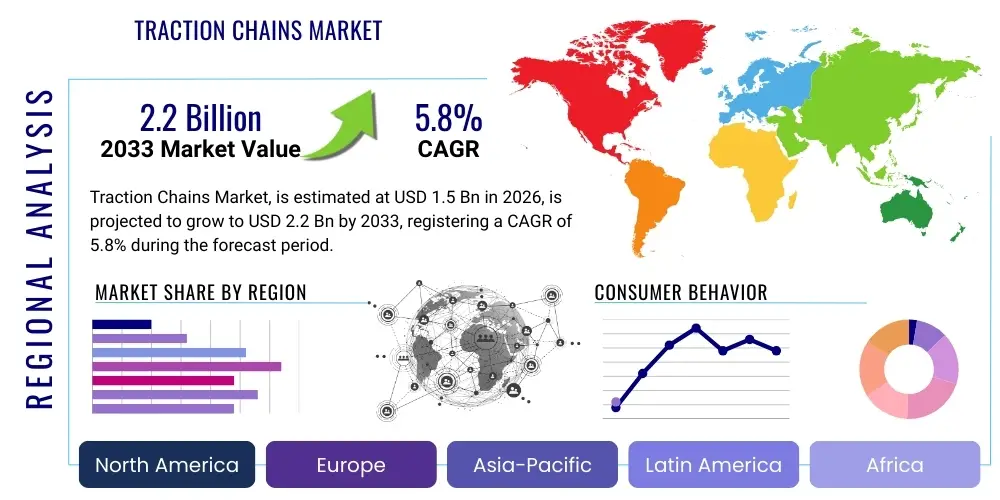

Traction Chains Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435182 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Traction Chains Market Size

The Traction Chains Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

Traction Chains Market introduction

The Traction Chains Market encompasses the design, manufacture, and distribution of robust devices specifically engineered to enhance traction on vehicles operating in adverse conditions such as snow, ice, mud, and uneven terrain. These critical accessories, often fitted over tires, are fundamental for ensuring safety, maintaining operational continuity, and complying with regional transportation regulations, particularly in regions prone to severe winter weather or demanding off-road industrial applications. The market's stability is intrinsically linked to the longevity and durability of the chains, which are typically constructed from hardened steel alloys or advanced composites to withstand extreme abrasive forces and low temperatures.

Traction chains find extensive application across several verticals, including passenger automobiles, heavy-duty commercial trucks, forestry machinery, agricultural equipment, and specialized military vehicles. Their primary benefit lies in significantly increasing the coefficient of friction between the tire and the slippery surface, which drastically reduces slippage and improves steering control and braking efficiency. The growing infrastructure development in remote, mountainous regions, coupled with increasingly stringent safety standards mandating the use of traction aids during inclement weather, are primary drivers for market expansion.

Product innovation focuses on enhancing ease of installation, reducing weight, and optimizing material composition to improve wear resistance and performance on various surfaces. Key driving factors include increasing winter tourism, expansion in the logistics and transportation sector requiring all-weather operational capability, and continuous regulatory pressure mandating vehicle safety accessories. The shift toward higher-performance, quick-fitting chain systems, particularly in the consumer segment, is shaping contemporary market dynamics.

Traction Chains Market Executive Summary

The global Traction Chains Market is characterized by steady growth driven predominantly by climatic volatility and mandatory regulatory compliance across North America and Europe. Business trends indicate a strong move toward automation in chain manufacturing processes and a rise in demand for premium, quick-install chains, particularly in the automotive aftermarkets. Strategic alliances between chain manufacturers and major tire and automotive OEMs are becoming prevalent, aimed at developing integrated traction solutions. Furthermore, the market is experiencing moderate consolidation as leading players acquire smaller, specialized manufacturers to gain patented technology related to composite or self-tensioning chains, thereby enhancing their product portfolio and distribution reach.

Regionally, North America maintains the largest market share, attributable to severe winter conditions in key logistics corridors and a high consumer adoption rate of winter preparedness accessories. Europe follows closely, driven by strict national regulations concerning winter tire equipment, especially in Scandinavian countries and the Alps region. The Asia Pacific region is forecast to demonstrate the highest Compound Annual Growth Rate (CAGR), fueled by rapid infrastructure development in mountainous territories (e.g., China and India) and the expanding use of heavy industrial equipment in resource extraction and construction, which necessitates reliable off-road traction solutions.

Segment-wise, the commercial vehicle application segment, particularly heavy trucks and buses, dominates revenue generation due to the necessity of maintaining operational schedules regardless of weather conditions, making reliable traction chains a critical operational expenditure. In terms of type, metal chains, especially those made from manganese steel and specialized alloys, continue to hold the majority share due to their superior durability and load-bearing capacity, although composite and rubber-based chains are gaining traction in the passenger vehicle segment due to lower weight and reduced noise pollution.

AI Impact Analysis on Traction Chains Market

Common user questions regarding AI's impact on the Traction Chains Market often revolve around predictive maintenance schedules, optimizing supply chains for seasonal demand fluctuations, and how AI might influence the design and manufacturing efficiency of traction devices. Users are particularly interested in whether AI-driven route optimization tools could negate the need for chains or if smart chains with integrated sensors are becoming feasible. The core theme emerging from user inquiries is the expectation that AI will primarily enhance the operational lifespan of existing chains and optimize logistics, rather than revolutionizing the core function of traction aids. Summarily, AI's influence is anticipated in enhancing manufacturing precision, automating quality control, and improving demand forecasting, leading to more resilient products and streamlined inventory management for highly seasonal demand.

- AI-powered predictive maintenance models minimize chain failure rates by analyzing material fatigue data and usage patterns.

- Generative Design algorithms optimize chain link geometry and material distribution, reducing weight while maintaining maximum tensile strength.

- Automated Vision Systems utilizing AI enhance quality control during manufacturing, ensuring zero-defect rates in welding and assembly.

- AI-driven demand forecasting improves inventory management, crucial for handling the highly seasonal sales peaks associated with winter weather.

- Integration of simple machine learning into vehicle telematics could alert drivers about optimal chain installation timing based on real-time road condition analysis.

DRO & Impact Forces Of Traction Chains Market

The Traction Chains Market is significantly shaped by a combination of stringent safety regulations and fluctuating climate patterns. The primary drivers include mandatory winter equipment laws in key northern hemisphere economies, the continuous expansion of construction, forestry, and mining activities requiring robust off-road mobility, and heightened consumer awareness regarding vehicle safety during severe weather events. Simultaneously, the market faces restraints suchased by the high initial cost of premium chains, competition from specialized winter tires that offer a year-round alternative, and the inherent difficulty and time consumption associated with manually installing traditional chains, which deter some users.

Opportunities for growth are abundant, particularly in the development of automated or semi-automated chain installation systems that address the major restraint of user convenience. Furthermore, the increasing adoption of lightweight, high-performance composite chains in electric vehicles (EVs) offers a lucrative niche, as traditional heavy metal chains can negatively impact EV range and require specialized mounting due to lower ground clearance. Expanding into emerging markets, especially those undergoing rapid industrialization but lacking sophisticated road infrastructure, presents a significant avenue for expansion.

The impact forces influencing the market are high. Technological shifts, particularly in material science, push manufacturers to innovate constantly, focusing on lighter, stronger, and more durable alloys or polymers. Regulatory mandates exert a strong positive force, creating guaranteed annual demand for compliance-based purchases. Conversely, environmental and sustainability concerns are a growing influence, pressuring manufacturers to adopt eco-friendly materials and energy-efficient production processes. Overall, the market remains moderately dynamic, balanced between the necessity of the product for safety and the search for more convenient, less intrusive alternatives.

Segmentation Analysis

The Traction Chains Market is comprehensively segmented based on product type, material composition, vehicle application, and distribution channel, providing a granular view of market dynamics across diverse end-user sectors. This segmentation helps identify specific growth pockets, such as the increasing demand for specialized chains for heavy machinery used in the extractive industries, and the shifting preference for easy-to-use, high-visibility chains in the passenger car aftermarket. The market structure reflects a clear bifurcation between high-volume consumer products and low-volume, high-specification industrial traction solutions.

The segmentation by Type distinguishes between traditional metal chains (ladder type, diamond pattern, or cable chains) and advanced non-metal alternatives (composite, rubber, or textile chains). While metal chains dominate in performance for heavy-duty applications, non-metal solutions are gaining prominence in urban passenger vehicle sectors due to reduced road wear, quieter operation, and ease of storage. Material analysis further breaks down the market by the use of alloy steel, manganese steel, carbon steel, and specialized polymers, reflecting cost and performance trade-offs inherent in different materials. Alloy steel remains the material of choice for demanding commercial use due to its superior toughness and longevity.

Vehicle application segments highlight differential demand, with commercial vehicles (trucks and buses) representing the core revenue base due to stringent operational requirements. The rapid expansion of the utility and construction vehicle segment, driven by infrastructure projects globally, is expected to accelerate demand for specialized, high-load capacity traction solutions during the forecast period. Understanding these distinct segment needs is crucial for manufacturers in tailoring product specifications and marketing strategies effectively.

- By Type:

- Metal Chains (Ladder, Diamond, Cable Chains)

- Non-Metal Chains (Composite, Rubber, Textile Chains)

- By Material:

- Alloy Steel

- Manganese Steel

- Carbon Steel

- Rubber and Composite Materials

- By Application:

- Passenger Vehicles (Sedans, SUVs)

- Commercial Vehicles (Heavy Trucks, Buses, Vans)

- Off-Road and Industrial Equipment (Forestry, Mining, Construction)

- Military Vehicles

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retail Stores, Online Sales, Specialized Distributors)

Value Chain Analysis For Traction Chains Market

The value chain for the Traction Chains Market begins with upstream activities, focusing heavily on raw material procurement, primarily specialized, high-grade steel alloys such as manganese steel and specific carbon steels designed for low-temperature resilience and high tensile strength. This stage is critical, as material quality directly dictates the chain's ultimate performance, durability, and safety rating. Key suppliers are often specialized metallurgy companies, and pricing fluctuations in steel commodities can significantly impact manufacturing costs and, consequently, final consumer pricing. Research and Development (R&D) plays an increasingly important upstream role, driving innovation in heat treatment processes and link geometry optimization.

Midstream activities involve core manufacturing processes, including steel wire drawing, cutting, forging, welding, and heat treatment. Manufacturers often employ sophisticated automated machinery to ensure uniformity in link size and weld integrity, critical factors for chain reliability. Quality control (QC) is paramount at this stage, focusing on stress testing and corrosion resistance. Leading players often integrate vertical processes, controlling both material preparation and final assembly, to maintain high-quality standards and minimize production lead times. The manufacturing stage for composite chains involves polymer formulation and specialized injection molding or braiding techniques.

Downstream analysis focuses on distribution and end-user engagement. The distribution channel is bifurcated into Original Equipment Manufacturer (OEM) sales, where chains are packaged with new vehicles or equipment, and the vast Aftermarket. Direct sales to large commercial fleets and indirect sales through specialized automotive parts retailers, general merchandisers, and a rapidly growing e-commerce channel define the indirect route. The aftermarket segment, driven by seasonal demand and regulatory compliance, demands highly efficient logistics and widespread retail presence. Effective marketing highlights ease of installation, compliance features, and product durability to capture the consumer segment.

Traction Chains Market Potential Customers

Potential customers for the Traction Chains Market span a broad spectrum, categorized mainly by the application intensity and regulatory necessity. The largest and most dependable customer segment comprises commercial logistics and heavy transportation companies operating within regions subject to mandatory winter tire or chain laws. These buyers prioritize reliability, ease of fitting (for reducing downtime), and longevity, often purchasing high volumes of heavy-duty, cross-country rated chains. Their purchasing decisions are driven by operational safety and compliance with strict governmental or corporate safety mandates.

Another significant customer base includes public and private entities involved in resource extraction and civil infrastructure, such as forestry, mining, and large-scale construction firms. These users require specialized, heavy-gauge chains capable of handling exceptionally high torque and resistance in severe off-road conditions, mud, or deep snow. The selection criteria here focus purely on ruggedness, load capacity, and anti-break performance, often justifying a premium price for specialized traction solutions that prevent costly machinery downtime.

The consumer segment, composed of individual passenger vehicle owners, forms a high-volume, highly seasonal demand pool, largely concentrated in mountainous areas or regions experiencing heavy snowfall. These customers are highly sensitive to ease of use, purchase convenience (often online or at gas stations/retailers), and compact storage. Furthermore, governmental bodies, including military and emergency services (ambulances, police, snowplows), represent a steady, niche customer base requiring specialized, often military-specification, rapid-fit chains to ensure mission-critical mobility during emergencies or severe weather events.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peerless Chain Company, Laclede Chain Manufacturing, Thule Group, RUD Ketten, Clark Industries, Trygg, König, Vredestein, Michelin, Ottinger, Nordic Traction Oy, Tellefsdal AS, Veriga K.F. d.o.o., Pewag International GmbH, REX-ROTH, Hangzhou Jinli Chain, Jiangsu Jinfeng Chain, Renold PLC, Wippermann Jr. GmbH, Diamond Chain Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Traction Chains Market Key Technology Landscape

The technological landscape of the Traction Chains Market, while rooted in traditional metallurgy, is increasingly influenced by material science and engineering innovations aimed at improving performance, reducing weight, and enhancing user experience. A major area of focus is the development of self-tensioning and quick-fit technologies, which eliminate the need for manual retightening after initial installation, drastically improving user safety and convenience. Leading manufacturers are integrating ratcheting systems or specialized elastic tensioners that automatically adjust the chain tension as the vehicle moves, ensuring optimal performance and minimizing the risk of damage to the vehicle's wheel wells or ABS sensors.

Material advancements constitute another crucial technological frontier. The shift towards proprietary high-tensile strength alloys, such as specific Manganese-Nickel-Chromium steels, allows for the use of thinner, lighter chain links without compromising abrasive resistance or load-bearing capacity. This is particularly relevant for the passenger vehicle segment, where reduced weight minimizes the impact on fuel efficiency and vehicle handling. Furthermore, the burgeoning segment of composite and textile chains leverages advanced polymer technology to offer superior grip on pure ice, quieter operation, and significantly lower weight, making them a preferred, albeit less durable, option for occasional use.

Digital integration is also beginning to emerge, particularly in the commercial and industrial segments. This includes the development of sensor-equipped chains for heavy machinery that transmit real-time data on chain wear, slippage rate, and remaining lifespan to the vehicle's telematics system. This technology enables fleet managers to conduct predictive maintenance, ensuring chains are replaced before catastrophic failure occurs, thereby maximizing uptime and operational efficiency. The continuous refinement of automated manufacturing techniques, including precision robotic welding and specialized heat treatment cycles, further ensures product consistency and integrity, which are paramount in safety-critical components.

Regional Highlights

The global demand for traction chains is heavily skewed toward geographies that experience prolonged and severe winter seasons, driving distinct regulatory and consumer behaviors across continents. North America, specifically the northern tier of the United States and Canada, represents the largest market, characterized by extensive road networks and a high dependency on commercial trucking, making reliable traction aids essential for cross-country logistics continuity. Regulatory frameworks in certain states and provinces mandate the carrying or use of chains for heavy vehicles during winter months, ensuring a stable, compliance-driven market base. The consumer market here favors heavy-duty, reliable metal chains, although there is growing acceptance of composite quick-fit systems for SUVs and passenger vehicles.

Europe stands as the second-largest market, exhibiting high demand concentrated in the Alpine regions (Austria, Switzerland, Italy, France) and Scandinavian countries. This market is highly fragmented but mature, characterized by very strict national regulations that often specify the precise type of equipment required (e.g., chains versus specific M+S marked tires). The European consumer shows a strong preference for certified, technologically advanced products, including those focusing on ease of mounting and minimal impact on the vehicle's structure. Germany, as a major hub for logistics, drives substantial demand in the commercial segment, valuing quality and durability highly.

The Asia Pacific (APAC) region is projected to register the fastest growth during the forecast period. This acceleration is predominantly driven by two factors: large-scale infrastructure and industrial expansion in China, India, and Southeast Asia, requiring heavy machinery to operate year-round in challenging mountainous and remote construction sites; and increasing affluence in regions like Japan and South Korea, leading to higher vehicle ownership and a corresponding rise in demand for winter safety accessories. While the market size is currently smaller than North America or Europe, the rapid industrialization and expansion of road networks in high-altitude areas present massive untapped potential for manufacturers of both heavy-duty industrial chains and consumer-grade snow chains.

- North America: Dominant market share driven by vast commercial trucking operations, severe winter weather, and mandatory chain laws in mountainous regions (e.g., Sierra Nevada, Rocky Mountains). High adoption of both traditional metal and new composite chains.

- Europe: Characterized by stringent, country-specific winter equipment mandates (Alpine regions, Nordic countries). Focus on certified, high-quality, and easy-to-install systems for both passenger cars and commercial fleets.

- Asia Pacific (APAC): Fastest-growing region due to infrastructure projects in mountainous terrains (Himalayas, parts of China) and expanding mining/forestry sectors, leading to increased demand for robust industrial chains.

- Latin America (LATAM): Moderate market presence, focused mainly on Chile and Argentina (Andes regions), where specialized chains are needed for high-altitude mining and transport; generally less regulatory stimulus elsewhere.

- Middle East and Africa (MEA): Smallest market share, with niche demand in high-altitude areas of Turkey, Iran, and South Africa where snow/ice conditions necessitate traction aids for commercial and specialized utility vehicles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Traction Chains Market.- Pewag International GmbH

- RUD Ketten Rieger & Dietz GmbH u. Co. KG

- Thule Group

- Peerless Chain Company

- Laclede Chain Manufacturing Company

- König (Part of Thule Group)

- Trygg (Norsk Kjetting AS)

- Clark Industries Inc.

- Ottinger Gmbh

- Michelin (via specialized product lines)

- Veriga K.F. d.o.o.

- Nordic Traction Oy (Tellefsdal AS)

- Jiangsu Jinfeng Chain Manufacturing Co. Ltd.

- Hangzhou Jinli Chain Co. Ltd.

- Vredestein (Apollo Vredestein B.V.)

- REX-ROTH Chain

- Wippermann Jr. GmbH

- Diamond Chain Company

- Renold PLC

- Daiso Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Traction Chains market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the Traction Chains Market?

Market growth is primarily driven by strict government regulations in North America and Europe mandating the use of winter traction equipment, coupled with increasing demand from commercial logistics and off-road industrial sectors (mining, forestry) that require dependable mobility in challenging weather conditions.

How do composite chains compare to traditional metal snow chains?

Composite chains (textile/rubber) are significantly lighter, easier to install, quieter, and less damaging to road surfaces and vehicle wheels. However, metal chains, particularly those made from hardened alloys, offer superior durability, load capacity, and traction performance in deep snow and heavy industrial use.

Which application segment holds the largest share in the Traction Chains Market?

The Commercial Vehicles segment (heavy trucks and buses) holds the largest market share due to the necessity of maintaining operational schedules during winter and the high volume of mandatory compliance purchases under various regional chain laws.

What is the primary technological innovation impacting traction chain adoption?

The primary technological innovation is the development of self-tensioning and rapid-fit chain systems. These technologies significantly reduce the effort and time required for installation, directly addressing the major consumer restraint related to manual chain fitting, thereby boosting user adoption rates.

Is the Asia Pacific region a significant growth area for traction chains?

Yes, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to expanding infrastructure projects in high-altitude areas of China and India and the continuous increase in mining and forestry operations requiring robust industrial traction solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager