TPMS Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432409 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

TPMS Battery Market Size

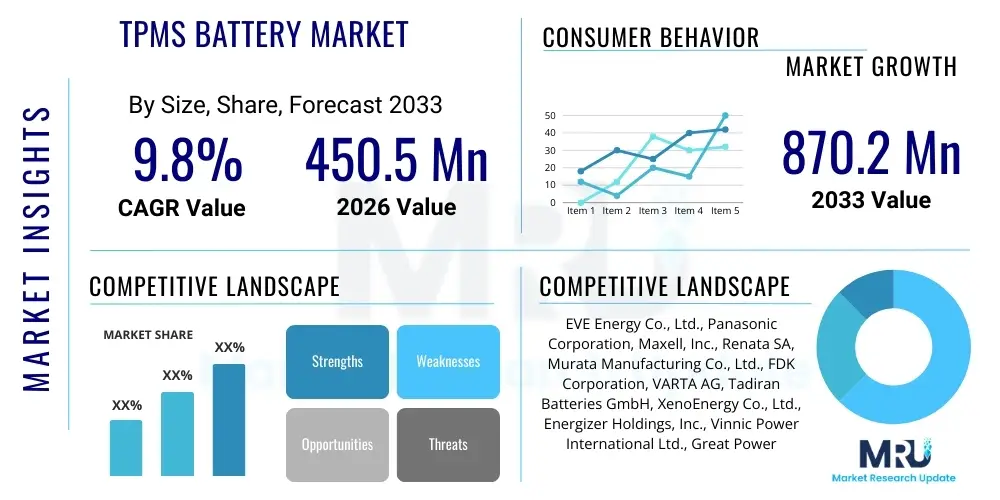

The TPMS Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 870.2 Million by the end of the forecast period in 2033.

TPMS Battery Market introduction

The Tire Pressure Monitoring System (TPMS) Battery Market is fundamentally driven by stringent governmental safety regulations mandating the installation of TPMS in all new vehicles across major automotive markets, particularly North America, Europe, and increasingly, Asia Pacific. TPMS are essential safety features designed to monitor the air pressure inside pneumatic tires on various types of vehicles, notifying the driver when the pressure drops to an unacceptably low level. This critical component ensures enhanced vehicle safety, reduces the risk of traffic accidents associated with under-inflated tires, and plays a significant role in optimizing vehicle performance metrics such as fuel efficiency and tire longevity. The batteries deployed in these sensors are highly specialized, typically non-rechargeable primary lithium cells, engineered to deliver consistent performance over an extended service life, often projected to span between five and ten years, commensurate with the expected lifetime of the sensor module.

These specialized batteries are crucial for the reliable operation of direct TPMS technologies, which directly measure pressure using a sensor mounted inside the tire or valve stem, transmitting data via radio frequency (RF) signals to the vehicle’s central receiver. The performance requirements for these power sources are exceptionally demanding, necessitating inherent characteristics such as extremely high energy density to maximize operational duration within a minimal physical footprint, and a remarkably low self-discharge rate to maintain readiness over many years. Crucially, the cells must also demonstrate stable electrochemical performance and structural integrity across an exceptionally wide operating temperature range, effectively coping with temperatures that can fluctuate from deep sub-zero conditions in winter months to extreme heat generated by friction and road surface temperatures during high-speed summer driving. This stringent technical profile limits the viable battery chemistries to a few highly specialized lithium primary types, driving specific technological development efforts within the market.

The market encompasses primary applications spanning across Passenger Vehicles (PVs), which constitute the largest volume segment, and Commercial Vehicles (CVs), including heavy-duty trucks, buses, and trailers, where tire management is paramount for operational logistics and cost control. Demand generation is segmented into two major streams: the Original Equipment Manufacturer (OEM) segment, focusing on new vehicle installations; and the massive Aftermarket segment, driven exclusively by replacement cycles. The growth trajectory is significantly benefited by the increasing average age of vehicles globally, regulatory enforcement expanding into new geographic regions (e.g., Southeast Asia, Latin America), and technological advancements aimed at producing even smaller, lighter sensor modules that require corresponding advancements in battery miniaturization and power output stability. Furthermore, the integration of TPMS data into sophisticated vehicle telematics systems elevates the importance of consistent battery performance for overall vehicle connectivity and data reliability.

TPMS Battery Market Executive Summary

The TPMS Battery Market exhibits robust growth, underpinned by non-discretionary replacement demand and tightening global automotive safety standards. Current business trends highlight a strategic focus among major battery producers on vertical integration, ensuring a stable supply of crucial raw materials like lithium and manganese, mitigating risks associated with supply chain volatility and geopolitical pressures. There is a palpable shift towards standardizing specific Li-MnO2 cell formats favored by Tier 1 automotive sensor suppliers (such as Continental and Sensata), streamlining production efficiencies and lowering unit costs. Furthermore, the rising awareness of the environmental impact of automotive electronics is spurring initial research into more easily recyclable or modular sensor designs, though performance and longevity requirements currently prioritize primary, sealed battery solutions.

Analyzing regional trends, Asia Pacific (APAC) stands out as the major growth engine, projected to overtake mature markets in terms of volumetric demand within the forecast period. This dominance is catalyzed by the exponential increase in automotive production—especially in China and India—coupled with the compulsory adoption of TPMS regulations, generating a rapid buildup of the vehicle parc requiring future service. North America and Europe, while growing at a steadier pace, maintain significant market value due to the high density of their existing vehicle fleets. The focus in these established regions is increasingly placed on aftermarket innovation, including the development of universal programmable sensors that require highly compatible and reliable battery cells, simplifying inventory management for service garages.

Segment trends confirm the overarching dominance of the Replacement Market over the OEM segment, accounting for the majority of battery consumption, a pattern expected to intensify as vehicles sold under early mandates mature past their 5-7 year replacement threshold. Within battery chemistries, Lithium-Manganese Dioxide (Li-MnO2) commands the largest share, valued for its proven performance in thermal extremes and cost-effectiveness for mass production. However, Lithium-Thionyl Chloride (Li-SOCl2) maintains a critical niche in specific high-performance or heavy-duty commercial vehicle applications, where its slightly higher energy density and superior performance in highly specialized temperature zones justify the increased cost. The Passenger Vehicle category remains the largest end-user, though the accelerated technological modernization and fleet adoption rates within the Commercial Vehicle segment signal strong, above-average growth prospects.

AI Impact Analysis on TPMS Battery Market

User inquiries frequently concentrate on the long-term ramifications of Artificial Intelligence (AI) and Machine Learning (ML) integration into TPMS and broader vehicle diagnostic systems, particularly concerning their influence on power requirements and battery longevity. Key themes explored include whether AI will introduce new energy demands (e.g., increased processing load for smart sensors), how AI-driven predictive failure models can optimize replacement timing, and if the introduction of smarter sensors necessitates a fundamentally different power source architecture. Users are keenly interested in determining if AI could potentially counteract the inherent lifespan limitation of current primary lithium cells, translating into reduced replacement frequency and subsequent market contraction in the long term.

The primary impact of AI is not in altering the battery composition but in enhancing the efficiency of the power consumption cycle. AI algorithms deployed within the vehicle's telematics and ECU can dynamically manage the sensor’s wake-up frequency and data transmission power based on predicted driving conditions, known tire degradation rates, and historical data patterns. For instance, if a vehicle is parked for an extended period, the AI system can reduce the TPMS sensor’s communication duty cycle to a minimum power-saving mode, thereby mitigating parasitic power drain and extending the overall effective battery lifespan far closer to its theoretical maximum. This intelligent duty cycling means that while the sensor might require bursts of power for high-frequency transmissions during highway travel, the overall average power consumption over the battery’s service life is optimized by AI.

Furthermore, AI significantly enhances the supply chain and manufacturing precision. Manufacturers utilize ML models to process vast datasets gathered from production lines and stress testing environments, enabling predictive modeling of component wear and failure points, particularly regarding the critical hermetic sealing required for TPMS batteries. This allows for proactive adjustments in manufacturing processes, minimizing defects and improving the consistency of the 10-year lifespan guarantee offered to OEMs. On the user side, AI facilitates the transition from reactive maintenance (replacing a sensor only after the battery has definitively failed) to predictive maintenance (replacing the sensor shortly before the AI predicts battery exhaustion), ensuring maximum uptime and reliability, particularly critical for commercial fleet operations where tire health directly impacts profitability and compliance.

- AI optimizes TPMS communication protocols, potentially reducing unnecessary power draw and extending battery life.

- Predictive maintenance algorithms driven by ML forecast precise battery exhaustion points, ensuring optimal replacement timing.

- Machine Learning enhances battery manufacturing quality control, specifically regarding hermetic sealing integrity and internal resistance optimization.

- Integration of TPMS data into advanced vehicle telematics requires high-reliability power sources to support increased, AI-mediated data transmission rates.

- Autonomous fleet operations rely on robust TPMS data, elevating the criticality of battery uptime metrics.

DRO & Impact Forces Of TPMS Battery Market

The TPMS Battery Market’s trajectory is defined by structural safety mandates (Drivers), technological limits of chemical energy storage in extreme environments (Restraints), opportunities arising from vehicular electrification (Opportunities), and external market pressures such as input cost volatility (Impact Forces). The primary driving force remains the legislative framework, which ensures a baseline, non-cyclical demand across all major global automotive regions, establishing TPMS as a required feature rather than an optional luxury. This regulatory environment continuously expands, encompassing more vehicle types and gradually spreading into developing markets, thus constantly increasing the global installed base.

Key drivers include the global expansion of mandatory TPMS installation regulations, the inherent necessity for battery replacement as TPMS sensors possess a finite operational life (generally 5-10 years), and the continuous, large-scale increase in the global vehicle parc, especially in rapidly motorizing nations in APAC. Furthermore, the push towards integrating real-time tire data into advanced driver-assistance systems (ADAS) reinforces the importance of sensor reliability. These systems require instantaneous and accurate data feeds, demanding batteries capable of delivering stable voltage and high pulse currents necessary for frequent and robust RF transmissions, thereby accelerating demand for premium, high-specification Li-MnO2 and Li-SOCl2 cells.

Restraints largely stem from technical limitations and market structure. The most significant restraint is the sealed, non-serviceable design of most direct TPMS sensors, which mandates the replacement of the entire sensor assembly when only the battery expires, leading to higher material costs and waste generation. Furthermore, the stringent requirement for consistent electrochemical performance across the enormous temperature gradient encountered within a tire cavity remains a formidable technical challenge, increasing R&D costs. Opportunities are found in developing novel power solutions, such as micro-harvesting technologies (utilizing kinetic energy from tire rotation) to supplement battery life, exploring rechargeable thin-film or solid-state cells, and expanding penetration into the growing commercial vehicle and off-road equipment sectors, which prioritize durability and extremely low maintenance frequency. Impact forces include intense price competition in the aftermarket, driven by the proliferation of lower-cost universal sensors, and the volatile global pricing of critical raw materials like lithium carbonate and specialized cathode materials, which directly affect manufacturer profit margins.

Segmentation Analysis

The comprehensive segmentation of the TPMS Battery Market allows for targeted strategic analysis, providing insights into specific demand pockets and competitive landscapes. Segmentation by Battery Chemistry is critical, distinguishing between the dominant Lithium-Manganese Dioxide (Li-MnO2), favored for its balance of cost and performance in standard passenger vehicles, and Lithium-Thionyl Chloride (Li-SOCl2), which is often specified for applications requiring maximum longevity and resilience in more extreme thermal or mechanical stress environments, typically found in heavy commercial vehicles.

Segmentation by Sales Channel, separating OEM from Aftermarket, is fundamental to understanding market mechanics. The OEM segment demands unparalleled quality control, zero-defect tolerance, and competitive pricing for high-volume contracts over multi-year cycles. Conversely, the Aftermarket segment is characterized by rapid inventory turnover, localized distribution networks, and a strong preference for standardized, universally compatible replacement units, where pricing and accessibility are key purchasing criteria for service professionals and individual vehicle owners. This aftermarket cycle ensures the longevity and stability of market demand beyond the initial vehicle sale phase.

- By Battery Type:

- Lithium-Manganese Dioxide (Li-MnO2): Dominant type, optimized for cost-performance balance and standard PV applications.

- Lithium-Thionyl Chloride (Li-SOCl2): Niche high-performance type, utilized where superior energy density and extreme temperature range tolerance (especially high heat) are required, often in CVs.

- Other Lithium Chemistries (e.g., emerging solid-state cells, enhanced polymer designs).

- By Vehicle Type:

- Passenger Vehicles (PV): Largest volumetric segment, including sedans, SUVs, and light trucks.

- Commercial Vehicles (CV): Fastest growing segment, including heavy-duty trucks, trailers, and buses, driven by fleet management requirements.

- Two-Wheelers (Emerging segment): Regulatory efforts slowly introducing TPMS requirements in high-end motorcycles.

- By Sales Channel:

- Original Equipment Manufacturer (OEM): Sales to vehicle assembly plants for new installations.

- Aftermarket (Replacement): Sales through independent repair shops, dealerships, and parts distributors, constituting the majority of annual battery consumption.

- By Application:

- Direct TPMS: Sensor mounted in the wheel, requires dedicated battery power, driving the core market demand.

- Indirect TPMS: Uses ABS wheel speed sensors, requiring minimal specific battery power for the function itself, but included for complete market context.

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Value Chain Analysis For TPMS Battery Market

The TPMS Battery value chain commences deep upstream with the mining and refining of critical raw materials, specifically lithium salts, manganese compounds, and high-purity solvents and electrolytes. Suppliers at this stage face geopolitical and commodity price volatility, requiring battery manufacturers (midstream) to maintain robust sourcing strategies. Specialized manufacturers then utilize advanced chemical processes and precision engineering to produce the cell components (anodes, cathodes, separators). This stage is capital intensive, driven by the need for extremely clean manufacturing environments and highly specific electrochemical standards necessary to guarantee ultra-low self-discharge rates over a decade.

The core midstream activity involves the assembly and sealing of the specialized battery cells. These cells are then shipped to Tier 1 automotive suppliers—the TPMS Module Integrators (e.g., Continental, Sensata)—who purchase them as B-components. The integrators embed the battery along with the ASIC, pressure transducer, and RF transmitter into the final, hermetically sealed sensor module. This step is crucial as the sensor integrator dictates the exact battery specifications, including size, pulse capability, and expected minimum lifespan, based on the requirements of their OEM contracts. Direct distribution channels involve the flow of these finished sensor modules from integrators directly to major global automotive OEMs for installation on new vehicles, adhering to just-in-time logistics protocols.

The downstream segment, focused on the aftermarket, is characterized by a fragmented but high-volume distribution network. TPMS sensor modules—containing the battery—are channeled through master distributors, regional wholesalers, and vast retail chains (e.g., tire specialists, general repair garages). An increasing portion of aftermarket sales is shifting towards specialized universal or programmable sensors, which simplifies inventory management for service providers but places higher demands on battery compatibility and data retention features. Indirect sales involve partnerships with diagnostic tool manufacturers, which bundle sensors and batteries with programming devices, ensuring that replacement units are accurately configured for the end vehicle, supporting the high-volume service needs generated by the aging global vehicle fleet.

TPMS Battery Market Potential Customers

The clientele for TPMS batteries is segmented into entities focused on initial installation and those dedicated to long-term maintenance and replacement. Original Equipment Manufacturers (OEMs), including global automotive giants spanning passenger car, light commercial, and heavy truck manufacturing, represent the cornerstone of the initial demand phase. These customers require bespoke, high-specification batteries integrated into sensor modules that meet the highest standards of reliability, noise immunity, and guaranteed lifespan. OEM procurement is driven by long-term strategic contracts, focusing intensely on supplier capability, consistent quality metrics (measured in PPB, parts per billion defect rates), and adherence to global regulatory compliance certifications.

The Aftermarket Service Providers constitute the largest and most frequent buyers of TPMS battery-inclusive sensors. This segment includes vast networks of independent automotive repair workshops, franchised dealerships, specialty tire and wheel service centers, and large national retail chains specializing in automotive parts distribution. For these customers, buying decisions are influenced heavily by product availability across multiple vehicle makes and models, ease of installation (favoring universal programmable sensors), warranty coverage, and competitive unit pricing. The purchasing volume in the aftermarket is intrinsically tied to the 5-to-10-year aging cycle of the global vehicle fleet, ensuring a reliable and growing stream of replacement demand.

A rapidly expanding customer cohort is the Commercial Fleet Management sector. Companies operating large fleets of heavy-duty trucks, trailers, and logistics vehicles are increasingly adopting advanced TPMS solutions, often integrated with telematics platforms, to mitigate risks associated with tire failure and optimize fuel consumption. These customers prioritize extremely rugged and durable batteries, often favoring Li-SOCl2 chemistries, which can withstand continuous vibration, extreme loads, and prolonged exposure to elevated road temperatures. Their procurement criteria emphasize long mean time between failures (MTBF) and compatibility with fleet management software for predictive maintenance scheduling, translating into demand for premium, ultra-reliable battery solutions capable of meeting the rigorous demands of 24/7 commercial operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 870.2 Million |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EVE Energy Co., Ltd., Panasonic Corporation, Maxell, Inc., Renata SA, Murata Manufacturing Co., Ltd., FDK Corporation, VARTA AG, Tadiran Batteries GmbH, XenoEnergy Co., Ltd., Energizer Holdings, Inc., Vinnic Power International Ltd., Great Power Energy Co., Ltd., Wuxi Sunpower Power Co., Ltd., Duracell, GP Batteries International Ltd., Continental AG, Sensata Technologies Inc., Schrader Valve, Mitsubishi Electric Corporation, Microchip Technology Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

TPMS Battery Market Key Technology Landscape

The technological landscape of the TPMS Battery market is dominated by advancements in lithium primary cell chemistry and high-precision manufacturing processes tailored to automotive longevity standards. The core technological focus is on maximizing the capacity-to-volume ratio (energy density) while minimizing the parasitic loss caused by self-discharge over the decade-long operational window. Li-MnO2 and Li-SOCl2 technologies are continually refined through improved electrode material purity, advanced electrolyte formulations that maintain low viscosity and conductivity stability across extreme temperatures, and specialized separator designs that mitigate the risk of internal short circuits under vibration stress.

A critical area of innovation revolves around the mechanical and chemical integrity of the cell casing, specifically the hermetic sealing. Because the battery is installed within the tire cavity, it is subjected to high levels of humidity, road debris, pressure changes, and thermal cycling, which necessitate laser-welded stainless steel cases and proprietary sealing materials to prevent premature electrolyte dry-out or leakage. Manufacturers are utilizing advanced non-aqueous solvent systems and optimizing the internal crimping pressure to guarantee the seal integrity for the mandated 10 years, a process often involving sophisticated, AI-guided quality checks during assembly to ensure every unit meets the stringent OEM performance criteria required for vehicle safety electronics.

Future technological shifts are exploring two main avenues: enhanced sustainability and alternative power sources. In sustainability, research focuses on developing safer, non-toxic components and battery designs that facilitate easier disassembly and material recovery at the end of the sensor’s life. In power source innovation, micro-energy harvesting techniques, utilizing piezoelectric or electromagnetic principles derived from wheel rotation, are being investigated to potentially trickle-charge or significantly extend the life of smaller, lighter secondary batteries integrated into the sensor. While currently immature for mass automotive application due to inconsistent energy output at low speeds, this technology represents the long-term trend away from purely primary (disposable) power cells, aiming for truly maintenance-free sensor operation across the full vehicle lifetime.

Regional Highlights

Regional market behavior in TPMS batteries is heavily differentiated by the maturity of automotive safety legislation and the density of the vehicle fleet. North America and Europe stand as the largest revenue contributors globally, primarily because their mandates (TREAD Act in the US, ECE R64 in the EU) have been in effect for over a decade. This maturity results in a huge installed base that has consistently reached the 5-10 year replacement cycle, ensuring that the aftermarket segment dominates sales volume. Demand in these regions is characterized by a high expectation for product quality, compliance with stringent RF certifications (315 MHz/433 MHz protocols), and robust logistical support to handle the widespread decentralized service market.

Asia Pacific (APAC) represents the locus of future volume growth, driven by unprecedented growth rates in new vehicle manufacturing, particularly in China and India. Regulatory bodies across APAC are rapidly aligning their safety standards with Western norms, making TPMS mandatory for a broader range of vehicle classes. This regulatory push creates massive initial demand for OEM batteries and concurrently establishes a massive future aftermarket requirement. Furthermore, many of the world's largest TPMS sensor and battery manufacturers have significant production facilities located within APAC, leveraging regional scale and cost advantages, making the area central to both supply and consumption dynamics.

The Latin America and Middle East & Africa (MEA) regions, while constituting a smaller segment of the global market currently, are pivotal for long-term strategic expansion. In Latin America, improving economic stability and increasing governmental focus on road safety are leading to gradual TPMS mandates, opening up localized OEM and aftermarket opportunities. The MEA region presents unique technical demands, particularly due to extreme high temperatures prevalent in the Gulf states and parts of Africa. This climatic challenge requires specialized, thermally optimized Li-SOCl2 batteries for commercial fleets, driving a niche demand for high-performance, resilient power solutions crucial for maintaining tire integrity under punishing operating conditions, thus offering distinct market entry points for specialized battery suppliers.

- North America (USA, Canada): Highly established replacement market; demand focused on standardized, certified 315 MHz sensor batteries; sustained demand due to high fleet volume and aging vehicles.

- Europe (Germany, UK, France): Strict compliance with ECE R64; emphasis on high quality and environmental standards; dominant use of 433 MHz sensors; significant premium vehicle segment requiring specialized, high-reliability batteries.

- Asia Pacific (China, Japan, India, South Korea): Highest projected CAGR; growth fueled by new domestic and export vehicle production; recent and widespread regulatory adoption driving initial OEM sales boom and future replacement surge.

- Latin America (Brazil, Mexico): Emerging markets with incremental regulatory adoption; focus on expanding local manufacturing and securing cost-competitive aftermarket supply chains.

- Middle East and Africa (MEA): Growth centered on commercial fleet management and niche requirements for batteries optimized for resilience against extreme high operational temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the TPMS Battery Market, encompassing both primary cell manufacturers and key TPMS system integrators.- EVE Energy Co., Ltd.

- Panasonic Corporation

- Maxell, Inc.

- Renata SA (Swatch Group)

- Murata Manufacturing Co., Ltd.

- FDK Corporation

- VARTA AG

- Tadiran Batteries GmbH

- XenoEnergy Co., Ltd.

- Energizer Holdings, Inc.

- Vinnic Power International Ltd.

- Great Power Energy Co., Ltd.

- Wuxi Sunpower Power Co., Ltd.

- Duracell Inc.

- GP Batteries International Ltd.

- Continental AG (Sensor & System Integration)

- Sensata Technologies Inc. (Sensor & System Integration)

- Schrader Valve (Tire Service International)

- Mitsubishi Electric Corporation

- Microchip Technology Inc. (ASIC supplier influencing power demand)

Frequently Asked Questions

Analyze common user questions about the TPMS Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan of a TPMS battery and why do they fail?

The operational lifespan of a TPMS battery typically ranges from 5 to 10 years, depending heavily on the sensor’s programmed communication frequency and the operational environment. Failure is usually attributed to the inevitable depletion of the non-rechargeable lithium capacity, often accelerated by extreme temperature exposure (heat is highly detrimental) and frequent pressure checking cycles which necessitate high-power radio frequency transmissions.

Are TPMS batteries replaceable or must the entire sensor be replaced?

In the vast majority of Original Equipment and high-quality aftermarket direct TPMS systems, the battery is hermetically sealed within the sensor housing to ensure protection against moisture and mechanical stress, rendering it non-replaceable. Consequently, when the battery expires, the entire sensor module must be replaced, although some niche or older designs might permit battery substitution.

Which battery chemistry dominates the TPMS market and why is it preferred by OEMs?

Lithium-Manganese Dioxide (Li-MnO2) is the preferred and dominant chemistry, particularly among OEMs. It is highly favored because it offers an optimal combination of high energy density for small size requirements, exceptional reliability, a very low self-discharge rate for long shelf life, and proven electrochemical stability across the wide range of automotive operating temperatures, all delivered at a competitive cost suitable for mass production volumes.

How do global safety regulations impact the TPMS Battery Market growth?

Global safety regulations, such as the enforcement of TPMS mandates in new vehicles across North America, Europe, and Asia Pacific, serve as the primary foundational driver of the market. These mandates ensure a stable, non-cyclical demand for initial OEM installations and, critically, establish a constantly expanding fleet base that guarantees substantial, predictable growth in the high-volume replacement (aftermarket) sector every five to ten years.

How does the commercial vehicle segment differ from passenger vehicles in battery requirements?

Commercial vehicles (CVs) demand more rugged and resilient batteries than passenger vehicles (PVs). CVs operate under continuous heavy loads, severe vibration, and often higher tire temperatures, pushing battery requirements towards superior thermal resilience. This frequently necessitates the use of Lithium-Thionyl Chloride (Li-SOCl2) cells in premium CV applications, which offer slightly higher energy density and improved stability in high-heat environments compared to standard Li-MnO2 cells used widely in PVs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager