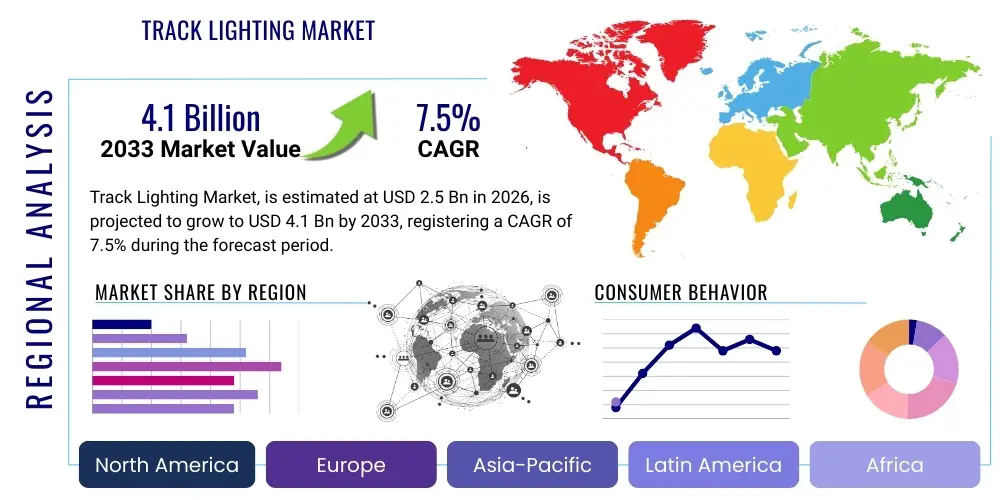

Track Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437046 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Track Lighting Market Size

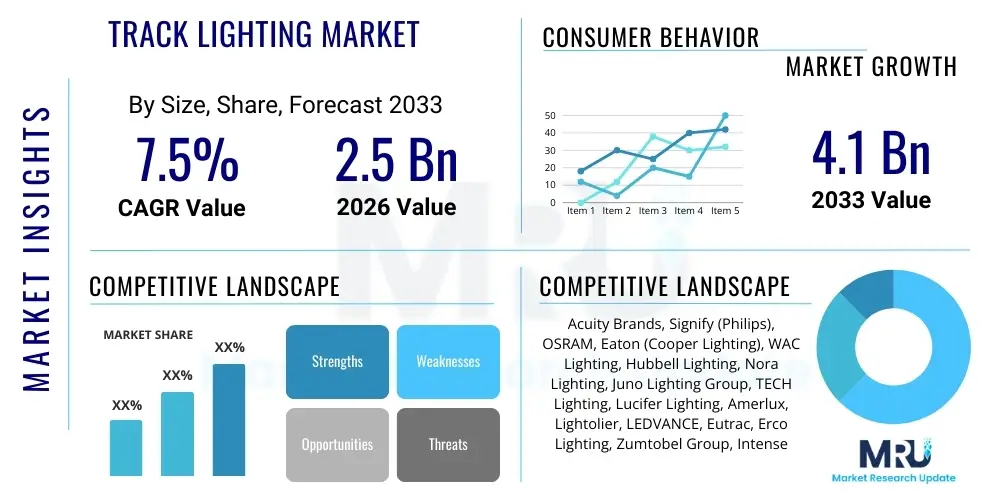

The Track Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.1 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for flexible, energy-efficient, and aesthetically pleasing lighting solutions across the commercial and residential construction sectors. The inherent modularity and adaptability of track lighting systems, particularly those incorporating advanced LED technologies, allow for precise illumination control, catering effectively to specialized needs in retail displays, galleries, and high-end residential interiors. Furthermore, ongoing infrastructure development and smart home integration trends are significantly boosting the adoption rate, solidifying the market's robust financial outlook over the coming decade.

Track Lighting Market introduction

The Track Lighting Market encompasses the manufacturing, distribution, and installation of lighting systems that utilize linear, electrified tracks onto which individual light fixtures, or heads, can be positioned anywhere along the track's length. This modular design provides unparalleled flexibility in lighting layout, making it a preferred solution for environments where lighting needs to be frequently adjusted, such as retail stores, museums, art galleries, and modern offices. The primary product components include the tracks themselves (available in various configurations like single-circuit, two-circuit, or low-voltage), the light fixtures (often incorporating LED or halogen bulbs), and connection accessories, including couplers, feeds, and mounting hardware. The shift towards energy efficiency has predominantly positioned LED track lighting as the dominant product type, overshadowing traditional incandescent or halogen variants due to superior longevity and reduced power consumption.

Major applications for track lighting systems span both functional and aesthetic domains. In commercial settings, they are crucial for accentuating specific merchandise, highlighting architectural features, and providing high-quality task lighting, thereby enhancing the overall customer experience and driving sales. Residential applications utilize track lighting primarily in kitchens, living spaces, and home galleries, offering homeowners versatile illumination that can adapt to changing furniture layouts or décor. The fundamental benefit of these systems lies in their easy reconfigurability without requiring structural changes to the ceiling, providing a scalable and future-proof lighting infrastructure. This flexibility is a significant market driver, especially in dynamic retail and hospitality environments where ambiance and focused illumination are critical success factors.

Key driving factors propelling market growth include the global construction boom, particularly in Asia Pacific and the Middle East, necessitating advanced interior finishing solutions. Simultaneously, stringent energy efficiency regulations implemented across North America and Europe mandate the adoption of high-performance lighting, favoring LED track systems. Furthermore, the integration of smart lighting controls, allowing users to remotely manage brightness, color temperature, and scheduling, is transforming track lighting from a purely functional product into a sophisticated element of integrated building management systems. The confluence of aesthetic versatility, energy savings, and smart technology integration ensures sustained high demand across diverse end-user segments, making it a critical segment within the broader architectural lighting market.

Track Lighting Market Executive Summary

The Track Lighting Market is undergoing rapid evolution, characterized by a substantial shift toward intelligent, networked systems and personalized lighting experiences. Business trends indicate strong consolidation among fixture manufacturers and technology providers focused on incorporating Internet of Things (IoT) capabilities directly into the lighting heads and track infrastructure. Key market participants are heavily investing in miniaturization and thermal management solutions to enhance the performance and aesthetic appeal of LED-based track systems. Furthermore, the rising popularity of magnetic track lighting, which offers tool-free installation and unparalleled versatility, represents a pivotal technological trend, positioning the market for accelerated adoption in premium and flexible architectural projects. Strategic collaborations between lighting companies and smart home platform providers are becoming crucial to maintain competitive differentiation and access the lucrative connected lighting segment.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing region, fueled by massive urbanization, rapid commercial infrastructure development (including malls, hotels, and modern office spaces), and increasing disposable incomes leading to greater adoption of sophisticated residential lighting. North America and Europe remain mature markets, focusing primarily on retrofitting older incandescent or halogen systems with modern, connected LED track lighting to meet sustainability goals and reduce operating costs. In these mature regions, the demand emphasizes high-quality light rendering (CRI) and advanced dimming protocols (like DALI or 0-10V), ensuring installations meet stringent professional standards. The Middle East and Africa (MEA) are emerging due to large-scale hospitality and retail construction projects, often demanding high-specification architectural lighting solutions.

Segment trends reveal that the LED Track Lighting segment maintains absolute dominance, driven by regulatory pressures and consumer preference for efficiency. Within the application segmentation, the Commercial segment, particularly retail and hospitality, constitutes the largest market share, utilizing track lighting extensively for visual merchandising and creating specific ambient zones. However, the Residential segment is experiencing the highest growth rate, propelled by the trend of open-plan living and the desire for customizable home lighting systems. Component trends show increasing complexity and value concentration in the fixture heads, which now often integrate smart sensors, wireless communication modules, and advanced optics, shifting the focus from the track itself to the intelligent components mounted upon it.

AI Impact Analysis on Track Lighting Market

Common user questions regarding AI's impact on the Track Lighting Market revolve around themes of automated light scene creation, predictive maintenance, energy optimization, and personalized user experience. Users frequently ask: "How can AI automatically adjust retail lighting based on customer movement patterns?" or "Will AI-driven diagnostics reduce the lifespan cost of my track lighting system?" These questions underscore a high expectation for AI to transform static lighting into a highly dynamic, responsive, and self-managing system. Key themes emerging from this analysis include the potential for AI algorithms to interpret real-time data from integrated sensors (occupancy, daylight harvesting, thermal metrics) and execute immediate, nuanced adjustments to light intensity and color temperature, thereby optimizing both human comfort and energy usage far beyond traditional programmed controls. Concerns often center on data privacy, system complexity, and the initial investment required for AI-enabled infrastructure.

The convergence of AI with advanced track lighting fixtures, which are increasingly equipped with embedded processors and connectivity modules, facilitates the creation of truly smart environments. AI systems analyze vast datasets related to occupant behavior, external environment conditions, and historical energy consumption to predict optimal lighting schedules and intensity levels. For example, in a large office complex, an AI system managing track lighting can learn typical work patterns, identifying underutilized zones and dimming lights proactively, or dynamically adjusting color temperature throughout the day to support circadian rhythms (Human-Centric Lighting, HCL). This shift moves track lighting from a passive fixture to an active, cognitive tool for building management.

Furthermore, AI significantly enhances operational efficiency through predictive maintenance. By continuously monitoring the electrical characteristics, temperature profiles, and operational hours of individual track heads, AI algorithms can accurately predict component failure (e.g., LED driver degradation) before it occurs. This transition from reactive replacement to proactive servicing minimizes downtime, optimizes inventory management for replacement parts, and extends the effective lifespan of the entire installation. This predictive capability translates directly into lower total cost of ownership (TCO), providing a strong value proposition for commercial and industrial end-users considering large-scale track lighting deployments.

- AI enables highly granular energy consumption optimization through real-time occupancy and daylight sensing integration.

- Predictive maintenance algorithms reduce operational downtime and extend fixture lifespan by forecasting component failure.

- AI facilitates Human-Centric Lighting (HCL) implementation by dynamically adjusting color temperature and intensity to match occupant physiological needs.

- Automated light scene generation in retail and museum settings based on object detection and visitor flow analysis enhances display impact.

- Natural Language Processing (NLP) integration allows for advanced voice-activated control and personalized lighting adjustments via smart assistants.

- Improved security and surveillance capabilities through AI analysis of sensor data collected by smart track lighting fixtures.

DRO & Impact Forces Of Track Lighting Market

The Track Lighting Market is influenced by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that shape its trajectory. Primary drivers include the global push for energy efficiency, specifically the widespread adoption of LED technology within track systems, which offers substantial operational cost savings and longevity advantages over traditional lighting. Further propulsion comes from the aesthetic flexibility and modularity inherent in track lighting designs, appealing directly to modern interior designers and architects seeking versatile, non-intrusive illumination solutions for dynamic spaces like commercial galleries and hospitality venues. The increasing integration of IoT and smart home technologies necessitates compatible lighting infrastructure, positioning connected track lighting systems as essential components of modern building management.

However, significant restraints temper the market's explosive growth potential. The initial high capital expenditure (CAPEX) associated with premium LED track lighting systems, especially those incorporating advanced smart features or magnetic mounting technology, can deter price-sensitive consumers or businesses considering large-scale retrofits. Furthermore, the technical complexity involved in installing and configuring sophisticated networked track lighting controls, particularly concerning wireless integration and cybersecurity risks, requires specialized professional expertise, which can increase overall project costs and complexity. Market maturity in certain developed economies, where widespread adoption has already occurred, limits the scope for entirely new installations, focusing the market primarily on replacement and upgrade cycles.

Opportunities for market expansion are substantial, primarily centered on developing low-voltage magnetic track lighting systems, which offer enhanced safety, flexibility, and ease of installation, appealing strongly to DIY enthusiasts and rapid commercial deployment projects. The burgeoning demand for Human-Centric Lighting (HCL) systems presents a niche but high-value opportunity, as track lighting can deliver dynamic light quality crucial for promoting well-being in corporate and educational environments. Geographically, emerging economies in Southeast Asia and Latin America represent untapped growth potential due to rapid construction activity and a growing appetite for aesthetically modern interior designs. External impact forces, such as government subsidies for green building technologies and the global acceleration of digital infrastructure deployment (5G, widespread Wi-Fi), create a favorable environment for interconnected smart lighting systems to thrive, overriding some of the initial cost concerns.

Segmentation Analysis

The Track Lighting Market segmentation provides a granular view of product preference and application dominance, categorized primarily by component type, light source technology, and end-use application. The underlying structure of the market is defined by the migration away from dated incandescent and halogen systems toward standardized, high-performance LED solutions, which now command the vast majority of new installations globally. Analyzing these segments is critical for manufacturers to align product development with high-growth sectors, particularly those demanding high Color Rendering Index (CRI) and precise beam control, essential characteristics in retail, museum, and high-end residential applications. Furthermore, the segmentation by track configuration, whether utilizing single-circuit, multi-circuit, or low-voltage systems, dictates the technical complexity and functional versatility offered to the end-user, impacting pricing strategies and distribution channels.

A deeper dive into the technological segmentation reveals that while traditional linear systems remain the workhorse, innovative segmentations like magnetic track lighting are rapidly gaining momentum, particularly in luxury and boutique commercial spaces where aesthetics and adaptability are paramount. This magnetic segment, though smaller in volume, drives higher average selling prices (ASPs) and necessitates sophisticated design capabilities from manufacturers. Application-wise, the commercial sector is segmented into distinct sub-markets—retail, hospitality, corporate offices, and institutions—each presenting unique requirements for beam angle, color temperature, and control integration. Retail track lighting, for instance, emphasizes spotlighting capabilities and high lumen output, while office track lighting focuses on uniform, low-glare, indirect illumination, demonstrating the diverse needs met by highly specialized product variations within the general market.

The component segmentation clarifies the supply chain and manufacturing complexity. The fixtures/heads segment represents the highest value addition, encompassing the optical, thermal, and electronic components (drivers and smart modules). Conversely, the tracks and connectors segment, while essential, tends to be commoditized, focused primarily on material durability (aluminum extrusion) and electrical safety standards compliance. Strategic insight suggests that market leaders must differentiate themselves not only through the quality of the light source but increasingly through the intelligence embedded within the fixture heads and the ease of installation provided by innovative connector and mounting mechanisms, capitalizing on the demand for plug-and-play solutions in professional installation environments.

- By Type:

- LED Track Lighting

- Halogen Track Lighting

- Incandescent Track Lighting

- By Application:

- Commercial (Retail, Hospitality, Museums & Galleries, Corporate Offices)

- Residential (Kitchens, Living Spaces, Home Galleries)

- Industrial

- By Component:

- Fixtures / Heads (Spotlights, Floodlights, Pendants)

- Tracks (Single-Circuit, Multi-Circuit, Low-Voltage/Magnetic)

- Connectors & Accessories (Couplers, End Caps, Power Feeds, Mounting Hardware)

Value Chain Analysis For Track Lighting Market

The Value Chain of the Track Lighting Market begins with upstream activities, focusing heavily on the sourcing and processing of raw materials and key technological components. This stage involves the procurement of aluminum for track extrusion, high-quality plastics for housing and optics, and critically, advanced semiconductor components (LED chips, drivers, and integrated circuits) which form the core of modern fixtures. Key upstream suppliers include major LED chip manufacturers (e.g., Nichia, Cree, Osram) and driver suppliers, where cost management and quality control are paramount. Since the performance of the final track lighting system is highly dependent on the efficiency and lifespan of the LED and driver, strong relationships with specialized electronic component suppliers are crucial. Manufacturers must manage complex global supply chains, often sourcing components from specialized regions to maintain cost efficiency while ensuring compliance with stringent quality and sustainability standards.

Midstream activities involve the design, manufacturing, and assembly of the track lighting systems. This stage requires significant investment in automated assembly lines, specialized optical engineering capabilities to design efficient reflectors and lenses, and electrical engineering expertise to integrate smart control modules (like Zigbee, Bluetooth, or DALI interfaces) into the fixture heads. Direct distribution channels involve large manufacturers selling directly to major commercial contractors, architects, and large retail chains through specialized sales teams, allowing for customized project solutions and direct technical support. Indirect distribution, conversely, leverages electrical wholesalers, lighting distributors, and large e-commerce platforms to reach smaller businesses, independent contractors, and individual consumers, requiring robust inventory management and standardized product lines.

Downstream activities center on installation, integration, and post-sales servicing, which are essential for customer satisfaction, particularly in complex commercial projects. The final link in the chain involves professional lighting designers, contractors, and installers who specify and implement the systems, often integrating the track lighting with broader building management or smart home platforms. The rising complexity of connected lighting means that downstream participants require extensive training in networking protocols and software configuration. After-market services, including maintenance contracts and software updates for smart fixtures, represent a growing revenue stream, further extending the value proposition beyond the initial product sale and creating long-term engagement with the end-user base.

Track Lighting Market Potential Customers

Potential customers for the Track Lighting Market are highly diversified, broadly categorized into commercial, residential, and institutional end-users, each seeking the product for distinct functional and aesthetic purposes. The largest segment remains the commercial sector, where track lighting is utilized heavily by retail entities—ranging from high-end boutiques requiring focused accent lighting for merchandise displays to large departmental stores needing versatile illumination for changing seasonal layouts. Hospitality venues, including hotels, restaurants, and bars, are significant buyers, leveraging track systems to create dynamic, mood-setting lighting environments that can adapt throughout the day. These commercial buyers prioritize energy efficiency, durability, and sophisticated control integration (like dimming and color temperature tuning) to reduce operational costs and enhance the customer experience.

The residential market constitutes the fastest-growing segment, driven by modern architectural trends favoring open-concept living, requiring flexible lighting solutions that can define different zones within a single space. Homeowners and interior designers utilize track lighting extensively in kitchens, where precise task lighting is essential, and in living rooms or home art galleries, where accent illumination highlights specific features. Residential buyers prioritize aesthetic integration, ease of installation (especially for low-voltage or magnetic systems), and compatibility with consumer-grade smart home platforms such as Amazon Alexa or Google Home. The shift towards DIY installation in the residential sector also creates demand for user-friendly, modular products that simplify the setup process without compromising on professional performance.

Institutional customers, including museums, art galleries, and educational facilities, represent a niche but high-value customer base demanding extremely high color rendering accuracy (CRI > 95) and precise beam shaping capabilities to protect and properly display valuable assets or ensure optimal learning conditions. Architects and specification engineers working on these projects seek systems that offer minimal visual intrusion, advanced thermal management to protect fixtures during long operational hours, and future-proofing through standardized connectivity protocols. Furthermore, specialized industrial environments, such as manufacturing clean rooms or laboratories, utilize track lighting when they require modular, high-output lighting that can be reconfigured around equipment changes without costly electrical modifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acuity Brands, Signify (Philips), OSRAM, Eaton (Cooper Lighting), WAC Lighting, Hubbell Lighting, Nora Lighting, Juno Lighting Group, TECH Lighting, Lucifer Lighting, Amerlux, Lightolier, LEDVANCE, Eutrac, Erco Lighting, Zumtobel Group, Intense Lighting, LSI Industries, Griven, Prolight Concepts |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Track Lighting Market Key Technology Landscape

The technological landscape of the Track Lighting Market is dominated by advancements in solid-state lighting (SSL) and control systems. The shift from traditional light sources to Light Emitting Diodes (LEDs) is the most critical technological transformation, offering unparalleled energy efficiency, extended operational lifespan, and precise control over color temperature and light quality. Modern track lighting fixtures leverage miniaturized, high-density LED arrays combined with advanced thermal management techniques (such as passive heat sinks and proprietary cooling materials) to maintain consistent performance and light output even under continuous, high-intensity operation. This focus on thermal stability is crucial, as inadequate heat dissipation is the primary factor contributing to premature lumen depreciation in LED products, a key concern for commercial end-users demanding long-term reliability.

A second pivotal technology is the emergence of Low-Voltage Magnetic Track Systems. Unlike traditional line voltage (120V/240V) tracks, these systems operate at safe, low voltages (e.g., 24V or 48V) and use magnetic adhesion instead of mechanical locking mechanisms to secure the fixtures. This technology fundamentally simplifies installation and modification, allowing users to effortlessly snap lights on or off the track and reposition them instantly without the need for tools or professional electricians. The magnetic track structure often integrates data lines alongside power conductors, enabling seamless, addressable control of individual fixtures using sophisticated digital protocols like DALI (Digital Addressable Lighting Interface) or proprietary wireless protocols, thereby enhancing the granular control capabilities and system intelligence. These low-voltage systems are increasingly specified in architectural projects prioritizing sleek aesthetics and maximal flexibility.

Furthermore, the widespread integration of wireless connectivity and IoT capabilities is reshaping the market. New generation track lighting heads are equipped with miniature sensors (PIR, ultrasonic, or camera-based) for occupancy detection, ambient light measurement (daylight harvesting), and communication modules (Bluetooth Mesh, Zigbee, Wi-Fi). This technological convergence allows the track lighting system to become part of the larger smart building ecosystem, facilitating real-time data collection and remote management via cloud-based platforms. Key technological focuses for manufacturers include developing highly secure communication protocols, ensuring cross-platform interoperability with various building management systems (BMS), and creating user interfaces (UIs) that simplify the commissioning and programming of complex lighting scenes, thereby overcoming the restraint of technical complexity observed in earlier smart lighting implementations.

Regional Highlights

Geographic analysis of the Track Lighting Market reveals distinct growth patterns and maturity levels across key regions. North America, encompassing the United States and Canada, represents a mature market characterized by high consumer awareness regarding energy efficiency and a strong propensity for adopting smart home and building automation technologies. The region's growth is primarily driven by rigorous retrofitting efforts in the commercial and municipal sectors, replacing outdated fluorescent and halogen systems with advanced, networked LED track lighting to comply with stringent energy codes like Title 24. High purchasing power supports the early adoption of premium technologies, such as magnetic track systems and high-CRI specialty lighting for art and retail applications, making it a critical market for technological innovation and high-value sales.

Europe holds a substantial market share, influenced by robust regulatory frameworks promoting sustainability, notably the European Union's directives on energy performance in buildings (EPBD). Countries like Germany, the UK, and France show strong demand for professional, high-quality architectural track lighting, emphasizing compliance with DALI standards for networked controls and focusing heavily on Human-Centric Lighting (HCL) solutions in corporate and educational environments. While market penetration is high, the continuous regulatory updates requiring better energy performance and environmental accountability drive ongoing replacement cycles. The European market is highly fragmented but demands high standards of product certification and reliability, favoring established global and regional lighting brands known for engineering excellence and long warranty periods.

Asia Pacific (APAC) is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) due to unprecedented urbanization and rapid expansion of commercial and residential infrastructure, particularly in developing economies such as China, India, and Southeast Asian nations. The increasing middle-class population and rising disposable incomes fuel demand for modern, aesthetically pleasing interior lighting solutions, driving large-scale adoption in new residential projects and sprawling retail complexes. While cost remains a significant factor, the growing awareness of long-term operational savings provided by LED track lighting is accelerating market penetration. This region is a major manufacturing hub, influencing global supply chain costs, and simultaneously represents the largest volume market opportunity globally for standardized and scalable track lighting solutions.

- North America: Market maturity, strong focus on smart lighting, high adoption of premium LED and low-voltage magnetic systems; significant retrofitting activity driven by energy efficiency mandates.

- Europe: Regulatory leadership in HCL and DALI controls, high demand for certified, professional architectural lighting; stable growth driven by replacement and strict energy performance standards.

- Asia Pacific (APAC): Highest growth rate, fueled by rapid commercial construction, urbanization, and increasing disposable income; critical region for volume manufacturing and market expansion, especially in China and India.

- Latin America: Emerging market with growing construction activity, primarily focused on balancing cost-effectiveness with LED efficiency; demand driven by retail expansion and infrastructure development in major urban centers.

- Middle East and Africa (MEA): Strong demand spurred by large-scale hospitality, tourism, and luxury residential projects (e.g., UAE, Saudi Arabia); preference for high-end, aesthetically sophisticated architectural track lighting solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Track Lighting Market.- Acuity Brands

- Signify (Philips Lighting)

- OSRAM

- Eaton (Cooper Lighting)

- WAC Lighting

- Hubbell Lighting

- Nora Lighting

- Juno Lighting Group

- TECH Lighting

- Lucifer Lighting

- Amerlux

- Lightolier (Genlyte Group)

- LEDVANCE

- Eutrac

- Erco Lighting

- Zumtobel Group

- Intense Lighting

- LSI Industries

- Griven

- Prolight Concepts

- Lutron Electronics

- Targetti Sankey S.p.A.

- iGuzzini illuminazione S.p.A.

- Daisalux, S.A.

- Regent Lighting

Frequently Asked Questions

Analyze common user questions about the Track Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of LED track lighting systems?

The primary driver is the superior energy efficiency and longevity of LED technology compared to traditional sources, resulting in substantial long-term operational cost savings and reduced environmental impact, essential criteria for both commercial retrofits and new construction projects.

How do smart control features enhance the utility of modern track lighting?

Smart controls, typically integrating IoT via protocols like DALI or Bluetooth Mesh, allow for granular adjustments of light intensity, color temperature, and scheduling, enabling personalized lighting scenes, daylight harvesting optimization, and remote management through centralized building management systems (BMS).

What are the key advantages of low-voltage magnetic track lighting over standard systems?

Low-voltage magnetic systems offer enhanced safety, tool-free installation, and unmatched flexibility, allowing fixtures to be repositioned instantly and easily by non-professionals, making them highly desirable for dynamic retail displays and adaptable architectural spaces.

Which geographical region exhibits the fastest growth potential for the Track Lighting Market?

The Asia Pacific (APAC) region, particularly driven by high commercial and residential construction rates in developing economies like China and India, is projected to record the highest Compound Annual Growth Rate (CAGR) during the forecast period due to rapid urbanization.

How does track lighting support Human-Centric Lighting (HCL) initiatives?

Track lighting fixtures equipped with tunable white technology can dynamically adjust color temperature and brightness throughout the day, closely mimicking natural daylight cycles, which supports the body's circadian rhythm and improves occupant well-being and productivity in office and institutional settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager