Train Loaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432505 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Train Loaders Market Size

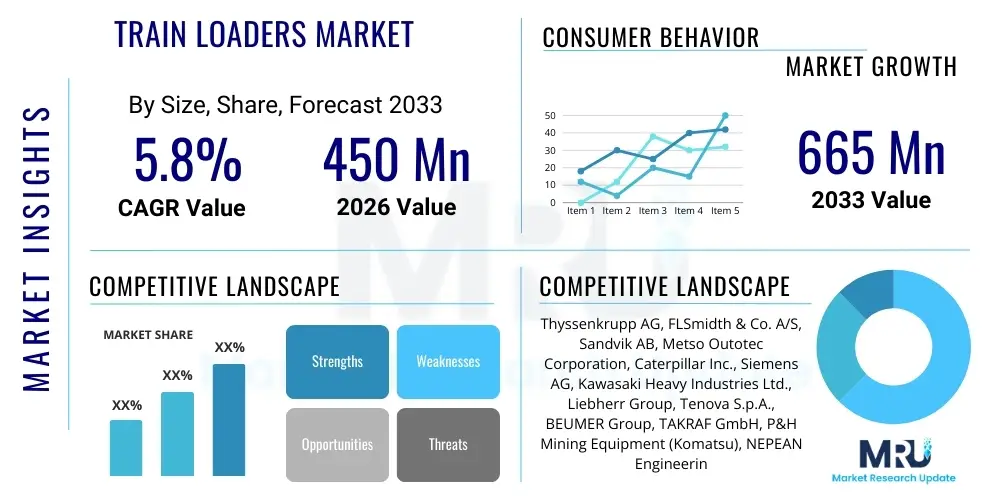

The Train Loaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Train Loaders Market introduction

The Train Loaders Market encompasses specialized heavy machinery and integrated systems designed for the rapid and efficient loading of bulk materials, such as coal, iron ore, grains, and aggregates, onto railcars or unit trains. These systems are critical components in the supply chains of mining operations, large-scale ports, and heavy industries where high-volume transportation efficiency is paramount. Modern train loading facilities, including flood loaders, volumetric loaders, and mass flow systems, are engineered to minimize train idle time and maximize throughput, thereby drastically reducing operational costs associated with logistics. The core function is to ensure precise and high-speed material handling, often requiring robust integration with conveying systems, storage silos, and sophisticated inventory management software.

Product descriptions within this market vary significantly based on application and material type. For instance, flood loading systems are dominant in coal and large mining operations due to their ability to fill entire railcars quickly as the train moves underneath the loading chute. Volumetric loaders, conversely, utilize precise weight and volume measurements to ensure regulatory compliance and optimize payload per car, particularly crucial for high-value commodities. These systems are characterized by their durable construction, high capacity, and increasing automation levels, designed to withstand harsh operating environments and continuous high-stress cycles typical in resource extraction and bulk handling sectors.

Major applications driving the demand for train loaders include the energy sector (coal handling), metallurgy (iron ore and bauxite), construction (aggregates and cement), and agriculture (grains and fertilizers). The principal benefits derived from adopting advanced train loading technologies are enhanced operational efficiency, reduced labor costs, minimization of material spillage and loss, and improved safety protocols. The market is significantly driven by global infrastructure development projects, the persistent demand for energy resources, and the need for logistics optimization in high-volume commodity trading, all of which necessitate reliable, high-speed bulk material transfer solutions.

Train Loaders Market Executive Summary

The Train Loaders Market exhibits robust growth propelled primarily by global infrastructure investment, particularly in emerging economies focused on expanding mining capabilities and upgrading outdated logistics networks. Current business trends indicate a strong shift towards fully automated and integrated loading systems that incorporate real-time monitoring and predictive maintenance capabilities, driven by the need for maximized uptime and minimized manual intervention. Leading manufacturers are focusing heavily on modular designs that allow for easy scalability and customization based on specific site requirements and material characteristics, moving away from rigid, legacy fixed installations. Furthermore, stringent environmental regulations regarding dust control and noise reduction are influencing equipment design, favoring enclosed and highly efficient loading solutions that meet global sustainability standards.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of growth, largely attributed to immense coal and iron ore export volumes from Australia and Indonesia, coupled with extensive infrastructure modernization projects underway in China and India. North America and Europe, while mature, are focusing on replacement cycles and the integration of highly sophisticated sensors and IoT connectivity into existing loader infrastructure to enhance precision and compliance. The Middle East and Africa (MEA) region presents significant opportunities, particularly tied to nascent mining industries and major government investments aimed at diversifying economies and improving internal commodity logistics, spurring demand for medium to high-capacity rail handling equipment.

Segment trends reveal that the flood loading system segment dominates the market in terms of volume handled, primarily due to its applicability in high-tonnage mining operations. However, the volumetric and mass flow measurement segment is expected to witness the highest technological penetration and value growth, owing to the increasing focus on payload optimization and accurate inventory management across various commodity types. The demand is particularly pronounced for fixed train loading systems over mobile counterparts, reflecting the permanent nature of major mining sites and port terminals, although mobile solutions are gaining traction in temporary or less volume-intensive aggregate extraction sites.

AI Impact Analysis on Train Loaders Market

Common user questions regarding AI's impact on the Train Loaders Market center on automation reliability, predictive maintenance capability, and the optimization of loading cycles under variable operational conditions. Users frequently ask: "How can AI reduce material spillage during high-speed loading?", "Will AI-driven systems improve train positioning accuracy to reduce delays?", and "What is the expected ROI from implementing AI for predictive maintenance on complex loader machinery?" These inquiries highlight key concerns around achieving operational excellence, improving safety, and ensuring cost efficiency through sophisticated data analysis rather than simply basic automation. The core expectation is that AI will transform train loading from a mechanical operation into a highly intelligent, self-optimizing logistical node.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the efficiency and reliability of train loading operations. AI applications are moving beyond simple automation into complex, real-time decision-making processes. For example, ML models can analyze sensor data from conveyers, chutes, and load cells to predict potential blockages or mechanical failures hours or even days before they occur, triggering preemptive maintenance actions. This capability drastically reduces unexpected downtime, which is arguably the largest operational cost factor in high-volume bulk handling facilities. Furthermore, computer vision systems, powered by deep learning, are being integrated to monitor material flow and detect anomalies in particle size or moisture content, allowing the system to dynamically adjust loading speed and flow rate for optimal car filling.

A significant area of AI impact is in the optimization of unit train management. AI algorithms can process data streams from railcar sensors, weighbridges, and yard management systems to optimize train staging, track allocation, and the precise velocity required for 'load-on-the-move' systems. This leads to optimal throughput, ensuring maximum car capacity utilization while adhering strictly to axle load regulations, which is critical for compliance and safety. As labor shortages continue to affect the heavy industry, AI-driven automation systems are becoming indispensable, enabling facilities to operate 24/7 with minimal personnel oversight, transforming the operational profile of train loading terminals globally and enhancing the precision of bulk material logistics.

- Enhanced Predictive Maintenance: AI models forecast equipment failures based on vibration, temperature, and current data, maximizing uptime.

- Real-Time Load Optimization: Machine learning adjusts material flow rates instantaneously to ensure precise car filling and regulatory compliance.

- Autonomous Train Spotting: Computer vision and AI guide train positioning under the loader chute with millimeter precision, reducing cycle time.

- Improved Safety Protocols: AI monitors operational zones, detecting human presence or unsafe conditions, and initiating automated shutdowns.

- Inventory Reconciliation: Integration of AI with stockyard management systems provides highly accurate, real-time commodity inventory reconciliation.

DRO & Impact Forces Of Train Loaders Market

The dynamics of the Train Loaders Market are shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate investment patterns and technological adoption. The primary driver remains the continuous global demand for bulk commodities, necessitating faster, more efficient logistics chains. This is complemented by the imperative for companies to achieve higher economies of scale, pushing investment towards high-capacity, automated loading solutions that minimize costs per ton handled. The move towards digitalization and Industry 4.0 principles also acts as a strong driver, encouraging the adoption of connected systems for improved data visibility and operational control. Conversely, the market faces significant restraints, including the high initial capital expenditure required for installing or retrofitting advanced loading infrastructure, and the complexity associated with integrating new, sophisticated systems with legacy material handling processes, particularly in older facilities.

Opportunities within the market are predominantly found in the development of modular and portable loading systems tailored for medium-scale mining or temporary aggregate operations, offering flexibility outside traditional large port settings. There is also a substantial opportunity in developing specialized loaders capable of handling complex or highly abrasive materials, expanding the application scope beyond conventional coal and iron ore. Furthermore, the stringent global focus on environmental protection, especially concerning fugitive dust emissions during loading, creates a lucrative opportunity for manufacturers specializing in advanced dust suppression and fully enclosed loading chute designs, addressing regulatory pressures proactively and providing significant competitive advantage to adopters.

Impact Forces, encompassing regulatory mandates and external economic volatility, significantly influence the market trajectory. Macroeconomic instability, particularly fluctuations in commodity prices, can rapidly halt or slow down planned infrastructure investments, posing a risk to market growth. However, the overarching force of global trade liberalization and the consequent need for competitive export logistics ensure sustained long-term demand for efficiency gains provided by advanced train loaders. Competitive forces are driving innovation in system reliability and maintenance contracts, shifting the market focus from merely the cost of equipment to the total cost of ownership (TCO) over the operational lifespan, emphasizing durability, energy efficiency, and post-installation support services.

Segmentation Analysis

The Train Loaders Market is comprehensively segmented based on System Type, Material Handled, Application, and Operating Mechanism, providing granular insights into demand patterns across various industrial end-users. Understanding these segments is crucial for manufacturers to tailor product offerings and for logistics providers to optimize their investment strategies. The segmentation highlights the intrinsic link between the type of material being transported and the necessary loading technology, ranging from the free-flowing characteristics of grains requiring volumetric measurement to the dense, high-tonnage requirements of coal demanding flood loading mechanisms. This multifaceted analysis allows market participants to identify lucrative niches, such as specialized loaders for difficult-to-handle materials like sticky clay or highly volatile chemicals, which require bespoke solutions often commanding higher margins.

The primary segmentation by System Type differentiates between Flood Loading Systems, Volumetric Loading Systems, and Mass Flow Systems, each catering to specific throughput and accuracy requirements. Flood loaders remain essential for sheer volume, while volumetric and mass flow systems address the growing regulatory demand for precise weight compliance and advanced inventory management, crucial in modern logistics. Further segmentation by Operating Mechanism separates Fixed/Stationary systems, dominant in long-term, high-throughput sites like major ports and mine heads, from Mobile/Portable systems, which offer flexibility for temporary or decentralized operations such prevalent in the construction material supply chain.

Analysis of the Material Handled segment reveals that the Coal segment continues to hold the largest market share due to global energy demands, followed closely by Metallic Ores, vital for infrastructure and manufacturing. However, the Grain/Agricultural Products segment is projected to show significant growth, driven by increasing global food trade and the need for highly sanitary and accurate loading systems compliant with international food safety standards. The granular detail provided by this segmentation informs research and development efforts, directing investment towards advanced material science solutions for improved wear resistance and optimized handling characteristics for diverse commodity classes.

- By System Type:

- Flood Loading Systems

- Volumetric Loading Systems

- Mass Flow Measurement Systems

- By Material Handled:

- Coal

- Metallic Ores (Iron Ore, Bauxite)

- Aggregates and Construction Materials

- Grains and Agricultural Products

- Fertilizers and Chemicals

- By Operating Mechanism:

- Fixed/Stationary Train Loaders

- Mobile/Portable Train Loaders

- By Application:

- Mining and Quarrying

- Ports and Terminals

- Manufacturing and Processing Plants

- Agriculture and Food Processing

Value Chain Analysis For Train Loaders Market

The Value Chain Analysis for the Train Loaders Market begins with the upstream suppliers responsible for providing essential components and raw materials, including high-grade steel alloys, sophisticated hydraulic and pneumatic systems, advanced electronic control units, and specialized sensor technology. Upstream activities are dominated by providers of heavy-duty fabrication services and industrial automation hardware, where quality and reliability of components directly dictate the lifespan and performance of the final train loader system. Key considerations at this stage include sourcing materials with superior wear resistance, critical for components in constant contact with abrasive bulk commodities, and ensuring the integration of standardized, reliable automation platforms that are compatible with complex industrial network protocols.

The midstream stage involves the core manufacturing, assembly, and integration of the train loading systems by major equipment OEMs. This phase encompasses detailed engineering design, system fabrication, quality assurance testing, and the integration of highly complex software systems for automated control and data logging. Manufacturers often employ specialized fabrication techniques, such as stress-relieving welds and applying abrasion-resistant linings (like ceramics or specialized polymers), to enhance durability. Direct channels involve OEMs selling high-value, customized flood or volumetric loaders directly to large mining corporations or government port authorities, often including comprehensive installation, commissioning, and long-term service contracts as part of the total package.

Downstream activities focus on installation, operational use, and maintenance services. The major end-users—mining companies, port operators, and bulk terminal managers—are responsible for the deployment and continuous operation of these assets. Indirect distribution channels primarily involve regional equipment dealers or specialized engineering firms that handle sales, delivery, and localized technical support for smaller or more standardized loading solutions. The post-sales service phase, including regular maintenance, spare parts supply, and technology upgrades (e.g., retrofitting AI-driven sensors), constitutes a critical and high-margin component of the downstream value chain, ensuring the sustained performance and compliance of these vital logistics assets over decades of use.

Train Loaders Market Potential Customers

Potential customers in the Train Loaders Market are characterized by their involvement in high-volume bulk commodity handling and their reliance on efficient rail logistics for domestic transport or international export. The primary customers are large-scale mining operators, particularly those involved in the extraction of coal, iron ore, and potash, who require constant, high-speed material transfer from mine sites to processing plants or export hubs. These customers demand extremely robust, high-capacity systems capable of achieving throughput rates exceeding 10,000 tons per hour, making system reliability and automation capabilities critical purchasing criteria. Their investment decisions are heavily influenced by global commodity price trends and regulatory environment for resource extraction.

A secondary, yet rapidly growing, customer segment includes major port and terminal operators, both private and government-owned, who manage the transshipment of diverse bulk goods. These entities require versatile train loading and unloading infrastructure capable of handling multiple commodity types, often with stringent accuracy and environmental compliance requirements regarding dust control and noise. For port authorities, the optimization of train turn-around time is paramount to reducing congestion and increasing terminal efficiency, making automated systems with integrated weighing and compliance certification features highly desirable.

Furthermore, large agricultural cooperatives and global grain merchants represent a specialized segment of potential customers. These users focus heavily on sanitation, gentle handling, and precise volumetric/weight measurement to meet specific trade specifications for grain, corn, and soybeans. Lastly, large construction and manufacturing conglomerates that manage their own internal raw material logistics, such as cement producers requiring bulk aggregate handling or steel mills requiring inbound iron pellets, also form a consistent customer base, often preferring fixed, durable systems integrated directly into their manufacturing flow.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thyssenkrupp AG, FLSmidth & Co. A/S, Sandvik AB, Metso Outotec Corporation, Caterpillar Inc., Siemens AG, Kawasaki Heavy Industries Ltd., Liebherr Group, Tenova S.p.A., BEUMER Group, TAKRAF GmbH, P&H Mining Equipment (Komatsu), NEPEAN Engineering and Manufacturing, Schenck Process Holding GmbH, McLanahan Corporation, RASCOR Group, FAM Forderanlagen Magdeburg GmbH, FEECO International, Inc., Telestack, ERS Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Train Loaders Market Key Technology Landscape

The technological landscape of the Train Loaders Market is undergoing rapid evolution, shifting from purely mechanical systems to highly intelligent, digitally integrated infrastructure. A core technological focus is the development and refinement of precision bulk weighing systems, including dynamic weigh-in-motion technologies that allow for extremely accurate material measurement as the train moves through the loading zone, minimizing stop-start cycles. Furthermore, advanced sensor fusion—integrating data from laser profilers, GPS systems, strain gauges, and load cells—is becoming standard, providing operators with a holistic, real-time view of the loading process and ensuring compliance with stringent rail load limits enforced by regulatory bodies worldwide. These systems rely heavily on robust industrial internet of things (IIoT) platforms to transmit high-frequency operational data efficiently for remote monitoring and analysis.

Automation and control systems represent another critical technology segment. Modern train loaders utilize sophisticated Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems, often overlaid with proprietary algorithms, to manage complex sequential operations such as material gate control, chute positioning, and anti-spillage mechanisms. The drive for fully autonomous operation is leading to the integration of specialized rail car tracking systems and automated positioning technologies, such as Differential GPS (DGPS) or advanced machine vision, ensuring the loading chute perfectly aligns with the railcar opening, even during minor speed variations or track irregularities. This advanced level of control is essential for maintaining throughput consistency and minimizing labor dependency.

Finally, material handling innovation is crucial, specifically focusing on dust suppression and reducing equipment wear. Technologies such as high-efficiency dry fog systems, specialized low-pressure water sprays, and telescopic loading chutes with integrated dust extraction are being mandated to meet environmental standards, particularly in proximity to populated areas or sensitive ecosystems. Furthermore, the use of specialized abrasion-resistant materials, including proprietary ceramic liners and high-density polyurethanes, is extending the lifespan of critical components like chutes and hoppers, drastically reducing maintenance frequency and enhancing the overall total cost of ownership (TCO) for these capital-intensive assets, thereby guaranteeing operational longevity under severe duty cycles.

Regional Highlights

The Asia Pacific (APAC) region currently dominates the Train Loaders Market in terms of volume and new project installations, driven by the massive scale of resource extraction and infrastructure development across countries like China, India, and Australia. Australia, in particular, remains a global powerhouse for iron ore and coal exports, necessitating continuous investment in high-capacity, dedicated flood loading systems at key port terminals and mine sites to maintain competitive global pricing and meet stringent export deadlines. China and India are focused on modernizing domestic rail logistics to handle growing internal demand for coal, aggregates, and imported metallic ores, leading to substantial government investment in new, highly automated rail handling facilities across major industrial corridors and ports. The regulatory environment in APAC is increasingly emphasizing high throughput coupled with improved environmental controls, pushing demand towards enclosed loading solutions.

North America (NA) and Europe represent mature markets characterized by replacement demand and technological upgrades aimed at maximizing the efficiency and compliance of existing infrastructure. In North America, the focus is heavily on implementing precise weighing and data analytics technology, driven by the need for compliance with strict rail safety regulations and maximizing payload utilization within federal load limits. The energy transition is influencing demand in certain pockets, with coal handling slowing down, but demand for loaders in mineral sands, potash, and aggregate sectors remains robust. European countries emphasize advanced automation, minimal environmental impact (noise and dust), and the highest safety standards, favoring highly integrated systems that seamlessly interface with sophisticated inventory management platforms and trackside automation devices, minimizing human intervention.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions exhibiting high growth potential, primarily tied to the expansion of new mining concessions and strategic government investments in logistics corridors. Brazil and Chile are major exporters of iron ore and copper, respectively, driving demand for heavy-duty, customized train loading solutions capable of operating reliably in often remote and challenging geographical conditions. The MEA region, particularly driven by Saudi Arabia's Vision 2030 and South Africa's ongoing mineral exports, is prioritizing the development of high-efficiency bulk terminals. Investments are often concentrated in robust, durable equipment designed for extreme climate resistance and requiring minimal local specialized maintenance input, often facilitated through comprehensive long-term service contracts provided by international OEMs.

Overall, while APAC leads in capacity expansion, North America and Europe lead in technological sophistication, particularly in sensor integration, predictive maintenance, and autonomous operation. The emerging markets of LATAM and MEA represent the future growth frontier, driven by initial infrastructure build-out for resource monetization and diversification goals. The varying regional requirements necessitate a highly flexible product portfolio from market leaders, capable of scaling from high-volume, fixed installations in Australia to modular, resilient systems in the Arabian Peninsula.

- Asia Pacific (APAC): Highest volume market, driven by coal and iron ore exports (Australia, Indonesia) and major infrastructure projects (China, India). Focus on high-capacity flood loading systems.

- North America: Mature market focusing on replacement, upgrade cycles, and regulatory compliance. Strong demand for dynamic weighing and AI-driven precision systems in potash and aggregates.

- Europe: Emphasis on environmental standards, high automation, and safety. Demand focused on sophisticated, low-noise systems integrated with advanced logistics software.

- Latin America (LATAM): High growth potential linked to copper and iron ore mining expansion (Brazil, Chile). Requires durable, robust equipment for challenging operational environments.

- Middle East & Africa (MEA): Emerging market driven by government-led diversification and resource development. Focus on new terminal development and climate-resistant equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Train Loaders Market.- Thyssenkrupp AG

- FLSmidth & Co. A/S

- Sandvik AB

- Metso Outotec Corporation

- Caterpillar Inc.

- Siemens AG

- Kawasaki Heavy Industries Ltd.

- Liebherr Group

- Tenova S.p.A.

- BEUMER Group

- TAKRAF GmbH

- P&H Mining Equipment (Komatsu)

- NEPEAN Engineering and Manufacturing

- Schenck Process Holding GmbH

- McLanahan Corporation

- RASCOR Group

- FAM Forderanlagen Magdeburg GmbH

- FEECO International, Inc.

- Telestack

- ERS Industries

Frequently Asked Questions

Analyze common user questions about the Train Loaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary types of train loading systems available in the market?

The market is primarily segmented into Flood Loading Systems, designed for high-volume, rapid filling of bulk commodities like coal; Volumetric Loading Systems, which measure material based on volume; and highly accurate Mass Flow Measurement Systems, often utilizing sophisticated weighbridges to ensure compliance with precise weight limits.

How is automation impacting the operational efficiency and safety of train loaders?

Automation significantly boosts efficiency by enabling high-speed, continuous loading (load-on-the-move) and reducing cycle times. For safety, integrated sensors, AI-driven monitoring, and remote operational capabilities minimize the need for personnel in hazardous loading zones, dramatically lowering risk.

Which geographical region exhibits the highest growth potential for train loader installations?

The Asia Pacific (APAC) region, specifically countries like Australia, China, and India, exhibits the highest growth due to substantial investment in resource extraction logistics and modernization of port infrastructure to meet escalating global bulk commodity demands.

What is the typical lifespan and maintenance requirement for a high-capacity train loader?

High-capacity, fixed train loaders are built for operational lifespans often exceeding 25 to 30 years. Maintenance requirements are substantial, focusing on scheduled replacement of abrasion-prone components (chute liners, conveyer belts) and integrating predictive maintenance technology to preemptively address complex mechanical or electronic failures.

How do Train Loaders address increasing environmental regulations, specifically regarding dust emissions?

Modern train loaders incorporate advanced environmental mitigation technologies, including fully enclosed loading chutes, high-efficiency dry fog or wet suppression systems, and integrated dust extraction systems, designed to capture and control fugitive dust created during high-speed material transfer, ensuring compliance with strict air quality standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager