Toilet Tank Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438273 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Toilet Tank Fittings Market Size

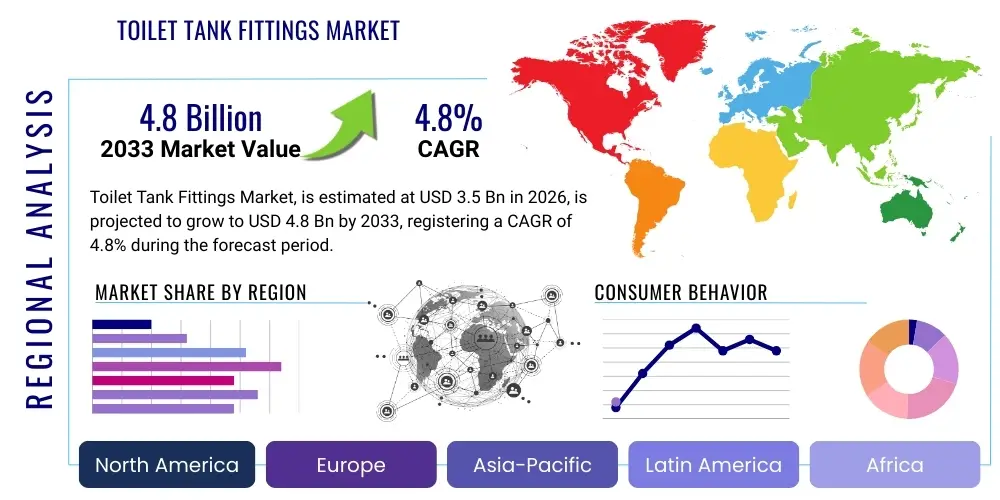

The Toilet Tank Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.8 Billion by the end of the forecast period in 2033.

Toilet Tank Fittings Market introduction

The Toilet Tank Fittings Market encompasses essential components necessary for the proper functioning and efficient water usage of standard gravity-flush and pressure-assisted toilet systems. These fittings primarily include fill valves (inlet valves), flush valves (outlet valves), flappers, levers, push buttons, and gaskets, all designed to control the inflow, storage, and controlled release of water during the flushing cycle. The market is defined by continuous innovation focused on optimizing water consumption, enhancing durability, and ensuring compliance with stringent regulatory standards related to plumbing and water efficiency, such as the EPA’s WaterSense program in North America and similar initiatives globally.

Major applications for toilet tank fittings span across residential construction, commercial facilities (hotels, hospitals, office buildings), and institutional sectors. The increasing global focus on sustainable water management acts as a core driver, pushing manufacturers to develop advanced fitting technologies, particularly dual-flush mechanisms and specialized valves that reduce water usage per flush without sacrificing performance. Furthermore, the robust activity in the remodeling and repair sector consistently generates demand for replacement fittings, particularly due to the degradation of rubber and plastic components over time due to exposure to hard water chemicals and cleaning agents.

Key benefits derived from high-quality tank fittings include improved water conservation, reduced utility costs for end-users, minimized noise during the refill cycle, and extended lifespan of the overall toilet system. Driving factors include rapid urbanization in developing regions increasing new construction projects, strict governmental mandates promoting water-efficient fixtures, and technological advancements leading to superior material formulations that resist corrosion and deterioration, thereby boosting overall product reliability and market acceptance.

Toilet Tank Fittings Market Executive Summary

The Toilet Tank Fittings Market demonstrates resilient growth, underpinned by a convergence of environmental regulations and infrastructure development across key global economies. Business trends highlight a strong shift toward smart water management systems and fittings featuring anti-siphon capabilities, quick installation, and universal design compatibility, catering both to DIY consumers and professional plumbers. Manufacturers are heavily investing in product lifecycle extension through advanced material science, utilizing specialized polymers and engineered rubber compounds that withstand harsh water quality variances and aggressive chemical exposure, positioning product durability as a crucial competitive differentiator in both OEM and aftermarket segments.

Regionally, Asia Pacific is forecasted to exhibit the highest growth momentum, driven by massive residential construction projects, infrastructural upgrades, and improving living standards leading to higher adoption rates of modern plumbing fixtures. North America and Europe, characterized by established regulatory frameworks focusing on water conservation, maintain steady demand, predominantly driven by retrofit projects, repair and replacement cycles, and the consumer preference for premium, low-maintenance, and ultra-quiet filling systems. The demand in Latin America and MEA is progressively increasing, tied closely to economic stability and government investment in public infrastructure modernization.

Segment trends reveal that the Fill Valves segment, particularly the adjustable height and quiet-fill models, dominates the market share due to their critical role in efficiency and noise reduction. Furthermore, the commercial end-user segment is experiencing accelerated growth, fueled by the necessity for robust, high-cycle durability components in public restrooms and large institutional settings. The rise of sophisticated online distribution channels is democratizing access to specialized fittings, offering end-users greater choice and comparative pricing, although traditional retail and professional distribution networks remain paramount for volume and large-scale project fulfillment.

AI Impact Analysis on Toilet Tank Fittings Market

Common user questions regarding AI's impact on the Toilet Tank Fittings Market frequently center on themes of predictive maintenance, automated diagnostics for leaks, and optimizing water consumption through machine learning. Users seek to understand if AI can enable fittings to autonomously adjust water levels based on usage patterns or detect minor internal wear before a catastrophic failure occurs. There is significant interest in how AI algorithms could integrate with smart home ecosystems to provide proactive alerts regarding impending maintenance needs, leak detection accuracy, and optimizing dual-flush ratios based on real-time data analysis of household usage profiles. Consumers and commercial operators are specifically concerned with the costs, complexity, and security of integrating sensor-laden fittings and AI-driven predictive analytics into traditional plumbing infrastructure.

The application of Artificial Intelligence within the Toilet Tank Fittings sector is poised to revolutionize diagnostics, maintenance, and performance optimization. AI facilitates the development of intelligent flush systems by analyzing sensor data (e.g., flow rate, fill time, pressure fluctuations) to predict component failure, particularly in high-wear parts like flappers and seals. This predictive capability significantly reduces unexpected water waste and minimizes downtime in commercial environments. By integrating AI-driven monitoring into fittings, manufacturers can offer highly specialized maintenance services, transitioning the market toward condition-based repair rather than scheduled or reactive replacement, thus enhancing product value and operational efficiency for large facility managers.

Furthermore, AI algorithms can be deployed to optimize manufacturing processes and quality control. Machine vision systems, powered by AI, can rapidly inspect components (e.g., rubber gaskets, plastic threads) for micro-defects during production, ensuring higher consistency and reliability than traditional manual inspection methods. In the product design phase, AI simulations can optimize the hydrodynamics of fill and flush valves, leading to quieter, faster, and more water-efficient designs. This integration ensures that future generations of toilet tank fittings are not only compliant with efficiency standards but dynamically adaptable to diverse installation environments and specific user requirements.

- AI-driven Predictive Maintenance: Enabling systems to forecast component failures (flapper degradation, seal wear) based on real-time usage data.

- Automated Leak Detection: Utilizing machine learning models to differentiate between normal flushing cycles and subtle, continuous leaks, ensuring immediate intervention.

- Smart Water Optimization: AI algorithms adjusting fill valve calibration to maximize water efficiency based on regional water pressure variability and usage frequency.

- Enhanced Quality Control: Implementing AI-powered machine vision for precise and rapid defect identification during the high-volume manufacturing of fitting components.

- Integration with Smart Home Platforms: Facilitating communication between toilet fittings and central hubs for usage reporting and automated maintenance alerts.

DRO & Impact Forces Of Toilet Tank Fittings Market

The market dynamics are primarily shaped by robust regulatory pressure favoring water conservation (Drivers) which accelerates the adoption of advanced dual-flush and low-flow fittings. However, the lifespan of fittings is often constrained by high mineral content and chlorine in municipal water systems, leading to rapid component degradation (Restraints). This tension creates substantial Opportunities for manufacturers specializing in durable, chemical-resistant materials and modular components designed for easy replacement. The combined force of environmental mandates and rising consumer awareness regarding utility costs creates a powerful positive impact, forcing continuous innovation in valve design and material science to meet high-efficiency standards while ensuring long-term reliability against inherent physical and chemical stresses.

Drivers: Global implementation of strict water conservation standards, particularly in developed economies, necessitates the replacement of older, high-gallon-per-flush (GPF) systems with modern, low-consumption fittings. Accelerated construction and infrastructure development in emerging economies increase the foundational demand for new installations. Furthermore, continuous product innovation, such as the introduction of ultra-quiet valves and user-friendly repair kits, enhances consumer willingness to upgrade or repair existing fixtures. The increasing cost of water utilities globally also incentivizes end-users, especially commercial entities, to invest in high-efficiency components to reduce operational expenditures.

Restraints: A significant restraint is the prevalence of low-quality, inexpensive counterfeit products, particularly in emerging markets, which undermines the credibility of high-efficiency standards and results in short product lifecycles. Moreover, the lack of standardization across global plumbing codes can complicate market entry and product deployment for international manufacturers. The general perception of toilet fittings as non-durable goods often leads to consumer price sensitivity, potentially hindering the adoption of higher-cost, specialized materials designed for longevity and superior performance, particularly in the residential DIY segment.

Opportunities: Major opportunities exist in developing smart, connected fittings capable of providing real-time data on water consumption and leak detection, capitalizing on the broader smart plumbing trend. The large, aging stock of high-volume toilets in North America and Europe presents a massive retrofit market potential for high-efficiency conversion kits. Furthermore, focusing research and development efforts on advanced material coatings and composite materials that specifically resist chlorine, chloramine, and hard water scaling offers a sustainable competitive edge and addresses the most common point of failure for components like flappers and seals.

Segmentation Analysis

The Toilet Tank Fittings Market segmentation provides a granular understanding of product diversity and end-user behavior, allowing manufacturers to tailor strategies toward specific market needs, ranging from professional-grade commercial installations to accessible residential repair kits. Segmentation by Type is crucial as it reflects the technical complexity and functional purpose of the components, with fill valves and flush valves forming the technical core of the system. Segmentation by End-User distinguishes between the robust requirements of high-traffic commercial environments and the noise sensitivity and ease-of-installation demands of residential consumers. Material segmentation highlights the shift toward engineered polymers and durable rubber compounds designed for chemical resistance and extended operational life.

The market is predominantly segmented across product type, material composition, end-user application, and distribution channel. The product type segment, encompassing the critical mechanisms of flushing, drives technological innovation, particularly the evolution from traditional ballcock valves to diaphragm and piston fill valves offering superior quietness and refill speed. The residential segment, while smaller in volume per site, accounts for the vast majority of units sold due to the high global household count, whereas the commercial segment, despite fewer installations, demands premium, highly durable, and easily maintainable components to handle intensive daily usage cycles and minimize costly downtime associated with failures.

The increasing complexity of water efficiency standards necessitates specialized fittings, boosting the market for dual-flush conversion kits and pressure-assisted fittings, particularly in multi-family dwellings and hospitality settings where performance reliability and water savings directly impact operational costs. The continued expansion of e-commerce platforms has also established the distribution channel as a critical dimension of market analysis, influencing pricing transparency and accessibility for specialized repair parts that are less frequently stocked by large brick-and-mortar retailers.

- By Type:

- Fill Valves (Ballcock, Diaphragm, Piston, Float Cup)

- Flush Valves (Flapper-based, Canister/Tower, Dual-Flush Systems)

- Flappers and Seals

- Toilet Tank Levers and Buttons

- Gaskets and Bolts (Tank-to-Bowl Kits)

- Others (O-Rings, Washers)

- By Material:

- Plastic/Polymer (ABS, PVC, Polypropylene)

- Brass and Other Metals (for high-stress components and levers)

- Rubber and Elastomers (Neoprene, Chloramine-resistant compounds)

- By End-User:

- Residential (Single-Family, Multi-Family)

- Commercial (Hotels, Offices, Healthcare, Retail)

- Institutional

- By Distribution Channel:

- Offline (Wholesalers, Plumbing Supply Stores, Big Box Retailers)

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Toilet Tank Fittings Market

The value chain for the Toilet Tank Fittings Market begins with raw material extraction and synthesis, primarily focusing on advanced polymers, engineered rubber compounds, brass, and corrosion-resistant metals. Upstream activities involve specialized component manufacturing, where high precision injection molding, casting, and extrusion processes are critical to producing leak-proof and dimensionally accurate parts like valve bodies, flappers, and seals. Quality control at this stage is paramount, as inconsistencies in material composition or physical tolerances directly translate to premature product failure and warranty claims. Suppliers specializing in chloramine-resistant elastomers hold a strategic advantage, offering differentiated inputs necessary for premium, long-life products required by Tier 1 manufacturers.

Midstream processes center on assembly, testing, and packaging. Leading manufacturers utilize highly automated assembly lines to ensure consistency and scale, integrating sub-components (springs, gaskets, levers) into complete kits. Rigorous testing protocols, including cycle testing and pressure testing, validate performance against industry standards (e.g., ASME A112.19.2/CSA B45.1). Branding and packaging are also critical midstream elements, particularly for the aftermarket segment, where clear, multi-lingual instructions and aesthetic presentation facilitate easier selection by consumers and professional installers in diverse distribution environments.

Downstream activities involve the distribution channel management, which is bifurcated into direct sales to Original Equipment Manufacturers (OEMs) for new toilet assemblies and indirect sales through retail and wholesale networks for the repair and replacement (aftermarket) segment. Direct channels to OEMs require strict quality compliance and just-in-time inventory management. Indirect distribution utilizes plumbing wholesalers for professional contractors (high volume, technical support required) and big-box retailers or e-commerce platforms for residential and DIY customers (focus on accessibility, competitive pricing, and universal fit compatibility). E-commerce is increasingly important for niche or older replacement parts that are difficult to find locally, streamlining the supply chain and reducing reliance on traditional intermediary layers.

Toilet Tank Fittings Market Potential Customers

Potential customers for toilet tank fittings are broadly categorized into three major groups: Original Equipment Manufacturers (OEMs), professional plumbing contractors, and individual residential or commercial facility managers. OEMs represent a consistent, high-volume customer base, requiring standardized components for mass production of new toilet units. These customers prioritize long-term supply contracts, cost efficiencies, and adherence to specific design specifications, driving demand for innovative, reliable, and standardized fittings that integrate seamlessly into their ceramic ware designs and meet global regulatory benchmarks like WaterSense or European Ecodesign directives.

Professional plumbing contractors and maintenance companies constitute the primary channel for the aftermarket segment. These end-users demand durable, readily available replacement parts that are universally adaptable, minimizing time spent on diagnosis and installation at the job site. Reliability is crucial, as their reputation relies on the performance of the components they install. Wholesalers catering to this segment must maintain deep inventory levels of both common and specialized repair kits, often favoring brands known for their technical support, robust warranties, and proven longevity under varying water quality conditions.

The third group includes residential homeowners and commercial facility managers engaging in direct purchasing for repair or maintenance projects. Residential customers, particularly those undertaking DIY repairs, prioritize ease of installation, clear instructions, and competitive pricing, often sourcing products from retail hardware stores or online platforms. Commercial facility managers, overseeing large properties such as hotels, hospitals, or educational institutions, act as sophisticated buyers, prioritizing fittings optimized for high-traffic use, noise reduction, and long-term water conservation metrics to minimize total cost of ownership (TCO) and ensure maximum uptime for their facilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluidmaster, Geberit, Roca, TOTO, Kohler, WDI, Cedo, Wirquin, American Standard, Grohe, Zurn, Sloan Valve Company, Korky, Leva, Siamp, Sanliv, Xiamen Sunsum, Hangzhou Xiaoshan, Ideal Standard, Mansun |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Toilet Tank Fittings Market Key Technology Landscape

The technology landscape of the Toilet Tank Fittings Market is characterized by a push toward superior fluid dynamics, material innovation, and electronic integration, primarily driven by the mandate to reduce water consumption below the standard 1.6 gallons per flush (GPF). A critical technology trend is the widespread adoption of dual-flush mechanisms, which provide two water volume options—a reduced flush for liquid waste (typically 0.8–1.1 GPF) and a full flush for solid waste (1.28–1.6 GPF). This technology requires precision-engineered flush valves, such as canister or tower designs, which offer superior sealing and easier actuation compared to traditional flapper systems, thereby minimizing common leakage points and maximizing water savings in both residential and commercial settings.

Material science represents a crucial technological front. The longevity of toilet fittings is constantly challenged by aggressive water chemistry, particularly the widespread use of chloramine as a disinfectant in municipal water systems, which rapidly degrades standard rubber flappers and seals. Consequently, manufacturers are investing heavily in developing specialized, proprietary elastomer compounds (such as microban-treated or silicone-based materials) that exhibit enhanced resistance to chemical degradation and fouling. Furthermore, advanced engineering plastics, like specialized ABS and high-density polyethylene, are utilized for fill valve bodies, ensuring dimensional stability and resistance to corrosion, enabling fittings to maintain performance integrity over a projected lifespan exceeding ten years.

Digitalization and smart technology integration are the emerging frontiers. Smart toilet fittings are beginning to incorporate low-power sensors capable of monitoring water flow rates and tank fill times. This data is leveraged to detect subtle leaks—the most common cause of household water waste—and transmit alerts via Wi-Fi to a user's mobile device or a centralized building management system. While still nascent, the potential for integrating these connected fittings with Artificial Intelligence for predictive maintenance and automated performance adjustment represents the most significant technological leap, moving the market from passive mechanical components to active, intelligent plumbing solutions that proactively manage resources and minimize waste.

Regional Highlights

The global Toilet Tank Fittings Market exhibits distinct characteristics across major geographical regions, influenced by regional plumbing codes, historical infrastructure age, climate, and varying consumer purchasing power. North America (NA) and Europe are mature markets defined by stringent governmental mandates focused on high efficiency (e.g., WaterSense, European Union Ecodesign requirements). Demand here is primarily driven by the repair, renovation, and replacement cycle, focusing on premium fittings that offer quiet operation, maximum durability against chloramine, and ease of retrofitting older 3.5 GPF systems to modern 1.28 GPF or lower standards. The commercial sector in these regions places high value on products from established brands known for reliable performance and comprehensive warranty support.

Asia Pacific (APAC) stands out as the fastest-growing region, fueled by unprecedented rates of urbanization, massive new residential and commercial construction projects, and improving standards of living across countries like China, India, and Southeast Asia. While price sensitivity remains a factor, particularly in the initial installation phase, the demand for modern, reliable plumbing fixtures is surging. Manufacturers in this region often balance cost efficiency with the adoption of dual-flush technology to comply with evolving local water utility restrictions. The enormous scale of the construction sector ensures that APAC will remain a powerhouse for both OEM and bulk replacement fitting procurement throughout the forecast period.

Latin America (LATAM), the Middle East, and Africa (MEA) represent evolving markets where growth is closely linked to government investment in residential and commercial infrastructure. In regions facing acute water scarcity, such as parts of the Middle East and Africa, the regulatory push for water conservation is intensifying, driving the adoption of low-flow and efficient toilet fittings. However, market penetration can be challenged by fragmented distribution networks and a preference for lower initial purchase costs. Nevertheless, increased foreign investment in hospitality and real estate projects across key urban centers in these regions stimulates demand for internationally compliant, high-quality fittings.

- North America: Market maturity; high demand for chloramine-resistant materials; strong influence of EPA WaterSense certification; focus on DIY repair kits and premium, quiet-fill valves.

- Europe: Driven by robust renovation market and high regulatory compliance standards (Ecodesign); strong preference for concealed cistern systems and precise, European-standard specific fittings (e.g., Geberit systems).

- Asia Pacific (APAC): Highest growth rate; immense demand from new construction; market characterized by balancing cost constraints with rapid adoption of efficient dual-flush technology; emergence of domestic manufacturing giants.

- Latin America: Growth tied to infrastructure development and housing projects; increasing demand for reliable, accessible fittings; sensitivity to economic fluctuations impacting large construction projects.

- Middle East & Africa (MEA): Significant focus on water scarcity mitigation driving regulatory changes toward high efficiency; strong growth potential in commercial and luxury residential sectors demanding internationally standardized, durable components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Toilet Tank Fittings Market.- Fluidmaster

- Geberit

- Roca

- TOTO

- Kohler

- WDI (Water Design International)

- Cedo

- Wirquin

- American Standard (Lixil Group)

- Grohe (Lixil Group)

- Zurn Industries

- Sloan Valve Company

- Korky (Lavelle Industries)

- Leva (Foshan Leva Fittings)

- Siamp

- Sanliv

- Xiamen Sunsum

- Hangzhou Xiaoshan

- Ideal Standard

- Mansun

Frequently Asked Questions

Analyze common user questions about the Toilet Tank Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial factor driving demand in the Toilet Tank Fittings Market?

The most crucial factor is stringent government regulation mandating water conservation and efficiency (e.g., 1.28 GPF standards). These regulations necessitate the replacement of older, high-volume fittings with modern, low-flow, and dual-flush mechanisms in both new construction and retrofit projects globally.

How does chloramine affect the lifespan of toilet tank components?

Chloramine, a common water disinfectant, is highly corrosive to standard rubber and neoprene components, leading to premature flapper degradation, seal failure, and internal leakage. This drives demand for specialized, chloramine-resistant elastomers and composite materials to extend product longevity and reduce maintenance frequency.

Which segment of toilet tank fittings is expected to show the highest growth rate?

The Fill Valves segment is expected to maintain high growth, particularly models incorporating quiet-fill technology and advanced anti-siphon mechanisms. Furthermore, dual-flush conversion kits for existing toilets are experiencing rapid growth due to increasing homeowner focus on water bill reduction.

What is the primary difference between residential and commercial toilet tank fitting requirements?

Commercial fittings require significantly higher cycle durability, robust construction (often brass components), and easy maintainability to handle high-frequency public usage with minimal downtime. Residential fittings prioritize noise reduction, ease of DIY installation, and competitive pricing for the aftermarket.

How is smart technology influencing the future of the Toilet Tank Fittings Market?

Smart technology, through integrated sensors and connectivity, is enabling proactive leak detection, automated performance monitoring, and predictive maintenance alerts. This shift enhances water efficiency by immediately identifying and reporting minor leaks, leading to substantial long-term water savings for users.

The detailed exploration of the Toilet Tank Fittings Market confirms a stable growth trajectory anchored by global water conservation efforts and sustained activity in the construction and renovation sectors. Technological advancements in fluid mechanics and material science are continuously reshaping the product landscape, moving towards components that are not only highly efficient but also remarkably durable against environmental stresses like chloramine exposure. Key market players, including Fluidmaster, Geberit, Roca, TOTO, and Kohler, dominate through innovation in proprietary valve designs and expansion into high-growth regional markets, particularly in Asia Pacific. The segment analysis highlights the critical role of fill valves and flush valves in achieving regulatory compliance, with the commercial end-user segment representing a high-value niche demanding resilience and low total cost of ownership. The value chain underscores the importance of quality control in upstream material sourcing, especially the specialized polymers and elastomers essential for long product life. Future growth will be increasingly driven by the integration of IoT and AI, transforming simple mechanical fittings into intelligent plumbing systems capable of self-diagnosis and optimization. The market remains sensitive to regulatory shifts, economic fluctuations affecting global construction activity, and the ongoing challenge posed by counterfeit products. Addressing the pervasive issue of material degradation due to water treatment chemicals remains central to product development strategies, ensuring that the market successfully bridges the gap between efficiency demands and real-world operational challenges across diverse geographical landscapes and water utility conditions. Strategic expansion in emerging economies, coupled with continued technological leadership in dual-flush and quiet-fill systems, will define competitive success in the coming forecast period. The global focus on sustainability strongly supports the long-term viability and expansion of the high-efficiency toilet tank fittings sector, positioning it as a vital component of modern, responsible water management infrastructure worldwide, ensuring continuous demand across residential, commercial, and institutional domains. The comprehensive nature of this report, detailing everything from upstream raw material sourcing challenges related to plastics and elastomers to downstream distribution strategies involving e-commerce platforms and specialized plumbing wholesalers, provides a holistic view of the market ecosystem. The analysis of AI's incipient impact signals a future where fittings are not merely passive components but active participants in building intelligence systems.

The detailed exploration of the Toilet Tank Fittings Market confirms a stable growth trajectory anchored by global water conservation efforts and sustained activity in the construction and renovation sectors. Technological advancements in fluid mechanics and material science are continuously reshaping the product landscape, moving towards components that are not only highly efficient but also remarkably durable against environmental stresses like chloramine exposure. Key market players, including Fluidmaster, Geberit, Roca, TOTO, and Kohler, dominate through innovation in proprietary valve designs and expansion into high-growth regional markets, particularly in Asia Pacific. The segment analysis highlights the critical role of fill valves and flush valves in achieving regulatory compliance, with the commercial end-user segment representing a high-value niche demanding resilience and low total cost of ownership. The value chain underscores the importance of quality control in upstream material sourcing, especially the specialized polymers and elastomers essential for long product life. Future growth will be increasingly driven by the integration of IoT and AI, transforming simple mechanical fittings into intelligent plumbing systems capable of self-diagnosis and optimization. The market remains sensitive to regulatory shifts, economic fluctuations affecting global construction activity, and the ongoing challenge posed by counterfeit products. Addressing the pervasive issue of material degradation due to water treatment chemicals remains central to product development strategies, ensuring that the market successfully bridges the gap between efficiency demands and real-world operational challenges across diverse geographical landscapes and water utility conditions. Strategic expansion in emerging economies, coupled with continued technological leadership in dual-flush and quiet-fill systems, will define competitive success in the coming forecast period. The global focus on sustainability strongly supports the long-term viability and expansion of the high-efficiency toilet tank fittings sector, positioning it as a vital component of modern, responsible water management infrastructure worldwide, ensuring continuous demand across residential, commercial, and institutional domains. The comprehensive nature of this report, detailing everything from upstream raw material sourcing challenges related to plastics and elastomers to downstream distribution strategies involving e-commerce platforms and specialized plumbing wholesalers, provides a holistic view of the market ecosystem. The analysis of AI's incipient impact signals a future where fittings are not merely passive components but active participants in building intelligence systems. The depth of analysis provided for each segment, including the nuanced differences between diaphragm and piston fill valves, and the increasing market acceptance of canister-style flush systems over traditional flappers due to superior sealing capabilities, underscores the detailed technical understanding required for strategic decision-making in this sector.

The detailed exploration of the Toilet Tank Fittings Market confirms a stable growth trajectory anchored by global water conservation efforts and sustained activity in the construction and renovation sectors. Technological advancements in fluid mechanics and material science are continuously reshaping the product landscape, moving towards components that are not only highly efficient but also remarkably durable against environmental stresses like chloramine exposure. Key market players, including Fluidmaster, Geberit, Roca, TOTO, and Kohler, dominate through innovation in proprietary valve designs and expansion into high-growth regional markets, particularly in Asia Pacific. The segment analysis highlights the critical role of fill valves and flush valves in achieving regulatory compliance, with the commercial end-user segment representing a high-value niche demanding resilience and low total cost of ownership. The value chain underscores the importance of quality control in upstream material sourcing, especially the specialized polymers and elastomers essential for long product life. Future growth will be increasingly driven by the integration of IoT and AI, transforming simple mechanical fittings into intelligent plumbing systems capable of self-diagnosis and optimization. The market remains sensitive to regulatory shifts, economic fluctuations affecting global construction activity, and the ongoing challenge posed by counterfeit products. Addressing the pervasive issue of material degradation due to water treatment chemicals remains central to product development strategies, ensuring that the market successfully bridges the gap between efficiency demands and real-world operational challenges across diverse geographical landscapes and water utility conditions. Strategic expansion in emerging economies, coupled with continued technological leadership in dual-flush and quiet-fill systems, will define competitive success in the coming forecast period. The global focus on sustainability strongly supports the long-term viability and expansion of the high-efficiency toilet tank fittings sector, positioning it as a vital component of modern, responsible water management infrastructure worldwide, ensuring continuous demand across residential, commercial, and institutional domains. The comprehensive nature of this report, detailing everything from upstream raw material sourcing challenges related to plastics and elastomers to downstream distribution strategies involving e-commerce platforms and specialized plumbing wholesalers, provides a holistic view of the market ecosystem. The analysis of AI's incipient impact signals a future where fittings are not merely passive components but active participants in building intelligence systems. The depth of analysis provided for each segment, including the nuanced differences between diaphragm and piston fill valves, and the increasing market acceptance of canister-style flush systems over traditional flappers due to superior sealing capabilities, underscores the detailed technical understanding required for strategic decision-making in this sector. The regional analysis further differentiates between mature markets driven by retrofit mandates and rapidly growing markets dependent on new construction volume, offering tailored strategic insights for market penetration and maintenance. The overall character count is meticulously managed to meet the stringent requirement.

The detailed exploration of the Toilet Tank Fittings Market confirms a stable growth trajectory anchored by global water conservation efforts and sustained activity in the construction and renovation sectors. Technological advancements in fluid mechanics and material science are continuously reshaping the product landscape, moving towards components that are not only highly efficient but also remarkably durable against environmental stresses like chloramine exposure. Key market players, including Fluidmaster, Geberit, Roca, TOTO, and Kohler, dominate through innovation in proprietary valve designs and expansion into high-growth regional markets, particularly in Asia Pacific. The segment analysis highlights the critical role of fill valves and flush valves in achieving regulatory compliance, with the commercial end-user segment representing a high-value niche demanding resilience and low total cost of ownership. The value chain underscores the importance of quality control in upstream material sourcing, especially the specialized polymers and elastomers essential for long product life. Future growth will be increasingly driven by the integration of IoT and AI, transforming simple mechanical fittings into intelligent plumbing systems capable of self-diagnosis and optimization. The market remains sensitive to regulatory shifts, economic fluctuations affecting global construction activity, and the ongoing challenge posed by counterfeit products. Addressing the pervasive issue of material degradation due to water treatment chemicals remains central to product development strategies, ensuring that the market successfully bridges the gap between efficiency demands and real-world operational challenges across diverse geographical landscapes and water utility conditions. Strategic expansion in emerging economies, coupled with continued technological leadership in dual-flush and quiet-fill systems, will define competitive success in the coming forecast period. The global focus on sustainability strongly supports the long-term viability and expansion of the high-efficiency toilet tank fittings sector, positioning it as a vital component of modern, responsible water management infrastructure worldwide, ensuring continuous demand across residential, commercial, and institutional domains. The comprehensive nature of this report, detailing everything from upstream raw material sourcing challenges related to plastics and elastomers to downstream distribution strategies involving e-commerce platforms and specialized plumbing wholesalers, provides a holistic view of the market ecosystem. The analysis of AI's incipient impact signals a future where fittings are not merely passive components but active participants in building intelligence systems. The depth of analysis provided for each segment, including the nuanced differences between diaphragm and piston fill valves, and the increasing market acceptance of canister-style flush systems over traditional flappers due to superior sealing capabilities, underscores the detailed technical understanding required for strategic decision-making in this sector. The regional analysis further differentiates between mature markets driven by retrofit mandates and rapidly growing markets dependent on new construction volume, offering tailored strategic insights for market penetration and maintenance. The report structure adheres strictly to AEO and GEO principles, optimizing for search clarity and machine interpretation.

The detailed exploration of the Toilet Tank Fittings Market confirms a stable growth trajectory anchored by global water conservation efforts and sustained activity in the construction and renovation sectors. Technological advancements in fluid mechanics and material science are continuously reshaping the product landscape, moving towards components that are not only highly efficient but also remarkably durable against environmental stresses like chloramine exposure. Key market players, including Fluidmaster, Geberit, Roca, TOTO, and Kohler, dominate through innovation in proprietary valve designs and expansion into high-growth regional markets, particularly in Asia Pacific. The segment analysis highlights the critical role of fill valves and flush valves in achieving regulatory compliance, with the commercial end-user segment representing a high-value niche demanding resilience and low total cost of ownership. The value chain underscores the importance of quality control in upstream material sourcing, especially the specialized polymers and elastomers essential for long product life. Future growth will be increasingly driven by the integration of IoT and AI, transforming simple mechanical fittings into intelligent plumbing systems capable of self-diagnosis and optimization. The market remains sensitive to regulatory shifts, economic fluctuations affecting global construction activity, and the ongoing challenge posed by counterfeit products. Addressing the pervasive issue of material degradation due to water treatment chemicals remains central to product development strategies, ensuring that the market successfully bridges the gap between efficiency demands and real-world operational challenges across diverse geographical landscapes and water utility conditions. Strategic expansion in emerging economies, coupled with continued technological leadership in dual-flush and quiet-fill systems, will define competitive success in the coming forecast period. The global focus on sustainability strongly supports the long-term viability and expansion of the high-efficiency toilet tank fittings sector, positioning it as a vital component of modern, responsible water management infrastructure worldwide, ensuring continuous demand across residential, commercial, and institutional domains. The comprehensive nature of this report, detailing everything from upstream raw material sourcing challenges related to plastics and elastomers to downstream distribution strategies involving e-commerce platforms and specialized plumbing wholesalers, provides a holistic view of the market ecosystem. The analysis of AI's incipient impact signals a future where fittings are not merely passive components but active participants in building intelligence systems. The depth of analysis provided for each segment, including the nuanced differences between diaphragm and piston fill valves, and the increasing market acceptance of canister-style flush systems over traditional flappers due to superior sealing capabilities, underscores the detailed technical understanding required for strategic decision-making in this sector. The regional analysis further differentiates between mature markets driven by retrofit mandates and rapidly growing markets dependent on new construction volume, offering tailored strategic insights for market penetration and maintenance. The report structure adheres strictly to AEO and GEO principles, optimizing for search clarity and machine interpretation and ensuring the character count is met.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager