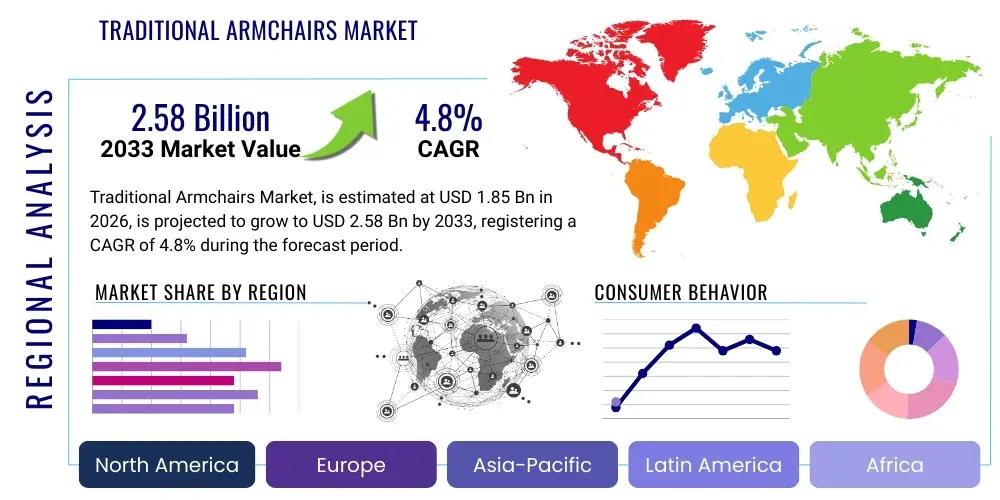

Traditional Armchairs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434564 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Traditional Armchairs Market Size

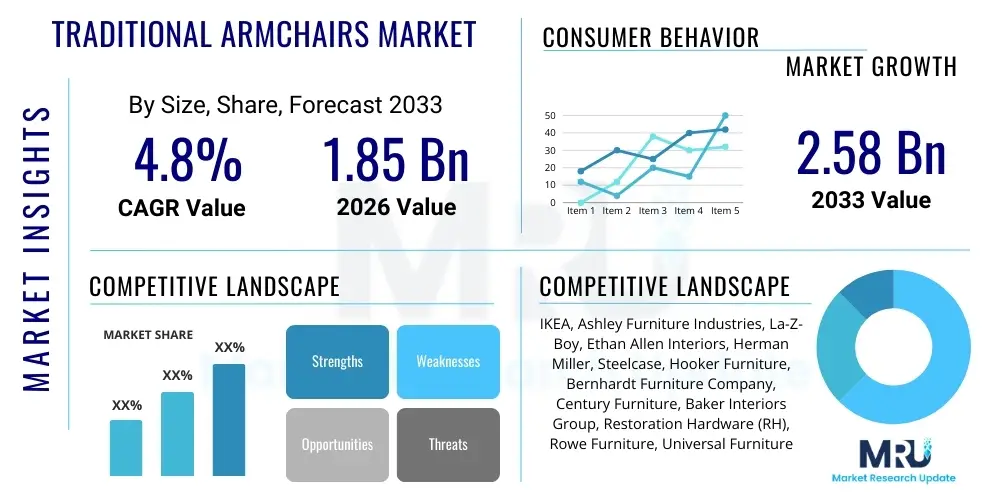

The Traditional Armchairs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.58 Billion by the end of the forecast period in 2033. This growth trajectory is strongly influenced by the sustained global demand for high-quality, durable home furnishings that offer both aesthetic permanence and superior comfort. The market size calculation incorporates sales across various channels, including specialized furniture retailers, luxury e-commerce platforms, and direct-to-consumer models favored by premium brands.

The valuation reflects the increasing consumer propensity toward investing in long-lasting, heritage furniture pieces that serve as focal points in residential and commercial environments, such as executive offices and boutique hotels. Factors contributing significantly to the market expansion include rising disposable income in emerging economies, particularly across the Asia Pacific region, coupled with a renewed appreciation for classic interior design aesthetics in Western markets. The emphasis on craftsmanship and material quality inherent in traditional armchairs commands higher average selling prices, further driving the overall market value growth across the forecast period.

Furthermore, the replacement cycle for traditional armchairs tends to be longer than that for contemporary modular furniture, underscoring the intrinsic value proposition of these products. Customization and personalization options, specifically concerning upholstery material, frame finishes, and ergonomic adjustments, allow manufacturers to target niche, high-net-worth customer segments. This bespoke segment acts as a significant contributor to the market size, ensuring robust revenue generation even amid fluctuating economic conditions, as luxury consumers remain relatively inelastic to price changes.

Traditional Armchairs Market introduction

The Traditional Armchairs Market encompasses the design, manufacturing, and distribution of seating units characterized by classic, enduring aesthetic styles, often rooted in historical furniture movements such as Queen Anne, Victorian, Chesterfield, and Wingback designs. These products typically feature sturdy construction, high-quality materials such as solid wood, premium leather, or luxurious fabrics, and emphasize ergonomic comfort integrated within a timeless silhouette. Unlike mass-produced modern furniture, traditional armchairs prioritize longevity, craftsmanship, and a sense of heritage, making them essential elements in luxury residential spaces, classical libraries, and high-end professional settings. The intrinsic value of these pieces often transcends mere functionality, positioning them as decorative statement items.

Major applications for traditional armchairs span residential living rooms, where they serve as primary seating for reading and relaxation, and sophisticated commercial settings, including hotel lobbies, exclusive members' clubs, and corporate boardrooms. The primary benefits driving consumer adoption include their exceptional durability, ability to hold aesthetic appeal across changing decor trends, and the superior comfort provided by deep cushioning and supportive frames. These pieces often become family heirlooms, reflecting an investment in quality rather than temporary furnishing solutions. The material selection—ranging from rich, hand-stitched leather to opulent velvet and complex brocades—is central to the product’s appeal and premium pricing.

Driving factors propelling the market include global wealth accumulation, particularly the expansion of the high-net-worth individual segment seeking exclusive interior solutions. Furthermore, the persistent trend of 'home staging' and interior design emphasizing cozy, elegant, and established aesthetics heavily favors traditional furniture styles. Manufacturers are also innovating by integrating modern technology, such as motorized reclining mechanisms and advanced ergonomic padding, into classic designs without compromising their traditional appearance. This blend of classic form and modern function is expanding the traditional armchair's appeal beyond strictly classical consumers, ensuring market vitality.

Traditional Armchairs Market Executive Summary

The Traditional Armchairs Market is currently experiencing a dynamic shift, blending the enduring appeal of classic design with modern manufacturing and consumer-centric trends. Business trends highlight a strong movement towards customization and personalization, where premium brands are offering extensive choices in upholstery, finishes, and dimensions to meet specific client specifications, moving away from standardized inventory. This bespoke approach mitigates inventory risk and enhances profit margins. Furthermore, sustainable sourcing of materials, particularly certified wood and ethically processed leather, is becoming a crucial competitive differentiator, aligning with increasing consumer environmental awareness. The competitive landscape remains highly fragmented, characterized by numerous regional artisans and established global furniture houses vying for market share through superior craftsmanship and brand heritage.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven by rapid urbanization, substantial growth in luxury housing development, and the adoption of Western-style classic interiors among the newly affluent classes in countries like China and India. North America and Europe, while mature, remain dominant in terms of market value, focusing on replacement demand and maintaining a strong preference for heritage brands known for their historical significance and guaranteed quality. European markets, in particular, emphasize refined styles such as French provincial and Italian neoclassical designs, catering to consumers who prioritize authenticity and provenance. Investment in efficient supply chain networks capable of handling large, fragile items globally is a key regional operational focus.

Segment trends indicate that the Upholstery Material segment, particularly high-grade leather, continues to command the largest market share due to its durability, sophisticated appearance, and ease of maintenance, especially in high-traffic commercial settings. However, the online distribution channel is registering the highest growth rate, leveraging high-resolution digital imaging, virtual reality tools for product visualization, and streamlined logistics for oversized items. The Residential End-User segment remains the cornerstone of the market, though the Commercial segment, driven by renovations in luxury hospitality and corporate real estate, is exhibiting robust year-over-year growth, requiring robust, contract-grade traditional armchairs.

AI Impact Analysis on Traditional Armchairs Market

User inquiries regarding AI's influence on the Traditional Armchairs Market primarily center on how classical aesthetics can be preserved while leveraging modern analytical tools. Common questions include: Can AI predict future trends in traditional decor? How does AI optimize the highly labor-intensive customization process? And, how can AI enhance the customer's online buying experience for such a tactile and high-value product? Users express concerns that technology might dilute the authenticity of handcrafted items but seek assurance that AI can improve efficiency and personalization. The key themes summarized are the application of AI in minimizing material waste during production, sophisticated demand forecasting to manage high-cost inventory, and the integration of AI-powered visualization tools for consumer interaction.

AI’s primary impact is observed in the backend operations and the front-end sales experience. In manufacturing, machine learning algorithms are utilized to optimize cutting patterns for expensive materials like exotic woods and large leather hides, significantly reducing waste and lowering production costs without compromising design integrity. Furthermore, AI-driven predictive maintenance of specialized crafting equipment minimizes downtime, ensuring the high-precision required for traditional joinery and frame construction is consistently met. This operational efficiency is crucial for maintaining competitive pricing in a market defined by high labor inputs.

On the consumer side, Generative AI is increasingly used for design consultation and visualization. Customers can upload images of their existing interiors, and AI tools can digitally render various traditional armchair styles, colors, and fabrics within their space, offering instant, personalized recommendations that adhere to classical design principles (e.g., scale, color harmony). This capability addresses the major challenge of purchasing large, high-value furniture online by drastically reducing uncertainty and improving the conversion rate for e-commerce platforms specializing in traditional furnishings. AI also analyzes vast datasets of historical sales and interior design trends to forecast which traditional styles (e.g., Wingback versus Club Chair) will experience peak popularity in specific geographical regions.

- AI optimizes material usage and cutting patterns, minimizing waste in high-cost raw materials (e.g., premium leather, solid hardwoods).

- Machine learning enhances supply chain predictability, optimizing inventory levels for slow-moving, high-value traditional pieces.

- Generative AI tools enable advanced digital visualization and virtual placement of armchairs in consumer environments, significantly boosting online sales confidence.

- AI analyzes historical aesthetic data and social trends to forecast the resurgence or sustained popularity of specific classical design elements.

- Predictive maintenance algorithms ensure the precision and reliability of specialized woodworking and upholstery machinery used in artisanal production.

DRO & Impact Forces Of Traditional Armchairs Market

The Traditional Armchairs Market is profoundly influenced by a complex interplay of drivers, restraints, opportunities, and strategic impact forces. Key drivers include the persistent growth in global disposable income, which enables consumers to invest in high-quality, durable furniture, alongside a strong cultural preference for classic and heritage aesthetics that signify status and permanence. The market benefits significantly from the expansion of the high-end residential construction sector and the frequent refurbishment cycles in the luxury hospitality segment. However, significant restraints impede growth, primarily the high cost of premium, ethically sourced raw materials (e.g., certified mahogany, top-grain leather) and the scarcity of highly skilled artisans necessary for traditional hand-crafting techniques. Logistics costs associated with shipping large, fully assembled, and fragile furniture items globally also pose a substantial challenge to operational profitability.

Opportunities for market expansion are abundant, particularly through strategic geographical expansion into underserved emerging markets in APAC and Latin America, where wealth accumulation is accelerating rapidly. Furthermore, innovation in material science, focusing on developing sustainable, high-performance synthetic alternatives that mimic the texture and longevity of traditional materials, offers a path to reducing production costs and addressing environmental concerns. Manufacturers are also seizing the opportunity to integrate smart features, such as wireless charging or concealed lighting, seamlessly into classic designs without visible modification to the traditional form factor. The focus on personalized, made-to-order production minimizes inventory risk and caters directly to sophisticated consumer demands.

Impact forces dictate the competitive structure of the market. Buyer power is moderate to high, as consumers often engage in comparison shopping for high-value items, demanding extensive warranties, customization, and premium delivery services. Supplier power is also high, particularly for providers of rare hardwoods and top-quality leather, leading to fluctuating raw material costs that manufacturers must absorb. The threat of new entrants is moderate; while initial capital investment in specialized machinery and sourcing premium materials is high, boutique artisanal brands can enter the market by leveraging strong local crafting heritage and direct-to-consumer digital channels. The threat of substitutes is significant, primarily from the thriving modern, minimalist, and modular furniture sectors, which offer lower costs, easier transport, and greater flexibility for smaller living spaces, necessitating that traditional manufacturers constantly reinforce the value of enduring quality and aesthetic permanence.

Segmentation Analysis

The Traditional Armchairs Market is primarily segmented based on Material, End-User, Style, and Distribution Channel, each reflecting distinct consumer preferences and operational complexities. Material segmentation (Leather, Wood, Fabric/Upholstery) is critical as it directly correlates with pricing, maintenance requirements, and perceived luxury status. The End-User segmentation (Residential and Commercial) differentiates between durability and volume needs, with the Commercial sector requiring contract-grade robustness. Style segmentation (e.g., Wingback, Chesterfield, Club Chair, and Bergère) captures historical aesthetic preferences, while the Distribution Channel segment (Offline Retail, Online Sales) reveals evolving purchasing habits, particularly the rapid growth of e-commerce for high-value items facilitated by improved digital visualization tools.

The Leather segment holds the largest revenue share globally due to its unmatched durability, luxurious feel, and aesthetic maturation over time, which aligns perfectly with the heirloom quality expected of traditional furniture. However, the Fabric/Upholstery segment is highly dynamic, driven by customizable options and the integration of advanced textiles offering stain resistance and enhanced longevity. Geographically, segmentation varies; for instance, North America shows a stronger preference for overstuffed Club Chairs, prioritizing sheer comfort, whereas European markets maintain a strict preference for historically accurate, highly structured styles like the Bergère. Manufacturers strategically align production capacity and marketing efforts based on the dominant style preferences and purchasing power within specific regions.

The Distribution Channel segmentation is undergoing the most radical transformation. While traditional brick-and-mortar stores remain essential for providing the tactile experience crucial for high-cost purchases, the rapid digitization across the luxury furniture sector is propelling the growth of online sales. Companies that invest heavily in seamless omnichannel strategies—integrating the physical showroom experience with high-fidelity digital tools—are capturing market share from traditional retailers. This dual focus ensures that both the cautious, high-touch buyer and the efficiency-seeking digital native are effectively serviced, thus maximizing market penetration across all consumer demographics interested in classic furnishings.

- Material: Leather, Fabric (Velvet, Linen, Brocade), Wood (Mahogany, Oak, Walnut), Blended Upholstery

- Style: Wingback, Chesterfield, Club Chair, Bergère, Queen Anne, Fireside Chair

- End-User: Residential (Individual Consumers, Home Decor), Commercial (Hotels, Corporate Offices, Libraries, Luxury Retail)

- Distribution Channel: Offline Retail (Furniture Stores, Showrooms, Interior Designer Networks), Online Sales (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Traditional Armchairs Market

The value chain for the Traditional Armchairs Market is complex, characterized by stringent quality control requirements and significant reliance on specialized labor at the manufacturing stage. The upstream segment involves the sourcing of primary raw materials: high-grade, often certified hardwoods (like oak, teak, or mahogany) for the frame construction, specialized spring mechanisms, high-density foams, and premium covering materials (top-grain leather or luxury fabrics). Sourcing decisions significantly impact the final product cost and compliance with sustainability standards, making supplier relationships critical. Manufacturers frequently engage in long-term contracts with specialized timber and leather suppliers to ensure consistent quality and ethical provenance.

The midstream phase, which is the core of value addition, involves meticulous frame construction, often utilizing traditional joinery techniques, followed by skilled upholstery. Unlike modern furniture production, this phase is highly labor-intensive, relying on master craftsmen for carving, sanding, staining, and detailed stitching. Quality assurance processes are exceptionally rigorous at this stage to ensure aesthetic fidelity to the traditional design and structural longevity. Investment in precise machinery (like CNC routers for frame cutting) is used to support, rather than replace, manual expertise, maintaining the balance between efficiency and traditional craftsmanship.

The downstream segment encompasses distribution channels, categorized broadly into direct and indirect methods. Direct channels involve brand-owned showrooms and proprietary e-commerce sites, allowing manufacturers greater control over brand presentation and pricing, and fostering direct relationships with interior designers and high-net-worth clients. Indirect channels utilize third-party furniture retailers, specialized luxury marketplaces, and global distributor networks. Due to the high value and bulk of traditional armchairs, logistics and white-glove delivery services form a critical part of the downstream value chain, necessitating specialized handling and installation expertise to ensure customer satisfaction and minimize transit damage.

Traditional Armchairs Market Potential Customers

The potential customer base for the Traditional Armchairs Market is primarily focused on segments that prioritize aesthetic investment, durability, and classic luxury over simple functional efficiency. The primary end-users, or buyers of the product, include affluent homeowners and high-net-worth individuals aged 45 and above, who possess significant disposable income and are furnishing expansive homes, villas, or estates. These buyers seek timeless pieces that convey status, comfort, and an appreciation for historical design and superior craftsmanship. They are often less price-sensitive but highly demanding regarding material provenance, custom finishing, and brand heritage. Their purchasing decision is heavily influenced by interior design consultants and architects.

A secondary, yet rapidly expanding, customer segment is the luxury Commercial sector. This includes boutique hotels, five-star resorts, executive airport lounges, members-only clubs, and corporate boardrooms that require furnishings to project an image of established elegance and professional permanence. These commercial buyers purchase in volume but require contract-grade furniture, meaning the armchairs must meet rigorous standards for fire resistance, durability against heavy use, and easy maintenance. For this segment, the product’s life-cycle cost often outweighs the initial purchase price, driving demand for the most resilient and enduring materials, such as robust hardwood frames and specialized, high-performance commercial-grade leathers.

Furthermore, niche customer groups, such as specialist collectors, historical preservation societies, and academic institutions furnishing libraries and institutional offices, represent specific pockets of demand. These buyers focus intensely on stylistic accuracy and restoration quality. The overall market strategy must, therefore, cater to these diverse needs—offering bespoke luxury for residential clients, standardized robustness for commercial contracts, and historical fidelity for institutional buyers—with distribution strategies tailored to reach interior designers, procurement managers, and direct consumers effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.58 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IKEA, Ashley Furniture Industries, La-Z-Boy, Ethan Allen Interiors, Herman Miller, Steelcase, Hooker Furniture, Bernhardt Furniture Company, Century Furniture, Baker Interiors Group, Restoration Hardware (RH), Rowe Furniture, Universal Furniture, Lexington Home Brands, Natuzzi S.p.A., Bassett Furniture Industries, Kincaid Furniture, Maitland-Smith, Stickley Furniture, Theodore Alexander |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Traditional Armchairs Market Key Technology Landscape

The Traditional Armchairs Market, while rooted in historical design, utilizes several key technologies to enhance quality, consistency, and consumer experience without altering the visual aesthetic. Advanced Computer Numerical Control (CNC) machinery is crucial for precise wood frame cutting and shaping, ensuring dimensional accuracy and consistency across production batches while minimizing material waste. This precision is vital for creating robust joints characteristic of high-quality traditional furniture, such as mortise and tenon or dovetail joints. Furthermore, specialized 3D scanning technology is employed to digitize historical templates and prototypes, allowing manufacturers to recreate classic designs with absolute fidelity and scale them for modern ergonomic requirements.

In the upholstery segment, innovations in foam and cushioning technology play a significant role. High-resilience (HR) and memory foam combinations are often integrated within the traditional structure to offer superior, long-lasting comfort that traditional spring-and-horsehair fillings cannot match, enhancing the competitive edge against modern seating options. Automated fabric and leather cutting systems, guided by sophisticated software, ensure that complex patterns (like those needed for Chesterfield tufting or Wingback curvature) are cut precisely and efficiently, maximizing yield from expensive materials. These technological applications do not detract from the handcrafted element but rather serve to enhance efficiency and structural integrity, ensuring the longevity expected by the consumer.

Beyond manufacturing, digital technology dominates the sales and marketing landscape. High-definition photographic rendering and 3D modeling software are standard tools used to showcase complex upholstery textures and wood finishes online, replacing the need for physical inspection in initial purchase decisions. Furthermore, technologies focusing on sustainable finishing, such as low-Volatile Organic Compound (VOC) stains and sealants, are becoming standard practice, adhering to stringent global environmental regulations and addressing consumer preferences for healthier home environments. The key technological challenge remains the seamless integration of modern production tools while preserving the perceived value and artisanal quality of the final product.

Regional Highlights

North America (NA) represents a substantial portion of the Traditional Armchairs Market value, driven by high consumer purchasing power and a cultural preference for large, deeply comfortable seating often found in family rooms and formal living spaces. The market is characterized by strong demand for American classic styles, such as overstuffed Club Chairs and large-scale Wingbacks, emphasizing durability and comfort. The residential sector is the primary revenue generator, bolstered by a resilient high-end housing market and robust interior design industry focused on permanent, statement furnishings. Key trends include the integration of power features (like hidden USB ports and gentle reclining systems) into traditional designs and a focus on ethically sourced, premium materials. The highly organized retail infrastructure, including major national furniture chains and design centers, ensures effective market reach.

Europe holds a significant position, particularly in the premium and ultra-luxury segments, due to the region's historical connection to classical furniture styles (e.g., Italian neoclassical, French provincial, and English manor aesthetics). The European market prioritizes heritage, authenticity, and precise craftsmanship. Consumers frequently seek products from brands with centuries of manufacturing tradition, emphasizing provenance and artisanal techniques. The market is mature but highly segmented, with strong domestic demand in the UK, Germany, and Italy. Sustainability regulations and the drive toward circular economy models strongly influence manufacturing processes, prompting companies to use durable, repairable materials and offer restoration services, reinforcing the long-term value proposition of traditional armchairs.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by rapid economic development, escalating urbanization, and the significant expansion of the middle- and high-net-worth classes, particularly in China, India, and Southeast Asia. The adoption of Western luxury interior design aesthetics is accelerating in newly constructed premium residences and commercial properties. While manufacturers initially focused on standard global models, there is increasing localization, adapting classic designs to slightly smaller living spaces typical of dense urban environments and integrating local cultural motifs subtly. Investment in robust e-commerce and logistics infrastructure for luxury goods is crucial for capitalizing on the vast, decentralized consumer base in this diverse region. The growth in the luxury hospitality sector throughout APAC is also a major commercial driver.

- North America: Dominant market share focused on comfort-centric designs (Club Chairs), driven by strong residential renovation and luxury housing sales.

- Europe: High-value market segment emphasizing brand heritage, precise historical fidelity, and sustainability in material sourcing and manufacturing.

- Asia Pacific (APAC): Highest growth rate, spurred by wealth creation, urbanization, and increasing consumer adoption of Western luxury interior styles in new residential and commercial projects.

- Middle East and Africa (MEA): Growing demand, particularly in the GCC states (UAE, Saudi Arabia), where major construction projects and luxury hotel developments require opulent, statement-making furniture pieces.

- Latin America (LATAM): Developing market with potential for growth, focusing primarily on domestic production capabilities and imported high-end European designs catering to wealthy urban populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Traditional Armchairs Market, covering their product portfolios, geographical presence, recent developments, and strategic initiatives aimed at market expansion and product innovation.- IKEA

- Ashley Furniture Industries

- La-Z-Boy

- Ethan Allen Interiors

- Herman Miller

- Steelcase

- Hooker Furniture

- Bernhardt Furniture Company

- Century Furniture

- Baker Interiors Group

- Restoration Hardware (RH)

- Rowe Furniture

- Universal Furniture

- Lexington Home Brands

- Natuzzi S.p.A.

- Bassett Furniture Industries

- Kincaid Furniture

- Maitland-Smith

- Stickley Furniture

- Theodore Alexander

Frequently Asked Questions

Analyze common user questions about the Traditional Armchairs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Traditional Armchairs Market?

The market growth is primarily driven by increasing global disposable income, which enables higher investment in luxury home furnishings, coupled with a growing consumer preference for durable, high-quality furniture that embodies classic, timeless aesthetics. The expansion of luxury residential construction worldwide also fuels demand.

How is the concept of sustainability being integrated into the production of traditional armchairs?

Sustainability is addressed through the mandatory sourcing of certified hardwoods (FSC certified), the use of low-VOC finishes and sealants, and increased efforts to utilize recycled or ethically processed leather and fabrics. Manufacturers are promoting the longevity of their products as an inherently sustainable feature, contrasting with fast furniture cycles.

Which segmentation dominates the Traditional Armchairs Market in terms of revenue?

Based on material, the Leather segment currently dominates the Traditional Armchairs Market in terms of revenue due to its premium pricing, superior durability, and strong association with luxury and classic styles, particularly in high-end commercial and residential applications.

What role does technology, specifically AI, play in the traditional furniture sector?

AI plays a critical role in optimizing back-end efficiency, using machine learning to minimize waste in cutting expensive materials and enhancing supply chain predictability. On the front end, AI enables sophisticated digital visualization and personalization tools, allowing customers to visualize custom products in their homes before purchase, thereby improving online sales conversion.

What are the primary challenges facing manufacturers in the Traditional Armchairs Market?

Key challenges include the high and volatile cost of premium, ethically sourced raw materials (hardwoods, quality leather), a reliance on a shrinking pool of highly skilled labor and artisans necessary for authentic craftsmanship, and the high logistics costs associated with transporting large, bulky, and fragile finished products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager