Topcon Solar Cell and Module Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434974 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Topcon Solar Cell and Module Market Size

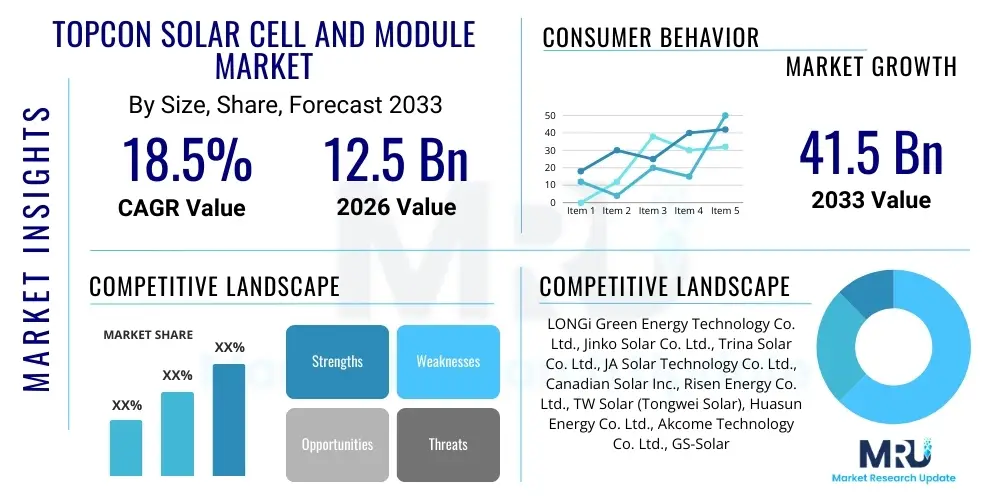

The Topcon Solar Cell and Module Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $41.5 Billion by the end of the forecast period in 2033.

Topcon Solar Cell and Module Market introduction

The Tunnel Oxide Passivated Contact (TOPCon) solar cell technology represents the leading edge of high-efficiency photovoltaic innovation, rapidly supplanting conventional Passivated Emitter Rear Cell (PERC) architectures in mass production. TOPCon cells distinguish themselves through a crucial feature: the application of an ultra-thin tunnel silicon oxide layer followed by a doped polysilicon layer on the rear side. This sophisticated passivation stack minimizes electron recombination losses, significantly boosting the cell's open-circuit voltage (Voc) and overall efficiency, which routinely exceeds 25.5% in commercial modules. This substantial efficiency gain, coupled with high bifaciality and lower temperature coefficients compared to PERC, makes TOPCon technology highly attractive for both utility-scale solar farms and constrained rooftop installations where maximizing energy yield per unit area is paramount.

Major applications for TOPCon modules span the entire solar ecosystem, from massive ground-mounted utility projects aimed at national grid decarbonization to commercial and industrial (C&I) rooftop systems seeking energy independence, and residential installations driven by lower Levelized Cost of Electricity (LCOE) over the module lifespan. The robustness and superior performance of N-type TOPCon modules under various environmental conditions, including low light and high temperatures, further cements their position as the preferred choice for developers globally. Benefits derived from deploying TOPCon technology include increased energy harvest, reduced balance-of-system (BOS) costs due to higher wattage per module, and improved long-term reliability against potential-induced degradation (PID) and light-induced degradation (LID), enhancing project bankability.

The market is primarily driven by aggressive global decarbonization targets, favorable government incentives such as tax credits and feed-in tariffs promoting photovoltaic deployment, and the ongoing, intense technological competition among major solar manufacturers. This competition is focused on achieving higher mass production efficiencies and reducing manufacturing costs per watt-peak ($/Wp). Furthermore, the decreasing cost differential between manufacturing conventional PERC cells and advanced TOPCon cells, achieved through optimization of deposition processes like LPCVD (Low-Pressure Chemical Vapor Deposition) or PECVD (Plasma-Enhanced Chemical Vapor Deposition), acts as a critical accelerant for widespread adoption, solidifying TOPCon as the new industry benchmark for silicon solar technology in the medium term.

Topcon Solar Cell and Module Market Executive Summary

The TOPCon Solar Cell and Module Market is experiencing a transformative phase, characterized by rapid technology migration and massive expansion of manufacturing capacity, especially within the Asia Pacific region. Key business trends indicate a significant capital expenditure shift from incumbent P-type PERC lines toward new N-type TOPCon facilities, driving a global output capacity surge that is redefining the competitive landscape. Leading solar manufacturers are focused on achieving commercially viable efficiencies above 26% in pilot production, aiming to consolidate their market dominance through technological superiority, vertical integration, and aggressive pursuit of economies of scale. Furthermore, the supply chain is witnessing tighter integration, with major players controlling ingot, wafer, cell, and module production, securing the flow of essential raw materials, particularly high-purity polysilicon optimized for N-type doping, which is vital for realizing TOPCon’s full potential.

Regional trends are highly polarized, with Asia Pacific, led emphatically by China, dominating the manufacturing and deployment landscape due to favorable industrial policies, extensive domestic utility-scale projects, and technological leadership in N-type cell production. In contrast, Europe and North America, while having slower domestic manufacturing adoption, exhibit exceptionally strong demand, primarily fueled by energy security concerns and supportive legislation like the Inflation Reduction Act (IRA) in the US and the European Green Deal. This robust demand creates lucrative import markets and is concurrently spurring efforts to establish resilient, localized supply chains for final module assembly and, increasingly, domestic cell production, influencing global pricing and trade flows significantly.

Segmentation trends decisively highlight the dominance of bifacial TOPCon modules across utility and large Commercial and Industrial (C&I) segments. The superior ability of bifacial modules to capture light from both sides, maximizing overall energy yield, makes them the preferred choice for maximizing asset utilization and project returns in ground-mounted systems. Monofacial applications, while decreasing in market share, remain relevant for constrained residential rooftop markets and specialized applications. Furthermore, the segmentation by wafer size is rapidly standardizing towards M10 (182mm) and G12 (210mm) formats, enabling higher module power outputs and consequently simplifying and reducing the cost of Balance of System (BOS) components. Ongoing research into advanced TOPCon structures, such as silicon-perovskite tandem cells, suggests future segment diversification focusing on ultra-high efficiency applications exceeding current silicon limits.

AI Impact Analysis on Topcon Solar Cell and Module Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the TOPCon Solar Cell and Module Market revolve primarily around three core themes: optimizing manufacturing processes for cost reduction, improving fault detection and predictive maintenance in deployed solar farms, and accelerating material science research. Users frequently ask how AI-driven process control systems can reduce the variability in the highly sensitive TOPCon tunneling oxide deposition process, minimizing quality defects, improving uniformity, and crucially increasing yield rates in high-volume production environments. There is also significant interest in AI's role in analyzing massive, complex datasets generated by operational solar farms (irradiance, ambient and module temperatures, inverter performance, performance ratios) to optimize energy forecasting, ensure grid stability, and identify subtle performance degradation specific to N-type modules, especially in large bifacial arrays mounted on trackers.

The application of AI extends beyond manufacturing and deployment into the critical phase of product research and development (R&D). Machine learning models are being utilized to rapidly simulate and test thousands of potential new material combinations for the passivation layers and metal contacts, significantly shortening the development cycle for TOPCon derivatives and next-generation tandem structures. This capability minimizes the time and cost associated with traditional trial-and-error physical experiments. Overall, the expectation is that AI will streamline the entire lifecycle—from material sourcing and precise process control in mass production to optimized operational management in the field—significantly lowering the overall Levelized Cost of Energy (LCOE) associated with TOPCon technology deployment and maintaining its competitive edge against other emerging PV technologies.

- AI-driven optimization of manufacturing parameters, particularly for LPCVD and PECVD equipment, leading to tighter quality control on the tunnel oxide layer thickness and uniformity, which is critical for cell efficiency.

- Enhanced Predictive Maintenance (PdM) for solar farms, utilizing machine learning algorithms to analyze real-time performance data, predict potential cell or module failure modes (e.g., due to hot spots or encapsulation failure), and schedule targeted repairs, thereby maximizing energy yield and uptime.

- Accelerated material discovery and simulation for developing next-generation N-type dopants, conductive adhesives, and specialized encapsulation stacks suitable for bifacial modules, reducing reliance on time-consuming physical experimentation cycles.

- Improved energy yield forecasting through sophisticated AI models that integrate complex variables like dynamic shading, localized weather data, specific array configuration (especially for bifacial modules), and historical performance to optimize energy output and grid dispatching.

- Automated visual inspection during cell fabrication and module assembly using computer vision and deep learning to instantly detect microscopic cracks, surface imperfections, or complex soldering defects specific to half-cut or shingled TOPCon connections, ensuring consistently higher end-product reliability and durability.

DRO & Impact Forces Of Topcon Solar Cell and Module Market

The TOPCon solar market is powerfully propelled by a confluence of technological drivers and ambitious global energy transition goals, while simultaneously constrained by existing manufacturing inertia and supply chain volatility unique to N-type silicon. Key drivers include the proven ability of TOPCon to deliver significantly higher efficiencies compared to older PERC technology, often surpassing 25.5% in mass production. This provides a clear, strong economic incentive for rapid adoption across utility-scale projects where maximizing power density minimizes land requirements and infrastructural costs. Additionally, the superior resistance of N-type cells to crucial degradation mechanisms like LID and PID makes TOPCon modules more reliable, increasing their bankability among project investors and financiers seeking stable, long-term returns on assets.

Drivers fueling the sustained growth of the TOPCon segment are intrinsically linked to the macroeconomic shift towards renewable energy independence and grid stability. Substantial policy support across major continents, including the European Green Deal, ambitious targets in India, and the powerful financial incentives provided by the Inflation Reduction Act (IRA) in the US, ensures a robust and accelerating demand pipeline for high-efficiency modules. The fierce competitive landscape among major solar manufacturers mandates continuous innovation, compelling firms to transition swiftly and decisively to TOPCon to maintain market relevance, secure major tender contracts, and achieve competitive pricing, thereby consolidating the technology’s market position as the new industry standard.

Despite strong tailwinds, the market faces significant restraining forces that slow full technological conversion. The supply chain for high-purity polysilicon optimized for N-type wafers remains concentrated and subject to geopolitical factors, leading to potential price volatility and supply bottlenecks, although the global polysilicon capacity is expanding rapidly to mitigate this. Moreover, the complexity and high capital expenditure (CapEx) required for converting or establishing new N-type cell production facilities, specifically involving the highly sensitive and precise deposition of the tunneling oxide and polysilicon layers, require specialized equipment and expertise, presenting substantial barriers to entry for smaller or less capitalized market participants. The primary impact forces driving the market trajectory include the rapid convergence and decline in manufacturing cost parity between PERC and TOPCon, technological leapfrogging (where manufacturers bypass incremental steps to adopt the latest N-type or even Heterojunction technologies directly), and fluctuating global trade tariffs which constantly reshape regional deployment and sourcing strategies.

- Drivers:

- Superior Efficiency and Higher Energy Yield: Commercial TOPCon cells consistently surpass 25.5% efficiency, maximizing energy output and consequently reducing project LCOE.

- High Bifaciality Factor: Enhanced power generation from both module sides, highly beneficial for ground-mounted utility deployments and tracker systems, optimizing space utilization.

- Favorable Government Policies and Decarbonization Mandates: Global incentives and regulatory pressures accelerating large-scale photovoltaic adoption worldwide.

- Excellent Anti-Degradation Performance: Inherently low susceptibility to Light-Induced Degradation (LID) and Potential-Induced Degradation (PID) ensures better long-term reliability and project bankability.

- Restraints:

- High Capital Expenditure (CapEx) for Manufacturing Transition: Significant investment required to convert existing PERC lines or build advanced, specialized N-type capacity.

- Complex Manufacturing Process Control: Tight tolerances required for the precise tunnel oxide layer deposition demanding specialized, high-cost equipment and highly refined technical expertise.

- Raw Material Supply Concentration: Dependence on a highly concentrated supply chain for specific high-purity N-type silicon wafers.

- Competition from Heterojunction (HJT): HJT presents an alternative, high-efficiency N-type technology requiring parallel market investment and differentiation.

- Opportunities:

- Integration with Next-Generation Technologies: Utilization of the stable TOPCon structure as a foundational base for silicon-perovskite tandem cells, promising practical efficiencies exceeding 30%.

- Growing Residential and C&I Demand: Need for smaller, higher power density modules in space-constrained urban applications and commercial rooftops.

- Expansion into Emerging Markets: Untapped potential in regions across Latin America, Southeast Asia, and Africa driven by urgent energy access and infrastructure development initiatives.

- Local Manufacturing Growth: Incentivized localization of supply chains in North America and Europe driven by political support and energy security goals.

- Impact Forces:

- Technology Standardization (M10/G12 wafers): Standardization of large wafer formats across the industry drives module power ratings up and effectively reduces BOS costs per watt.

- Cost Reduction Parity: Achieving similar or lower manufacturing costs compared to PERC is accelerating mass market acceptance and displacement of older technology.

- Geopolitical Trade Dynamics: Implementation of tariffs, anti-dumping duties, and localized content requirements significantly influencing regional sourcing and deployment strategies.

- System Integration Optimization: Development of inverters and tracking systems specifically designed to maximize the yield of high-power, bifacial TOPCon modules.

Segmentation Analysis

The TOPCon Solar Cell and Module Market is comprehensively segmented primarily by Cell Type, Module Type, Application, and Geography, providing analysts and investors with a critical, granular view of market dynamics, revealing where capital investment is most concentrated and which technological pathways are gaining the fastest market traction. Cell type segmentation differentiates between the initial N-type TOPCon 1.0 architectures and the newer, highly optimized designs (2.0 and beyond) which feature improved metallization schemes and advanced selective emitters, reflecting the intensive ongoing efforts in industrial optimization and yield improvement. Crucially, the segmentation by Module Type highlights the pervasive and accelerating shift towards bifacial structures, which now dominate large-scale installations due to their inherent energy yield advantages under optimal mounting conditions, often providing 5-30% more energy harvest depending on albedo.

Segmentation by Application is critical as it directly reflects the end-user deployment scenario and varying project economics, encompassing the three major sectors: utility-scale, commercial and industrial (C&I), and residential. Utility-scale projects, which often require multi-gigawatt capacity additions, are the single largest consumer segment. These projects are ruthlessly focused on achieving the highest efficiency and lowest LCOE possible, aligning perfectly with TOPCon's proven high-performance profile. The C&I sector requires durable, high-power modules for large, typically non-penetrating rooftop installations, where maximizing energy production within limited square footage is a key determinant of economic viability. Residential adoption, while historically slower due to brand preference inertia, is accelerating as homeowners seek premium, high-power density modules to offset increasing grid reliance and achieve rapid payback periods.

Geographical segmentation remains pivotal, clearly distinguishing between the highly developed, integrated manufacturing hubs like Asia Pacific, and the high-demand, high-value consumption regions in North America and Western Europe. Understanding these regional segments helps solar manufacturers tailor product specifications to comply with localized certifications (e.g., IEC, UL, TUV), manage complex logistical challenges, and navigate the fragmented incentive and policy landscapes globally. Overall, the market segmentation analysis unequivocally confirms the overwhelming global industry transition towards high-performance, N-type bifacial modules as the established norm for all major solar applications worldwide, signaling a clear phase shift in photovoltaic technology adoption.

- By Cell Type:

- N-type TOPCon 1.0 (Initial Generation Architecture)

- N-type TOPCon 2.0 (Optimized Structures with Enhanced Passivation)

- High-Efficiency TOPCon (Tandem-ready Base Cells)

- By Module Type:

- Monofacial TOPCon Modules (Primarily Residential/Rooftop)

- Bifacial TOPCon Modules (Dominant in Utility/Ground-Mount)

- Half-Cut Cell Modules (Standard Configuration)

- Shingled Cell Modules (Niche, High Power Density Applications)

- Large-Format Modules (M10 and G12 Wafers)

- By Application:

- Utility-Scale Solar Farms (Ground-mounted, centralized generation)

- Commercial and Industrial (C&I) Rooftop Systems (Large consumption sites)

- Residential Solar Installations (Premium home energy solutions)

- Off-Grid and Specialized Applications (Remote power, BIPV)

- By End-User:

- Independent Power Producers (IPPs) and Utilities

- Engineering, Procurement, and Construction (EPC) Firms

- System Integrators, Distributors, and Wholesalers

- Residential Consumers and Specialized Developers

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, Spain, Netherlands, Italy, Poland)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia)

- Latin America (Brazil, Chile, Argentina)

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa)

Value Chain Analysis For Topcon Solar Cell and Module Market

The value chain for the TOPCon Solar Cell and Module Market is intensely integrated, technologically sophisticated, and geographically concentrated, starting with the complex upstream processing of semiconductor-grade raw materials. The upstream segment involves the energy-intensive production of high-purity metallurgical-grade silicon, followed by the rigorous purification into solar-grade polysilicon, a commodity highly susceptible to global pricing fluctuations. The most critical step here involves the crystal growth of N-type monocrystalline silicon ingots and slicing them into ultra-thin, highly uniform wafers. The superior material quality of the N-type wafer, particularly the minority carrier lifetime, is absolutely paramount for achieving the maximum potential TOPCon efficiency, necessitating stringent quality control and high-tech equipment across this segment. Currently, due to scale and historic investment, a vast majority of this upstream manufacturing capacity is consolidated within China, creating substantial economic leverage and strategic supply control.

The core manufacturing process, defined as the midstream, involves the sequential, high-tech cell fabrication steps that create the TOPCon architecture. These processes include initial wafer cleaning and texturing, precise doping to create the front-side selective emitter, and the foundational step of the crucial deposition of the ultra-thin tunneling oxide layer (typically 1-2 nm thick), followed by the deposition and crystallization of the doped polysilicon layer (using methods like LPCVD or PECVD). These steps are highly specialized and sensitive to process variability. Following passivation, the cells undergo complex metallization (screen printing or plating) and subsequent high-temperature firing processes. The efficiency differential and product quality margin among manufacturers are largely determined by the meticulous process control and yield optimization achieved during these demanding midstream fabrication steps, which is where the bulk of the technological intellectual property resides.

The downstream segment, encompassing module assembly, sales, and deployment, involves interconnecting the finished cells (often in half-cut configurations), precise lamination using specialized encapsulant materials optimized for bifacial performance (POE/EVA), framing, and stringent final quality control. The distribution channel is logically bifurcated into direct and indirect routes. Direct distribution typically involves large, multi-gigawatt contracts between major integrated manufacturers and key Independent Power Producers (IPPs) or large global EPC firms for utility-scale projects, characterized by long-term supply agreements and high transactional volume. Indirect channels rely on an extensive, localized network of regional distributors, wholesalers, and specialized system integrators who serve the more fragmented Commercial and Industrial (C&I) and residential markets. Effective management of these downstream channels requires robust global logistics, regional warehousing, and localized product certification expertise to ensure modules reach their diverse end-users compliantly and efficiently across highly regulated global jurisdictions.

Topcon Solar Cell and Module Market Potential Customers

Potential customers for TOPCon solar cells and modules are a heterogeneous group spanning the entire energy generation ecosystem, but heavily centered on commercial entities and large asset owners prioritizing superior energy generation, long-term asset reliability, and overall low LCOE. The primary and largest segment of buyers consists of Independent Power Producers (IPPs) and utility companies that develop, finance, own, and operate centralized solar power plants, often in the hundreds of megawatts. These entities function under strict financial models that necessitate maximizing power output and minimizing operational and maintenance costs over typical 25-30 year lifecycles, making the superior efficiency, enhanced performance ratio, and lower long-term degradation characteristics of TOPCon technology highly appealing for securing investment and maximizing returns.

The second critical and substantial group comprises Engineering, Procurement, and Construction (EPC) firms, who are the immediate buyers of modules in bulk on behalf of their diverse clients (spanning utility, C&I, and public sector developers). EPCs prioritize practicality: ease of installation, compatibility with standardized mounting systems, the adoption of large-format wafers (M10 and G12), and the ability of the modules to integrate seamlessly with standard inverters and existing balance-of-system (BOS) components. They place a high value on high-power density because it directly translates into a reduced module count per project, leading to faster deployment times, lower labor costs, and reduced logistical complexity. Their purchase decisions are often dictated by immediate project specifications, validated supplier track records, and the guaranteed availability of modules meeting high regional quality standards.

Finally, a rapidly growing customer base includes commercial and industrial businesses seeking to install large solar arrays on their facilities to achieve substantial operating expense reductions and meet increasingly stringent sustainability and ESG goals, along with specialized residential installers serving the premium home energy market. These decentralized buyers are highly sensitive to energy yield per square meter, especially in dense urban environments or on constrained rooftop spaces. This sensitivity ensures that premium TOPCon modules, despite a higher upfront cost per unit, command a growing market share compared to standard P-type products, further fueling innovation and market adoption across these segmented customer demographics by focusing on long-term value creation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $41.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LONGi Green Energy Technology Co. Ltd., Jinko Solar Co. Ltd., Trina Solar Co. Ltd., JA Solar Technology Co. Ltd., Canadian Solar Inc., Risen Energy Co. Ltd., TW Solar (Tongwei Solar), Huasun Energy Co. Ltd., Akcome Technology Co. Ltd., GS-Solar Co. Ltd., Maxeon Solar Technologies, Qcells (Hanwha Solutions), SunPower Corporation, Meyer Burger Technology AG, Eging PV, Astronergy, GCL System Integration Technology Co. Ltd., Lerri Solar Technology Co. Ltd., Boviet Solar Technology Co. Ltd., Zhejiang Sunflower Light Energy Science & Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Topcon Solar Cell and Module Market Key Technology Landscape

The technological landscape of the TOPCon market is defined by intense, continuous process refinements aimed at reducing the production cost per watt, enhancing the overall scalability of the process, and further pushing the efficiency boundary closer to the theoretical limit of silicon solar cells. The core technology centers rigorously around the precise deposition of the ultra-thin tunnel oxide layer (SiO2), which requires extremely precise control over thickness and uniformity to ensure optimal quantum tunneling and minimize interface defects. Current industrial practice heavily favors Low-Pressure Chemical Vapor Deposition (LPCVD) for the subsequent deposition of the highly doped polysilicon layer due to its superior film quality, uniformity, and established reliability in high-volume production, although the adoption of Plasma-Enhanced Chemical Vapor Deposition (PECVD) is growing rapidly as a lower-temperature, potentially lower-cost, and higher-throughput alternative, especially crucial when dealing with extremely large wafer formats like G12.

Peripheral yet strategically critical technologies include the advancement of wafer slicing techniques, such as continuous diamond wire sawing, which are essential to minimize material kerf loss and optimize wafer thickness reductions without sacrificing structural integrity, thereby lowering raw material consumption. Furthermore, there is a strong industrial trend toward implementing silver-reduced or entirely silver-free metallization schemes (e.g., copper plating or alternative conductive pastes) to manage the rapidly increasing cost of silver, a major material expense. Implementing precise selective emitter structures on the front side and employing advanced laser processes for localized opening of the polysilicon layer are standardized steps necessary to optimize charge carrier transport and reduce resistive losses across the cell surface, ensuring the maximum possible current extraction from the cell.

Looking forward, the established and robust structure of TOPCon technology serves as an exceptionally effective foundational platform for the development of next-generation solar advancements. Specifically, the highly effective rear-side passivation provided by the TOPCon stack makes it an ideal and stable bottom cell partner in innovative silicon-perovskite tandem architectures. This tandem approach represents the single most significant technological leap on the horizon, promising to breach the 30% efficiency barrier by combining the stable, reliable energy absorption of bulk silicon with the high-energy absorption capabilities of perovskite materials in the upper layer. This ability to integrate seamlessly with future high-efficiency concepts solidifies TOPCon's relevance as the industry standard for the medium term, even as manufacturers simultaneously invest R&D efforts into Heterojunction Technology (HJT) as the main competing high-efficiency N-type alternative.

Regional Highlights

The global TOPCon Solar Cell and Module market exhibits significant regional variations in terms of manufacturing capacity, consumption demand profile, and regulatory landscape, shaping the global competitive dynamics. Asia Pacific, specifically dominated by China, remains the undisputed global manufacturing powerhouse, controlling upwards of 90% of the world's solar manufacturing capacity across the entire vertically integrated value chain, spanning from high-purity polysilicon to final module assembly. This overwhelming dominance is underpinned by massive governmental support, highly integrated domestic supply chains, continuous technological innovation, and the largest domestic solar deployment market globally. This region is the key driver of global capacity expansion, technological refinement, and the aggressive cost reduction required for mass adoption worldwide. Additionally, countries like India and emerging economies in Southeast Asia are rapidly scaling up localized cell and module production, driven by import substitution policies and burgeoning internal energy security needs.

Europe represents a strategically crucial demand market characterized by ambitious, legally binding renewable energy targets, high existing electricity prices, and a strong preference for sustainable and ethically sourced products, fostering robust demand for high-efficiency modules that maximize output in constrained spaces (residential rooftops) and accelerate financial returns in utility-scale projects. While high-volume manufacturing capacity within Europe is still limited, often focusing on niche, premium products or specialized competing N-type technologies like HJT, the continent is a massive net consumer of high-quality TOPCon imports. Regulatory frameworks, such as the European Union’s emphasis on supply chain transparency, carbon footprint assessment, and extended product longevity guarantees, significantly influence which specific TOPCon products are favored and purchased by European developers and financiers, creating a focus on quality and long-term reliability over sheer cost.

North America, led by the rapidly expanding United States market, is undergoing a profound structural transformation driven by the comprehensive financial incentives embedded within the Inflation Reduction Act (IRA). The IRA provides substantial, multi-faceted tax credits and production tax credits (PTCs) for both deploying solar projects and manufacturing solar components domestically. This regulatory shift has triggered significant announcements of new, multi-gigawatt TOPCon manufacturing facilities and expanded capacity within the US and its key North American trading partners. Consequently, the North American market is experiencing a polarization: near-term demand relies heavily on imported TOPCon modules, while the medium-to-long-term focus is intensely centered on establishing a resilient, cost-competitive, and highly localized TOPCon supply chain, affecting regional pricing strategies, sourcing diversification, and significant capital investment allocation across the continent.

- Asia Pacific (APAC): The global epicenter for TOPCon manufacturing, accounting for the majority of new capacity installation; China dominates technological adoption and cost leadership; strong governmental policies support rapid N-type technology transition and domestic consumption; ongoing expansion into India and Southeast Asia drives localized growth and supply chain diversification.

- North America: High-value import market coupled with aggressive domestic manufacturing incentives (IRA); utility-scale and large C&I projects drive premium demand for high-bifaciality TOPCon modules; significant short-term reliance on imports and medium-term establishment of a localized N-type supply chain defining market trajectory.

- Europe: Quality-focused, high-demand market driven by aggressive climate targets and high electricity costs; heavy reliance on high-quality imports; demand sensitive to product sustainability, carbon footprint, and enhanced reliability standards; key markets include Germany, Spain, and the Netherlands.

- Latin America (LATAM): Rapidly expanding utility market with exceptionally high solar irradiance levels; countries like Brazil, Mexico, and Chile are major deployment centers; demand primarily driven by cost-competitiveness and utility-scale tenders; TOPCon’s high performance ensures rapid penetration by reducing LCOE.

- Middle East and Africa (MEA): Emerging utility market characterized by extremely high ambient temperatures and harsh desert conditions; TOPCon’s favorable temperature coefficient provides a critical performance advantage over conventional technologies under severe heat stress; investment concentrated in large, government-backed solar projects, such as those in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Topcon Solar Cell and Module Market. These industry giants are driving the technological transition and capacity build-out, essential for migrating the global solar industry from P-type PERC to N-type TOPCon as the mainstream, high-efficiency technology standard. Their strategic initiatives, focusing on continuous process optimization and rapid capacity expansion, are critical determinants of the future market structure.- LONGi Green Energy Technology Co. Ltd.

- Jinko Solar Co. Ltd.

- Trina Solar Co. Ltd.

- JA Solar Technology Co. Ltd.

- Canadian Solar Inc.

- Risen Energy Co. Ltd.

- TW Solar (Tongwei Solar)

- Huasun Energy Co. Ltd.

- Akcome Technology Co. Ltd.

- GS-Solar Co. Ltd.

- Maxeon Solar Technologies

- Qcells (Hanwha Solutions)

- SunPower Corporation

- Meyer Burger Technology AG

- Eging PV

- Astronergy

- GCL System Integration Technology Co. Ltd.

- Lerri Solar Technology Co. Ltd.

- Boviet Solar Technology Co. Ltd.

- Zhejiang Sunflower Light Energy Science & Technology Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Topcon Solar Cell and Module market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is TOPCon technology and why is it replacing PERC?

TOPCon (Tunnel Oxide Passivated Contact) is an advanced N-type solar cell structure utilizing an ultra-thin silicon oxide layer combined with a highly doped polysilicon layer on the rear surface. This stack effectively passivates the surface, drastically reducing electron recombination losses. This results in efficiencies consistently exceeding 25.5%, a significant advantage over P-type PERC cells, alongside superior performance characteristics like better temperature coefficients and lower degradation, positioning it as the new industry benchmark.

How does the LCOE of TOPCon modules compare to conventional solar technology?

The Levelized Cost of Electricity (LCOE) for projects utilizing TOPCon modules is generally lower than that of conventional P-type technologies. Although the initial capital investment per manufacturing facility may be high, TOPCon's superior efficiency (higher wattage per module) and high bifaciality factor mean fewer modules and less land are required for the same total energy output. This reduces Balance of System (BOS) costs, increasing the lifetime energy yield and resulting in a compellingly lower overall LCOE for large-scale deployments.

What are the primary challenges facing the widespread adoption of TOPCon?

The key market challenges include the high capital expenditure required for manufacturers to transition existing P-type lines or establish new N-type TOPCon facilities. Another major constraint is the technological complexity associated with precise control over the ultra-sensitive tunnel oxide deposition process. Maintaining quality and uniformity across giga-watt scale production necessitates highly specialized equipment, a steep operational learning curve, and managing potential supply volatility for high-purity N-type silicon wafers.

Is TOPCon considered a bridge technology or the long-term solution for silicon solar?

TOPCon is currently the leading mainstream technology, replacing PERC rapidly. While it represents the peak efficiency for single-junction crystalline silicon, it is also highly regarded for its future-proofing potential. Its robust passivated structure makes it an ideal, stable bottom cell component for high-efficiency silicon-perovskite tandem architectures. This positions TOPCon not just as a bridge, but as a crucial, enabling technology for the next generation of PV, likely dominating the market for the next 5-10 years.

Which regional market is driving the most capacity growth and cost reduction?

Asia Pacific (APAC), particularly China, drives the overwhelming majority of global TOPCon manufacturing capacity expansion and is the primary engine for continuous cost reduction through technological optimization and unparalleled economies of scale. While North America and Europe drive strong, high-value demand, APAC's integrated supply chain and massive investment strategies dictate the global availability, pricing, and rapid technological advancements of TOPCon modules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager