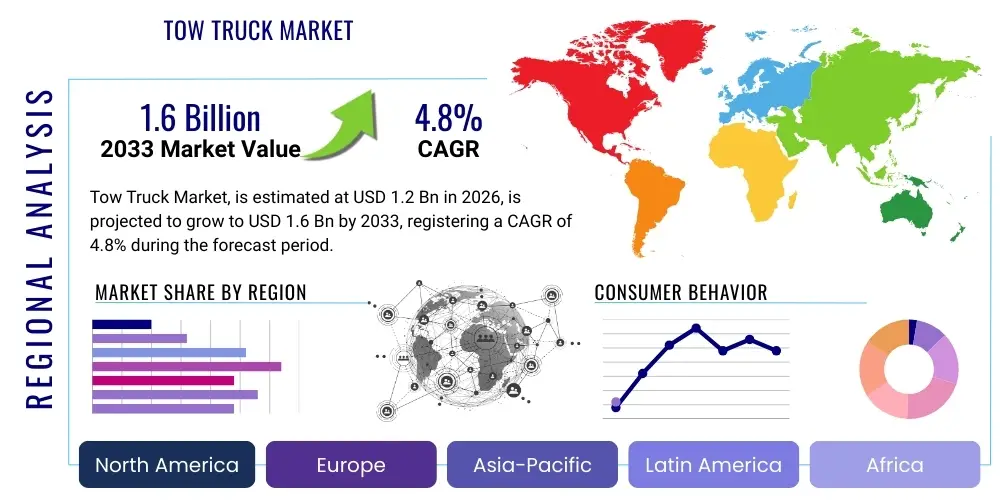

Tow Truck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437944 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Tow Truck Market Size

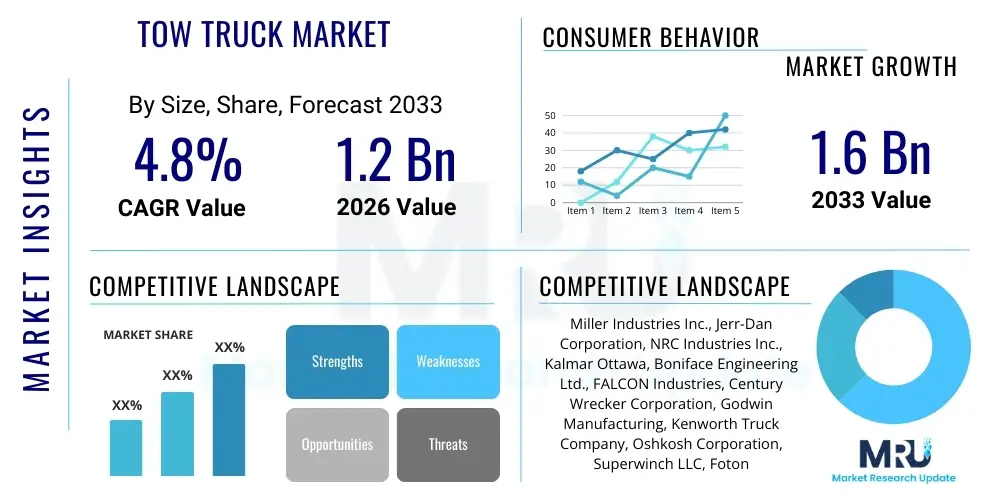

The Tow Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.6 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the increasing volume of vehicle sales globally, leading to a larger operational vehicle fleet that requires periodic roadside assistance and accident recovery services. Furthermore, rapid infrastructural development and the consequent rise in traffic congestion contribute significantly to the demand for efficient towing and recovery solutions, establishing a stable growth trajectory for the specialized vehicle segment.

The market valuation reflects the essential role tow trucks play in maintaining operational efficiency across commercial logistics and private transport sectors. Demand is segmented across various types, including flatbed, wheel-lift, and integrated recovery systems, each catering to specific needs such as accident scene management, vehicle repossession, or general maintenance hauling. Technological integration, particularly in telematics and navigation systems, is enhancing the efficiency of tow truck operations, allowing service providers to offer faster and more reliable services, thereby justifying premium pricing models and supporting the upward revision of market forecasts.

Tow Truck Market introduction

The Tow Truck Market encompasses the manufacturing, distribution, and utilization of specialized motor vehicles designed for the recovery, towing, and transportation of disabled, impounded, or otherwise non-operational vehicles. These products range from light-duty trucks used for passenger cars to heavy-duty rotators capable of recovering tractor-trailers and commercial vehicles. Major applications include roadside assistance for breakdowns, vehicle recovery following accidents, municipal vehicle impoundment, and specialized transportation for vintage or high-value vehicles. The primary benefit of this market lies in ensuring safety on roadways, minimizing traffic obstruction, and providing reliable logistic support for vehicle maintenance and legal processes.

Driving factors for the market expansion are multifaceted, including the continuous growth of the global vehicle parc, which naturally increases the probability of breakdowns and collisions. Furthermore, stringent traffic laws and an emphasis on urban mobility management necessitate prompt removal of disabled vehicles. Technological advancements, such as the development of hybrid and electric tow trucks, are also shaping the market by addressing environmental concerns and improving operational efficiency through enhanced torque delivery and lower maintenance requirements. The complexity of modern vehicle designs, especially those with advanced driver-assistance systems (ADAS) and electric powertrains, necessitates specialized towing equipment, further segmenting and strengthening market demand for sophisticated recovery tools.

Tow Truck Market Executive Summary

The Tow Truck Market is undergoing significant transformation driven by evolving business trends centered on technological integration and operational optimization. Current business trends show a pronounced shift towards specialized, heavy-duty tow trucks (rotators) required for complex commercial vehicle recovery, alongside a focus on lighter, fuel-efficient models for standard roadside assistance. Investment in telematics and integrated dispatch systems represents a major operational trend, allowing towing companies to reduce response times and improve resource allocation efficiency. Furthermore, the market is consolidating, with larger manufacturers acquiring smaller, niche players to gain access to specialized technologies and expanded geographic reach, emphasizing vertical integration and standardized fleet management practices.

Regionally, North America and Europe dominate the market due to robust infrastructure, high vehicle ownership rates, and well-established insurance and roadside assistance networks that mandate professional recovery services. The Asia Pacific region, particularly China and India, presents the highest growth potential, fueled by rapid urbanization, massive infrastructure projects, and a burgeoning middle class increasing vehicle penetration. These emerging markets are seeing substantial investment in organized towing services, moving away from informal practices. However, these regions face challenges related to regulatory standardization and the availability of skilled operators for specialized heavy-duty recovery.

In terms of segment trends, the flatbed tow truck segment retains the largest market share due to its versatility, safety profile (especially for electric and high-end vehicles), and ability to transport multiple types of cargo. However, the wheel-lift segment is witnessing increasing adoption for municipal and residential towing due to its maneuverability and lower operational costs. The most critical segment trend is the rising demand for tow trucks specifically adapted for electric vehicles (EVs). These trucks require specialized lifting points, non-metallic chains, and greater weight capacities to handle the heavy battery packs, pushing manufacturers toward innovation in chassis design and recovery accessory kits.

AI Impact Analysis on Tow Truck Market

User queries regarding the influence of Artificial Intelligence on the Tow Truck Market primarily revolve around how AI can optimize operational efficiency, specifically focusing on autonomous towing vehicles, dynamic pricing strategies, and intelligent dispatch systems. Users frequently ask if AI will replace human operators, or if it will simply enhance route planning and predictive maintenance for the tow truck fleet itself. A major theme is the potential for AI-driven dynamic routing, which considers real-time traffic data, weather conditions, and proximity to specialized equipment requirements to dispatch the most appropriate vehicle in the shortest time, directly impacting profitability and customer satisfaction rates. The consensus expectation is that AI will revolutionize backend logistics and fleet management rather than immediately replacing the physical recovery process, which remains human-intensive.

Concerns often center on data privacy, the initial investment required for sophisticated AI-powered telematics systems, and the retraining necessary for human dispatchers and drivers. However, the anticipated benefits, such as reducing fuel consumption through optimized routing (a significant operating expenditure) and improving accident prediction models, outweigh these initial hurdles. AI's ability to analyze vast amounts of historical breakdown data, predicting where and when demand peaks will occur, allows towing companies to strategically position their fleet preemptively, turning reactive services into proactive operations, thus enhancing the overall utility and responsiveness of the sector.

- AI-Powered Dispatch Optimization: Algorithms minimize travel time and maximize service coverage by analyzing real-time data, resulting in faster customer response.

- Predictive Maintenance: AI monitors vehicle health (engine, hydraulics) to schedule maintenance before failure, increasing fleet uptime and reliability.

- Autonomous Repositioning: Limited deployment of self-driving tow trucks for relocation within yards or low-traffic areas, reducing labor costs.

- Dynamic Pricing Models: Algorithms adjust service charges based on demand, distance, time of day, and severity of the incident.

- Insurance Claims Automation: AI accelerates the documentation and processing of accident scenes by analyzing captured images and data from the tow truck’s integrated camera systems.

DRO & Impact Forces Of Tow Truck Market

The Tow Truck Market is propelled by several strong drivers, notably the increasing vehicle population and the resultant rise in road accidents and breakdowns globally, demanding immediate recovery services. Infrastructure growth, particularly complex highway systems and urban expansion, also acts as a driver, as these environments necessitate professional removal of disabled vehicles to maintain traffic flow. Conversely, the market faces significant restraints, including the high initial procurement cost of heavy-duty, technologically advanced tow trucks and the shortage of highly skilled operators capable of handling sophisticated recovery equipment like hydraulic rotators. Regulatory complexity, which varies significantly by municipality regarding permits, zoning, and weight limits, also adds friction to large-scale operational expansion.

Opportunities for growth are concentrated in the rapid adoption of electric vehicles (EVs). Since EVs require specialized handling and heavier equipment due to battery weight, manufacturers introducing EV-specific towing solutions will gain a competitive edge. Furthermore, the development of Smart Cities and IoT integration offers opportunities for centralized, automated emergency response systems that seamlessly integrate tow truck dispatch, creating highly efficient service ecosystems. The impact forces acting on the market are dominated by technological influence, which mandates continuous hardware and software upgrades, and regulatory pressures, particularly related to safety standards and environmental mandates (e.g., lower emissions standards for fleet vehicles).

The overall impact force of opportunities currently outweighs the restraints, primarily driven by the undeniable necessity of the service provided. Despite high initial costs, the long-term operational efficiency gains realized through telematics, optimized route planning, and specialized equipment for high-value recoveries (like commercial cargo and electric vehicles) ensure consistent investment. The trend towards professionalization and outsourcing of fleet management by logistics and insurance companies also supports market growth, shifting the financial burden of fleet ownership away from smaller, independent operators towards large, consolidated service providers who can better absorb the high capital expenditure associated with advanced tow truck technologies.

Segmentation Analysis

The Tow Truck Market is comprehensively segmented based on product type, vehicle capacity, and primary application, allowing manufacturers and service providers to target specific operational niches efficiently. Segmentation by product type—flatbed, wheel-lift, integrated, and hook & chain—is crucial as each design offers distinct advantages in recovery scenarios, maneuvering capabilities, and the level of damage prevention to the towed vehicle. Capacity segmentation, ranging from light-duty (passenger cars) to heavy-duty (large commercial vehicles), directly impacts the capital investment required and the types of services a company can offer. Application-based segmentation highlights the major end-user verticals, such as roadside assistance, accident recovery, and vehicle impoundment, reflecting varying contractual and regulatory requirements.

- By Product Type:

- Flatbed Tow Truck (Most preferred for high-end and electric vehicles)

- Wheel-Lift Tow Truck (Commonly used for municipal and general passenger car towing)

- Integrated Tow Truck (Heavy-duty recovery, combining wheel-lift and boom functions)

- Hook and Chain Tow Truck (Declining usage due to potential vehicle damage)

- By Capacity:

- Light-Duty Tow Trucks (Up to 10,000 lbs GVWR)

- Medium-Duty Tow Trucks (10,000 lbs to 26,000 lbs GVWR)

- Heavy-Duty Tow Trucks (Above 26,000 lbs GVWR, including Rotators)

- By Application:

- Roadside Assistance

- Accident Recovery

- Vehicle Impoundment and Repossession

- Transportation Services (e.g., specialty equipment hauling)

Value Chain Analysis For Tow Truck Market

The value chain for the Tow Truck Market begins with upstream activities involving raw material suppliers, predominantly providing high-strength steel, aluminum, hydraulic components, and specialized chassis components. Chassis manufacturers (such as Ford, International, and Hino) form a critical part of the upstream segment, providing the bare foundation upon which the specialized towing mechanism is built. Strong contractual relationships between tow truck body builders and chassis suppliers are essential for consistent quality and adherence to regulatory safety standards. Efficient sourcing of hydraulic systems, which dictate the lifting and pulling capabilities of the truck, significantly impacts the final product's performance and cost structure.

Midstream activities are dominated by tow truck body manufacturers (like Miller Industries and Jerr-Dan), who specialize in the complex engineering and installation of the boom, winch, and recovery systems onto the procured chassis. This stage involves significant investment in specialized tooling and welding technology. Downstream activities focus on the distribution channels, which are segmented into direct sales to large fleet operators (e.g., state police, large insurance companies) and sales through authorized regional dealerships. Dealerships often provide essential services such as customization, financing, and post-sale maintenance, playing a crucial role in reaching smaller, independent towing operators. The dominance of indirect distribution via specialized dealers ensures regional market penetration and localized support.

The integration of technology, particularly telematics hardware installation and software integration, is increasingly becoming a core value-added step in the midstream and downstream segments. Manufacturers are partnering with IT firms to embed fleet management and operational tracking systems directly into the trucks before sale. Furthermore, after-market services, including repairs, specialized parts replacement, and operator training, represent a significant revenue stream in the value chain, ensuring the long operational lifespan of these high-capital assets. The efficiency of the entire chain relies heavily on adherence to international safety certifications and standards, which are paramount given the critical and often dangerous operational environment of tow trucks.

Tow Truck Market Potential Customers

The primary end-users and buyers in the Tow Truck Market span multiple sectors, characterized by organizations requiring reliable, rapid vehicle recovery and transport capabilities. Insurance companies and large-scale automobile clubs (e.g., AAA in North America) represent major institutional customers, often contracting for large fleets through third-party towing providers, thus driving demand for standardized, high-volume light- and medium-duty trucks. Municipal and governmental agencies, including police departments and state highway authorities, are key customers for heavy-duty and integrated tow trucks, utilizing them for regulatory enforcement, traffic clearance, and accident scene management, often purchasing directly from manufacturers or specialized government contractors.

Another significant customer segment includes independent towing operators and small-to-medium enterprises (SMEs) specializing in roadside assistance and vehicle repossession. These smaller players typically purchase individual units or small fleets through regional dealers, focusing on affordability, durability, and versatility. Furthermore, logistics and transportation companies with large commercial fleets occasionally invest in their own in-house recovery units, particularly heavy-duty rotators, to minimize downtime when their tractor-trailers or specialized hauling vehicles encounter issues on remote routes, prioritizing speed of recovery over external service costs.

The emerging category of potential customers includes specialized electric vehicle service centers and EV charging infrastructure providers. As the EV market grows, these entities require highly specialized, non-damaging recovery equipment tailored to the unique structural and weight constraints of electric cars. These customers prioritize flatbed and specialized wheel-lift systems that avoid contacting or damaging the battery enclosure, necessitating advanced training and specific vehicle configurations from manufacturers, representing a high-growth niche for potential sales in the forecast period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.6 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miller Industries Inc., Jerr-Dan Corporation, NRC Industries Inc., Kalmar Ottawa, Boniface Engineering Ltd., FALCON Industries, Century Wrecker Corporation, Godwin Manufacturing, Kenworth Truck Company, Oshkosh Corporation, Superwinch LLC, Foton Motor Group, Dongfeng Motor Corporation, ZOOMLION Heavy Industry Science and Technology Co., Ltd., and VDL Groep. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tow Truck Market Key Technology Landscape

The technology landscape in the Tow Truck Market is rapidly evolving, moving beyond simple mechanical hoisting toward highly interconnected, smart operational systems. A key development is the widespread integration of advanced telematics and IoT devices, enabling real-time GPS tracking, driver behavior monitoring, and detailed operational data logging. These systems are crucial for optimizing fleet utilization, ensuring regulatory compliance regarding Hours of Service (HOS), and providing instant communication between dispatchers and drivers, thereby significantly improving response times, which is a critical differentiator in the competitive roadside assistance sector. Furthermore, modern tow trucks rely on sophisticated hydraulic and pneumatic control systems, often managed digitally, providing greater precision and safety during complex lifts and recoveries.

Another significant technological shift involves the adoption of specialized equipment for electric vehicle (EV) towing. Manufacturers are engineering recovery decks with non-ferrous materials or incorporating specialized protective padding to prevent damage to sensitive battery packs during transport. Furthermore, the push for environmental sustainability is driving innovation in powertrain technology, leading to the introduction of hybrid and fully electric tow truck models, especially in urban environments where noise and emissions regulations are stringent. These electric variants offer immediate torque benefits, which are highly advantageous for towing heavy loads, alongside reduced long-term fuel and maintenance costs.

The integration of advanced sensor technology, including collision avoidance systems and 360-degree cameras, is now standard in high-end tow truck models, enhancing operational safety for both the operator and the public at the recovery site. Furthermore, proprietary software solutions are being developed for mobile operations, allowing drivers to complete digital inspection reports, process payments, and manage documentation directly from the truck cab. This digitalization reduces administrative friction and accelerates the entire service delivery cycle, providing comprehensive data streams that inform future strategic decisions regarding fleet purchasing and geographical service expansion.

Regional Highlights

North America holds the dominant share of the Tow Truck Market, characterized by high disposable income, extensive highway networks, and a mature ecosystem supported by major auto clubs and insurance providers. The region benefits from stringent safety regulations and a high demand for heavy-duty recovery services due to large commercial trucking fleets. The United States specifically sees continuous demand driven by aging vehicles requiring service and significant investment in specialized, high-capacity rotators for complex accident management on interstates. Canada follows a similar trend, emphasizing durability and specialized components to cope with harsh winter conditions, which increase the frequency of required recovery operations.

Europe represents a robust, highly regulated market where the emphasis is shifting towards greener solutions. Western European nations, driven by strict urban emissions standards (e.g., Euro VI), are leading the demand for hybrid and electric tow trucks. Germany, France, and the UK are primary consumers, necessitated by the high density of vehicles and strict regulatory requirements for quick vehicle removal to maintain traffic flow. The region is seeing strong growth in the medium-duty flatbed segment, favored for safely handling luxury and performance cars, alongside increasing adoption of integrated telematics required for cross-border operational transparency and adherence to varying national road safety laws.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period. This rapid expansion is attributed to massive vehicle population growth, improving road infrastructure in developing economies like India and Indonesia, and a governmental push towards organizing the previously fragmented roadside assistance sector. China is a major manufacturing hub and consumer, benefiting from high volumes of domestic vehicle sales and large infrastructure projects demanding heavy-duty recovery support. However, market growth in APAC is often hampered by price sensitivity and fragmented regulatory landscapes, which means manufacturers must offer durable, cost-effective solutions tailored to diverse local operational standards and maintenance practices.

- North America: Market dominance due to established insurance schemes, high commercial fleet volumes, and strong demand for specialized heavy-duty rotators.

- Europe: Focus on regulatory compliance, advanced telematics integration, and rising demand for hybrid and electric tow truck models, especially in urban low-emission zones.

- Asia Pacific (APAC): Highest growth potential driven by urbanization, expanding vehicle parc in China and India, and increasing professionalization of roadside assistance services.

- Latin America: Moderate growth, highly dependent on macroeconomic stability and governmental investment in road infrastructure and public services.

- Middle East and Africa (MEA): Growth concentrated in GCC nations (UAE, Saudi Arabia) due to high infrastructure spending and investment in large commercial and oilfield fleets requiring robust recovery capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tow Truck Market.- Miller Industries Inc.

- Jerr-Dan Corporation

- NRC Industries Inc.

- Boniface Engineering Ltd.

- FALCON Industries

- Century Wrecker Corporation

- Godwin Manufacturing

- Kalmar Ottawa

- Kenworth Truck Company

- Oshkosh Corporation

- Superwinch LLC

- Foton Motor Group

- Dongfeng Motor Corporation

- ZOOMLION Heavy Industry Science and Technology Co., Ltd.

- VDL Groep

- Manitowoc Company, Inc.

- Volvo Group (for chassis)

- Hino Motors, Ltd. (for chassis)

- ISUZU MOTORS LIMITED (for chassis)

- PALFINGER AG

Frequently Asked Questions

Analyze common user questions about the Tow Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for heavy-duty tow trucks?

The primary drivers are the increasing size and weight of commercial vehicles, stringent regulations requiring immediate clearance of major highways, and the growing specialization needed for complex recovery of multi-axle trucks and heavy construction equipment.

How is the adoption of electric vehicles (EVs) impacting tow truck design?

EV adoption necessitates tow trucks with higher gross vehicle weight ratings (GVWR) to handle heavy battery packs, along with specialized flatbed designs and non-metallic recovery tools to prevent structural or electrical damage during lifting and transport.

Which geographical region offers the highest growth potential for the Tow Truck Market?

The Asia Pacific (APAC) region, particularly China and India, offers the highest growth potential due to rapid motorization, extensive infrastructure projects, and the ongoing shift from fragmented, informal towing services to organized, professional fleet operations.

What technological advancements are most critical for operational efficiency in towing services?

Advanced telematics systems for real-time fleet tracking, AI-powered dispatch optimization software for reduced response times, and specialized sensor technology for safer roadside operations are the most critical technologies currently boosting efficiency.

Are hook and chain tow trucks still utilized, and in which applications?

Hook and chain tow trucks are rapidly declining in modern usage due to the risk of vehicle damage. They are primarily limited to recovering severely damaged, salvage, or scrap vehicles where aesthetic damage is not a concern, or in highly rural areas where simpler equipment is preferred.

What is the typical lifecycle of a medium-duty tow truck?

The typical operational lifecycle for a well-maintained medium-duty tow truck is between 15 to 20 years, though the body and recovery apparatus often outlast the chassis, leading to frequent re-chassising (transferring the recovery system to a new chassis) to extend the overall service life.

How do emission standards affect manufacturers in the Tow Truck Market?

Stringent global emission standards (like Euro VI and EPA standards) compel manufacturers to invest heavily in advanced engine technologies, alternative fuels, and increasingly, fully electric or hybrid powertrains, raising manufacturing costs but promoting sustainable operational practices in urban fleet deployments.

What role does fleet management software play for large towing companies?

Fleet management software is essential for tracking vehicle location, managing driver logs, scheduling preventative maintenance, optimizing fuel consumption through routing, and ensuring compliance with regulatory requirements, significantly improving profitability and service reliability.

Which segment, by product type, holds the largest market share?

The flatbed tow truck segment holds the largest market share globally due to its versatility, ability to transport vehicles safely without suspension stress, and suitability for all-wheel-drive and electric vehicles, minimizing liability for high-value recoveries.

What are the key challenges faced by independent tow truck operators?

Independent operators face challenges related to high insurance costs, steep capital investment for advanced equipment, competition from large consolidated service providers, and difficulties in recruiting and retaining skilled heavy-duty recovery technicians.

How is government regulation influencing the pricing of towing services?

Government regulations, particularly municipal ordinances and state laws regarding impoundment and accident clearance, often set maximum allowable fees for certain types of towing, influencing profit margins and encouraging operators to seek higher-margin private contracts.

What is the primary difference between an Integrated Tow Truck and a Wheel-Lift Tow Truck?

The Integrated Tow Truck (often called a 'self-loader') typically features the boom and wheel-lift mechanism integrated directly into the chassis frame, designed specifically for heavy-duty lifting and recovery, offering superior strength and stability compared to the standard Wheel-Lift model used primarily for lighter passenger vehicles.

How is predictive maintenance implemented in tow truck fleets?

Predictive maintenance uses IoT sensors on critical components (engine, hydraulics, tires) to feed data into AI algorithms, which analyze usage patterns and detect anomalies, allowing fleet managers to proactively schedule repairs and replace parts before catastrophic failure occurs, maximizing vehicle uptime.

What are the main risks associated with cross-border towing operations in Europe?

Main risks include navigating highly disparate national regulations regarding vehicle weight limits, differing road safety certifications, varying tariffs and taxes on services, and the necessity of adhering to diverse labor laws regarding driver working hours across multiple jurisdictions.

Do advancements in autonomous driving technology affect the market outlook?

While fully autonomous towing is not yet widespread, autonomous driving technologies in consumer cars increase the demand for specialized recovery techniques for disabled high-tech vehicles, requiring more careful handling and sophisticated flatbed equipment, positively impacting the market for specialized units.

What is the current trend regarding the manufacturing materials used for tow truck bodies?

There is a growing trend towards using high-strength, lightweight materials such as specialized steel alloys and aluminum in tow truck body construction. This reduces the overall vehicle weight, improves fuel efficiency, and allows for greater payload capacity without exceeding legal weight limits.

Which types of customers drive demand for highly specialized heavy-duty rotators?

Demand for rotators is driven primarily by government agencies (highway patrol), large commercial freight companies, construction companies, and port authorities, as these vehicles are essential for recovering overturned tractor-trailers, buses, and heavy machinery.

What impact does the increasing number of car-sharing services have on the towing market?

Car-sharing services generate steady demand for towing services, particularly for routine maintenance transfers, repositioning of vehicles between service zones, and managing minor accidents within their large, professionally maintained fleets, supporting consistent light-duty tow truck utilization.

How important is operator training in the heavy-duty segment?

Operator training is critically important in the heavy-duty segment due to the inherent dangers and complexity of high-capacity recovery. Specialized training programs are essential to ensure safe operation of hydraulic booms, outriggers, and winches, mitigating risk and liability associated with complex recoveries.

What is the difference between accident recovery and roadside assistance applications?

Roadside assistance generally involves non-emergency breakdowns, flat tires, or mechanical failures requiring transport to a service garage. Accident recovery, conversely, involves more complex, often high-risk operations requiring specialized equipment (like rotators) and coordination with emergency services at the scene of a collision.

How does the resale value of tow trucks influence purchasing decisions?

Tow trucks, particularly models from reputable brands, maintain high resale values due to their robust construction and long service life. This factor significantly influences purchasing decisions, encouraging operators to invest in quality, durable equipment despite higher initial costs.

What measures are being taken to enhance safety during towing operations?

Safety enhancements include the integration of advanced lighting packages, reflective striping, standardized traffic management kits, remote control systems for hydraulic functions (allowing operators to stand clear), and mandatory ongoing training in traffic incident management (TIM) protocols.

How are environmental regulations affecting the disposal of old tow trucks?

Environmental regulations require the proper draining and disposal of hazardous fluids, fuels, and refrigerants from decommissioned trucks. Manufacturers are also increasingly utilizing recyclable materials in new builds to support a circular economy model and comply with extended producer responsibility mandates.

Is financing easily available for purchasing new tow truck fleets?

Yes, financing is generally available, often through specialized commercial vehicle lenders or manufacturer-affiliated financing arms. Given the high capital cost, many operators rely on long-term loans or leasing arrangements, which are supported by the consistent revenue generation potential of the assets.

How critical is the winch system capacity to the overall utility of a tow truck?

The winch system capacity is absolutely critical, as it determines the maximum dead weight that can be pulled or righted. In heavy-duty applications, multiple powerful winches are required, often rated between 25,000 lbs to 60,000 lbs, forming the core strength of the recovery apparatus.

What impact does urbanization have on the demand for specific tow truck types?

Increased urbanization drives demand for smaller, highly maneuverable wheel-lift and light-duty integrated tow trucks. These smaller vehicles are better suited for operating in confined city streets, parking garages, and high-traffic areas where large flatbeds or heavy rotators are impractical.

How has the rise of smartphone applications influenced customer expectations for towing services?

Smartphone applications have significantly increased customer expectations for transparency, requiring real-time tracking of the assigned tow truck, guaranteed arrival times, upfront price quotes, and digital payment options, driving technological adoption among service providers.

What are the typical lead times for ordering a custom-built heavy-duty tow truck?

Lead times for custom-built heavy-duty tow trucks can be substantial, often ranging from 9 to 18 months, depending on the chassis manufacturer's availability, the complexity of the body and rotator specifications, and the current backlog of the specialized body builder.

In the value chain, what is the role of specialized equipment distributors?

Specialized equipment distributors provide regional sales and critical after-sales support, including customized installation, technical maintenance, proprietary parts supply, and operator training, acting as the crucial interface between the major manufacturers and localized towing operators.

How does cybersecurity risk relate to modern tow truck operations?

Cybersecurity risks pertain primarily to the integrated telematics and dispatch systems. Breaches could compromise sensitive customer location data, impact fleet routing algorithms, or disrupt communication infrastructure, making secure data handling and encryption protocols essential for modern fleet management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager