Tonneau Covers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432757 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Tonneau Covers Market Size

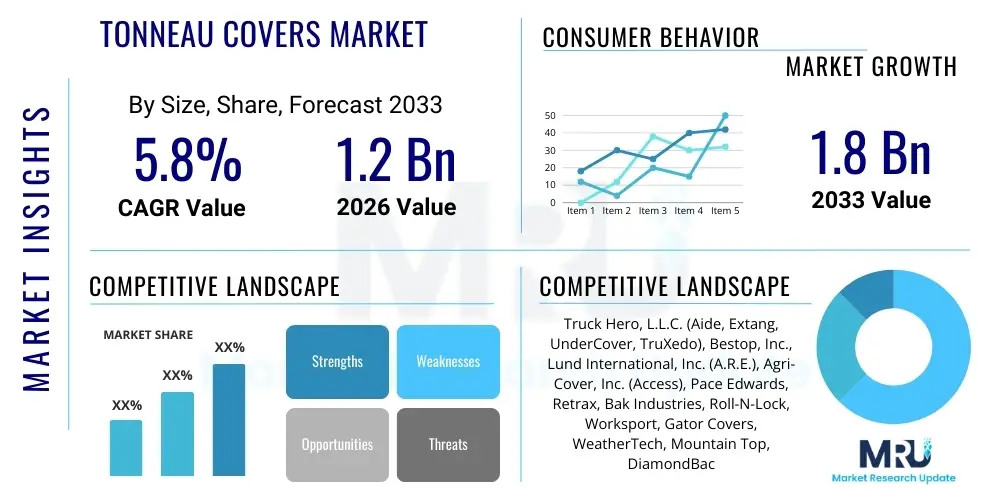

The Tonneau Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Tonneau Covers Market introduction

The Tonneau Covers Market encompasses the manufacturing, distribution, and sale of protective covers specifically designed for the beds of pickup trucks and utility vehicles. These covers, essential accessories for truck owners, serve multiple critical functions, including securing cargo against theft and adverse weather conditions, enhancing the vehicle's aerodynamic profile to improve fuel efficiency, and aesthetically upgrading the vehicle’s appearance. The product range is diverse, featuring materials such as vinyl, aluminum, fiberglass, and various polymers, tailored to meet different durability, security, and budgetary requirements of consumers across various geographical regions. Product designs vary significantly, including hard folding, soft roll-up, retractable, and snap-on styles, reflecting ongoing innovation focused on ease of use and maximum cargo accessibility. The integration of advanced locking mechanisms and lightweight, durable materials is central to current market offerings.

Major applications of tonneau covers span both recreational and commercial sectors. In the commercial sphere, they are indispensable for construction companies, logistics providers, and utility fleets that require secure transportation of tools, equipment, and sensitive materials, mitigating loss and damage risk while in transit. For individual consumers, the primary applications revolve around protecting personal belongings, luggage, and sports gear, making them popular among outdoor enthusiasts, hunters, and travelers. The increasing adoption of pickup trucks, especially in North America and Southeast Asia, as multi-purpose family and work vehicles directly contributes to the heightened demand for these protective accessories. Furthermore, growing consumer awareness regarding vehicle customization and the long-term protection of vehicle beds from environmental corrosion fuels consistent aftermarket demand.

Key benefits of utilizing tonneau covers include significant cargo protection from rain, snow, dirt, and UV radiation, which extends the lifespan of transported goods and the truck bed itself. Security is another major driving factor; modern hard covers often incorporate sophisticated locking systems that integrate with the truck’s central locking mechanism, providing robust anti-theft capabilities. Economically, these covers contribute to fuel savings by reducing aerodynamic drag created by an open truck bed, a measurable advantage that resonates with commercial fleet operators and environmentally conscious buyers. Driving factors propelling market growth include robust growth in the global automotive aftermarket, rising disposable incomes in emerging economies leading to increased vehicle personalization, and continuous product innovation resulting in more durable, user-friendly, and technologically integrated cover solutions. The continuous release of new truck models requiring tailored cover fits also sustains market vitality.

Tonneau Covers Market Executive Summary

The Tonneau Covers Market is characterized by vigorous competition and sustained growth, driven primarily by the strong sales performance of pickup trucks globally and the escalating consumer interest in vehicle personalization and utility enhancement. Current business trends indicate a significant shift towards high-security, hard folding and retractable covers, especially those manufactured from lightweight, robust aluminum or impact-resistant polymers, moving away from traditional soft vinyl options. Manufacturers are heavily investing in modular designs that simplify installation and removal, reducing professional fitting costs and appealing directly to the DIY consumer segment. Furthermore, the integration of smart features, such as remote-controlled retraction mechanisms and integrated LED lighting, represents a critical area of technological differentiation, raising the average selling price and market value.

Regionally, North America maintains its dominance as the largest consumer base, attributed to the deep-rooted cultural significance and high penetration rate of full-size and mid-size pickup trucks in both commercial and personal use. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fuelled by rapidly expanding infrastructure projects requiring commercial utility vehicles, particularly in countries like Thailand, Australia, and India, which are major hubs for light commercial vehicle manufacturing and consumption. Europe presents a niche but growing market, primarily focused on smaller, high-efficiency utility vehicles, where aesthetic integration and fuel economy benefits of tonneau covers are key selling points. Regulatory shifts impacting fuel efficiency standards globally also indirectly benefit the market by highlighting the aerodynamic advantages offered by these accessories.

Segment trends reveal that the Aftermarket distribution channel commands the largest share, as consumers often purchase covers separately from the vehicle for customization or replacement purposes; however, the Original Equipment Manufacturer (OEM) segment is growing due to increased collaboration between truck makers and cover suppliers to offer factory-installed accessories packages. By type, the hard folding segment is anticipated to witness substantial growth due to its superior security features and ease of partial access. Material segmentation shows increasing preference for durable, lightweight materials, particularly aluminum, driven by the requirement for covers that can withstand heavy loads and harsh weather without significantly penalizing vehicle payload capacity. The overall market resilience is highly tied to the economic health of the automotive sector and sustained infrastructure development worldwide.

AI Impact Analysis on Tonneau Covers Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Tonneau Covers Market often center on how AI can streamline manufacturing processes, personalize the consumer experience, and enhance the functional intelligence of the covers themselves. Key user concerns focus on AI’s role in optimizing supply chains, predicting component failure, and designing next-generation materials tailored for extreme durability and reduced weight. Consumers are increasingly expecting smart accessories, prompting questions about AI-driven integration, such as automatic adjustment of the cover tension based on temperature or weather predictions, predictive maintenance alerts, and seamless connectivity with vehicle infotainment systems. The primary theme identified is the expectation that AI will move tonneau covers from being purely mechanical accessories to integrated, intelligent components of the modern smart truck ecosystem, addressing customization, security, and efficiency through data analysis and automation.

- AI-Driven Design Optimization: Utilizing generative design algorithms to test thousands of structural variations quickly, leading to ultra-lightweight yet robust cover frames that maximize strength-to-weight ratios.

- Predictive Maintenance: AI models analyzing usage patterns, environmental exposure, and sensor data embedded in smart covers to predict potential component wear or failure (e.g., motor or seals), prompting proactive service alerts.

- Manufacturing Efficiency: Implementation of AI-powered robotics and quality control systems in fabrication, reducing material waste, improving precision welding or stitching (for soft covers), and accelerating production throughput.

- Supply Chain and Inventory Management: AI algorithms forecasting regional demand fluctuations for specific cover types (e.g., retractable vs. folding) and materials, optimizing inventory levels, and minimizing lead times for both OEM and aftermarket distributors.

- Personalized Consumer Recommendations: Using machine learning to analyze vehicle model, geographic location, typical use (commercial/recreational), and budget to provide highly tailored recommendations for the most suitable tonneau cover type and material, enhancing conversion rates in e-commerce platforms.

- Smart Integration and IoT Features: AI managing the responsiveness of smart covers, such as automating opening/closing cycles based on recognized proximity, integrating biometric security features, or optimizing battery life for motorized components.

- Material Science Advancement: Machine learning accelerating the discovery and formulation of new polymers and composites that offer enhanced UV resistance, flexibility, and insulation properties specific to tonneau cover applications.

DRO & Impact Forces Of Tonneau Covers Market

The Tonneau Covers Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that collectively determine its growth trajectory and competitive landscape. The primary drivers include the consistent global demand for pickup trucks, which serve as foundational platforms for these accessories, coupled with strong consumer preference for customizing utility vehicles to enhance functionality and appearance. Significant market restraint stems from the high initial cost of premium, hard-material and technologically advanced retractable covers, which can deter price-sensitive buyers, particularly in cost-conscious emerging markets. Furthermore, the complexity of inventory management, given the need to stock covers tailored to dozens of specific truck models and bed lengths, imposes logistical challenges on distributors. Opportunities are vast, primarily residing in technological innovation—specifically, the development of integrated smart covers, lightweight eco-friendly materials, and expansion into untapped regional aftermarket sectors, particularly in Southeast Asia and Latin America, where commercial truck use is rapidly accelerating. These forces exert pressure through regulatory compliance, economic cycles affecting new vehicle sales, and material cost volatility.

The core Impact Forces shaping market behavior include increasing regulatory pressure for vehicle fuel efficiency, which favors the adoption of tonneau covers due to their proven aerodynamic benefits, and the rising global incidence of cargo theft, which drives demand towards high-security, hard covers. Economically, the market is moderately sensitive to disposable income levels; while aftermarket sales remain robust during economic downturns (as owners upgrade existing vehicles instead of buying new ones), OEM sales are directly correlated with new vehicle production volumes. Technologically, the rapid obsolescence cycle of truck models necessitates constant research and development efforts from cover manufacturers to ensure perfect fitment and integration, acting as a barrier to entry for smaller players. Socially, the proliferation of specialized truck customization communities and online review platforms amplifies consumer awareness and preference for specific brands and material types, turning product quality and brand reputation into major competitive factors.

Specifically regarding restraints, the proliferation of counterfeit and low-quality covers, often sold through non-authorized online channels, poses a threat to established premium brands, leading to price erosion in certain segments and potential consumer distrust if the counterfeits fail quickly. Another significant challenge involves the installation complexity for certain DIY-unfriendly designs, often requiring specialized tools or professional assistance, which adds to the total cost of ownership and inconvenience. Addressing these issues requires standardized installation systems (quick-clamp technology) and rigorous quality assurance. The overall impact forces suggest that while the foundational demand is stable, driven by utility and security needs, future growth will heavily rely on manufacturers successfully lowering the cost of advanced materials and features while maintaining ease of installation and high levels of vehicle integration, effectively bridging the gap between premium security and mainstream affordability.

Segmentation Analysis

The Tonneau Covers Market is segmented based on several critical factors, including the material used for the cover construction, the mechanical type of the cover, the distribution channel utilized for sales, and the specific vehicle type they are designed for. This segmentation is essential for understanding consumer behavior, pinpointing lucrative sub-markets, and optimizing product development strategies. The market structure reflects the diverse needs of truck owners, ranging from commercial fleets prioritizing durability and security to individual consumers focusing on aesthetic appeal and quick cargo access. The primary differentiation often lies in the trade-off between security (hard covers) and cost/flexibility (soft covers), defining clear segment boundaries. Analyzing these segments provides strategic insights into investment areas, such as the growing demand for aluminum covers in the hard folding segment and the necessity for robust OEM partnerships.

- By Material:

- Vinyl/Soft Materials

- Aluminum

- Fiberglass

- Plastic/Composite (ABS, HDPE)

- By Type:

- Hard Folding (Tri-Fold, Multi-Panel)

- Soft Folding

- Retractable (Manual, Electric)

- Roll-up (Soft Roll-up, Hard Roll-up)

- Snap-on/Hinged

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Specialty Retailers, E-commerce, Distributors)

- By Vehicle Type:

- Light-duty Pickup Trucks (Mid-size and Full-size)

- Heavy-duty Pickup Trucks

- Utility Vehicles/SUVs (Niche segment)

Value Chain Analysis For Tonneau Covers Market

The value chain for the Tonneau Covers Market begins with the Upstream activities, which involve the sourcing and processing of raw materials. This includes procuring high-grade aluminum, specialized industrial plastics (ABS, HDPE, composites), commercial-grade vinyl, and specific components like hinges, gas struts, and locking mechanisms. The complexity lies in managing volatile commodity prices, ensuring material quality meets stringent automotive standards, and maintaining robust relationships with specialized material suppliers, especially those providing UV-resistant and lightweight composites. Manufacturers often engage in strategic partnerships with aluminum extruders and polymer compounders to ensure a steady supply of customized, durable materials. High-volume purchases and long-term contracts are utilized to mitigate supply chain disruptions and stabilize manufacturing costs. The efficiency of this upstream phase directly impacts the final product’s cost, durability, and weight characteristics, critical factors for consumer acceptance.

The core manufacturing stage involves design, fabrication, assembly, and quality control. Fabrication processes vary significantly depending on the cover type: soft covers require specialized cutting and stitching machinery, while hard covers necessitate precision metal stamping, welding, or advanced rotational molding for fiberglass and composite shells. Investment in sophisticated machinery capable of achieving tight tolerances is essential to ensure perfect fitment on specific truck beds, a non-negotiable consumer requirement. Midstream operations also include rigorous testing for weather resistance, load bearing capacity, and lock functionality. Optimization efforts focus on reducing assembly time, implementing modular designs that allow for efficient customization based on vehicle model, and adopting lean manufacturing principles to minimize in-process inventory and operational overheads. The transition from manual assembly to automated or semi-automated processes, driven by AI and robotics, is becoming a key competitive differentiator in this stage.

Downstream activities center on distribution channels, marketing, and final delivery to the end-user. The primary channels are Direct (OEM integration) and Indirect (Aftermarket sales). OEM distribution requires complex logistics, long-term contracts, and just-in-time delivery to truck assembly plants, often involving lower margins but higher volumes. The Aftermarket channel, which is significantly larger, utilizes a diverse network comprising specialized automotive accessory retailers, large-scale general merchandisers, and, increasingly, dedicated e-commerce platforms. E-commerce platforms are critical as they allow consumers to easily compare prices, read detailed reviews, and utilize fitment guides. Effective downstream management involves maintaining large regional warehousing facilities to quickly fulfill diverse customer orders, providing comprehensive technical support for DIY installation, and managing highly targeted digital marketing campaigns based on vehicle ownership demographics. Success in the downstream market hinges on efficient logistics and strong brand recognition.

Tonneau Covers Market Potential Customers

The potential customers for the Tonneau Covers Market are broadly categorized into two major groups: Commercial Fleet Operators and Individual Vehicle Owners, each possessing distinct procurement needs and prioritizing different product features. Commercial customers, including construction companies, landscape service providers, utility companies, and logistics fleets, prioritize security, long-term durability, and rapid accessibility. They often purchase heavy-duty, aluminum or fiberglass hard covers that can withstand constant use, harsh job site environments, and provide superior protection for valuable tools and equipment. Purchasing decisions in this segment are typically driven by total cost of ownership (TCO), warranty terms, fleet discounts, and the cover’s contribution to overall operational efficiency, including fuel savings. These buyers often source through direct contracts with distributors or specialized fleet upfitters rather than typical retail channels.

Individual vehicle owners constitute the largest customer segment, encompassing a wide demographic range from everyday commuters to extreme outdoor enthusiasts. This group's motivation is highly diverse, combining utility, personalization, and security. Commuters may favor soft roll-up covers for lightweight convenience and basic weather protection, while owners in areas with high crime rates or severe weather typically opt for hard folding or retractable covers with advanced locking features. Lifestyle buyers, such as campers, fishermen, and hunters, look for covers that can easily accommodate specialized racks or carriers, requiring integrated accessory features. This segment’s purchasing journey is heavily influenced by digital content—online reviews, social media recommendations, and detailed product tutorials—making strong brand presence and comprehensive e-commerce capabilities essential for manufacturers.

A rapidly growing customer segment comprises owners of newer, specialized utility vehicles and the emerging electric pickup truck segment. Electric truck owners, in particular, are highly motivated to adopt tonneau covers because the aerodynamic benefits translate directly into extended battery range, a critical performance metric. Manufacturers targeting this advanced segment must develop products that offer seamless electronic integration, lightweight construction (to preserve payload), and innovative features that complement the high-tech nature of these vehicles. Furthermore, the OEM segment represents indirect potential customers; here, the target is the truck manufacturer itself, which requires covers that meet rigorous internal quality standards, integrate perfectly into the vehicle design aesthetic, and can be mass-produced efficiently to be offered as factory-installed options or official dealer accessories, positioning the cover as a premium add-on at the point of sale.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Truck Hero, L.L.C. (Aide, Extang, UnderCover, TruXedo), Bestop, Inc., Lund International, Inc. (A.R.E.), Agri-Cover, Inc. (Access), Pace Edwards, Retrax, Bak Industries, Roll-N-Lock, Worksport, Gator Covers, WeatherTech, Mountain Top, DiamondBack Covers, REV Group (Fold-a-Cover), Leer. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tonneau Covers Market Key Technology Landscape

The technology landscape of the Tonneau Covers Market is increasingly sophisticated, moving beyond simple mechanical function to incorporate advanced material science and smart electronics. Core technological advancements focus on achieving superior weather sealing, enhancing security without increasing weight, and simplifying installation. Key innovations in material technology involve the use of advanced polymer coatings on vinyl for enhanced UV and abrasion resistance, high-strength aluminum alloys (often utilized in aircraft components) for retractable and hard folding systems, and honeycomb or foam-filled composite structures that provide rigidity and insulation while remaining significantly lighter than solid materials. Furthermore, the development of sophisticated rail and clamp systems utilizing quick-release mechanisms has revolutionized the ease of installation, significantly reducing the reliance on drilling or complex modifications, thereby supporting the massive growth of the DIY aftermarket segment.

The introduction of smart technology represents the frontier of innovation. Retractable tonneau covers are increasingly utilizing small, highly durable electric motors coupled with integrated circuit boards that allow for remote operation via key fobs or smartphone applications. These systems often include integrated sensors to detect obstructions during retraction or deployment, preventing damage to the cover or cargo. Furthermore, seamless integration with vehicle electronics, utilizing CAN bus systems in premium truck models, allows for synchronized locking with the truck’s doors and provides operational feedback through the vehicle's infotainment display. This shift towards electro-mechanical and connected components requires manufacturers to invest heavily in software development and reliable, low-power electronic hardware suitable for outdoor, variable temperature environments, addressing user concerns regarding long-term reliability and battery life.

Manufacturing technology also plays a crucial role in maintaining quality and efficiency. Precision CNC machining is mandatory for producing the intricate hardware components, such as hinges, latches, and rail components, ensuring smooth operation and a watertight seal across all models. Advanced robotics are utilized in the assembly of complex multi-panel folding covers to ensure panel alignment and consistent gap control, which is critical for weather protection. Crucially, the focus on sustainable manufacturing processes is driving technological adoption, including the increased use of recycled aluminum and polymers, and processes that minimize scrap material. Future technological evolution is expected to focus on solar power integration into covers to charge auxiliary batteries (for lighting or motors) and the deployment of flexible, transparent materials for specialized covers that allow light transmission while maintaining protection and security features.

Regional Highlights

- North America (U.S. and Canada): This region is the undisputed global leader in the Tonneau Covers Market, primarily due to the deeply embedded culture of truck ownership, high per capita customization spending, and the large sales volume of full-size and mid-size pickup trucks. Demand is dominated by hard folding and retractable covers, reflecting a strong emphasis on security and premium features. The presence of major manufacturing and distribution hubs, coupled with a highly organized and competitive aftermarket industry, ensures continuous innovation. The market is mature but experiences robust growth driven by frequent new truck model releases and the replacement cycle of aging accessories. The move towards electric trucks (like the Ford F-150 Lightning and Tesla Cybertruck) is a critical growth accelerator, as covers provide measurable range extension benefits.

- Europe: The European market is smaller and more fragmented, focusing primarily on smaller utility vehicles and pickups, which are less common than in North America. Growth is steady, driven by commercial fleet operators in construction and agriculture who require secure bed storage. The preference here leans towards practical, durable, and often lighter covers (soft roll-up or specialized rigid covers) due to stringent regulations regarding overall vehicle weight and dimensions. Germany, the UK, and France represent the largest national markets, characterized by a higher demand for OEM-integrated solutions than the extensive aftermarket seen in the U.S. Environmental regulations regarding material recyclability are a key regional consideration.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive infrastructure investment, rapid industrialization, and subsequent growth in demand for light commercial vehicles (LCVs), particularly in Thailand (a major truck manufacturing hub), Australia, and India. The market here is sensitive to price, leading to strong demand for cost-effective soft folding and roll-up covers, although the adoption of high-security hard covers is increasing in urban areas. Australia shows strong parallels with the North American market in terms of customization culture. Expansion strategies for manufacturers must focus on establishing local partnerships and optimizing supply chains to manage high tariffs and varying import regulations.

- Latin America (LATAM): This region offers significant potential, driven by the agricultural and mining sectors, which rely heavily on durable pickup trucks. Brazil and Mexico are the largest markets, characterized by high demand for robust, weather-resistant covers capable of handling demanding road conditions and high temperatures. Security is a paramount concern, driving preference towards locking hard covers. Economic instability in several countries can pose a short-term restraint, yet the long-term utility needs of commercial users ensure sustained underlying demand. Distributors often manage fragmented retail landscapes, making localized marketing essential.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the high operational demands of the oil and gas, construction, and fleet management sectors, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. Extremely high temperatures and abrasive sand necessitate exceptionally durable, UV-resistant materials and robust sealing technologies. Demand is strong for high-performance retractable and hard folding covers that offer maximum protection against environmental degradation and theft. Market growth is closely tied to investment cycles in natural resource extraction and large-scale government infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tonneau Covers Market.- Truck Hero, L.L.C. (Aide, Extang, UnderCover, TruXedo)

- Bestop, Inc.

- Lund International, Inc. (A.R.E.)

- Agri-Cover, Inc. (Access)

- Pace Edwards

- Retrax

- Bak Industries

- Roll-N-Lock

- Worksport Ltd.

- Gator Covers

- WeatherTech

- Mountain Top Industries

- DiamondBack Covers

- REV Group (Fold-a-Cover)

- Leer, Inc.

- Samyang America Inc. (Peragon)

- Rugged Liner, Inc.

- TruXmart Tonneau Covers

- Industrial Plastics Inc.

- Stampede Products

Frequently Asked Questions

Analyze common user questions about the Tonneau Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Tonneau Covers Market?

The dominant driving factor is the sustained increase in global pickup truck sales across North America and emerging APAC markets, coupled with rising consumer demand for security features and personalized vehicle utility that enhances both cargo protection and fuel efficiency through improved aerodynamics.

Which type of tonneau cover offers the highest security and durability?

Hard folding (tri-fold) and retractable tonneau covers, particularly those made from heavy-gauge aluminum or fiberglass composites, offer the highest levels of security due to integrated locking mechanisms, rigid panel construction, and resistance to cutting or prying attacks.

Is the OEM or Aftermarket distribution channel the larger segment?

The Aftermarket distribution channel currently holds the largest market share, driven by consumer preference for customization, competitive pricing, and the ability to choose from a wider variety of brands and types post-purchase, though OEM sales are rapidly gaining traction through factory-installed options.

How do tonneau covers specifically impact vehicle fuel efficiency?

Tonneau covers improve fuel efficiency by streamlining the airflow over the truck bed. An open truck bed creates significant aerodynamic drag (a low-pressure vacuum), whereas a cover smooths the air transition over the tailgate, potentially leading to measured fuel savings ranging from 5% to 10% depending on speed and vehicle design.

What is the role of advanced materials in future tonneau cover design?

Advanced materials, such as high-strength, lightweight aluminum alloys and specialized UV-resistant polymer composites, are crucial for future design, enabling manufacturers to produce covers that are easier to handle, more fuel-efficient, extremely durable, and better integrated with smart electronic features while maintaining structural integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Truck Tonneau Covers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Truck Tonneau Covers Market Size Report By Type (Hard Folding, Soft Rolling, Retractable), By Application (OEM, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager