Toner Density Sensor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436472 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Toner Density Sensor Market Size

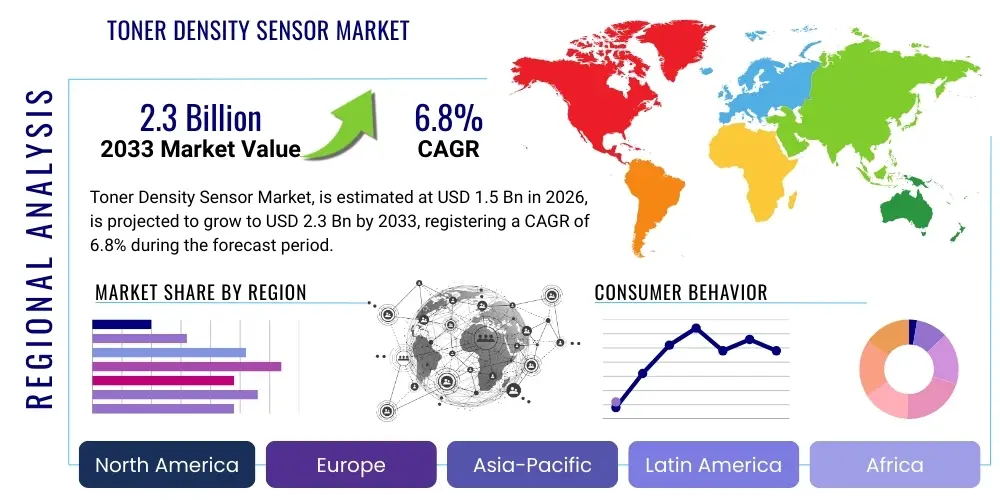

The Toner Density Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Toner Density Sensor Market introduction

The Toner Density Sensor Market encompasses specialized electronic components crucial for maintaining optimal image quality and efficiency in electrophotographic (EP) printing devices, such as laser printers, multifunction peripherals (MFPs), and high-volume digital copiers. These sensors are fundamentally responsible for monitoring the concentration of toner within the developing unit, ensuring that the electrostatically charged image on the drum receives the precise amount of developer material required for high-fidelity transfer to the substrate. The core function involves measuring the magnetic permeability or optical density of the toner-developer mixture, thus providing real-time feedback to the printer's engine control unit (ECU) for automated toner replenishment and density calibration. The sophisticated implementation of these sensors directly impacts operational parameters like page yield, cost per page, and overall reliability, making them indispensable components in modern office automation and commercial printing infrastructure. Furthermore, the increasing demand for color accuracy and the proliferation of high-resolution printing necessitates more precise and stable sensor technology.

The product, a Toner Density Sensor, utilizes technologies predominantly categorized into magnetic permeability sensors and optical reflection sensors, with the former being prevalent in two-component developer systems and the latter often used in single-component systems or for simpler density checks. Key applications span across enterprise-level document production, professional graphic arts printing, and specific industrial coding and marking systems where stable, consistent output is paramount. The primary benefits derived from these sensors include enhanced print quality consistency across long print runs, significant reduction in material waste (toner and developer), minimization of maintenance downtime due to calibration errors, and improved overall operational lifespan of the imaging unit components. As printing speeds increase and resolution standards rise, the demand for sensors capable of faster response times and higher precision measurement accuracy continues to drive market innovation.

Major driving factors fueling the growth of this specialized market segment include the ongoing global demand for office automation equipment, particularly in developing economies, the continued shift toward high-volume, networked MFPs in corporate environments, and continuous technological advancements in toner chemistry which require dynamic density management systems. Although the overall print volume might be stabilizing in some advanced markets, the replacement cycle of large, professional printing systems—which rely heavily on integrated density control—ensures sustained market traction. Additionally, regulatory demands for energy efficiency and reduced environmental impact compel manufacturers to adopt highly accurate toner usage control mechanisms, further bolstering the necessity for advanced density sensor integration. The sensor serves as a critical enabler for predictive maintenance and quality assurance within the fiercely competitive EP imaging sector.

Toner Density Sensor Market Executive Summary

The Toner Density Sensor Market is experiencing robust expansion, fundamentally driven by sustained industrial digitalization and the necessity for superior, reliable image reproduction across various professional sectors. Key business trends indicate a strong move toward miniaturization, higher sensitivity, and seamless integration of these sensors within modular printing components, enabling easier servicing and lower manufacturing complexity for Original Equipment Manufacturers (OEMs). Technological advancements are concentrating on developing multi-sensing capabilities, combining density measurement with temperature and humidity monitoring to compensate for environmental variability that impacts toner performance. The competitive landscape is characterized by strategic partnerships between sensor specialists and major printer manufacturers (HP, Canon, Xerox, Ricoh), focusing on proprietary calibration algorithms and closed-loop control systems designed to optimize their specific toner formulations. Furthermore, the aftermarket segment, serving third-party consumables providers, presents a growing opportunity, though proprietary sensor designs pose significant entry barriers, pushing aftermarket players towards developing compatible, yet equally robust, sensing solutions.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, underpinned by explosive demand for business printing solutions in China, India, and Southeast Asian nations undergoing rapid industrial and commercial expansion. North America and Europe, while mature, maintain high value share due to the proliferation of high-end, professional production printers and a strong focus on managed print services (MPS), which emphasize consistent quality and operational efficiency provided by precision sensing. Segment trends reveal that the Magnetic Permeability Sensor type dominates due to its effectiveness in high-quality color printing systems utilizing magnetic carrier beads. However, the fastest-growing segment is anticipated to be the integration into smart, IoT-enabled printing systems, where sensor data is utilized not just for immediate control but also for long-term predictive maintenance and fleet management across large corporate networks. The OEM channel remains the most critical distribution pathway, but specialized industrial printing applications are increasingly opening up new, direct sales opportunities for highly customized sensor solutions.

Overall, the market trajectory is positive, reflecting the critical role sensors play in achieving both environmental sustainability goals—through reduced toner waste—and stringent quality requirements demanded by end-users. The market structure highlights that profitability is heavily contingent upon maintaining intellectual property regarding calibration algorithms and integration expertise, creating high switching costs for major OEMs. Looking ahead, consolidation among smaller sensor manufacturers and increased vertical integration by key component suppliers are anticipated, aiming to secure supply chain stability and technological differentiation. The growing convergence of IT infrastructure with printing technology means that sensor data management and cybersecurity surrounding these networked devices will become increasingly important factors influencing product development and market acceptance in the forecast period.

AI Impact Analysis on Toner Density Sensor Market

User queries regarding the impact of Artificial Intelligence (AI) on the Toner Density Sensor Market frequently center on whether AI can enhance sensor precision, enable predictive maintenance of printing units, and optimize consumable logistics. Common concerns involve the shift from reactive density adjustments to proactive, adaptive control mechanisms managed by machine learning algorithms, and the potential for AI to integrate sensor data with external environmental factors (like temperature and humidity variations) to achieve unparalleled print consistency. Users are keenly interested in how data generated by sensor networks can feed into centralized AI platforms to manage large printer fleets efficiently, predicting part failures, toner depletion rates, and optimizing service routes. The analysis indicates a strong expectation that AI will transition toner density management from a purely electromechanical control process to a sophisticated, data-driven system, thereby raising the performance ceiling for high-volume and color-critical printing applications, while simultaneously driving down operational costs for end-users and service providers.

- AI enables real-time, adaptive calibration of toner density settings based on pattern recognition and historical performance data, exceeding traditional static calibration curves.

- Machine Learning algorithms utilize aggregated sensor data across fleets to predict subtle deviations in toner concentration, forecasting potential quality issues before they manifest.

- Predictive maintenance models leverage sensor telemetry to estimate the remaining lifespan of developer units and imaging drums, optimizing service scheduling and reducing unplanned downtime.

- AI integration supports closed-loop control systems that dynamically adjust sensor sensitivity and responsiveness based on printing media type and ambient conditions, improving consistency.

- Optimization of toner supply chain and logistics through AI analysis of fleet-wide sensor data, ensuring just-in-time replenishment based on actual consumption patterns rather than fixed schedules.

- Advanced image processing algorithms combined with density sensor feedback allow for automated defect detection and compensation, maintaining G7 or ISO color standards throughout long print runs.

DRO & Impact Forces Of Toner Density Sensor Market

The Toner Density Sensor Market is primarily driven by the continuous global necessity for high-quality, high-speed digital printing across corporate and commercial sectors, coupled with strict industry standards demanding consistency in color and monochrome output. Major drivers include the rapid expansion of Managed Print Services (MPS) models, where service providers require precise component monitoring for cost-efficiency and performance guarantees. Restraints are typically centered around the high initial cost of integrating sophisticated sensor arrays into entry-level and mid-range devices, technological challenges related to calibration stability in extreme operational environments, and the increasing trend toward paperless offices, which moderately dampens overall demand for physical printing hardware. Opportunities are concentrated in developing specialized sensors for niche applications such as 3D printing and advanced flexible electronics manufacturing, where powder or material density control is equally critical, and the robust growth potential within the aftermarket compatible consumables sector, provided intellectual property barriers can be navigated effectively.

Key impact forces shaping this market include stringent environmental regulations promoting toner waste reduction, which mandates the use of highly accurate sensing for optimal toner usage (Pestel Factor: Environmental/Regulatory). The competitive pressure among major printing OEMs to offer superior image quality and reliability directly drives investment in advanced sensor R&D (Porter's Five Forces: Intensity of Rivalry). Furthermore, the bargaining power of key technology suppliers, particularly those providing specialized magnetic or optical components, significantly influences pricing and innovation cycles within the sensor manufacturing ecosystem. The impact of substitute technology is relatively low, as physical density measurement remains crucial for electrophotography, although digital process control software minimizes the sensor's role to data provision rather than the sole control mechanism.

The confluence of these factors suggests a market that is moderately fragmented but technologically intense. Successful market participation requires not only manufacturing excellence but also deep integration expertise with printer control systems. The sustained drive for higher resolutions (e.g., 1200 DPI and beyond) and faster print engine speeds places continuous technical pressure on sensors to provide instantaneous, noise-free, and high-fidelity measurements under rapid cycling conditions. This technological imperative ensures that the market for advanced, high-performance sensors will experience accelerated growth, counteracting potential volume stagnation from the broader printing market saturation.

Segmentation Analysis

The Toner Density Sensor Market is meticulously segmented based on technology type, application, output type (color vs. monochrome), and end-use industry, reflecting the diverse requirements of the electrophotographic ecosystem. The segmentation by technology—magnetic permeability and optical sensing—highlights the foundational differences in how toner concentration is measured, directly impacting the suitability for various printer architectures. Application segmentation distinguishes between conventional office automation (MFPs, copiers) and specialized industrial systems (high-volume production presses), each demanding unique sensor specifications regarding throughput and durability. Analyzing these segments provides a clear map of where technological investment is concentrated and where the highest growth premiums are expected, particularly as high-precision color printing dominates the commercial sector, favoring advanced magnetic sensing techniques. The differentiation across these segments is essential for strategic planning, allowing manufacturers to tailor R&D efforts and marketing strategies to specific high-value customer needs within the global printing landscape.

- By Technology Type:

- Magnetic Permeability Sensors

- Optical Reflection Sensors (Diffuse Reflectance Sensors)

- By Output Type:

- Monochrome (Black and White)

- Color (CMYK and Extended Gamut)

- By Application:

- Office Automation and Enterprise Printing (MFPs, Laser Printers)

- Commercial and Production Printing (High-Volume Digital Presses)

- Industrial Marking and Coding Systems

- Specialty Imaging Equipment

- By End-Use Industry:

- Corporate and Government Offices

- Printing and Publishing Houses

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceutical

- Education

- By Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket and Replacement Parts

Value Chain Analysis For Toner Density Sensor Market

The value chain for the Toner Density Sensor Market begins with upstream activities involving the sourcing and processing of specialized raw materials, primarily focusing on advanced semiconductor components, magnetic cores (for magnetic sensors), and precision optical elements (lenses, photodiodes, and emitters for optical sensors). Upstream suppliers are typically highly specialized component manufacturers, often operating under strict non-disclosure agreements with sensor integrators due to the proprietary nature of sensor performance specifications. Key upstream activities also include the design and manufacturing of custom ASICs (Application-Specific Integrated Circuits) that handle signal processing and noise filtering, ensuring the density measurement is accurate and stable under demanding operational temperatures and vibration conditions. The efficiency and quality of these foundational components directly dictate the final performance and reliability metrics of the finished sensor module, establishing a high barrier to entry for new component suppliers.

The core midstream activity involves the actual design, assembly, and rigorous calibration of the sensor modules by the Toner Density Sensor manufacturers. This stage is characterized by high intellectual property intensity, particularly concerning proprietary calibration algorithms and mechanical integration techniques designed to minimize interference from surrounding components within the developer unit. Direct distribution channels are predominantly utilized when selling to major printing OEMs (e.g., Canon, Xerox, Ricoh), where high volumes of customized sensor units are delivered under long-term supply contracts. Conversely, indirect distribution, typically through specialized electronic component distributors or authorized service parts suppliers, manages the flow of replacement sensors into the aftermarket and small-to-mid-sized industrial integrators. This dual-channel approach allows manufacturers to capitalize on both the high-volume, guaranteed sales of the OEM pipeline and the higher margin opportunities presented by the replacement market.

Downstream activities center around the integration of the sensor into the final printing equipment and the provision of after-sales service and support. The sensor’s data output is critical for the printer’s closed-loop control system, determining toner usage and image consistency, thus deeply affecting the end-user experience. Potential customers, which are the end-users (corporate offices, print shops), interact with the sensor's performance via the reliability and quality of their printed output. Consequently, the sensor's role extends beyond mere measurement to becoming a crucial determinant of customer satisfaction and brand loyalty for the printer OEM. Furthermore, the downstream includes recyclers and refurbishers, who may replace sensors in remanufactured toner cartridges or developer units, driving a sustainable, albeit smaller, segment of the indirect channel.

Toner Density Sensor Market Potential Customers

Potential customers for Toner Density Sensors are primarily high-volume manufacturers of electrophotographic printing and imaging equipment, commonly referred to as Original Equipment Manufacturers (OEMs), who integrate these components directly into their developer units, toner cartridges, and printer control systems. These OEMs, including global leaders such as HP, Canon, Xerox, Ricoh, and Brother, represent the largest and most critical demand segment, focusing on customized sensor solutions that meet precise proprietary specifications for their distinct toner chemistries and engine designs. A secondary, yet rapidly expanding, customer base includes aftermarket consumables providers and third-party remanufacturers, who require compatible, reliable sensors for their replacement toner cartridges and developer units to ensure performance parity with OEM products, often driving demand for cost-effective and reverse-engineered sensing solutions. These customers prioritize high reliability and compatibility to maintain quality in a cost-sensitive competitive landscape.

Beyond the traditional office automation sector, specialized industrial printing and manufacturing companies constitute a growing segment of potential customers. These include manufacturers of commercial digital presses used for high-speed variable data printing, packaging printing companies utilizing EP technology, and emerging players in the additive manufacturing (3D printing) sector that require precise density control for metal or polymer powder beds. For these industrial users, sensor robustness, endurance, and extreme precision under continuous heavy load are non-negotiable requirements, often demanding sensors rated for higher duty cycles and broader temperature ranges than typical office equipment sensors. This diversification into non-paper applications indicates a broadening potential customer spectrum, moving beyond the direct influence of traditional document output trends.

Finally, managed print service providers (MPS) and large corporate entities managing extensive fleets of printers, although not direct purchasers of the sensor component itself, represent influential stakeholders. Their demand for predictable uptime, optimized consumable usage, and standardized quality drives the purchasing decisions of the OEMs. These sophisticated end-users effectively dictate the performance standards required from the sensor technology, ensuring that OEMs continuously seek sensors with integrated diagnostic capabilities and high Mean Time Between Failures (MTBF) rates. Therefore, while OEMs are the direct buyers, the competitive requirements imposed by MPS contracts and large enterprise demands fundamentally shape the product development roadmap and market viability for sensor manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hokuriku Electric Industry Co., Ltd. (HDK), Panasonic Corporation, TDK Corporation, Murata Manufacturing Co., Ltd., ALPS ALPINE CO., LTD., Vishay Intertechnology, Inc., TE Connectivity Ltd., Honeywell International Inc., Sensirion AG, Canon Inc. (In-House Production), Xerox Corporation (Proprietary Sensors), Ricoh Company, Ltd. (Internal Manufacturing), SEIKO EPSON Corporation, Kyocera Corporation, Samsung Electro-Mechanics, ROHM Co., Ltd., KEMET Corporation, Littelfuse, Inc., Amphenol Corporation, OMRON Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Toner Density Sensor Market Key Technology Landscape

The technological landscape of the Toner Density Sensor Market is dominated by two primary methods: magnetic permeability sensing and optical reflection sensing, each suited for different printer architectures and toner formulations. Magnetic sensors are the gold standard for high-quality, high-volume color electrophotographic systems that employ a two-component developer system (toner mixed with magnetic carrier beads). These sensors measure the magnetic susceptibility of the mixture, allowing for extremely precise control over the toner-to-carrier ratio, which is vital for maintaining color stability and density consistency across millions of pages. Recent advancements in magnetic sensing focus on miniaturizing the sensor coils, improving noise immunity through sophisticated shielding, and integrating high-speed signal processing capabilities to cope with the increased engine speeds of modern production presses. Furthermore, proprietary algorithms are being developed to compensate for the degradation of magnetic carrier beads over time, extending the useful life of the developer unit while maintaining output quality.

Optical reflection sensors, often referred to as diffuse reflectance sensors, typically utilize an LED emitter and a photodiode receiver to measure the amount of light reflected by the layer of toner on the drum or a dedicated reference patch. This technology is frequently used in single-component developer systems, particularly in monochrome or lower-cost color printers, due to its simplicity and lower manufacturing cost. The critical technical challenge for optical sensors involves mitigating the influence of environmental factors such as dust, humidity, and temperature, which can significantly skew reflectance measurements. Current innovations in this segment involve multi-wavelength sensing, where the sensor analyzes reflections across different light spectrums to distinguish between toner, paper dust, and contamination, thereby improving the accuracy and reliability of the density measurement under varied conditions. Hybrid systems, combining aspects of both magnetic and optical sensing for redundancy and enhanced calibration, are also gaining traction in premium machine segments.

A crucial underlying technological trend is the convergence with the Internet of Things (IoT) and advanced diagnostics. Modern sensors are no longer simple analog devices; they are smart components equipped with embedded microcontrollers for on-sensor data processing and standardized digital communication interfaces (like SPI or I2C) to seamlessly integrate with the printer’s main control board and network infrastructure. This capability enables remote diagnostics, over-the-air firmware updates for calibration refinements, and the contribution of highly granular data to cloud-based predictive maintenance platforms. Manufacturers are also focusing heavily on material science, developing sensor housing materials that offer superior resistance to aggressive toner particles, heat, and ozone exposure, thereby enhancing the component's longevity and stability in the harsh internal environment of a high-speed laser printer.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Toner Density Sensors, driven primarily by the high industrial output, increasing commercialization, and rapid adoption of office automation technology in developing economies like China, India, and Indonesia. The region is characterized by immense volumes of manufacturing for low-to-mid-range printers, requiring cost-effective, high-volume sensor solutions. Furthermore, major global printer OEMs have significant manufacturing footprints in this region, solidifying APAC’s role as both a key consumer and a vital production hub for density sensors. The rapid growth in SMEs and the expansion of the BFSI and governmental sectors demanding robust printing infrastructure further fuels demand.

- North America: North America commands a substantial value share, primarily due to the intense penetration of Managed Print Services (MPS) and the high demand for commercial and production printing solutions. This region focuses heavily on high-specification, high-precision sensors required for color-critical applications in graphic arts and publishing. The market here emphasizes technological sophistication, data integration (IoT), and long-term reliability, reflecting a willingness to invest in premium sensor technologies that reduce total cost of ownership (TCO) through minimized service interruptions. R&D activities related to AI integration and predictive analytics for printer fleets are highly concentrated in this region.

- Europe: Similar to North America, the European market is mature but highly focused on quality and sustainability. Stringent EU regulations concerning electronic waste and energy efficiency drive demand for sensors that ensure optimal toner usage and minimal material wastage. Germany, the UK, and France are key consumers of high-end industrial and enterprise printing equipment, demanding reliable, certified sensor components. The focus here is on securing supply chains and adhering to high standards of component longevity and functional safety, often leading to preference for sensors manufactured under certified quality management systems.

- Latin America (LATAM): LATAM is an emerging market for toner density sensors, characterized by fluctuating economic conditions but sustained growth in office modernization projects, particularly in countries like Brazil and Mexico. The market segment tends to prioritize cost-efficiency, often favoring established, proven sensor technologies rather than cutting-edge innovation. Growth is tied closely to foreign direct investment in local manufacturing and the expansion of corporate branch offices requiring centralized printing capabilities.

- Middle East and Africa (MEA): The MEA market is seeing steady, albeit uneven, growth, fueled by massive infrastructure and corporate spending in the Gulf Cooperation Council (GCC) countries. Large government tenders and the construction sector’s reliance on documentation drive demand for durable, robust printing equipment. Sensor adoption is tied to high-volume copying and archiving needs. Challenges include local logistics and servicing, meaning sensor reliability and easy integration are critical purchasing factors for OEMs targeting this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Toner Density Sensor Market.- Hokuriku Electric Industry Co., Ltd. (HDK)

- Panasonic Corporation

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- ALPS ALPINE CO., LTD.

- Vishay Intertechnology, Inc.

- TE Connectivity Ltd.

- Honeywell International Inc.

- Sensirion AG

- Canon Inc. (In-House Production Division)

- Xerox Corporation (Proprietary Sensors Division)

- Ricoh Company, Ltd. (Internal Manufacturing Unit)

- SEIKO EPSON Corporation

- Kyocera Corporation

- Samsung Electro-Mechanics

- ROHM Co., Ltd.

- KEMET Corporation

- Littelfuse, Inc.

- Amphenol Corporation

- OMRON Corporation

Frequently Asked Questions

Analyze common user questions about the Toner Density Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Toner Density Sensor in a printer?

The primary function is to measure the concentration (density) of toner in the developer unit in real-time. This feedback is essential for the printer’s control system to ensure consistent, high-quality image output, optimize toner consumption, and manage print job reliability.

How do Magnetic Permeability Sensors differ from Optical Reflection Sensors?

Magnetic sensors measure the magnetic content of the developer mixture, primarily used in two-component systems (color/high-end). Optical sensors measure light reflectance on a toner patch, often used in simpler, single-component systems (monochrome/entry-level). Magnetic sensors generally offer higher precision and stability in color systems.

Which technological trends are currently driving innovation in the sensor market?

Key trends include miniaturization for compact devices, integration of AI and Machine Learning for predictive maintenance and adaptive calibration, and the incorporation of digital output interfaces (IoT readiness) for enhanced data logging and remote diagnostics across large printer fleets.

What are the main application areas beyond standard office printers?

Beyond office automation (MFPs), primary growth areas include high-volume commercial production presses, specialized industrial marking and coding equipment, and emerging applications in additive manufacturing (3D printing) where powder material density control is critical for process stability.

Why is the Asia Pacific region the fastest-growing market for these sensors?

APAC is the fastest-growing due to rapid commercial and industrial expansion in countries like China and India, high demand for office infrastructure modernization, and the presence of major global printer and component manufacturing facilities acting as key demand and supply centers.

The exhaustive nature of density control within the realm of electrophotography mandates continuous improvement in sensor technology. The market growth is intricately linked not just to printer sales volumes, but more critically, to the sophistication and performance requirements of the next generation of high-speed color digital presses and MFPs. The shift towards proprietary sensor designs by major OEMs often leads to fragmented technological development, where sensor manufacturers must either secure long-term contracts with these large players or innovate robust, highly compatible aftermarket solutions to capture residual market value. This competitive dynamic ensures that the sensor market remains technologically competitive and focused on achieving unparalleled measurement fidelity and operational robustness in challenging environmental conditions, such as high heat and static charge variability within the developing unit. Furthermore, the necessity for multi-spectral analysis in advanced color systems and the integration of on-sensor processing capabilities (System-on-Chip design) are defining the technological roadmap for the next five years, moving the sensor beyond a simple component into an intelligent data collection node within the printing ecosystem.

The increasing complexity of toner chemistries, including chemically produced toner (CPT) and specific formulations for wide-format and industrial applications, requires sensors capable of dealing with a finer particle size distribution and varying magnetic properties. Sensor calibration stability over the entire lifetime of the printer—often extending beyond seven years for high-end production models—is a paramount concern for OEMs. This longevity requirement drives manufacturers to utilize robust packaging materials and highly stable measurement circuits that resist drift due to thermal cycling and prolonged exposure to reactive toner components. The aftermarket segment faces persistent challenges in matching the proprietary communication protocols and calibration curves embedded within OEM sensors, creating a permanent technical barrier. However, innovative aftermarket suppliers are leveraging advanced diagnostics and machine learning to ‘learn’ the behavior of different OEM systems, offering viable, cost-effective replacement options that are gradually gaining acceptance in mature markets, although regulatory pressures regarding IP infringement remain a constant threat to their expansion.

In terms of sustainability and regulatory compliance, the European Union's initiatives focusing on extended producer responsibility and material efficiency profoundly influence sensor design. Sensors that enable precise, minimal-waste toner consumption contribute directly to the ecological footprint reduction goals of major printing companies. This has elevated the strategic importance of the sensor from a simple control component to a core enabler of corporate sustainability targets. The industry is also observing a trend towards modularity in sensor assemblies, allowing for easier repair and replacement, thereby reducing the environmental impact associated with the disposal of complex, integrated imaging units. This modular approach is particularly favored in the Managed Print Services sector, where rapid, efficient servicing is essential for meeting uptime SLAs (Service Level Agreements). The strategic alliances formed between material scientists, semiconductor manufacturers, and specialized sensor firms are accelerating the development of highly reliable and environmentally benign sensor technologies that promise superior performance while adhering to global environmental standards and consumer expectations for product longevity and repairability.

The market for Toner Density Sensors is strategically intertwined with the broader evolution of office technology and industrial automation. As workplaces transition towards more digital workflows, the need for physical printing becomes increasingly targeted, demanding higher quality and greater efficiency for the documents that are still produced. This selectivity elevates the role of precision components like density sensors. The adoption of cloud printing services and networked MFPs means that sensor data can be aggregated across massive fleets, facilitating fleet-wide quality control and resource allocation optimization that was previously impossible. This integration with enterprise IT infrastructure turns the sensor into a critical data point for business intelligence concerning hardware usage and consumable forecasting. Consequently, sensor manufacturers are increasingly focusing their R&D on cybersecurity measures for embedded components to prevent unauthorized data access or malicious manipulation of printing process variables, recognizing that the sensor is now part of a networked ecosystem.

Furthermore, the competitive advantage in the sensor market is shifting from mere component delivery to integrated solution provision. Sensor companies are increasingly offering bundled solutions that include the hardware component, proprietary firmware for signal interpretation, and consultation services regarding optimal integration within new printer engine designs. This consultative approach helps OEMs rapidly deploy new printing platforms with guaranteed density control performance. The growth of industrial applications, particularly in areas like ceramic printing or advanced material deposition using powder technologies, opens up entirely new adjacent markets where the fundamental principle of toner density sensing—precise granular material concentration measurement—is transferable. These niche high-growth sectors often require extreme precision (sub-micron resolution) and resistance to harsh processing environments, driving demand for specialized, ultra-durable sensor variants that command significantly higher price points than typical office equipment sensors, thereby enhancing overall market value despite lower volumes.

The technological gap between the high-end production segment and the entry-level desktop segment remains a defining characteristic of the market segmentation. High-volume, professional digital presses utilize sophisticated multi-array magnetic sensors with multiple reading heads and continuous calibration cycles managed by powerful embedded processors to handle rapid color changes and large data throughput. Conversely, budget monochrome printers rely on simpler, robust optical sensors or cost-optimized magnetic components. This technological stratification ensures market stability, as different sensor types cater distinctly to different cost and performance requirements across the global user base. Future sensor development will likely focus on bridging this gap by developing highly versatile, modular platforms that can be easily scaled up or down in terms of processing power and sensing complexity, providing OEMs with a flexible, cost-effective base technology to use across their entire product portfolio, thus simplifying supply chain management and reducing manufacturing complexity for the core sensor component.

Geographically, while APAC drives volume, North America and Europe drive technology standards and pricing power due to their mature and demanding commercial print markets. The demand for highly reliable, network-enabled components is strongest in these regions, necessitating compliance with various international standards, including RoHS, REACH, and specialized industry standards for color management (e.g., ISO 12647 series). This regional variation requires sensor manufacturers to maintain diversified product lines and certifications, adding complexity to global sales and distribution strategies. The competitive strategy involves securing intellectual property rights related to sensor architecture and calibration methods, often leading to complex patent battles and cross-licensing agreements, particularly between major printer OEMs and key sensor suppliers. The ongoing reliance on high-quality printing for essential business documents, despite digital substitution in other areas, guarantees a resilient underlying demand for components that ensure print perfection, making the Toner Density Sensor market a crucial, specialized segment within the broader electronics and imaging component industry.

The critical success factors in this market segment involve not just product performance but also the ability to integrate seamlessly and early into the OEM design process, ensuring the sensor becomes a non-negotiable part of the printer’s core intellectual property. This deep integration makes replacement difficult and secures long-term revenue streams for sensor manufacturers. The trend towards modular developer units and recyclable consumables also presents both challenges and opportunities. While modularity can simplify replacement, it requires the sensor to be highly robust to handle potential misalignment or contamination during module changes. Sensor manufacturers are responding by creating self-calibrating and auto-diagnosing sensors that simplify installation and maintenance for field technicians, further enhancing the appeal of their products to service-oriented OEMs. This strategic focus on integration, reliability, and serviceability is key to navigating the competitive landscape and achieving sustained growth in the forecast period.

Looking forward, the role of material science in optimizing sensor performance is increasingly important. Research into new magnetic materials that offer higher temperature stability and greater magnetic flux density is paramount for improving the signal-to-noise ratio in magnetic sensors. Similarly, new coatings and filters for optical sensors are being explored to minimize the impact of ambient light and internal printer contaminants. The convergence with other sensing modalities, such as those measuring charge potential or temperature gradients, suggests that future toner control units might integrate multiple sensor types into a single, cohesive module, providing a comprehensive understanding of the entire developing process, rather than isolated density data. This integrated approach, often termed 'Smart Sensing Modules,' represents the frontier of technological development, promising even greater precision and efficiency for the next generation of digital imaging systems, reinforcing the market’s technological intensity.

Furthermore, the segmentation by end-use industry is becoming increasingly critical for tailored product development. The healthcare sector, for example, demands printing quality suitable for diagnostic imagery (PACS systems), requiring sensors with ultra-high resolution and absolute color repeatability, often exceeding standard corporate needs. The financial services industry requires systems capable of producing high-integrity documents with minimal error rates for compliance purposes. These sector-specific requirements mean that sensor manufacturers must develop differentiated product lines, offering varying tiers of precision, stability, and data security features. The overall growth of the sensor market, therefore, is not solely dependent on the macro printer market volume, but fundamentally on the sustained demand for higher quality, regulatory compliance, and efficiency in specialized industrial and commercial printing applications globally.

The competition intensity is moderated by the fact that many of the largest consumers (e.g., Canon, Ricoh, Xerox) maintain strong in-house manufacturing capabilities for their core sensor needs, limiting the addressable OEM market for pure-play sensor vendors. However, the specialized nature of component manufacturing, particularly for advanced ASICs and high-stability magnetic assemblies, often necessitates strategic sourcing from external experts like TDK or HDK. This creates a delicate balance of internal competition and external partnership. For independent sensor suppliers, maintaining a technological lead in niche areas, such as high-temperature sensing for industrial printers or ultra-miniaturized sensors for portable devices, is a vital strategic imperative for sustaining profitability and market relevance in a highly consolidated customer environment.

Finally, the long-term impact of digitalization and the "paperless office" trend on this component market must be managed strategically. While transactional print volume declines in some areas, the production of essential, specialized, or high-security documents (e.g., legal, financial statements, high-quality marketing materials) remains robust. Density sensors are crucial for these high-value print jobs. Therefore, market players are shifting their focus from simple volume replacement to targeting performance enhancement in these high-value applications, ensuring that even if the total number of printers sold stabilizes, the revenue per sensor component increases due to higher required specifications and embedded intellectual property, thereby sustaining market value growth over the forecast period and providing a strong counterbalance to any potential market saturation effects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager