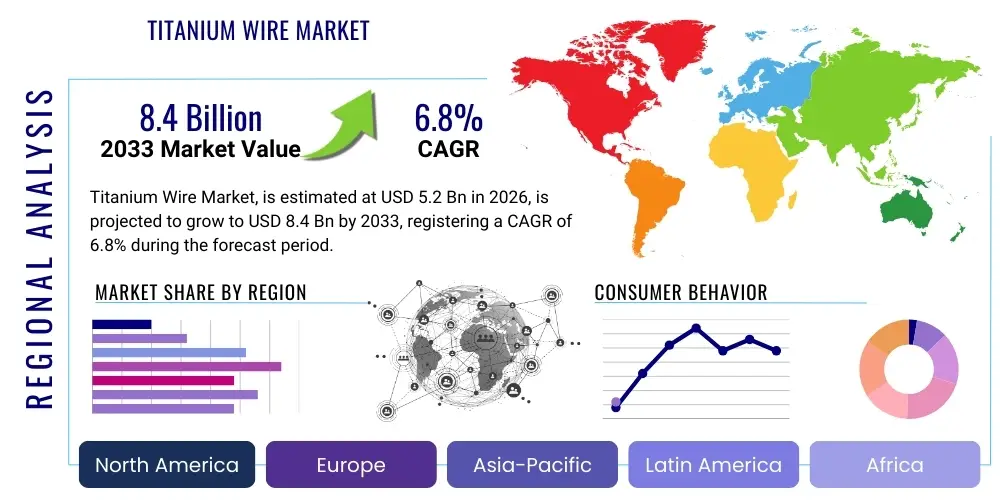

Titanium Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438819 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Titanium Wire Market Size

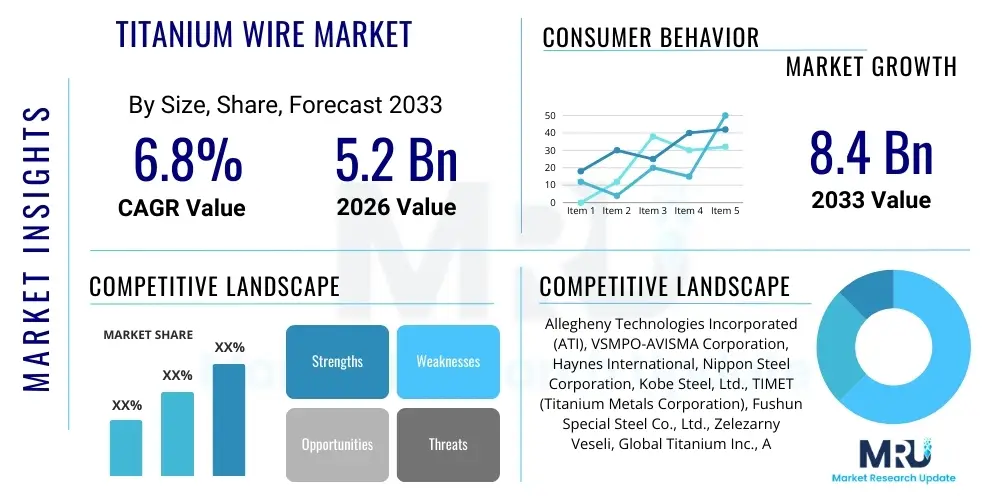

The Titanium Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033.

Titanium Wire Market introduction

Titanium wire represents a critical segment of the broader titanium product industry, characterized by its superior combination of strength, low density, and exceptional corrosion resistance. This material is manufactured through complex processes involving hot working, cold drawing, and precision annealing, resulting in fine wire products that adhere to stringent industry standards, particularly AMS (Aerospace Material Specifications) and ASTM (American Society for Testing and Materials). The primary product categories include Commercially Pure (CP) titanium wires (Grades 1–4) and high-strength titanium alloy wires, most notably Ti-6Al-4V (Grade 5), which is dominant in high-performance applications. The production quality, surface finish, and dimensional accuracy are paramount, driving the technological requirements within the manufacturing landscape.

Major applications of titanium wire span high-value sectors such as aerospace and defense, where it is utilized in fasteners, structural components, and welding filler material due to its lightweight properties and thermal stability. In the medical field, titanium wire is indispensable for orthopedic implants, pacemakers, dental archwires, and surgical staples because of its excellent biocompatibility and non-ferromagnetic nature. Furthermore, industrial applications, particularly in chemical processing plants, marine environments, and oil and gas exploration, leverage the material's unparalleled resistance to highly corrosive media, including chlorides and acids. The sustained demand from these technically demanding sectors acts as a foundational driver for market growth.

The inherent benefits of titanium wire—including its high strength-to-weight ratio, superior fatigue resistance, and ability to withstand extreme temperatures—position it as a material of choice over traditional alloys like stainless steel or nickel-based superalloys in critical engineering designs. Current market dynamics are heavily influenced by the expansion of global commercial aircraft fleets, the increasing prevalence of complex orthopedic and cardiovascular procedures necessitating advanced biomaterials, and escalating defense expenditures globally. These factors collectively underscore the strategic importance of titanium wire within the global supply chain for advanced manufacturing and high-reliability systems.

Titanium Wire Market Executive Summary

The Titanium Wire Market demonstrates robust growth, propelled primarily by sustained investment and expansion within the global aerospace manufacturing sector and continuous advancements in medical device technology. Business trends indicate a strong move towards specialization, where manufacturers focus on producing ultra-fine diameter wires with enhanced surface finishes and tighter dimensional tolerances to meet the stringent requirements of dental and medical implant applications. Furthermore, the industry is witnessing increased automation in cold drawing and annealing processes to optimize yield rates and reduce the high manufacturing costs traditionally associated with titanium processing. Supply chain stability, particularly regarding the sourcing of titanium sponge (the raw material), remains a key strategic focus for major market participants aiming to mitigate geopolitical supply risks.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by rapid industrialization, burgeoning defense spending in countries like China and India, and significant domestic infrastructure projects. North America and Europe, while mature, maintain dominant market shares, primarily due to the established presence of large aerospace OEMs and leading medical device manufacturers who specify high-grade, certified titanium alloys. The demand structure in these regions is shifting towards higher-value applications, such as additive manufacturing (AM) feedstock, which requires specialized wire forms with superior metallurgical cleanliness and powder characteristics.

Segment trends reveal that the Titanium Alloy Wire segment, specifically Ti-6Al-4V, holds the largest market share owing to its pervasive use in aircraft structures and biomedical implants requiring high tensile strength. By application, the Aerospace & Defense sector remains the largest consumer, although the Medical sector is projected to exhibit the highest CAGR due to demographic shifts leading to increased demand for joint replacements and cardiovascular devices. The market is consolidating around quality and certification; smaller players are increasingly seeking strategic partnerships or acquisitions to gain access to proprietary drawing techniques and secure long-term contracts with stringent regulatory customers.

AI Impact Analysis on Titanium Wire Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Titanium Wire Market center on three primary themes: how AI can optimize the notoriously complex and high-cost manufacturing processes, the potential for AI-driven material informatics to accelerate the development of new high-performance titanium alloys, and the role of predictive maintenance in improving equipment longevity and minimizing downtime in wire drawing facilities. Users are particularly interested in AI's capacity to manage and interpret vast datasets generated during hot rolling and cold drawing, ensuring tighter control over microstructural properties and dimensional consistency, which are crucial for aerospace and medical grades. The underlying expectation is that AI tools will significantly enhance operational efficiency and product quality verification, thereby offsetting some of the inherent cost disadvantages of titanium wire production relative to other materials.

- AI-driven optimization of annealing cycles and draw speed parameters to achieve specific mechanical properties and surface finishes.

- Implementation of machine learning models for non-destructive testing and real-time quality control, rapidly identifying internal defects or surface imperfections.

- Predictive maintenance schedules for high-wear equipment like drawing dies and spooling machinery, minimizing unplanned operational stoppages.

- AI-enhanced supply chain management for optimizing raw material inventory (titanium sponge and billets) and demand forecasting for specialized wire gauges.

- Utilizing generative design and material informatics to simulate and test new titanium alloy compositions optimized for specific end-use environments (e.g., extreme temperature or high corrosion).

DRO & Impact Forces Of Titanium Wire Market

The Titanium Wire Market is fundamentally driven by the expanding backlog in the global commercial aviation sector, requiring substantial quantities of fasteners and welding wire, alongside the global aging population that necessitates a continuous surge in advanced medical procedures utilizing titanium implants. However, growth is substantially restrained by the extremely high capital investment required for specialized titanium processing equipment and the persistent volatility in the price of titanium sponge, which is often tied to geopolitical mining dynamics. Opportunities lie significantly in developing specialized wire products for additive manufacturing feedstock, particularly wire-arc additive manufacturing (WAAM), and expanding usage in high-end consumer electronics and renewable energy applications where corrosion resistance is critical. These forces—strong intrinsic demand from high-reliability sectors, countered by high processing costs and raw material price fluctuations—dictate the pace and direction of market development.

Drivers include the continuous push for lightweighting in aerospace design to improve fuel efficiency and the regulatory requirements, particularly in the medical field (FDA, CE Mark), mandating highly biocompatible materials for internal fixation devices. The high strength-to-density ratio of titanium alloys ensures their indispensability in these fields. Furthermore, defense modernization programs globally, focusing on new generation fighters and naval vessels, consistently specify titanium wire for critical systems demanding longevity and resistance to stress corrosion cracking. The increasing complexity of modern systems necessitates materials that can perform reliably under extreme conditions, cementing titanium's market position.

Conversely, significant restraints hinder wider adoption. The high energy consumption and complex, multi-stage processing required for drawing titanium alloys into fine wires contribute significantly to high material costs relative to stainless steel or aluminum. Technical barriers related to welding titanium and the need for inert gas environments also add complexity to end-user applications. The reliance on highly specialized manufacturing expertise and stringent quality control protocols, which translate into long qualification cycles for new suppliers, further constrains rapid market expansion. Despite these restraints, the unique performance attributes of titanium ensure that end-users are willing to absorb the premium cost for critical applications where failure is not an option.

Key opportunities center on innovation in manufacturing efficiency and product diversification. The development of advanced coating technologies for titanium wire (e.g., nitride coatings) can enhance wear resistance and longevity in industrial applications. Additionally, the increasing focus on customized small-batch orders, facilitated by flexible manufacturing systems, addresses the specialized needs of boutique medical device manufacturers. The long-term impact forces are generally positive, driven by persistent technological progression in high-growth sectors, but market resilience depends heavily on the industry's ability to stabilize raw material costs and optimize energy-intensive processing routes.

Segmentation Analysis

The Titanium Wire Market is structurally segmented based on product type, grade, diameter, and critical end-use applications, reflecting the diverse requirements across industries ranging from surgical intervention to deep-sea exploration. Segmentation based on type differentiates between wires made from Commercially Pure (CP) titanium, which offers excellent corrosion resistance and ductility, and high-strength Titanium Alloy wires, engineered for superior mechanical properties under load. Further granular analysis by diameter is crucial, as the production methodology and target end-user (e.g., ultra-fine wires for orthodontic procedures vs. large diameter rods for welding) vary significantly. Understanding these segment dynamics is essential for market participants to align their production capabilities with specific high-demand niches.

- By Type:

- Commercially Pure (CP) Titanium Wire

- Titanium Alloy Wire (e.g., Ti-6Al-4V, Ti-3Al-2.5V, Ti-5Al-2.5Sn)

- By Grade:

- Grade 1-4 (CP Grades)

- Grade 5 (Ti-6Al-4V)

- Grade 9 (Ti-3Al-2.5V)

- Other Grades

- By Diameter:

- < 1.0 mm (Ultra-fine and Fine Wire)

- 1.0 mm – 3.0 mm (Medium Wire)

- > 3.0 mm (Thick Wire/Rod)

- By Application:

- Aerospace & Defense (Fasteners, Welding Filler Material, Springs)

- Medical & Dental (Implants, Orthodontics, Surgical Instruments)

- Industrial (Chemical Processing, Marine, Oil & Gas)

- Automotive

- Consumer Goods and Others

Value Chain Analysis For Titanium Wire Market

The value chain for the Titanium Wire Market is complex, beginning with the highly capital-intensive upstream extraction and processing of titanium ore (rutile or ilmenite) into titanium sponge through the Kroll process. This material is then melted, often multiple times via Vacuum Arc Remelting (VAR), to produce clean, homogenous ingots and billets. Upstream suppliers exert significant price influence due to the energy-intensive nature of sponge and ingot production. The quality and purity of these initial materials directly determine the mechanical performance of the final wire product, leading to strict quality agreements between wire manufacturers and primary metal producers.

The midstream segment involves specialized wire producers who perform hot rolling, peeling, drawing, and annealing operations. This phase requires proprietary drawing die technologies and precise thermal treatments to achieve the necessary grain structure, mechanical strength, and surface finish. Distribution channels are varied; large volume contracts for aerospace applications typically involve direct sales and long-term agreements between the wire producer and Tier 1 or OEM manufacturers. For highly specialized medical wires, distribution often flows through smaller, specialized distributors who handle inventory, cutting, and packaging to meet specific client specifications (indirect channel).

Downstream analysis focuses on the transformation of the wire into finished products. In aerospace, this involves cold heading into fasteners or utilizing the wire in welding processes. In the medical sector, downstream processing includes precision coiling, shaping, and surface modification for implants or surgical devices. Direct channels are favored when technical specifications are complex or proprietary, ensuring tight communication regarding quality control. Indirect channels are prevalent for standard or off-the-shelf welding wires. The efficiency of this value chain is continuously threatened by high conversion costs and the need for meticulous certification at every stage, especially for safety-critical applications.

Titanium Wire Market Potential Customers

The primary consumers and end-users of titanium wire are entities operating within highly regulated and technically demanding industries where material failure carries catastrophic consequences. These customers prioritize quality certification (such as ISO 13485 for medical, or AS9100 for aerospace) and metallurgical traceability over cost savings. Key buyers include major commercial aircraft manufacturers (Boeing, Airbus) and their extensive network of fastener and structural component suppliers who require high volumes of aerospace-grade alloy wire (Ti-6Al-4V) for critical structural joints and engine components. These users require material that meets strict AMS specifications for chemical composition and mechanical properties.

Another crucial customer base lies within the medical device manufacturing sector. Companies specializing in orthopedic implants (knee, hip), spinal fusion hardware, cardiovascular stents, and dental devices are continuous, high-value purchasers of fine-diameter CP and alloy wire due to titanium’s unmatched biocompatibility and elasticity. These customers are interested in specific surface finishes, low inclusion counts, and fatigue performance characteristics. The demand is often for specialized grades and ultra-fine diameters, necessitating close collaboration with wire manufacturers for custom specifications.

Industrial customers, particularly those involved in offshore oil and gas production, chemical processing (acid and caustic handling), and desalination plants, also represent significant long-term potential. These users procure titanium wire, usually in CP grades, for use in basket filtration, specialized corrosion-resistant components, and welding filler material to maintain the integrity of their processing infrastructure. While volume may be less than aerospace, the consistent replacement cycle and severe operating environments ensure steady demand for corrosion-resistant titanium solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allegheny Technologies Incorporated (ATI), VSMPO-AVISMA Corporation, Haynes International, Nippon Steel Corporation, Kobe Steel, Ltd., TIMET (Titanium Metals Corporation), Fushun Special Steel Co., Ltd., Zelezarny Veseli, Global Titanium Inc., Ametek Inc., ADMA Products Inc., Fort Wayne Metals, Puris LLC, Reading Alloys Inc., Baoji Titanium Industry Co., Ltd. (BAOTI), Western Superconducting Technologies Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Titanium Wire Market Key Technology Landscape

The technology landscape governing the production of high-quality titanium wire is focused heavily on achieving metallurgical purity, superior surface finish, and tight dimensional control necessary for critical applications. Key technological advancements center around optimizing the cold drawing and heat treatment (annealing) processes. Cold drawing requires highly durable, low-friction drawing dies, often made from cemented carbides or specialized diamond materials, designed to reduce the wire diameter incrementally while minimizing material work hardening and internal stress. Vacuum or inert gas annealing furnaces are critical for performing intermediate and final heat treatments, ensuring the final product possesses the required microstructure and mechanical properties, particularly ductility and tensile strength, without contamination.

Surface technology is another crucial area of innovation. Prior to drawing, titanium billets must undergo thorough surface conditioning, including specialized acid pickling or mechanical peeling, to remove the alpha case—a hard, brittle surface layer formed during high-temperature processing. Contemporary technology involves improved surface lubrication systems and non-contact monitoring systems during the draw process to maintain a flawless finish, which is non-negotiable for medical implants and aerospace fasteners. The demand for ultra-fine wires (less than 0.5 mm) necessitates advanced capillary drawing techniques and specialized multi-stage spooling machinery to prevent breakage and maintain uniform tension.

Furthermore, technology related to testing and certification is evolving rapidly. Non-destructive testing (NDT) methodologies, including eddy current testing and advanced ultrasonic inspection, are increasingly integrated inline to detect sub-surface defects in real-time. The adoption of Wire-Arc Additive Manufacturing (WAAM) technology has also spurred technological demand for specialized, high-purity, and precisely spooled large-diameter titanium wire feedstock, requiring new melting and casting technologies to control residual stresses and chemical composition accuracy suitable for AM applications. This shift necessitates manufacturers to invest in cleaner melting processes and advanced wire handling robotics.

Regional Highlights

- North America: This region maintains the largest market share, predominantly driven by the robust presence of the aerospace and defense industry, particularly in the United States. Major aircraft manufacturers and the significant demand for high-grade Ti-6Al-4V fasteners and welding material ensure consistent, high-value contracts. Additionally, the U.S. is a global leader in advanced medical device manufacturing, utilizing titanium wire extensively for FDA-regulated surgical and orthopedic implants, reinforcing demand for ultra-fine, highly certified wire grades.

- Europe: Europe represents a significant, mature market, characterized by strong demand from the regional aerospace sector (Airbus, defense contractors) and a sophisticated medical technology industry, especially in Germany and Switzerland. Strict EU regulations concerning material safety and traceability drive manufacturers toward premium, high-pspecification wire products. Investment in chemical processing infrastructure also contributes to steady consumption of CP titanium wire for corrosion-resistant equipment.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid expansion is fueled by rising defense budgets (China, India, South Korea), significant growth in domestic commercial aviation manufacturing and MRO activities, and massive infrastructure development requiring robust, high-performance materials. Furthermore, the increasing accessibility and quality standards of healthcare services across major APAC economies are boosting the use of titanium in biomedical applications.

- Latin America, Middle East, and Africa (LAMEA): This combined region shows moderate but growing demand, primarily concentrated in countries with active oil and gas extraction industries and those investing heavily in military modernization. The Middle East, in particular, utilizes titanium wire for specialized components in petrochemical processing plants and corrosive marine environments. Market growth here is often volatile, tied directly to commodity prices and government spending on infrastructure and defense procurements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Titanium Wire Market.- Allegheny Technologies Incorporated (ATI)

- VSMPO-AVISMA Corporation

- TIMET (Titanium Metals Corporation)

- Kobe Steel, Ltd.

- Nippon Steel Corporation

- Haynes International

- Fort Wayne Metals

- Fushun Special Steel Co., Ltd.

- Zelezarny Veseli

- Global Titanium Inc.

- Ametek Inc.

- ADMA Products Inc.

- Puris LLC

- Reading Alloys Inc.

- Baoji Titanium Industry Co., Ltd. (BAOTI)

- Western Superconducting Technologies Co., Ltd.

- OSAKA Titanium technologies Co., Ltd.

- Toho Titanium Co., Ltd.

- Hitachi Metals, Ltd.

- Safran S.A. (Materials Division)

Frequently Asked Questions

Analyze common user questions about the Titanium Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Commercially Pure (CP) titanium wire and titanium alloy wire?

CP titanium wire (Grades 1-4) is valued for its superior ductility, weldability, and exceptional corrosion resistance, making it ideal for chemical processing and non-load-bearing medical applications. Titanium alloy wire, specifically Ti-6Al-4V (Grade 5), possesses significantly higher tensile strength and is critical for high-stress applications like aerospace fasteners and major orthopedic implants.

Which application segment drives the highest demand and market value for titanium wire?

The Aerospace and Defense sector consistently drives the highest market value, due to the critical nature of components, stringent certification requirements, and large-scale use of high-cost alloy grades (Ti-6Al-4V) in airframe structures, engines, and missile systems, primarily procured as welding filler material and precision fasteners.

What are the main technical challenges in manufacturing ultra-fine titanium wire?

Key technical challenges include managing severe work hardening during cold drawing, preventing wire breakage at small diameters, achieving the required defect-free surface finish, and maintaining extremely tight dimensional tolerances essential for specialized medical devices like stents and orthodontic wires, which requires high-precision tooling and lubrication systems.

How does the volatile price of titanium sponge impact the final cost of titanium wire?

Titanium sponge is the primary upstream raw material, and its price volatility is a major determinant of the final wire cost. Since titanium processing is highly energy-intensive and conversion yields are lower than traditional metals, fluctuations in sponge cost are amplified throughout the value chain, directly affecting manufacturer margins and end-user procurement budgets.

In which regional market is the growth potential for titanium wire consumption highest?

The Asia Pacific (APAC) region is projected to demonstrate the highest growth potential, fueled by accelerated industrial growth, increasing investment in both commercial aerospace manufacturing capacity and military modernization programs, and expanding high-quality medical device production bases in economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager