Transfer Agency Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431843 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Transfer Agency Services Market Size

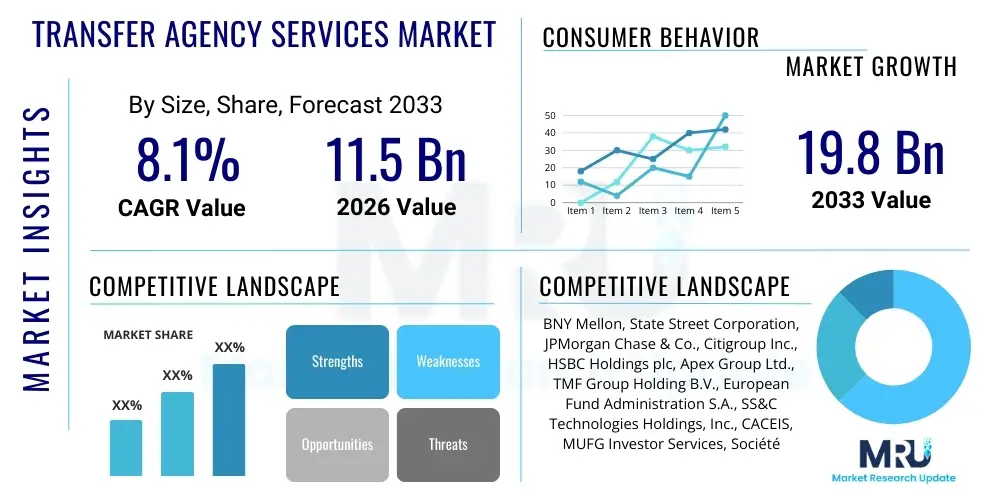

The Transfer Agency Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $19.8 Billion USD by the end of the forecast period in 2033.

Transfer Agency Services Market introduction

Transfer Agency (TA) services are foundational components of the investment fund ecosystem, providing essential administrative and compliance functions related to investor record-keeping, share registration, and transaction processing. These services act as the official liaison between the fund manager and the investors, ensuring accurate maintenance of the fund register, handling subscriptions, redemptions, switches, and managing dividend distributions. The core mandate of TAs includes rigorous Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, which are increasingly crucial in a stringent global regulatory environment. The market is witnessing a profound shift driven by the need for digital transformation, enhanced operational efficiency, and scalable solutions capable of handling complex global fund structures, such as UCITS and AIFs.

The product scope of the Transfer Agency Services Market encompasses a wide array of activities, extending beyond basic registry maintenance to include specialized services such as fee calculation, performance reporting, regulatory reporting (e.g., FATCA, CRS), and client communication management. Major applications span across various fund types, including mutual funds, hedge funds, private equity funds, and real estate funds. The necessity for specialized expertise in navigating diverse jurisdictional requirements makes outsourcing TA functions attractive to asset managers, allowing them to focus on core investment strategies rather than burdensome administration. Benefits derived from robust TA services include reduced operational risk, improved investor experience through seamless digital portals, and guaranteed compliance with evolving international financial regulations, thereby bolstering investor confidence and institutional reputation.

Key driving factors accelerating market growth include the steady global expansion of the asset management industry, particularly in emerging economies, leading to an increased volume of transactions requiring professional administration. Furthermore, the persistent pressure on fund managers to reduce Expense Ratios, coupled with the rising complexity of financial products and heightened global regulatory scrutiny (e.g., MiFID II, GDPR), necessitates investment in sophisticated, centralized Transfer Agency platforms. Technological advancements, notably the integration of cloud computing, Robotic Process Automation (RPA), and distributed ledger technology (DLT), are also fueling market expansion by enabling TAs to offer highly automated, cost-effective, and transparent services, thereby setting new benchmarks for operational excellence within the financial sector.

Transfer Agency Services Market Executive Summary

The Transfer Agency Services Market is characterized by intense competition and consolidation, driven by the imperative for scale to manage high fixed costs associated with advanced technology and extensive regulatory compliance frameworks. Current business trends indicate a strong move towards comprehensive outsourcing models, where asset managers seek bundled services (fund administration and TA) from single providers to streamline vendor management and achieve greater cost synergies. Major market players are heavily investing in digital investor portals and integrated data analytics capabilities to enhance the investor journey, providing real-time access to transaction data and reporting. Regional trends show robust growth in the Asia Pacific (APAC) region, particularly driven by expanding retail investor bases in countries like China and India, alongside sustained demand in established markets like North America and Europe, which are focused on adopting advanced digitalization to meet cross-border fund distribution requirements.

Segment trends highlight the increasing importance of technology adoption, with platforms capable of handling diverse asset classes and complex jurisdictional requirements gaining significant traction. By Service Type, shareholder servicing and regulatory reporting segments are experiencing rapid growth due to increasing investor expectations for transparency and the stringent global enforcement of compliance standards such as AML and KYC. Within fund types, the alternatives segment, including private equity and hedge funds, is showing above-average growth, reflecting the specialized administrative needs related to capital calls, complex fee structures, and the handling of institutional investor demands. The market structure continues to favor large, established financial institutions that possess the necessary capital and technological infrastructure to manage global operations, although specialized FinTech providers are emerging to offer niche, highly automated solutions, particularly in digital investor onboarding and reporting.

Overall, the market trajectory is strongly linked to global capital market stability, regulatory harmonization efforts, and the pace of technological innovation within the financial services sector. The ability of Transfer Agents to effectively mitigate cyber risk and operational failures while simultaneously delivering personalized, digital-first investor experiences will define future competitive advantages. Geopolitical shifts and evolving tax regulations pose consistent challenges, demanding adaptable systems and highly skilled personnel. Consequently, strategic mergers and acquisitions remain prevalent as firms seek geographic reach, technological superiority, and enhanced economies of scale to maintain profitability in a highly regulated and price-sensitive operational environment.

AI Impact Analysis on Transfer Agency Services Market

User questions regarding the impact of Artificial Intelligence (AI) on Transfer Agency Services primarily revolve around three core themes: efficiency gains through automation, the future role of human staff, and the accuracy and compliance implications of automated decision-making. Users are keen to understand how AI and Machine Learning (ML) can revolutionize the traditionally labor-intensive processes of KYC/AML checks, document validation, and complex query resolution, aiming for faster processing times and reduced manual errors. Concerns frequently surface regarding data security, the governance framework needed for AI-driven compliance decisions, and how smaller TAs can afford and integrate these transformative technologies without falling behind larger competitors. Furthermore, there is a strong expectation that AI will enhance, not replace, high-value human activities, shifting focus towards complex client relationship management and strategic regulatory interpretation.

AI’s deployment is already redefining operational workflows within Transfer Agency operations. Natural Language Processing (NLP) is proving indispensable in automating the review of lengthy subscription documents and complex regulatory filings, significantly cutting down onboarding time for new investors and ensuring consistency in document handling. ML algorithms are being utilized for predictive analytics, identifying potential compliance risks, detecting anomalous transaction patterns indicative of fraud or market abuse, and optimizing staffing levels based on forecasted transaction volumes. This integration moves TAs from reactive service providers to proactive risk managers, enhancing the integrity of the fund registry and improving overall operational resilience in the face of escalating global transaction complexity.

The long-term influence of AI centers on creating highly personalized, scalable investor experiences and achieving near-perfect compliance. AI-powered chatbots and virtual assistants handle a large volume of routine investor inquiries 24/7, freeing up human agents for complex problem-solving. By generating predictive models, TAs can anticipate investor behavior, optimize communication strategies, and even customize reporting formats. This technological transition positions Transfer Agents not merely as record keepers, but as data custodians providing actionable insights to fund managers, cementing AI as a pivotal competitive differentiator in achieving both regulatory excellence and client satisfaction.

- AI facilitates the rapid processing and validation of complex KYC/AML documentation, drastically reducing investor onboarding time.

- Machine Learning algorithms enhance fraud detection capabilities by identifying subtle anomalies in transaction patterns and investor behavior.

- Robotic Process Automation (RPA) automates high-volume, repetitive tasks such as data entry, reconciliation, and routine reporting, leading to significant cost savings.

- Natural Language Processing (NLP) is utilized for extracting key information from legal agreements and regulatory mandates, ensuring automated compliance checks.

- Predictive analytics allows TAs to forecast transaction peaks and optimize resource allocation, minimizing service disruption during high-demand periods.

- AI-driven chatbots and virtual assistants provide 24/7 investor support, improving service levels and responsiveness.

- Implementation of AI requires substantial investment in secure cloud infrastructure and specialized data governance frameworks.

DRO & Impact Forces Of Transfer Agency Services Market

The dynamics of the Transfer Agency Services Market are shaped by a strong interplay of growth drivers and significant regulatory and technological restraints, with numerous emerging opportunities arising from market fragmentation and the demand for digital transformation. Driving forces center on the globalization of investment funds, mandatory compliance with complex, localized regulations across multiple jurisdictions, and the inherent economies of scale achieved through outsourcing administrative functions. These drivers ensure a consistent demand floor for professional TA services. Restraints largely involve high capital expenditure required for continuous technological upgrades, the increasing threat of cyberattacks targeting sensitive investor data, and acute fee pressure exerted by large asset managers seeking to minimize administrative costs, which compresses profit margins for service providers. The net impact of these forces is a market pushing towards consolidation and mandatory digitalization.

Opportunities are prevalent in the underserved alternative investment segment, which requires highly customized and intricate administrative services, and in the deployment of Distributed Ledger Technology (DLT) or blockchain, promising unparalleled transparency and efficiency in fund unit registration and settlement processes. Furthermore, the rising adoption of Environmental, Social, and Governance (ESG) investing mandates presents an opportunity for TAs to integrate specialized reporting and compliance checks related to sustainability criteria. The critical impact forces include technological disruption, which is necessitating a shift from legacy systems to advanced cloud-based platforms, and regulatory harmonization efforts, such as the push for pan-European fund passporting, which simultaneously simplify cross-border operations while raising the compliance burden for domestic TAs.

The regulatory burden acts as a double-edged sword: while it is a significant restraint due to compliance costs, it is also a fundamental driver, creating an insurmountable barrier to entry for new, smaller players and solidifying the necessity of specialized TA expertise for asset managers. The overall impact forces compel Transfer Agents to evolve into technology-enabled data custodians rather than mere administrative processors. Success is increasingly tied to global service capability, robust cybersecurity frameworks, and the ability to integrate seamlessly with the entire fund ecosystem, including fund accounting, custody, and trading platforms, making resilience and innovation the core determinants of market leadership and survival.

Segmentation Analysis

The Transfer Agency Services Market segmentation provides a granular view of service adoption across different client types, fund structures, and service delivery mechanisms, crucial for identifying areas of high growth and specialized demand. Segmentation by Service Type reveals the dominance of basic shareholder servicing and the accelerated growth in complex regulatory reporting and compliance services, reflecting the global trend toward stricter governance. Segmentation by Fund Type highlights the differential needs between traditional mutual funds, which require high-volume transactional processing, and alternative funds (such as private equity and real estate), which demand bespoke capital call administration and partnership accounting support. Understanding these distinct segment needs allows TAs to tailor their technology stacks and operational models effectively, ensuring maximum client retention and efficient resource deployment.

Further analysis by Delivery Channel is critical, differentiating between captive in-house operations maintained by large financial institutions and outsourced services provided by specialist third-party administrators. The continued trend favors outsourcing due to the economies of scale, technological expertise, and regulatory agility offered by specialized TAs, especially for mid-tier and smaller asset managers. Geographically, market behavior varies significantly, driven by regional investment fund structures, local tax laws, and the maturity of the retail investment market. For example, North America prioritizes seamless digital integration for large 401(k) plans, while Europe focuses heavily on complex cross-border distribution requirements necessitated by directives like UCITS and AIFMD, mandating TAs to maintain multi-jurisdictional compliance expertise and platform scalability.

The increasing complexity of investment instruments and global regulatory fragmentation necessitates that TAs offer modular, adaptable services. This modularity is a key competitive differentiator, allowing fund managers to select specific services—ranging from pure record-keeping to full-suite support including KYC/AML management, dividend calculation, and client communication—based on their operational requirements and target investor base. The emphasis remains strongly on technology platforms that support straight-through processing (STP) and provide real-time data accessibility, ensuring transparency and reducing the scope for manual intervention and error across all segmented offerings.

- By Service Type

- Shareholder Servicing

- Fund Register Maintenance

- Regulatory Reporting and Compliance (KYC, AML, FATCA, CRS)

- Distribution and Commission Management

- Transaction Processing (Subscriptions, Redemptions, Switches)

- By Fund Type

- Mutual Funds (Open-ended Funds)

- Hedge Funds

- Private Equity and Venture Capital Funds

- Real Estate Funds

- Exchange-Traded Funds (ETFs)

- By End-User

- Asset Management Firms

- Insurance Companies

- Pension Funds

- Wealth Managers and Family Offices

- By Delivery Model

- In-House / Captive TA

- Outsourced / Third-Party Administration

Value Chain Analysis For Transfer Agency Services Market

The Value Chain for Transfer Agency Services begins with the upstream activities centered on core technology development and regulatory expertise acquisition. Upstream providers include specialized software vendors who supply fund accounting platforms, secure data storage solutions, and compliance tools necessary for robust record-keeping. The quality of these foundational technologies determines the TA’s ability to handle high transaction volumes, complex calculations, and rapid regulatory changes. Strategic relationships with FinTech firms specializing in identity verification and blockchain solutions are becoming crucial components of the upstream supply chain, driving automation and enhancing data integrity early in the process.

The core TA operations form the middle section of the value chain, encompassing essential processes such as investor onboarding (KYC/AML), transaction processing, maintenance of the shareholder register, and performance of regulatory checks. Efficiency in this stage is paramount, relying heavily on Straight-Through Processing (STP) capabilities and robust operational resilience. Cost management is critical here, pushing TAs towards adopting shared service models and centralized platforms to achieve economies of scale across different geographical regions and client mandates. Successful TAs utilize workflow management tools and automated reconciliation systems to minimize operational risk and accelerate service delivery times for fund managers.

Downstream activities focus on the delivery of services to fund managers and direct interaction with the end investors via distribution channels. These include producing customized investor statements, facilitating dividend and distribution payments, generating complex regulatory reports required by jurisdictions, and managing all investor communications. Distribution channels are increasingly digitized, with sophisticated client portals providing self-service functionalities, detailed fund information, and instant access to transaction history. While direct channels (client portals) are growing, indirect distribution through platforms and intermediary networks (wealth managers, brokers) remains significant, requiring TAs to maintain interoperability and seamless data exchange capabilities with external financial platforms, thereby ensuring transparency and compliance throughout the investor lifecycle.

Transfer Agency Services Market Potential Customers

The primary customers for Transfer Agency services are institutions responsible for managing pooled investment vehicles, necessitating rigorous administrative oversight and adherence to strict regulatory mandates. Asset Management Firms constitute the largest segment of end-users, encompassing entities managing mutual funds, hedge funds, and private equity vehicles. These firms rely on TAs to manage the complex relationship with their investor base, ensuring accurate share registration and compliance with jurisdictional requirements, thereby outsourcing non-core, yet mission-critical, administrative burdens to specialists. The increasing global focus on fiduciary responsibility makes the quality and resilience of TA operations a key consideration for these managers.

Institutional Investors, such as Pension Funds, Insurance Companies, and Sovereign Wealth Funds, frequently utilize TA services when investing in complex fund structures, particularly alternative assets, where capital calls, distribution waterfalls, and investor transparency requirements are intricate. Although they are investors rather than fund managers, their mandates often necessitate robust reporting and verification processes which are facilitated by specialized TAs. Moreover, the growth of Defined Contribution (DC) schemes and retirement planning products has expanded the need for high-volume, automated TA services capable of handling massive retail investor bases efficiently and securely.

A growing segment of potential customers includes specialized financial intermediaries like Wealth Managers, Family Offices, and Fund Distributors. While these entities do not typically manage the funds themselves, they require sophisticated TA integration to facilitate trading, settlement, and regulatory data transmission on behalf of their underlying clients. The demand for seamless digital integration, API connectivity, and tailored data feeds from TAs is high among these intermediaries, who are seeking to optimize their client service offerings and minimize operational friction when interacting with various fund providers. This symbiotic relationship reinforces the necessity for TAs to continually enhance their technology infrastructure to support complex B2B data exchange.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $19.8 Billion USD |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BNY Mellon, State Street Corporation, JPMorgan Chase & Co., Citigroup Inc., HSBC Holdings plc, Apex Group Ltd., TMF Group Holding B.V., European Fund Administration S.A., SS&C Technologies Holdings, Inc., CACEIS, MUFG Investor Services, Société Générale Securities Services, Northern Trust Corporation, Global Shares (J.P. Morgan), Mainstream Group Holdings Limited, Link Group, Ultimus Fund Solutions, Intertrust Group (CSC), Vistra Group, Brown Brothers Harriman & Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Transfer Agency Services Market Key Technology Landscape

The technology landscape governing the Transfer Agency Services market is undergoing radical transformation, moving away from fragmented, costly legacy systems towards integrated, cloud-native platforms designed for scalability and global reach. Central to this evolution is the migration to Software-as-a-Service (SaaS) models, which significantly reduce the need for localized hardware maintenance and enable TAs to deploy updates and regulatory changes swiftly across their entire client base. The adoption of robust data governance frameworks, underpinned by advanced encryption and intrusion detection systems, is mandatory, given the highly sensitive nature of investor data and the increasing threat surface posed by sophisticated cyberattacks. Furthermore, Application Programming Interfaces (APIs) are becoming essential connectors, allowing seamless integration between TA platforms, fund accounting systems, custodian banks, and client-facing digital portals, optimizing the entire data flow lifecycle.

Digitalization and automation technologies, particularly Robotic Process Automation (RPA) and Artificial Intelligence (AI), are the primary technological differentiators. RPA is deployed to handle high-volume, rules-based tasks like routine data input, quality checks, and cross-system reconciliations, drastically improving operational efficiency and accuracy while simultaneously lowering human error rates. AI and Machine Learning (ML) are utilized in complex areas such as enhanced due diligence (eKYC), sophisticated anti-money laundering transaction monitoring, and personalized investor communications. These advanced tools enable TAs to process investor interactions at speed and scale previously unattainable, positioning technology investment as a key strategic lever for competitive advantage rather than a mere cost center.

Looking forward, Distributed Ledger Technology (DLT), commonly known as blockchain, holds profound potential to revolutionize the core functions of transfer agency. DLT promises to create an immutable, shared record of ownership across all parties—fund managers, TAs, and investors—potentially eliminating the need for complex, time-consuming reconciliation processes and enabling near real-time settlement of fund units. While adoption remains in pilot stages due to regulatory uncertainties and the need for industry standardization, the long-term view anticipates DLT significantly streamlining cross-border transactions and reducing the overall friction in the fund distribution chain. The successful TA of the future will be defined by its open architecture, its mastery of cloud computing infrastructure, and its early, pragmatic integration of blockchain and machine learning capabilities to meet future investor demand for speed and transparency.

Regional Highlights

- North America (NA)

North America, particularly the United States, represents the largest and most technologically mature market for Transfer Agency services, driven by the colossal size of the mutual fund industry, the proliferation of defined contribution retirement plans (401(k)s), and a highly developed institutional investment landscape. The primary regional focus is on large-scale processing efficiency, ensuring stringent compliance with domestic regulations such as SEC rules and local tax codes. Competition is fierce among major custodians and specialized providers, leading to continuous investment in investor-facing digital platforms and advanced cybersecurity measures. Consolidation remains a key theme as firms seek to leverage scale to absorb high fixed costs related to technology infrastructure and regulatory reporting requirements. The region is a leading adopter of AI and RPA for shareholder servicing and compliance checks.

The market dynamic is heavily influenced by the constant pressure on expense ratios, prompting asset managers to demand highly efficient and cost-effective TA solutions, often resulting in complex performance-based service agreements. The rise of Exchange-Traded Funds (ETFs) presents a distinct administrative challenge, requiring TAs to adapt their systems for unique creation/redemption mechanisms and capital markets oversight, differing significantly from traditional mutual fund administration. The robust legal framework governing investor data privacy and protection further compels TAs in North America to maintain world-class technological resilience and operational integrity, reinforcing the regional dominance of major global financial service providers.

- Europe

Europe is characterized by significant market complexity driven by cross-border fund distribution and the fragmented regulatory landscape stemming from directives like UCITS (Undertakings for Collective Investment in Transferable Securities) and AIFMD (Alternative Investment Fund Managers Directive). The necessity for Transfer Agents to operate across multiple jurisdictions, handle diverse currencies, and comply with localized tax reporting (e.g., DAC6) makes service delivery highly intricate and specialized. Luxembourg and Ireland serve as critical hubs for the market, acting as domiciles for a vast majority of cross-border funds, which fuels demand for sophisticated multi-lingual and multi-currency TA platforms capable of passporting funds across the EU/EEA.

Regulatory adherence, particularly concerning MiFID II (Markets in Financial Instruments Directive II) requirements for investor protection and transparency, and extensive AML/KYC requirements (5th and 6th AML Directives), is a primary driver of expenditure and technology adoption. The European market is slowly moving towards greater technological harmonization; however, the ongoing reliance on national infrastructure and differing legal interpretations across member states continues to pose operational challenges. Opportunities are emerging in servicing the burgeoning sustainable finance sector, where TAs are developing specialized reporting capabilities related to ESG criteria and the EU Taxonomy Regulation, establishing Europe as a leader in compliance-driven TA innovation.

- Asia Pacific (APAC)

The Asia Pacific region is forecast to exhibit the highest growth rate, fueled by rapidly expanding middle-class wealth, increasing penetration of financial products, and relatively high levels of individual savings allocated to investment funds, particularly in key markets such as China, Japan, Australia, and India. Market development is asymmetrical, with mature markets like Australia and Japan demanding advanced digital investor portals and stringent local regulatory compliance, while emerging markets like India and Southeast Asia are experiencing exponential growth in the retail investor base, necessitating scalable, high-volume processing capabilities.

Regional challenges include highly diverse regulatory regimes, non-standardized fund structures, and varying levels of digital infrastructure maturity. This complexity often requires Transfer Agents to deploy regionally tailored solutions rather than standardized global platforms. Furthermore, the region is witnessing a rapid push toward localizing administrative operations to meet capital controls and data residency requirements. The opportunity lies in providing robust, digital onboarding solutions (eKYC) to capture the large, increasingly digitally savvy retail investor segment and supporting the growing cross-border distribution flows within the region, particularly leveraging financial passporting initiatives like the ASEAN Collective Investment Schemes and the Mutual Recognition of Funds between Hong Kong and mainland China.

- Latin America (LATAM) and Middle East & Africa (MEA)

The LATAM and MEA regions represent niche but growing markets, primarily focused on institutional funds and local pension schemes, often characterized by significant local regulatory volatility and relatively less mature digital infrastructure compared to North America and Europe. In LATAM, regulatory environments are often complex due to currency fluctuation and specific national tax laws, necessitating highly localized TA solutions. Key markets such as Brazil and Mexico are leading the adoption of institutional fund administration services, driven by domestic pension fund growth and sovereign wealth management.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing growth linked to the diversification of national economies away from oil, leading to the creation of new financial free zones (e.g., DIFC, ADGM) that attract global fund managers. These zones often adopt sophisticated international regulatory standards, creating demand for best-in-class TA services. Challenges in both regions include political risk, limitations in technology investment, and the requirement for providers to navigate high levels of administrative friction, though the long-term potential for expansion is substantial as financial market liberalization continues.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Transfer Agency Services Market.- BNY Mellon

- State Street Corporation

- JPMorgan Chase & Co.

- Citigroup Inc.

- HSBC Holdings plc

- Apex Group Ltd.

- TMF Group Holding B.V.

- European Fund Administration S.A.

- SS&C Technologies Holdings, Inc.

- CACEIS

- MUFG Investor Services

- Société Générale Securities Services

- Northern Trust Corporation

- Global Shares (J.P. Morgan)

- Mainstream Group Holdings Limited

- Link Group

- Ultimus Fund Solutions

- Intertrust Group (CSC)

- Vistra Group

- Brown Brothers Harriman & Co.

Frequently Asked Questions

Analyze common user questions about the Transfer Agency Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Transfer Agent in the investment management industry?

The primary function of a Transfer Agent (TA) is to maintain the official register of a fund's investors, accurately recording all transactions such as subscriptions, redemptions, and switches. TAs also ensure regulatory compliance, process dividend payments, and manage mandatory investor communications on behalf of the fund manager.

How is technology, specifically AI and Blockchain, transforming Transfer Agency operations?

AI and Robotic Process Automation (RPA) are driving efficiency by automating complex KYC/AML checks, data reconciliation, and high-volume transaction processing, significantly reducing manual errors. Blockchain (DLT) holds the potential to create shared, immutable records of fund ownership, drastically streamlining cross-border settlement and enhancing overall market transparency.

What are the most significant regulatory challenges facing the Transfer Agency Services Market?

The most significant challenges include navigating fragmented international regulatory landscapes (e.g., UCITS, AIFMD in Europe), adhering to increasingly rigorous global Anti-Money Laundering (AML) and Know Your Customer (KYC) directives, and ensuring compliance with complex data privacy laws like GDPR and CCPA.

Which geographic region is expected to demonstrate the fastest growth in Transfer Agency services?

The Asia Pacific (APAC) region is projected to show the fastest growth, driven by rapid wealth creation, expanding retail investor participation, and the increasing institutionalization of investment funds in key economies like China and India, necessitating scalable, localized TA solutions.

Do fund managers prefer in-house or outsourced Transfer Agency models?

The prevailing trend favors outsourced Transfer Agency models. Fund managers seek third-party specialists to leverage their economies of scale, dedicated technological infrastructure, and expertise in navigating diverse regulatory frameworks, allowing the fund manager to focus resources on core investment strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager