Tractor Mounted Boom Sprayer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433788 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Tractor Mounted Boom Sprayer Market Size

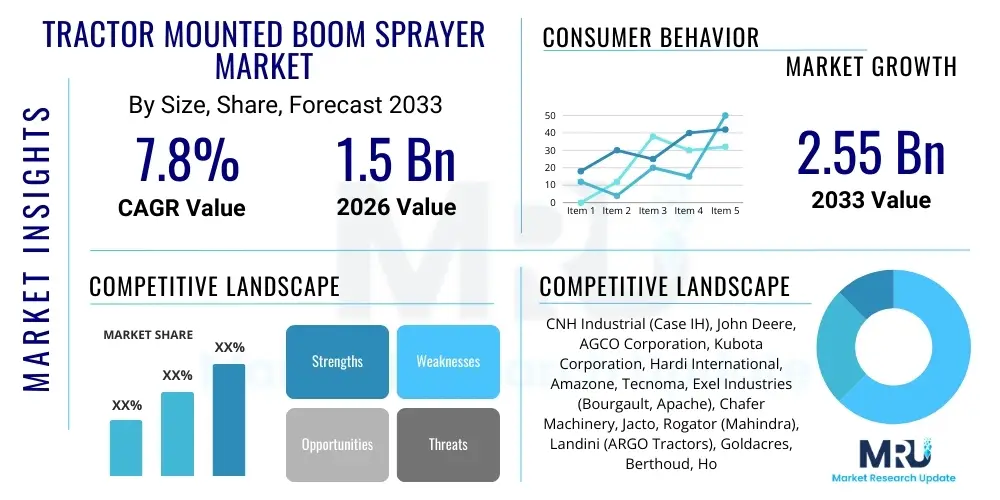

The Tractor Mounted Boom Sprayer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Tractor Mounted Boom Sprayer Market introduction

The Tractor Mounted Boom Sprayer Market encompasses specialized agricultural machinery designed for efficient and precise application of liquid substances, including pesticides, herbicides, fungicides, and fertilizers, across large cultivated areas. These sprayers are characterized by a horizontal boom structure, often mounted directly onto the three-point hitch or chassis of a standard agricultural tractor, providing stability and mobility necessary for effective field operations. The product’s mechanism typically involves a large tank, a high-pressure pump system, control valves, and a series of nozzles distributed along the boom, ensuring uniform coverage and minimizing chemical waste. Modern iterations incorporate advanced features like GPS guidance, automatic boom section control, and variable rate technology, significantly enhancing operational efficiency and environmental stewardship.

Major applications for tractor mounted boom sprayers span diverse agricultural segments, including large-scale row crops such as corn, soybeans, and wheat, specialty crops like vineyards and orchards, and high-value vegetable farming. The primary benefit derived from using these sprayers is the substantial improvement in crop yield quality and quantity through timely and accurate pest and disease management. Furthermore, the capacity for broad swath coverage allows farmers to cover significant acreage rapidly, which is critical during short spraying windows necessitated by weather conditions or specific crop development stages. The adaptability of these sprayers to various terrain types and different tractor sizes makes them an indispensable tool in modern precision agriculture practices.

Driving factors propelling the expansion of this market include the global imperative to increase agricultural output to meet growing food demands, coupled with diminishing arable land resources necessitating higher productivity per hectare. The increasing adoption of mechanized farming techniques, particularly in emerging economies undergoing agricultural modernization, provides a strong tailwind. Additionally, stringent regulations regarding chemical use efficiency and environmental protection encourage farmers to invest in technologically superior sprayers that offer better drift control and targeted application, thereby reducing operational costs and environmental impact. The continual innovation in nozzle technology and material science further contributes to market momentum by improving the durability and performance of the equipment.

Tractor Mounted Boom Sprayer Market Executive Summary

The Tractor Mounted Boom Sprayer Market is witnessing robust expansion driven by global trends toward precision agriculture and increasing farm mechanization, particularly across developing regions. Business trends indicate a strong shift towards incorporating smart technology, such as telematics, sensor integration, and sophisticated control systems, to enhance application accuracy and data collection capabilities. Manufacturers are focusing on developing lightweight yet durable composite materials for tanks and booms to improve fuel efficiency and minimize soil compaction. Mergers and acquisitions remain a crucial strategy for leading players seeking to expand geographical footprint and integrate specialized component technologies, ensuring a highly competitive yet innovative market landscape characterized by continuous product refinement and feature enhancements aligned with sustainability goals.

Regionally, Asia Pacific is poised to exhibit the highest growth rate, fueled by substantial government initiatives promoting farm modernization, especially in India and China, coupled with the rising prevalence of large commercial farms adopting western agricultural practices. North America and Europe, representing mature markets, maintain dominance in terms of technological adoption and market value, driven by strict environmental regulations mandating high precision equipment and a shortage of farm labor encouraging automated solutions. These developed regions see steady demand for replacement cycles featuring upgraded models with superior drift reduction technology and connectivity, maintaining a focus on optimizing input costs through efficiency gains. Latin America, particularly Brazil and Argentina, demonstrates strong potential due to vast soybean and grain production, necessitating high-capacity spraying solutions.

Segment trends highlight the dominance of high-capacity sprayers (over 1000 liters) in terms of revenue, catering to large-scale commercial farming operations, although medium-capacity models remain popular among small to mid-sized farms transitioning to modern equipment. Hydraulically folding booms are gaining preference over manual systems due to the ease of operation and safety benefits, especially for wider working widths that maximize coverage area. Furthermore, the component segment focusing on advanced nozzle systems, flow meters, and electronic control units is experiencing rapid growth, reflecting the industry's commitment to optimizing spray quality and complying with evolving regulatory standards related to pesticide application safety and efficacy across diverse agricultural environments and crop types.

AI Impact Analysis on Tractor Mounted Boom Sprayer Market

Common user inquiries regarding the influence of Artificial Intelligence on the Tractor Mounted Boom Sprayer Market revolve primarily around efficiency maximization, chemical reduction, and predictive maintenance capabilities. Users frequently ask about the implementation of computer vision systems for real-time weed detection, how AI algorithms optimize spray patterns in variable terrains, and the return on investment associated with integrating sophisticated machine learning models into existing sprayer fleets. Concerns often center on the complexity of retrofitting older equipment with AI components, the necessary infrastructure for data handling (cloud storage and connectivity), and the cybersecurity risks associated with networked agricultural machinery. Expectations are high regarding the promise of true spot spraying—where chemicals are applied only exactly where needed—which is anticipated to drastically reduce input costs and environmental exposure, setting a new benchmark for sustainable crop management practices.

AI's influence is profound, transitioning sprayers from simple application tools to complex, data-driven execution platforms. AI-powered computer vision and deep learning algorithms enable instantaneous classification of weeds versus crops, facilitating highly targeted, precise application decisions at the individual plant level, an advancement known as green-on-green or green-on-brown spraying. This real-time processing capability allows for highly dynamic adjustment of nozzle pressure, flow rate, and boom height, moving beyond traditional zone-based application maps toward true plant-specific intervention. Such precision not only minimizes herbicide and pesticide usage—reducing costs by up to 80% in specific applications—but also significantly mitigates chemical runoff and the development of resistant weeds, addressing major sustainability and economic concerns for farmers globally.

Beyond field operations, AI contributes substantially to predictive maintenance and operational optimization. Machine learning models analyze telematics data, sensor readings (vibration, temperature, pump performance), and operational history to forecast potential equipment failure long before it occurs, shifting maintenance from reactive to proactive. This dramatically reduces costly downtime during critical spraying windows. Furthermore, AI algorithms optimize field routes and operational speed based on topographic data, weather forecasts, and field shape complexity, ensuring that application coverage is maximized while fuel consumption and operational hours are minimized. The integration of these intelligent systems establishes a foundation for fully autonomous spraying operations in the future, marking a significant technological leap in market evolution.

- AI-driven Computer Vision enables real-time weed detection and identification.

- Machine Learning algorithms optimize variable rate application (VRA) for targeted spot spraying.

- Predictive maintenance schedules are generated based on operational telemetry and sensor data.

- Route optimization and speed adjustments are automated to maximize field coverage and fuel efficiency.

- Facilitates integration with Farm Management Information Systems (FMIS) for centralized data analysis.

- Enhances regulatory compliance through highly detailed application record keeping and reporting.

DRO & Impact Forces Of Tractor Mounted Boom Sprayer Market

The Tractor Mounted Boom Sprayer Market is governed by dynamic forces where technological innovation intersects with global agricultural demands and environmental pressures. Key drivers include the necessity for increased food production efficiency globally, supported by government subsidies and incentives promoting farm mechanization, particularly in large agrarian economies. The rapid adoption of precision farming techniques mandates the use of highly accurate spraying equipment capable of utilizing GPS and real-time mapping, thus stimulating demand for advanced boom sprayers. However, the market faces significant restraints, notably the high initial capital expenditure associated with purchasing sophisticated, wide-boom machinery equipped with smart technologies, which poses a barrier to entry for smaller farming operations in developing markets. Furthermore, fluctuations in global commodity prices and agricultural income variability directly impact farmers' willingness and capacity to invest in new equipment.

Opportunities for growth are concentrated in the continuous development of ultra-low volume (ULV) and electrostatic spraying technologies, which promise higher efficacy with less water and chemical use, appealing to both cost-conscious farmers and environmental regulators. The emergence of affordable telematics and sensor packages that can be retrofitted onto existing machinery provides a pathway for modernization, expanding the market scope beyond only new equipment sales. Moreover, substantial opportunities exist in the aftermarket services segment, including specialized calibration, maintenance contracts, and the provision of data analytics services derived from sprayer usage, transforming the traditional manufacturing model into a more service-oriented structure. The transition toward organic and sustainable farming also opens niche opportunities for bio-pesticide and targeted biological agent application equipment.

The market is subject to intense impact forces stemming from regulatory mandates, particularly those concerning pesticide drift minimization and worker safety. Regulatory bodies in regions like the European Union enforce strict guidelines on nozzle design, sprayer inspection frequency, and application record keeping, compelling manufacturers to invest heavily in certified drift-reducing technologies (DRT) and sophisticated monitoring systems. Competitive intensity is high, characterized by continuous technological rivalry between established global players and regional manufacturers, often revolving around boom stability, fold speed, and integration compatibility with various tractor brands. Finally, the environmental impact force, driven by consumer preference for sustainably grown produce, pushes the entire value chain toward adopting the most efficient and least chemically intensive application methods available.

Segmentation Analysis

The Tractor Mounted Boom Sprayer Market is intricately segmented based on capacity, type of boom folding mechanism, application, and end-user farming type, reflecting the diverse requirements of the global agricultural sector. Capacity segmentation is crucial as it directly relates to the size of the operation; smaller farms prioritize maneuverability and lower cost (low capacity), while large commercial operations require maximum efficiency and uptime (high capacity). The distinction between manual, hydraulic, and air-assisted boom types separates equipment based on required working width, terrain adaptation capabilities, and chemical delivery efficiency. This detailed segmentation allows manufacturers to target specific demographic and geographical markets with tailored product offerings, ensuring optimal performance across varying field conditions and crop types worldwide, driving overall market efficiency and penetration across distinct agricultural ecosystems.

- By Capacity:

- Low Capacity (Up to 500 Liters)

- Medium Capacity (500 to 1,500 Liters)

- High Capacity (Above 1,500 Liters)

- By Boom Type:

- Manual Folding Boom

- Hydraulic Folding Boom

- Air-Assisted Boom

- By Application:

- Herbicides

- Pesticides

- Fungicides

- Fertilizers and Growth Regulators

- By Farming Type:

- Row Crop Farming

- Orchards and Vineyards

- Specialty Crop Farming

- By Sales Channel:

- OEMs (Original Equipment Manufacturers)

- Aftermarket

Value Chain Analysis For Tractor Mounted Boom Sprayer Market

The value chain for the Tractor Mounted Boom Sprayer Market begins with upstream activities dominated by raw material suppliers and component manufacturers. Raw materials primarily include high-density polyethylene (HDPE) for tanks, various grades of steel and aluminum for chassis and booms, and high-performance polymers for nozzles and seals. Component suppliers specialize in manufacturing critical parts such as sophisticated GPS receivers, variable rate controllers, high-pressure diaphragm and piston pumps, and specialized valves. This upstream segment is characterized by strong relationships between sprayer manufacturers and specialized technology providers (e.g., electronic control unit developers) to ensure seamless integration of smart features and adherence to stringent quality standards for durability and operational safety, particularly regarding chemical resistance and pressure handling.

The middle segment of the value chain involves Original Equipment Manufacturers (OEMs) who handle design, assembly, and quality control. OEMs often source essential components globally to balance cost and performance. Their primary focus is on innovation in boom stability, weight reduction, and the integration of precision agriculture technologies like automatic section control and telematics. Distribution channels are paramount, involving both direct sales to large corporate farms and, more commonly, indirect sales through extensive networks of authorized agricultural equipment dealers and distributors. These dealers provide essential localized support, including financing options, technical advice, spare parts inventory, and crucially, post-sale service and calibration required for precision machinery, acting as vital intermediaries between the manufacturer and the end-user farmer.

Downstream activities center around the end-users—the farmers and agricultural service providers—and the subsequent provision of aftermarket services. The direct channel serves large-scale, technologically savvy farms often purchasing high-end models directly from the manufacturer. The indirect channel dominates smaller and medium farm segments, where dealers provide critical education and hands-on operational training. The aftermarket segment, including replacement parts (nozzles, filters, pumps), periodic maintenance, and technological upgrades (e.g., adding spot spraying kits or advanced control consoles), contributes significantly to overall market revenue and ensures the longevity and optimal performance of the equipment throughout its lifecycle. Furthermore, third-party calibration services and agricultural consultants often play a role in optimizing the sprayer settings for specific crops and chemical formulations.

Tractor Mounted Boom Sprayer Market Potential Customers

The primary potential customers for Tractor Mounted Boom Sprayers are commercial agricultural enterprises that require efficient and large-scale liquid application across extensive fields. This segment includes large corporate farming entities and cooperatives involved in row crop production such as corn, wheat, rice, and oilseeds, which demand high-capacity, wide-boom sprayers for maximizing efficiency during critical application windows. These customers prioritize features like high tank capacity, rapid folding mechanisms, and full integration with sophisticated Farm Management Information Systems (FMIS) for data logging and regulatory compliance. They view the equipment as a capital investment crucial for achieving optimal yields and reducing operational input costs through high-precision targeting.

A second crucial customer group comprises medium to large independent farmers who are increasingly adopting modern farming techniques but operate on slightly smaller scales than corporate farms. These customers typically seek medium-capacity sprayers (500L to 1,500L) that balance precision technology with affordability and ease of maintenance. The decision criteria for this group often focus on the reliability of the local dealer support network, the ease of coupling and uncoupling the sprayer from their existing tractor fleet, and the availability of financing options. They are gradually moving away from manual controls towards entry-level hydraulic or electronically assisted systems to improve application quality and reduce operator fatigue.

Additionally, agricultural service contractors represent a rapidly growing customer base. These contractors own high-end, versatile sprayer fleets and provide spraying services to multiple small and medium-sized farms that cannot justify the investment in their own sophisticated equipment. Contractors demand robust, highly durable sprayers with minimal downtime, often investing in the latest technologies, including advanced AI-powered spot spraying systems, to offer premium, differentiated services to their clients. Their purchase decisions are driven by total cost of ownership (TCO), operational speed, and the ability to switch quickly between different crop types and field conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CNH Industrial (Case IH), John Deere, AGCO Corporation, Kubota Corporation, Hardi International, Amazone, Tecnoma, Exel Industries (Bourgault, Apache), Chafer Machinery, Jacto, Rogator (Mahindra), Landini (ARGO Tractors), Goldacres, Berthoud, Househam Sprayers, Bateman Engineering, AS-Motor, Agrifac Machinery, Montana Agricola, Vicon (Kverneland Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Tractor Mounted Boom Sprayer Market Key Technology Landscape

The technological landscape of the Tractor Mounted Boom Sprayer Market is rapidly evolving, driven primarily by the pursuit of ultra-precision application and maximizing resource efficiency. Key innovations center on advanced electronic control systems (ECS) that manage flow rate, pressure, and section control with sub-meter accuracy. GPS-enabled guidance systems, coupled with automatic steering and boom height adjustments using ultrasonic sensors, are now standard features on high-end models, mitigating drift and ensuring consistent canopy penetration. Furthermore, pulse width modulation (PWM) nozzle technology is gaining traction, allowing instantaneous control over flow rate without affecting droplet size, thus maintaining spray quality across a wide range of operating speeds and application rates, which is crucial for variable rate applications (VRA) based on prescription maps.

Connectivity and data management define the competitive edge in modern sprayers. Telematics systems allow real-time monitoring of operational metrics, equipment diagnostics, and application data transfer to cloud platforms, facilitating seamless integration with farm management software for regulatory reporting and agronomic analysis. The development of sophisticated boom suspension systems, including active hydraulic damping and independent wheel suspension for trailed sprayers, is critical for maintaining stable boom height across uneven terrain, a prerequisite for accurate spraying, especially with extremely wide booms (up to 40 meters or more). Materials science also plays a vital role, with manufacturers utilizing lightweight composites and specialized plastics for tanks and plumbing to enhance corrosion resistance and reduce overall machine weight, minimizing soil compaction.

Looking forward, the integration of Artificial Intelligence (AI) and Machine Vision systems represents the cutting edge of the technology landscape. These systems utilize high-resolution cameras and onboard processors to identify specific weeds or plant stress conditions in real-time, enabling true 'see and spray' or 'spot spraying' capabilities. This technology reduces chemical consumption dramatically, representing a paradigm shift from blanket spraying to targeted intervention. Additionally, the development of specialized sensors for measuring environmental conditions (wind speed, temperature inversions) and canopy density is becoming crucial for optimizing application timing and drift control, ensuring that regulatory compliance and environmental stewardship are met simultaneously while delivering superior agronomic outcomes for the grower.

Regional Highlights

Regional dynamics are highly differentiated, reflecting varying levels of agricultural modernization, farm sizes, and regulatory environments across the globe. North America maintains market leadership in terms of technological adoption and value, characterized by very large commercial farms demanding high-capacity, sophisticated sprayers integrated with advanced guidance and telematics systems. The focus here is on reducing labor dependency, maximizing operational speed, and adopting AI-driven spot spraying for expensive inputs like herbicides. The region's stringent regulatory framework regarding drift control also fuels demand for the latest nozzle and boom stability technologies.

Europe represents a mature market driven by extremely tight regulatory constraints (e.g., the EU’s Sustainable Use of Pesticides Directive) which necessitates investment in certified drift-reducing technologies (DRT) and highly accurate application equipment. Farm sizes are generally smaller than in North America, favoring medium-capacity tractor-mounted sprayers with high maneuverability and advanced environmental monitoring features. Germany, France, and the UK are key markets, focusing on both precision technology and ensuring environmental compatibility through mandatory sprayer testing and calibration programs, maintaining a steady replacement demand for compliant machinery.

Asia Pacific (APAC) is projected as the fastest-growing region due to rapid farm mechanization initiatives, particularly in China, India, and Southeast Asia. While the region currently utilizes smaller-capacity sprayers, increasing commercialization of agriculture, rising labor costs, and government subsidies promoting modern equipment are shifting demand toward medium and eventually high-capacity models. This market is highly price-sensitive but shows strong potential for entry-level precision technologies and durable, easily maintainable equipment suitable for diverse cropping patterns and climates.

Latin America, dominated by Brazil and Argentina, is critical due to vast row crop production (soybeans, corn). These regions require extremely large, robust sprayers capable of operating across challenging terrains and applying chemicals over expansive acreage efficiently. Demand here is focused on high-speed operations, large tank capacities, and reliable pumps, often adopting technology similar to North America but with a strong emphasis on durability under intense operational schedules.

The Middle East and Africa (MEA) market is nascent but developing, driven by large state-owned agricultural projects and a necessity to optimize water usage in arid environments. This necessitates specialized low-volume, high-efficiency sprayers. Growth is highly dependent on foreign investment and stability in agricultural commodity markets.

- North America: Dominates high-value segment; driver is AI integration, labor saving, and drift mitigation. Focus on large, high-speed, integrated systems.

- Europe: Driven by environmental regulation (DRT certification); focus on compliance, accuracy, and medium-capacity maneuverability.

- Asia Pacific (APAC): Highest growth potential; driven by farm mechanization, government subsidies, and rising labor costs. Shifting from low to medium capacity.

- Latin America (LATAM): High demand for large-capacity, robust sprayers for vast grain and oilseed production, emphasizing durability and high utilization rates.

- Middle East & Africa (MEA): Emerging market; demand driven by water conservation needs and large-scale government agricultural initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Tractor Mounted Boom Sprayer Market.- CNH Industrial (Case IH)

- John Deere

- AGCO Corporation

- Kubota Corporation

- Hardi International

- Amazone

- Tecnoma

- Exel Industries (Bourgault, Apache)

- Chafer Machinery

- Jacto

- Rogator (Mahindra)

- Landini (ARGO Tractors)

- Goldacres

- Berthoud

- Househam Sprayers

- Bateman Engineering

- AS-Motor

- Agrifac Machinery

- Montana Agricola

- Vicon (Kvernelland Group)

Frequently Asked Questions

Analyze common user questions about the Tractor Mounted Boom Sprayer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the adoption of high-capacity tractor mounted boom sprayers?

The primary drivers are the economic necessity for large-scale commercial farms to maximize efficiency, reduce operational time during critical windows, and cover extensive acreage swiftly. This is supported by rising investments in precision agriculture technologies, which require the integration of sophisticated high-capacity platforms.

How does precision agriculture technology impact the design of boom sprayers?

Precision technology mandates the integration of GPS guidance, automatic boom section control, ultrasonic height sensors, and Pulse Width Modulation (PWM) nozzle systems. These features ensure accurate chemical placement, minimize overlap, control drift, and enable variable rate application (VRA) based on agronomic mapping data.

What are the main restraints hindering the growth of the market in emerging regions?

The main restraints include the high initial purchase cost of technologically advanced sprayers, lack of consistent financing options for small and medium-sized farmers, and insufficient infrastructure for maintenance, calibration, and training required for operating complex electronic control units and guidance systems.

What role does Artificial Intelligence (AI) play in optimizing sprayer performance?

AI enables real-time decision-making through computer vision, facilitating highly accurate spot spraying where chemicals are applied only to target weeds (green-on-green technology). AI also optimizes route planning, operational speed, and predictive maintenance scheduling, leading to significant input cost savings and reduced downtime.

Which regional market is expected to show the fastest growth rate for boom sprayers?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is attributed to massive government support for agricultural mechanization, the increasing shift from manual labor to machine-based operations, and the rapid commercialization of farming practices across countries like India and China.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager