Topotecan Hydrochloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438915 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Topotecan Hydrochloride Market Size

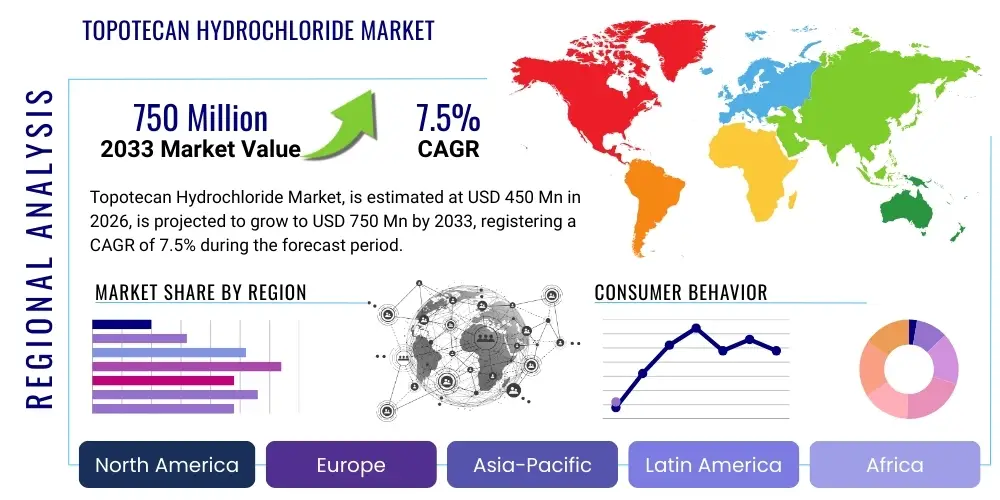

The Topotecan Hydrochloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the rising global incidence of targeted malignancies, particularly ovarian cancer and small cell lung cancer (SCLC), where Topotecan remains a critical second-line and subsequent-line chemotherapeutic option. Furthermore, the expiration of key patents and the subsequent entry of high-quality generic versions have significantly improved patient access and affordability, stabilizing demand across major pharmaceutical markets, especially in regions with burgeoning oncology infrastructure. The steady expansion of indications for use in combination therapies also contributes positively to the overall market valuation.

Topotecan Hydrochloride Market introduction

Topotecan Hydrochloride is a semi-synthetic derivative of camptothecin, functioning as a potent antineoplastic agent primarily targeting Topoisomerase I, an essential nuclear enzyme involved in DNA replication and repair. By binding to the Topoisomerase I-DNA complex, Topotecan prevents the religation of single-strand DNA breaks, ultimately leading to cytotoxic double-strand breaks during the S phase of the cell cycle. This mechanism of action positions Topotecan as a vital therapeutic resource, especially in treating recurrent or refractory malignancies. The product is commercially available in intravenous (IV) injection forms and oral capsules, providing versatility in administration protocols in both inpatient and outpatient settings.

The major applications of Topotecan Hydrochloride center around the treatment of various solid tumors, notably recurrent or progressive ovarian cancer following initial chemotherapy, small cell lung cancer (SCLC) that has relapsed after primary treatment, and metastatic cervical cancer. Its primary benefit lies in its demonstrated efficacy in palliative and salvage chemotherapy regimens, often extending progression-free survival and improving the quality of life for patients with limited remaining therapeutic options. The market is propelled by persistent high incidence rates of these cancers globally, combined with continuous research into novel drug delivery systems aimed at improving bioavailability and reducing systemic toxicity. Driving factors include the increasing geriatric population susceptible to cancer, enhanced screening capabilities leading to earlier diagnosis, and favorable reimbursement policies for established chemotherapy drugs.

Topotecan Hydrochloride Market Executive Summary

The Topotecan Hydrochloride Market exhibits stable growth, fueled by its established role in second-line oncology treatments and the increasing availability of cost-effective generic formulations. Key business trends include strategic collaborations between generic manufacturers and regional distributors to optimize supply chain logistics and maximize market penetration in emerging economies. There is a perceptible shift towards oral administration forms (capsules) due to convenience and reduced healthcare expenditure associated with outpatient treatment, though the IV formulation remains dominant in acute hospital settings. Furthermore, ongoing clinical trials exploring Topotecan's effectiveness in combination with novel targeted agents, such as PARP inhibitors and immune checkpoint blockers, suggest potential future indication expansion, safeguarding the compound's commercial viability against newer, high-cost therapies.

Regional trends indicate North America and Europe retaining the largest market shares due to advanced healthcare infrastructure, high awareness of oncology management protocols, and substantial investment in cancer research. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by increasing patient volumes, improving access to cancer screening and treatment, and significant government investments aimed at modernizing oncology care facilities. Segment trends reveal that Ovarian Cancer application dominates the market, reflecting the drug’s long-standing use and proven efficacy in this challenging indication. The Dosage Form segment is slowly shifting, with oral formulations capturing niche markets, particularly where patient compliance and convenience are prioritized. Overall, the market remains moderately consolidated, driven by pricing competition among generic players and strategic investments in manufacturing compliance.

AI Impact Analysis on Topotecan Hydrochloride Market

User inquiries regarding AI's influence on the Topotecan Hydrochloride market primarily center on optimizing treatment personalization, predicting drug efficacy and toxicity profiles, and streamlining clinical trial design for combination therapies involving Topotecan. Users are concerned about how machine learning algorithms could potentially guide oncologists in selecting patients most likely to respond to Topotecan (pharmacogenomics integration) versus those who might experience severe myelosuppression, a key adverse effect. Furthermore, questions arise concerning AI's role in accelerating the discovery of novel drug delivery systems or improving manufacturing efficiency for the active pharmaceutical ingredient (API), reducing costs while ensuring purity. The underlying expectation is that AI will enhance the precision of Topotecan usage, moving away from generalized dosing to highly individualized therapeutic approaches, thereby maximizing patient outcomes and minimizing healthcare burden.

Artificial intelligence and machine learning are increasingly integrated into pharmaceutical R&D and clinical decision support systems, promising nuanced applications within the Topotecan domain. Specifically, AI algorithms are being deployed to analyze vast datasets derived from electronic health records (EHRs) and clinical trial results, identifying subtle biomarkers that correlate with Topotecan response in SCLC and ovarian cancer patients. This enhanced data analysis capability facilitates the stratification of patient populations, making clinical trials more focused and potentially accelerating the approval process for new indication expansions or improved dosing regimens. The rigorous computational power of AI also supports structure-activity relationship (SAR) studies, optimizing the synthesis of Topotecan analogs or refining formulation stability, particularly for oral delivery.

Moreover, the integration of AI in diagnostic imaging analysis (radiomics) and pathology slides offers predictive value regarding tumor response kinetics following Topotecan administration. By detecting early signs of resistance or rapid tumor shrinkage that might be missed by conventional clinical assessment, AI tools provide timely feedback to clinicians, allowing for adaptive dosing strategies. This paradigm shift toward precision oncology, underpinned by sophisticated computational models, helps to manage the drug's narrow therapeutic index, mitigating risks like severe neutropenia and thrombocytopenia, which are major limitations of conventional chemotherapy administration. This analytical precision is key to extending the competitive lifespan of established cytotoxic agents like Topotecan against emerging immunotherapies.

- AI-driven optimization of clinical trial design for Topotecan combination therapies.

- Predictive modeling for patient response and toxicity risk (myelosuppression), enabling personalized dosing.

- Enhanced pharmacovigilance through natural language processing (NLP) analysis of adverse event reports.

- Streamlining API synthesis and quality control in generic manufacturing using predictive maintenance and process optimization.

- Identification of novel biomarkers associated with resistance or sensitivity to Topotecan via deep learning analysis of genomic and transcriptomic data.

DRO & Impact Forces Of Topotecan Hydrochloride Market

The dynamics of the Topotecan Hydrochloride market are shaped by a complex interplay of established therapeutic efficacy, generic competition, stringent regulatory oversight, and the continuous emergence of competing oncology treatments. Drivers center on the rising global incidence of targeted malignancies and the successful genericization of Topotecan, which enhances accessibility. Restraints include significant side effects (myelosuppression), the development of drug resistance over time, and the continuous entry of advanced targeted and immunotherapies that may displace conventional chemotherapy. Opportunities lie in leveraging combination therapies, exploring new delivery methods (e.g., liposomal formulations), and expanding use in neglected therapeutic areas. These forces collectively define the market landscape, requiring manufacturers to balance cost-effectiveness with consistent clinical outcomes.

Drivers: A primary driver is the designation of Topotecan as a standard second-line agent for recurrent ovarian cancer and SCLC, ensuring consistent demand in established oncology protocols worldwide. The broad availability of generic versions following patent expiration has democratized access to treatment in developing markets, bolstering global volume sales despite competitive pricing pressures. Furthermore, increasing awareness and adoption of cancer screening programs globally, particularly in major developing economies, lead to a larger pool of patients requiring subsequent-line chemotherapy upon relapse. The established pharmacokinetic profile and familiarity among oncologists further contribute to its sustained utilization, even as newer drugs enter the pipeline.

Restraints: Significant clinical challenges restrain market growth. Topotecan is notoriously associated with dose-limiting toxicities, primarily severe myelosuppression (neutropenia and thrombocytopenia), necessitating careful patient monitoring and often leading to dose delays or reductions. Moreover, tumor cells frequently develop acquired resistance to Topotecan through various mechanisms, including efflux pump upregulation and altered Topoisomerase I expression, limiting its long-term efficacy. Economically, the market faces intense downward pricing pressure from generic competition, squeezing profit margins for manufacturers. The continuous advancement of biological drugs, targeted therapies, and checkpoint inhibitors represents a substantial threat, as these modalities often offer improved efficacy or fewer systemic side effects, potentially substituting Topotecan in future standard treatment guidelines.

Opportunities: Strategic opportunities exist in exploring synergistic combination regimens involving Topotecan and drugs targeting resistance pathways (e.g., DNA damage repair mechanisms or angiogenesis). Developing enhanced drug delivery systems, such as liposomal or nanoparticle encapsulations, offers the potential to reduce systemic toxicity while concentrating the drug at the tumor site, thereby expanding the therapeutic window and potentially improving patient adherence to treatment protocols. Geographically, opportunities are particularly strong in the APAC and Latin American markets, which are rapidly building oncology infrastructure and where cost-effective generic chemotherapy options are highly favored over premium-priced novel therapies. Additionally, leveraging real-world data and advanced computational models to refine dosing protocols based on patient specific characteristics represents a key area for value creation.

Segmentation Analysis

The Topotecan Hydrochloride Market is segmented based on Application, Dosage Form, and Distribution Channel. This segmentation provides a granular view of demand dynamics, helping stakeholders understand where utilization is highest and which delivery methods are preferred by both clinicians and patients. The Application segment defines the core therapeutic areas driving consumption, predominantly focusing on malignancies where the drug demonstrates proven efficacy. The Dosage Form segment distinguishes between the traditional, hospital-centric intravenous administration and the increasingly adopted, patient-friendly oral formulations. Analyzing these segments is critical for manufacturers designing their commercial strategies and optimizing supply chains to meet varied global regulatory and clinical requirements.

Analysis of these segments reveals distinct growth patterns. The application segment remains dominated by ovarian cancer treatment, which relies heavily on Topotecan for salvage therapy, underpinning market stability. However, the SCLC segment is witnessing gradual expansion due to increasing global awareness regarding early diagnosis and the need for sequential chemotherapy options. Within the Dosage Form segment, while the injectable form holds the majority share owing to its superior bioavailability and precision dosing in acute settings, the oral capsule market is expected to exhibit slightly higher growth, capitalizing on patient preference for home administration and reduced need for clinic visits, especially in chronic or palliative care settings. Understanding these utilization patterns is essential for projecting future capacity requirements and formulating effective marketing strategies across different therapeutic landscapes.

- By Application:

- Ovarian Cancer

- Small Cell Lung Cancer (SCLC)

- Cervical Cancer

- Others (e.g., Neuroblastoma)

- By Dosage Form:

- Injection/Lyophilized Powder

- Oral Capsules

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Topotecan Hydrochloride Market

The value chain for Topotecan Hydrochloride starts with the Upstream Analysis, focusing on the procurement and synthesis of raw materials, primarily the camptothecin precursor. This stage is characterized by dependence on specialized chemical synthesis facilities and strict adherence to Good Manufacturing Practices (GMP) due to the cytotoxic nature of the compound. Key challenges include maintaining the purity and stereochemistry of the API and managing geopolitical risks associated with sourcing chemical intermediates. The midstream involves the transformation of the API into finished dosage forms—either lyophilized powder for injection or oral capsules—requiring sophisticated aseptic manufacturing techniques and stringent quality control processes necessary to comply with global regulatory standards set by bodies like the FDA and EMA. Generic manufacturers often compete intensely on production efficiency and scale to reduce the cost of goods sold.

The downstream analysis encompasses the complex processes of distribution and end-user engagement. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers supplying large hospital systems or specialized oncology centers, maintaining greater control over inventory and pricing. Indirect distribution relies heavily on major pharmaceutical wholesalers and third-party logistics (3PL) providers who handle bulk transport, warehousing, and delivery to regional retail and hospital pharmacies. Given the injectable form's requirement for cold chain storage and careful handling, the logistics component demands specialized expertise. The final stage involves dispensing to the end-user (patient) via specialized oncology pharmacies or hospital outpatient units, often coupled with intensive patient support programs to manage side effects and ensure compliance. Price negotiations and reimbursement policies significantly impact the final pricing structure observed at the consumer level.

The predominance of generic Topotecan dictates a highly streamlined and cost-efficient value chain structure. Key players continuously seek vertical integration or secure long-term contracts with specialized API suppliers to ensure supply stability and cost predictability. The transition from upstream synthesis to downstream distribution requires robust regulatory compliance documentation at every stage, especially concerning stability testing and batch release protocols for cytotoxic drugs. The distribution channel dynamics are heavily influenced by national health systems; in markets with centralized procurement (e.g., single-payer systems), negotiation power shifts heavily to the buyers (governments/hospitals), while in decentralized markets, competition among wholesalers defines the distribution landscape. Effective management of the supply chain, particularly minimizing risks related to cross-contamination and maintaining sterility for injectable forms, is paramount for market success and regulatory approval.

Topotecan Hydrochloride Market Potential Customers

The primary potential customers and end-users of Topotecan Hydrochloride are specialized healthcare institutions and individual patients requiring subsequent-line chemotherapy for specific refractory cancers. Leading consumers are Comprehensive Cancer Centers (CCCs) and large multi-specialty hospitals with dedicated oncology departments, which utilize the injectable form extensively in inpatient and outpatient infusion clinics. These institutional buyers value the drug based on clinical efficacy data, inclusion in national treatment guidelines, and favorable hospital formulary pricing achieved through bulk purchasing agreements. Given Topotecan's role in second- and third-line treatment, patient populations are typically those who have failed or relapsed following platinum-based chemotherapy or other first-line regimens.

Other significant customer segments include governmental and private sector procurement agencies responsible for national drug stockpiling and supplying regional medical centers. These entities focus heavily on securing stable, cost-effective supplies of generic Topotecan to manage public healthcare budgets while ensuring patient access. Furthermore, community oncology practices and independent infusion centers constitute a growing customer base, particularly for the oral dosage form, enabling local administration and reducing patient travel burden. For oral capsules, the final purchasers include retail and specialized oncology pharmacies that cater directly to ambulatory patients, emphasizing the importance of patient education and adherence support programs provided by the manufacturer or distributor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GlaxoSmithKline (GSK), Teva Pharmaceutical Industries Ltd., Mylan N.V., Sandoz (Novartis), Pfizer Inc., Fresenius Kabi AG, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories, Cipla Ltd., Baxter International Inc., Zydus Cadila, Aurobindo Pharma, Bristol-Myers Squibb, Hospira (Pfizer), Hikma Pharmaceuticals, Accord Healthcare, Intas Pharmaceuticals, Jiangsu Hengrui Medicine, Daiichi Sankyo, Apotex Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Topotecan Hydrochloride Market Key Technology Landscape

The technology landscape surrounding the Topotecan Hydrochloride market is primarily focused on optimizing drug delivery systems and improving manufacturing synthesis rather than developing new molecular entities, given that Topotecan is an established generic molecule. A key technological focus is the advancement of liposomal encapsulation technology. Liposomal formulations aim to entrap the Topotecan molecules within lipid vesicles, which allows for passive accumulation at tumor sites through the enhanced permeability and retention (EPR) effect. This targeted delivery mechanism is critical for reducing systemic exposure, particularly to the bone marrow, thereby mitigating severe hematological toxicities—a major limitation of the conventional intravenous drug. Successful implementation of these advanced delivery systems could significantly expand the therapeutic window and patient tolerability, driving market differentiation for advanced generic or specialty pharmaceutical companies.

Another crucial technological area involves continuous manufacturing and advanced chemical process engineering for the synthesis of the Topotecan API. Due to intense generic competition, maintaining extremely high purity levels of the active ingredient while simultaneously reducing production costs is essential. Techniques such as flow chemistry and advanced crystallization methodologies are being adopted to achieve higher yields, improve batch consistency, and minimize the generation of unwanted, potentially toxic, enantiomers or impurities. Furthermore, specialized formulation technologies are employed to enhance the bioavailability of the oral capsule form. This involves using permeation enhancers or sophisticated particle size reduction techniques to ensure adequate and consistent absorption in the gastrointestinal tract, making the oral formulation a reliable alternative to the IV route for maintenance therapy.

In addition to formulation and synthesis technologies, the market leverages advanced analytical techniques for Quality Control (QC). High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are routinely used to ensure the stability and purity of the cytotoxic drug throughout its shelf life, a requirement that is especially rigorous for oncology injectables. Furthermore, the pharmaceutical packaging technology plays a vital role. Specialized vial and syringe technologies are utilized to prevent needle-stick injuries and ensure safe handling of the cytotoxic solution by healthcare professionals, reflecting a focus on occupational safety and compliance. The future technology landscape is likely to see further integration of sensors and digital tracking mechanisms within packaging to monitor temperature and ensure cold chain integrity during distribution, particularly for the sensitive IV formulations of Topotecan.

Regional Highlights

Regional dynamics play a crucial role in the Topotecan Hydrochloride Market, reflecting variances in healthcare spending, regulatory hurdles, cancer prevalence, and access to generic medications. North America, specifically the United States, commands the largest market share due to its sophisticated healthcare infrastructure, high incidence of target cancers, well-established oncology treatment protocols, and high drug consumption rates, supported by robust insurance coverage and complex reimbursement mechanisms. However, this region also faces the most intense pressure from novel, high-cost biological therapies that potentially substitute Topotecan.

Europe represents a mature market characterized by centralized drug procurement and high regulatory standards (EMA). Western European countries exhibit high utilization rates, driven by national guidelines for SCLC and ovarian cancer management. Generic penetration is high, leading to strong pricing competition. The Asia Pacific (APAC) region is poised for the most rapid market expansion. Countries like China, India, and South Korea are experiencing significant improvements in cancer diagnosis and treatment capacity. The large patient pool, coupled with a high preference for affordable generic medicines, drives volumetric growth in this region. Regulatory harmonization efforts across ASEAN and other regional blocs are also simplifying market entry for generic manufacturers.

Latin America and the Middle East & Africa (MEA) remain smaller markets but present significant untapped potential. Growth in MEA is often constrained by fragmented healthcare systems and reliance on international aid, yet increasing investment in private oncology centers is gradually improving access. In Latin America, economic volatility and currency fluctuations pose challenges, but the growing prevalence of cancer and improved generic registration processes are contributing to steady, albeit slower, market expansion, positioning these regions as crucial strategic areas for long-term generic pharmaceutical growth.

- North America (U.S. and Canada): Dominant market share due to established treatment protocols and sophisticated oncology centers; focus on combination therapies and management of severe toxicities.

- Europe (Germany, UK, France): High generic market penetration; stable demand driven by mandatory inclusion in national treatment guidelines for recurrent SCLC and ovarian cancer.

- Asia Pacific (China, India, Japan): Fastest growth expected; driven by increasing cancer prevalence, rising healthcare expenditure, and preference for cost-effective generic chemotherapy options.

- Latin America (Brazil, Mexico): Market expansion constrained by economic instability but supported by increasing government focus on cancer control programs and generic availability.

- Middle East and Africa (MEA): Growth driven by infrastructure development in key Gulf Cooperation Council (GCC) countries and increasing focus on advanced oncology care.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Topotecan Hydrochloride Market.- GlaxoSmithKline (GSK)

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V. (now Viatris)

- Sandoz (Novartis)

- Pfizer Inc.

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories

- Cipla Ltd.

- Baxter International Inc.

- Zydus Cadila

- Aurobindo Pharma

- Bristol-Myers Squibb

- Hospira (a Pfizer company)

- Hikma Pharmaceuticals

- Accord Healthcare

- Intas Pharmaceuticals

- Jiangsu Hengrui Medicine

- Daiichi Sankyo

- Apotex Inc.

Frequently Asked Questions

Analyze common user questions about the Topotecan Hydrochloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Topotecan Hydrochloride?

Topotecan Hydrochloride is a topoisomerase I inhibitor. It acts by stabilizing the cleavable complex between Topoisomerase I and DNA, preventing the re-ligation of DNA strands. This interference leads to irreversible DNA damage, ultimately causing cell death, particularly in rapidly dividing cancer cells during the S-phase of the cell cycle.

Which cancer types are primarily treated using Topotecan?

Topotecan is primarily approved and utilized globally for the treatment of metastatic ovarian cancer, recurrent or progressive small cell lung cancer (SCLC), and metastatic cervical cancer. It is often employed as a second-line or subsequent-line therapy after failure of initial platinum-based regimens.

What are the key differences between the intravenous (IV) and oral forms of Topotecan?

The IV form is standard, ensuring complete bioavailability and used predominantly in hospital settings. The oral capsule form offers convenience for outpatient use and maintenance therapy. However, the oral form exhibits lower, more variable bioavailability and may require dose adjustments compared to the precise IV administration.

What major side effects are associated with Topotecan therapy?

The most significant and dose-limiting side effect is severe myelosuppression, including neutropenia (low white blood cell count) and thrombocytopenia (low platelet count), which increases the risk of serious infections and bleeding. Non-hematologic side effects include nausea, vomiting, diarrhea, and fatigue.

How does the generic status of Topotecan impact the market?

As a genericized drug, Topotecan benefits from highly competitive pricing, significantly increasing its affordability and accessibility across global markets, particularly in emerging economies. This high generic availability ensures its sustained use as a cost-effective option despite the emergence of newer, premium-priced cancer treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager