Tire Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438134 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tire Sealant Market Size

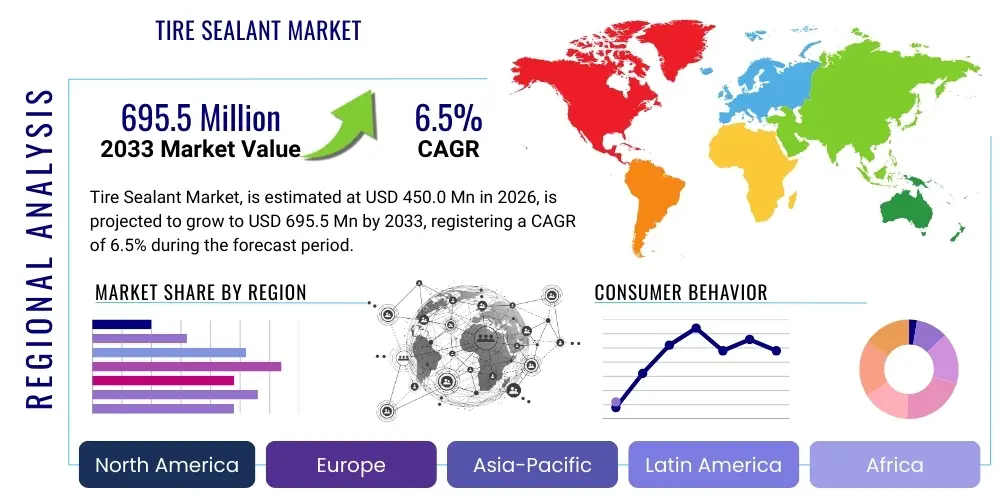

The Tire Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 695.5 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the increasing global vehicle parc, coupled with stringent safety regulations mandating immediate solutions for tire failures, thereby reducing vehicle downtime and enhancing road safety. The shift towards lightweight and fuel-efficient vehicles also encourages the adoption of sealants over traditional spare tires.

Tire Sealant Market introduction

The Tire Sealant Market encompasses a range of chemical solutions designed to temporarily or permanently repair punctures and prevent air leakage in pneumatic tires. These products are typically composed of natural or synthetic polymers, fibers (such as aramid or fiberglass), binders, and carriers (water or solvents). When a puncture occurs, the internal tire pressure forces the sealant mixture into the hole, where the fibers and polymers congeal and cure, creating a flexible, air-tight plug. The primary applications span across on-road passenger vehicles, commercial fleets, heavy-duty off-road equipment (mining, agriculture), and bicycles, serving both emergency repair needs and preventative maintenance protocols.

A major driving factor for this market is the continued emphasis on vehicle lightweighting, especially in the context of electric vehicles (EVs) where maximizing battery range is crucial. Replacing a heavy spare tire and associated tools with a compact, efficient tire sealant kit significantly reduces overall vehicle weight. Furthermore, the operational efficiency benefits for large commercial and agricultural fleets—where tire downtime translates directly into significant financial losses—are substantial, driving high adoption rates in the Business-to-Business (B2B) segment. The constant expansion of infrastructure projects globally, particularly in emerging economies, further boosts the demand for sealants in heavy machinery.

The benefits associated with tire sealants extend beyond simple repair; they offer improved safety by eliminating the need for roadside tire changes, provide temporary mobility until a professional repair shop is reached, and in preventative applications, they can increase tire longevity by reducing the frequency of small, unnoticed air leaks. Key market participants are continually innovating formulations to meet stricter environmental standards, focusing on biodegradable and low volatile organic compound (VOC) content products, thus ensuring alignment with global sustainability mandates and securing future market expansion potential.

Tire Sealant Market Executive Summary

The Tire Sealant Market is characterized by robust growth, propelled primarily by increasing adoption in the automotive aftermarket and the critical utility provided to commercial fleets seeking minimized operational disruption. Business trends indicate a strong move toward water-based and eco-friendly formulations, responding to escalating consumer preference and regulatory pressures, particularly in Europe and North America. The aftermarket segment currently dominates due to the large existing pool of vehicles requiring immediate and accessible repair solutions, although the Original Equipment Manufacturer (OEM) segment is expanding rapidly as manufacturers integrate sealant kits as standard equipment, particularly in premium and electric vehicle models seeking weight savings.

Regionally, the Asia Pacific (APAC) area is poised for the fastest expansion, fueled by burgeoning automotive production, rapid urbanization, and massive investment in construction and infrastructure development across countries like China and India, leading to increased demand for sealants in both passenger vehicles and heavy equipment. North America and Europe, while mature, demonstrate stable growth driven by strict adherence to fleet maintenance standards and high consumer awareness regarding product utility and safety. Segment trends show that preventative sealants, which are installed before damage occurs, are gaining traction over emergency repair kits, signaling a market shift towards proactive maintenance strategies, especially within high-value logistics and rental fleets.

Overall, the market remains highly competitive, with differentiation occurring primarily through product efficacy (sealing capacity and speed), ease of use, compatibility with various tire types (run-flat, tubeless), and adherence to environmental standards (non-toxic ingredients). Strategic collaborations between sealant manufacturers and major tire and automotive OEMs are defining the competitive landscape, ensuring that new products are seamlessly integrated into next-generation vehicle platforms. The ongoing technological integration of tire sealants with advanced tire technologies, such as TPMS and smart tires, represents a core area of strategic investment for market leaders.

AI Impact Analysis on Tire Sealant Market

User queries regarding the impact of Artificial Intelligence (AI) on the Tire Sealant Market typically revolve around three central themes: optimizing logistics and distribution, enhancing product development through predictive chemistry, and integrating sealants within vehicle diagnostics systems. Users frequently question how AI can improve the notoriously complex supply chain for sealants, which often requires precise inventory management due to shelf-life constraints. Furthermore, there is significant interest in AI-driven predictive maintenance, where algorithms could analyze real-time tire pressure and temperature data to recommend preventative sealant application or flag potential failure scenarios before they necessitate emergency repair. Consumers and fleet managers are focused on maximizing efficiency and minimizing unforeseen costs associated with tire management, viewing AI as the crucial tool for achieving predictive reliability.

AI is set to revolutionize the research and development pipeline for advanced sealant formulations. By utilizing machine learning algorithms, manufacturers can analyze vast datasets of polymer behavior, curing times, viscosity, and chemical interactions under various environmental stresses (temperature, humidity, pressure). This enables rapid virtual prototyping and identification of optimal, sustainable, and highly effective ingredient combinations without extensive, costly physical lab testing. This accelerated discovery process helps in creating specialized sealants tailored for unique applications, such as high-speed performance tires or specialized mining equipment operating under extreme conditions, thus shortening the time-to-market for next-generation products that comply with evolving safety and ecological mandates.

In the commercial logistics sector, AI-powered route optimization and demand forecasting significantly enhance the effectiveness of tire sealant deployment. For fleet management, AI systems can process telemetry data from vehicles (including load, road conditions, and utilization rates) to predict where and when tire failure risks are highest. This allows fleet operators to proactively schedule maintenance, including preventative sealant application, minimizing the need for expensive, time-consuming emergency services. This predictive capability transforms the sealant from a reactive repair item into a proactive safety and operational asset, driving substantial adoption within large-scale trucking, logistics, and public transportation entities.

- AI-driven supply chain optimization reduces waste and improves inventory management for perishable sealant products.

- Machine learning accelerates the discovery of new, eco-friendly sealant polymers with superior efficacy and longevity.

- Predictive maintenance algorithms integrate tire sealant usage into proactive fleet management strategies.

- AI analyzes TPMS data in real-time to alert drivers about small pressure drops that can be fixed preventatively by integrated sealants.

- Automated quality control systems use computer vision to ensure consistency during the sealant manufacturing and bottling processes.

DRO & Impact Forces Of Tire Sealant Market

The dynamics of the Tire Sealant Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces influencing industry growth and structure. Key drivers include the global mandate for vehicle safety, the financial imperative for commercial fleets to minimize downtime, and the technological push towards vehicle lightweighting, especially prevalent in the fast-growing EV sector. These factors create strong pull forces for both preventative and emergency sealant products. Conversely, the market faces significant restraints, notably consumer skepticism regarding the long-term effectiveness of temporary repair solutions, the issue of chemical compatibility with certain advanced tire compounds, and regulatory restrictions on Volatile Organic Compounds (VOCs) and specific chemicals, which necessitates continuous and costly reformulation efforts.

Significant opportunities arise from the convergence of smart tire technology and tire sealant integration. The development of self-healing materials and intelligent sealants that can communicate their status through vehicle systems presents a massive untapped potential. Expansion into niche high-stress applications, such as military, aerospace ground support, and heavy industrial settings, offers higher margin opportunities compared to the competitive consumer segment. Moreover, the increasing adoption of tubeless tires across bicycles and light motorized vehicles in developing nations provides a burgeoning mass market for readily available, low-cost repair solutions.

The primary impact forces acting on the market are technological disruption and regulatory stringency. Technological substitution, particularly the rise of sophisticated run-flat tires, poses a threat by diminishing the perceived necessity of sealants in certain new vehicle categories. Simultaneously, stringent environmental regulations in mature markets (EU, North America) compel manufacturers to invest heavily in R&D to develop non-toxic, biodegradable, and water-soluble formulas, impacting production costs but simultaneously creating a competitive advantage for early movers in sustainable chemistry. The balance between maintaining high sealing performance and achieving ecological compliance is the core tension driving innovation and strategic direction.

Segmentation Analysis

The Tire Sealant Market is rigorously segmented across various dimensions, including the chemical composition (Type), the end-user application, and the primary sales channel. Understanding these segments is crucial for manufacturers to tailor product properties—such as viscosity, curing speed, and temperature resistance—to specific consumer needs, whether for a high-performance motorcycle tire or a slow-moving agricultural implement. The diversity of chemical types reflects the industry's response to environmental concerns and performance requirements, while the application segmentation highlights the disparity in demand volume and average selling price (ASP) between consumer-focused and industrial-grade sealants. The segmentation by distribution channel is vital, reflecting the critical difference in market penetration strategies required for OEM supply chain integration versus the visibility and accessibility needed in the highly fragmented aftermarket.

- By Type

- Water-based (Eco-friendly, low VOC)

- Solvent-based (High performance, faster curing)

- Rubber-based (Latex, natural/synthetic)

- Other Chemical Types (Fiber-reinforced, specialized compounds)

- By Application

- On-Road Vehicles (Passenger Cars, Light Trucks, Motorcycles)

- Off-Road Vehicles (Agricultural Tractors, Construction Equipment, Mining Vehicles)

- Bicycles and Recreational Vehicles

- Industrial and Specialized Applications (Military, Port Equipment)

- By Distribution Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail Stores, Online Channels, Professional Garages)

Value Chain Analysis For Tire Sealant Market

The value chain for the Tire Sealant Market begins with the Upstream Analysis, focusing on the sourcing and supply of critical raw materials. These materials primarily include polymers (such as ethylene-propylene-diene monomer (EPDM) or proprietary synthetic latex), natural rubber, binding agents, stabilizing chemicals, and various reinforcement fibers (like microfibers, mica, or cellulose). Raw material procurement is subject to global commodity price volatility, particularly for petroleum derivatives and natural latex, which significantly impacts manufacturing costs. Manufacturers must manage complex relationships with chemical suppliers to ensure consistent quality and compliance with regional chemical registration standards (e.g., REACH in Europe). The efficiency of this upstream stage determines the final product's cost structure and performance characteristics, requiring sophisticated inventory and risk management strategies.

The core manufacturing and distribution phases involve formulation, mixing, filling, and packaging, followed by extensive quality control testing for parameters such as viscosity, pressure resistance, and shelf life. Due to the diverse nature of sealants (some being highly proprietary and chemically complex), manufacturing often requires specialized mixing equipment and controlled environments. Downstream Analysis focuses on the varied distribution channels. The OEM channel demands rigorous certification, high-volume production, and long-term contractual stability, often requiring tailored product specifications for specific vehicle models. Conversely, the Aftermarket channel relies heavily on consumer visibility, competitive pricing, extensive retail partnerships (physical and e-commerce), and effective point-of-sale education regarding proper usage and storage of the sealant kit.

Direct sales are common for specialized industrial applications, where sealants are sold directly to fleet maintenance departments or heavy equipment operators, often involving technical support and customized bulk packaging. Indirect distribution, predominantly through automotive parts distributors, mass merchandise retailers, and online platforms, dominates the consumer segment. The success of the downstream operation hinges on efficient logistics—managing the weight and volume of the packaged product while ensuring adequate shelf life across varying climatic conditions. Strategic alliances with logistics providers and major e-commerce platforms are critical for maintaining market reach and ensuring timely product availability, especially during seasonal peaks in consumer demand for tire maintenance products.

Tire Sealant Market Potential Customers

The potential customer base for tire sealants is highly diversified, ranging from individual consumers focused on safety and convenience to large industrial enterprises prioritizing operational uptime. A primary customer segment includes Automotive OEMs, who integrate emergency sealant kits into new vehicles, especially passenger cars and increasingly, electric vehicles, as a standard replacement for the traditional spare tire assembly to meet weight reduction goals. The procurement process for OEMs is long-cycle, based on stringent quality standards, and requires highly reliable, validated formulations that comply with vehicle warranty requirements and international safety standards, making them a high-value, high-barrier entry customer group.

Another crucial customer segment consists of large Commercial Fleet Operators (trucking, logistics, public transport, and rental companies). For these customers, the cost of downtime far outweighs the cost of the sealant itself, driving demand for preventative sealants applied routinely to minimize roadside failures and maintenance costs. Agricultural and Construction Machinery Operators represent another specialized, high-demand segment, requiring heavy-duty, robust sealants capable of addressing substantial punctures caused by large debris in harsh operating environments. These customers prioritize industrial-strength performance and longevity over consumer-grade convenience, often purchasing in bulk for in-house maintenance shops.

Finally, the DIY Consumer/Retail Buyer forms the largest volume segment, purchasing emergency repair kits from auto parts stores, hardware retailers, or online marketplaces. These buyers prioritize ease of use, clear instructions, and competitive pricing. The growth in the E-bike and Motorcycle communities also constitutes a rapidly expanding niche segment, valuing lightweight, fast-acting solutions for tubeless tires. Targeting these varied customers requires tailored marketing strategies, emphasizing safety and convenience for consumers, and highlighting return-on-investment and operational efficiency for commercial entities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 695.5 Million |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fix-a-Flat, Slime (ITW), Permatex (ITW), Stan's NoTubes, Continental AG, Michelin, Bridgestone Corporation, OKO Global, Berryman Products, TEKTITE Manufacturing, X-Treme Tire Sealant, SmartSeal, Rema Tip Top, Hutchinson, Zinga Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Sealant Market Key Technology Landscape

The technological landscape of the Tire Sealant Market is undergoing significant evolution, driven by the demand for higher efficacy, longer shelf life, and environmental compliance. A key technological focus is the development of advanced polymer chemistry, specifically engineered self-healing polymers. These materials possess microcapsules containing healing agents that rupture upon puncture, initiating a quick, permanent chemical bond repair. This moves sealants beyond temporary fixes, improving their reputation and expanding their viability for high-speed and critical applications. Furthermore, the industry is heavily investing in synthetic latex and fiber-reinforced formulations that offer superior puncture sealing capabilities, resisting leakage even under high internal pressure and centrifugal force, an essential requirement for modern high-performance vehicle tires.

Another pivotal technological advancement involves compatibility enhancement, particularly the challenge of ensuring the sealant does not corrode or negatively interact with internal tire components, such as Tire Pressure Monitoring Systems (TPMS) sensors and specialized inner liners used in run-flat tires. Many traditional, older formulations contained ammonia or other corrosive chemicals which led to sensor damage and voided warranties. Modern, advanced sealants are engineered to be pH-neutral, non-corrosive, and easily washable, addressing major OEM concerns regarding integration and long-term vehicle maintenance. This focus on chemical inertness is vital for penetrating the OEM market, which demands validated, risk-free solutions that do not compromise existing vehicle systems.

The third critical technology area involves the integration of connectivity and smart systems. Advanced sealant kits are increasingly paired with intelligent pumps and connectivity features that guide the user through the repair process and automatically report the repair status to the vehicle's onboard diagnostics system. For fleet managers, this means the sealant application process can be logged and monitored digitally, integrating into broader telematics systems. Research is also ongoing into incorporating microscopic "smart tags" or markers within the sealant formula, allowing professional repair centers to quickly identify the type and quantity of sealant used, facilitating appropriate permanent repair actions and ensuring compliance with tire manufacturer guidelines. This digital integration represents the future standard for high-end preventative and emergency tire care.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, primarily driven by China and India, which are experiencing massive growth in automotive manufacturing, commercial fleet expansion, and construction activity. The adoption of tubeless tires across two-wheelers and passenger cars is escalating, creating a vast aftermarket opportunity. Governments are also increasing safety standards, indirectly supporting the use of sealants as an emergency safety tool. Low labor costs and large manufacturing capacities in countries like China position the region as a major global exporter and consumer of tire sealant products.

- North America: North America holds a substantial market share, characterized by high consumer awareness, large commercial fleets (trucking, logistics), and a strong DIY culture. The market is mature but stable, with growth fueled by the rapid adoption of electric vehicles, which heavily utilize sealant kits for weight reduction. Strict Department of Transportation (DOT) regulations and high insurance liability standards drive commercial fleets to prioritize preventative maintenance and effective roadside solutions, ensuring continued, high-volume demand for premium, heavy-duty formulations.

- Europe: The European market is highly regulated, placing immense pressure on manufacturers to comply with strict environmental standards, particularly regarding VOC content (REACH regulations). This region leads the trend towards water-based, biodegradable, and non-flammable sealants. OEM penetration is high, especially in Germany and France, where premium vehicle manufacturers frequently include sealant kits. The region’s focus on road safety and stringent periodic technical inspection requirements (PTI) further solidifies the steady demand for reliable, certified repair solutions.

- Latin America (LATAM): LATAM is an emerging market with strong growth potential, primarily centered in Brazil and Mexico. Economic factors, including high rates of urbanization and infrastructural projects, increase demand for sealants in construction and public transport vehicles. The presence of challenging road conditions and high rates of tire punctures in rural and industrial areas necessitate robust emergency repair solutions, favoring affordable and easily accessible aftermarket products.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the GCC states (UAE, Saudi Arabia) due to large infrastructure projects, and in South Africa, which has a significant mining and agricultural sector. The extremely high ambient temperatures in the region require specialized sealant formulations that maintain viscosity and efficacy under severe heat stress. Demand is driven by fleet operators managing logistics across vast, remote distances where professional roadside assistance is scarce, making self-sufficiency via sealant kits critical.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Sealant Market.- Fix-a-Flat (ITW)

- Slime (ITW)

- Permatex (ITW)

- Stan's NoTubes

- Continental AG

- Michelin

- Bridgestone Corporation

- OKO Global

- Berryman Products

- TEKTITE Manufacturing

- X-Treme Tire Sealant

- SmartSeal

- Rema Tip Top

- Hutchinson

- Zinga Industries

- Kevlar Tire Sealant

- Gempler's

- Specialty Products Company (SPC)

- Victor Reinz (Dana Incorporated)

- Holts Auto (Part of Holt Lloyd International)

Frequently Asked Questions

Analyze common user questions about the Tire Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Tire Sealant Market in the commercial sector?

The primary driver is the critical need for commercial fleet operators to minimize vehicle downtime. Utilizing preventative or emergency tire sealants significantly reduces the time and expense associated with roadside assistance and complex tire replacement, directly boosting operational efficiency and financial returns for logistics and transport companies globally.

Are modern tire sealants safe to use with Tire Pressure Monitoring Systems (TPMS)?

Yes, leading manufacturers now produce advanced, water-based, and non-corrosive tire sealants that are explicitly engineered to be TPMS-safe. These formulations avoid chemicals like ammonia, which can damage sensor components, thus ensuring system functionality and compliance with OEM warranty requirements. Users should verify the TPMS compatibility labeling before purchase.

What is the key technological innovation influencing the future development of tire sealants?

The most significant innovation is the development of self-healing polymer technology. These advanced sealants use microencapsulation to initiate a chemical curing process upon puncture, offering a more durable, semi-permanent repair solution compared to traditional fiber-based sealants. This technology enhances reliability, particularly in high-speed applications.

How does the shift towards electric vehicles (EVs) affect the demand for tire sealants?

The adoption of EVs strongly correlates with increased demand for tire sealants. Manufacturers often replace heavy spare tires with lightweight sealant kits to reduce overall vehicle weight, directly improving energy efficiency and maximizing the vehicle’s electric driving range, thereby making sealants a standard component in the EV ecosystem.

Which geographical region exhibits the fastest growth potential for the Tire Sealant Market?

The Asia Pacific (APAC) region, driven by countries such as China and India, holds the fastest growth potential. This is attributed to rapid industrialization, massive expansion in vehicle ownership, increasing infrastructure development leading to greater off-road equipment usage, and growing consumer awareness regarding vehicle safety and maintenance tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager