Trading Cards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433296 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Trading Cards Market Size

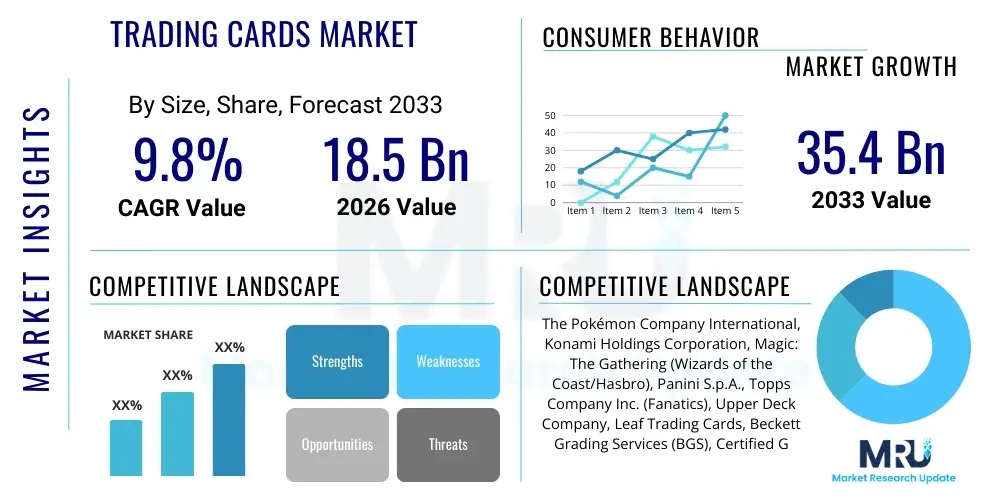

The Trading Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $18.5 Billion USD in 2026 and is projected to reach $35.4 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the confluence of digital integration, robust investment sentiment, and the enduring nostalgic appeal of physical collectibles. The market dynamic has shifted significantly in recent years, moving beyond a niche hobby into a recognized alternative asset class, attracting diverse investor profiles globally. This growth trajectory is underpinned by soaring secondary market values for highly graded, rare cards, particularly within established franchises like sports, Pokémon, and Magic: The Gathering (MTG), reinforcing the market's perceived stability and growth potential.

The valuation reflects both the primary market (sealed product sales) and the expanding influence of the secondary market, which dictates pricing and liquidity. Key drivers of market size expansion include advanced grading technologies provided by firms like PSA and BGS, which enhance authenticity and increase transactional confidence, subsequently boosting perceived value. Furthermore, the increasing acceptance of trading cards as legitimate investment vehicles, especially among younger, digitally native demographics, ensures sustained demand. The accessibility provided by large-scale online marketplaces, coupled with strategic releases and collaborations by major licensors and publishers, fuels continuous consumer engagement and high-volume sales globally.

Geographically, North America and Asia Pacific remain the pivotal revenue centers, though emerging markets are rapidly accelerating their adoption rates, particularly concerning international sports and local gaming franchises. The forecast accounts for potential cyclicality associated with specific sports seasons or game release schedules, but the overarching trend is strongly positive due to diversification across product types—including non-sport, entertainment, and burgeoning metaverse-linked digital cards. The calculated CAGR of 9.8% demonstrates robust confidence in the market's long-term sustainability, supported by continuous content innovation and sophisticated collector behavior focusing on long-term appreciation and portfolio diversification.

Trading Cards Market introduction

The Trading Cards Market encompasses the production, distribution, and sale of collectible card products across various themes, including sports, fantasy gaming, and entertainment. These products, which serve as both recreational items and tangible assets, include game cards (designed for competitive play, such as MTG or Pokémon) and non-sport collectible cards (focused purely on collection, aesthetic value, and investment, such as movie franchises or archival sets). The core appeal lies in rarity, condition, and intellectual property (IP) strength, generating significant primary revenue streams through booster packs and boxed sets, and monumental value generation in the secondary market through trading and auction houses. The evolution of printing technologies, coupled with sophisticated licensing agreements with major sports leagues and entertainment studios, ensures a continuous supply of highly desirable content, maintaining market relevance and driving consumer loyalty across multiple generations of collectors and investors.

The major applications of trading cards are broadly segmented into three categories: competitive gaming, recreational collecting, and financial investment. In competitive gaming, cards are essential components of established, structured tournament ecosystems, demanding continuous product acquisition to maintain competitive viability and team strategy. Recreational collecting is driven by nostalgia, completionism, and the enjoyment derived from physical ownership and display. Crucially, the investment application has surged to prominence; high-grade, low-population cards are now viewed as liquid, appreciating assets, stored in secure vaults and often traded digitally through fractional ownership platforms. The intrinsic benefit of trading cards lies in their dual utility—they offer entertainment while holding potential intrinsic financial worth, providing a unique combination of leisure and asset ownership distinct from purely digital entertainment formats.

Key driving factors propelling the market include the digitization of authentication and grading processes, which instill trust and liquidity; the resurgence of nostalgic IP, drawing back former collectors with disposable income; and the immense marketing power of global sports and esports phenomena. The COVID-19 pandemic inadvertently acted as a powerful catalyst, directing consumer spending towards storable, leisure-based assets, cementing cards' status as mainstream collectibles. Furthermore, sophisticated market participants are leveraging social media and online streaming platforms to showcase card openings and collection achievements, significantly expanding the hobby's visibility and lowering the barrier to entry for new entrants. The strategic cross-pollination between physical cards and digital collectibles (NFTs) further future-proofs the market structure, ensuring continuous innovation and revenue diversification for publishers and associated service providers.

Trading Cards Market Executive Summary

The Trading Cards Market is experiencing a robust period of expansion, driven primarily by strong secondary market valuation and the increased institutional acceptance of cards as a legitimate alternative investment class. Business trends indicate a strategic focus among major publishers on premiumization—releasing high-end, limited-edition sets designed specifically to cater to investors and high-volume collectors, often incorporating serialization, autographs, and unique patch materials. A significant operational shift involves vertical integration, exemplified by large companies acquiring grading services or major distribution platforms to control quality, authentication, and market access, thereby optimizing the profit capture across the value chain. Furthermore, partnerships between publishers and major grading services are becoming commonplace, streamlining the submission process and enhancing transparency for primary buyers, solidifying transactional confidence and accelerating market velocity.

Regionally, the market displays distinct growth pockets. North America maintains dominance due to the deeply entrenched culture surrounding professional sports cards (NBA, NFL, MLB) and established gaming franchises (MTG). However, Asia Pacific is registering the fastest growth, largely fueled by the unparalleled global popularity of Japanese IPs like Pokémon and Yu-Gi-Oh!, coupled with a vast and rapidly expanding base of wealth focusing on tangible, high-value collectibles. Europe presents a strong, diversified market, focused both on local soccer leagues and global gaming sets, with a growing infrastructure for professional grading and secure storage solutions. The Middle East and Africa (MEA) and Latin America, while smaller, represent strategic future growth areas, driven by increasing internet penetration and access to global online marketplaces, facilitating cross-border trade and IP exposure.

Segment trends highlight the overwhelming supremacy of the Sports Card sector in terms of financial volume, followed closely by the Gaming Card sector, which drives high-frequency pack purchases and sustained ecosystem engagement. The Investment Application segment is the fastest-growing use case, surpassing pure recreational collecting in terms of value contribution to high-grade individual cards. Distribution channels show a continued migration towards specialized Online Retailers and direct-to-consumer (DTC) digital platforms, which offer better access to limited drops and transparency in pricing. Crucially, the convergence of physical and digital assets, with digital collectibles often bundled with physical card products, signals a pivotal technological shift designed to capture engagement across both analog and metaverse environments, catering to the evolving demands of the modern collector and investor.

AI Impact Analysis on Trading Cards Market

User queries regarding the impact of Artificial Intelligence (AI) on the Trading Cards Market largely revolve around authenticity verification, market valuation predictions, and the potential disruption caused by AI-generated card artwork and concepts. Users frequently ask if AI can accurately detect counterfeit cards with greater precision than human graders, reflecting deep concern over fraud prevention which directly affects investment security. Furthermore, there is significant interest in how AI algorithms can predict fluctuating secondary market prices, asking whether machine learning models can outperform traditional appraisal methods by analyzing vast datasets including sales history, population reports, and macroeconomic indicators. A third major theme concerns content generation: collectors are curious about the ethical and creative implications of using AI to design new card art, themes, and rarity schemes, potentially accelerating the speed of product development and diversification within established IP franchises.

The deployment of AI and machine learning (ML) is fundamentally transforming critical aspects of the trading card lifecycle, moving beyond mere novelty into essential operational infrastructure. In authentication and grading, advanced computer vision systems powered by AI are trained on millions of high-resolution images of authenticated cards, enabling them to detect minute imperfections, trimming, and restoration attempts with superhuman precision. This reduces human error, speeds up the certification process, and significantly enhances consumer trust, directly combating the pervasive threat of counterfeiting that plagues the high-end segment of the market. Grading companies are aggressively integrating these ML tools to standardize consistency across vast volumes of submissions, thereby solidifying the integrity of the market’s primary value determinant: the grade assigned to the card.

Furthermore, predictive AI models are reshaping investment strategies and inventory management across the ecosystem. These models analyze granular market data, including social media sentiment, supply chain announcements, athlete performance metrics (for sports cards), and game-meta shifts (for gaming cards), to forecast short-term and long-term price movements. This data-driven approach benefits major distributors by optimizing inventory holdings and aids fractional ownership platforms in accurately pricing their offerings. For the creators, AI is becoming a powerful tool in design and concept iteration. Generative AI is being explored to assist artists in creating unique visual elements, producing randomized but aesthetically coherent card attributes, and even assisting in the procedural generation of unique digital card variations, potentially creating entirely new tiers of artificial rarity and driving collector interest through algorithmic uniqueness.

- Enhanced Anti-Counterfeiting: AI-powered computer vision systems for rapid and precise authentication and defect detection during the grading process.

- Predictive Pricing Analytics: Machine learning models forecast secondary market values based on historical sales, population data, and real-time social sentiment, optimizing investor timing.

- Supply Chain Optimization: AI analyzes demand cycles and rarity distribution patterns to help publishers manage production quantities and prevent market saturation or scarcity crises.

- Generative Card Design: Utilization of AI to assist in creating unique, complex, or randomized card artwork, flavor text, and border designs, increasing design velocity.

- Personalized Product Recommendations: AI algorithms analyze collector purchasing habits to suggest targeted products, boosting conversion rates for online retailers.

- Fractional Ownership Valuation: Automated, real-time valuation of high-value assets used by fractionalization platforms, ensuring accurate security pricing and liquidity management.

DRO & Impact Forces Of Trading Cards Market

The Trading Cards Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the core Impact Forces. The primary drivers are centered around the robust appeal of Intellectual Property (IP), which provides an intrinsic, emotionally resonant value base, combined with the increasing financialization of collectibles, attracting serious investment capital seeking portfolio diversification away from volatile traditional assets. Key restraints include the persistent challenge of counterfeiting and market integrity, which necessitates continuous investment in authentication technologies, and the cyclical nature of demand tied to specific game or sports league performance. Opportunities are vast, focused largely on the integration of digital assets (NFTs and augmented reality features) with physical cards, expanding geographical reach into underserved emerging markets, and capitalizing on the rapidly developing infrastructure for secure, professional storage and insurance of high-value collections.

Specific market drivers include the effectiveness of scarcity marketing strategies employed by major publishers, ensuring that demand consistently outstrips supply for highly coveted sets, thereby maintaining high secondary market premiums. The generational transfer of collecting habits is also crucial; parents who collected in the 1990s and 2000s are now introducing their children to the hobby, creating a sustainable, multi-generational demand base. Furthermore, the global infrastructure built around grading (PSA, BGS, CGC) provides the necessary confidence for transactional liquidity, making cards highly tradable across international borders. The financial impact force is significant; the widespread coverage of record-breaking auction sales in mainstream media consistently attracts new investors, reinforcing the perception of cards as appreciating tangible assets. The competitive gaming ecosystem associated with Trading Card Games (TCGs) also acts as a continuous demand driver, as players require new expansion sets to adapt to evolving competitive metas.

Conversely, the market faces structural restraints that moderate runaway growth. The high entry cost for desirable products and graded cards can deter new or casual collectors, leading to market segmentation where low-end products stagnate while high-end products soar. Regulatory uncertainty surrounding collectibles, especially concerning taxation and potential classification as financial securities in certain jurisdictions, presents an ongoing risk. The reliance on complex global supply chains for specialized printing and foil materials, particularly volatile post-pandemic, can lead to production delays and fluctuating primary market prices. The impact forces of digitalization cut both ways: while digital integration offers opportunities, the proliferation of purely digital collectibles (NFTs) poses a competitive threat, demanding that physical card publishers continuously innovate to justify the unique physical appeal and tangible holding costs associated with their product offerings.

Segmentation Analysis

The Trading Cards Market is meticulously segmented across dimensions of Type, Product, Application, and Distribution Channel, reflecting the diverse landscape of consumer engagement, purchase motivation, and product usage. Understanding these segmentations is crucial for publishers and investors to accurately gauge market penetration and identify high-growth niches. The segmentation is dynamic, particularly in the Application category, where the blurring lines between recreational collecting and financial investment have necessitated more nuanced market assessment. Product categorization delineates between traditional game-centric cards, which are functionally integrated into competitive play, and pure collectible cards, often featuring unique non-sport IP or artistic focus, serving primarily aesthetic or investment purposes.

The most significant segmentation factor driving market value is Type, where Sports Cards, historically dominant in North America, have seen their investment profile surge globally, often tracking athlete fame and long-term career success. Gaming Cards (TCGs) maintain market stability through continuous content updates and strong community engagement, relying on structured tournaments and high-volume regular purchases. Non-Sport/Entertainment Cards, driven by film, television, and pop culture franchises, provide diversification and capitalize on episodic nostalgia cycles. Analyzing these types reveals that while Gaming focuses on high frequency and broad participation, Sports and Non-Sport are increasingly focused on low-population, high-value, graded rarities that drive massive secondary market capital flow.

The distribution channel analysis further highlights market structure. The shift toward Online Retail (including publisher-operated DTC sites and third-party marketplaces) dominates volume, providing global reach and price transparency. However, Offline Retail (Local Hobby Shops and Big Box Retailers) remains vital for community building, immediate purchases, and introductory engagement. Auctions, both online and physical, are critical for price discovery and establishing the valuation benchmarks for ultra-high-end graded assets. Strategic marketing requires publishers to manage product exclusivity across these channels, balancing mass accessibility with the premium feeling associated with limited, high-profile drops executed through controlled online events or specialized hobby shop allocations.

- Type

- Sports Cards (Basketball, Baseball, Football, Soccer, Motorsport, UFC)

- Gaming Cards (TCGs like Pokémon, MTG, Yu-Gi-Oh!, Vanguard)

- Non-Sport/Entertainment Cards (Movie/TV Franchises, Anime, Pop Culture, Historical)

- Product

- Collectible Cards (Focus on aesthetic, autograph, patch, and rarity elements)

- Game Cards (Focus on competitive functionality and playability)

- Application

- Collecting (Personal enjoyment, completionism, display)

- Investment (Asset appreciation, fractional ownership)

- Gaming/Play (Competitive and casual play use)

- Distribution Channel

- Online Retail (E-commerce marketplaces, publisher DTC sites)

- Offline Retail (Hobby Shops, Retail Chains, Convenience Stores)

- Auctions and Specialty Trade Shows (High-value transaction environment)

Value Chain Analysis For Trading Cards Market

The Value Chain for the Trading Cards Market is complex, involving highly specialized production stages followed by diversified distribution channels that cater to both mass-market and high-value transactions. Upstream analysis focuses on content acquisition and manufacturing. This phase involves negotiating crucial intellectual property licensing agreements with sports leagues, athletes, movie studios, and game designers, a non-negotiable step that dictates market appeal. Following licensing, the production phase relies on specialized high-security printing facilities capable of handling intricate foil stamping, serialization, die-cutting, and specialized packaging necessary for blind-packed booster products. Raw material sourcing, including high-quality card stock and inks, is critical for maintaining the tactile feel and visual integrity demanded by collectors, with cost and quality significantly influencing the final primary market price of the product.

The downstream component encompasses the intricate process of distribution, secondary market trading, and specialized services. Traditional distribution moves finished goods through wholesalers and distributors to mass-market retail and specialized hobby shops. The high-value secondary market introduces several key intermediaries: grading companies (PSA, BGS) are essential for authenticating and establishing investment value; secure storage vaults and insurance providers cater to high-net-worth collectors; and auction houses facilitate the highest-tier transactions, setting market benchmarks. The efficiency of the distribution channel, particularly the balance between controlled release schedules (to manage scarcity) and broad accessibility, directly impacts consumer satisfaction and prevents market flooding, which would erode secondary values.

Both direct and indirect distribution channels play synergistic roles. Direct distribution (DTC) through publisher websites allows companies like Wizards of the Coast or Panini to capture higher margins, control product allocation precisely, and foster direct customer relationships, often utilized for highly exclusive, limited-edition drops. Indirect channels, relying on established networks of hobby shops and mass-market retailers, ensure broad market penetration and sustained volume sales. Crucially, the growth of online marketplaces (eBay, dedicated trading platforms) functions as a massive indirect channel for the secondary market, providing essential liquidity and price discovery for collectors globally. The interplay between these channels, especially the speed and integrity of the authentication services, determines the overall financial health and investor confidence within the ecosystem.

Trading Cards Market Potential Customers

The potential customer base for the Trading Cards Market is highly heterogeneous, spanning multiple demographic segments defined less by age or geography and more by their primary motivation for engagement: collector, investor, or player. Collectors, often driven by nostalgia and passion for specific IP (Pokémon, Marvel), seek completeness, focusing on acquiring full sets or chasing specific rare variants for personal enjoyment and display. This segment values the artistry, story, and emotional connection to the product, sustaining the foundational purchasing volume in the primary market. They are the most loyal customer group, generating predictable demand for regular expansion releases and new base sets, and are significantly influenced by IP anniversaries and media releases.

Investors represent the fastest-growing and highest-value customer segment. These buyers prioritize scarcity, certified condition (grading), market liquidity, and long-term appreciation potential over playability or personal affection for the IP. They are sophisticated buyers who track population reports, auction results, and macroeconomic trends, viewing high-grade trading cards as tangible alternative assets comparable to fine art or rare coins. Their demand is concentrated almost exclusively on high-end, professionally graded, low-population cards, often transacting through auction houses or dedicated investment platforms. The growth of fractional ownership platforms has expanded this segment, allowing smaller investors to gain exposure to multi-million-dollar assets previously accessible only to ultra-high-net-worth individuals, significantly broadening the capital flowing into the market.

The third major segment consists of Players, who are essential for the sustainability of Trading Card Games (TCGs). These customers purchase product primarily for competitive utility—acquiring the necessary cards to build and optimize tournament-legal decks. Their purchase decisions are driven by the current 'meta' of the game, requiring them to constantly update their collections with new expansion packs and singles (individual cards). This segment ensures consistent, high-frequency pack sales and maintains the community structure necessary for the IP's long-term health. Retailers must cater to all three segments, offering a diverse inventory ranging from sealed mass-market packs to securely stored, high-grade investment singles, necessitating specialized operational security and inventory management protocols tailored to the distinct needs of each buyer profile.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion USD |

| Market Forecast in 2033 | $35.4 Billion USD |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Pokémon Company International, Konami Holdings Corporation, Magic: The Gathering (Wizards of the Coast/Hasbro), Panini S.p.A., Topps Company Inc. (Fanatics), Upper Deck Company, Leaf Trading Cards, Beckett Grading Services (BGS), Certified Guaranty Company (CGC), Professional Sports Authenticator (PSA), Ravensburger AG, Fandom Sports Media, Dave & Adam's Card World, Collectors Universe Inc., Cartamundi Group, Legend Story Studios, MetaZoo Games, Rittenhouse Archives, SAGE Collectibles, TRISTAR Productions. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trading Cards Market Key Technology Landscape

The technology landscape supporting the Trading Cards Market is characterized by innovation across manufacturing, authentication, and digital integration, transforming what was once a traditional printing industry into a high-security, digitally augmented collectibles sector. At the manufacturing level, advancements in specialized printing technologies are paramount. This includes sophisticated holographic foiling, highly precise die-cutting for unique shapes, anti-tamper security features embedded directly into the card stock, and advanced variable data printing (VDP) necessary for unique serialization, limited numbering, and personalized autographed cards. Publishers are increasingly leveraging proprietary printing processes to ensure high-quality tactile feel and visual appeal, differentiating their premium products and making counterfeiting significantly harder, thus safeguarding the investment value of their output.

In the post-production and secondary market, authentication technology represents the single most impactful technological driver. Leading grading companies utilize high-resolution digital imaging combined with AI-powered computer vision software to meticulously analyze card centering, surface integrity, corner sharpness, and potential alterations. This reliance on objective, non-human assessment minimizes subjective biases and dramatically increases the speed and volume of card processing. Furthermore, secure, tamper-proof encapsulation technology, such as ultrasonic welding for grading slabs, provides physical protection and verifiable proof of authentication, which is essential for maximizing secondary market liquidity and investor confidence, essentially standardizing the asset class for mass transaction. Blockchain technology is also gaining traction, primarily to digitally register card ownership and verify the provenance of ultra-rare items.

The future technology trajectory is defined by convergence with the digital sphere. Publishers are actively incorporating Near-Field Communication (NFC) chips or scannable Quick Response (QR) codes directly onto physical cards. These technologies link the tangible asset to a unique digital twin—often an NFT or a verifiable registration in a digital wallet. This integration serves multiple purposes: it offers another layer of anti-counterfeiting verification, allows for dynamic tracking of ownership history and market value, and bridges the physical collecting experience with metaverse platforms and digital gaming environments. Augmented Reality (AR) features are also being explored, where scanning a card with a mobile device triggers animations or interactive content, enhancing the novelty and play value for the younger, tech-savvy collector base and ensuring the physical product remains relevant in a digitally saturated landscape.

Regional Highlights

- North America: Dominant Market Center and Investment Hub

North America holds the largest market share, driven primarily by the colossal influence of major sports leagues (NBA, NFL, MLB) and deeply established Trading Card Games (MTG). The region possesses the most sophisticated and liquid secondary market infrastructure, anchored by the leading professional grading services (PSA, BGS). Investment activity is extremely high, with trading cards fully integrated into alternative investment portfolios and frequently featured in high-profile auctions. The mature regulatory environment and extensive collector base ensure sustained demand across all product categories, from high-volume retail packs to multi-million-dollar singular assets. The US market dictates global trends in sports card valuation and grading standards.

- Asia Pacific (APAC): Fastest Growing Region and IP Powerhouse

The APAC region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the immense popularity of local and Japanese intellectual property, notably Pokémon, Yu-Gi-Oh!, and various regional anime franchises. The rapid growth of middle-class wealth and disposable income in economies like China, South Korea, and Southeast Asia fuels extensive demand for premium collectibles. While historically focused on gaming and non-sport cards, the interest in global sports (especially NBA and European soccer) is accelerating rapidly. Japan remains a central manufacturing and licensing hub, influencing product development and rarity schemes globally. Digital integration and cross-border e-commerce are key facilitators of this market boom, connecting local collectors to global supply chains.

- Europe: Diversified Market with Strong Gaming Presence

The European market is robust and highly diversified, characterized by strong consumer interest in localized soccer and motorsport card franchises, alongside major international TCGs like MTG and Pokémon. Key growth areas include the UK, Germany, and France, where organized play communities and professional grading submission services are increasingly established. The region serves as a crucial balancing market, often reflecting global trends but maintaining distinct preferences for local sports leagues (e.g., Premier League, Bundesliga). Investment liquidity is improving as European collectors gain better access to US-based grading services, solidifying the market’s transition toward higher-value, authenticated assets.

- Latin America (LATAM): Emerging Market Potential and Sports Focus

The LATAM market is emerging, demonstrating high potential driven by passionate fanbases for regional soccer leagues and increasing access to global retail channels via e-commerce platforms. The primary segment driver is overwhelmingly sports cards, particularly soccer and regional baseball. Challenges include high import duties and reliance on indirect distribution channels, but increasing internet penetration and smartphone usage are expanding the consumer base. Publishers are beginning to tailor specific content and distribution strategies to address local market demands, particularly in high-population economies like Brazil and Mexico, signaling future investment concentration.

- Middle East and Africa (MEA): Untapped Collector Base

The MEA region currently accounts for a smaller share but represents a strategic area for long-term growth. Demand is primarily centered in affluent urban centers (e.g., UAE, Saudi Arabia) and focuses heavily on high-end investment pieces—often global sports stars or premier non-sport franchises. Establishing efficient and secure distribution networks is a priority for key players. The lack of deeply established local hobby shop infrastructure means that the market relies heavily on online retail and international auction platforms for acquisition and valuation, suggesting that future growth will be heavily digital-centric and tailored towards investment-grade collectibles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trading Cards Market, covering major publishers, licensing bodies, and essential secondary market service providers.- The Pokémon Company International

- Konami Holdings Corporation (Yu-Gi-Oh!)

- Magic: The Gathering (Wizards of the Coast/Hasbro)

- Panini S.p.A.

- Topps Company Inc. (Fanatics)

- Upper Deck Company

- Leaf Trading Cards

- Beckett Grading Services (BGS)

- Certified Guaranty Company (CGC)

- Professional Sports Authenticator (PSA)

- Ravensburger AG (Acquire IP for TCGs)

- Fandom Sports Media

- Dave & Adam's Card World (Major Retail/Distributor)

- Collectors Universe Inc. (Parent Company of PSA)

- Cartamundi Group (Specialized Printing Manufacturer)

- Legend Story Studios (Flesh and Blood TCG)

- MetaZoo Games

- Rittenhouse Archives

- SAGE Collectibles

- TRISTAR Productions

Frequently Asked Questions

Analyze common user questions about the Trading Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the increase in Trading Cards Market value?

The market value surge is predominantly driven by two critical factors: the robust financialization of collectibles, attracting institutional and high-net-worth investors seeking tangible alternative assets, and the standardization provided by professional grading services (PSA, BGS) which enhances asset liquidity and consumer trust in high-value transactions. Strong, nostalgic Intellectual Property (IP) and successful scarcity marketing further propel demand.

How is the integration of AI influencing the authenticity and grading of trading cards?

AI is being utilized primarily to enhance market integrity through advanced computer vision technology. This technology allows grading companies to perform rapid, objective, and highly precise analysis of card condition, detecting subtle flaws, trimming, and counterfeiting attempts with greater accuracy than manual inspection, significantly bolstering confidence in the certified condition of high-value assets.

Which segmentation—Sports, Gaming, or Non-Sport—holds the highest investment value currently?

While all segments show growth, Sports Cards, particularly ultra-rare, high-grade rookie cards of iconic athletes (e.g., basketball and baseball), currently hold the highest individual investment values and dictate the largest volume of high-end secondary market transactions. Gaming cards maintain high volume, but sports cards are the predominant focus for large-scale financial investment.

What are the key risks associated with investing in the Trading Cards Market?

Key investment risks include market volatility tied to cyclical demand and athlete performance, the persistent threat of sophisticated counterfeiting, liquidity challenges for niche or ultra-expensive non-graded cards, and potential regulatory changes concerning the taxation or classification of collectibles as financial instruments.

How are physical trading cards integrating with digital technologies like NFTs and Blockchain?

Publishers are bridging the gap by linking physical cards to unique digital twins, often implemented as NFTs or verified blockchain records, via technologies like NFC chips or unique QR codes embedded in the product. This integration offers provable digital ownership, verifiable provenance, and enhanced anti-counterfeiting measures, future-proofing the physical asset in the digital collecting ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager