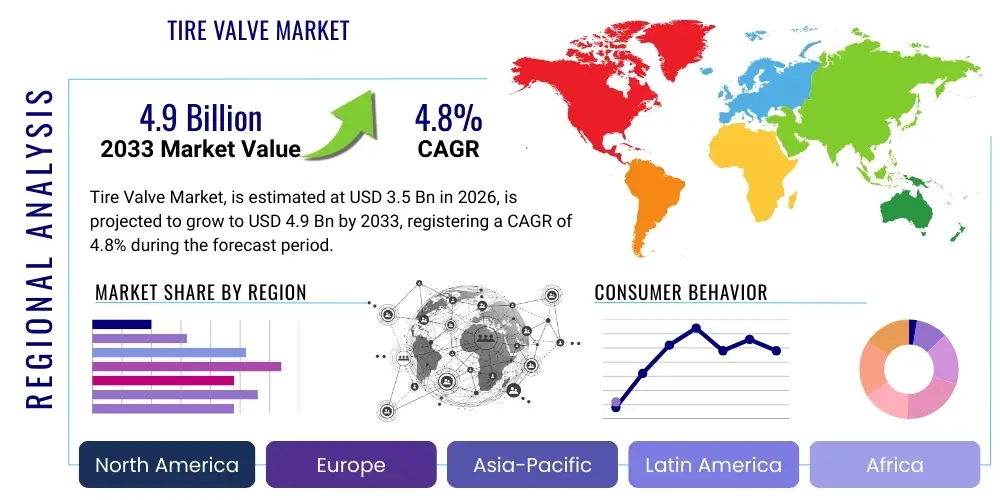

Tire Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438281 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Tire Valve Market Size

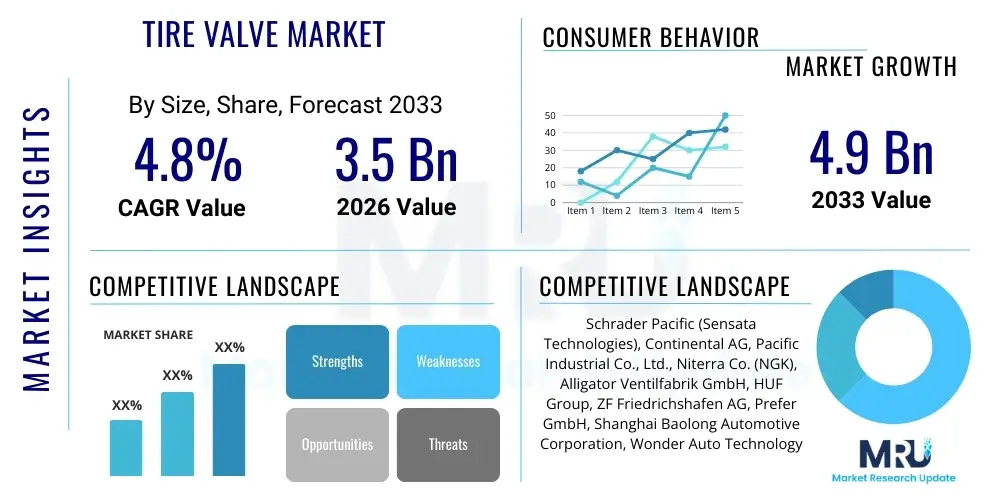

The Tire Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Tire Valve Market introduction

The Tire Valve Market encompasses the manufacturing, distribution, and sale of components essential for regulating air pressure within pneumatic tires. These devices, primarily composed of a valve stem and a valve core, facilitate the inflation and deflation of tires while preventing air leakage, maintaining vehicle safety, fuel efficiency, and tire longevity. The fundamental product has evolved significantly from simple rubber and metal assemblies to integrated systems incorporating advanced sensors, particularly driven by the mandatory adoption of Tire Pressure Monitoring Systems (TPMS) across major automotive markets globally. Modern tire valves must withstand harsh operating conditions, including extreme temperatures, high speeds, and corrosive road salts, necessitating the use of high-grade materials such as specialized brass alloys, stainless steel, and durable EPDM rubber compounds.

Major applications of tire valves span the entire automotive sector, including Passenger Vehicles (PVs), Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Off-Highway Vehicles, and specialized machinery. The increasing global production of vehicles, coupled with stringent safety standards requiring precise tire pressure maintenance, acts as a pivotal driver for market expansion. Furthermore, the growing demand for tubeless tires, which inherently rely on high-integrity snap-in or clamp-in valves for sealing, significantly bolsters the market. The benefits derived from high-quality tire valves include enhanced vehicle handling, reduced risk of blowouts, optimized tire wear, and minimized rolling resistance, directly contributing to sustainability goals by improving fuel economy.

Driving factors in this mature but evolving market are primarily rooted in regulatory compliance and technological integration. Government mandates concerning vehicle safety, especially those related to TPMS implementation in regions like North America (FMVSS 138), Europe (ECE R64), and gradually in Asia Pacific countries, necessitate the use of specialized valve assemblies that can reliably house electronic sensors. The secondary driver is the relentless pursuit of performance and durability in high-end automotive segments, demanding clamp-in valves capable of securing TPMS sensors under extreme forces. The shift towards electric vehicles (EVs) also plays a role, as EVs require tires—and consequently, valves—capable of handling greater vehicle weight and instantaneous torque, demanding higher quality seals and material resilience.

Tire Valve Market Executive Summary

The Tire Valve Market is experiencing robust growth fueled by mandatory safety regulations and the sustained high volume of global vehicle production, particularly within the Asia Pacific (APAC) region. Key business trends indicate a strong bifurcation in product development: while the aftermarket remains cost-sensitive, the Original Equipment Manufacturer (OEM) segment is overwhelmingly transitioning toward sophisticated clamp-in valves that are optimized for integrated TPMS sensors and high-speed driving requirements. Manufacturers are focusing heavily on vertical integration and developing materials science capabilities to reduce failure rates associated with corrosion and fatigue, which are critical for valve performance over the extended lifecycles of modern vehicles. Supply chain resilience, particularly the sourcing of specialized metal alloys, is a rising strategic priority for market leaders.

Regional trends highlight APAC, led by China and India, as the primary engine for volume growth due to expansive domestic automotive manufacturing and rapid motorization. Conversely, North America and Europe represent the mature markets, characterized by high Average Selling Price (ASP) driven by the pervasive use of TPMS technology and a consumer preference for premium, sensor-equipped valves. The European market, in particular, shows strong adoption of advanced valve systems due to strict emissions and safety compliance protocols. The competitive landscape is consolidating, with major players investing in standardization efforts to comply with varied international regulatory frameworks and to combat the proliferation of lower-quality, non-compliant valves in the global aftermarket.

Segment trends underscore the dominance of the clamp-in valve type in terms of revenue, directly attributable to the high unit cost and necessary integration with TPMS sensors. Conversely, snap-in valves maintain the highest unit volume, driven by the vast aftermarket segment and their use in certain standard vehicle models. Vehicle type segmentation confirms passenger vehicles as the largest revenue generators, although commercial vehicles (HCVs) are increasingly adopting sensor-equipped valves to minimize downtime and optimize operational costs through better pressure management. The aftermarket segment remains crucial for profitability, particularly as vehicles age and require replacement parts, stimulating demand for universal and standardized valve designs.

AI Impact Analysis on Tire Valve Market

User interest regarding AI’s impact on the Tire Valve Market centers predominantly on how artificial intelligence can enhance manufacturing precision, optimize supply chain logistics, and revolutionize the field of predictive maintenance for integrated valve systems, particularly TPMS. Users frequently inquire about the feasibility of using AI-driven visual inspection systems to achieve zero-defect assembly, given the criticality of the seal and core components. Key themes emerging from common questions involve leveraging machine learning algorithms to predict material fatigue and corrosion failure based on real-time sensor data, thus shifting maintenance from reactive to proactive strategies. There is also significant curiosity regarding AI's potential in designing next-generation valve materials and geometries for improved sealing efficiency and durability under extreme conditions.

The integration of AI into the manufacturing process represents a paradigm shift toward Industry 4.0 standards. Machine vision systems, powered by deep learning models, are now capable of inspecting microscopic defects in valve components—such as rubber degradation, brass alloy inclusions, or irregular threading—at high throughput speeds, far exceeding human capability. This enhanced quality control is crucial, as even minor flaws can lead to catastrophic air leaks in high-performance or commercial applications. Furthermore, AI algorithms are being applied to optimize production line scheduling, resource allocation, and energy consumption within valve manufacturing facilities, leading to lower operational costs and a more sustainable production footprint. These applications ensure tighter tolerances and consistency, which are vital for maintaining the integrity of TPMS sensor housing.

Beyond manufacturing, AI significantly influences the downstream lifecycle of tire valves. For fleet operators, machine learning models analyze continuous data streams from connected TPMS sensors, differentiating between gradual pressure loss (often due to core failure or stem seal issues) and rapid pressure loss (puncture events). This predictive analysis allows for targeted maintenance interventions on the valve itself before total failure occurs. In the supply chain, AI optimizes inventory management for the millions of varied valve types required globally, predicting regional demand fluctuations based on vehicle sales, seasonal maintenance cycles, and regulatory changes, thereby minimizing logistical delays and stockouts, particularly for specialized TPMS valve kits.

- AI-driven visual inspection systems ensure zero-defect manufacturing of critical valve components (stems and cores).

- Predictive maintenance algorithms analyze TPMS data to forecast valve core failure or stem corrosion, enabling proactive replacement.

- Machine learning optimizes complex supply chains by accurately forecasting demand for various OEM and aftermarket valve configurations.

- AI assists in material science research by simulating the long-term stress and corrosion resistance of novel valve alloys and rubber compounds.

- Automated robotic assembly guided by AI maximizes precision in the installation and calibration of TPMS sensors within clamp-in valve bodies.

DRO & Impact Forces Of Tire Valve Market

The Tire Valve Market dynamics are critically influenced by a confluence of regulatory mandates (Drivers), complex standardization issues (Restraints), and the emergence of connectivity technologies (Opportunities). The primary driver remains the global proliferation and mandatory adoption of Tire Pressure Monitoring Systems (TPMS), which necessitates a higher-value, more technically complex valve structure (clamp-in) capable of housing and protecting sensitive electronics. This regulatory environment ensures sustained demand in OEM channels. Simultaneously, the steady increase in global vehicle production, particularly the expansion of automotive manufacturing bases in emerging economies, provides a robust volume driver for both standard and TPMS-ready valve sales. These drivers collectively exert a significant positive impact force, reshaping the market structure toward specialized, high-precision products.

Conversely, the market faces notable restraints. A major challenge is the influx of substandard and counterfeit tire valves, predominantly in the aftermarket, which compromise safety and erode brand value. These low-cost alternatives, often made from inferior materials, lead to premature air loss and potential sensor damage, creating a persistent quality control issue for legitimate manufacturers. Furthermore, the lack of complete global standardization across TPMS communication protocols and valve sensor designs complicates inventory management and maintenance, especially for international fleet operators and repair shops, marginally constraining growth by increasing complexity. The fluctuating costs and volatile supply chains for key raw materials, such as specialized brass, aluminum, and rubber polymers, also introduce cost pressures that manufacturers must absorb or pass on, impacting overall market pricing.

Significant opportunities are emerging through technological advancements. The development of 'Smart Valves' that integrate enhanced diagnostics, potentially beyond simple pressure measurement (e.g., temperature and self-sealing capabilities), presents a substantial avenue for premium market growth. Additionally, the rapid electrification of the automotive industry (EVs) creates demand for valves compatible with specialized, heavier tires operating at higher pressures, driving innovation in material resilience and sealing technology. Manufacturers focusing on proprietary high-durability coatings (anti-corrosion) and highly reliable sealing mechanisms are poised to capitalize on these premium segments, ensuring that the market evolution focuses on safety and longevity rather than just volume.

Segmentation Analysis

The Tire Valve Market is systematically segmented based on product design, the vehicle type utilizing the valve, the sales channel, and the specific tire application (tubeless or tube). This segmentation allows for precise market analysis, differentiating between the high-volume, cost-sensitive aftermarket demand for standard components and the high-value, technologically sophisticated requirements of the OEM sector for integrated safety systems. The distinction between snap-in and clamp-in valves is crucial, as it directly correlates with TPMS integration—clamp-in valves dominate revenue due to their ability to securely fasten heavy sensor units and withstand higher speeds, while snap-in valves remain the volumetric leader for basic applications and replacement parts.

Segmentation by vehicle type underscores the critical role of Passenger Vehicles (PVs) as the largest market segment, driven by universal TPMS mandates. However, the Commercial Vehicle (CV) segment is rapidly gaining ground, fueled by fleet management efficiency initiatives and the need to minimize downtime associated with underinflated tires. The sales channel distinction highlights the stable revenue stream derived from the Original Equipment Manufacturer (OEM) channel, characterized by long-term contracts and stringent quality requirements, versus the highly competitive and price-sensitive Aftermarket channel, which caters to replacement needs throughout the vehicle lifecycle. Understanding these dynamics is essential for strategic planning, resource allocation, and product development efforts across regional markets.

- Product Type

- Snap-in Valves (Rubber-based, lower speed rating, typically non-TPMS compatible or replacement)

- Clamp-in Valves (Metal-based, high speed rating, mandatory for TPMS sensor housing)

- Vehicle Type

- Passenger Vehicles (PVs)

- Commercial Vehicles (CVs)

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

- Off-Road Vehicles (ORVs)

- Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and repair)

- Application

- Tubeless Tires

- Tube Tires

- Material

- Brass

- Aluminum

- EPDM Rubber

Value Chain Analysis For Tire Valve Market

The value chain for the Tire Valve Market is complex, beginning with the sourcing of specialized raw materials, moving through high-precision manufacturing and assembly, and concluding with a multi-tiered distribution network. Upstream analysis focuses heavily on the procurement of quality brass and aluminum alloys for the valve stems and cores, along with specific rubber compounds (EPDM or natural rubber) for seals and snap-in bodies. Suppliers of these primary materials, particularly those offering corrosion-resistant and fatigue-resistant grades, hold considerable influence over component cost and quality. Strict quality control at the material input stage is non-negotiable, given the high-pressure and environmental demands placed on the final product, especially for TPMS-integrated valves where material failure can lead to expensive sensor replacement.

The core manufacturing process involves highly automated stamping, machining, molding, and intricate assembly, often involving robotic processes to ensure minute tolerances, especially in the valve core and seating mechanism. Midstream players include specialized valve manufacturers and Tier 1 automotive suppliers who integrate TPMS sensors into the clamp-in valve structure. This integration requires expertise in electronics protection and sealing technology. Downstream distribution is bifurcated: Direct distribution involves supplying finished valves (often pre-assembled with sensors) directly to global automotive OEMs on just-in-time schedules for integration into new vehicle production lines. This channel demands high volumes, consistent quality, and global logistical capabilities.

The indirect distribution channel caters primarily to the vast global aftermarket. This involves distributing replacement valves and repair kits through a network comprising wholesale distributors, large retail auto parts chains, specialized tire service centers, and independent garages. Profit margins in the aftermarket can be higher but are significantly more sensitive to price competition and counterfeiting. The effective management of the indirect channel requires strong brand recognition, comprehensive inventory management to cover thousands of vehicle models, and robust anti-counterfeiting measures. The entire value chain is undergoing digitalization, with major players utilizing cloud platforms to track materials, manage production quality, and optimize global logistics, striving for AEO compliance in parts delivery and traceability.

Tire Valve Market Potential Customers

The primary customer base for the Tire Valve Market is highly segmented, ranging from global automotive manufacturers requiring millions of units annually to small, independent garages needing specialized replacement kits. The most significant potential customers are the global Original Equipment Manufacturers (OEMs), including major automakers like Toyota, Volkswagen Group, Ford, and General Motors. These customers demand the highest quality standards, complex technical specifications (especially regarding TPMS compatibility), and adherence to strict regulatory certifications, often purchasing directly from Tier 1 suppliers like Continental or Sensata, who incorporate the valves into larger chassis or wheel assemblies.

Another major customer group consists of large global tire manufacturers (e.g., Michelin, Bridgestone, Goodyear), who often purchase specialized valve types for their premium lines or factory-installed tires, particularly tubeless variants. Fleet operators, managing large numbers of commercial vehicles (trucking, logistics, public transit), are increasingly important customers. They invest in high-durability, TPMS-equipped valves to ensure regulatory compliance, reduce fuel consumption, and minimize vehicle downtime due to pressure loss, frequently engaging directly with aftermarket suppliers for bulk replacements and maintenance contracts.

Finally, the extensive aftermarket segment targets independent repair shops, chain tire centers (e.g., Discount Tire, TBC Corporation), and DIY consumers. These customers prioritize availability, standardized fitment, and competitive pricing for replacement snap-in valves and universal TPMS service kits (caps, cores, grommets). E-commerce platforms and major parts distributors facilitate the purchase experience for these end-users, requiring suppliers to offer comprehensive product information and robust technical support to ensure correct part selection and installation, a key aspect of Generative Engine Optimization (GEO) in the parts domain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schrader Pacific (Sensata Technologies), Continental AG, Pacific Industrial Co., Ltd., Niterra Co. (NGK), Alligator Ventilfabrik GmbH, HUF Group, ZF Friedrichshafen AG, Prefer GmbH, Shanghai Baolong Automotive Corporation, Wonder Auto Technology Co., Ltd., Hamaton Automotive Technology Co., Ltd., STEMCO, 31 Incorporated, Tech International, A. Schrader's Son Inc., Presta Valve, VDO, SLIME, Henan Yuxin Auto Parts Co., Ltd., Nanjing Schrader International Valve Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tire Valve Market Key Technology Landscape

The technological landscape of the Tire Valve Market is rapidly transitioning from a focus on basic mechanical functionality to sophisticated electronic integration, primarily due to the ubiquitous adoption of Tire Pressure Monitoring Systems (TPMS). The critical evolution involves the miniaturization and ruggedization of the valve stem to reliably house direct TPMS sensors, necessitating advanced clamp-in valve designs made of high-strength, lightweight aluminum or specialized brass alloys. These materials must offer superior resistance to galvanic corrosion when in contact with the wheel rim and maintain mechanical integrity under varying temperature and pressure cycles inherent to high-performance driving. Innovations in sealing technology, utilizing proprietary elastomer formulations, ensure hermetic seals at the rim interface and around the valve core, which is essential for preserving the lifespan of the sensitive electronics within the sensor body.

Beyond sensor integration, significant technological efforts are directed towards improving valve core performance and developing non-contact monitoring systems. The core mechanism is the most frequently serviced component and is highly susceptible to contamination and fatigue. Manufacturers are utilizing precision-machined metallic components and self-lubricating polymers to enhance core durability and reduce pressure loss rates. Furthermore, the future technology landscape includes the development of indirect TPMS systems that do not require sensors integrated into the valve (though still requiring a functional valve), and advanced systems that monitor tire health parameters beyond pressure, such as embedded self-sealing layers within the valve stem to immediately repair minor leaks caused by road debris or fatigue.

Another crucial area of innovation is in connectivity and data transmission standards. Next-generation tire valves, especially those used in connected commercial fleets, are being developed with advanced communication capabilities (e.g., Bluetooth Low Energy or proprietary protocols) to transmit detailed tire data wirelessly for fleet management systems. This necessitates a shift in manufacturing expertise toward microelectronics assembly and antenna optimization within the valve body, ensuring reliable communication despite the harsh operating environment inside the tire. These technological advancements are moving the tire valve from a simple passive component to an active, data-generating subsystem critical for vehicle safety and performance optimization in the era of connected and autonomous vehicles.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, predominantly driven by massive domestic vehicle production in countries like China, India, Japan, and South Korea. While the region includes both price-sensitive standard valve demand (China's aftermarket) and technologically advanced OEM requirements (Japan and South Korea for export models), the sheer volume of vehicle manufacturing ensures its market leadership. Regulatory pressures regarding TPMS are increasing in countries like South Korea and India, gradually shifting the market mix towards high-value clamp-in valves. The region serves as the global manufacturing hub for many valve component suppliers, benefiting from lower production costs and established automotive supply chains.

- North America: This region represents a mature and highly regulated market, where the adoption of high-quality TPMS-compatible valves (clamp-in) is nearly 100% due to the mandatory enforcement of FMVSS 138. The market is characterized by a strong demand for premium replacement valves and TPMS service kits, ensuring high average selling prices (ASPs). Growth here is driven more by technological replacements (upgrading older TPMS systems) and regulatory compliance in heavy-duty commercial vehicles than by unit volume increase in new car production. Material quality and anti-corrosion features are paramount due to varying climate conditions.

- Europe: Europe is highly influenced by strict safety and environmental regulations (ECE R64), mandating TPMS across all new passenger vehicles. The market exhibits high demand for technically sophisticated valves, particularly those integrated seamlessly with sophisticated vehicle electronics systems. Sustainability is a key focus, prompting interest in lighter, recyclable aluminum valve materials and long-life rubber components. The replacement market is robust, supported by a structured network of certified service providers who specialize in TPMS maintenance and calibration, further ensuring the use of high-quality, authorized replacement parts.

- Latin America and Middle East & Africa (MEA): These regions are emerging markets with moderate growth potential. Latin America's market expansion is linked to increasing domestic vehicle assembly and potential future regulatory alignment with TPMS standards seen in the US and EU. MEA remains price-sensitive, with a high proportion of demand for standard snap-in valves for both new and older vehicles, although the demand for specialized valves is increasing in specific high-income markets and for modern fleet operations, driven by operational efficiency rather than strict safety mandates alone.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tire Valve Market.- Schrader Pacific (Sensata Technologies)

- Continental AG

- Pacific Industrial Co., Ltd.

- Niterra Co. (NGK Spark Plug Co.)

- Alligator Ventilfabrik GmbH

- HUF Group

- ZF Friedrichshafen AG

- Prefer GmbH

- Shanghai Baolong Automotive Corporation

- Wonder Auto Technology Co., Ltd.

- Hamaton Automotive Technology Co., Ltd.

- STEMCO

- 31 Incorporated

- Tech International

- A. Schrader's Son Inc.

- Presta Valve

- VDO (A brand of Continental)

- SLIME (ITW Global Brands)

- Henan Yuxin Auto Parts Co., Ltd.

- Nanjing Schrader International Valve Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Tire Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between snap-in and clamp-in tire valves?

Snap-in valves are typically made of rubber and are designed for lower speeds and pressures, often used in the aftermarket or basic tire assemblies. Clamp-in valves are metallic (brass or aluminum), offer superior sealing integrity, and are mandatory for securely mounting Tire Pressure Monitoring System (TPMS) sensors in modern vehicles, especially those rated for higher speeds.

How do global TPMS mandates influence the growth of the tire valve market?

TPMS mandates significantly drive market revenue by compelling automakers and the aftermarket to utilize higher-cost, specialized clamp-in valves that integrate electronic pressure sensors. This regulatory requirement ensures sustained demand for sophisticated valve assemblies over standard, lower-cost components, particularly in North America and Europe.

What are the key material science challenges facing modern tire valve manufacturers?

Manufacturers face challenges in developing materials resistant to environmental factors, including galvanic corrosion (interaction between metal valve and aluminum wheels), chemical degradation from road salts and tire sealants, and maintaining resilience under high thermal and dynamic stress, crucial for ensuring long-term valve integrity and sensor protection.

Which geographical region dominates the production and consumption of tire valves?

The Asia Pacific (APAC) region dominates both the production volume and consumption of tire valves, driven by its expansive automotive manufacturing base, particularly in China and India. While North America and Europe lead in the adoption of high-value TPMS-integrated valves, APAC commands the overall unit volume market share.

What future technological trends are expected to impact the tire valve industry?

Future trends include the development of smart valves with enhanced diagnostic capabilities, integration of AI-driven quality control in manufacturing, and widespread use of advanced materials (e.g., specialized polymers and lighter alloys) to reduce weight and improve compatibility with high-performance and electric vehicle (EV) tires.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Tire Valve Market Size Report By Type (Rubber Tire Valve, Metal Tire Valve), By Application (Two-Wheelers, Passenger Car, Commercial Vehicles, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Tire Valve Market Statistics 2025 Analysis By Application (Two-Wheelers, Passenger Car, Commercial Vehicles), By Type (Rubber Tire Valve, Metal Tire Valve), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager