Trampoline Park Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433478 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Trampoline Park Market Size

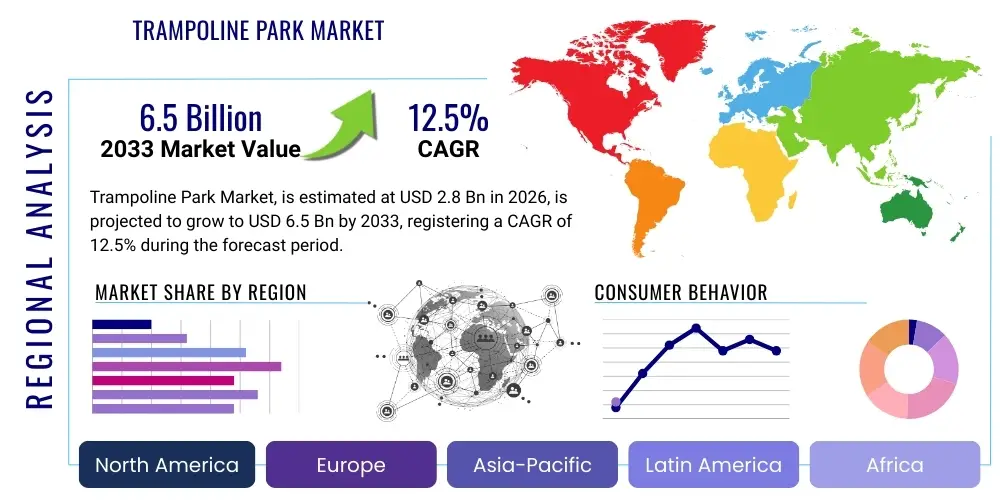

The Trampoline Park Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing consumer preference for active and indoor recreational activities, particularly in urban and suburban environments where year-round entertainment options are highly valued. The market expansion is further supported by significant investments in enhanced safety features and the diversification of trampoline park offerings beyond traditional jumping areas to include fitness classes, ninja warrior courses, and elaborate party hosting facilities, broadening the appeal across various demographic segments, from children and teenagers to corporate groups and adults seeking novel fitness experiences.

Trampoline Park Market introduction

The Trampoline Park Market encompasses commercial entertainment centers featuring interconnected trampolines used for recreational jumping, fitness activities, sports, and social gatherings. These facilities offer a dynamic alternative to traditional entertainment venues, providing high-energy, low-impact exercise opportunities alongside group socialization platforms. The core product offering has evolved significantly, integrating advanced safety padding, foam pits, airbag landings, and specialized attractions like trampoline dodgeball courts, basketball lanes, and structured climbing walls, transforming them into comprehensive Family Entertainment Centers (FECs). Major applications include general admission recreational jumping, birthday party hosting, corporate team-building events, and specialized fitness programs, catering to a diverse clientele seeking both physical activity and entertainment value.

The market benefits from several intrinsic advantages, notably the ability to operate year-round regardless of weather conditions, high foot traffic generation, and relatively strong recurring revenue streams derived from repeat visitors and scheduled events. Key driving factors accelerating market penetration include the global focus on combating childhood obesity by promoting active play, rising disposable incomes in emerging economies, and strategic franchising models that enable rapid geographical expansion. Furthermore, the continuous introduction of innovative attractions that enhance the overall user experience and stimulate novelty is crucial for maintaining competitive edge and driving sustained market demand across established and burgeoning recreational economies.

Trampoline Park Market Executive Summary

The Trampoline Park Market is experiencing significant upward business trends characterized by consolidation among major operators, increased emphasis on digital integration for booking and operational efficiency, and a strategic pivot toward experiential retail locations. Operators are investing heavily in advanced safety protocols and comprehensive liability management systems to mitigate risks, which is vital for maintaining consumer trust and reducing insurance costs. Technologically, the adoption of RFID wristbands, automated scoring systems for games, and sophisticated CRM tools is streamlining operations and enhancing the customer journey, positioning trampoline parks not just as recreational venues but as high-tech entertainment hubs. The move towards highly themed and diversified attractions, such as virtual reality integration and high-tech arcade zones within the parks, reflects a mature market strategy focused on maximizing average spend per visit.

Regionally, North America and Europe currently dominate the market share, driven by high consumer spending power and established recreational infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, primarily owing to rapid urbanization, the emergence of a large middle class with increased leisure expenditure, and the nascent stage of the organized FEC market in countries like China and India. Segment trends indicate that the 'Children and Teenagers' age group remains the core revenue generator, yet the 'Adult Fitness' segment, driven by specialized trampoline workout classes (e.g., jump fitness), is emerging as the fastest-growing niche, signaling a successful expansion of the market appeal beyond traditional family entertainment into dedicated wellness and active lifestyle categories. The Birthday Parties and Events segment continues to be the most crucial revenue stream for localized profitability.

AI Impact Analysis on Trampoline Park Market

Common user questions regarding AI's impact on Trampoline Parks center primarily on enhancing safety, personalizing the customer experience, and automating operational tasks. Users frequently inquire whether AI can detect unsafe jumping behaviors in real-time, predict equipment maintenance needs before failure, and optimize staffing schedules based on predicted foot traffic patterns. There is also significant curiosity about how AI-driven recommendation engines could suggest customized fitness classes or event packages to individual customers based on their past visits or demographic profiles, thereby boosting engagement and revenue. The key themes revolve around achieving hyper-efficiency, ensuring proactive risk mitigation, and leveraging data analytics to transition from a reactive service model to a highly personalized and predictive entertainment operation. This interest highlights a strong market expectation for AI to solve persistent challenges related to safety compliance and labor management while simultaneously driving differentiated competitive advantages through superior customer interaction.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to revolutionize park operations, moving them away from manual, labor-intensive management towards data-driven precision. For instance, computer vision systems, powered by deep learning, can monitor high-risk areas like foam pits or climbing walls to automatically flag dangerous activity or overcrowding, sending immediate alerts to floor staff, drastically improving response times and reducing potential accident liability. Furthermore, sophisticated demand forecasting using ML models can analyze historical data, weather patterns, local events, and holiday cycles to accurately predict staffing requirements hour by hour, minimizing unnecessary labor costs during slow periods and ensuring adequate safety coverage during peak times. This focus on predictive analytics allows management to optimize resource allocation, inventory for concessions, and marketing spend with unprecedented accuracy, directly impacting the bottom line and operational stability across multiple park locations.

Beyond safety and operations, AI is increasingly crucial in optimizing the customer lifecycle. AI-powered chatbots and virtual assistants handle routine customer service inquiries, manage bookings, and process cancellations 24/7, freeing human staff to focus on in-park customer interaction and supervision. Moreover, utilizing AI to analyze booking history and in-park activity data allows for the creation of highly targeted marketing campaigns and personalized promotional offers, such as discounts on specific classes or tailored party packages based on observed spending habits and interests. This shift towards personalized engagement fosters greater customer loyalty and higher lifetime value. Integrating AI into interactive park elements, such as competitive games with adaptive difficulty levels, also enhances the overall entertainment value, ensuring that the experience remains novel and challenging for repeat visitors, thereby mitigating market saturation risks.

- Real-time safety monitoring through computer vision to detect unsafe maneuvers or overcrowding.

- Predictive maintenance schedules for trampolines and equipment using sensor data analysis.

- Optimizing staff deployment and scheduling based on AI-driven foot traffic forecasts.

- Personalized marketing and tailored offer generation via Machine Learning recommendation engines.

- Automated customer service via AI chatbots for 24/7 booking and inquiry management.

- Enhancement of interactive game experiences with adaptive, AI-controlled difficulty levels.

DRO & Impact Forces Of Trampoline Park Market

The dynamics of the Trampoline Park Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate market growth and profitability. Primary drivers include the growing global interest in leisure activities that blend entertainment with physical fitness, particularly among the youth and families seeking alternatives to screen time. The opportunity landscape is robust, centered on diversification into specialized fitness programs (e.g., trampoline yoga, parkour training), expansion into untapped geographic regions, particularly emerging urban centers in APAC and MEA, and the integration of advanced technologies like augmented reality (AR) into the jumping experience. However, the market faces significant restraints, chiefly high insurance premiums driven by liability concerns associated with participant injuries, stringent governmental safety regulations (especially concerning equipment standards and staffing requirements), and high initial capital expenditure required for facility setup, often involving specialized real estate acquisition and customization. These forces necessitate operators adopt meticulous risk management strategies and continuously innovate to maintain relevance and operational viability.

The driving force of experiential leisure demand cannot be overstated; modern consumers prioritize experiences over material goods, and trampoline parks offer a high-value, shareable experience that aligns well with social media trends and family outings. This consistent demand underpins the market's stability. Conversely, the high seasonality and dependency on local school holidays represent a critical internal restraint, requiring operators to develop sophisticated pricing models and off-peak promotions to ensure stable revenue generation throughout the year. The opportunity to leverage the park infrastructure for non-traditional uses, such as corporate team-building events during weekdays or dedicated adult-only fitness sessions, helps mitigate reliance on core weekend family traffic. Successful market navigation requires operators to aggressively pursue diversification opportunities while strictly adhering to evolving safety standards to counter the primary restraint of liability risk.

The overall impact forces lean towards moderate growth, provided operators strategically address the capital-intensive nature of the business and the regulatory compliance burden. The market rewards those who commit to continuous safety improvements, such as adopting automated safety monitoring systems and certified training programs for all staff. Furthermore, competitive pressure is intensified by the presence of large, well-funded franchises that can benefit from economies of scale in procurement and marketing. Therefore, smaller, independent parks must capitalize on unique local branding and hyper-local community engagement to survive. The long-term success relies heavily on transitioning the public perception of trampoline parks from simply a 'jumping space' to a multi-faceted, high-quality, and highly safe Family Entertainment Center destination.

Segmentation Analysis

The Trampoline Park Market is primarily segmented based on the Facility Size, End-User, Park Type, and Revenue Source. Analyzing these segments provides critical insights into consumer behavior, operational strategies, and market investment priorities. Facility Size segmentation, spanning small (under 10,000 sq ft) to large (over 30,000 sq ft), dictates the capacity, range of attractions offered, and required capital investment, directly influencing localized market penetration strategy. End-User segmentation, focusing on groups like Children (5-12), Teenagers (13-18), and Adults/Families, guides marketing efforts and the development of age-appropriate attractions and specialized programs, such as toddler-only jump times or dedicated adult fitness classes.

Furthermore, segmentation by Park Type, including Traditional Trampoline Parks, Extreme Adventure Parks (incorporating ninja warrior courses, climbing walls, and zip lines), and Hybrid Centers (integrating trampolines with arcade games or bowling), reveals the industry's trend toward experiential diversification. Revenue Source segmentation, comprising General Admission, Parties/Events, Food & Beverages (F&B), and Merchandise, highlights that while general admission provides the baseline, ancillary services like events and F&B are crucial for maximizing profitability and enhancing the overall customer value proposition. Understanding the proportional contribution of these segments allows operators to optimize facility design and pricing strategies to capture maximum market share within their specific geographical and competitive context.

- By Facility Size:

- Small (Under 10,000 sq ft)

- Medium (10,000 – 30,000 sq ft)

- Large (Above 30,000 sq ft)

- By End-User:

- Children (Ages 5-12)

- Teenagers (Ages 13-18)

- Adults and Families

- Corporate Groups/Fitness Enthusiasts

- By Park Type:

- Traditional Trampoline Parks

- Extreme Adventure Parks

- Hybrid Family Entertainment Centers (FECs)

- By Revenue Source:

- General Admission/Open Jump

- Birthday Parties and Group Events

- Food and Beverages (F&B)

- Merchandise and Ancillary Services

Value Chain Analysis For Trampoline Park Market

The value chain of the Trampoline Park Market begins with upstream activities focused on the manufacturing and procurement of specialized equipment and infrastructural components. This includes the sourcing of high-tensile steel frames, specialized high-performance trampoline mats, safety padding (often requiring foam or high-density polymers), and foam pit cubes or large airbags for safe landings. Key upstream suppliers are specialized manufacturing firms that adhere strictly to international safety standards (e.g., ASTM F2970). Operators must engage in rigorous quality control during this stage, as the longevity and safety of the primary assets directly influence operational costs and liability exposure. Effective negotiation with a stable supplier base for long-term maintenance parts is crucial for mitigating operational downtime and managing capital expenditures efficiently over the park's lifespan.

Midstream activities involve the construction, facility fit-out, and operational setup, including obtaining necessary permits, architectural design tailored to maximize safe flow and capacity, and installing complex HVAC systems crucial for indoor air quality management in high-activity environments. This stage involves significant capital outlay and strategic decision-making regarding the blend of attractions (e.g., ratio of open jump space to dodgeball courts or ninja areas). The downstream segment is defined by the service delivery itself—the daily operation of the park, encompassing staffing, safety supervision, customer engagement, and managing ancillary services like F&B and party hosting. The effectiveness of staff training and adherence to safety protocols forms the most critical value-added component in the downstream segment, directly influencing brand reputation and customer satisfaction.

Distribution channels for the trampoline park service are inherently direct, as the customer physically visits the location. However, digital channels play a dominant role in pre-purchase activities. Direct distribution involves online booking platforms, mobile applications for loyalty programs, and in-person ticket purchasing at the facility. Indirect channels, primarily focused on awareness and lead generation, include partnerships with local schools, community organizations for fundraising events, third-party ticketing platforms (less common but used for corporate deals), and extensive social media marketing campaigns. Maximizing the efficiency of the online booking process and ensuring seamless integration between digital outreach and the physical experience is paramount for optimizing conversion rates and minimizing front-desk friction.

Trampoline Park Market Potential Customers

The primary end-users and buyers in the Trampoline Park Market are segmented into distinct demographic and psycho-graphic profiles, each requiring tailored marketing and service offerings. The largest volume segment comprises families with children aged 5 to 12, where parents act as the ultimate purchasers seeking safe, engaging, and supervised physical activity options. This group is highly sensitive to safety records, cleanliness, and ease of party planning services, often prioritizing facilities that offer inclusive, package-based deals for birthday celebrations. The secondary, but rapidly growing segment, includes teenagers and young adults (13-25) who utilize the parks for social gatherings, competitive sports (like dodgeball tournaments), and high-intensity, challenging physical activities such as ninja warrior courses. Marketing to this group often leverages social media trends, competitive formats, and late-night or special event scheduling.

A crucial niche segment involves fitness enthusiasts and adults seeking unique workout regimes. These customers are buyers of specialized fitness classes (e.g., cardio trampoline classes) and are often repeat customers with high loyalty, less price-sensitive than general admission jumpers, and focused entirely on the health benefits and structured nature of the activity. Corporate entities also represent significant potential customers, utilizing the parks during off-peak hours for team-building exercises, corporate retreats, and employee family days. Targeting this B2B segment requires a focus on structured group packages, private event space, and integrated F&B catering capabilities. Successfully capturing this diverse customer base necessitates a flexible pricing strategy and a multi-faceted facility layout that can safely and effectively segregate these different user groups during peak operational times.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sky Zone LLC, Altitude Trampoline Park, Get Air Trampoline Park, CircusTrix Holdings (parent company of Defy, Sky High), Urban Air Adventure Park, Rebounderz Family Entertainment Centers, Launch Trampoline Park, Rush Trampoline Parks, BOUNCE Inc., Jump Zone, Big Air Trampoline Park, Gravit8 Trampoline Park, AirHop Trampoline Park, Super Tramp Parks, Flip Out Global, Springtime Trampoline Park, MaxAir Trampoline Park, Jumpsquare, Trampo Extreme, Planet Fitness (through specialized offerings) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Trampoline Park Market Key Technology Landscape

The Trampoline Park Market is increasingly reliant on technology to enhance safety, improve efficiency, and elevate the customer experience. A critical technological component is the integration of advanced sensor technology embedded within the equipment, which monitors impact forces and material stress points, providing predictive data for maintenance and alerting management to potential structural fatigue before failure occurs. This proactive approach significantly reduces operational risks and extends the lifespan of high-value assets. Furthermore, digital ticketing and point-of-sale (POS) systems are standard, but the latest iteration involves fully integrated cloud-based management platforms that handle scheduling, waiver management, inventory control (especially for F&B), and real-time sales reporting across multi-site operations, providing franchisees and corporate operators a unified view of business performance and efficiency metrics.

Interactive technology is crucial for customer engagement and competitive differentiation. This includes the widespread adoption of RFID wristband technology, which serves multiple purposes: tracking entry/exit times for accurate billing, facilitating cashless payments for concessions, and enabling interactive gameplay features where jumps or movements trigger visual effects or accumulate scores on linked screens. This gamification of the jumping experience appeals especially to the younger demographic and encourages repeat visits. Moreover, the integration of Augmented Reality (AR) and Virtual Reality (VR) into dedicated zones, allowing users to jump through virtual worlds or compete in digital environments while performing physical actions on the trampoline, is rapidly evolving from a niche offering to a mainstream attraction differentiator, driving premium pricing structures.

Safety and surveillance systems represent another major technological investment area. High-definition camera systems, often utilizing AI-driven computer vision as previously discussed, are standard for monitoring all jumping areas. Beyond visual monitoring, specialized floor padding materials and impact absorption technology have advanced significantly, offering better force dissipation to reduce injury severity. Specialized software is also utilized for mandatory digital waiver collection and storage, ensuring legal compliance and reducing the administrative burden associated with verifying participation consent. The confluence of these technologies—operational efficiency systems, experiential enhancement tools, and critical safety infrastructure—is defining the competitive landscape, where technological superiority increasingly equates to higher market attractiveness and reduced liability exposure.

Regional Highlights

Regional dynamics within the Trampoline Park Market showcase varied maturity levels and growth prospects, driven by demographic trends, discretionary spending, and regulatory environments. North America, particularly the United States, represents the most mature and dominant market globally. It is characterized by high penetration rates, intense competition among large franchise operators (like Sky Zone and Urban Air), and a strong focus on diversified offerings, including fitness and high-tech attractions. Strict safety standards, heavily influenced by organizations like ASTM International, mandate continuous investment in equipment and training, which in turn raises the barriers to entry but ensures consumer confidence. Market growth here remains steady, focusing on consolidation and the upgrading of existing facilities.

Europe follows as a strong contender, demonstrating robust growth, particularly in the UK, Germany, and the Nordic countries. The European market tends to emphasize premium, experience-driven parks with high-quality interior design and strong F&B offerings, appealing to families and young adults. Regulatory frameworks are generally aligned with high safety standards, and market expansion is often achieved through sophisticated franchising models targeting secondary and tertiary cities where recreational options might be scarcer. The competitive environment is fragmented but increasingly seeing the entry of large international players consolidating local operators, leading to professionalization and standardization.

The Asia Pacific (APAC) region stands out as the future growth engine for the Trampoline Park Market. Countries like China, India, and Australia are experiencing rapid market uptake, fueled by surging disposable incomes, increasing awareness of westernized recreational activities, and dense urban populations requiring structured indoor entertainment. While infrastructure costs can be high, the enormous untapped consumer base presents lucrative opportunities. However, regulatory standards can be inconsistent across different APAC nations, posing challenges related to uniform safety implementation and operational consistency for multinational operators. The Middle East and Africa (MEA) region, particularly the GCC countries, shows high potential due to significant government investment in leisure infrastructure and a climate that favors indoor entertainment, demanding premium, climate-controlled facilities targeting affluent families and tourists.

- North America (Dominant Market): High market maturity, intense franchise competition, focus on diversification (fitness, extreme sports), and stringent ASTM safety adherence.

- Europe (Strong Growth): Emphasis on premium facilities, sophisticated design, robust presence in the UK and Germany, driven by strong consumer leisure spending.

- Asia Pacific (Fastest Growth): Rapid expansion in China and India due to urbanization and middle-class growth; high demand for large, modern FECs; regulatory standardization challenges exist.

- Latin America: Emerging market with localized adoption; growth potential linked to improving economic stability and targeted investment in major metropolitan areas.

- Middle East & Africa (Niche High-Value Market): Growth concentrated in affluent GCC countries, demanding high-specification, indoor, climate-controlled adventure parks focused on luxury and safety.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Trampoline Park Market.- Sky Zone LLC

- Altitude Trampoline Park

- Get Air Trampoline Park

- CircusTrix Holdings (Defy, Sky High, etc.)

- Urban Air Adventure Park

- Rebounderz Family Entertainment Centers

- Launch Trampoline Park

- Rush Trampoline Parks

- BOUNCE Inc.

- Jump Zone

- Big Air Trampoline Park

- Gravit8 Trampoline Park

- AirHop Trampoline Park

- Super Tramp Parks

- Flip Out Global

- Springtime Trampoline Park

- MaxAir Trampoline Park

- Jumpsquare

- Trampo Extreme

- Aerosports Trampoline Parks

Frequently Asked Questions

Analyze common user questions about the Trampoline Park market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Trampoline Park Market?

The Trampoline Park Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, driven by increasing leisure spending and demand for active entertainment.

What are the primary factors restraining growth in the Trampoline Park Market?

The primary restraints include high liability insurance costs due to injury risks, significant initial capital investment required for facility construction, and the necessity of adhering to increasingly stringent international safety regulations and operational standards.

Which technology is most crucial for enhancing safety in modern trampoline parks?

AI-driven computer vision systems are becoming critical for enhancing safety, enabling real-time monitoring of jumping areas and overcrowding, allowing staff to proactively intervene and mitigate potential accidents more rapidly than manual supervision alone.

Which geographical region is expected to show the fastest market expansion?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, is expected to exhibit the fastest market expansion, fueled by rapid urbanization, growing middle-class disposable income, and increasing demand for organized indoor family entertainment centers (FECs).

How are trampoline parks diversifying their revenue streams beyond general admission?

Operators are actively diversifying through high-margin ancillary services, specifically specialized offerings such as birthday party hosting and corporate events, dedicated adult fitness classes (e.g., trampoline aerobics), and enhanced Food and Beverage (F&B) sales.

What role does gamification play in market sustainability?

Gamification, often implemented through interactive floor projection systems and RFID tracking, transforms standard jumping into competitive activities. This appeals strongly to teens and young adults, boosting repeat visits and increasing the long-term sustainability and novelty of the park experience.

What is the significance of the Hybrid FEC model in market evolution?

The Hybrid FEC (Family Entertainment Center) model integrates trampolines with diverse attractions like ninja courses, arcades, and climbing walls. This model maximizes customer dwell time and average spend per visitor, making the facility a comprehensive destination rather than a single-activity venue, thus boosting profitability and competitive resilience.

How does upstream analysis affect operational costs?

Upstream analysis, focusing on sourcing high-quality, durable components like high-tensile steel and specialized padding materials, directly impacts long-term operational costs. Investing in superior quality equipment reduces maintenance frequency, lowers insurance risks, and extends the asset life, proving cost-effective over the park's operational tenure.

What are the key concerns for trampoline park operators regarding facility size?

Facility size directly influences capacity and attraction diversification. Smaller facilities face challenges in offering a variety of high-demand attractions, while larger facilities require significantly higher initial capital investment, complex zoning compliance, and higher ongoing operational utility costs, demanding careful site selection and market analysis.

How are customer relationship management (CRM) systems utilized in this industry?

CRM systems manage customer data, including waiver information, purchase history, and loyalty program participation. They are essential for personalized marketing campaigns, automated communications regarding safety updates, and ensuring targeted promotion delivery, driving higher customer retention and lifetime value.

What is the trend regarding adult participation in trampoline parks?

The trend shows a significant increase in adult participation, driven primarily by the growth of specialized fitness classes (such as structured cardio-jump workouts) that market trampolining as an effective, low-impact exercise alternative to traditional gym activities, expanding the market beyond typical family leisure.

What role do franchising models play in regional expansion?

Franchising models enable rapid and standardized regional and international expansion. They provide localized entrepreneurs with established brand recognition, proven operational blueprints, safety protocols, and supply chain benefits, crucial for mitigating risks associated with entering new, complex geographical markets.

What is the primary revenue stream for most established trampoline park businesses?

While general admission provides a stable baseline, the primary driver for overall profitability remains the Birthday Parties and Group Events segment, due to high average transaction values, often inclusive of F&B and premium package upgrades, maximizing revenue per square foot during peak weekend slots.

How does seasonality impact trampoline park operations?

Seasonality creates peak demand during school holidays and adverse weather periods, leading to staffing and capacity challenges. Operators mitigate low demand during off-peak times by offering targeted weekday promotions, hosting structured fitness classes, or engaging in B2B corporate team-building events.

What security measures are vital beyond standard CCTV?

Beyond standard CCTV, vital security measures include real-time access control systems (using RFID), mandatory digital waiver collection linked to entry, and specialized staff training protocols focused on first aid, emergency response, and proactive intervention based on dynamic risk assessment of jumper behavior.

How is the market addressing environmental sustainability concerns?

Market operators are increasingly addressing sustainability through facility design (e.g., efficient LED lighting, high-efficiency HVAC systems), waste reduction programs in F&B, and sourcing eco-friendly materials for foam pits and consumable supplies, appealing to environmentally conscious consumers.

What are the key differences between traditional and extreme adventure parks?

Traditional parks focus primarily on open jump areas and basic dodgeball courts. Extreme adventure parks incorporate complex, higher-risk, and higher-skill activities like zip lines, elaborate ninja warrior courses, and professional climbing walls, targeting a broader, often older, thrill-seeking demographic.

What is the regulatory body often cited for safety standards in North America?

In North America, the primary voluntary regulatory body influencing safety standards is ASTM International, particularly the F2970 standard, which covers the design, manufacture, installation, and operation of Trampoline Court Parks, essential for liability and insurance compliance.

How are emerging economies impacting equipment manufacturing?

The rapid growth in emerging economies, particularly in APAC, is increasing the global demand for specialized trampoline equipment. This is driving scale in manufacturing, potentially leading to reduced procurement costs for major international operators while simultaneously increasing the diversity of low-cost, though not always safety-compliant, local suppliers.

Why is Food and Beverage (F&B) segment important for park revenue?

The F&B segment is important because it serves as a critical revenue multiplier and enhances customer comfort. It captures revenue that would otherwise be spent outside the park, significantly increasing the average spend per visitor, especially during long stays associated with birthday parties and events.

What is the main challenge related to operational efficiency in multi-site operations?

The main challenge is maintaining consistency in safety standards and service quality across multiple geographically dispersed sites while managing centralized procurement and staffing schedules. This requires robust, cloud-based Enterprise Resource Planning (ERP) and operational management systems to ensure brand integrity and efficiency.

How does competitive pricing strategy evolve in dense urban markets?

In dense urban markets with high competition, pricing strategies shift from standard hourly rates to complex tiered systems, including time-of-day pricing (peak vs. off-peak), family passes, loyalty discounts, and all-inclusive attraction packages, aimed at capturing market share through perceived value and flexibility.

What are the primary considerations for real estate selection for a new park?

Primary considerations include ceiling height (minimum 25-30 feet required), proximity to high-density population areas and schools, ample parking capacity, favorable zoning ordinances for entertainment/recreation use, and accessibility to major transport links to ensure high foot traffic potential.

How is virtual reality (VR) utilized within the trampoline park setting?

VR is used in dedicated, often tethered, zones where participants jump on trampolines while wearing VR headsets. This merges physical activity with immersive digital environments, creating unique, highly differentiated experiences that justify a premium price point and appeal strongly to technologically savvy demographics.

What are the future opportunities regarding personalized customer experiences?

Future opportunities center on leveraging AI and customer data to deliver hyper-personalized experiences, such as offering custom difficulty levels in games, sending targeted promotions for fitness classes based on historical activity, or remembering specific customer preferences for party catering.

What is the role of insurance in market profitability?

Insurance is a major fixed cost and directly impacts profitability. High safety compliance and low accident rates are essential, as they lead to lower premium rates, while failure to adhere to standards can result in prohibitive costs or an inability to obtain adequate coverage, making risk mitigation central to financial viability.

What are the growth drivers specific to the trampoline park fitness segment?

Growth drivers specific to the fitness segment include the recognized health benefits of low-impact, high-intensity workouts, the novelty compared to traditional gyms, and the strong community aspect created by structured group classes, attracting adults seeking engaging exercise routines.

How do operators manage the critical labor force and training requirements?

Operators manage labor through continuous, mandatory certification programs focusing on safety supervision, first aid, and customer service. High turnover is managed by utilizing predictive scheduling software (often AI-assisted) and offering structured career progression to retain high-performing, safety-conscious staff members.

What are the typical marketing channels used by large operators?

Large operators utilize a multi-channel approach: search engine optimization (SEO) for local discovery, targeted paid social media advertising (Facebook, Instagram, TikTok), email marketing for loyalty programs, and partnerships with local schools and community organizations for group bookings and fundraising events.

What is the expected evolution of trampoline material technology?

The expected evolution involves materials science improvements, focusing on enhanced durability, superior impact absorption capabilities in padding and mat materials to further reduce injury risk, and specialized coatings that improve grip and hygiene in high-traffic environments, ensuring operational excellence.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Trampoline Park Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Trampoline Parks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mini Trampoline, Medium Trampoline, Large Trampoline), By Application (Domestic Use, Trampoline Park Use, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager