Titania Slag Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435343 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Titania Slag Market Size

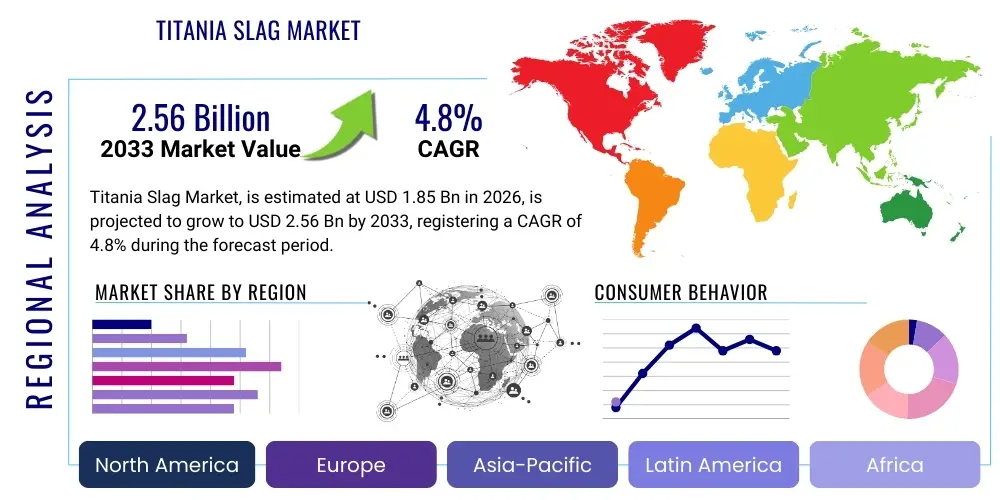

The Titania Slag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Titania Slag Market introduction

Titania slag, a high-purity iron-titanium material derived primarily from the smelting of ilmenite ore, serves as a crucial intermediate product in the global chemicals and materials industries. Its fundamental application lies in the production of titanium dioxide (TiO2) pigment, which is essential for paints, coatings, plastics, papers, and inks due to its excellent opacity and brightness. The demand for TiO2 is intrinsically linked to global construction and automotive sectors, providing a consistent growth trajectory for the titania slag market. Furthermore, its chemical composition and low impurity levels make it highly desirable for specialized applications, including the manufacture of welding electrodes and specific metallurgical processes requiring titanium input.

The product is typically characterized by a titanium dioxide content ranging from 75% to over 90%, depending on the smelting method (e.g., electric furnace smelting or plasma smelting) and the purity requirements of the end-user industry. The primary benefit of using titania slag over raw ilmenite is the pre-reduction and concentration of titanium content, making the subsequent production of TiO2 via the chloride process or sulfate process more efficient and less energy-intensive. This efficiency advantage drives market adoption, particularly in regions with stringent environmental regulations that favor cleaner processing routes.

Driving factors for the sustained expansion of the market include the rapid urbanization and infrastructure development in emerging economies, particularly across Asia Pacific, which necessitates massive volumes of high-quality paints and coatings. Technological advancements in smelting processes, leading to higher purity and improved consistency of the slag product, also contribute significantly. Additionally, the growing application of welding electrodes in industrial fabrication, shipbuilding, and energy infrastructure projects further solidifies the essential role of high-grade titania slag in the global industrial supply chain.

Titania Slag Market Executive Summary

The Titania Slag Market is characterized by moderate but stable growth, anchored by robust demand from the titanium dioxide pigment sector. Business trends indicate a focus on vertical integration among major producers, aiming to secure ilmenite supply and optimize smelting operations to minimize costs and improve product consistency, a necessary response to fluctuating energy prices and increasing regulatory pressure regarding waste management. The adoption of the chloride process for TiO2 production, which prefers high-grade slag, is accelerating, compelling slag producers to invest in advanced purification technologies. Strategic mergers and acquisitions are observed, primarily driven by companies seeking to consolidate market share and control key raw material inputs, thereby reinforcing oligopolistic market characteristics in certain segments.

Regionally, the Asia Pacific (APAC) stands as the dominant consumption hub, fueled by unprecedented growth in construction, automotive manufacturing, and consumer goods packaging sectors in China and India. North America and Europe, while mature, exhibit demand stability driven by replacement cycles and a strong focus on high-performance coatings, particularly in aerospace and industrial maintenance. Emerging markets in Latin America and the Middle East and Africa (MEA) represent significant opportunities, supported by ongoing large-scale infrastructure and energy projects, which consume substantial amounts of welding electrodes and high-opacity paints.

Segment trends reveal that the high-grade titania slag segment (typically >85% TiO2) is experiencing faster growth due to the expansion of the chloride process. Application-wise, the Pigments segment maintains the largest market share, but the Welding Flux segment is exhibiting above-average growth, driven by specialized industrial fabrication needs. Furthermore, environmental regulations are driving demand for slag produced using cleaner, lower-emission smelting technologies, favoring producers capable of demonstrating sustainable practices and minimal environmental footprint, thereby creating a competitive advantage for technologically advanced market participants.

AI Impact Analysis on Titania Slag Market

User inquiries regarding AI's impact on the Titania Slag market frequently revolve around operational efficiency, raw material quality assessment, and demand forecasting reliability. Key concerns center on how AI can optimize the energy-intensive smelting process, predicting optimal furnace parameters to maximize yield while minimizing electricity consumption—a crucial factor given the high operational expenditure. Users also express interest in AI-driven solutions for real-time monitoring of input ilmenite composition and output slag purity, ensuring stringent quality control for the lucrative chloride-grade market. Furthermore, sophisticated supply chain managers seek AI tools for predictive maintenance of specialized smelting equipment and for accurate, dynamic forecasting of TiO2 pigment demand fluctuations, translating downstream shifts into actionable production schedules for titania slag.

The implementation of machine learning algorithms in operational technology (OT) environments is poised to revolutionize resource management within titania slag production facilities. By analyzing massive datasets related to temperature, power input, chemical reactions, and ore characteristics, AI can generate dynamic models that optimize energy allocation, significantly reducing the carbon footprint and operational costs associated with electric arc furnace smelting. This level of optimization is critical for maintaining profitability amidst volatile energy markets and increasingly strict climate goals, offering a decisive competitive edge to early adopters.

Beyond process optimization, AI systems are beginning to influence market strategy by providing nuanced demand signals. Integration of generative AI tools with vast public and proprietary construction, automotive, and coatings industry data allows slag producers to forecast demand with unprecedented precision, adjusting inventory levels and long-term procurement strategies for ilmenite. This predictive capability minimizes the risks associated with market oversupply or shortages, ensuring efficient capital deployment and responsiveness to global economic cycles that profoundly affect downstream pigment consumption.

- AI-Powered Process Optimization: Real-time adjustment of smelting furnace parameters (temperature, voltage, feed rate) to maximize TiO2 recovery and reduce specific energy consumption per ton of slag produced.

- Predictive Maintenance: Utilization of sensor data and ML algorithms to anticipate equipment failures in specialized smelting reactors, reducing unplanned downtime and enhancing overall plant utilization rates.

- Quality Control Automation: Deployment of computer vision and spectroscopic analysis combined with AI to automatically assess the purity, color index, and particle size distribution of resultant titania slag, ensuring compliance with chloride-grade specifications.

- Supply Chain and Logistics Forecasting: Advanced algorithms predicting fluctuations in global shipping costs and ilmenite availability, enabling producers to optimize inventory holding strategies and mitigate raw material risk.

- Sustainable Resource Management: AI models optimizing the utilization of secondary raw materials or recycled inputs in the smelting process, supporting circular economy initiatives and reducing reliance on virgin ore.

- Dynamic Pricing Strategies: Analysis of competitive intelligence and real-time market sentiment using AI to implement optimal, dynamic pricing strategies for various grades of titania slag globally.

- Safety and Risk Assessment: AI monitoring of operational environments to detect abnormal patterns or potential safety hazards within high-temperature smelting areas, enhancing worker safety protocols.

- Carbon Footprint Modeling: ML predicting the carbon intensity of different production batches based on energy source and process parameters, aiding in achieving sustainability targets and mandatory reporting requirements.

- R&D Acceleration: AI simulating the impact of novel fluxing agents or alternative reductants on slag quality, speeding up the development of next-generation, higher-purity products.

- Enhanced Corrosion Monitoring: Using smart sensors and AI analysis to predict the lifespan of refractory linings in smelting furnaces, preventing catastrophic failures and extending operational cycles.

- Waste Stream Minimization: Optimization models reducing the volume and improving the composition of non-titania waste materials (e.g., iron co-products), facilitating their beneficial reuse.

- Market Intelligence Synthesis: Generative AI collating global construction project pipelines and regulatory changes affecting pigment use (e.g., REACH), providing comprehensive market insights to strategic planners.

DRO & Impact Forces Of Titania Slag Market

The Titania Slag market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its future trajectory. A primary driver is the inexorable global demand for high-quality titanium dioxide pigment, intrinsically linked to population growth, urbanization, and rising living standards that increase consumption of coated products and finished goods. Counterbalancing this growth are significant restraints, notably the energy-intensive nature of the smelting process, which exposes producers to volatile electricity and coking coal prices, and stringent environmental regulations concerning sulfur dioxide emissions and solid waste disposal. Opportunities arise from technological advancements, specifically the shift toward high-purity slag favored by the more environmentally friendly and economically efficient chloride process, coupled with the potential for expansion into specialized metallurgical markets where titanium additions are crucial for material performance.

Drivers: Robust expansion in the construction and automotive sectors globally, particularly in developing nations, significantly boosts demand for paints and coatings, directly translating into increased consumption of TiO2, the main derivative of titania slag. Furthermore, the rising adoption of titania slag in the welding industry, especially for electrodes used in demanding infrastructure and shipbuilding projects, provides a niche but high-growth driver. The technological superiority and processing advantages of high-grade slag over lower-content feedstocks (like raw ilmenite) in modern TiO2 plants incentivize its adoption, supporting premium market pricing and sustained volume growth.

Restraints: The high capital expenditure required for establishing or upgrading electric arc smelting facilities acts as a significant barrier to entry, limiting competitive expansion. Operational challenges, specifically high energy consumption and the need for consistent, low-cost electricity supply, constrain profitability, particularly in regions where energy costs are high or unstable. Environmental scrutiny, especially related to the generation of slag residue and processing emissions, requires continuous investment in pollution abatement technologies, increasing operating costs and potentially slowing production expansions in environmentally sensitive regions like Europe.

Opportunities: The principal opportunity lies in the ongoing global transition from the sulfate process to the chloride process for TiO2 production, as the latter requires higher purity titania feedstock, guaranteeing premium demand for specialized, high-grade slag. Development of innovative methods for processing lower-grade ilmenite ores efficiently into high-quality slag offers supply diversification opportunities. Furthermore, the market benefits from exploring novel applications in advanced materials, ceramics, and specialized metallurgical alloys where titania slag derivatives can impart unique performance characteristics, moving beyond traditional pigment applications.

Impact Forces Summary: The dominant impact force is the balance between surging demand from APAC urbanization and the escalating operational complexity due to energy costs and environmental compliance. While demand pull remains strong, the market structure is heavily influenced by the ability of key producers to manage input volatility and invest in process efficiency (e.g., plasma smelting technologies). The long-term market dynamic will favor producers that successfully integrate sustainable sourcing and energy-efficient processing, mitigating the restraints and capitalizing on the high-purity demand opportunity presented by the chloride route expansion.

Segmentation Analysis

The Titania Slag Market is comprehensively segmented based on its Titanium Dioxide Content, the specific Process used for its production, and its diverse end-use Applications. Understanding these segments is crucial as the performance requirements and pricing structures vary significantly. The purity level (TiO2 content) dictates suitability for the chloride or sulfate process, with high-grade segments commanding a premium. The market structure reflects the dichotomy between bulk supply to the pigment industry and specialized demand from the welding and metallurgy sectors, demanding tailored product specifications and quality assurance protocols based on end-user application.

- By TiO2 Content Grade:

- High-Grade Titania Slag (78% to 92% TiO2)

- Low-to-Medium Grade Titania Slag (70% to 78% TiO2)

- By Production Process:

- Electric Arc Furnace (EAF) Smelting

- Plasma Smelting

- Other Advanced Reduction Methods

- By Application:

- Pigments (Titanium Dioxide Production)

- Welding Flux and Electrodes

- Metallurgical Additives (e.g., Titanium Sponge)

- Other Specialized Uses (e.g., Ceramics, Refractories)

- By End-User Industry:

- Paints and Coatings

- Plastics and Rubber

- Paper and Pulp

- Construction and Infrastructure

- Automotive and Aerospace

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Titania Slag Market

The Titania Slag value chain initiates with the upstream mining and beneficiation of primary raw materials, predominantly ilmenite and sometimes rutile sands. Ilmenite processing involves substantial capital investment in dredging, magnetic separation, and gravity separation to produce a concentrate suitable for smelting. Efficiency in this upstream stage is paramount, as the quality and concentration of the titanium ore directly dictate the energy inputs required in the subsequent smelting phase. Major players often integrate backward to secure consistent, high-quality ilmenite supply, minimizing exposure to raw material price volatility and ensuring feedstock consistency for high-purity slag production.

The midstream phase centers on the energy-intensive process of smelting, where ilmenite concentrate is reduced using carbon sources (like coal or petroleum coke) in electric arc furnaces or increasingly, in advanced plasma furnaces. This transformation yields high-titanium liquid slag and a high-purity iron co-product (pig iron or cast iron). Operational optimization in smelting is the key value addition point, involving intricate control over furnace chemistry and thermal management to achieve the required TiO2 purity (e.g., 85% for chloride process feedstock) while managing massive energy loads and complying with strict emission standards for sulfur and dust. The resulting titania slag is then solidified, crushed, and milled according to the purchaser's specifications.

The downstream distribution channel primarily focuses on two routes: direct sales to major TiO2 pigment producers and sales to specialized manufacturers of welding electrodes and metallurgical additives. Direct sales constitute the largest volume, often managed through long-term supply contracts, ensuring stable revenue streams. Indirect channels involve trading houses and specialized distributors who manage logistics, quality verification, and smaller batch deliveries, particularly to regional welding electrode manufacturers. The logistics component is critical due to the bulk nature of the product, necessitating optimized rail and maritime transport to move slag from smelting hubs (e.g., South Africa, Norway, Canada) to large TiO2 manufacturing clusters in Asia and Europe, influencing final delivered costs significantly.

Titania Slag Market Potential Customers

The primary customers for titania slag are large multinational chemical corporations specializing in the production of titanium dioxide (TiO2) pigment, which forms the vast majority of market demand. These customers operate high-capacity manufacturing plants utilizing either the sulfate process (typically using lower-grade slag) or the more modern chloride process (demanding high-grade, purified slag). Their purchasing decisions are driven by consistent supply, stringent quality specifications, and long-term price stability. Securing long-term supply agreements with these major pigment producers is crucial for titania slag manufacturers, as this ensures high volume throughput and reduces market exposure.

Secondary, yet significantly growing, customer segments include manufacturers of welding consumables, specifically those producing covered electrodes and submerged arc welding fluxes. Titania slag acts as a fluxing agent and stabilizer, providing shielding characteristics and enhancing arc stability and weld quality. These customers require finely milled slag with precise chemical properties and particle size distribution. The tertiary segment comprises metallurgical industries, including those involved in the production of titanium metal sponge and specialty alloys, where titania slag or its derivatives are used as a raw material or additive to improve mechanical properties or corrosion resistance. This segment values specialized, high-purity products tailored to complex material science requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Iluka Resources Limited, Tronox Holdings plc, Rio Tinto Fer et Titane (RTFT), Exxaro Resources Limited, Kenmare Resources plc, Eramet Group, Tinfos AS, TiZir Limited (a subsidiary of Eramet and Mineral Deposits Limited), White Sivan Holdings (Pty) Ltd., The Chemours Company, VSMPO-AVISMA Corporation, OSAKA Titanium technologies Co., Ltd., Shanghai Titanium Dioxide Chemical Co., Ltd., Henan Billions Chemical Co., Ltd., China National Nuclear Corporation (CNNC), Kronos Worldwide, Inc., Jiangxi Tikon Titanium Co., Ltd., PanAsia Titanium Industry Co., Ltd., Gulf Titanium Group, Travancore Titanium Products Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titania Slag Market Key Technology Landscape

The technological landscape of the Titania Slag market is centered on enhancing the efficiency of ilmenite reduction and increasing the purity of the resulting slag, primarily to meet the stringent requirements of the chloride process. Historically dominated by conventional electric arc furnace (EAF) smelting, the industry is increasingly investing in advanced methods. EAF smelting involves reducing the iron oxide content in ilmenite using carbon at high temperatures, physically separating the resulting titania-rich slag from the liquid iron co-product. Improvements in EAF technology focus on furnace design, refractory material lifespan, and energy input control to maximize thermal efficiency and reduce energy consumption per ton of slag produced.

A major technological shift involves the adoption of plasma smelting, a process utilizing ultra-high temperature plasma torches instead of traditional electrodes. Plasma technology offers several key advantages: it allows for the processing of lower-grade or highly variable ilmenite feedstocks that are unsuitable for conventional EAFs, achieves faster reaction kinetics, and results in a higher purity slag with fewer metallic contaminants. Crucially, plasma smelting can lead to lower carbon emissions compared to traditional methods that rely heavily on fossil fuels as reductants, aligning with global decarbonization goals and offering a clear pathway to sustainable production of high-grade titania slag for premium applications.

Furthermore, significant technological effort is directed toward post-smelting purification and waste management. Technologies such as leaching processes (e.g., using acid or caustic solutions) are employed to further remove impurities like calcium, magnesium, and residual iron from the slag, pushing the TiO2 content above 90% and making it optimal for the chloride route. In terms of waste, advanced separation and utilization technologies are being developed to find beneficial uses for the large volumes of iron co-products and minor gangue minerals, turning waste streams into valuable secondary products, thereby improving the overall economic and environmental profile of the titania slag manufacturing operation.

Regional Highlights

Regional dynamics heavily influence the Titania Slag market, driven by varying industrial growth rates, regulatory environments, and the concentration of both raw material sources and downstream processing facilities. The market is broadly divided into major consumption centers (APAC, Europe, North America) and key supply hubs (MEA, Canada, Norway, Australia).

- Asia Pacific (APAC): APAC represents the largest and fastest-growing consumer market globally, primarily driven by massive infrastructure and housing projects in China, India, and Southeast Asian nations. The region dominates global TiO2 pigment production, creating immense demand for titania slag feedstock. While production is significant in China, reliance on imports from suppliers in Africa and Australia is high, particularly for chloride-grade slag. Regulatory relaxation compared to Western counterparts, coupled with sustained industrial investment, ensures APAC remains the engine of market expansion.

- Europe: Europe is characterized by slow but stable growth, focusing heavily on high-specification coatings, aerospace applications, and adherence to strict environmental regulations (e.g., REACH). Demand is primarily for high-grade, premium titania slag suitable for the chloride process. The region is a net importer of titania slag, sourcing heavily from smelting operations in Norway (Tinfos) and South Africa, prioritizing supply chain sustainability and environmental accountability in procurement decisions.

- North America: The North American market is mature, marked by stable consumption driven by the revitalized construction sector and specialized industrial manufacturing. Key demand drivers include automotive coatings and specialized welding applications used in the energy sector (oil and gas pipelines, refinery maintenance). Major players like Tronox and Chemours operate significant downstream TiO2 facilities, creating steady demand for consistent, high-purity slag, sourced both domestically and internationally.

- Middle East and Africa (MEA): MEA is pivotal primarily as a major global sourcing hub for ilmenite and titania slag, particularly South Africa (Exxaro) and mineral-rich regions in Africa. These regions benefit from large, high-quality mineral sands reserves and relatively lower energy costs, positioning them as cost-competitive production centers. Internal consumption within MEA is relatively low but is rising due to increased local infrastructure development and downstream industrial diversification efforts, particularly in the UAE and Saudi Arabia.

- Latin America (LATAM): LATAM represents an emerging consumer market, with demand growth tied directly to regional economic stability, infrastructure investment in Brazil, Mexico, and Chile, and domestic manufacturing expansion. While production capacity is limited, the region imports titania slag for use in localized pigment production and substantial heavy industrial projects, including mining equipment fabrication and large-scale public works. Market expansion here is highly dependent on foreign direct investment in the industrial sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titania Slag Market.- Tronox Holdings plc

- Rio Tinto Fer et Titane (RTFT)

- Iluka Resources Limited

- Exxaro Resources Limited

- Kenmare Resources plc

- Eramet Group

- Tinfos AS

- TiZir Limited

- The Chemours Company

- Kronos Worldwide, Inc.

- White Sivan Holdings (Pty) Ltd.

- Jiangxi Tikon Titanium Co., Ltd.

- PanAsia Titanium Industry Co., Ltd.

- Guangxi Ciba Mining Co., Ltd.

- Travancore Titanium Products Ltd.

- Shanghai Titanium Dioxide Chemical Co., Ltd.

- Henan Billions Chemical Co., Ltd.

- Mineral Deposits Limited

- GSC Group

- Gulf Titanium Group

Frequently Asked Questions

Analyze common user questions about the Titania Slag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the Titania Slag Market growth, and how does environmental regulation affect supply?

The primary driver is the pervasive and increasing global demand for Titanium Dioxide (TiO2) pigment, essential for paints, coatings, and plastics, directly linked to urbanization and infrastructure development, particularly in Asia Pacific. Environmental regulations act as a critical constraint and opportunity; stringent rules regarding sulfur dioxide emissions and solid waste (slag residue) disposal increase operational costs for producers but simultaneously drive demand for high-purity slag processed via the cleaner chloride route, favoring technologically advanced and compliant suppliers over those using older, high-emission sulfate process technology.

How does the shift from the sulfate process to the chloride process influence the demand for specific grades of titania slag?

The global shift toward the chloride process is fundamentally altering demand dynamics by requiring higher quality, high-grade titania slag, typically with a TiO2 content exceeding 85%. The chloride process is more efficient and environmentally preferred, but it demands feedstock with minimal impurities (such as calcium, magnesium, and heavy metals). Consequently, demand for premium-priced, high-purity slag (often produced via advanced smelting or acid leaching) is accelerating significantly, while demand growth for lower-grade slag suitable only for the aging sulfate process is decelerating or remaining stagnant.

Which geographical region holds the largest market share for Titania Slag, and what are the key factors contributing to its dominance?

The Asia Pacific (APAC) region currently holds the largest market share in terms of consumption. This dominance is attributed to several critical factors: the region is the world’s largest hub for TiO2 pigment manufacturing; it experiences the fastest growth in downstream sectors like construction, automotive, and consumer goods; and high-volume, cost-competitive manufacturing environments, particularly in China and India, necessitate vast quantities of titania slag feedstock to meet industrial production requirements and internal consumption demand.

What role does energy cost volatility play in the production economics of Titania Slag, and what solutions are being explored?

Energy cost volatility is a major restraint because titania slag production is highly energy-intensive, relying heavily on electricity for the electric arc furnace (EAF) smelting process. High and unstable energy prices directly squeeze profit margins, forcing producers to seek efficiencies. Solutions being explored include investing in state-of-the-art energy recovery systems, migrating to advanced plasma smelting technology which offers higher thermal efficiency, securing long-term power purchase agreements, and exploring captive renewable energy generation to mitigate exposure to grid price fluctuations.

Beyond pigments, what are the emerging specialized applications for high-grade Titania Slag derivatives?

While pigments remain the primary application, high-grade titania slag derivatives are increasingly valued in specialized fields. Emerging applications include its use as a key flux ingredient in advanced welding electrodes (essential for high-integrity joints in shipbuilding and energy pipelines), as a source material for manufacturing high-purity titanium metal sponge used in aerospace and medical implants, and as an additive in high-performance ceramics and specialized refractories where its chemical inertness and high melting point are beneficial for extreme thermal environments and structural integrity applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager