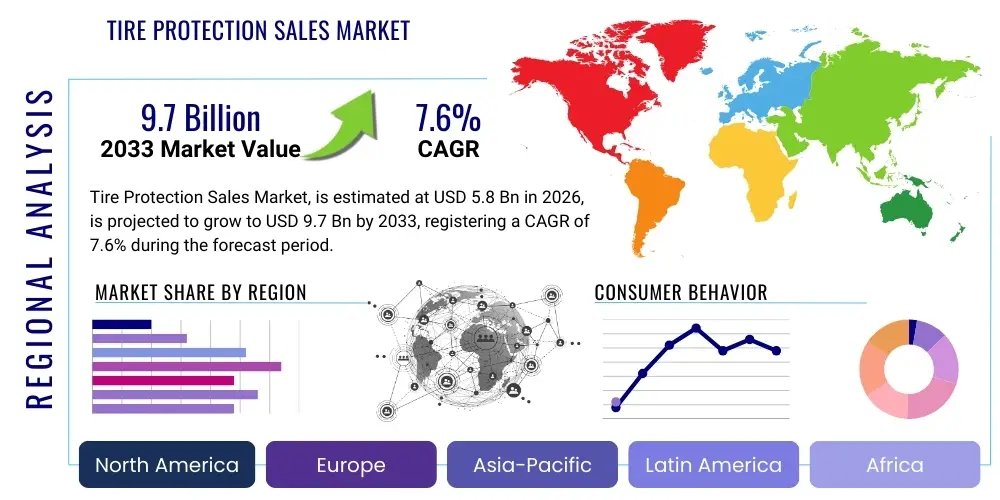

Tire Protection Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436921 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Tire Protection Sales Market Size

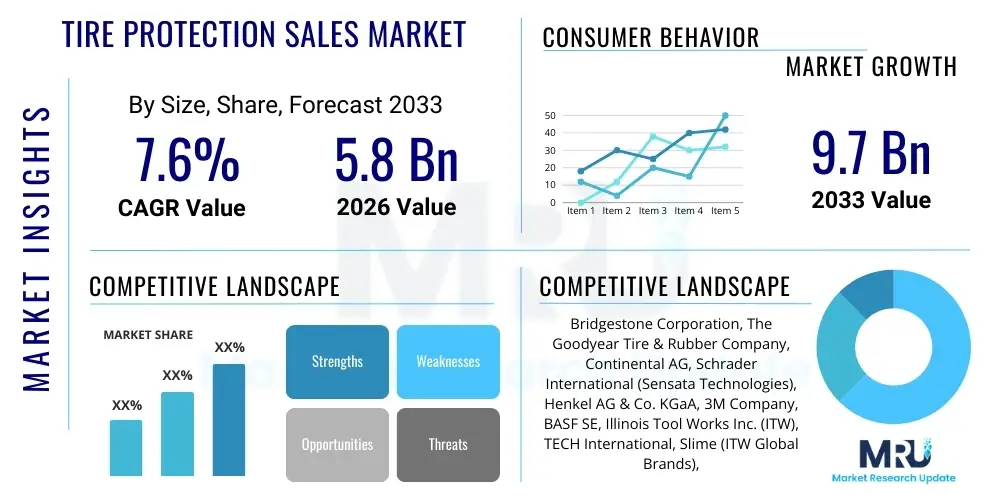

The Tire Protection Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.6% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.7 Billion by the end of the forecast period in 2033.

Tire Protection Sales Market introduction

The Tire Protection Sales Market encompasses a wide range of products and services designed to enhance tire longevity, safety, and performance, primarily by mitigating damage from punctures, maintaining optimal pressure, and reducing wear and tear. Key product categories include advanced tire sealants, specialized protective liners, and sophisticated Tire Pressure Monitoring Systems (TPMS). These solutions are increasingly critical across the automotive landscape, driven by consumer demand for greater safety features, stringent regulatory mandates concerning vehicle efficiency, and the operational necessity of minimizing downtime for commercial fleets. The adoption rate is accelerating due to innovations in material science, leading to more effective, environmentally safer sealant formulations and durable tire construction components.

The core application areas of tire protection span across passenger vehicles, commercial trucks and buses, and highly demanding off-highway and industrial vehicles. For passenger vehicles, the focus is often on convenience and safety, ensuring drivers can quickly address minor punctures without immediate roadside assistance or through automated pressure maintenance via advanced TPMS. In the commercial sector, where tire failure translates directly into significant logistical costs and revenue loss, robust protection mechanisms—such as heavy-duty liners and proactive digital monitoring solutions—are paramount. The integration of these protective measures contributes directly to lowering the Total Cost of Ownership (TCO) for vehicle operators by extending tire life and improving fuel efficiency.

Driving factors propelling market expansion include rising global production of automobiles, particularly in developing regions, coupled with increasingly complex road infrastructures that increase the risk of tire damage. Furthermore, legislative actions in major economies, such as mandatory TPMS installation (e.g., in the U.S. and Europe), have cemented the baseline demand for pressure monitoring technology, which is a key subset of tire protection. The ongoing shift toward electric vehicles (EVs) also plays a critical role, as EVs require tires capable of handling higher instantaneous torque and carrying heavier battery loads, necessitating enhanced structural integrity and protection features to manage these unique stresses effectively.

Tire Protection Sales Market Executive Summary

The Tire Protection Sales Market is witnessing robust growth, fundamentally reshaping how vehicle owners and fleet managers approach tire management. Current business trends indicate a strong movement toward integrated solutions where traditional physical protection (sealants, structural enhancers) converges with digital monitoring (smart TPMS, telematics integration). This shift is maximizing efficiency and enabling predictive maintenance. Key industry players are focusing on mergers, acquisitions, and strategic partnerships to acquire niche technologies, particularly those related to material innovation for self-healing elastomers and wireless sensor integration. Furthermore, sustainability is becoming a central theme, pushing manufacturers to develop biodegradable sealant formulations and recyclable tire protection components, aligning with global environmental, social, and governance (ESG) standards.

Regional dynamics highlight distinct growth patterns. North America and Europe maintain leading positions, primarily due to rigorous safety regulations, high consumer awareness regarding vehicle maintenance, and the rapid adoption of advanced telematics in commercial fleets. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid urbanization, massive infrastructure development, and escalating vehicle production and sales in countries like China, India, and Southeast Asian nations. This growth in APAC is largely driven by the burgeoning aftermarket segment and increasing governmental focus on road safety standards. Latin America and MEA are slower to adopt, but steady industrialization and mining activities are creating significant localized demand for heavy-duty, off-highway tire protection solutions.

Segment trends confirm the rising importance of technologically advanced solutions. The TPMS segment, especially the direct TPMS variant, continues to dominate in terms of value, driven by legislative mandates and the integration of these systems into vehicle electronics architecture. Concurrently, the aftermarket distribution channel is experiencing significant expansion as vehicle lifecycles extend, and consumers seek cost-effective ways to maintain optimal performance without replacing entire tire sets. Within the product type category, advanced polymer sealants are gaining traction due to improvements in their sealing effectiveness, durability, and compatibility with various tire constructions, including run-flat and self-sealing tires, offering a preventive layer of protection against minor road hazards.

AI Impact Analysis on Tire Protection Sales Market

Common user questions regarding AI's influence typically revolve around how AI can enhance predictive capabilities, reduce human error in maintenance, and optimize inventory management for tire protection products. Users are highly interested in the feasibility of AI-driven systems moving beyond simple pressure warnings (standard TPMS) to predicting specific failure modes, estimating the remaining useful life of protective sealants, and determining the optimal application schedule for retreading or sealant re-application based on real-time driving data and road conditions. Concerns often focus on data privacy, the reliability of AI algorithms in diverse environmental conditions, and the cost associated with retrofitting existing fleets with AI-compatible sensor technology. The overall expectation is that AI will transform tire protection from a reactive maintenance task into a fully predictive and automated asset management strategy.

- AI-Powered Predictive Maintenance: Algorithms analyze data from connected TPMS, road surface sensors, and historical wear patterns to forecast potential punctures or pressure loss events before they occur, triggering automated alerts or sealant deployment protocols.

- Optimized Sealant Formulation: Machine learning models accelerate R&D by simulating chemical interactions and material fatigue under various stresses, leading to faster development of more durable and environmentally friendly tire sealant compounds.

- Intelligent Inventory Management: AI tools optimize supply chains for tire protection components and sealants, predicting regional demand shifts based on seasonal weather patterns, infrastructure projects, and vehicle sales forecasts.

- Fleet Management Optimization: AI systems integrate tire health data into overall logistics planning, recommending optimal routes that minimize exposure to known hazards and optimizing tire rotation schedules to maximize lifespan.

- Generative Design for Protective Liners: AI assists engineers in designing novel internal liner structures that offer superior impact resistance while minimizing weight, balancing protection effectiveness with fuel economy goals.

DRO & Impact Forces Of Tire Protection Sales Market

The dynamics of the Tire Protection Sales Market are significantly shaped by a combination of key market drivers, entrenched restraints, and emerging opportunities, collectively forming the core impact forces that dictate trajectory and competitive intensity. A primary driver is the global escalation of regulatory mandates, especially those requiring TPMS in newly manufactured vehicles, which creates a foundational demand floor for electronic monitoring solutions. Concurrently, the increasing complexity and high cost of modern tires necessitate robust protection solutions to maximize return on investment for consumers and fleet operators, directly boosting the demand for high-performance sealants and protective mechanisms. These factors—regulation and economics—form a symbiotic force accelerating market maturation.

However, the market faces notable restraints, particularly the perceived high initial cost associated with advanced tire protection systems, especially sophisticated direct TPMS systems and certain proprietary self-sealing tire technologies, which can deter budget-sensitive buyers in emerging markets. Another significant restraint is the logistical and environmental challenge posed by traditional chemical sealants, including concerns about disposal, potential compatibility issues with internal tire materials, and installation complexity in the aftermarket. These factors lead to resistance from certain consumer segments and maintenance professionals, requiring manufacturers to invest heavily in consumer education and product simplification to overcome adoption barriers.

Opportunities for future expansion lie heavily in the continued technological integration of IoT and cloud computing, allowing tire protection data to feed directly into broader vehicle telematics platforms, enabling real-time optimization and fleet-wide monitoring. Furthermore, the massive growth in the electric vehicle sector presents a distinct opportunity; EVs require specialized tire construction to manage their torque and weight, making advanced, lightweight protection solutions essential for ensuring range performance and safety. The ongoing shift towards specialized, eco-friendly sealant formulations (biodegradable and less corrosive) also represents a significant avenue for market expansion and competitive differentiation, satisfying both regulatory bodies and environmentally conscious consumers. These impact forces collectively indicate a transition toward highly automated, data-driven, and sustainable tire protection solutions.

Segmentation Analysis

The Tire Protection Sales Market is systematically segmented based on product type, application, and distribution channel, providing a clear map of market demand and supply dynamics. The product segmentation separates the market into physical protection mechanisms (sealants, liners, protective compounds) and electronic monitoring systems (TPMS, smart sensors). This distinction is vital for understanding competitive positioning, as traditional chemical manufacturers compete alongside high-tech electronics suppliers. Segmentation by application allows manufacturers to tailor solutions to specific end-user needs, recognizing the distinct requirements of passenger cars, which prioritize comfort and convenience, versus commercial fleets, which emphasize rugged durability and operational uptime.

Further granularity is achieved through the segmentation of TPMS into direct (dTPMS) and indirect (iTPMS) systems, reflecting differences in accuracy, cost, and complexity. Direct systems, utilizing sensors within the tire or wheel assembly, provide superior accuracy but come at a higher cost, often dominating the OEM channel. Conversely, indirect systems leverage existing vehicle components (like the ABS wheel speed sensor) and are common in budget-conscious or older vehicle models. The distribution channel segmentation, primarily OEM versus Aftermarket, is crucial for strategizing sales and marketing efforts. The OEM segment is driven by contractual agreements and mandatory installations, while the Aftermarket thrives on replacement cycles, product innovation, and competitive pricing for maintenance and upgrades.

Understanding these segments is essential for stakeholders to effectively target investment and product development. For instance, the growing e-commerce channel within the Aftermarket segment demands distinct logistical and marketing strategies compared to traditional brick-and-mortar retail or specialized service garages. The continuous convergence of these segments—where aftermarket solutions adopt OEM-level technology and physical protection integrates electronic feedback—is a key trend defining market maturity and future growth opportunities, particularly in integrating smart sealants with connected vehicle diagnostics.

- By Product Type:

- Tire Sealants (Chemical, Polymer-based, Biodegradable)

- Protective Tire Liners

- TPMS (Direct TPMS, Indirect TPMS)

- Tire Retreading Solutions (Focused on structural integrity and longevity)

- By Application:

- Passenger Vehicles (Sedans, SUVs, Light Trucks)

- Commercial Vehicles (Heavy Trucks, Buses, Vans)

- Off-Highway Vehicles (Construction, Mining, Agriculture, Industrial)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail Stores, Specialized Service Centers, E-commerce)

- By Technology:

- Standard Systems

- Smart/Connected Systems (IoT enabled)

Value Chain Analysis For Tire Protection Sales Market

The value chain for the Tire Protection Sales Market begins with raw material suppliers, predominantly chemical companies providing specialized polymers, elastomers, and sensor components (microprocessors, transmitters, batteries). The upstream phase is characterized by intense R&D focusing on material science to develop lighter, more durable, and environmentally safer sealant formulations and protective liner materials. Key challenges in this phase involve maintaining stringent quality control for sensitive electronic components used in TPMS and securing long-term supply contracts for specialized chemical feedstocks, which are often subject to volatile commodity pricing. Efficiency in the upstream segment directly impacts the final product cost and performance, setting the foundation for quality.

The midstream phase involves the manufacturing and assembly of the final tire protection product. This includes specialized chemical blending and packaging for sealants, the fabrication and incorporation of protective liners into tire structures (OEM channel), and the highly specialized assembly and calibration of TPMS modules. Manufacturing complexity is significant for direct TPMS due to the required integration of sensors within the harsh environment of the tire cavity. For the OEM segment, manufacturers often collaborate closely with tire producers and vehicle assemblers, requiring just-in-time delivery and adherence to rigorous automotive standards. Scaling production capacity while maintaining precision calibration is a central challenge in this stage.

The downstream distribution channels vary widely between the OEM and Aftermarket segments. Direct distribution to OEMs is streamlined, involving large-volume contracts with vehicle manufacturers. Conversely, the Aftermarket requires a complex network involving wholesale distributors, specialized tire service centers, general automotive retail outlets, and, increasingly, robust e-commerce platforms. Indirect channels, particularly in the aftermarket, rely heavily on effective logistics, warehousing, and professional installation services. Direct channels through specialized service centers often provide higher margins due to the inclusion of installation and calibration services, particularly for sophisticated TPMS and specialized sealant applications. Effective downstream management is crucial for product visibility and consumer accessibility.

Tire Protection Sales Market Potential Customers

The primary end-users and potential customers of the Tire Protection Sales Market are highly diverse, spanning from individual consumers to large industrial and governmental entities. Passenger vehicle owners represent a massive customer base, seeking convenience, safety, and reduced long-term maintenance costs. These customers are highly sensitive to brand reputation and ease of application, making the aftermarket retail segment and integrated OEM solutions key targets. The rise of vehicle connectivity has also created a segment of tech-savvy consumers who actively seek advanced TPMS solutions integrated with their vehicle’s infotainment and diagnostic systems, prioritizing real-time data and safety alerts.

Commercial fleet operators, including logistics companies, public transport providers, and taxi services, constitute the most value-driven segment. For these buyers, tire protection is not merely a safety feature but a critical operational tool impacting efficiency and profitability. Their purchasing decisions are based on measurable KPIs such as tire lifespan extension, reduction in roadside breakdowns, and overall impact on fuel economy. This segment primarily purchases heavy-duty protective liners, bulk quantities of industrial-grade sealants, and subscription-based services for advanced telematics-integrated TPMS solutions, often acquired directly through specialized commercial tire service providers or large-scale wholesale distributors.

The third major segment encompasses owners and operators of off-highway vehicles (OHV), including entities in mining, construction, and agriculture. Tires in these environments operate under extreme stress, facing high probability of catastrophic damage from debris and heavy loads. Consequently, demand is intensely focused on the most robust and durable protection methods, such as ultra-heavy-duty tire liners and highly specialized industrial sealants designed for extreme temperature and load conditions. Government agencies, including municipal service fleets (police, fire, sanitation), also represent significant institutional buyers prioritizing product reliability and long-term service contracts for essential vehicle operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.7 Billion |

| Growth Rate | 7.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, Schrader International (Sensata Technologies), Henkel AG & Co. KGaA, 3M Company, BASF SE, Illinois Tool Works Inc. (ITW), TECH International, Slime (ITW Global Brands), Autoseal, BADA TPMS, WONDER Wulian, ZAP TPMS, NIRA Dynamics, Michelin Group, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Trelleborg AB, Safety Seal Puncture Repair Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Protection Sales Market Key Technology Landscape

The technological landscape of the Tire Protection Sales Market is rapidly evolving, driven by the need for superior reliability, lighter weight, and improved environmental profiles. A primary focus area is the development of next-generation chemical and polymer science for sealants. Modern sealants move beyond simple latex formulations, incorporating advanced thixotropic gels and fiber-reinforced compounds that remain liquid until activated by a puncture, forming a more robust and permanent seal. Innovations here are geared towards creating formulations that are non-corrosive to alloy wheels and TPMS sensors, possess a longer shelf life, and are easily removable or biodegradable, thereby addressing key consumer and environmental concerns that have historically limited sealant adoption rates.

In the realm of electronic monitoring, the transition from standard TPMS to smart or connected systems represents a fundamental technological shift. Current generation direct TPMS integrates not only pressure and temperature sensors but also advanced accelerometers and gyroscopes to gather richer data, such as load estimation and specific wear pattern analysis. These sensors utilize low-power wireless communication protocols, often leveraging Bluetooth Low Energy (BLE) or specialized radio frequency technology, to transmit data to the vehicle’s Electronic Control Unit (ECU) or directly to cloud-based fleet management platforms. The trend is moving toward autonomous power harvesting for sensors, eliminating the need for internal batteries, which enhances system longevity and reduces maintenance requirements, a critical breakthrough for the high-end commercial market.

Furthermore, the integration of protective liners and self-sealing tire technologies is becoming more sophisticated. Protective liners now utilize complex multi-layer polymer composites that offer exceptional penetration resistance while minimizing added weight to maintain fuel efficiency and handling characteristics. A significant technological push involves integrating these physical protection methods with digital monitoring. For example, some high-end tires incorporate sensors embedded directly within the carcass or liner material, which can differentiate between a minor sealant-repairable leak and a major structural failure, providing immediate, actionable intelligence to the driver or fleet manager. This convergence of material science and digital technology defines the cutting edge of tire protection, moving toward fully integrated, "smart tire" systems.

Regional Highlights

- North America (U.S., Canada, Mexico): This region is characterized by high adoption of TPMS due to the TREAD Act (Transportation Recall Enhancement, Accountability, and Documentation Act) and a highly consolidated commercial fleet sector that readily invests in advanced telematics and predictive maintenance systems. The demand for premium, integrated tire protection solutions (both OEM and high-end aftermarket sealants) is substantial, driven by high consumer spending power and a strong focus on road safety and vehicle performance. The U.S. remains the single largest market for tire protection innovation and consumption.

- Europe (Germany, U.K., France, Italy): European market growth is robust, driven by stringent vehicle emissions standards and a strong regulatory environment mandating TPMS. The region shows a high propensity for adopting eco-friendly solutions, pushing demand for biodegradable sealants and energy-efficient tire protection systems that minimize rolling resistance. Germany, with its large premium automotive manufacturing base, is a key hub for OEM integration of advanced, self-sealing tire technologies and sophisticated TPMS.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC represents the fastest-growing region, fueled by massive increases in vehicle production, rapid infrastructure development, and growing consumer awareness of safety features. China and India are major engines of growth, particularly in the aftermarket segment where cost-effective sealant and basic TPMS solutions see high demand. Japan and South Korea, however, lead in the technological adoption, incorporating connected tire technology into their domestically produced high-tech vehicles. The sheer volume of commercial vehicle activity in the region necessitates strong localized protection solutions.

- Latin America (Brazil, Argentina): Market penetration for advanced tire protection remains moderate, primarily concentrated in commercial and off-highway sectors (mining and agriculture), where severe operating conditions mandate protective measures. The passenger vehicle segment is growing but often favors indirect TPMS or basic sealants due to price sensitivity. Regulatory enforcement of safety standards is gradually increasing, expected to drive future growth in OEM sales.

- Middle East and Africa (MEA): Growth in MEA is highly localized. The Middle East, particularly the GCC countries, sees significant demand for durable protection solutions due to high temperatures and long driving distances, leading to high adoption in luxury and high-performance segments. In Africa, the primary demand comes from the massive mining and construction sectors, requiring highly resilient, industrial-grade tire protection and repair systems to handle exceptionally harsh operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Protection Sales Market.- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Continental AG

- Schrader International (Sensata Technologies)

- Henkel AG & Co. KGaA

- 3M Company

- BASF SE

- Illinois Tool Works Inc. (ITW)

- TECH International

- Slime (ITW Global Brands)

- Autoseal

- BADA TPMS

- WONDER Wulian

- ZAP TPMS

- NIRA Dynamics

- Michelin Group

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries

- Trelleborg AB

- Safety Seal Puncture Repair Systems

Frequently Asked Questions

Analyze common user questions about the Tire Protection Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Direct TPMS and Indirect TPMS, and which is safer?

Direct TPMS (dTPMS) uses pressure sensors mounted inside each tire or wheel assembly, providing highly accurate, real-time pressure and temperature readings regardless of vehicle movement. Indirect TPMS (iTPMS) estimates tire pressure using the Anti-lock Braking System (ABS) wheel speed sensors, inferring pressure loss from changes in wheel rotation speed. dTPMS is generally considered safer and more reliable as it provides immediate, precise data and detects slow leaks more effectively than iTPMS.

How are environmental concerns impacting the formulation of modern tire sealants?

Environmental regulations and consumer demand for sustainability are driving manufacturers toward developing biodegradable, water-based, and non-toxic sealant formulas. Modern, advanced polymer sealants are designed to be non-flammable and non-corrosive, ensuring they do not damage alloy wheels or interfere with the sensitive internal electronics of TPMS sensors, simplifying disposal and improving compatibility with various tire constructions.

What role does the electric vehicle (EV) market play in driving demand for specialized tire protection?

EVs place unique stresses on tires due to their higher curb weight (from battery packs) and instantaneous torque delivery, leading to faster wear and increased risk of stress-related failure. This drives demand for specialized, high-load protective liners, durable self-sealing tires, and lightweight TPMS systems that minimize rolling resistance, thereby helping to preserve the vehicle's critical driving range.

Which geographic region exhibits the fastest growth rate for the Tire Protection Sales Market?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, primarily driven by the massive expansion of automotive manufacturing bases, particularly in China and India, coupled with rapid urbanization and substantial investment in infrastructure projects. This growth is supported by increasing regulatory focus on road safety and expanding consumer access to aftermarket tire protection solutions.

How does AI integration enhance commercial fleet tire maintenance beyond simple pressure alerts?

AI integration transforms commercial maintenance by enabling predictive analytics. By processing real-time sensor data, historical performance logs, and external factors (like weather and route complexity), AI algorithms can forecast the remaining useful life of a tire, predict the likelihood of a specific failure mode (e.g., sidewall stress or underinflation-induced heat), and automatically optimize rotation and service schedules, minimizing downtime and optimizing tire asset management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager