Total Retail SaaS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434649 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Total Retail SaaS Market Size

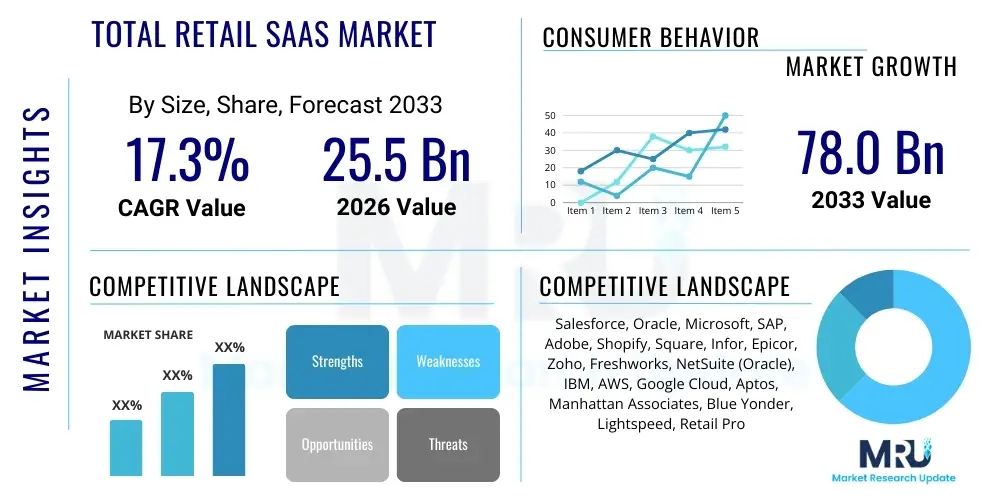

The Total Retail SaaS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.3% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 78.0 Billion by the end of the forecast period in 2033.

Total Retail SaaS Market introduction

The Total Retail Software as a Service (SaaS) Market encompasses a diverse range of cloud-based applications designed specifically for retail operations, including but not limited to point-of-sale (POS) systems, inventory management, customer relationship management (CRM), supply chain management (SCM), and e-commerce platforms. Retail SaaS solutions provide retailers with scalability, flexibility, and reduced operational expenditure compared to traditional on-premise software. These tools are crucial enablers of digital transformation, allowing retailers to swiftly adapt to evolving consumer behaviors, particularly the strong demand for personalized, seamless omnichannel shopping experiences across physical and digital storefronts.

The core product offering in this market involves subscription-based models for software deployment, ensuring continuous updates and maintenance, which is vital in the fast-paced retail technology landscape. Major applications span across enhancing store operations, optimizing complex global supply chains, managing customer data for targeted marketing, and facilitating secure payment processing. The primary benefit derived by retailers is the ability to integrate siloed operational data into a unified commerce platform, thereby improving efficiency, reducing stockouts, and dramatically enhancing the overall customer journey from discovery to post-purchase support.

Driving factors for the robust expansion of the Retail SaaS market include the rapid global proliferation of e-commerce, the necessity for retailers to maintain technological parity with large online competitors, and the critical need for advanced data analytics to understand consumer trends. Furthermore, the increasing acceptance of cloud infrastructure among Small and Medium-sized Enterprises (SMEs), spurred by the lower upfront investment costs of SaaS, is significantly contributing to market acceleration. Regulations surrounding data privacy and the demand for real-time inventory visibility across multiple channels are also compelling retailers to adopt modern, agile SaaS solutions.

Total Retail SaaS Market Executive Summary

The Total Retail SaaS Market is characterized by intense innovation and rapid technological shifts, primarily driven by the imperative for unified commerce and advanced analytics. Current business trends indicate a strong move away from monolithic enterprise resource planning (ERP) systems toward modular, API-first, and composable commerce architectures, allowing retailers to choose best-of-breed solutions for specific operational requirements, such as specialized pricing engines or advanced fulfillment optimization tools. This shift empowers businesses with greater agility and faster time-to-market for new customer-facing features. Furthermore, mergers and acquisitions remain a key strategy for large technology providers seeking to integrate niche capabilities, particularly in areas like headless commerce, conversational AI, and last-mile delivery optimization.

Regionally, North America maintains the largest market share due to the early adoption of cloud technology, high digital literacy rates among retailers, and the presence of major SaaS vendors. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive e-commerce penetration in countries like China and India, coupled with rapid urbanization and increasing investment in digital infrastructure by emerging economies. European markets demonstrate steady growth, largely catalyzed by stringent data protection regulations (such as GDPR) that necessitate robust, cloud-based data management solutions and a growing focus on sustainable supply chain transparency solutions integrated via SaaS platforms.

In terms of segment trends, solutions related to Customer Experience Management (CXM) and advanced inventory optimization are seeing disproportionate growth. The deployment segment is heavily dominated by the public cloud model, favored by its scalability and lower total cost of ownership, especially among SMEs. Conversely, large, globally distributed retailers are increasingly adopting hybrid cloud strategies to manage sensitive customer data locally while leveraging public cloud environments for high-volume operational tasks. The shift towards machine learning integration within core retail operations—from personalized product recommendations to automated fraud detection—is reshaping segment dynamics across the board.

AI Impact Analysis on Total Retail SaaS Market

User queries regarding AI's impact on Retail SaaS primarily revolve around automation capabilities, the efficacy of personalization, and potential job displacement within retail operations. Users frequently inquire about how AI enhances predictive inventory modeling to reduce waste and stockouts, and the extent to which AI-powered chatbots can replace human customer service agents. There is also significant interest in the competitive advantage derived from generative AI tools that automate content creation for product descriptions and marketing campaigns. These concerns summarize the key expectations of AI—namely, increased efficiency, hyper-personalization, and automated decision-making—while acknowledging anxieties regarding data governance, algorithmic bias, and the substantial technical investment required for adoption.

The integration of Artificial Intelligence and Machine Learning (AI/ML) is fundamentally transforming the Total Retail SaaS market, transitioning solutions from reactive tools to proactive, predictive platforms. AI algorithms are embedded across the entire retail value chain, starting with demand forecasting, where historical data, external factors (weather, social trends), and real-time sales are analyzed to predict future needs with high accuracy. This capability minimizes overstocking and reduces warehousing costs. Furthermore, AI is central to optimizing pricing strategies dynamically; SaaS platforms now automatically adjust prices based on competitor actions, inventory levels, and consumer willingness to pay, maximizing both revenue and sell-through rates.

Beyond operational efficiencies, AI elevates the Customer Experience (CX) through sophisticated personalization engines. SaaS solutions use AI to analyze vast streams of customer data (browsing history, purchase patterns, sentiment analysis) to deliver highly relevant product recommendations, tailored marketing messages, and optimized website layouts. This hyper-personalization is crucial for maintaining customer loyalty in highly competitive digital environments. Moreover, generative AI is accelerating content velocity, enabling retailers to quickly produce engaging, customized content across thousands of SKUs, thereby reducing the manual effort required by marketing and merchandising teams and speeding up time-to-market for new products.

- AI-powered demand forecasting reduces operational waste and optimizes inventory levels.

- Generative AI automates content creation for marketing and product descriptions, increasing speed and scale.

- Machine learning drives dynamic pricing algorithms based on real-time market conditions.

- AI enhances personalized customer journeys through advanced recommendation engines and predictive analytics.

- Conversational AI improves customer service through sophisticated virtual assistants and automated query resolution.

- Fraud detection and security monitoring are significantly strengthened using AI pattern recognition in transactions.

DRO & Impact Forces Of Total Retail SaaS Market

The Total Retail SaaS market is influenced by a powerful combination of drivers, significant restraints, and clear long-term opportunities that collectively shape its trajectory and impact forces. The dominant driver is the pervasive and irreversible trend toward digital transformation across the global retail sector, requiring robust cloud infrastructure to support omnichannel operations. This drive is restrained by complex challenges related to data security and regulatory compliance, particularly concerning cross-border data transfer. However, the opportunity to integrate emerging technologies like 5G, IoT, and edge computing presents new avenues for growth, enabling hyper-efficient physical store operations and real-time inventory tracking. These factors create a high-impact force environment where innovation dictates market leadership and rapid scalability is mandatory.

Key drivers include the imperative for retailers to create seamless, unified commerce experiences, allowing customers to transact effortlessly across online, mobile, and physical store environments. The low-CAPEX model offered by SaaS is highly attractive, especially to mid-sized retailers who lack the resources for massive on-premise infrastructure investments. Furthermore, the explosion of e-commerce, accelerated significantly by global events, mandates that retailers adopt scalable cloud solutions that can handle extreme traffic fluctuations and process high volumes of transactions securely and rapidly. The need for real-time visibility into global supply chains—from manufacturing to last-mile delivery—is also fueling the demand for specialized SaaS SCM and logistics platforms.

Restraints primarily revolve around organizational inertia, particularly among legacy retailers, and the complexities associated with migrating massive volumes of historical data from legacy systems to new cloud environments. Data security and privacy concerns remain a major bottleneck; retailers handle sensitive payment information and personal customer data, making breaches extremely costly and reputationally damaging. Therefore, stringent security certifications and compliance guarantees are non-negotiable requirements for SaaS vendors, raising the barrier to entry. Opportunities are abundant, focusing on the verticalization of SaaS solutions (e.g., specialized software for luxury retail or grocery), the expansion into emerging geographical markets, and the integration of sophisticated AI capabilities to automate decision-making across merchandising, marketing, and fulfillment functions.

Segmentation Analysis

The Total Retail SaaS Market is segmented based on component, deployment model, organizational size, and application type, reflecting the diverse needs of the global retail ecosystem. This segmentation analysis provides a granular view of market dynamics, revealing where investment is concentrated and which technological approaches are gaining traction. The solutions segment, comprising core operational tools like ERP, CRM, and POS, dominates the market share, while the services segment, which includes managed services and professional consulting, is growing rapidly as retailers seek expert assistance in complex cloud migration and integration projects. Understanding these segments is crucial for technology providers aiming to tailor their offerings to specific pain points within the retail environment.

Deployment model segmentation highlights the ongoing preference for the public cloud due to its inherent benefits of accessibility and elasticity, especially appealing to enterprises seeking rapid scaling during peak retail seasons. However, the private cloud remains essential for large enterprises with highly sensitive data requirements or strict internal compliance mandates. The organizational size component indicates robust adoption among Large Enterprises (who typically require customized, expansive solutions), while the SME segment exhibits the highest CAGR, driven by accessible, out-of-the-box SaaS solutions that level the competitive playing field against retail giants. Application segmentation demonstrates the core areas of retail focus, with Inventory Management and Customer Experience Management (CXM) being pivotal growth areas.

- Component:

- Solutions (ERP, CRM, SCM, POS, Analytics & BI, E-commerce Platforms)

- Services (Professional Services, Managed Services)

- Deployment Model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Organizational Size:

- Large Enterprises

- SMEs (Small and Medium-sized Enterprises)

- Application:

- E-commerce & Omnichannel Operations

- Inventory Management & Optimization

- Store Operations Management (including POS)

- Supply Chain Management & Logistics

- Customer Experience Management (CXM)

- Data Analytics & Business Intelligence (BI)

Value Chain Analysis For Total Retail SaaS Market

The value chain of the Total Retail SaaS Market begins with Upstream activities centered on core technology infrastructure providers, including hyperscalers like AWS, Microsoft Azure, and Google Cloud, which supply the necessary cloud computing power, storage, and foundational platform services. Upstream also includes specialized software component developers that supply APIs, microservices, and specialized modules (e.g., payment gateways, advanced security protocols) utilized by SaaS providers. The quality and reliability of these upstream inputs directly influence the performance and scalability of the final retail SaaS product. Partnerships at this stage are critical for maintaining technological competitiveness and ensuring high uptime and robust data security.

The Midstream phase is dominated by the core SaaS vendors—the developers and integrators—who design, build, customize, and maintain the retail-specific applications. These players focus on product development, ensuring seamless integration between modules (e.g., linking inventory to e-commerce storefronts), continuous platform innovation, and managing the subscription and service delivery aspects. The midstream also includes a vast network of system integrators and implementation partners who specialize in tailoring generic SaaS solutions to the unique operational and data requirements of individual retail clients. Their expertise in minimizing disruption during migration and maximizing feature utilization is a crucial component of value delivery.

Downstream activities involve the distribution channel and the end-users. SaaS solutions are typically distributed through direct sales teams for large enterprise contracts, offering specialized consultation and service level agreements (SLAs). Indirect distribution occurs via channel partners, value-added resellers (VARs), and marketplaces (like the Salesforce AppExchange or AWS Marketplace), particularly targeting SMEs with standardized, easy-to-deploy products. The ultimate end-users are the retailers—from large multinational chains to independent boutiques—who leverage these solutions to enhance efficiency, drive sales, and improve customer satisfaction, marking the final realization of value within the chain.

Total Retail SaaS Market Potential Customers

The primary customers for Total Retail SaaS solutions encompass the entire spectrum of the global retail industry, categorized by organizational size, geographic footprint, and industry vertical. Potential buyers are broadly segmented into Large Enterprises (global chains with complex, multi-site, multi-country operations) and Small and Medium-sized Enterprises (SMEs), each seeking different solution characteristics—robust customization and scalability for the former, and affordability and ease-of-use for the latter. The buying decision is often driven by the need for operational efficiency, competitive differentiation through superior customer service, and the capability to execute a unified omnichannel strategy.

Within specific industry verticals, the apparel and footwear sector is a significant consumer, requiring sophisticated inventory management tools to handle seasonal cycles, frequent style changes, and complex sizing matrices. The grocery and quick-service restaurant (QSR) sectors demand highly efficient POS systems, localized supply chain optimization, and perishable inventory tracking. Furthermore, the electronics and general merchandise sectors rely heavily on CXM and data analytics SaaS tools to manage high-value transactions, complex product specifications, and tailored warranty tracking. The common thread among all these buyers is the need for cloud-native solutions that provide real-time data access and can integrate legacy systems without excessive overhaul costs.

Emerging potential customer groups include pure-play direct-to-consumer (D2C) brands, which prioritize headless commerce and marketing automation SaaS tools to maintain complete control over their brand experience and quickly iterate on their digital storefronts. Additionally, wholesalers and distributors, who are increasingly moving towards direct digital selling models, represent a growing buyer segment for SCM and B2B e-commerce SaaS platforms. The decision-makers within these organizations typically include Chief Information Officers (CIOs), Chief Digital Officers (CDOs), and heads of E-commerce, whose priorities align with technological agility and measurable return on investment (ROI) from cloud subscriptions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 78.0 Billion |

| Growth Rate | 17.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Oracle, Microsoft, SAP, Adobe, Shopify, Square, Infor, Epicor, Zoho, Freshworks, NetSuite (Oracle), IBM, AWS, Google Cloud, Aptos, Manhattan Associates, Blue Yonder, Lightspeed, Retail Pro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Total Retail SaaS Market Key Technology Landscape

The technological landscape of the Total Retail SaaS market is rapidly evolving, driven by the principles of agility, elasticity, and interoperability. The foundational shift is towards a Microservices Architecture, replacing monolithic retail systems with smaller, independently deployable services that communicate via Application Programming Interfaces (APIs). This architectural style supports the creation of Composable Commerce, enabling retailers to select and swap out specific best-of-breed functionalities (e.g., checkout, tax calculation, payment processing) without impacting the entire application suite. Headless Commerce is a central element of this landscape, separating the front-end customer experience layer (the 'head') from the back-end commerce logic (the 'body'), allowing retailers to deliver consistent, customized experiences across any touchpoint, including mobile, IoT devices, and interactive displays.

Advanced cloud computing features, particularly Serverless Computing and Function-as-a-Service (FaaS), are crucial for enabling cost-effective scaling during high-demand periods like holiday sales, eliminating the need for retailers to manage underlying infrastructure. Furthermore, the integration of cutting-edge data management and analysis tools is foundational; this includes robust, real-time data lakes and sophisticated Business Intelligence (BI) platforms that allow retailers to synthesize information from various sources—online clicks, physical store traffic, and inventory movements—to generate actionable insights instantly. The increasing utilization of Edge Computing is also noteworthy, pushing computational power closer to the physical store or warehouse, supporting ultra-low latency applications like smart POS systems and automated robotics for fulfillment.

Security technologies within the SaaS ecosystem are paramount, featuring advanced threat detection systems powered by machine learning, multi-factor authentication (MFA), and comprehensive data encryption both in transit and at rest, ensuring compliance with global standards like PCI DSS and GDPR. The rapid proliferation of IoT devices, such as smart shelves, RFID tags, and sensor-equipped logistics vehicles, requires SaaS platforms to handle enormous volumes of streaming data, making connectivity and data ingestion protocols vital technological components. Finally, the growing adoption of low-code/no-code platforms is democratizing access to customization, allowing retail business users, rather than solely IT developers, to configure workflows and create basic applications, accelerating digital adoption and transformation within retail organizations.

Regional Highlights

Regional dynamics significantly influence the adoption and maturity of the Total Retail SaaS Market, reflecting differing levels of digital infrastructure development, e-commerce penetration, and regulatory environments. North America dominates the global market, characterized by technological maturity, early and widespread cloud adoption, and the presence of numerous market leaders in the SaaS space (such as Salesforce and Oracle). Retailers in this region are prioritizing investment in sophisticated AI-driven CXM solutions and advanced supply chain visibility platforms to manage complex cross-border logistics and meet high consumer expectations for speed and personalization. The competitive intensity in the U.S. and Canadian markets drives continuous demand for cutting-edge, scalable SaaS solutions.

Europe represents the second-largest market, exhibiting steady growth fueled by strong digitalization efforts and significant regulatory pressures. The General Data Protection Regulation (GDPR) mandates that European retailers employ stringent data handling practices, driving the demand for SaaS platforms that are inherently compliant and offer advanced data governance features. Western European countries demonstrate high adoption rates, focusing on integrating SaaS for omnichannel retail operations and sustainable sourcing tracking. However, market fragmentation across different languages and diverse tax systems necessitates vendors to provide highly localized and configurable solutions, creating a specialized demand segment.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, propelled by a booming e-commerce sector, high mobile penetration rates, and massive investments in digital infrastructure, particularly in countries like China, India, and Southeast Asia. The retail sector in APAC is characterized by rapid adoption of mobile-first commerce and super-app ecosystems, driving demand for highly agile, API-driven SaaS solutions. The market is still relatively underdeveloped in certain areas, providing significant opportunities for both local and international SaaS vendors. Finally, the Latin America (LATAM) and Middle East & Africa (MEA) regions are emerging markets, where growth is currently concentrated in urban centers and driven by the need for basic retail management solutions, POS modernization, and localized payment gateway integration through flexible, affordable SaaS models.

- North America: Market leader; characterized by high technological maturity, early adoption of AI in CXM, and dominance of major SaaS providers. Focus on large-scale, complex enterprise solutions.

- Europe: Steady growth driven by digital transformation and stringent regulatory environment (GDPR). Strong demand for localized, compliant SaaS solutions for omnichannel execution.

- Asia Pacific (APAC): Fastest-growing region; fueled by massive e-commerce growth, mobile-first strategies, and increasing investment in supply chain and logistics SaaS in emerging economies.

- Latin America (LATAM): Emerging market; growing demand for modern POS systems, payment processing integration, and affordable cloud solutions for scaling SMEs.

- Middle East & Africa (MEA): Nascent market; concentrated growth in urban hubs (UAE, KSA, South Africa); driven by large-scale retail development and the necessity for basic, efficient cloud-based operational tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Total Retail SaaS Market.- Salesforce

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- Adobe Inc.

- Shopify Inc.

- Square (Block Inc.)

- Infor

- Epicor Software Corporation

- Zoho Corporation

- Freshworks Inc.

- NetSuite (Oracle)

- IBM Corporation

- Amazon Web Services (AWS)

- Google Cloud Platform

- Aptos, LLC

- Manhattan Associates

- Blue Yonder

- Lightspeed Commerce Inc.

- Retail Pro International

Frequently Asked Questions

Analyze common user questions about the Total Retail SaaS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Retail SaaS Market?

The primary driver is the mandatory shift towards unified omnichannel commerce, requiring retailers to seamlessly integrate physical and digital sales channels. SaaS provides the scalable, flexible cloud infrastructure necessary to manage complex, real-time inventory and customer data across all touchpoints without high upfront capital expenditure.

How does AI technology specifically benefit retail inventory management within SaaS platforms?

AI benefits inventory management by enabling advanced predictive analytics and demand forecasting. AI algorithms analyze historical sales data, seasonal trends, and external factors (like weather) to optimize stock levels, minimize stockouts, and drastically reduce overstocking and associated carrying costs.

Which regional market is anticipated to exhibit the fastest growth in Retail SaaS adoption?

The Asia Pacific (APAC) region is projected to experience the fastest market growth. This rapid expansion is primarily fueled by accelerated e-commerce penetration, high mobile user adoption, and substantial governmental and private investment in digital infrastructure modernization across key economies.

What are the main concerns retailers have when considering migrating to a Retail SaaS solution?

The main concerns for retailers include data security and privacy compliance (especially GDPR requirements), the complexity and potential disruption involved in migrating large volumes of data from legacy on-premise systems, and ensuring seamless integration with existing core business applications.

What is Headless Commerce and why is it important in the current Retail SaaS landscape?

Headless Commerce is an architectural approach that separates the front-end presentation layer from the back-end commerce engine. It is crucial because it allows retailers to deploy highly customized and consistent customer experiences across diverse and emerging touchpoints (websites, apps, IoT, kiosks) while maintaining a single, centralized commerce logic, ensuring agility and speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager