Titanium Bicycles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434285 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Titanium Bicycles Market Size

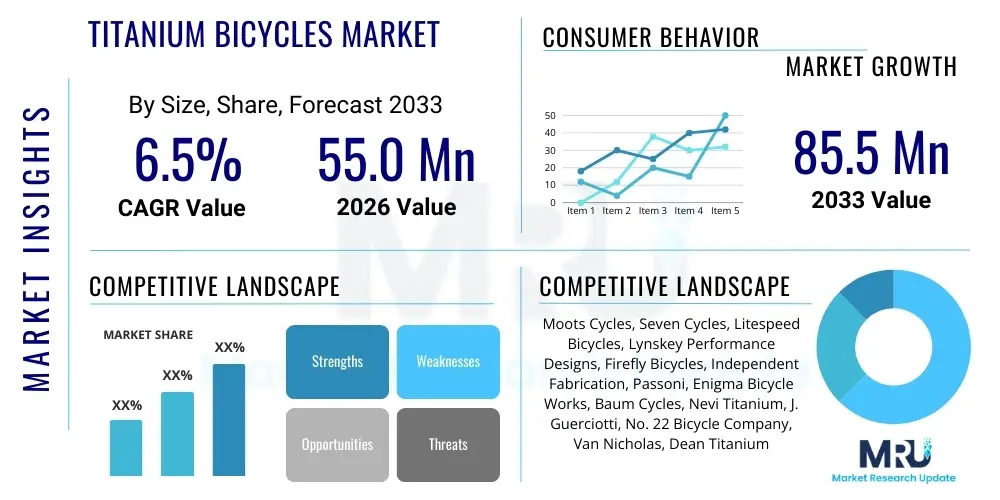

The Titanium Bicycles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $55.0 million in 2026 and is projected to reach $85.5 million by the end of the forecast period in 2033.

Titanium Bicycles Market introduction

The Titanium Bicycles Market is a specialized, high-end segment within the global cycling industry, characterized by products that prioritize longevity, durability, and superior ride quality over absolute minimum weight. Titanium alloy, primarily 3Al/2.5V and 6Al/4V, serves as the core material for frames, offering unmatched corrosion resistance, high tensile strength, and natural vibration damping properties, positioning these bicycles as premium, lifetime investments. These bikes cater predominantly to affluent enthusiasts, long-distance touring cyclists, and gravel riders who demand reliability and comfort across varied terrains and extended usage periods. The product description emphasizes custom fabrication and artisanal craftsmanship, contrasting with the high-volume manufacturing models prevalent in carbon and aluminum segments.

Major applications of titanium bicycles span across road endurance cycling, adventure/gravel riding, mountain biking, and bikepacking/touring. In endurance road cycling, titanium frames offer fatigue-reducing compliance, allowing riders to maintain peak performance longer. For gravel and touring, the robustness and resilience of the material against impact and environmental wear make it the ideal choice, ensuring structural integrity even under heavy load or harsh conditions. The inherent benefits—such as exceptional resilience, negligible corrosion concerns, and the aesthetic appeal of a durable, non-painted finish—drive consumer preference despite the significantly higher initial cost compared to composite or conventional metal alternatives. The lifetime value proposition is a critical market differentiator.

Driving factors for this niche market include the rising popularity of cyclotourism and adventure sports, which necessitate equipment that is both lightweight and rugged. Furthermore, increasing disposable incomes in key global markets allow a broader consumer base to invest in luxury sporting goods, viewing titanium bikes not just as transportation but as heirloom quality possessions. The desire for custom geometry and personalized build specifications is also a significant catalyst, as titanium fabrication typically involves highly skilled, low-volume production optimized for individual client needs. Technological advancements in tube forming and welding processes, coupled with growing environmental consciousness favoring durable goods, continue to sustain steady growth in this exclusive segment.

Titanium Bicycles Market Executive Summary

The Titanium Bicycles Market is exhibiting stable, premium growth driven primarily by niche demand for durable, customizable, and high-performance cycling solutions. Key business trends indicate a strong shift towards Direct-to-Consumer (D2C) models, especially among custom builders, leveraging digital platforms to streamline design consultations and order fulfillment, thereby maximizing margins and maintaining brand exclusivity. There is also an observable increase in manufacturer collaboration with specialized materials providers to integrate advanced titanium alloys (like 6/4 Ti) into high-stress components, boosting performance characteristics previously associated mainly with carbon fiber. The competitive landscape remains fragmented, dominated by small-to-mid-sized artisanal manufacturers whose competitive edge rests on craftsmanship and brand heritage rather than scale. Supply chain stability, specifically concerning titanium raw material sourcing and specialized tube drawing, remains a consistent operational challenge that influences pricing and lead times.

Regionally, North America and Europe dominate the market, characterized by mature cycling cultures, high levels of discretionary spending, and robust infrastructures supporting adventure cycling and long-distance touring. North America, particularly the U.S., sees high demand fueled by the booming gravel cycling segment, requiring bikes that offer the blend of compliance and toughness titanium provides. Europe benefits from established custom frame-building traditions in the UK and Italy, where consumers value heritage and bespoke engineering. The Asia Pacific region, while currently smaller, is projected for accelerated growth, particularly in countries like Japan and Australia, where increasing affluence and interest in premium outdoor activities are translating into higher sales of high-end equipment.

Segment trends underscore the dominance of the Gravel/Adventure segment, which has outpaced traditional Road and Mountain Bike (MTB) segments in recent years, owing to titanium’s optimal properties for multi-terrain versatility and resilience. Frames constructed from the 3Al/2.5V alloy represent the largest volume segment due to its excellent balance of cost, ductility, and strength, while the more expensive 6Al/4V alloy is reserved for performance-critical applications and top-tier custom builds. Distribution trends highlight the continued importance of specialty cycling retailers for technical consultation and fitting services, though the previously mentioned D2C trend is rapidly gaining market share, capitalizing on the personalized nature of titanium bicycle purchases.

AI Impact Analysis on Titanium Bicycles Market

User queries regarding AI's influence in the titanium bicycle sector primarily revolve around how advanced computational tools can mitigate the high costs and complexity associated with custom frame design and manufacturing. Common questions focus on AI's ability to optimize frame geometry based on rider biometrics and intended usage, predict material fatigue under various loading conditions, and streamline the highly manual processes of tube cutting and welding. Users are keen to understand if AI can democratize access to true custom fabrication, reducing lead times and the need for iterative prototyping, thereby lowering the barrier to entry for smaller custom builders. Furthermore, there is significant interest in how AI-driven predictive maintenance could enhance the long-term ownership experience, leveraging the inherent durability of titanium.

AI is beginning to play a pivotal role in the design phase, particularly through Generative Design methodologies. Machine learning algorithms can process thousands of design parameters—including stiffness goals, rider weight, power output, and desired compliance—to generate optimized tube profiles and joint structures that maximize material efficiency and performance. This capability moves beyond traditional finite element analysis (FEA) by suggesting novel design solutions that human engineers might overlook, ensuring that every gram of titanium contributes optimally to the bike’s overall structural integrity and ride feel. By automating the preliminary design optimization, manufacturers can significantly accelerate the R&D cycle and achieve a higher level of personalization accuracy from the outset.

In the manufacturing and supply chain segments, AI-powered systems are utilized for highly precise material traceability and quality control, ensuring that raw titanium stock meets stringent metallurgical standards necessary for high-integrity welding. Furthermore, predictive modeling helps custom builders manage their niche inventory effectively, forecasting demand for specific tube sets or component sizes based on incoming personalized orders, reducing both waste and unnecessary stockpiling. Although the final welding often remains a highly skilled manual process, AI vision systems are increasingly employed to inspect weld beads in real-time for defects, ensuring consistency and reliability, which is crucial given the high stress tolerances required for aerospace-grade titanium alloys used in cycling.

- AI-driven Generative Design optimizes frame topology for improved weight-to-strength ratio.

- Machine Learning algorithms predict material performance and fatigue life under varying rider profiles.

- AI enhances quality control through real-time inspection of complex titanium welds and joints.

- Predictive analytics streamline inventory management for specialized titanium tube sets.

- Custom geometry tools use AI to translate precise rider biomechanics into optimized frame specifications quickly.

DRO & Impact Forces Of Titanium Bicycles Market

The Titanium Bicycles Market is influenced by a dynamic interplay of factors where the material’s intrinsic advantages meet market-specific financial and competitive constraints. Drivers center on titanium's exceptional durability, corrosion resistance, and unique ride comfort, appealing to a clientele prioritizing long-term investment over cost sensitivity. Opportunities arise from technological advancements, specifically in additive manufacturing (3D printing of titanium lugs and joints), which promises to significantly reduce the labor intensity and complexity of custom fabrication, potentially lowering costs and expanding the segment's reach. Conversely, the market faces intense restraints due to the high cost of raw titanium (a strategic metal), the complexity of specialized manufacturing processes requiring expert welders, and fierce competition from technologically advanced, high-volume carbon fiber products that often offer superior lightness and stiffness at comparable high-end prices. These factors collectively determine the market's trajectory, establishing titanium cycling as a robust but inherently niche sector.

Key drivers sustaining market momentum include the sustained demand for "gravel" and "adventure" bikes, where titanium’s robustness is highly valued for tackling varied and unpredictable terrains without the risk of catastrophic failure associated with other materials. The emotional value derived from owning a bespoke, artisan-crafted product, often considered an investment or an heirloom, strengthens brand loyalty and justifies the premium price points. Furthermore, the material’s natural ability to dampen high-frequency road vibrations provides a tangible comfort benefit, highly valued by aging endurance cyclists who prioritize reduced physical strain over multi-hour rides. These intrinsic material and experiential benefits insulate the titanium market from broader cycling industry volatility.

Restraints fundamentally challenge the scalability of titanium bicycle production. The difficulty and expense of sourcing and manipulating high-grade titanium tubing require specialized machinery and highly compensated labor, establishing inherent cost floors that limit mass-market adoption. Competition from high-modulus carbon fiber frames remains the most persistent external threat; carbon frames often achieve superior torsional stiffness and lower weights, properties highly prioritized in professional racing and performance segments. Opportunities, however, present pathways for growth, particularly through the use of 3D printing to create highly complex, lightened titanium joining components (lugs), which can significantly simplify the frame assembly process and allow for unprecedented design customization without compromising material integrity. Furthermore, leveraging sustainable manufacturing narratives—emphasizing the longevity and recyclability of titanium—offers a strong marketing differentiator against materials with shorter lifespans.

Segmentation Analysis

The Titanium Bicycles Market is comprehensively segmented based on frame type (material grade), application (cycling discipline), and distribution channel. Segmentation by material grade distinguishes between the commercially standard 3Al/2.5V alloy, which provides an excellent balance of strength, ductility, and cost, and the higher-performance 6Al/4V alloy, typically used in premium or specialized frame sections due to its superior strength and lower density, despite being harder to work with. Application segmentation is crucial, recognizing the specialized needs of road, mountain, and increasingly dominant gravel/adventure segments. Finally, the distribution channel highlights the critical role of bespoke custom builders utilizing direct-to-consumer models versus established brands relying on specialty retail networks, reflecting the high-touch nature of the product purchase.

- By Material Grade:

- 3Al/2.5V Titanium Alloy (Most common, balances cost and performance)

- 6Al/4V Titanium Alloy (Premium grade, higher strength-to-weight ratio, difficult to machine)

- By Application/Discipline:

- Road Cycling (Endurance and Performance)

- Mountain Biking (Hardtail and Full Suspension)

- Gravel/Adventure Cycling (Rapidly growing segment)

- Touring/Bikepacking

- By Distribution Channel:

- Direct-to-Consumer (Custom Builders)

- Specialty Retail Stores

- Online Retail Platforms (For complete bikes and components)

- By End-User:

- Professional Athletes/Racers

- Enthusiast/Hobbyists (Largest segment)

- Touring Cyclists

Value Chain Analysis For Titanium Bicycles Market

The value chain for the Titanium Bicycles Market is characterized by high expertise required at the upstream and manufacturing stages, leading to significant value addition early in the process. Upstream activities involve the specialized mining, refining, and alloying of titanium, followed by the demanding process of drawing seamless, cycling-specific titanium tubing (often aerospace grade, 3Al/2.5V or 6Al/4V). Due to the high criticality of material purity and dimensional tolerances, sourcing from specialized metal processors constitutes a significant cost component. Midstream activities are dominated by highly skilled fabrication—frame design, precise cutting, machining, and especially high-integrity TIG welding, typically executed by master craftsmen or sophisticated robotic systems tailored for small-batch production. The craftsmanship and intellectual property residing in frame geometry and joining techniques are major value drivers.

Downstream analysis focuses on the distribution and end-user engagement, where the direct-to-consumer model is exceptionally strong. Many leading titanium builders bypass traditional multi-tiered distribution to interact directly with the buyer, offering personalized consultation, bike fitting, and custom finishing services. This approach maintains high margins, controls brand narrative, and ensures precise fulfillment of bespoke orders. Indirect channels utilize highly specialized cycling retailers who offer expert technical advice, professional fitting services, and often handle localized warranty support, essential for premium products requiring specific setup and maintenance.

The critical element in this value chain is the flow of information regarding customization and quality assurance. Direct communication between the fabricator and the end-user (D2C) minimizes distortion in translating rider specifications into frame design, enhancing customer satisfaction and reinforcing the brand’s luxury positioning. For indirect sales through specialty retail, the distributor’s role is primarily logistical, whereas the retailer acts as the essential high-touch interface, providing the technical expertise necessary to justify the product's high price point. Efficient inventory management of specialized components (like proprietary dropouts or integrated cable routing systems) across both direct and indirect channels is vital to minimizing lengthy lead times, a common pain point in custom bicycle manufacturing.

Titanium Bicycles Market Potential Customers

Potential customers for titanium bicycles primarily reside within the high-net-worth individual (HNWI) segment and dedicated cycling enthusiasts who view their equipment as a long-term investment rather than a temporary purchase. The key end-users are seasoned hobbyists, often aged 40 and above, who prioritize comfort, reliability, and longevity over the marginal weight savings offered by competition-focused carbon models. These buyers are typically well-educated, have high disposable incomes, and possess deep brand awareness, seeking out manufacturers with strong reputations for quality craftsmanship and bespoke services. They are motivated by the desire for a ‘forever bike’ that resists obsolescence and maintains its aesthetic appeal without required painting or frequent material upgrades.

Another significant customer segment is the adventure cyclist and bikepacker. These individuals routinely subject their equipment to harsh conditions, high loads, and remote environments where failure is not an option. For them, titanium’s unparalleled resilience, corrosion resistance (especially important when crossing geographical boundaries or riding in salty air), and repairability are non-negotiable functional requirements. This user group values robustness and modularity, often requiring custom mounting points for racks, bags, and specialized gear, which custom titanium fabricators are uniquely equipped to provide, positioning titanium as the material of choice for demanding expeditions.

Finally, a smaller but influential segment includes professional endurance athletes and dedicated racers who use titanium frames for training or specific non-competitive events. While carbon dominates professional racing, many elite riders appreciate titanium for its compliant, low-maintenance characteristics during high-volume training blocks, reducing physical fatigue. Additionally, buyers who value sustainability and craftsmanship are increasingly drawn to titanium due to its exceptional longevity and material recyclability, aligning with consumer trends favoring durable, ethically sourced goods over fast-cycling consumer products. This sophisticated customer base is less price-sensitive and more value-driven regarding enduring quality and personalized experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $55.0 Million |

| Market Forecast in 2033 | $85.5 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Moots Cycles, Seven Cycles, Litespeed Bicycles, Lynskey Performance Designs, Firefly Bicycles, Independent Fabrication, Passoni, Enigma Bicycle Works, Baum Cycles, Nevi Titanium, J. Guerciotti, No. 22 Bicycle Company, Van Nicholas, Dean Titanium Bicycles, XACD, Kona Bicycle Company, Specialized Bicycle Components (Select Models), Trek Bicycle Corporation (Select Models), Merida Industry Co., Ltd. (Select Models). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titanium Bicycles Market Key Technology Landscape

The technology landscape in the titanium bicycle market is characterized by precision engineering focused on refining material properties and fabrication techniques rather than high-volume automation. The core technological differentiator lies in the metallurgy of the tubing itself, particularly the move towards cold-worked, seamless, variable-butted titanium tubing (often 3Al/2.5V and 6Al/4V). Cold working enhances the material’s fatigue strength and tensile performance while reducing wall thickness in low-stress areas, optimizing weight without compromising structural integrity. Advanced welding techniques, specifically orbital TIG welding in a controlled atmosphere (purge chambers), are critical to preventing contamination of the weld zone, which could otherwise drastically reduce the alloy's strength and corrosion resistance. The mastery of these welding technologies is a fundamental competitive advantage.

A transformative technology gaining traction is the use of Additive Manufacturing (AM), or 3D printing, for creating highly complex frame junctions, such as bottom brackets, head tubes, and dropouts, often utilizing the harder 6Al/4V powder. AM allows designers to integrate features like internal cable routing ports, specific bearing seats, and customized geometry reinforcements that would be impossible or prohibitively expensive to achieve using traditional machining and tube welding. By 3D printing lugs and bonding them to standard titanium tubes, manufacturers can simplify the main assembly process, reduce the need for highly complex, multi-axis tube mitering, and significantly improve turnaround times for truly bespoke frames, positioning AM as a key enabling technology for future customization and efficiency.

Furthermore, technology related to digital fitting and personalized geometry modeling is essential. Manufacturers utilize sophisticated 3D body scanners and dynamic bike fitting systems (e.g., Retül, Guru) to capture precise rider biometrics and preferred riding positions. This data is then fed into CAD/CAM software tailored for titanium geometry design, ensuring the resultant frame offers optimal fit and handling characteristics tailored to the individual. Integration technologies, such as proprietary coupling systems for travel bikes (S&S couplers), also continue to be important, offering niche technological solutions that cater to the high-end touring segment, enabling easy disassembly and transport of full-sized frames without compromising material integrity or ride quality.

Regional Highlights

The Titanium Bicycles Market exhibits distinct regional consumption and manufacturing patterns, heavily influenced by local cycling culture, economic maturity, and infrastructure supporting niche luxury goods.

- North America (U.S. and Canada): This region is a dominant consumer market, characterized by strong demand for high-end sporting goods and a burgeoning gravel cycling scene. The U.S. hosts several globally renowned custom titanium builders (e.g., Moots, Seven Cycles), benefiting from robust intellectual property and a large base of affluent consumers seeking specialized, highly durable equipment.

- Europe (UK, Germany, Italy): Europe is a key manufacturing and consumption hub. Countries like the UK and Italy have deep traditions in custom frame building, valuing heritage and craftsmanship highly. Germany and the Netherlands provide a substantial consumer base focused on reliability and long-distance touring, driving demand for compliant and robust titanium frames used in daily commuting and extended travel.

- Asia Pacific (APAC): While smaller than Western markets, APAC is the fastest-growing region. Increased affluence in countries like Japan, South Korea, and Australia is driving demand for premium cycling products. China also plays a critical role as a manufacturing base, with several large fabrication houses offering OEM services, often specializing in cost-effective titanium welding, though high-end consumer demand remains concentrated in wealthier nations.

- Latin America, Middle East, and Africa (MEA): These regions represent emergent or niche markets. Demand is highly concentrated among urban elite populations in major financial centers. Market growth is constrained by high import duties and limited specialized retail infrastructure, meaning sales often rely heavily on international online D2C channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titanium Bicycles Market.- Moots Cycles

- Seven Cycles

- Litespeed Bicycles

- Lynskey Performance Designs

- Firefly Bicycles

- Independent Fabrication

- Passoni

- Enigma Bicycle Works

- Baum Cycles

- Nevi Titanium

- J. Guerciotti

- No. 22 Bicycle Company

- Van Nicholas

- Dean Titanium Bicycles

- XACD (Xi'an Changda Titanium Products Co., Ltd.)

- Kona Bicycle Company (Select Models)

- Specialized Bicycle Components (Select Models/Limited Editions)

- Trek Bicycle Corporation (Historical/Niche Offerings)

- Merida Industry Co., Ltd. (OEM Fabricators)

- Titus Titanium

Frequently Asked Questions

Analyze common user questions about the Titanium Bicycles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of choosing a titanium bicycle over carbon fiber or steel?

Titanium bicycles offer a superior combination of longevity, ride quality, and corrosion resistance. Unlike carbon, titanium is highly durable, resistant to impact damage, and exhibits natural compliance to dampen road vibrations. Unlike steel, it does not rust, making it a maintenance-free, premium investment often referred to as a ‘bike for life’.

Are titanium bicycles generally heavier than carbon fiber frames?

Yes, titanium frames are typically slightly heavier than the lightest high-modulus carbon fiber frames available on the market. However, advances in titanium metallurgy and the use of 6Al/4V alloys allow titanium bikes to achieve excellent strength-to-weight ratios, often matching mid-to-high end carbon frames while providing greater durability.

What alloy grades are commonly used in high-end titanium bicycle manufacturing?

The most common and widely utilized alloy is 3Al/2.5V (3% Aluminum, 2.5% Vanadium), prized for its weldability and good ductility. For ultra-premium or performance-critical sections, the stronger and lighter 6Al/4V alloy is used, although it requires more specialized manufacturing techniques, often involving 3D printing or complex machining.

Which cycling discipline drives the most demand for titanium frames currently?

The Gravel and Adventure Cycling segment currently drives the strongest growth. Titanium’s resilience, vibration damping, and ability to handle heavy loads and varied terrain make it the optimal material choice for bikepacking, cyclotourism, and competitive gravel racing, where reliability under harsh conditions is paramount.

Why are titanium bicycles significantly more expensive than mass-produced aluminum frames?

The high cost stems from several factors: the raw cost of titanium material (a strategic metal); the difficulty in processing and specialized tubing manufacture; and the highly labor-intensive, precision fabrication process, particularly the TIG welding performed by master craftsmen under strictly controlled, inert environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager