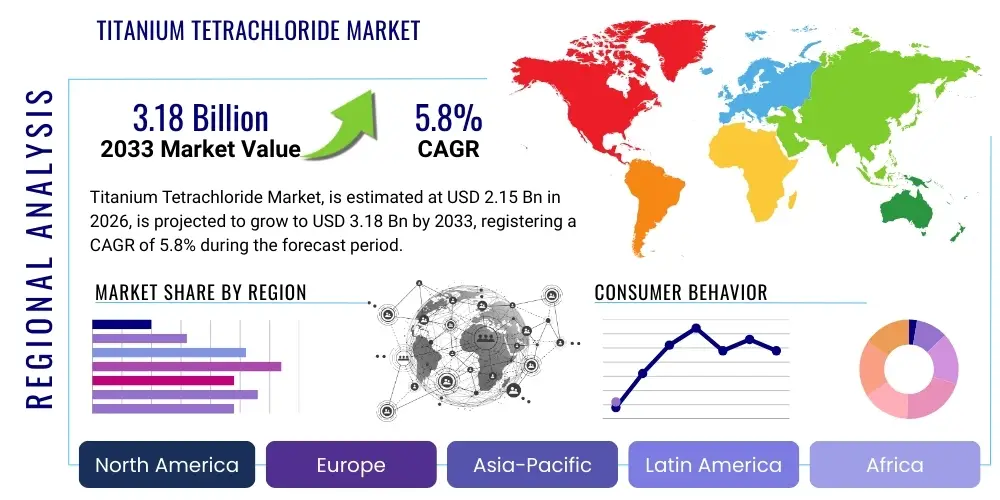

Titanium Tetrachloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436357 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Titanium Tetrachloride Market Size

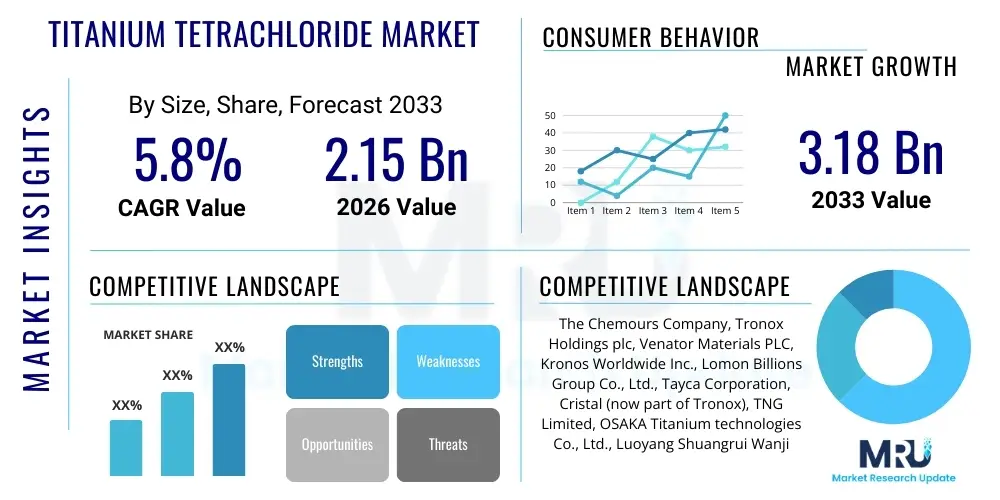

The Titanium Tetrachloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.18 Billion by the end of the forecast period in 2033.

Titanium Tetrachloride Market introduction

Titanium tetrachloride (TiCl4), often referred to as "tickle," is a crucial intermediate chemical compound characterized as a colorless, non-flammable, volatile liquid that produces dense white smoke upon contact with moist air, owing to the formation of titanium dioxide and hydrochloric acid. Its chemical versatility and reactivity make it indispensable in several high-value industrial applications. Primarily, TiCl4 serves as the critical feedstock for producing titanium dioxide (TiO2) pigments, which are essential components in paints, coatings, plastics, and paper due to their exceptional opacity and brightness. The robust demand from the construction and automotive sectors, particularly in emerging economies, underpins the stability of this market.

Beyond pigment production, Titanium Tetrachloride plays an essential role in manufacturing metallic titanium. It is the core input for the Kroll and Hunter processes, where it is reduced using magnesium or sodium to yield pure titanium metal. Titanium metal is highly valued for its high strength-to-weight ratio, excellent corrosion resistance, and biocompatibility, making it vital for aerospace, medical implants, and defense industries. The increasing global focus on lightweight materials in aviation and automotive manufacturing acts as a significant market driver, ensuring sustained technological importance for TiCl4.

Key driving factors for the Titanium Tetrachloride Market include accelerating industrialization and urbanization globally, leading to higher consumption of TiO2 pigments, particularly in the Asia-Pacific region. Furthermore, technological advancements leading to increased efficiency in the chloride process manufacturing method are stabilizing production costs. The intrinsic benefits of using TiCl4, such as its purity and efficient conversion rates into downstream products, secure its position as a critical chemical cornerstone in modern heavy industries.

Titanium Tetrachloride Market Executive Summary

The Titanium Tetrachloride Market exhibits strong resilience driven primarily by the sustained global demand for high-quality titanium dioxide pigments and the strategic requirements of the aerospace and defense sectors for titanium metal. Business trends indicate a shift towards optimizing the chloride process due to its environmental and efficiency advantages over the traditional sulfate route, influencing market share distribution among key manufacturers. Geographically, Asia Pacific remains the central growth engine, spearheaded by rapid infrastructure development and expanding manufacturing bases in China and India. Regional expansion strategies are focusing on establishing local production capabilities near major consumer hubs to mitigate logistics costs and supply chain vulnerabilities.

Segment trends reveal that the Pigments application segment dominates the market in terms of volume, capitalizing on the expansive global coatings and plastics industry. However, the Titanium Metal segment is expected to demonstrate superior growth rates, reflecting increasing geopolitical investments in defense technology and the burgeoning commercial aviation sector's long-term material requirements. High-purity grades of TiCl4, utilized in producing advanced catalysts and specialized materials for semiconductors, are carving out a premium niche, underscoring the market's evolving demand profile towards specialized chemical applications.

The overall market trajectory is cautiously optimistic, balancing robust industrial demand against potential regulatory scrutiny concerning emissions and hazardous material handling. Strategic mergers and acquisitions aimed at securing raw material (titanium mineral sands) supply chains and vertical integration are defining the competitive landscape. Innovation remains centered on refining purification techniques and enhancing process safety, ensuring that TiCl4 production remains compliant with increasingly stringent global environmental, social, and governance (ESG) standards.

AI Impact Analysis on Titanium Tetrachloride Market

User inquiries regarding AI's influence on the Titanium Tetrachloride market frequently center on operational efficiency, predictive maintenance, and optimizing complex chemical processes like the chlorination of titaniferous ores. Users are keen to understand how AI can minimize waste, enhance yield rates in the chloride process, and improve safety protocols in handling this volatile compound. Key themes include the use of machine learning algorithms for real-time quality control of TiCl4 purity, especially for specialized applications like fiber optics and advanced catalysts, and the implementation of digital twins to simulate and fine-tune large-scale production facilities. Concerns often revolve around the initial investment required for AI infrastructure and the availability of skilled personnel capable of managing and interpreting AI-driven insights in traditional chemical manufacturing environments.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning to forecast equipment failure in reactors and pipelines, minimizing unplanned downtime and maximizing asset lifespan in TiCl4 plants.

- Process Optimization: Employing advanced analytics and algorithms to continuously monitor and adjust temperature, pressure, and flow rates, optimizing the exothermic chlorination reaction for improved yield and reduced energy consumption.

- Real-time Quality Control: Implementing computer vision and spectroscopic analysis combined with AI for instantaneous detection of impurities, ensuring high-purity TiCl4 output required for specialized applications such as aerospace-grade titanium and fiber optics.

- Supply Chain Resilience: Using AI models to predict demand fluctuations for TiO2 and titanium metal, optimizing raw material (ilmenite/rutile) procurement and inventory levels, thereby stabilizing production costs.

- Safety Enhancement: Deploying AI-powered monitoring systems to detect anomalies indicative of leaks or hazardous conditions associated with handling highly corrosive and reactive TiCl4, significantly improving worker safety.

DRO & Impact Forces Of Titanium Tetrachloride Market

The Titanium Tetrachloride market is predominantly driven by the pervasive demand for titanium dioxide pigments globally, fueled by rapid expansion in the housing, infrastructure, and automotive industries, particularly across developing regions. Simultaneously, restraints manifest primarily through the hazardous nature of TiCl4, requiring stringent handling, storage, and transportation protocols, which inflate operational costs and impose regulatory burdens. Opportunities arise from technological innovation in purifying TiCl4 for use in emerging high-tech sectors, such as solar cells, advanced ceramics, and specialized catalyst manufacturing, offering avenues for market diversification beyond traditional applications. These factors converge to define the impact forces, where the high capital investment required for new plant construction acts as a barrier to entry, maintaining the dominance of established, vertically integrated market players.

The primary driver remains the continuous shift towards lightweight materials, especially in the aerospace and premium automotive sectors, which rely entirely on TiCl4 as a precursor for titanium metal production. Furthermore, the longevity and performance benefits of TiO2 pigments, offering superior color opacity and UV resistance compared to alternatives, ensure steady demand regardless of short-term economic fluctuations. However, the market faces constraints related to the volatility of raw material prices (titanium ores), which directly impact the final cost of TiCl4 and subsequent downstream products. Environmental concerns surrounding the proper disposal of by-products generated by the older sulfate process further pressurize manufacturers to transition to the cleaner, albeit more complex, chloride process.

Impact forces are heavily skewed by geopolitical factors influencing defense spending and civil aviation investment, directly affecting the demand for titanium metal. The market structure, being highly concentrated with a few global giants controlling the majority of production capacity and raw material sourcing, dictates pricing strategies and supply stability. The critical opportunity lies in leveraging sustainability trends, particularly the adoption of circular economy principles in titanium manufacturing, utilizing TiCl4 processing by-products effectively, which could enhance profitability and regulatory compliance moving forward. The balance between industrial demand momentum and regulatory oversight defines the current operating environment.

Segmentation Analysis

The Titanium Tetrachloride market is fundamentally segmented based on application, grade, and manufacturing process, reflecting the diverse industrial requirements and product quality standards. The application segmentation highlights the dominant role of pigment manufacturing, which consumes the largest volume, followed by the strategic segments of titanium metal production and specialized chemical synthesis. Grade segmentation differentiates between standard industrial purity, sufficient for pigment production, and high purity grades required for sensitive applications such as catalysts, fiber optics, and electronics. Understanding these segments is crucial for market participants to tailor production capabilities and sales strategies toward specific end-user demands, optimizing profitability within the highly competitive chemical intermediate market.

- By Application:

- Pigments (Titanium Dioxide Production)

- Titanium Metal Production

- Catalysts (Ziegler-Natta, polymer synthesis)

- Chemical Intermediates and Others (Smoke screens, specialized glass)

- By Grade:

- Standard Grade (98%-99.5% Purity)

- High Purity Grade (99.9% Purity and above)

- By Manufacturing Process:

- Chloride Process

- Sulfate Process

- By End-Use Industry:

- Paints and Coatings

- Plastics and Rubber

- Aerospace and Defense

- Automotive

- Chemical and Petrochemical

Value Chain Analysis For Titanium Tetrachloride Market

The value chain for Titanium Tetrachloride is highly integrated and spans from raw material extraction to highly specialized end-user applications. The upstream segment involves the mining and beneficiation of titanium-containing ores, primarily ilmenite and rutile. Securing consistent, high-quality feedstock is paramount, given that the quality of the ore directly impacts the efficiency of the chlorination process and the purity of the resulting TiCl4. Major producers often engage in vertical integration, controlling resource extraction to mitigate supply risk and maintain cost competitiveness. Pricing power at this stage is dictated by resource availability, geopolitical factors affecting mining operations, and transportation logistics for moving bulk mineral sands to processing facilities.

The middle segment is the production of TiCl4 itself, carried out predominantly through the exothermic chlorination of titanium slag or rutile in fluid bed reactors—the chloride process being favored for its higher purity output and lower environmental impact compared to the sulfate route. Manufacturers invest heavily in capital-intensive facilities focused on rigorous impurity removal, especially for vanadium, iron, and silicon chlorides, to meet the strict quality standards required for subsequent titanium metal or high-grade pigment production. Distribution channels involve specialized chemical logistics due to the hazardous nature of TiCl4, requiring specialized tanks, dedicated railcars, and adherence to strict international safety regulations (IMO/ADR/DOT), thereby influencing distribution costs and delivery lead times.

The downstream segment includes the conversion of TiCl4 into marketable products, primarily TiO2 pigments via oxidation or titanium sponge metal via reduction. Direct sales are common for high-volume customers in the pigment and titanium metal industries, often involving long-term supply contracts. Indirect distribution through specialized chemical distributors is used for smaller volume purchasers, particularly those requiring TiCl4 for catalyst synthesis or niche chemical applications. The highest value addition occurs in the conversion phase, where the intermediate chemical is transformed into high-performance materials critical to multiple end-use sectors like aerospace (titanium metal) and construction (TiO2 pigments), where demand remains inelastic.

Titanium Tetrachloride Market Potential Customers

Potential customers for Titanium Tetrachloride are predominantly large-scale industrial consumers operating within high-growth manufacturing sectors that require titanium-based components or pigments. The largest segment of buyers comprises global pigment manufacturers who utilize TiCl4 as the feedstock for the chloride process production of titanium dioxide, a critical white pigment. These companies prioritize consistent supply volume, exceptional purity, and competitive pricing due to the scale of their operations. Strategic buyers also include primary titanium metal producers who rely on TiCl4 for generating titanium sponge, essential for aerospace and defense manufacturing, where material specifications are non-negotiable and demand high-purity TiCl4 grades.

Another significant group of buyers includes specialty chemical companies utilizing TiCl4 as a precursor for Ziegler-Natta catalysts used in the polymerization of polyolefins, such as polyethylene and polypropylene. The petrochemical industry requires extremely high-purity TiCl4, often greater than 99.9%, to ensure catalyst efficiency and polymer quality. Furthermore, governmental agencies and large defense contractors are indirect consumers, driving demand for high-grade titanium metal used in military aircraft, naval vessels, and armored vehicles, translating into stringent requirements for the TiCl4 supply chain.

Emerging potential customers include manufacturers focused on advanced materials, such as those producing optical fiber preforms, specialized ceramic powders, and certain types of high-refractive index glasses. These niche applications, while lower in volume, command premium pricing and require the highest specifications of TiCl4 purity, representing a growth opportunity for suppliers capable of advanced purification techniques. Geographical concentration of buyers is high in regions with robust chemical manufacturing and heavy industry, particularly Northeast Asia, Western Europe, and North America.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.18 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chemours Company, Tronox Holdings plc, Venator Materials PLC, Kronos Worldwide Inc., Lomon Billions Group Co., Ltd., Tayca Corporation, Cristal (now part of Tronox), TNG Limited, OSAKA Titanium technologies Co., Ltd., Luoyang Shuangrui Wanji Chemical Co., Ltd., Gujarat Alkalies and Chemicals Limited (GACL), CINKARNA CELJE - Tovarna kemičnih izdelkov d.o.o., Pangang Group Vanadium & Titanium Resources Co., Ltd., Ishihara Sangyo Kaisha, Ltd. (ISK), Ansteel Group Corporation Limited, Shanghai Yuejiang Titanium Chemical Manufacturer Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titanium Tetrachloride Market Key Technology Landscape

The technological landscape of the Titanium Tetrachloride market is predominantly defined by advancements in the chloride process, which is the cornerstone for high-quality production globally. Key technological focus areas include improving the efficiency and yield of the fluid bed chlorinator reactors, managing the complex exothermic reactions, and ensuring consistent high purity of the final product. Innovations center around developing enhanced calcination techniques for pre-treating titanium ores and slag, leading to improved reactivity and reduced undesirable by-products. Furthermore, sophisticated scrubbing and recycling systems are crucial for managing the corrosive hydrochloric acid and chlorine gas involved in the process, minimizing emissions and adhering to strict environmental regulations.

Another significant technological domain involves advanced purification methods necessary for producing the ultra-high purity TiCl4 grades required for non-pigment applications, specifically catalysts and advanced material precursors. Technologies such as fractional distillation under controlled atmospheric conditions are critical for removing trace metal impurities like vanadium oxychloride, iron chloride, and silicon tetrachloride. Continuous R&D investment is channeled into optimizing these distillation columns to reduce energy consumption and maximize separation efficiency, directly impacting the profitability of high-grade TiCl4 supply for high-end markets like electronics and specialized polymers.

Emerging technologies also involve process digitization and automation. Manufacturers are implementing sophisticated control systems, often leveraging AI and IoT sensors, to maintain tight control over process variables (temperature, pressure, gas composition) in real-time. This technological integration aims to enhance safety, reduce human error in handling volatile chemicals, and maintain consistent product quality across different production batches. The push for sustainable manufacturing also necessitates R&D into alternative, less energy-intensive chlorination routes or utilizing recycled titanium scrap as feedstock, though these remain nascent compared to established industrial processes.

Regional Highlights

- Asia Pacific (APAC): APAC holds the dominant share in the Titanium Tetrachloride market, primarily driven by China and India. This region is characterized by explosive growth in infrastructure development, automotive production, and massive paint and coatings consumption, sustaining the high demand for TiO2 pigments. The presence of large-scale, cost-competitive integrated production facilities, coupled with accessible titanium mineral resources, solidifies APAC's position as both the largest producer and consumer globally.

- North America: North America represents a mature, high-value market, where demand is stable and driven significantly by the aerospace, defense, and specialized catalyst sectors. The focus here is less on volume growth (like APAC) and more on supplying high-purity TiCl4 grades necessary for advanced manufacturing and adherence to stringent environmental compliance standards. Leading global players maintain significant production capacity in this region to serve critical defense and commercial aviation customers.

- Europe: The European market is characterized by a strong emphasis on regulatory compliance (REACH) and sustainability. While pigment demand remains steady, driven by the premium architectural coatings segment, the region is highly focused on optimizing the chloride process and exploring circular economy initiatives related to titanium manufacturing. Demand for high-grade TiCl4 for specialized chemical synthesis and medical implants is a key regional driver.

- Latin America: This region exhibits moderate growth potential, tied closely to fluctuating economic stability and construction cycles, particularly in Brazil and Mexico. The market is often served by imports from North America and Asia, although localizing production remains an objective for larger players seeking to capitalize on increasing domestic automotive and infrastructure projects.

- Middle East and Africa (MEA): Growth in MEA is largely fueled by infrastructure investments, particularly in the GCC countries, leading to consistent demand for TiO2 in coatings and construction materials. MEA is also strategically important due to its potential as a source of titanium mineral sands, influencing future upstream investment decisions for global TiCl4 producers aiming to secure raw material supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titanium Tetrachloride Market.- The Chemours Company

- Tronox Holdings plc

- Venator Materials PLC

- Kronos Worldwide Inc.

- Lomon Billions Group Co., Ltd.

- Tayca Corporation

- OSAKA Titanium technologies Co., Ltd.

- TNG Limited

- Luoyang Shuangrui Wanji Chemical Co., Ltd.

- Gujarat Alkalies and Chemicals Limited (GACL)

- CINKARNA CELJE - Tovarna kemičnih izdelkov d.o.o.

- Pangang Group Vanadium & Titanium Resources Co., Ltd.

- Ishihara Sangyo Kaisha, Ltd. (ISK)

- Ansteel Group Corporation Limited

- Shanghai Yuejiang Titanium Chemical Manufacturer Co., Ltd.

- Huntsman Corporation (Legacy operations included in Venator/Tronox)

- VeraChem Industries, LLC

- Zhejiang Lida Chemical Co., Ltd.

- Jiangsu Kemao Chemical Co., Ltd.

- Sichuan Lomon Titanium Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Titanium Tetrachloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Titanium Tetrachloride (TiCl4)?

The primary application of TiCl4 is as the essential precursor (feedstock) in the chloride process for manufacturing titanium dioxide (TiO2) pigments, which are widely used in paints, coatings, and plastics. It is also critical for producing titanium metal used in aerospace and medical devices.

Which manufacturing process dominates the Titanium Tetrachloride market?

The Chloride Process is the dominant and preferred manufacturing method globally. It involves the direct chlorination of high-grade titanium-bearing ores (rutile) or refined slag, yielding high-purity TiCl4 necessary for quality TiO2 pigments and titanium metal.

What factors are driving the growth of the TiCl4 market?

Market growth is driven by accelerated global urbanization and infrastructure development, which sustains high demand for paints and coatings (TiO2 consumption), alongside increasing investment and technological requirements within the aerospace and defense sectors for lightweight, high-performance titanium metal.

How do geopolitical tensions impact the Titanium Tetrachloride supply chain?

Geopolitical tensions affect the supply chain in two main ways: by potentially disrupting the mining and transportation of critical titanium mineral ores (upstream restraint) and by influencing defense spending and aerospace manufacturing, which directly dictates the specialized demand for titanium metal (downstream driver).

Why is handling Titanium Tetrachloride considered hazardous?

TiCl4 is highly corrosive, volatile, and reacts violently with moisture, generating dense, toxic fumes of hydrochloric acid and titanium dioxide. Its hazardous nature necessitates stringent safety protocols, specialized logistics, and high operational expenditure, acting as a structural restraint on market operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager