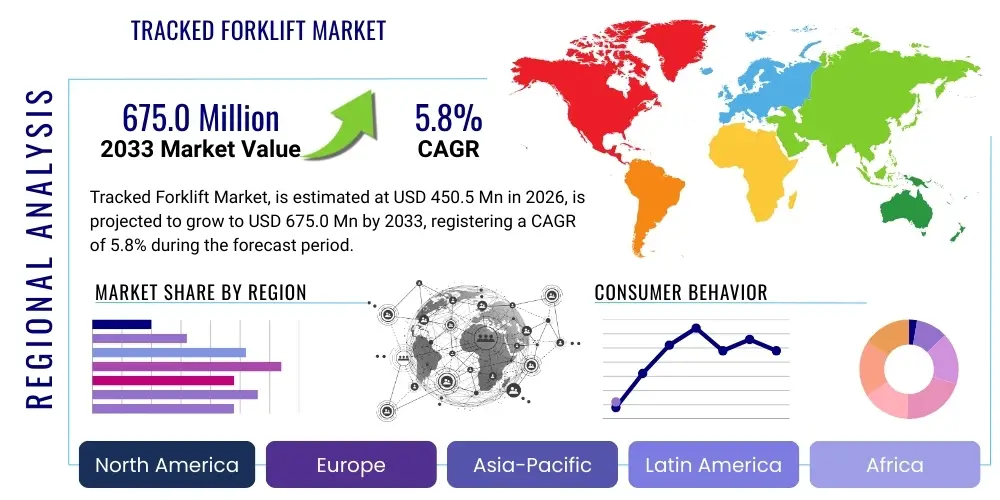

Tracked Forklift Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437704 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Tracked Forklift Market Size

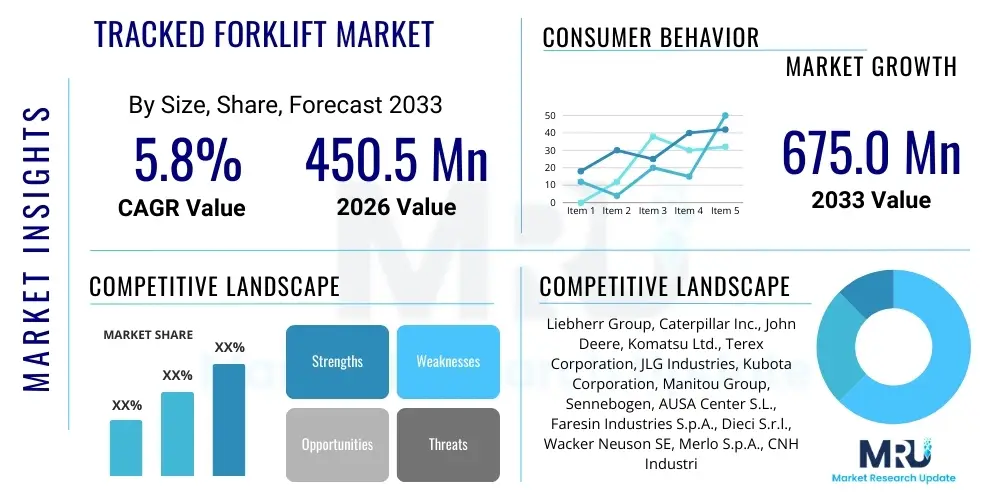

The Tracked Forklift Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 million in 2026 and is projected to reach USD 675.0 million by the end of the forecast period in 2033.

Tracked Forklift Market introduction

The Tracked Forklift Market encompasses heavy-duty material handling equipment designed with continuous tracks instead of conventional wheels. These specialized machines are engineered to operate effectively in demanding environments, particularly uneven, muddy, or sandy terrains where wheeled forklifts fail to maintain traction or stability. Tracked forklifts offer superior weight distribution through lower ground pressure, minimizing soil disruption and enhancing flotation on soft surfaces. This unique capability positions them as essential machinery in sectors requiring reliable heavy lifting and transportation across challenging outdoor job sites, such as infrastructure development, forestry, and rugged agricultural operations. Their design emphasizes stability, high lift capacity, and the ability to navigate steep grades.

Key applications of tracked forklifts span across construction sites that are still under development, remote mining operations, and specialized agricultural fields, particularly orchards or vineyards located on inclines. The product generally includes specialized features such as oscillating tracks, hydrostatic drive systems, and heavy-duty protective frames to withstand harsh working conditions. Benefits derived from their adoption include increased operational efficiency in adverse weather, improved safety due to enhanced stability on uneven ground, and the capacity to extend construction seasons by handling materials even when ground conditions are unfavorable. This resilience and versatility drive their increasing adoption across global markets focused on expanding infrastructure in developing regions.

Driving factors for this market expansion include the rapid pace of global infrastructure spending, particularly in emerging economies where construction sites often lack paved or stable access roads. Furthermore, increased mechanization within the agricultural and forestry sectors, aiming to improve productivity and reduce manual labor, significantly contributes to demand. Regulatory trends favoring enhanced site safety and environmental standards, which often necessitate equipment with low ground pressure to protect sensitive ecosystems, also serve as critical market accelerators. The ability of tracked units to perform zero-turn maneuvers and operate in confined spaces further enhances their utility, solidifying their role as indispensable assets in specialized material handling tasks.

- Product Description: Specialized material handling equipment utilizing continuous rubber or steel tracks for superior traction and stability on challenging terrains.

- Major Applications: Construction site material delivery, forestry log handling, mining logistics, specialized agriculture, and utility infrastructure maintenance.

- Key Benefits: Enhanced stability on steep slopes, lower ground pressure preventing site damage, all-terrain operational capability, and increased payload security during transit.

- Driving Factors: Growth in infrastructure projects, increasing demand for off-road construction capabilities, and stringent worker safety regulations mandating stable equipment operation.

Tracked Forklift Market Executive Summary

The Tracked Forklift Market is currently experiencing robust growth, primarily fueled by global investments in infrastructure and the mandatory requirement for resilient, all-terrain equipment in the mining and energy sectors. Business trends indicate a strong move toward electrification and hybrid models, driven by sustainability targets and the need for reduced operational noise, particularly in urban construction environments. Furthermore, key players are heavily investing in telematics and remote monitoring systems to optimize fleet management, predictive maintenance, and operational security. Mergers and acquisitions focusing on specialized attachment providers are becoming common as manufacturers aim to offer comprehensive, integrated solutions tailored to specific industry niches, such as pipeline laying or steep-slope agriculture.

Regional dynamics highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily due to massive governmental spending on developing foundational infrastructure, including roads, railways, and renewable energy projects in remote areas. North America and Europe, while mature markets, show high adoption rates of advanced, often electric, tracked models, driven by stringent environmental regulations and a focus on operational safety technologies like stability control systems. The Middle East and Africa (MEA) region is also emerging as a significant market, where oil and gas exploration and large-scale utility construction projects frequently occur in desert or underdeveloped landscapes, making tracked mobility essential for project timelines.

Segmentation trends reveal that the rubber track segment holds a dominant market share due to its versatility, lower cost of maintenance, and reduced damage risk to sensitive surfaces compared to steel tracks. However, the steel track segment remains critical for extreme-duty applications like heavy demolition and deep mining. By capacity, the medium lift capacity (3 to 6 tons) segment is anticipated to witness the highest growth, aligning perfectly with the typical requirements of residential and commercial construction logistics. The aftermarket service segment, encompassing parts, maintenance, and fleet servicing, is also expanding rapidly as companies prioritize minimizing downtime through optimized service contracts and advanced diagnostics.

AI Impact Analysis on Tracked Forklift Market

User queries regarding AI in the tracked forklift domain frequently revolve around concerns about autonomous operation reliability on unstable ground, the integration of AI-driven predictive maintenance with complex track systems, and the regulatory framework for AI-controlled heavy machinery. Users are keen to understand how AI can enhance safety metrics, specifically preventing rollovers or maximizing stability limits in real-time on uneven gradients. The prevailing expectation is that AI will transition tracked forklifts from merely automated systems to truly intelligent platforms capable of self-diagnosis, optimized route planning across dynamic job sites, and precise load handling under obscured visibility conditions. This technological shift is seen as essential for future efficiency and worker protection in hazardous environments.

- AI enhances operational safety by real-time stability monitoring and dynamic load balancing adjustments on inclines.

- Predictive maintenance algorithms analyze sensor data from track systems and hydraulics to forecast component failures, reducing unexpected downtime.

- Autonomous navigation systems utilize AI for optimized path planning across rough and unstructured outdoor environments, improving material flow logistics.

- Computer vision systems powered by AI facilitate precise material identification and placement, mitigating human error during lifting operations.

- AI integration enables semi-autonomous functions, allowing operators to focus on high-level maneuvers while the system manages stability and traction control automatically.

DRO & Impact Forces Of Tracked Forklift Market

The Tracked Forklift Market is driven by the escalating demand for infrastructure development in regions with poor road conditions, particularly in developing nations, coupled with the inherent stability and all-terrain capability of tracked systems which significantly reduce operational risks. Restraints primarily involve the higher initial acquisition costs compared to conventional wheeled forklifts, coupled with increased maintenance complexities related to track wear and tear, which can deter smaller enterprises from adoption. Opportunities lie in the continued refinement of hybrid and electric models, responding to tightening global emission standards, and the expansion into niche markets such as specialized disaster relief logistics and military applications requiring highly mobile material handling capabilities.

Key drivers include the global expansion of the energy sector, specifically large-scale solar and wind farm construction in remote locations where ground conditions are challenging. Additionally, stringent safety regulations enforced by agencies globally necessitate the use of stable equipment for lifting heavy loads, favoring tracked options over wheeled counterparts on difficult terrain. These factors collectively push manufacturers to innovate continuously, focusing on enhanced hydraulic power and improved operator comfort features to maximize productivity in demanding work cycles. The versatility to switch between various attachments (e.g., winches, buckets, standard forks) further enhances their appeal.

Impact forces on the market are multifaceted. Technological advancements, particularly in telematics and remote diagnostics, exert a strong positive impact by improving machine uptime and lowering the total cost of ownership over time. Conversely, raw material price volatility, especially for steel components used in tracks and frames, poses a significant external restraint, potentially affecting profitability and final product pricing. The competitive landscape is characterized by moderate fragmentation, where large construction equipment OEMs compete alongside specialized tracked equipment manufacturers, leading to continuous innovation but also intense pricing pressure in high-volume segments.

Segmentation Analysis

The segmentation analysis for the Tracked Forklift Market provides a critical understanding of the product characteristics, operational requirements, and end-user demands shaping the industry landscape. The market is primarily divided based on track type, lift capacity, power source, and end-use industry. These distinctions allow for tailored manufacturing and marketing strategies, ensuring that products meet the highly specific demands of sectors ranging from heavy mining to precise agricultural operations. Understanding these segments is crucial for forecasting growth areas, identifying investment opportunities, and optimizing product development pipelines focused on efficiency and durability.

- By Track Type:

- Rubber Track

- Steel Track

- By Lift Capacity:

- Up to 3 Tons (Light Duty)

- 3 Tons to 6 Tons (Medium Duty)

- Above 6 Tons (Heavy Duty)

- By Power Source:

- Diesel

- Electric/Battery

- Hybrid

- By End-Use Industry:

- Construction

- Forestry and Logging

- Mining and Quarrying

- Agriculture

- Oil and Gas/Utilities

- Other Industries (e.g., Military, Disaster Relief)

Value Chain Analysis For Tracked Forklift Market

The value chain for the Tracked Forklift Market begins with extensive upstream activities centered on the procurement and processing of specialized raw materials, including high-grade steel alloys for structural components and tracks, advanced polymers for rubber tracks, and complex electronic components for control systems and telematics. Key upstream suppliers include steel manufacturers specializing in heavy equipment grades, engine and powertrain suppliers (often third-party diesel or electric motor manufacturers), and hydraulic system providers. Quality assurance and consistent material supply are critical at this stage, as the durability of the final product hinges on the resilience of these fundamental components.

The manufacturing stage involves the precision assembly of the chassis, integration of the powertrain and hydraulic systems, followed by the installation of the track assembly and counterweights. This phase requires specialized engineering for welding, corrosion protection, and testing the stability limits of the final machine. Downstream activities focus heavily on distribution and post-sale support. Due to the high investment nature of the product, direct sales through dedicated regional dealers equipped with technical expertise are preferred over indirect consumer channels. This ensures proper machine configuration, operator training, and reliable ongoing service provision essential for maintaining high machine uptime.

Distribution channels in this market are predominantly direct or through authorized, specialized dealerships that possess inventory, financing options, and certified repair capabilities. Indirect channels, such as rental fleets and third-party logistics providers, play a crucial role in providing access to smaller contractors who cannot afford outright purchase or require specialized equipment only for short-term projects. The value chain concludes with aftermarket services, including the supply of replacement parts (especially tracks and hydraulic hoses), regular maintenance contracts, and technological upgrades, representing a significant long-term revenue stream for manufacturers and their affiliated dealers.

Tracked Forklift Market Potential Customers

Potential customers for tracked forklifts are predominantly heavy industry entities and specialized construction contractors whose operations consistently require moving heavy materials across undeveloped or unstable terrain. The primary customer base includes large civil engineering firms engaged in infrastructure projects like bridge building, road construction in remote regions, and utility corridor development, as well as general contractors focusing on commercial construction where site access conditions are frequently adverse. These buyers prioritize high stability, maximum payload capacity, and the ability to operate reliably in challenging weather conditions, ensuring project timelines are met regardless of the site environment.

A second significant customer segment is rooted in the resource extraction industries, specifically mining, quarrying, and oil and gas exploration. Companies operating these remote sites require robust machinery capable of traversing deep mud, rocky slopes, or sandy environments while maintaining material flow, often involving specialized tasks such as handling heavy pipes, explosive precursors, or large rock samples. In these environments, the low ground pressure and enhanced stability of tracked systems are non-negotiable requirements for both operational safety and environmental protection, minimizing disturbance to the landscape.

Furthermore, the agricultural and forestry sectors represent a growing segment of potential customers, particularly those involved in high-value specialty crops grown on steep or difficult slopes, such as certain vineyards or fruit orchards. Forestry operations, including logging and timber retrieval, also rely heavily on tracked equipment for navigating dense forests and soft ground without sinking or causing excessive soil compaction. These customers typically seek models optimized for maneuverability in tight spaces and equipped with specialized attachments designed for handling irregularly shaped loads like tree trunks or heavy crates of produce.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 675.0 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr Group, Caterpillar Inc., John Deere, Komatsu Ltd., Terex Corporation, JLG Industries, Kubota Corporation, Manitou Group, Sennebogen, AUSA Center S.L., Faresin Industries S.p.A., Dieci S.r.l., Wacker Neuson SE, Merlo S.p.A., CNH Industrial N.V. (New Holland/Case), Bobcat (Doosan Group), Skytrak, XCMG, Sany Group, Zoomlion Heavy Industry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tracked Forklift Market Key Technology Landscape

The Tracked Forklift Market is increasingly defined by sophisticated technological integration focused on optimizing performance, ensuring operator safety, and minimizing environmental impact. Core technological advancements revolve around hydrostatic drive systems, which provide seamless power transmission and precise speed control, crucial for maneuvering heavy loads on gradients. Modern hydrostatic systems are often electronically controlled, allowing for dynamic track speed differentiation, enhancing turning radius efficiency, and providing zero-turn capability for use in confined spaces. Furthermore, the development of robust, high-tensile rubber track technology has significantly reduced ground vibration and improved operator comfort while maintaining load stability.

The transition toward sustainable power sources represents a substantial technological shift. Electric and hybrid tracked forklifts are gaining traction, utilizing high-density lithium-ion battery packs to power electric motors that drive the tracks and hydraulics. This allows for reduced noise pollution and zero tailpipe emissions, making them ideal for indoor warehouse use (if equipped with non-marking tracks) or sensitive urban construction sites. Simultaneously, manufacturers are focusing on optimized diesel engine technology that complies with stringent global emission standards (e.g., Tier 4 Final/Stage V), often integrating sophisticated exhaust after-treatment systems without compromising the necessary torque and power output required for heavy-duty lifting.

Another pivotal technological area is the deployment of advanced sensor technology and telematics. Modern tracked forklifts feature comprehensive telematics systems offering real-time data on location, fuel consumption, diagnostics, and operational efficiency. Integrated stability management systems use gyroscopic sensors to continuously monitor the machine's tilt and load status, providing immediate warnings or automatic intervention to prevent tip-overs. Furthermore, remote operating capabilities and drone integration for site assessment prior to machine deployment are being explored, enhancing both safety and the overall utilization rate of these high-value assets.

Regional Highlights

North America is a mature market characterized by high adoption rates of advanced, often specialized tracked forklifts, driven primarily by robust residential and commercial construction activity and significant investment in oil and gas infrastructure. The demand here centers on high-capacity models and those featuring advanced safety and emission-reducing technologies. Regulatory pressure for environmentally compliant machinery favors the adoption of hybrid and electric models, especially in California and states with large metropolitan areas. The market also benefits from a high replacement cycle rate among major rental companies and construction fleets.

Europe exhibits steady growth, influenced by strict EU directives regarding workplace safety, noise pollution, and machinery emissions. Western European countries, particularly Germany and the Nordic region, prioritize precision-engineered equipment and demand high levels of operational efficiency and ergonomic design. The market here is highly competitive, pushing manufacturers toward innovation in compact, tracked units suitable for restoration projects in historical centers and utility work in densely populated areas where maneuverability and low noise are paramount. Eastern Europe's growth is linked to ongoing industrial modernization and transport network expansion.

The Asia Pacific (APAC) region stands out as the primary growth engine for the tracked forklift market globally. This exponential growth is underpinned by massive governmental investments in infrastructure development, urbanization, and the expansion of mining operations in Australia, China, India, and Southeast Asia. The demand is often for durable, cost-effective machines capable of operating in diverse and extreme climatic conditions. China, in particular, is both a massive consumer and a major global producer, driving competitive pricing and rapid scaling of production capacity to meet regional and global needs.

Latin America’s market growth is tied closely to commodity prices, driving demand in mining (Chile, Peru) and large-scale agriculture (Brazil, Argentina). The necessity for robust equipment that can handle rough, often ungraded access roads is critical, strongly favoring tracked designs over wheeled alternatives. Meanwhile, the Middle East and Africa (MEA) region shows accelerating potential, dominated by requirements from the massive oil and gas sector and large public works projects in the GCC states and heavy resource extraction activities across Africa. The extreme temperatures and challenging desert terrains make specialized, high-performance tracked units essential for sustained operations.

- Asia Pacific (APAC): Highest growth region driven by infrastructure development and urbanization; strong demand from China and India for medium-to-heavy capacity models.

- North America: Mature market focused on technological upgrades, safety compliance, and the adoption of hybrid and electric tracked telehandlers for improved efficiency.

- Europe: Stable growth underpinned by stringent environmental and safety regulations; emphasis on compact design and low-emission power sources for urban environments.

- Middle East & Africa (MEA): High demand from oil and gas pipeline construction and utility projects in desert environments where all-terrain capability is mandatory.

- Latin America: Growth tied to agricultural expansion and mining investments, requiring robust, high-traction machines for operation on steep and unstable land.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tracked Forklift Market.- Liebherr Group

- Caterpillar Inc.

- John Deere

- Komatsu Ltd.

- Terex Corporation

- JLG Industries

- Kubota Corporation

- Manitou Group

- Sennebogen

- AUSA Center S.L.

- Faresin Industries S.p.A.

- Dieci S.r.l.

- Wacker Neuson SE

- Merlo S.p.A.

- CNH Industrial N.V. (New Holland/Case)

- Bobcat (Doosan Group)

- Skytrak

- XCMG

- Sany Group

- Zoomlion Heavy Industry

Frequently Asked Questions

Analyze common user questions about the Tracked Forklift market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of tracked forklifts over standard wheeled forklifts?

Tracked forklifts offer superior stability, significantly lower ground pressure, and enhanced traction on soft, muddy, sandy, or extremely uneven terrains. This capability minimizes soil damage and ensures continuous operation on construction, forestry, and agricultural sites where wheeled vehicles would become immobilized or unsafe.

How does the total cost of ownership (TCO) compare between tracked and wheeled models?

The TCO for tracked forklifts is generally higher due to the greater initial purchase price and the increased complexity and frequency of track maintenance and replacement compared to tires. However, their superior performance and ability to operate year-round in adverse conditions can lead to higher productivity and lower project delay costs, often justifying the premium for specialized tasks.

What role does electrification play in the future development of the tracked forklift market?

Electrification is a critical trend, allowing manufacturers to develop quieter, zero-emission tracked forklifts. These electric and hybrid models are highly sought after in indoor applications, urban construction, and environmentally sensitive areas, driving innovation in battery longevity, power delivery, and thermal management systems to meet heavy-duty operational demands.

Which industry segment accounts for the highest demand for tracked forklifts globally?

The Construction industry segment, particularly large-scale infrastructure and heavy civil engineering projects, currently accounts for the highest global demand. This is due to the necessity of moving heavy building materials across undeveloped job sites that lack paved access roads or stable ground conditions during project phases.

What factors determine the choice between rubber tracks and steel tracks for tracked forklifts?

Rubber tracks are typically preferred for versatility, faster speed, reduced surface damage (e.g., pavement, concrete), and lower vibration. Steel tracks are selected for extreme-duty applications involving sharp debris, aggressive digging, or operations requiring maximum traction and durability in highly abrasive environments like rock quarries or heavy demolition sites.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager