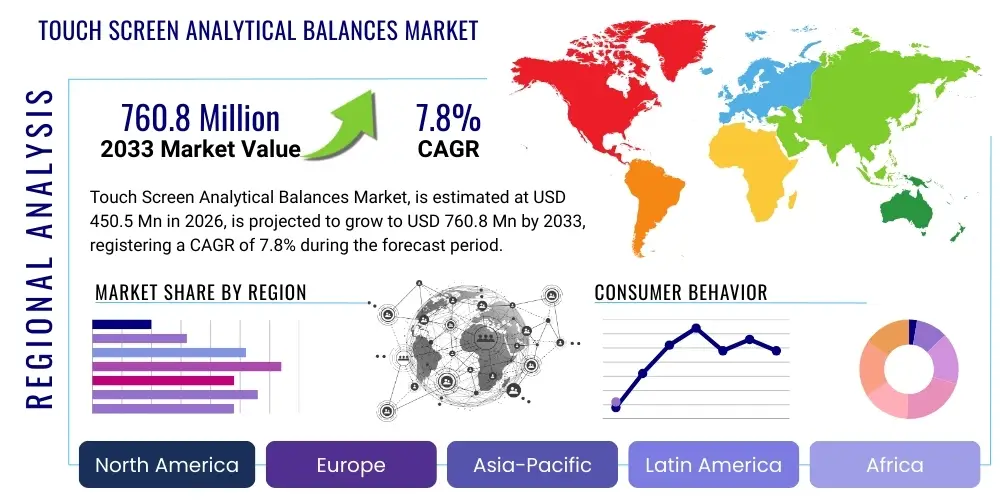

Touch Screen Analytical Balances Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438768 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Touch Screen Analytical Balances Market Size

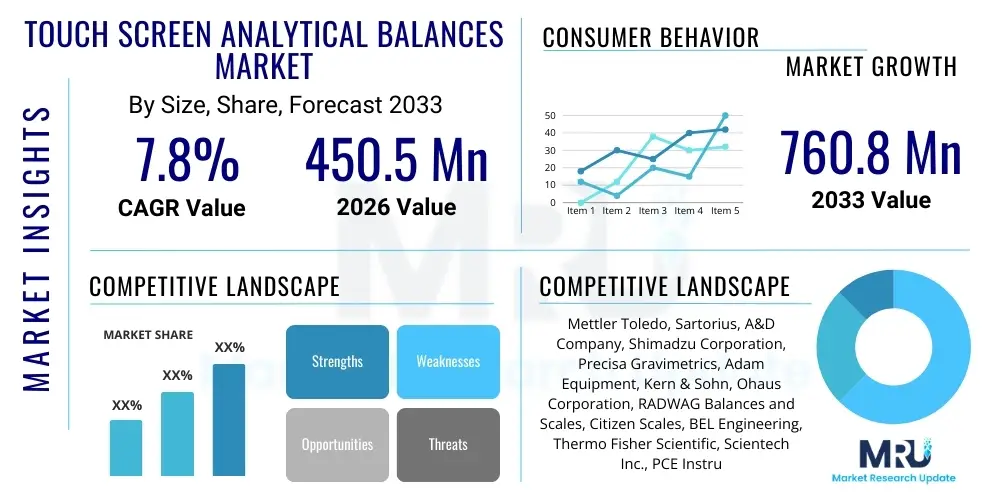

The Touch Screen Analytical Balances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 760.8 million by the end of the forecast period in 2033.

Touch Screen Analytical Balances Market introduction

The Touch Screen Analytical Balances Market encompasses high-precision laboratory weighing instruments characterized by advanced capacitive or resistive touchscreen interfaces, replacing traditional mechanical keypads. These modern balances offer superior user experience, streamlined workflow integration, and enhanced data management capabilities, catering primarily to highly regulated industries requiring minute measurement accuracy, such as pharmaceutical quality control and specialized chemical analysis. The product provides significantly faster calibration processes, multi-language support, and connectivity options (like LIMS integration and Wi-Fi), which are crucial for contemporary laboratory environments aiming for efficiency and regulatory compliance. Key applications span across formulation development, quality assurance testing, density determination, and highly sensitive sample preparation in analytical chemistry.

The primary benefits driving the adoption of touch screen analytical balances include their intuitive operation, which reduces the potential for human error during complex weighing sequences, and their ability to store and manage vast amounts of weighing data, fulfilling stringent audit trail requirements (e.g., FDA 21 CFR Part 11). These instruments often feature advanced integrated software that guides users through standard operating procedures (SOPs), ensuring consistency across multiple technicians and reducing training overhead. Furthermore, the modern touch screen design facilitates easier cleaning and sanitation compared to traditional button interfaces, enhancing safety and cross-contamination prevention, especially relevant in sterile pharmaceutical manufacturing settings and bioscience research.

Key driving factors propelling market expansion include the rapid growth of the global pharmaceutical and biotechnology sectors, necessitating ultra-precise weighing for drug discovery and quality control; increasing investments in research and academic institutions upgrading older laboratory infrastructure; and the persistent demand for automation and data traceability in analytical laboratories worldwide. The push for digitalization in laboratory operations (Lab 4.0) makes these technologically sophisticated balances indispensable tools for maximizing productivity and adhering to evolving international quality standards for measurement and calibration integrity.

Touch Screen Analytical Balances Market Executive Summary

The global market for Touch Screen Analytical Balances is experiencing robust growth, primarily fueled by the accelerating convergence of digitalization in laboratory environments and stringent regulatory demands for verifiable measurement accuracy across developed economies. Business trends highlight a significant competitive focus on developing smart balances equipped with built-in application software for specific tasks (e.g., pipette calibration, dynamic weighing), enhancing their utility beyond basic mass measurement. Furthermore, manufacturers are increasingly integrating advanced security features and cloud connectivity to facilitate remote monitoring and seamless data transfer, aligning with the industry's shift towards networked laboratory ecosystems. Strategic mergers and acquisitions among leading instrumentation providers are consolidating the market, allowing larger entities to capture broader geographic footprints and technological expertise, particularly in high-growth segments such as personalized medicine and specialty chemicals.

Regional trends indicate that North America and Europe continue to dominate the market share, driven by high R&D spending, mature pharmaceutical industries, and rapid adoption of cutting-edge laboratory automation technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, underpinned by massive government investments in expanding domestic biotechnology capabilities, the establishment of new contract research organizations (CROs), and increasing foreign direct investment in manufacturing facilities in countries like China, India, and South Korea. These emerging markets are rapidly adopting modern, high-throughput analytical instruments to meet global export quality standards, creating substantial demand for advanced touch screen balances that offer reliable performance and regulatory compliance.

Segmentation trends reveal a strong preference for high-precision models (0.01mg readability or better) within the pharmaceutical and materials science sectors, driven by the need to measure minute quantities of active pharmaceutical ingredients (APIs) and exotic materials. Concurrently, the proliferation of specialized applications is boosting demand for niche product variations, such as anti-static models and large-capacity analytical balances. The end-user segment of research and academia remains a stable cornerstone, while environmental testing laboratories are showing accelerated adoption rates as global regulations on pollution and quality control tighten, requiring highly precise measurements of contaminants in diverse samples. The push toward integrated laboratory systems ensures that balances offering superior compatibility and programming flexibility maintain a competitive advantage.

AI Impact Analysis on Touch Screen Analytical Balances Market

User inquiries regarding AI's influence on analytical balances primarily focus on how Artificial Intelligence can enhance weighing accuracy, automate calibration routines, and predict instrument maintenance needs to minimize downtime. Key concerns revolve around the integration of AI-driven data processing capabilities directly into the balance interface, allowing for immediate error detection, complex statistical analysis of weighing results, and improved compliance auditing. Users are seeking instruments that leverage machine learning algorithms to learn user behavior, optimize workflow patterns, and automatically adjust environmental parameters (like vibration or temperature compensation) to maintain peak precision. The overarching expectation is that AI will transform the balance from a static measurement device into an intelligent analytical node within the laboratory network.

- AI enhances data integrity by immediately flagging anomalous measurement readings.

- Predictive maintenance algorithms minimize instrument downtime through proactive alerts on mechanical wear or calibration drift.

- Machine learning models optimize self-calibration frequency based on usage and environmental fluctuations.

- AI-driven workflow optimization simplifies complex multi-step weighing procedures, reducing technician training time.

- Integration with LIMS systems facilitates automated, AI-verified data entry and compliance checks (e.g., 21 CFR Part 11).

- Deep learning is used to filter out noise and environmental disturbances, improving the repeatability of ultra-micro weighing results.

DRO & Impact Forces Of Touch Screen Analytical Balances Market

The market dynamics for touch screen analytical balances are governed by a complex interplay of regulatory drivers mandating superior accuracy and data integrity, technological advancements increasing device capability, and the persistent need for efficiency improvements in laboratory operations. The strict global quality standards, such as those imposed by the FDA, EMA, and ISO guidelines, necessitate instruments that not only provide precise measurement but also offer comprehensive audit trails and secure data handling, inherently favoring advanced touch screen models over older analog versions. This regulatory pressure acts as a fundamental driver, forcing laboratories to upgrade their existing inventory. Conversely, high initial investment costs and the complexities associated with integrating new smart instruments into legacy laboratory information management systems (LIMS) present notable restraints, particularly for smaller academic or research facilities operating under tight budget constraints.

Opportunities for market growth lie predominantly in the burgeoning field of personalized medicine and the rapid expansion of contract research and manufacturing organizations (CROs/CMOs), particularly in fast-developing regions. These organizations require scalable, high-throughput, and compliant instrumentation, creating a continuous demand pipeline for sophisticated analytical balances. Furthermore, the trend toward miniaturization in chemical synthesis and materials science necessitates balances capable of sub-microgram measurements, pushing manufacturers to continuously innovate precision and sensitivity. The ongoing development of cloud-based laboratory software and IoT connectivity presents a chance to offer subscription-based services centered around data management and remote diagnostics, generating sustainable post-sale revenue streams.

The primary impact forces shaping the competitive landscape are technological innovation—specifically the speed at which manufacturers integrate connectivity features, application software, and compliance tools—and the intensifying standardization requirements globally. These forces compel companies to invest heavily in R&D to maintain product relevance and market positioning. Another significant impact force is the scarcity of highly skilled lab technicians; therefore, instruments that simplify complex procedures through intuitive, touch-based graphical interfaces and automated calibration sequences gain substantial market traction. The consolidation of research budgets post-pandemic also forces end-users to prioritize multi-functional, durable, and highly reliable instruments, increasing the barriers to entry for new market participants and favoring established brands known for calibration expertise and extensive service networks.

Segmentation Analysis

The Touch Screen Analytical Balances market is segmented based on product type (differentiated primarily by readability/precision), end-user application, and geographical region. Segmentation by type focuses on the degree of accuracy required by the application, with high-precision balances catering to ultra-sensitive environments like pharmaceutical QA/QC, and standard precision models suitable for general university research or food quality testing. The end-user classification highlights the dominance of the pharmaceutical and biotechnology sector due to its high volume of mandatory analytical testing. Understanding these segments is crucial for manufacturers to tailor product features, such as specific application modes (e.g., formulation, checking, statistics) and connectivity options, to meet the distinct needs of specialized laboratory workflows.

- By Type

- High Precision (Readability < 0.1mg)

- Standard Precision (Readability 0.1mg to 1mg)

- By End-User

- Pharmaceutical & Biotechnology Companies

- Research & Academic Institutions

- Chemical & Petrochemical Industry

- Food & Beverage Testing Laboratories

- Environmental Testing Agencies

- Contract Research Organizations (CROs)

- By Capacity

- Micro Balances (Below 5g)

- Semi-Micro Balances (5g to 50g)

- Analytical Balances (50g to 500g)

- By Sales Channel

- Direct Sales

- Distributors and Resellers

Value Chain Analysis For Touch Screen Analytical Balances Market

The value chain for Touch Screen Analytical Balances starts with upstream analysis, which involves the sourcing of highly specialized and expensive components, including precision load cells (e.g., electromagnetic force restoration technology), sophisticated microprocessors, high-resolution capacitive touch screens, and robust housing materials. Key upstream activities are characterized by strict quality control over sensor manufacturing, as the accuracy of the final instrument is fundamentally dependent on the quality and stability of the load cell. Strategic supplier relationships are vital to ensure the consistent supply of certified components, minimizing delays and maintaining cost competitiveness, particularly in the production of proprietary weighing mechanisms and highly durable software interfaces designed for lab environments.

The downstream analysis focuses on the distribution, sales, and post-sales service of the analytical balances. Products reach end-users through two primary channels: direct sales teams employed by multinational corporations for large contracts and specialized distributors/resellers who provide localized support, installation, and routine maintenance services. Direct channels are preferred for high-volume, strategically important accounts (like global pharmaceutical giants), offering direct factory support and technical consultation. Indirect channels leverage the geographical reach and established customer bases of distributors, which is crucial for penetrating smaller laboratories and academic institutions globally. The distribution channel selection often hinges on the level of required customer training and the complexity of the balance model being sold, with touch screen balances often requiring more focused application support.

Post-sales service represents a significant portion of the downstream value, including scheduled calibration, certification, repairs, and software updates. For touch screen analytical balances, the ability to provide remote diagnostics and software support for LIMS integration adds substantial value. Effective distribution channels ensure prompt delivery and specialized handling of sensitive instruments, maintaining their calibration integrity from the factory floor to the lab bench. The direct and indirect market dynamics are balanced, with direct sales emphasizing technical expertise and brand loyalty, while indirect channels provide essential market access and rapid regional deployment, often handling ancillary services like trade-ins or equipment rentals.

Touch Screen Analytical Balances Market Potential Customers

The primary consumers (End-User/Buyers) of Touch Screen Analytical Balances are diverse research and quality control laboratories requiring extremely accurate and traceable mass measurements. Pharmaceutical and biotechnology companies represent the largest customer base, using these instruments extensively in drug discovery, formulation testing, stability testing, and final product quality assurance, adhering strictly to pharmacopeial standards (USP, EP, JP). The need for audit-proof data and guided workflows makes the touch screen interface a mandatory requirement in highly regulated environments, ensuring compliance with standards such as GLP (Good Laboratory Practice) and GMP (Good Manufacturing Practice).

Academic and governmental research institutions constitute the second major customer segment. Universities and publicly funded research centers utilize these balances for foundational chemistry, physics, and materials science projects, where budgetary cycles often dictate procurement schedules but the demand for high precision remains constant. Furthermore, industrial quality control labs in the chemical, petrochemical, and plastics sectors are significant buyers, employing these instruments for raw material verification, product consistency checks, and complex mixture preparation. The Food and Beverage industry is an increasingly important customer, particularly for testing nutritional content, trace contaminants, and ensuring batch uniformity, necessitating fast and reliable measurements supported by user-friendly interfaces.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 million |

| Market Forecast in 2033 | USD 760.8 million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mettler Toledo, Sartorius, A&D Company, Shimadzu Corporation, Precisa Gravimetrics, Adam Equipment, Kern & Sohn, Ohaus Corporation, RADWAG Balances and Scales, Citizen Scales, BEL Engineering, Thermo Fisher Scientific, Scientech Inc., PCE Instruments, Acculab, Shanghai Hengping Scientific Instrument, Setra Systems, Avery Weigh-Tronix, Essae Technoquip, Gram Precision |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Touch Screen Analytical Balances Market Key Technology Landscape

The technological landscape of the Touch Screen Analytical Balances market is defined by advancements aimed at enhancing user interaction, integration capabilities, and measurement performance stability. The core technology remains the Electromagnetic Force Restoration (EMFR) mechanism, providing the highest level of precision and stability required for analytical weighing. However, modern balances integrate sophisticated digital signal processing (DSP) to filter out noise and improve settling time, crucial for high-throughput laboratories. The transition from resistive to high-definition capacitive touchscreens has significantly improved durability, responsiveness, and cleanability, enabling gestures and multi-touch functionality commonly found in consumer electronics, which enhances user acceptance and reduces operational complexity in often gloved environments.

Connectivity protocols are rapidly evolving, moving beyond standard RS-232 and USB interfaces. Contemporary touch screen balances are now commonly equipped with Wi-Fi, Ethernet, and Bluetooth capabilities, supporting the seamless transfer of data directly to LIMS, ERP systems, or cloud storage platforms. This integration supports the trend of Laboratory 4.0, facilitating central data management and regulatory compliance efforts, particularly concerning data integrity (ALCOA+ principles). Furthermore, integrated sensor technology is becoming standard, including sophisticated internal temperature monitoring and automatic internal calibration (AIC) features that adjust the balance based on ambient conditions without requiring manual user intervention, thereby ensuring measurement accuracy across fluctuating laboratory environments.

Software sophistication represents a crucial differentiator in the current market. Advanced firmware includes embedded applications for complex tasks such as density determination, formulation, percentage weighing, and statistical quality control (SQC) routines. Many high-end models now feature modular software architecture allowing for custom applications and user profiles, simplifying compliance by enforcing specific SOPs through the touch interface. The incorporation of anti-static technologies, such as integrated ionizers, is also a key innovation, particularly important when dealing with fine powders and plastics which can generate static electricity and drastically affect weighing accuracy, further solidifying the instruments’ reliability in diverse scientific applications.

Regional Highlights

- North America: This region holds the largest market share, driven by massive expenditures in biopharmaceutical R&D, the presence of major key market players, and stringent FDA regulations demanding the highest standards of measurement accuracy and data traceability. The high adoption rate of laboratory automation and digitalization across academic and industrial labs further solidifies its dominant position.

- Europe: Characterized by a strong presence of advanced chemical industries and rigorous regulatory frameworks (e.g., EMA), Europe is a mature market focusing on replacing legacy equipment with connected, compliant touch screen models. Germany, Switzerland, and the UK are primary hubs for innovation and high-precision instrument manufacturing and usage.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid expansion of pharmaceutical manufacturing bases, increasing government funding for scientific research in countries like China and India, and rising awareness of international quality standards. Low manufacturing costs and increasing foreign investment are accelerating the demand for sophisticated analytical instrumentation.

- Latin America (LATAM): Growth in LATAM is steady, primarily concentrated in Brazil and Mexico, fueled by expanding local manufacturing and increased investment in food safety and quality control laboratories. However, market adoption is often sensitive to economic stability and local currency fluctuations affecting import costs.

- Middle East and Africa (MEA): This region is an emerging market, driven largely by investments in petroleum and petrochemical research and development, alongside nascent efforts to build biotechnology infrastructure. Adoption is selective, focusing mainly on large governmental labs and key industrial testing facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Touch Screen Analytical Balances Market.- Mettler Toledo

- Sartorius

- A&D Company

- Shimadzu Corporation

- Precisa Gravimetrics

- Adam Equipment

- Kern & Sohn

- Ohaus Corporation

- RADWAG Balances and Scales

- Citizen Scales

- BEL Engineering

- Thermo Fisher Scientific

- Scientech Inc.

- PCE Instruments

- Acculab

- Shanghai Hengping Scientific Instrument

- Setra Systems

- Avery Weigh-Tronix

- Essae Technoquip

- Gram Precision

Frequently Asked Questions

What is the projected CAGR for the Touch Screen Analytical Balances Market between 2026 and 2033?

The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period from 2026 to 2033, driven by digitalization and regulatory demands for improved precision.

Which end-user segment dominates the demand for touch screen analytical balances?

The Pharmaceutical and Biotechnology sector is the dominant end-user segment, primarily due to the stringent requirements for high-precision weighing, data integrity, and compliance with global regulatory standards like GMP.

How does the touch screen interface enhance laboratory compliance?

The touch screen interface facilitates compliance by enabling guided workflows, securing user access via login profiles, and providing intuitive platforms for managing audit trails and securely exporting data directly compatible with LIMS systems, supporting 21 CFR Part 11 requirements.

What are the primary technological innovations influencing this market?

Key technological innovations include the integration of advanced connectivity (Wi-Fi, Ethernet) for Laboratory 4.0 integration, AI-driven predictive maintenance and self-calibration, and sophisticated application software built into the touch interface for specialized analytical tasks.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate, fueled by substantial government investment in research infrastructure and the rapid expansion of domestic pharmaceutical and contract research organizations (CROs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager