maintenance (CBM), drastically cutting costs associated with premature replacement and catastrophic failures.

Furthermore, AI algorithms are instrumental in optimizing the manufacturing process of TPCs. By analyzing material stress tests and real-world performance data, manufacturers can employ generative design to simulate and refine link geometries, material combinations, and welding patterns, leading to lighter yet stronger chains. In logistics, AI optimizes the complex global distribution networks required to supply specialized chains and parts to remote mining sites, predicting demand fluctuations based on commodity prices and seasonal mining activity. This integration of AI elevates the value proposition of TPC systems, shifting them from a cost center item to a strategic asset contributing directly to operational efficiency and profitability metrics.

- AI-driven predictive maintenance forecasts chain wear and potential failure points, maximizing asset utilization.

- Machine learning optimizes inventory management for TPC components based on usage patterns and operational forecasts.

- Real-time data processing from smart chains enhances route planning and operational efficiency for heavy machinery.

- AI facilitates generative design processes, leading to the manufacturing of lighter, stronger, and more durable chain structures.

- Advanced analytics integrate TPC performance data with overall vehicle telematics for holistic fleet health monitoring.

DRO & Impact Forces Of Tire Protection Chains Market

The Tire Protection Chains market is fundamentally shaped by a confluence of strong, persistent drivers related to industrial activity, balanced by restraints linked to high initial costs and operational complexity, yet offering substantial long-term opportunities through technological innovation. The dominant driver is the unrelenting global requirement for raw materials derived from mining and quarrying, particularly those supporting the transition to renewable energy infrastructure, such as lithium, copper, and rare earth minerals. This demand fuels continuous, intensive use of OTR tires in highly abrasive environments, making TPCs a necessity rather than an optional accessory. Restraints primarily involve the substantial upfront capital investment required for high-quality TPC systems, which can be prohibitive for smaller operations, alongside the specialized training required for installation and maintenance, occasionally leading to slower adoption rates in less developed regions.

Opportunities are largely rooted in market penetration expansion into emerging application areas like extreme waste handling, recycling facilities, and specialized port operations where ground conditions are highly destructive to standard rubber tires. Furthermore, significant opportunity exists in the development of lightweight, composite material TPCs that could maintain protective capabilities while substantially reducing the adverse impact on fuel consumption and engine strain. Impact forces governing the market include the price volatility of key input materials (steel and chromium), stringent industry safety regulations mandating equipment resilience, and the relentless pressure on resource extraction companies to minimize operational downtime and improve TCO. The bargaining power of sophisticated buyers (large mining conglomerates) remains high, compelling suppliers to focus heavily on product quality and reliability rather than sheer volume.

The impact forces also involve significant technological shifts. The advent of autonomous heavy machinery, while potentially reducing direct human operator error, introduces new demands for TPCs capable of interfacing with autonomous vehicle management systems, ensuring seamless performance monitoring and remote diagnostics. Environmental regulations concerning tire waste and material sourcing further influence product development, pushing toward more sustainable manufacturing processes and lifecycle management of the chains. These interconnected drivers and constraints result in a market where durability and material science expertise are the primary differentiators, ensuring that only specialized, high-performance manufacturers can maintain competitive advantages.

Segmentation Analysis

The Tire Protection Chains market is systematically segmented based on Type, Application, and Material, providing a clear framework for understanding demand patterns and supply dynamics across various industrial verticals. Segmentation by Type categorizes products based on their structural configuration, such as ring type, link type, and net type, each offering distinct advantages regarding coverage area, traction performance, and ease of repair. Application-based segmentation reflects the primary industries utilizing these specialized chains, with mining and quarrying being the dominant segments, followed by construction, forestry, and heavy industrial waste management, each presenting unique operational demands that influence chain selection.

Material composition forms another critical axis of segmentation, as the metallurgical properties dictate the chain's ultimate longevity and performance in abrasive environments. High-grade alloy steel and specialized manganese steel are the foundational materials, chosen for their superior hardness and work-hardening capabilities when exposed to impact. Analyzing these segments helps stakeholders—from manufacturers planning production mixes to investors assessing market potential—to pinpoint areas of highest growth potential, typically correlating with regions experiencing intensive mineral exploration or large-scale infrastructure projects. This granular segmentation ensures that product development remains highly aligned with the specific operational realities of end-users.

The trend observed within segmentation shows a proportional increase in demand for Net Type chains, especially in high-impact mining operations, due to their comprehensive coverage offering protection to both the tread and the sidewalls of the expensive OTR tires. Simultaneously, the manganese steel segment is expected to outpace standard alloy steel growth rates, driven by the desire for maximum service life in the most aggressive applications. This focus on material performance underscores the market's preference for longevity and reliability over initial purchase price, reflecting the high costs associated with unexpected equipment downtime in capital-intensive industries.

- By Type:

- Ring Type

- Link Type

- Net Type

- By Application:

- Mining (Open-Pit & Underground)

- Construction and Infrastructure

- Quarrying and Aggregates

- Forestry and Logging

- Waste Handling and Recycling

- By Material:

- Alloy Steel (Standard Grade)

- Manganese Steel (Work Hardening Grade)

- Other Specialized Alloys

Value Chain Analysis For Tire Protection Chains Market

The value chain for the Tire Protection Chains Market begins with upstream activities heavily focused on securing and processing high-quality raw materials, primarily specialized steel alloys, manganese, nickel, and chromium, which determine the finished product's durability. Key upstream suppliers include major steel mills and specialized metallurgical processors who must meet stringent specifications regarding material purity and tensile strength. The efficiency and cost-effectiveness of this initial stage are highly sensitive to global commodity prices and geopolitical stability, directly influencing the final manufacturing cost. Manufacturers often engage in long-term supply agreements to mitigate price volatility and ensure material consistency, given the critical nature of the chains' protective function.

The core manufacturing phase involves specialized processes such as forging, automated welding, heat treatment (case hardening), and assembly, requiring high capital investment in precision machinery. This middle stage is dominated by specialized global players who possess proprietary chain design techniques and metallurgical knowledge that act as significant barriers to entry for new competitors. Distribution channels are typically dual-layered: direct sales to major mining companies and Original Equipment Manufacturers (OEMs) for large-scale fleets, and indirect distribution through specialized regional dealers and service providers. The dealers often provide essential aftermarket services, including fitting, repair, and ongoing maintenance, adding significant value by ensuring proper chain management and minimizing operational disruption for end-users.

Downstream analysis focuses on the end-users—large organizations in the mining, construction, and quarrying sectors. These heavy equipment operators are sophisticated buyers who prioritize total cost of ownership (TCO) over upfront price. Their purchasing decisions are heavily influenced by product reliability, manufacturer reputation, and the quality of post-sale support. The relationship is often collaborative, with manufacturers working closely with end-users to design customized chain solutions for specific equipment types and challenging operational terrains. The effectiveness of the value chain is ultimately measured by the reduction in tire damage frequency and the resulting improvement in fleet utilization rates achieved by the end-user.

Tire Protection Chains Market Potential Customers

The primary customer base for the Tire Protection Chains Market consists overwhelmingly of large-scale enterprises engaged in resource extraction and heavy infrastructure development, where OTR tires are subjected to continuous severe wear. This includes multinational mining corporations operating massive fleets of wheel loaders, dozers, and haulage trucks in open-pit operations extracting iron ore, copper, gold, and coal. These end-users are driven by the necessity of operational continuity; unexpected tire failure in a 24/7 mining environment results in catastrophic economic losses, making TPCs a vital insurance policy for their highest-value consumables.

Another significant segment comprises quarrying and aggregate producers, particularly those dealing with hard, sharp, or highly abrasive rock types like granite and basalt. While their equipment might be smaller than that used in large mines, the continuous, sharp impact and repetitive movements necessitate durable tire protection. Furthermore, governmental and private entities engaged in major public works, such as large dam construction, highway projects in mountainous regions, or tunnel boring, represent substantial potential customers for construction-grade TPCs, prioritizing safety and project timeline adherence.

The emerging customer profile includes operators in specialized, non-traditional heavy industries such as municipal and industrial waste management facilities, particularly recycling and landfill operations. The debris, contamination, and abrasive nature of waste environments, which include metal shards and glass, destroy standard tires rapidly. These organizations are increasingly adopting TPCs to manage hazardous materials handling efficiently. Finally, Original Equipment Manufacturers (OEMs) of heavy equipment often function as strategic customers, integrating TPC recommendations or systems directly into their maintenance packages, reflecting the chains' essential role in defining equipment lifespan and reliability metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 490.8 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pewag Group, RUD, Trygg (Nøsted &), Las Zirh, Veriga, Kufuda, Laitex, Erlau (Michelin), Gislaved, Clark Industries, TPC International, Gunther TPC, KITO Group, Tianhe Group, WRT, OTR Chain, Grip Metal Chain, TPC South Africa, Titan International, Metso Outotec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Protection Chains Market Key Technology Landscape

The technology landscape for the Tire Protection Chains Market is constantly evolving, driven primarily by material science and digitalization, aiming for superior wear resistance and enhanced operational monitoring. Metallurgical advancements focus on creating proprietary alloys, such as specialized boron steel and high-manganese variants, which offer exceptional surface hardness combined with core ductility, preventing catastrophic chain link shattering under extreme impact. Modern chain production utilizes sophisticated, highly controlled heat treatment processes, including deep case hardening and tempering, ensuring uniform hardness penetration across the entire chain surface, which is crucial for maximizing service life in continuously abrasive environments. Manufacturers invest heavily in computer-aided design (CAD) and finite element analysis (FEA) to simulate real-world stress and optimize link geometry, leading to designs that distribute wear evenly and reduce stress concentration points, thereby extending the chain's operational span before required repair or replacement.

Beyond material technology, the market is increasingly integrating digital technologies to provide value-added services. The development of 'Smart Chains' incorporates radio-frequency identification (RFID) tags and miniature, ruggedized sensors directly into key links. These sensors track critical parameters such as temperature, tension, cumulative operational hours, and impact events. This data is transmitted wirelessly to central fleet management platforms, leveraging telematics infrastructure already present on heavy machinery. This technological shift enables predictive maintenance programs, allowing managers to schedule timely rotation or repair based on actual usage wear rather than generic estimates, which significantly boosts utilization rates and minimizes unforeseen downtime incidents that are highly disruptive in mining operations.

Furthermore, technology is improving the usability and safety of TPCs. Automated and semi-automated fitting systems are being developed to reduce the time and inherent danger involved in manually installing these extremely heavy chain systems onto large OTR tires. Quick-release and modular repair systems are also essential technological features, allowing on-site maintenance crews to replace individual damaged links rapidly, minimizing the machinery's time out of service. This focus on serviceability, combined with advanced material technologies, defines the competitive edge in the modern TPC market, emphasizing that the technology is now as much about data management and operational integration as it is about the physical protective barrier itself.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to exhibit the highest growth rate, fueled by massive infrastructure projects, rapid urbanization, and extensive mineral extraction activities, particularly in China, India, and Southeast Asia. The region represents a critical volume market, driven by governmental investment in resource development and a strong demand for materials like coal, iron ore, and construction aggregates. However, price sensitivity is generally higher here compared to Western markets, leading to competition across both premium and mid-range product categories. Australian mining operations specifically demand high-end, durable TPCs due to stringent safety standards and the remote nature of operations, where logistical downtime is exceptionally costly.

- North America: North America is characterized by mature mining operations, high labor costs, and a strong regulatory environment emphasizing safety and equipment longevity. This region focuses heavily on adopting high-performance, specialized alloy TPCs and integrated digital monitoring systems (Smart Chains). The market is driven by replacement cycles in established quarries and large-scale oil sands and metallic mining operations. Premiumization, combined with advanced service and maintenance contracts provided by manufacturers, is a defining trend. Canada, with its vast resource base, is a particularly strong consumer of cold-weather specialized chains.

- Europe: The European market, while smaller in volume than APAC, demands the highest standards of quality, environmental compliance, and technological integration. Key demand centers include quarrying in Scandinavia and central Europe, and industrial applications. Strict safety regulations often accelerate the adoption of chains that offer superior protective coverage and feature quick, safe installation systems. Innovation in material science, often driven by European manufacturers, remains a core highlight, focusing on minimizing chain weight while maximizing lifespan to meet stringent fuel efficiency targets.

- Latin America: This region is a major growth engine, primarily due to large-scale copper, iron ore, and gold mining operations in countries like Chile, Brazil, and Peru. The market dynamics are highly tied to global commodity prices. There is a strong, growing demand for TPCs that can withstand aggressive, high-altitude operational conditions. Manufacturers must navigate complex logistics and focus on establishing robust local distribution and service networks to support remote mining sites effectively.

- Middle East and Africa (MEA): The MEA market shows significant potential, particularly driven by emerging mining exploration across Africa (e.g., South Africa, Ghana) and infrastructure development projects in the Middle East. Demand is highly localized, often requiring extremely robust chains capable of handling high temperatures and highly abrasive desert sand conditions. South Africa remains a traditional hub for underground mining TPC consumption, demanding specialized solutions for confined spaces and unique loading conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Protection Chains Market.- Pewag Group

- RUD Ketten Rieger & Dietz GmbH u. Co. KG

- Trygg (Nøsted &)

- Las Zirh Chain Co., Ltd.

- Veriga

- Kufuda Group

- Laitex Oy

- Erlau AG (a subsidiary of Michelin)

- Clark Industries (TPC)

- Gunther TPC

- Tianhe Group

- WRT (Wear Protection Solutions)

- OTR Chain

- Grip Metal Chain

- KITO Group

- Titan International

- Tractor Supply Company (Specialty Segment)

- Metso Outotec (indirectly through wear parts)

- TPC South Africa

- Gislaved Däck AB

Frequently Asked Questions

Analyze common user questions about the Tire Protection Chains market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of investing in Tire Protection Chains (TPCs) over standard tire maintenance?

The primary benefit of TPCs is the exponential extension of Off-The-Road (OTR) tire lifespan, significantly reducing the Total Cost of Ownership (TCO) by mitigating catastrophic tire failures caused by sharp debris and abrasive surfaces. TPCs prevent costly unscheduled downtime in heavy industrial operations, which is far more expensive than the chains themselves, thereby ensuring operational continuity and enhanced safety.

How does the selection of TPC material, specifically Manganese Steel versus Alloy Steel, affect performance?

Manganese steel (work-hardening steel) is preferred for extremely high-impact and highly abrasive environments, particularly in deep mining and hard rock quarrying, as it hardens upon impact, increasing its wear resistance over time. Standard alloy steel TPCs are suitable for less severe, general construction, or moderate quarrying applications, offering a balance of protection and cost-effectiveness. Selection depends critically on the specific operating conditions and material hardness encountered.

What role does the Net Type chain configuration play in modern mining operations?

Net Type chains offer superior, comprehensive protection because their dense mesh structure covers both the tread and the vulnerable sidewalls of the tire. This configuration is essential in modern, severe mining environments where sidewall damage from debris and cutting is a frequent cause of costly OTR tire failure. The net design provides maximum contact area, enhancing traction and stability.

Are Tire Protection Chains compatible with heavy machinery utilizing autonomous systems?

Yes, modern TPCs are compatible with autonomous heavy machinery. Furthermore, leading manufacturers are integrating 'Smart Chain' technology, which includes sensors and RFID, allowing autonomous vehicle management systems and telematics platforms to continuously monitor the chain's condition, tension, and wear rate in real-time, feeding critical data back into the AI-driven operational optimization processes.

Which regional market is driving the fastest adoption rate for Tire Protection Chains?

The Asia Pacific (APAC) region is currently driving the fastest adoption rate, primarily due to the massive scale of infrastructure development, urbanization, and continuous expansion of mining activities in major economies like China and India. While North America and Europe demand high-premium replacement chains, APAC represents the highest volume growth potential, fueled by new project starts and increased industrial mechanization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager